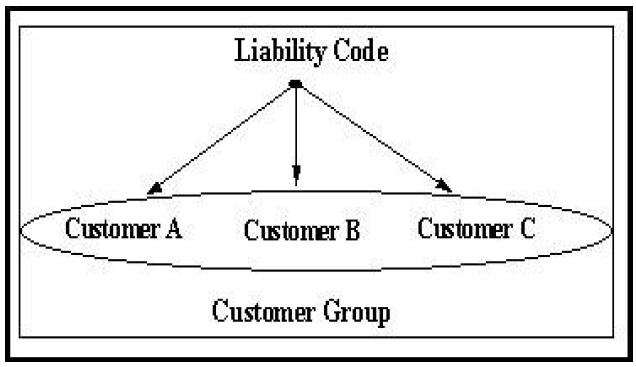

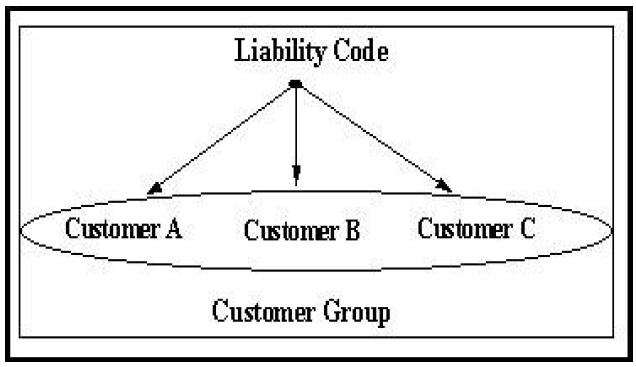

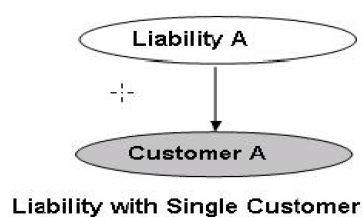

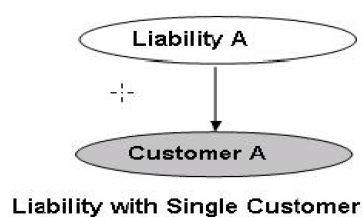

| Liability Code

|

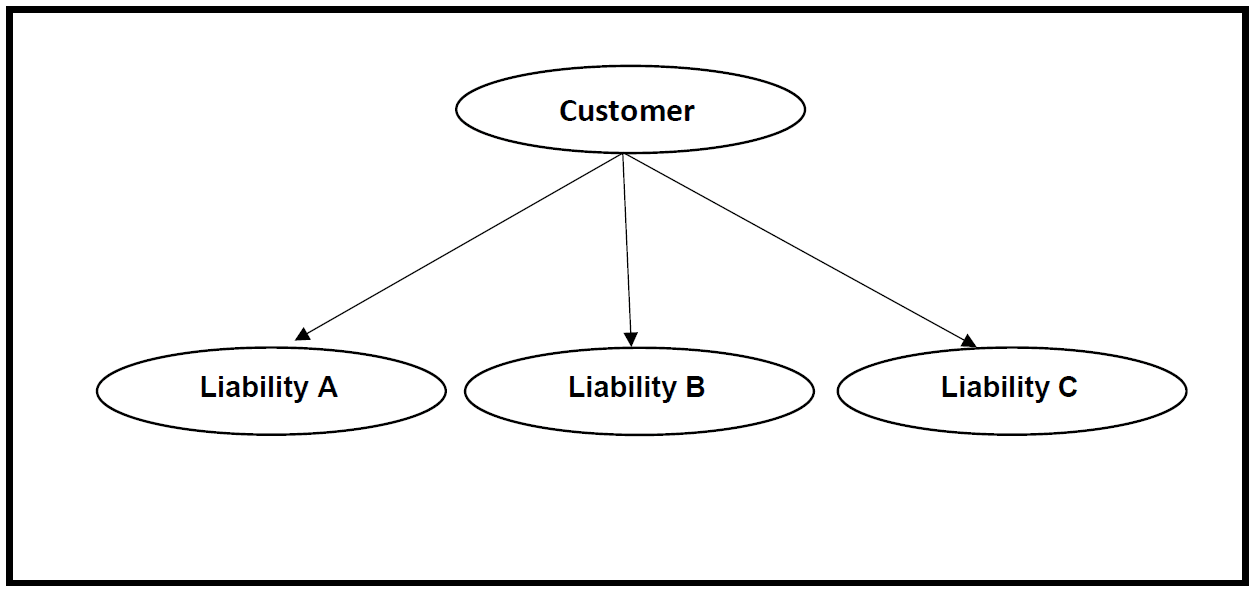

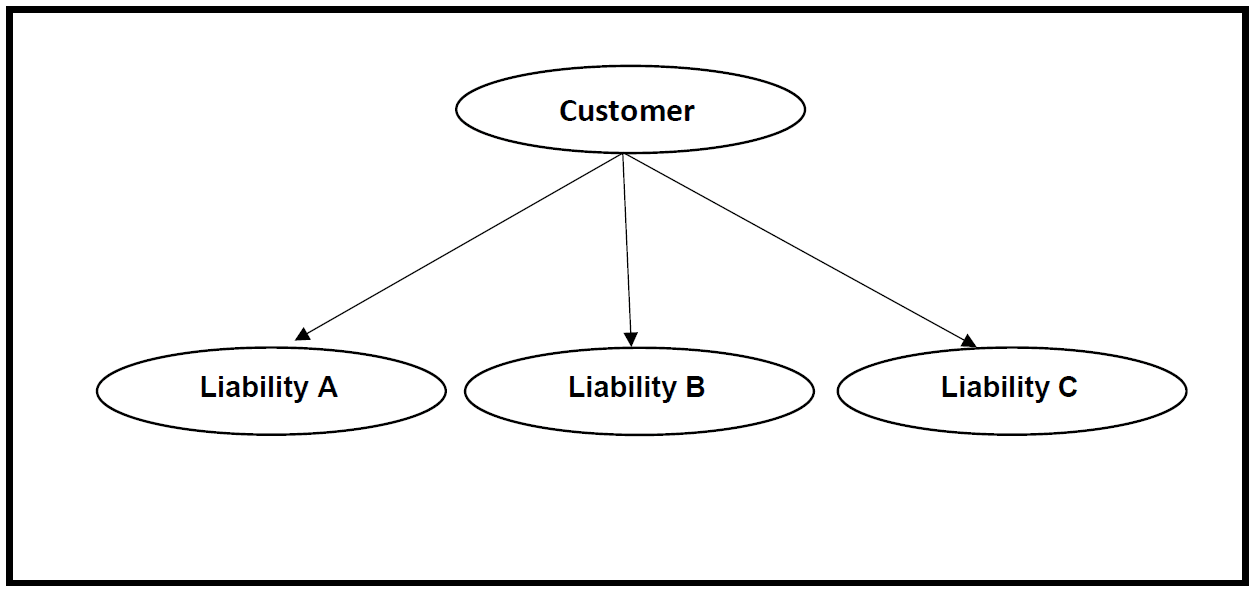

Specify the liability code. Liability code is

assigned to borrowing entity which can be a single entity or

a group entity having multiple customers associated. |

| Liability

Name |

Specify the liability name for the borrowing

entity. |

| Liability Branch

|

Click the  icon and select the branch in which liability is

associated. icon and select the branch in which liability is

associated.

|

| Main Liability Code

|

Click the  icon and select the required main liability from

the list of liability code maintained in the system. This is

optional icon and select the required main liability from

the list of liability code maintained in the system. This is

optional

Note: Child liability and

parent liability (main liability) can be in different

branches.

During Utilization and block

transactions, the utilization and block amounts are

tracked for both the specified Liability and the linked

parent Liability.

After the child

liability creation, you can change or delink the

selected main liability through the Main

Liability Change screen , if required.

If the main liability is not

selected during child liability creation, you can link

the main liability at any time through the

Main Liability Change screen

.

Note: The child liability's

overall limit amount should not exceed the parent

liability's overall limit amount.

|

| Main Liability Name

|

This field is automatically populated based

on the selected from Main Liability

Code.

|

| Liability Currency

|

Click the  icon and select the currency with which the

liability limit is signified. icon and select the currency with which the

liability limit is signified.

Note:

User can modify the liability currency after

authorization if:

- There are no lines, collaterals or

collateral pools linked to the liability.

- The liability is not utilized.

- The liability is not the parent

liability for another child liability.

|

| Liability Category

|

Click the  icon and select the liability category from the

list of categories available Category Maintenance

screen. icon and select the liability category from the

list of categories available Category Maintenance

screen.

|

| Liability

Status |

Click the  icon and select the status of liability. (For

example, NORM for normal, BLOCKED,and so on). Liability

status will be updated as Active on creation and can be

subsequently modified as per requirement. icon and select the status of liability. (For

example, NORM for normal, BLOCKED,and so on). Liability

status will be updated as Active on creation and can be

subsequently modified as per requirement.

|

| Review Date |

Specify the date on which bank would want to

review the limit for the liability. The limit check

continues irrespective of the date maintained here. The

revision date must be greater than the start date and can

also be left blank. |

| User

Reference |

Provision to capture comments/reference

details about the liability. |

| Overall Limit

|

Liability/borrowing entity based on

appraisal. If a main liability is attached during creation,

sub liability limit cannot exceed main liability

limit.

Limit amount of line linked to a liability

cannot be more than liability level limit amount.

Only the parent facilities will be

considered while validating against the overall

limit.

Note: The system

validates the overall limit amount with the internal

lending limit equivalent amount. If the overall limit

amount is greater than the Internal Lending Limit

Equivalent Amount, then the system displays an override

message as Overall limit amount $1 of the customer

liability exceeds the maintained Internal Lending

Limit Equivalent Amount $2.

Internal

lending amount is arrived at considering internal

lending percentage applied on amount derived considering

central bank lending percentage on bank

capital.

|

| Counterparty Appetite

|

Specify the total project limit which can be

sanctioned to the customer.

Note:

- It is not a mandatory field. Counter

party appetite is user enterable.

- If entered, cannot be less than the

overall limit .If not entered it is derived from

the overall limit.

- If entered more than overall limit,

then it is not derived from the overall

limit.

|

| Headroom Limit

|

The system displays the headroom available to

the borrowing entity. The headroom limit is updated based on

the limit amount of facilities created under the liability.

Headroom limit will be updated as

counterparty appetite at the time of liability

creation.

Headroom limit is shown as

ZERO if it is negative. However internally it will be

tracked and suitably updated if any linked facility is

closed.

Note: Facilities

created under a child liability will update only the

headroom limit of child liability. Update on the

headroom limit of child liability will not affect the

headroom limit of the parent liability.

Sub-lines will not update the headroom

limit.

|

| Utilization Amount

|

This field displays the utilized amount for

the liability ID at any point in time. This is a derived

field and not editable. |

| Block Amount |

This field displays the blocked amount for

the liability at any point in time. This is a derived field

and not editable. |

| Tanked Utilization

|

Utilization transactions received post

initiation of EOD are tanked and the same are updated

against tanked utilization field.

After BOD

process, this utilization amount is updated for the

liability which is linked to the transaction as per the

contract and the amount is cleared from the

Tanked Utilization

field.

|

| Liability Clean Risk

Limit

|

This limit is captured in the

Customer Maintenance screen

(STDCIF). This field is populated only when the

liability is created using Auto liability

Creation option in Customer

Maintenance screen.

Note: This field is only display field and

no other validations as such are supported.

|

| Secondary Clean Risk Limit

|

This limit is captured in the Customer

Maintenance screen (STDCIF). This field is

populated only when the liability is created using Auto

liability Creation option in Customer

Maintenance screen.

This field is

only display field and no other validations as such are

supported.

|

| Secondary Pre-Settlement Risk

Limit |

This limit is captured in the

Customer Maintenance screen

(STDCIF). This field is populated only when the

liability is created using Auto liability

Creation option in Customer

Maintenance screen.

This

field is only display field and no other validations as

such are supported.

|

| Available

Amount |

This amount is derived considering utilized

and blocked amounts at liability level out of limit amount.

|

| External Credit

Rating

|

The primary credit rating maintained in the

credit rating sub-screen is displayed.

Note: These details are maintained only for

information and have no processing impact.

|

| Internal Credit

Rating |

The internal credit rating maintained in the

credit rating sub-screen is displayed. |

| External Credit

Score |

The primary credit score maintained in the

credit score data segment is

displayed.

Note: These

details are maintained only for information and have no

processing impact.

|

| Internal Credit

Score |

The internal credit score maintained in the

credit score data segment is displayed. |

| Unadvised

|

Switch to  for this feature to be enabled. for this feature to be enabled.

Switch to  for this feature to be disabled. for this feature to be disabled.

For any

transaction involving an unadvised liability, you are

notified. When a facility is created for an unadvised

liability, an information message is displayed.

|

| Netting Required

|

Switch to  for the netting amount to be defined. for the netting amount to be defined.

Switch to  for not defining the netting

amount. for not defining the netting

amount.

Facility level netting can be enabled if

liability level netting is enabled.

User can

have the Facility to display the Netting Amount in the

Netting Contribution screen.

For more details on this feature, refer the

Including Netting Amount in Facility's

Netting Contribution topic.

|