Creating Statutory Adjustment Journals

Use the statutory adjustment journal to adjust calculated CGST, SGST/UTGST, or IGST on advance receipts or payments when you supply goods or services.

You can also use it to enter ITC reversal adjustments for GST claims if you don't meet the specific ITC claim conditions such as entering late fees or interest for a purchase. Statutory adjustment journal records show up in the GST3B report under section 5.1 Interest & Late Fee Payable.

To create a statutory adjustment journal:

-

Go to Transactions > Financial > Make Journal Entries.

-

In the Custom Form field, select India Statutory Adjustments.

-

Fill out the necessary fields at the top of the form as described in Entering General Journal Transactions.

-

In the Tax Information section, fill out the following fields:

-

(Optional) In the Nexus field, the nexus for this journal entry.

-

(Optional) In the Subsidiary Tax Reg. Number field, the tax registration number for this journal entry.

-

In the Adjustment Type field, select the adjustment type for this journal entry.

-

In the Adjustment Sub Type field, select the adjustment subtype for this journal entry.

-

In the Place of Supply field, select the place of supply for this journal entry.

-

In the Classification of Supply field, select the classification for this journal entry.

-

-

On the Lines subtab, enter the details for the journal lines.

-

In the Account field, select the ledger account to be affected by this journal entry.

Note:Select at least one ledger account for the adjustment journal. Accounts must be of type Other Current Liability or Other Current Asset.

-

Enter the Debit or Credit amount for the line.

-

In the India Tax Account box, check if the journal line account is a tax account for India.

-

(Optional) In the Memo field, enter a memo to help you locate this journal entry in a register for this account.

-

(Optional) In the Name field, select an entity to link to this journal entry. Click the double down arrows to pick from the List or Search.

-

(Optional) If you've enabled the Departments feature and classify at the transaction level, in the Department field, select the correct department for this journal entry.

-

(Optional) If you've enabled the Classes feature and classify at the transaction level, in the Classes field, select the correct class for this journal entry.

For more information, see Departments and Classes Overview.

-

(Optional) If you've enabled the Locations feature and classify at the line level, in the Location field, select the correct location for this line.

For more information, see Locations Overview.

-

Click Add.

-

-

Click Save.

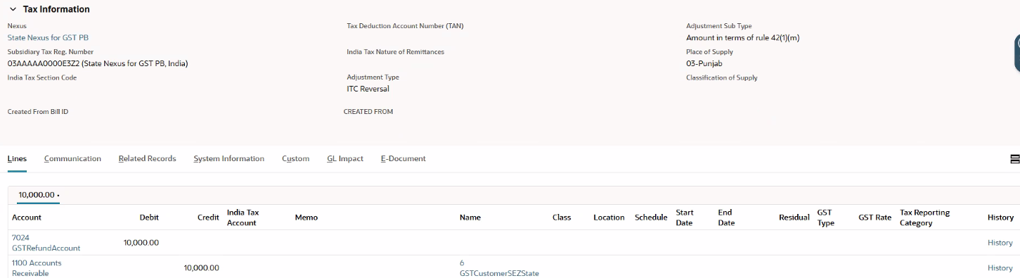

Statutory Adjustment Journal

Wolfe has a purchase transaction (PO 1234) that includes goods worth INR 10,000 for its employees as incentives. Since the goods aren't for business purposes, this transaction isn't eligible for ITC claims. However, this purchase will still show up on Wolfe's GST report. You'll need to do an ITC reversal for this transaction when filing your GST report.

In the image below, the statutory adjustment journal uses the sub type Amount in terms of rule 42(1)(m) because the goods in PO 1234 aren't for business purposes.