- Settlements User Guide

- The Settlements Service

- Settlement Preferences

- Receive Parties

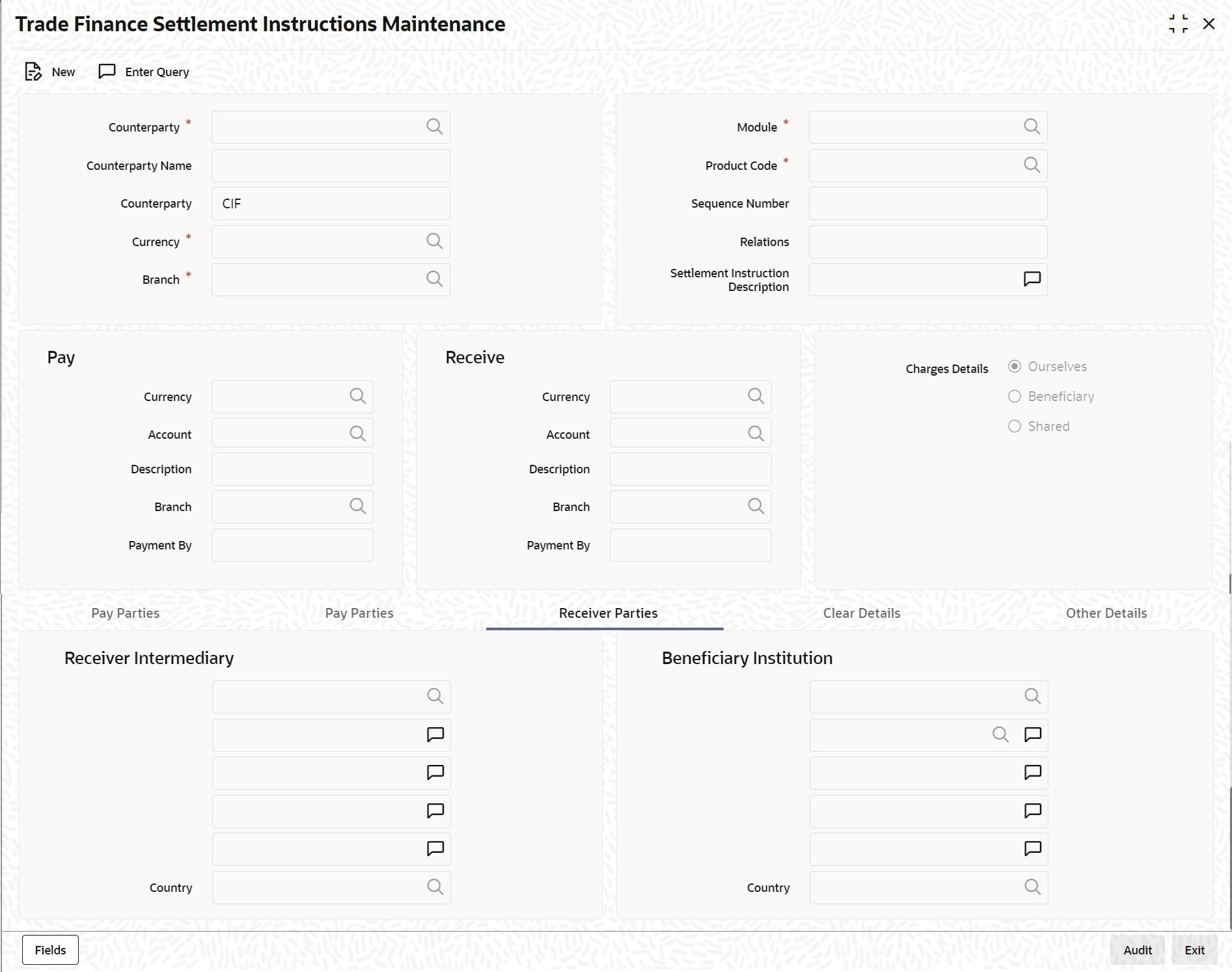

1.2.2 Receive Parties

This topic provides the systematic instructions to view the settlement instructions maintenance - receive parties.

From the Homepage, navigate to Trade Finance Settlement Instructions Maintenance screen.

- On Trade Finance Settlement Instructions Maintenance

screen, click Receive Parties.The Trade Finance Settlement Instructions Maintenance - Receive Parties screen is displayed.

Figure 1-4 Trade Finance Settlement Instructions Maintenance - Receiver Parties

- On Trade Finance Settlement Instructions Maintenance - Receive Parties screen, specify the details as required.

- Click Save to save the details or Cancel to close the screen.

For information on fields, refer to Table 1-5:

Table 1-5 Trade Finance Settlement Instructions Maintenance - Receive Parties - Field Description

Field Description Receiver Intermediary This field corresponds to field 56a of S.W.I.F.T. Specify details of the financial institution between the ‘Receiver’ and the ‘Account With Institution’, through which the amount must pass. The Intermediary may be a branch or affiliate of the Receiver or of the Account With Institution, or an entirely different financial institution. In this field you can choose to enter the:- ISO Bank Identifier Code of the bank

- Name and address of the Bank

Country Specify the country of the receiver’s intermediary. This adjoining option list displays all valid country codes maintained in the system. You can choose the appropriate one. Beneficiary Institution This field corresponds to field 58a of S.W.I.F.T. Enter details of the institution in favor of which the payment is made. It is in reality the bank, which services the account of the ultimate beneficiary. You will be allowed to make entries into this field only for Bank transfers (MT 200 or MT 202). In this field you can enter either the: - The ISO Bank Identifier Code of the Beneficiary Institution

- The Name and Address of the Beneficiary Institution

Country Specify the country of the beneficiary institution. This adjoining option list displays all valid country codes maintained in the system. You can choose the appropriate one. For more details on Mantas, refer 'Mantas' interface documentNote:

If you have already maintained this information in the Settlement Instructions Maintenance screen, then it will be picked up and reflected here.The country information is captured to enable Mantas to analyze the transactions for possible money laundering activities.

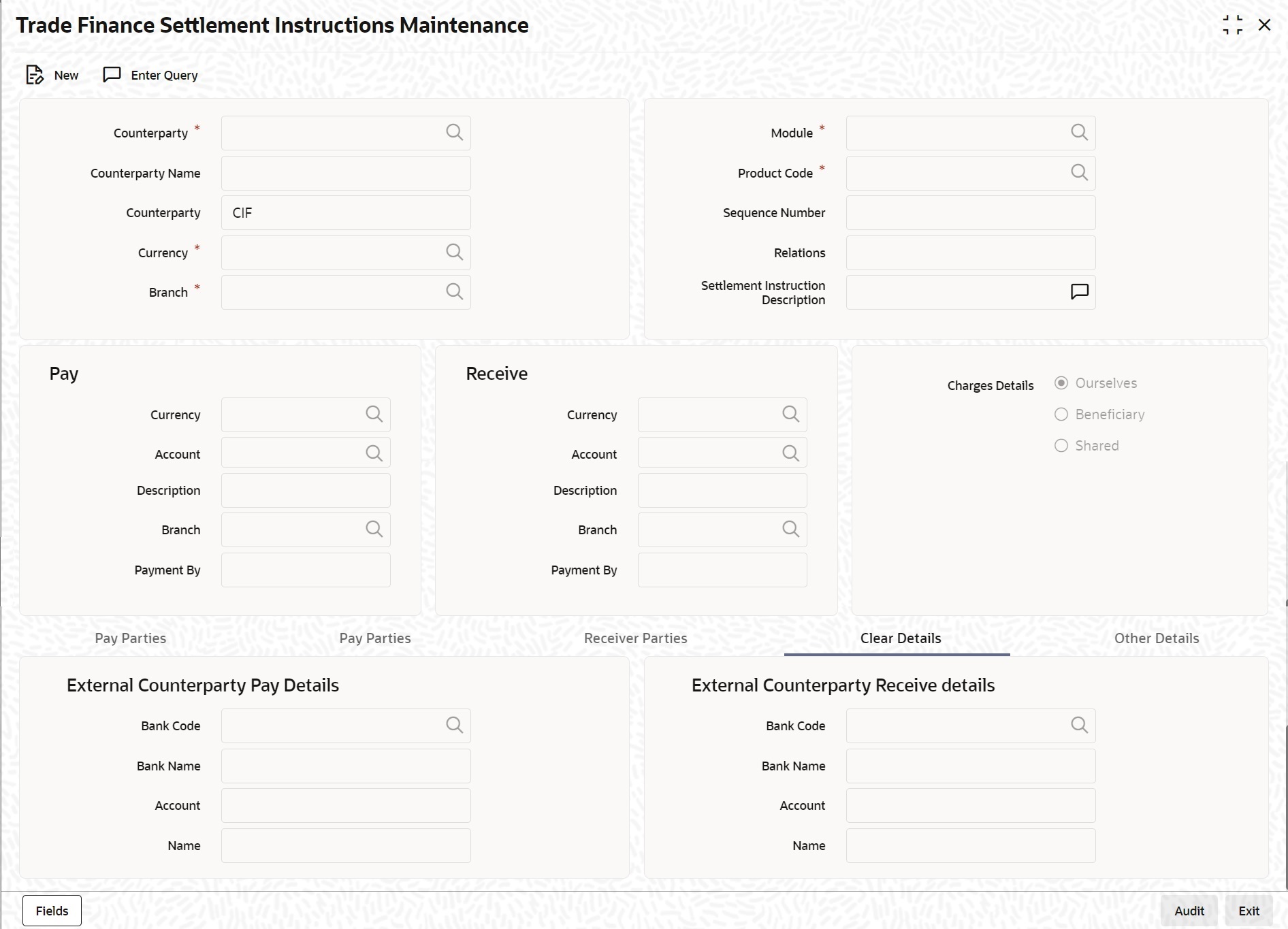

- On the Settlement Instructions Maintenance screen, click Clear Details.When you specify settlement instructions for a customer, you can indicate whether payment for local currency transactions is to be effected via messaging or over the local clearing network. You can also indicate whether a cover is required for payment, and whether the cover is through messaging or over the local clearing network.Specify these details in the Settlement Instructions screen. In the Payment By field, indicate the mode of payment either Message or Clear Details; and in the Cover By field, indicate the mode through which cover must be available.

Figure 1-5 Settlement Instructions Maintenance - Clear Details

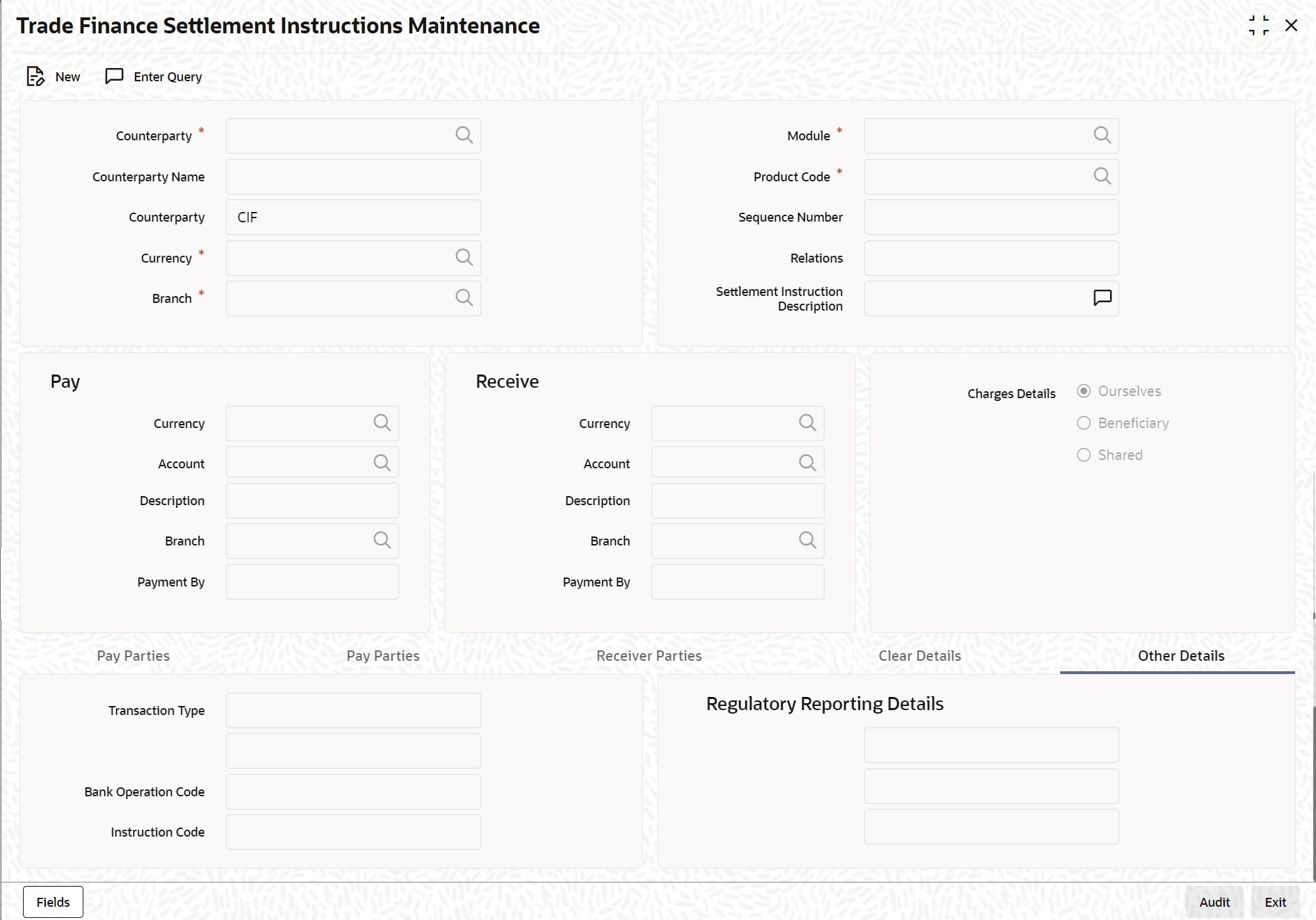

- On the Settlement Instruction Maintenance screen, Click Other Details.Define the default values for fields in MT 103 messages that are generated in respect of contracts involving the customer. When a contract is entered for the customer in any module, the values that you maintain here will default for MT 103 generation in respect of the contract.The Settlement Instruction Maintenance with Other Detail tab is displayed.

Figure 1-6 Settlement Instruction Maintenance - Others Details

- On the Settlement Instruction Maintenance screen, specify the details as required.For information on fields, refer to: Table 1-6.

Table 1-6 Settlement Instruction Maintenance - Other tab - Field Description

Field Description Bank Operation Code Indicate the bank operation code that will be inserted in Field 23B of the MT 103 message. The options available are SPRI, SSTD, SPAY and CRED. Note:

If the Bank Operation Code contains SPAY, SSTD or SPRI, the following validations are done:C11: If an account with the institution is used with D option, then party identifier is mandatory. (Either Clearing code or account has to be specified in the account line).

C12: Account is mandatory in field 59.

Instruction Code Description Specify the additional information, if any, which needs to be inserted to qualify the Instruction Code in Field 23E of the MT103 message. The instruction code description can only be maintained for the instruction codes PHON, PHOB, PHOI, TELE, TELB, TELI, HOLD or REPA. For instance, if the Instruction Code is REPA and the description is ‘Repayment’ then the text ‘REPA/Repayment’ is inserted in Field 23E.

Transaction Type Indicate the Transaction Type that will be inserted in Field 26T of the MT103 message. Regulatory Reporting Details Specify the Regulatory Reporting Details. The entered value will be inserted in Field 77B of the MT103 message.

Parent topic: Settlement Preferences