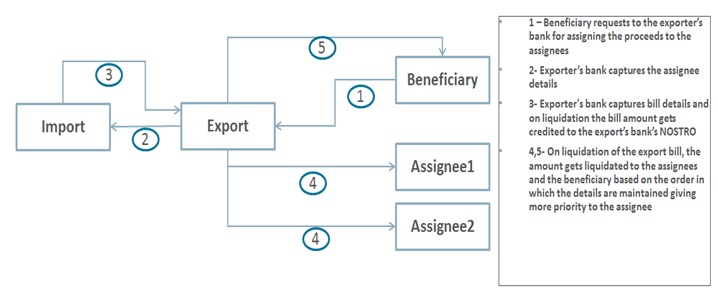

4.2.2.10 Case2 - The assignment of proceeds is done by the exporter's Bank Processing at import Bill

There will be no impact on import bill in this case. The proceedings of the import bill will get credited to the Nostro of the export bank.

Processing of the liquidation of the bill will happen as explained in case1 for import bank. The flag, Assignment Done by Us will be checked in this case.

It will be possible to maintain the assignment details.

On liquidation of the export bill, the liquidated amount will get allocated to the exporter, and the assignees as per the order maintained, giving more priority to the assignee. Split settlement functionality of bills And Collections contract will be used for achieving the above.

On discount or purchase of the bill, the system will throw an error if the purchase amount is given more than the (bill amount - total assigned amount).

To go back to the tabular column, entry Assignment Paid by Importer, click Assignment Paid by Importer

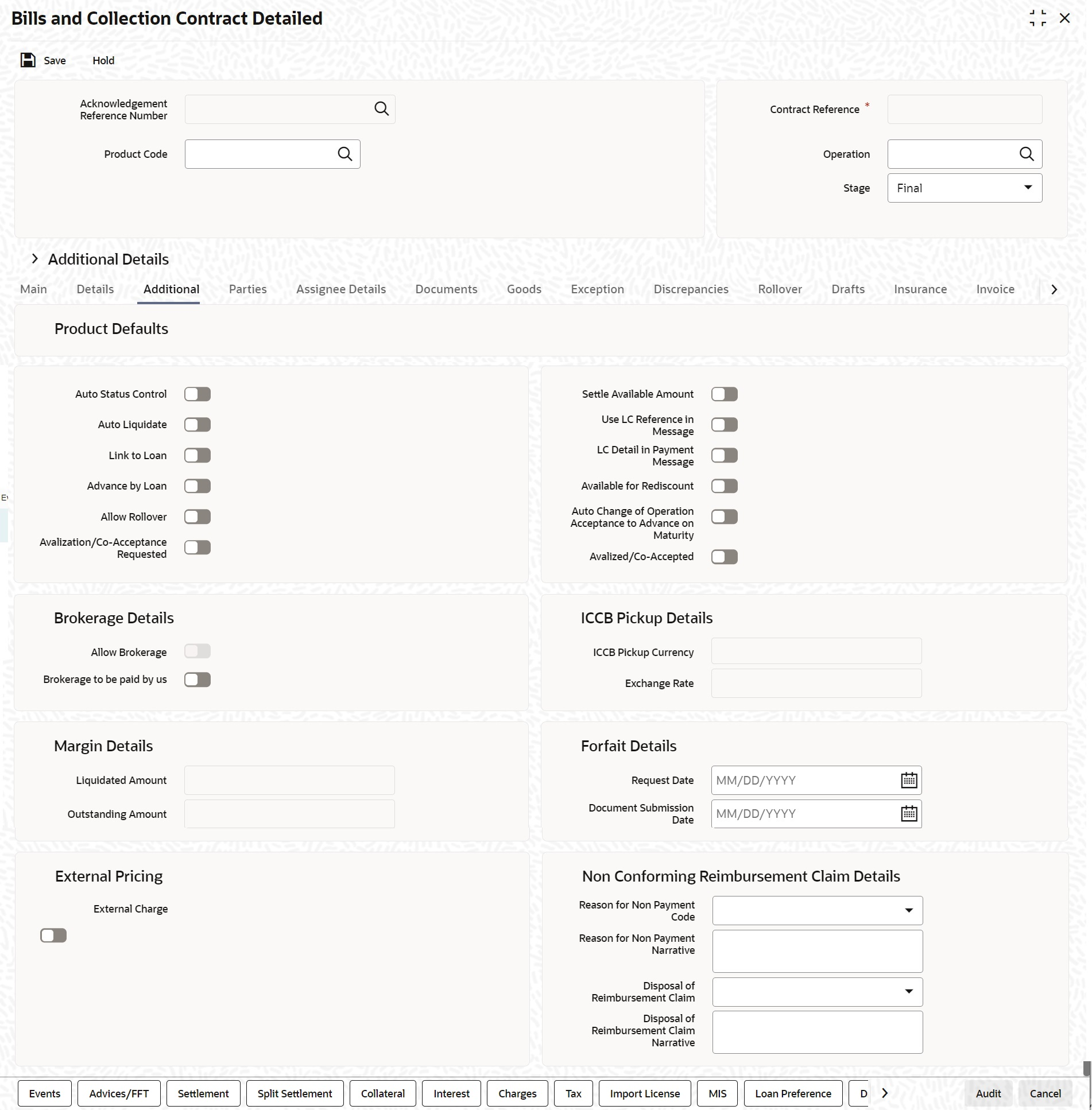

- On the Bills and Collection Contract Detailed screen,

click Additional.There are some events that triggered automatically, when the batch process is run as part of the EOD or BOD. Batch processing preferences for a product is specified in the Bills - Product Preferences screen. The preferences indicated for the product involved in the bill will be defaulted.Bills and Collection Contract Detailed - Additional tab details screen is displayed.

Figure 4-11 Contract detailed - Additional tab

Description of "Figure 4-11 Contract detailed - Additional tab" - Click Save to save the details or

Cancel to exit from the screen.For Information on fields, refer to: Table 4-12

Table 4-12 Bills and Collection Contract Detailed - Additional Details Tab

Field Description Brokerage Details Following are the Brokerage Details

Allow Brokerage Brokerage To Be Paid By Us ICCB Pickup Details For any export purchases, indicate whether you want to levy the charges and interest in the ICCB pickup currency or the contract currency for the customer.

ICCB Pickup Currency Indicate the currency in which interest and the charge pick-up will happen for the contract. Exchange Rate Specify the exchange rate between ICCB pick-up currency and contract currency. You are not allowed to change the ICCB pickup currency for EIM (Effective Interest Method) contracts. It gets defaulted to the contract currency and will be disabled here. You have to manually select the settlement account for BC module tags in the ICCB pickup currency. Settlement pickup of ICCB and charge tags will happen based on the ICCB pickup currency.

In case where the charges and interest are based on ICCB pickup currency, you have to maintain the ICCB rule in table Table 4-8

Floating rate pickup and customer margin pickup for interest components will be based on ICCB pickup currency. So, you need to maintain the floating rate code and customer margin for the respective ICCB pickup currency.

Also, if you want to apply charges in ICCB pickup currency, then you have to define the charge component with amount tags suffixed by _ICCY. If charge components are defined with normal bills amount tags, then charges will be computed in contract currency. Thus, apply charges in contract currency or ICCB pickup currency based on basis amount tag of a charge component.

Margin Details Following are the Margin details

Liquidated Amount While liquidating a bill, the margin you retain for a bill during the discount is proportionally released and displayed here. Outstanding Amount The Outstanding Margin Amount applicable to the bill at any point in time is displayed here. The margin that you liquidate should be less than or equal to the outstanding margin amount Forfeit Details Following are the Forfeit details:

Request Date Specify the date on which your customer requests for bill Forfaiting. Document Submission Date The requester of Forfaiting will invariably submit a document. This may or may not happen on the date of request. So capture the date of submission of the Forfaiting document here. Note:

These two fields are only meant for information purpose. The system performs no processing or validation on them.External Pricing Following are the External Pricing

External Charge While booking a contract under a product for which ‘External Charges’ is enabled at product level, it defaults the same value for contract also which fetches external charges from external pricing and billing engine. MT744 - Notice of Non-conforming Reimbursement Claim System is enhanced to generate the SWIFT message MT744 - Notice of Non-conforming Reimbursement Claim on bill booking as per SR2018 standard. - Fields to capture the Non-conforming Reimbursement Claim details in BC contract online screen is introduced.

- Support to generate message Notice of Non-conforming Reimbursement Claim, provided the mandatory details are included during bill booking or bill closure

- As per the existing system, message

MT744 will be generated only during bill closure and

the only possible value supported for tag 73S is

CANC whereas the current system is enhanced to

support the generation of the message both in bill

booking and in bill closure. The possible values of

tag 73S is also updated as per the SR2018

standards.

- Reason for Non Payment Code

- Reason for Non Payment Narrative

- Disposal of Reimbursement Claim

- Disposal of Reimbursement Claim Narrative

- Reason for Non Payment Code is a drop-down list and will list the applicable codes of tag 73R as per SR2018 standard.

- Below are the possible values:

- DIFF

- DUPL

- INSU

- NAUT

- OTHR

- OVER

- REFE

- TTNA

- WINF

- XAMT

Narrative value of tag 73R can be captured against the field Reason for Non Payment Narrative. Provided text can be appended with the code against tag 73R.Only narrative cannot be provided when the code is blank.

Disposal of Reimbursement claim is a drop-down list and will list the applicable codes of tag 73S as per SR2018 standard. Below are the list of possible values:- CANC

- HOLD

- RETD

Narrative value of tag 73S can be captured against the field Disposal of Reimbursement claim narrative. Provided text can be appended with the code against tag 73S. Only narrative cannot be provided when the code is blank. An override message will be thrown if the Disposal of Reimbursement claim is HOLD and the corresponding narrative is blank.- System will ensure to validate the below scenarios:

- Non-confirming reimbursement claim details are applicable only for the reimbursement claim products. Bill processing will not be allowed for other products with these details.

- Non-confirming reimbursement claim details are applicable only for the bills during bill booking (stage as INITIAL) or bill closure. System restricts the details to be provided for any other events.

- System restricts the value of Disposal of Reimbursement claim to be only HOLD during bill booking and other than HOLD (only CANC or RETD) during bill closure.

- Narrative fields cannot be provided when the claim code is not available.

- Override will be displayed when Disposal of Reimbursement claim is HOLD and the narrative text is blank.

- Both the claim codes are mandatory and if any one of it is not provided, the message will not be processed and it will be suppressed.

For example, let us assume the following:

Bill Currency = USD

ICCF Pickup Currency = GBP

Exchange Rate = 12

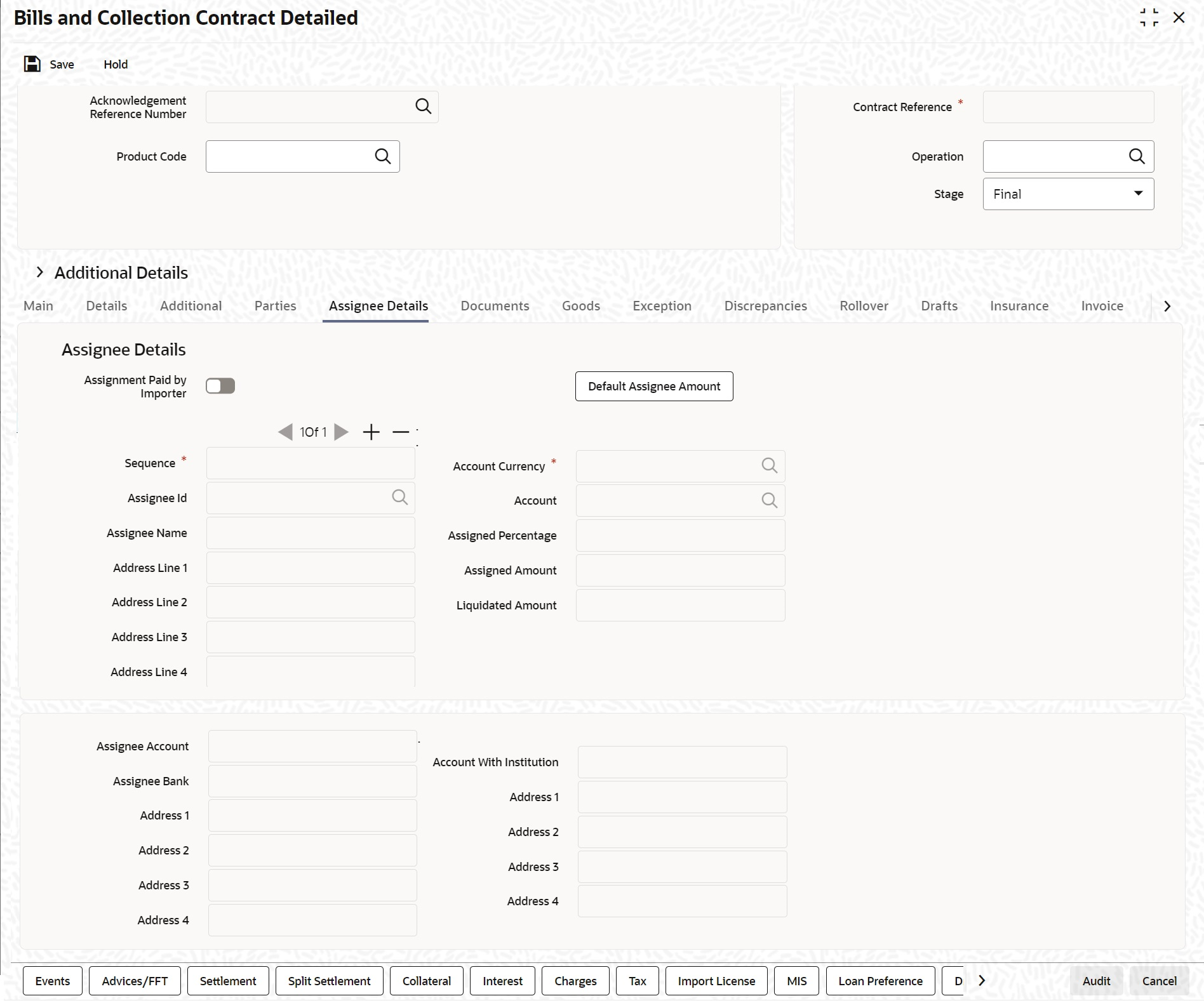

- On the Bills and Collection Contract Detailed screen,

Click Assignee Details tab.The Assignee Details is displayed.

- Click Save to save the details or

Cancel to exit from the screen.For Information on fields, refer to: Table 4-13

Table 4-13 Bills and Collection Contract Detailed - Assignee Details Tab

Field Description Assignee Details Assignee details will be defaulted from Export LC on LC default. Assignees cannot be added in Bills not under LC. Assignees cannot be added in Bills if assignees available for LC. Assignees can be added in Bills if assignees is not available for LC. Assignee can be walk-in customers, Bank customers, and Third Party customers.For Third Party Customers, user must maintain those parties in Third Party screen (TFDTPMNT). It will be possible to maintain assignee details in export type of letter of credit contract. You can set the following assignee details:.

Sequence Sequence in which the assignee details are maintained. Value for this should be greater than or equal to zero. Sequence will not accept any decimal points. This should be unique. Assignee Id To maintain the party ID. This will fetch all the parties maintained in Third party maintenance screen and walkin customer along with Bank customer. It will not be possible to maintain the same assignee multiple times other than walkin customer. This field is optional.

Assignee Name Assignee name will be displayed based on the Assignee Id. Assignee name can be modified only Walk-in Customer.

Assignee Address Line 1 Address Line 1 will be displayed based on the Assignee ID.Address Line 1 can be modified only for Walk in customer. This field is optional.

Assignee Address Line 2 Address Line 2 will be displayed based on the Assignee ID.Address Line 2 can be modified only for Walk in customer. This field is optional.

Assignee Address Line 3 Address Line 3 will be displayed based on the Assignee ID.Address Line 3 can be modified only for Walk in customer. This field is optional.

Assignee Address Line 4 Address Line 4 will be displayed based on the Assignee ID.Address Line 4 can be modified only for Walk in customer. This field is optional.

Account Currency Specify the currency of the account of the assignee. Accounts Specify the account to which the amount should be credited. This can be the account of the assignee with the bank if he is a customer of the bank. If he is not the customer of the bank then this can be the Nostro account of his bank maintained in the current bank. If Assignee is a bank customer (Individual/Corporate/Bank customer) then Account LOV will provide customer accounts maintained in External Customer Account for the selected bank customer. If Assignee is a Third party or Walk in customer then Account LOV will display the NOSTRO accounts for the currency. If Assignee id is not provided then Account LOV will provide customer Accounts and Nostro Accounts

Either Account or Assignee account is mandatory.

Assigned Percentage Specify the percentage of assignment to the assignee. Sum of assignee percentage should not exceed 100 percent.Either Assigned Percentage or Assigned Amount should be entered. If assigned percentage is provided and assigned amount is not provided, system will compute assigned amount based on assigned percent of contract amount.If assigned amount is provided and assigned percentage is not provided, system will compute assigned percentage based on assigned amount. If both assigned percentage and assigned amount is provided, system will compute assigned amount based on assigned percentage

If both assigned percentage and assignment amount is not provided, system will provide error message.

Assigned Amount Specify the amount of assignment to the assignee in LC currency.bThis should be greater than zero. Decimal points will be based on the LC currency Liquidated Amount This will give the liquidated amount in bill currency against each assignee. This will be populated by the system and will be a read only field.

Assignee Account Indicates Account of Assignee which is Ultimate Beneficiary Account. If user provides Invalid Accounts then system will assign walkin customer to Assignee id and Nostro Account to Account field.

Assignee Bank Indicates Bank of Assignee Address Line 1 Indicates Assignee Bank address details. Address Line 2 Indicates Assignee Bank address details. Address Line 3 Indicates Assignee Bank address details. Address Line 4 Indicates Assignee Bank address details. Account with Institution Indicates Account with Institution. Address Line 1 Indicates Assignee Bank address details. Address Line 2 Indicates Assignee Bank address details. Address Line 3 Indicates Assignee Bank address details. Address Line 4 Indicates Assignee Bank address details. Default Assignee Amount Button Calculate the Assignee Amount based on the assignee percentage. Assignment Paid by Importer If this flag is checked, then it is mandatory to maintain the assignment details. Validation will be there to check whether assignee details are maintained. For export type of products the assignment details will be defaulted from the linked letter of credit contract: - On click of Default button in the main tab, system will default the assignment details captured at the Letter Of Credit contract

- It will not be possible to add or delete assignees

- Assignees details and Account details cannot be modified

- It will be possible to modify the assignment amount

- If the assigned amount for each assignee considering all the BC contracts booked under the same LC goes above the assignment amount at LC contract level for the corresponding assignee, then system will throw an error message

- If the assignment amount for each assignee is not in proportion with the BC amount to LC amount proportion, then system will throw an override

For import type of contract data can be entered by the user as mentioned in below section:- Before doing the maintenance of assignee details in BC contract screen, those parties should be maintained in Other Party screen

- All validations related to assignee details mentioned for Letter of Credit contract will be applicable in this case as well.

- It will be possible to add any number of assignees in this block.

- All the fields are mandatory to input.

- It will be possible to amend the details of the assignee. The above mentioned validation will be applied on modification as well.

- It will be possible to add new assignees, system will validate the total amount against the bill amount.

- It will be possible to delete the existing details. But the below validations will be applicable.

- Once the liquidation against one assignee has happened, it will not be possible to delete that assignee.

- Amount cannot go below the liquidated amount against the assignee.

Once the liquidation is done, it will not be possible to change the Assignee Name, Assignee Id, Account Currency or Account. There will be validation to check whether the sum of the amount for all the assignee does not exceed the bill amount. Assignment of proceeds is done at import or export bill based on the business scenario. A new flag is introduced to indicate this A new flag, Assignment Done by Us will be introduced at Bills and collections contract screen. Check this flag to mandatory to maintain the assignment details. Validation is there to check whether assignee details are maintained.

Account details provided from External system to be mapped to Assignee Account field which is newly introduced.

Assignee ID, Account and Assignee Account derivation will be as below:Table 4-14 Table Assignee Details

Assignee Id Account Assignee Account Processing on Save Customer selected from LOV Customer Account selected from LOV Not provided Assignee account to be defaulted with Account on Save Not provided Customer Account selected from LOV Not provided Customer id to be derived and Assignee Account to be defaulted with Account Not provided Not provided Valid Customer account provided Customer id to be derived and Account to be defaulted with Assignee Account Not provided Not provided Invalid Customer account provided Walk in customer and Nostro account of the walk in customer to be defaulted Customer selected from LOV Not provided Not provided Error to be thrown. Either account or assignee account should be provided Customer selected from LOV Customer selected from LOV Invalid Customer account provided Assignee account to be defaulted with Account on Save and required override will be thrown. Customer selected from LOV Customer selected from LOV Valid Customer account provided (Different) Assignee account to be defaulted with Account on Save and required override will be thrown. Customer selected from LOV Customer selected from LOV Valid Customer account provided (Same) Contract will be saved with the provided details without any override. During Bill liquidation, assignee details to be defaulted to Settlement subsystem as below:Table 4-15 Assignee Details

Assignee Details Settlement Subsystem Assignee Account Ultimate Beneficiary 1 Assignee Name Ultimate Beneficiary 2 Assignee Address 1 Ultimate Beneficiary 3 Assignee Address 2 Ultimate Beneficiary 4 Assignee Address 3 Ultimate Beneficiary 5 Assignee Bank Beneficiary Institution 1 Assignee Bank Address Line 1 Beneficiary Institution 2 Assignee Bank Address Line 2 Beneficiary Institution 3 Assignee Bank Address Line 3 Beneficiary Institution 4 Assignee Bank Address Line 4 Beneficiary Institution 5 Account with Institution Account with Institution 1 Address Line 1 Account with Institution 2 Address Line 2 Account with Institution 3 Address Line 3 Account with Institution 4 Address Line 4 Account with Institution 5

Parent topic: Main Tab