Accounting for Creditable Withholding Tax - Philippines

The withholding tax system in the Philippines collects in advance the approximate income tax for a specific income payment. This tax is deducted and remitted to the Bureau of Internal Revenue (BIR) using the appropriate tax returns by the buyer in a transaction, acting as a withholding agent on behalf of the BIR to collect taxes from the vendor or seller.

Upon installation, the Withholding Tax SuiteApp features enable tracking, computation, and reporting of creditable withholding taxes for the Philippines.

Read the following sections for more information:

Withholding Tax Fields

To enable NetSuite to track and generate withholding tax report, the Withholding Tax SuiteApp adds a WH Tax Code field to vendor records, customer records, and item records:

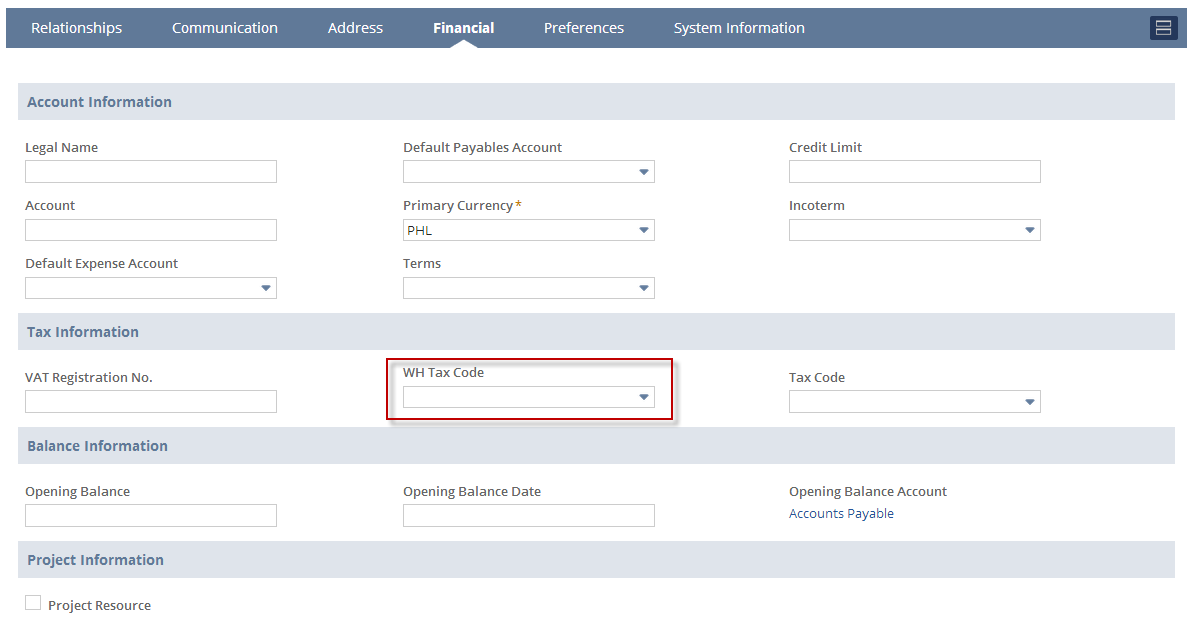

Vendor Records

On the Financial subtab:

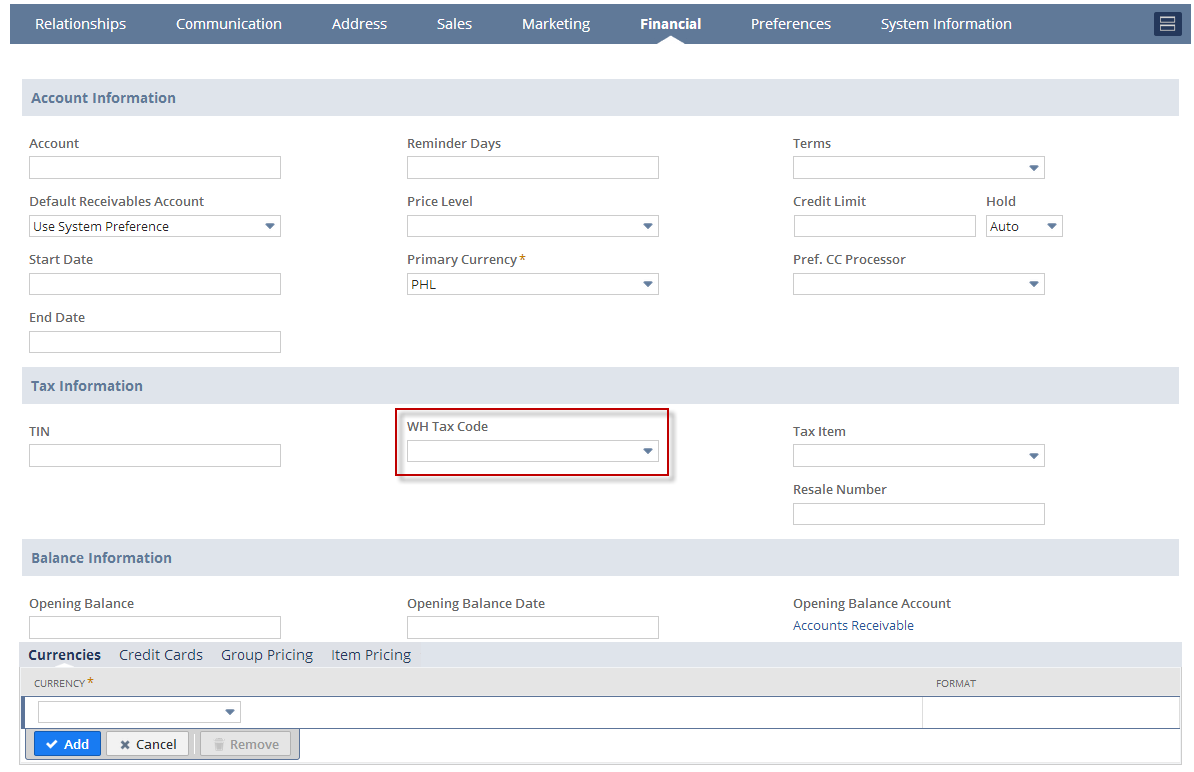

Customer Records

On the Financial subtab:

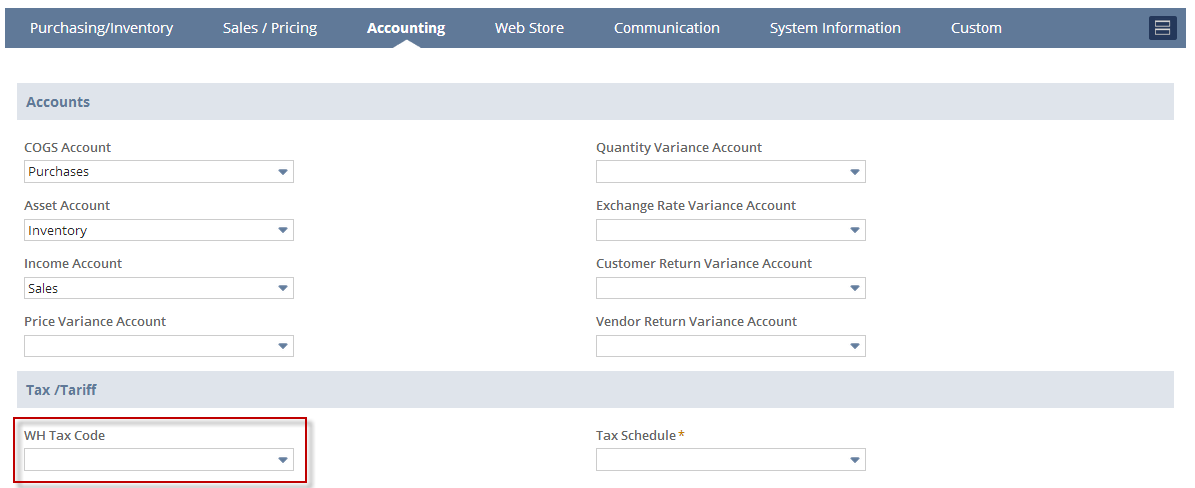

Item Records

On the Accounting subtab:

Withholding Taxes on Bills and Payments

With the Withholding Tax SuiteApp, you can record withholding taxes on bills and payments. For information, see Applying Withholding Taxes on Transactions as a Buyer and Recording Withholding Taxes on Transactions as a Seller.

You can also define the default computation of withholding taxes. For information, see Setting Up Withholding Tax - Philippines.

Tax Types and Tax Control Accounts for Creditable Withholding Tax

Upon installation, the Withholding Tax SuiteApp automatically creates a withholding tax type to support Philippines expanded or creditable withholding tax. Other withholding tax types can be added as appropriate (for example, support for final withholding tax, VAT withholding, and others).

After you install the Withholding Tax SuiteApp, you must define the tax control accounts that are needed to manage and track withholding tax liability and creditable income tax. This can be done by selecting an account from the chart of accounts as the withholding tax control account both for purchase transactions (as a buyer) or payment transactions (as a seller).

For more information, see Setting Up Withholding Tax Types.

Withholding Tax Reporting

The Withholding Tax SuiteApp provides the following withholding tax reports for the Philippines:

-

Certificate of Creditable Tax Withheld at Source (Form 2307)

-

Monthly Remittance Return of Creditable Income Taxes Withheld (Expanded) (Form 1601-E)

-

Quarterly Remittance Return of Creditable Income Taxes Withheld (Expanded) (Form 1601-EQ)

For information, see Withholding Tax Reports - Philippines.

Related Topics

- Setting Up Withholding Tax - Philippines

- Creating Withholding Tax Types - Philippines

- Creating Withholding Tax Codes - Philippines

- Creditable Withholding Tax Codes - Philippines

- Withholding Tax Reports - Philippines

- Withholding Tax Overview

- Setting Up Withholding Tax

- Setting Default Withholding Tax Codes

- Applying Withholding Taxes on Transactions as a Buyer

- Recording Withholding Taxes on Transactions as a Seller

- Importing Withholding Tax Transactions Using CSV Import

- Importing Withholding Tax Transactions Using SOAP Web Services