- Settlements User Guide

- The Settlements Service

- Settlement Preferences

- Settlement Instructions Maintenance

1.2.1 Settlement Instructions Maintenance

This topic provides the systematic instructions to view the settlement instructions maintenance.

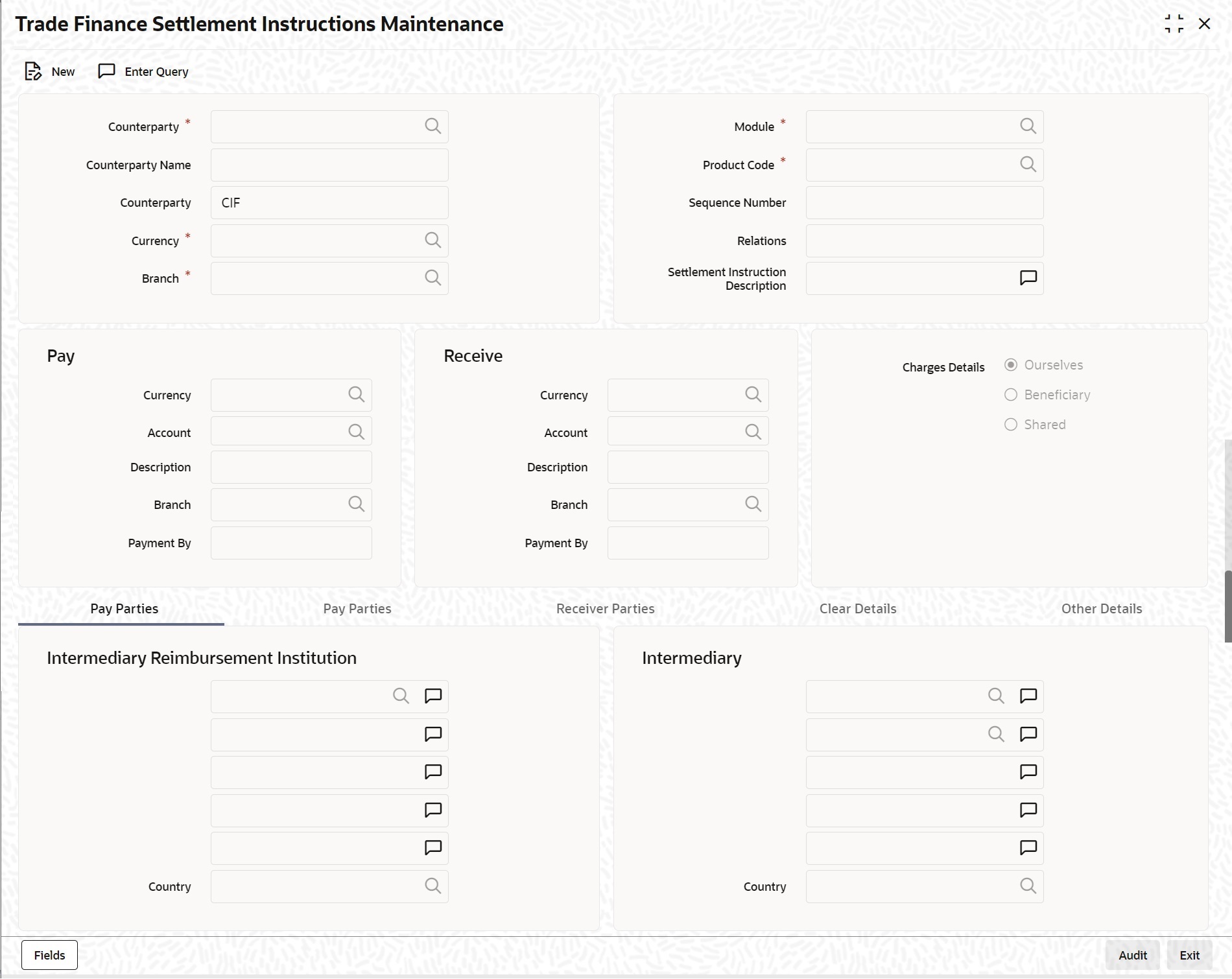

- On the Homepage, type 'ISDTFINS' in the text box, and click the next arrow.The Trade Finance Settlement Instructions Maintenance screen is displayed.

Figure 1-1 Trade Finance Settlement Instructions Maintenance

- On the Trade Finance Settlement Instructions Maintenance screen, specify the details as required.

- Click Save to save the details Or click Cancel to close the screen. Maintain the following basic settlement preferences for an entity (Customer /BIC), module, currency, product, Sequence Number and branch combination.

- The Pay (out) Account, and Currency

- The Receive Account (for incoming payments), and Currency

- If the charge (for the message) is to be borne by the bank or the beneficiary, or share between them

- The charge account, which will be used as the default account for all charges during contract input

- If a receive notice (MT 210) has to be generated for money settlements made in a specific currency

Table 1-2 Trade Finance Settlement Instructions Maintenance - Field description

Field Description Counter Party Maintain settlement instructions for all the customers or for specific customers only. From the option list select the specific customer number or choose the ALL option. Counterparty Type The Counterparty Type can either be CIF or BIC depending on whether your bank has an accounting relationship with the party for whom the instruction is being maintained or whether it only has a SWIFT messaging relationship. If the counterparty is a CIF in Oracle Banking Trade Finance, you will have to select CIF as the party type and choose the relevant CIF ID in the adjacent field. However, if the entity is not an actual customer of your bank but you would be sending/receiving payment messages to/from that party, you will have to choose BIC as the counterparty type and specify the counterparty address as well. As a result, you will need to identify the preferred Nostro/ Vostro accounts for that currency and BIC code combination.In addition, you can maintain the details of the various intermediaries involved in payments and receipts. The preferences maintained for an entity determine the manner in which money settlements are made on behalf of the entity.Note:

If you opt to generate receive notices for settlements made in all currencies, involving all counter-parties, and transactions in all modules of Oracle Banking Trade Finance, an MT 210 will automatically be generated for any money settlement made by your branch.Counterparty Name The system displays the name of the specified counterparty based on the details maintained at External Customer Input. Module Maintain different settlement instructions for different products. If you choose Module as ‘AL,’ then the Product must also be chosen as ‘ALL’. If you choose a specific module for maintaining settlement instructions, then you can choose any Product available under the module from the option list provided. Also, choose ‘AL’ to maintain settlement instructions for all products under the selected module. Product Code Indicate a specific product code or choose All from the option list. However, if you have chosen AL in the Module field, this field will be defaulted to ALL. You will not be allowed to change this. Currency Maintain settlement instructions for a particular currency or for all the currencies From the option list select the particular currency code or choose the *.* option. Branch Maintain settlement instructions for all the branches or for a particular branch. From the option list select the particular branch code or choose the ALL option. Payment By Indicate the method of payment for both Outgoing as well as Incoming Payments, for, Account and Currency combination. The following options are available: - Instrument (settlement is done through a Check, MCK etc.)

- Message (payment is made by means of a SWIFT Message)

- Clearing (the transaction is a local payment transaction and the settlement is routed through the Clearing House of the bank)

Note:

Indicate the payment method as ‘Clearing’ only,If the payment currency is the local currency of the branch

If it is one of the clearing currencies defined for the branch

If you have selected ‘*.*’ in the currency field

No payment message will be generated for settlements routed through a Clearing House.

Note:

Select ‘Payment By’ as ‘Instrument’, to ensure the payment by Instrument in SI settlements screen and then the system would look for the instrument type.

Charge Details Specify whether charges for the message are to be borne by the bank (ourselves) or the beneficiary, or will be shared. This information is inserted in Field 71A of an MT103 message involving the combination for which settlement instructions are being maintained. You can select one of the following options: - Ourselves – It is displayed as ‘OUR’ in the message and it indicates that all transaction charges are to be borne by the ordering customer.

- Beneficiary – It is displayed as ‘BEN’ in the message and it indicates that all transaction charges are to be borne by the beneficiary customer.

- Shared – It is displayed as ‘SHA’ in the message and it indicates that the transaction charges on the Sender’s side are to be borne by the ordering customer and the transaction charges on the Receiver’s side are to be borne by the beneficiary customer.

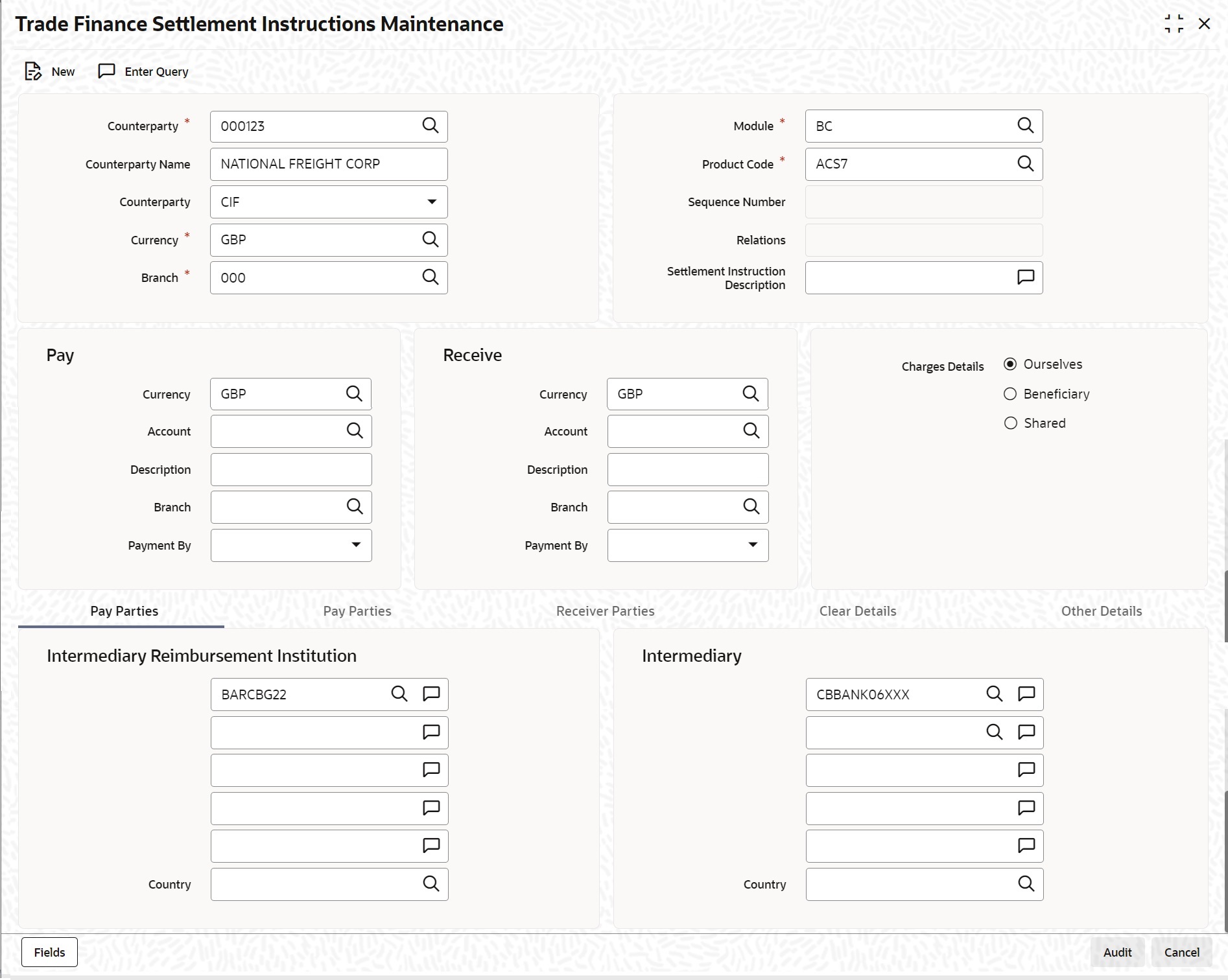

- On the Settlement Instructions Maintenance screen, click Pay Parties. Before funds actually reach the Ultimate Beneficiary of a payment, it may have to pass through several other banks or parties.

The Settlement Instructions Maintenance screen is displayed.

Figure 1-2 Settlement Instructions Maintenance

- On the Settlement Instructions Maintenance screen, specify the details as required. These screens contain fields that mark possible routes of a payment.

For information on Fields, refer to Table 1-3:

The Settlement Instructions Maintenance screen is displayed:Table 1-3 Settlement Instructions Maintenance - Field Description

Field Description Intermediary Reimbursement Institution An ‘Intermediary Reimbursement Institution’ is the financial institution between the Sender’s Correspondent and the Receiver’s Correspondent, through which the reimbursement of the transfer takes place. Country Specify the country of the intermediary reimbursement institution. This adjoining option list displays all valid country codes maintained in the system. You can choose the appropriate one. Intermediary The ‘Intermediary’ in a payment refers to the financial institution, between the ‘Receiver’ and the ‘Account With Institution’, through which the transfer must pass. The Intermediary may be a branch or affiliate of the Receiver or the account with Institution, or an entirely different financial institution. This field corresponds to field 56a of a SWIFT message.

Either enter:- ISO Bank Identifier Code of the bank

- The Name and address of the Bank

Country Specify the country of the intermediary institution. This adjoining option list displays all valid country codes maintained in the system. You can choose the appropriate one. For more details on Mantas, refer Mantas interface document.Note:

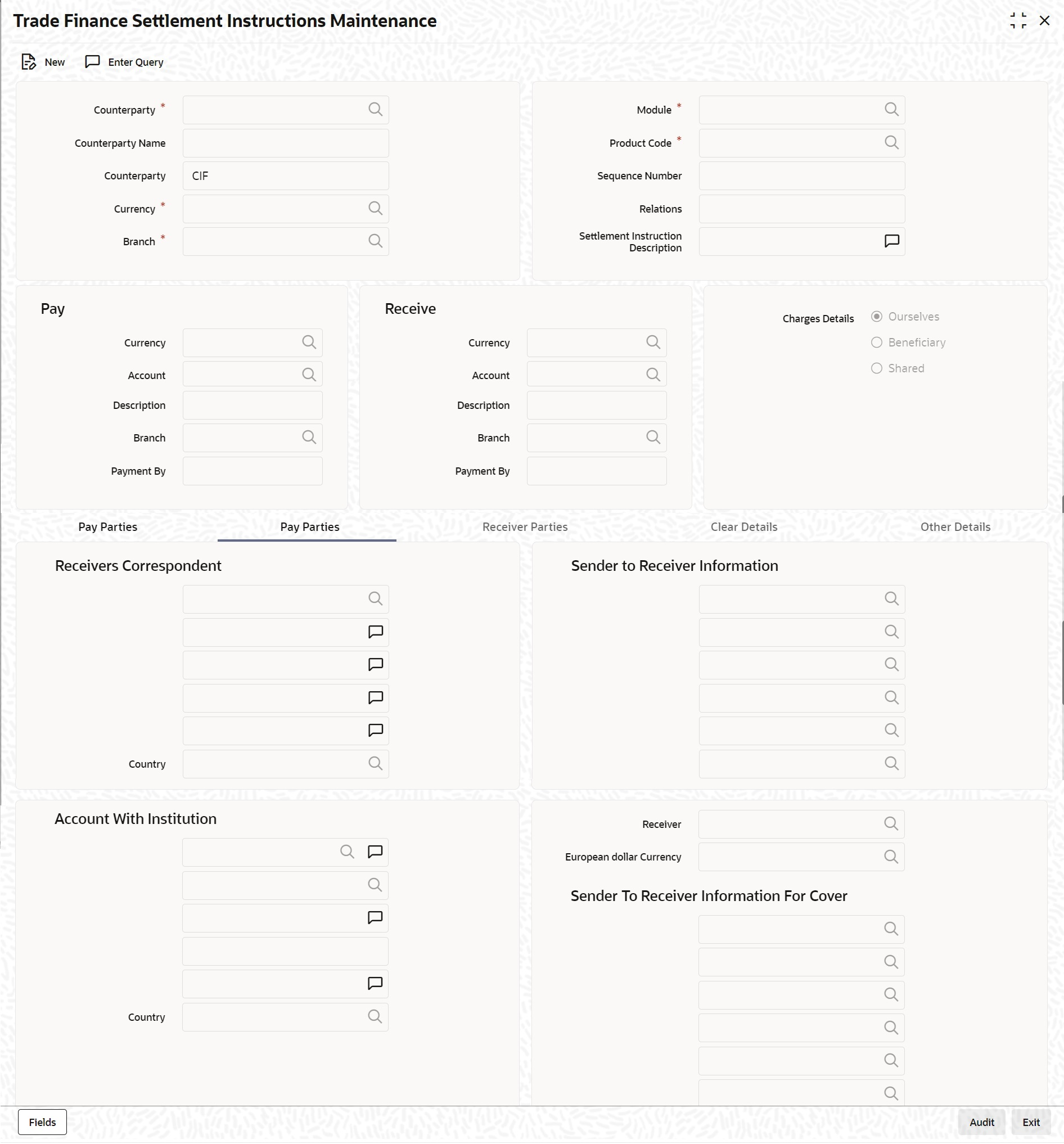

The country information is captured to enable Mantas to analyze the transactions for possible money laundering activities.Receiver’s Correspondent The ‘Receiver’s Correspondent’ is the branch of the receiver, or another financial institution, at which the funds will be made available to the receiver. Figure 1-3 Trade Finance Settlement Instructions Maintenance Pay Parties

- On Settlement Instructions Maintenance with Pay Parties, specify the details.

- Click Ok to Save OR Cancel to close the screen.

For information on fields, refer to Table 1-4:

Table 1-4 Settlement Instructions Maintenance Pay Parties - Field Description

Field Description Receivers Correspondent This field corresponds to field 54a of S.W.I.F.T. Enter the branch of the Receiver or another financial institution at which the funds will be made available to the Receiver. You can enter any one of the following: - ISO Bank Identifier Code of the bank

- The branch of the Receiver’s Correspondent

- Name and address of the Receiver’s Correspondent

Country Specify the country of the branch of the receiver / institution. This adjoining option list displays all valid country codes maintained in the system. You can choose the appropriate one Sender to Receiver Information The sender to receiver information maintained in the settlement instructions can be defaulted in the field 72 in the confirmation messages. The adjoining option lists displays the following values: - /ACC/ - Account with Institution

- /BNF/ - Beneficiary

- /BUP/ - Backup Payment

- /CHEQUE/ - Pay only by Cheque

- /CLSTIME/ - CLS Time

- /INS/ - Instructing Institution

- /INT/ - Intermediary

- /MANPAY/ - Mandated Payment

- /PHON/ - Deal by Phone

- /PHONBEN/ - Contact beneficiary by phone

- /PHONIBK/ - Contact intermediary by phone

- /RCB/ - Receiver’s correspondent

- /REC/ - Receiver

- /REJT/ - /REJT/

- /RETN/ - /RETN/

- /TELE/ - /TELE/

- /TELEBEN/ - /TELEBEN/

- /TELEIBK/ - /TELEIBK/

- /TSU/ - Trade Services Utility transaction

- /BROKER/ - Broker negotiating the contract

- / ELEC/ - Deal has been arranged via an electronic

- means

- /TELEX/ - Deal by TELEX

- /TIME/ - Time of transaction execution

- /VENU/ - Venue of transaction execution

Sender to Receiver Information Cover The sender to receiver information maintained in the settlement instructions can be defaulted in the field 72 in the confirmation messages. The adjoining option lists displays the following values: - /ACC/ - Account with Institution

- /BNF/ - Beneficiary

- /BUP/ - Backup Payment

- /CHEQUE/ - Pay only by Cheque

- /CLSTIME/ - CLS Time

- /INS/ - Instructing Institution

- /INT/ - Intermediary

- /MANPAY/ - Mandated Payment

- /PHON/ - Deal by Phone

- /PHONBEN/ - Contact beneficiary by phone

- /PHONIBK/ - Contact intermediary by phone

- /RCB/ - Receiver’s correspondent

- /REC/ - Receiver

- /REJT/ - /REJT/

- /RETN/ - /RETN/

- /TELE/ - /TELE/

- /TELEBEN/ - /TELEBEN/

- /TELEIBK/ - /TELEIBK/

- /TSU/ - Trade Services Utility transaction

- /BROKER/ - Broker negotiating the contract

- / ELEC/ - Deal has been arranged via an electronic

- means

- /TELEX/ - Deal by TELEX

- /TIME/ - Time of transaction execution

- /VENU/ - Venue of transaction execution

Account With Institution An ‘Account with Institution’ refers to the financial institution, at which the ordering party requests the Beneficiary to be paid. The Account With Institution may be a branch or affiliate of the Receiver, or of the Intermediary, or of the Beneficiary Institution, or an entirely different financial institution. This field corresponds to Field 57A of a SWIFT message. Enter one of the following:- ISO Bank Identifier Code of the bank

- Branch of the Receiver’s Correspondent

- Name and address of the Receiver’s Correspondent

- Other identification codes (for example, account number)

Country Specify the country of the account with institution. This adjoining option list displays all valid country codes maintained in the system. You can choose the appropriate one. For more details on Mantas, refer 'Mantas' interface document.Note:

The country information is captured to enable Mantas to analyze the transactions for possible money laundering activities.Receiver You can specify the final Receiver as apart from the Account With Institution if the Ultimate Beneficiary desires that the payment message should be sent there. If this is not maintained, the Account With Institution becomes the default Receiver. Capture the Sender to Receiver Information in this screen. For more details relating to specific parties, please refer to the SWIFT manuals.

ERI Currency For every Counterparty and 'In' Currency (combination) for which you maintain settlement instructions, you can define an Euro Related Information (ERI) Currency. The ERI Currency can be: - 'In' currency

- Euro

Settlement Through an Instrument or Message When the actual settlement event for a contract (involving the entity) takes place, the payment and receive message details are updated in a message hand-off table. The Messaging system picks up the details from this table, and based on the formats set up, generates the messages.

Parent topic: Settlement Preferences