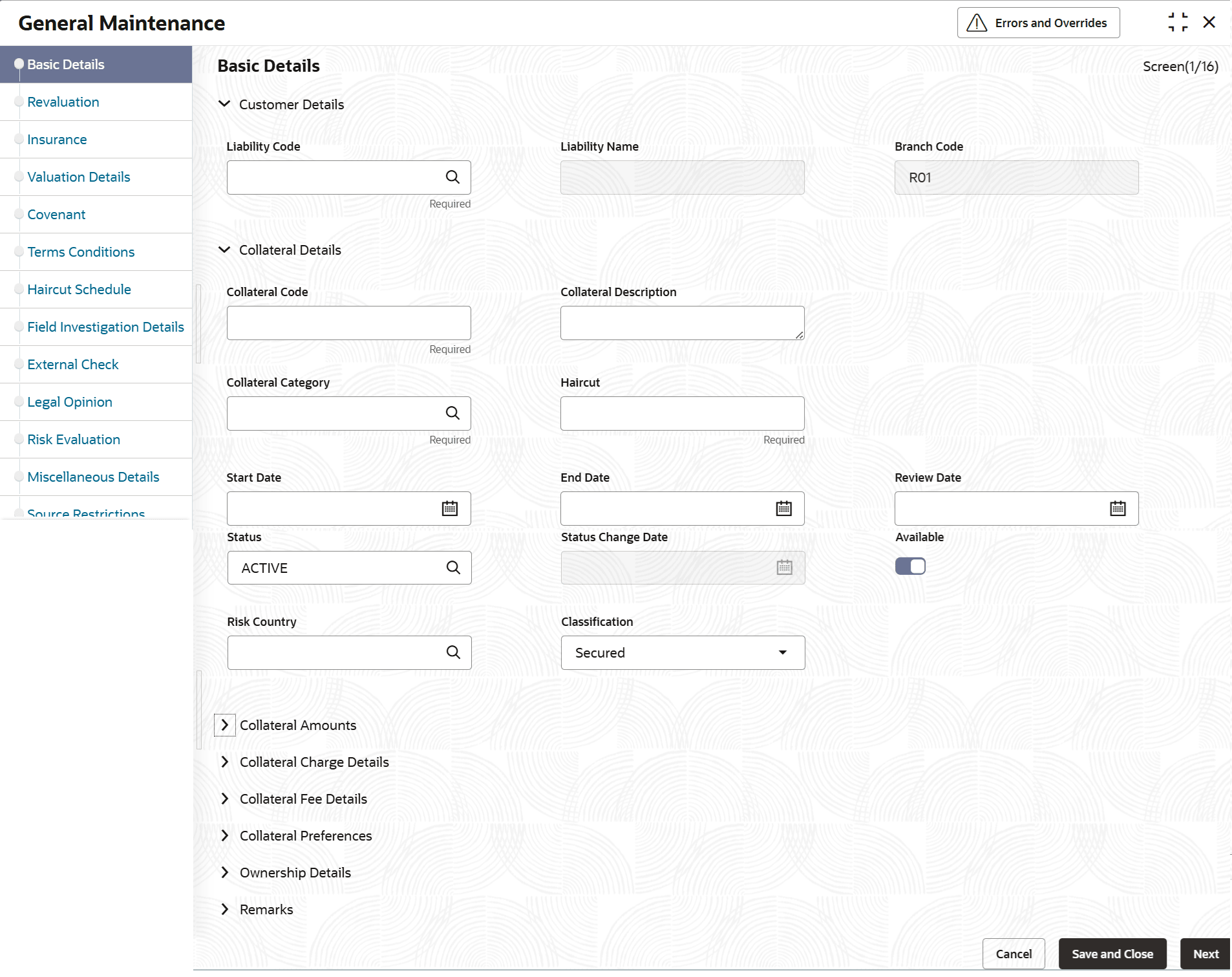

3.11.1 General Maintenance

This topic provides systematic instructions about general collateral maintenance.

- From Menu, select Limits and Collaterals. Under Limits and Collaterals, select Collaterals.

- Under Collaterals, select Maintenances. Under Maintenance, select Collateral Types.

- Under Collateral Types, select General. Under General,

Select General MaintenanceThe General Maintenance screen is displayed.

- On Collaterals Maintenance screen, specify the

fields.For more information on fields, refer to the field description table.

Table 3-27 Collaterals Maintenance - Field Description

Field Description Basic Details This section displays the basic details. Liability Code Click the  icon and select the liability code from the list.

icon and select the liability code from the list.

Collaterals are created under the Liability.

Liability Name This field gets defaulted from the liability code. Branch Code Defaults the logged in user;s branch where collateral is created Collateral Code Specify the Collateral Code here. A maximum of 20 alphanumeric characters are allowed in this field. Each Collateral code should be unique.

In case mask code maintenance is configured for collateral entity, Collateral Code gets auto generated automatically based on mask code sequence at the time of Collateral creation.

Collateral Description Specify a brief description of the collateral. Collateral Category Click the  icon and select the collateral category from the

list.

icon and select the collateral category from the

list.

Sub Category Click the  select the appropriate sub category configured for

the selected category from the list from the list upon

selecting the category, details like revaluation get

defaulted.

select the appropriate sub category configured for

the selected category from the list from the list upon

selecting the category, details like revaluation get

defaulted.

Haircut This field gets defaulted from the collateral category and sub category. The Haircut can be increased or decreased within the Haircut variance, if the haircut modification and hair cut decrease allowed parameters are selected at Collateral Type-Category combinations. Start Date Specify the start date of the collateral. If start date is not entered, current application date is considered as start date. If the Start date is future dated, Available flag will remain as N and will be updated as Y on reaching Start date. Collateral will not be available for utilization or block till the system reaches Start date.

The start date indicates the date from which the collateral becomes effective.End Date End date is updated based on farthest maturity date/end date when multiple child records are linked to a collateral. In case of select collaterals types, End date can be updated directly on the main screen. For example, Inventory, Miscellaneous, Funds, Stocks, Commodities, Metals, Property, Vehicles, Machinery, and so on.

The collateral is considered effective only during start and end date.

Review Date Specify the review date. Status Click the  icon and select the status from the list.

The following status updates are possible for the collateral during its life cycle.

icon and select the status from the list.

The following status updates are possible for the collateral during its life cycle.- Active - By Default, the collateral status is displayed as active when the collateral is created.

- Expired - On the collateral end date, the collateral status is updated as expired by the collateral expiry batch process.

- Extended - The collateral status is updated as extended, when the collateral end date is updated to a future date after the collateral expiry.

- Reactivated - Suspended collateral can be reactivated by updating the status as reactivated. Reactivated collateral will be available for utilization.

- Suspended - Collateral can be suspended by updating the status as suspended. Suspended collateral will not be available for amendment and utilization.

- Released - Collateral can be released by updating the status as released. Before releasing the collateral, you must delink the collateral from all the linked facilities and pools and ensure there is no active utilization on collateral.

Status can be changed to Active from Extended on changing the End Date. However, Status cannot be moved to Active from any other status.

Status Change Date Date on which the collateral status is changes get defaulted/updated. Available This toggle is selected by default, indicating that the collateral is available for linking to the collateral pool and Credit Facility. You can deselect this so as to manually freeze this collateral. If the Available check box is deselected then the collateral is frozen, that is, it is not available for subsequent linkages to new collateral pools Or Credit Facility. The collateral’s current links to collateral pools and Credit Facility is not affected.

Note:- As a part of Collateral Pool creation for a Liability, only those collaterals which are checked as Available is displayed in the list for collateral pool linkage. Similarly, while linking Collaterals directly to the Facility, only the Collaterals with Available check box ticked is displayed for linking.

- Collateral which was Available and which has been linked to pool/ pools can be modified as unavailable later on. Unavailable collateral is not available for subsequent new collateral pool linkage or Credit Facility, but the old linkages is not affected.

Risk Country Click the  icon and select the country in which the collateral

has credit risk.

icon and select the country in which the collateral

has credit risk.

Classification Select the classification from the list. The available options are: - Secured

- Unsecured

- Liquid

Collateral Currency Click the  icon and select the currency in which the

Collateral has to be maintained. Once authorized you cannot

change this entry.

icon and select the currency in which the

Collateral has to be maintained. Once authorized you cannot

change this entry.

Collateral Value The collateral value is derived based on child records in all of the collateral type maintenance screens except in case of Collaterals(General Collateral) Maintenance. Collateral value is directly entered in the main screen. The collateral value depends on whether the security is Market Value based or Non-Market Value based.

Agreed Collateral Value Specify the value of collateral that the customer has agreed to provide to the bank. Lendable Margin On save of the collateral, system calculates the Lendable Margin for the collateral. This value will be: 100% – Haircut (%). This is a display only field.

Limit Contribution The Limit Contribution amount is derived after applying the Hair cut percentage on the Collateral Value.

Example

Collateral value = $1000

Haircut = 10%

Lendable Margin = 90%

Limit Contribution = $900 ($1000*90%)

The limit contribution indicate that the loan can be granted only to the extent of the Limit Contribution amount.

Utilization Amount The system computes and displays the Utilization Amount of the Collateral, if a collateral is directly linked to a contract or account and not through a pool or Credit Facility. Available Amount This field is automatically populated when the record is saved. The Formulae to compute the Available Amount is Limit Contribution - (Utilization Amount + Pool Amount + Block Amount + Facility Contribution)

Facility Contribution If the collateral is linked with a facility after collateral creation, the collateral amount contributed to the facility is displayed in this field. Pool Contribution When the collateral is linked to the collateral pool, the system computes and displays the amount contributed to be Pool. The Contribution amount is computed based on the linked percentage or linked amount specified when a collateral is linked to a Collateral Pool. For example: Collateral ‘Collat1’ is created with collateral value of 10000 USD. And 60% of Collat1 is linked to a Collateral Pool, then the Contributed amount of the collateral is updated as 6000 (that is, 60% of 10000). The available amount of collateral is updated as 4000(10000- 6000). The available amount of the collateral is arrived by using the formulae mentioned in the Available Amount field. Any utilization to the pool will only impact the available amount and the utilization of the pool and not the collateral.

Collateral Block Amount The system computes and displays the block amount of the Collateral,if a block is directly placed on the collateral. IF the Collateral is linked either to Collateral Pool or Credit Facility and if the Block is placed on Facility or Collateral Pool, then there will be no impact on the Block Amount at Collateral level. Tanked Utilization Utilization transactions sent to the collateral during the EOD process are tanked and the utilization are updated to the Tanked Utilization field instead of Utilization field. During BOD process, the tanked utilization are moved to 'Utilization' field and Tanked Utilization field is cleared.

Charge Registration Required Select this check box for recording registration details for the charge on collateral. As part of charge registration, notice with required details can be sent to the appropriate registration authority. Filing statement can be sent to registrar for charge creation.

Note: Based on the Collateral Category selected, charge registration details are defaulted during customer collateral maintenance which can be modified.

Charge Type Click the  icon and select the appropriate charge type from

the list.

icon and select the appropriate charge type from

the list.

Seniority of Claim Click the  icon and select the seniority of the claim from the

list.

icon and select the seniority of the claim from the

list.

Charge Renewal Frequency A charge can be renewed as per the charge renewal frequency and units. For every charge type, a Charge Renewal Frequency can be configured. Select the charge renewal frequency from the drop-down list. The available options are: - Daily

- Weekly

- Monthly

- Quarterly

- Half Yearly

- Yearly

Units Specify the units for the collateral. For example: If Charge Renewal Frequency is selected as Monthly and Unit is selected as 2, then the system updates the charge end date considering perfection date + 2 months.

Filing Lead Days Specify the number of days prior to charge expiry date during this period charge can be renewed. Grace Days Specify the grace days past the next due/revision date allowed for collateral. Mortgage Initiated Indicates if mortgage has been initiated for the collateral. Taken Over Indicates if the collateral has been taken over. Class Code Click the  icon and select the collateral fee class code in

Class field in main screen Fee

rules configured for the class code will be defaulted in fee

preferences data.

icon and select the collateral fee class code in

Class field in main screen Fee

rules configured for the class code will be defaulted in fee

preferences data.

Events Displays the date wise/ Event wise Fee accrual and liquidation details along with fee amount. Refer Figure 3.32 and Table 3.30 for more details on Collateral Event Details.

Auto Pool Create Select the Auto Pool Create if you want to automatically create a collateral pool as and when you create collateral. To facilitate this, it is essential that the Available option is selected for the collateral. The system then creates a collateral pool with the following characteristics when you save the record: - The Pool Code, Pool Description, and Pool Currency will be same as the Collateral Code, Collateral Description and Collateral Currency respectively

- The Collateral Linked Percentage is set at 100%.

- Collateral linked to the pool which is auto created will have order number as 1 by default.

Note: You cannot modify this option after the collateral is authorized

Sharing Required Select Sharing Required check box to indicate that the collateral can be shared among other liabilities. If you choose this option, you can specify the details of such liabilities in the Shared Details screen.

The shared options allows:- Linking of Collateral to the Facility with Shared Liability

- Linking of Collateral to the Collateral Pool with the Shared Liability

Revaluation of shared collaterals impacts the pools / facility to which the same has been linked.

Ownership Type Select the collateral ownership type from the drop-down list. The options available are: - Single

- Joint

- Tenants in Common

- Others

If one of the ownership type from the drop-down list is selected, then the following fields displays.- Customer Number

- Customer Name

- Ownership Percentage

- Is Primary Customer

User Reference Specify the user reference number for the collateral. Internal Remarks Specify the internal remarks for the collateral. Remarks Specify the remarks about the ownership. Computation of Collateral Value: The collateral value is the submission of all the child collateral value.

If it is Market value based then the collateral value is calculated as shown in the following examples.Example:

Input in case of a nominal quoted security:Input in case of a unit quoted security:Table 3-28 Nominal Amount quoted Collateral Value

Nominal Amount Price Code Market Price Collateral Value [(Market price/100) * Nominal Amount] 10,00,000 BOM1 65 (65/100) *10,00,000=650000 5,00,000 BOM2 70 (70/100) * 5,00,000= 350000 7,00,000 BOM3 80 (80/100) * 7,00,000= 560000 Table 3-29 Unit quoted Collateral Value

Number of Units Price Code Market Price Collateral Value (Number of Units x Market Price 65 BOM1 120 7800 70 BOM2 130 9100 40 CAL1 95 3800 If it is Non-Market Value based then the user has to enter the collateral value manually.Note:

In case 'Collateral Value' is increased, then in the 'Collateral Pool Maintenance' screen, the 'Linked Amount' is updated only if the 'Amount Basis' is 'Percentage'. If the 'Amount Basis' is 'Amount', then the 'Linked Amount' is retained as is. However based on the changed 'Collateral Value', the 'Linked Percent Number' is re-calculated considering the retained amount.Reduction of collateral value

When collateral is only linked to pool:

Linkage basis is percentage – reduction in collateral value results in recalculating collateral pool contribution to the pool and accordingly linked block amount on collateral changes.

Linkage basis is amount – reduction in collateral value is permitted only to the extent of allocation already done, so that linked block amount on collateral continues to be same.

When collateral is only linked to facility:

Linkage basis is percentage – reduction in collateral value results in recalculating facility contribution amount and accordingly linked block amount on collateral changes.

Linkage basis is amount – reduction in collateral value is permitted only to the extent of available amount of the collateral, so that linked block amount on collateral continues to be same.

When pool is linked to facility and no utilization has taken place- Scenario 1 - Collateral to pool linkage is

percentage and Pool to facility linkage is amount

- Collateral value – 20000

- Linkage to pool – 50% - 10000

- Pool to facility – 6000

- Post modification of collateral value to 10000

- Pool to Facility-6000

Modification is not allowed since the modified pool value is going below the linked amount at Facility level.

- Scenario 2 - Collateral to pool linkage is Percentage

and Pool to facility linkage is Percentage

- Collateral value – 20000

- Linkage to pool – 50% - 10000

- Pool to facility –50%-5000

- Post modification of collateral value to15000

- Linkage to pool – 50% - 7500

- Pool to Facility-50%-3750

Modification is allowed since the reduced Collateral value is recalculating pool and facility contribution based on percentage.

- Scenario 3 - Collateral to pool linkage is Amount and

Pool to facility linkage is Amount

- Collateral value – 20000

- Linkage to pool –10000

- Pool to facility – 5000

- Post modification of collateral value to 8000

- Linkage to pool – 10000

- Pool to Facility-5000

Modification is not allowed since the modified Collateral value is going below the Linked amount.

- Scenario 4 - Collateral to pool linkage is Amount and

Pool to facility linkage is Percentage

- Collateral value – 20000

- Linkage to pool –10000

- Pool to facility –50%-5000

- Post modification of collateral value to 8000

- Linkage to pool –10000

- Pool to Facility-50%- 5000

Modification is not allowed since the modified Collateral value is going below the Linked amount.

When pool is linked to facility and utilization has taken place- Scenario 1 – Collateral linked to pool with pool

level utilization existing

- Collateral value – 20000

- Linkage to pool – 50% - 10000

- Utilization amount at Collateral Pool level-4000

- Post modification of collateral value to 7000

- Linkage to pool – 50% - 3500

Modification is not allowed since the modified Collateral value which in turn modifies the Limit Contribution is going below the Utilized amount at Pool level.

- Scenario 2 – Collateral linked to pool which in turn

is linked to facility and utilization has taken place at

facility level

- Collateral value – 20000

- Linkage to pool – 50% –10000

- Pool to facility – amount - 10000

- Utilization amount at facility level – 10000

- Post modification of Collateral value to 16000

- Linkage to pool – 50% – 8000

- Pool to facility – amount – 10000

- Existing utilization at facility level – 10000

Modification is not allowed since the modified Collateral value resulting in pool contribution to facility to go below existing utilization.

- Click Events on Collateral Maintenance screen.The Collateral Events Details screen displays.

For more information, refer section 5.3 under Collateral Event.

- Collateral Revaluation

This topic provides systematic instructions on Collateral Revaluation Details. - Insurance Maintenance

This topic provides information on Specifying the Insurance Details. - Valuation Details

This topic provides systematic instructions on Maintaining Valuation Details. - Covenant Maintenance

This topic provides systematic instructions on specifying covenant details. - Terms and Conditions

This topic provides systematic instructions about terms and conditions. - Fee Preference

This topic provides systematic instructions about fee preferences. - Collateral Perfection

This topic provides systematic instructions on collateral perfection details of collateral maintenance. - Haircut Maintenance

This topic provides systematic instructions about Maintaining Haircut Schedule. - Field Investigation Details

This topic provides systematic instructions about Maintaining Field Investigation details. - External Check

This topic provides systematic instructions on Maintaining External Check Details. - Legal Opinion

This topic provides systematic instructions on Maintaining Legal Opinion. - Risk Evaluation

This topic provides systematic instructions on Risk Evaluation. - Miscellaneous Details

This topic provides systematic instructions on Maintaining Miscellaneous Details. - Shared Details Maintenance

This topic provides systematic instructions about shared details. - Source Maintenance

This topic provides systematic instructions on Maintaining Source Restrictions. - MIS Details

This topic provides systematic instructions on MIS Class Maintenance of Collateral maintenance.

Parent topic: Collaterals Maintenance