- Islamic Letters of Credit

- Automatic Processes

- Batch Process

13.3 Batch Process

This topic provides the systematic instructions to display the Batch Process.

- On the Homepage, type EIDMANPE in the text box, and click the next

arrow.

Mandatory Batch Program Maintenance screen is displayed.

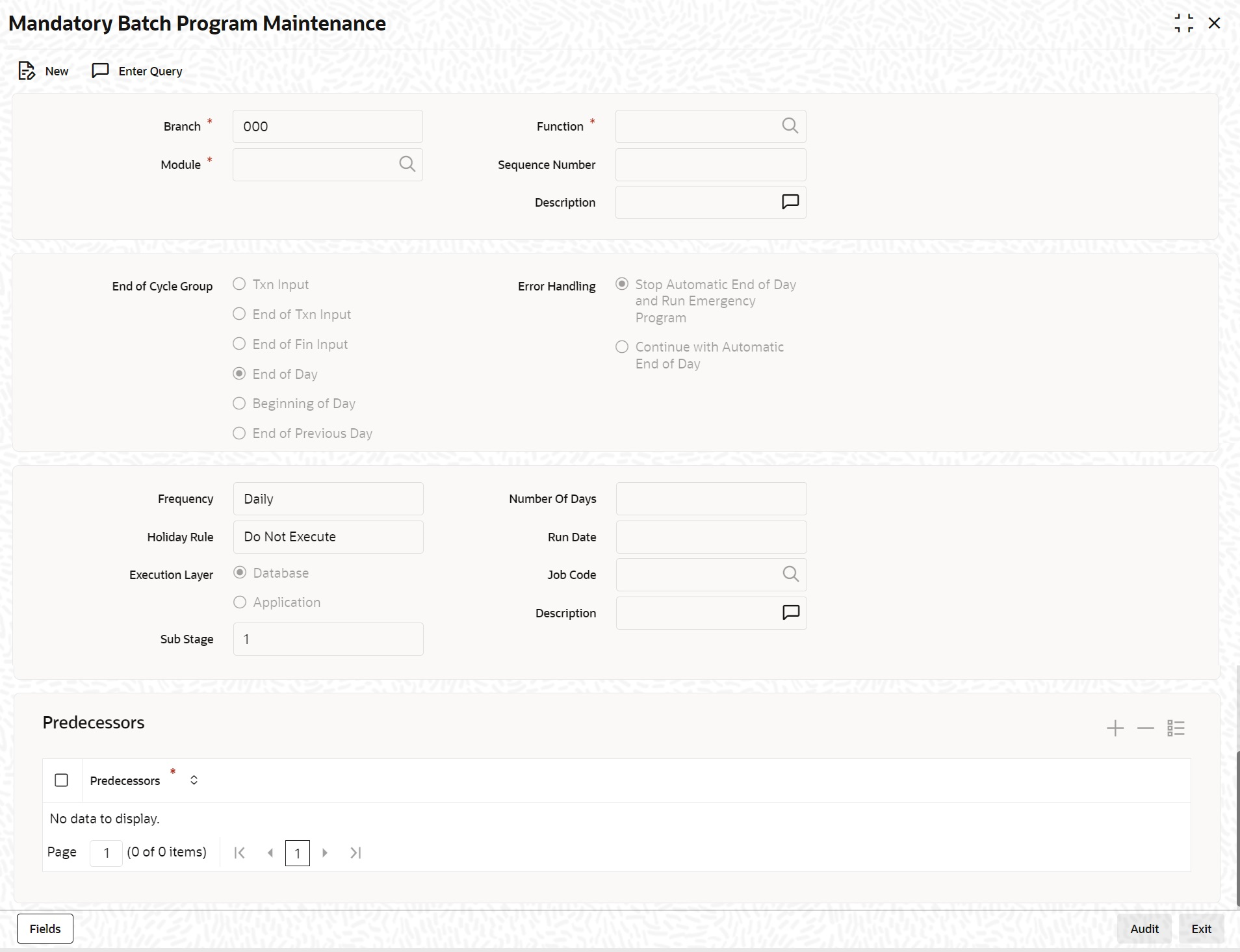

Figure 13-2 Mandatory Batch Program Maintenance

Description of "Figure 13-2 Mandatory Batch Program Maintenance" - On the Mandatory Batch Program Maintenance screen, click New.

- On the Mandatory Batch Program Maintenance - New screen, specify the details as required.

- Click Save to save the details OR

Exit to close the screen.For information on fields, refer to the field description table below:

Table 13-2 Mandatory Batch Program Maintenance - Field Description

Field Description Module This is a Mandatory field. Choose the module code from the adjoining option list.

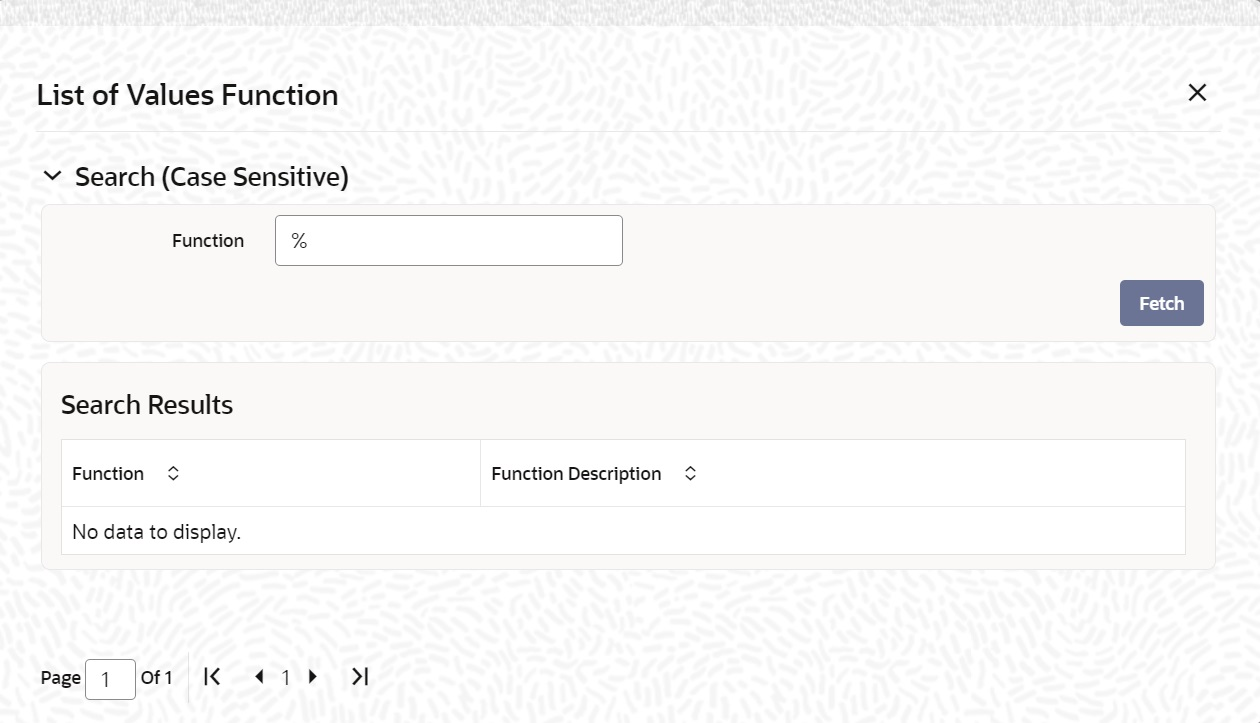

Function Identification Choose the function ID of batch that you wish to run. The adjoining option list displays all batch processes available for the module as shown in Figure 13-3 You can configure the batch to be run at various stages of day like EOD, EOTI etc.

For further details about this screen, refer the chapter ‘Setting- up Mandatory Programs for EOD’ in the AEOD User Manual.

Automatic Events Executed During Beginning of Day (BOD) The Batch program when run as part of BOD processes the following events: - Automatic liquidation of periodic commissions

- Automatic Reinstatement of an Islamic LC

- Calculation of periodic commission

Automatic Liquidation of Periodic Commission The periodic commission components of an Islamic LC is automatically liquidated, if the commission components fall due on or before the current system date. As a part of BOD, this function liquidates the commission components of the Islamic LC contracts, whose commission liquidation date is between the last working date and the current processing date.

The commission components that are liquidated by this function are posted to the accounts specified, in the settlements screen of the Islamic LC. These might be a customer’s accounts or a receivable accounts.

On liquidation of the commission components of an Islamic LC by the function:- The necessary tax related entries associated with the liquidation is passed.

- The necessary debit advices is generated

- The relevant accounting entries is passed. Typically they are

- Table 13-3

- Table 13-4

As a part of EOD, this function liquidates the commission components of all the Islamic LC contracts, for which commission liquidation date falls between the current processing date and the next working date.

If the next working day happens to fall in the next month, this function will pick up only those contracts whose commission liquidation date, falls within the current processing month.

Process Run during End of Day (EOD) All Islamic LC contracts, for which you had specified automatic reinstatement, is reinstated when the batch process for the day, is run as part of BOD. The revolving details specified for the Islamic LC, in the Contract Main screen, are used to reinstate the contracts. The reinstatement is done subject to the Maximum Liability and the Maximum Islamic LC Amount allowed for the contract. The unutilized credit is removed from the contingent entries for non-cumulative Islamic LCs.

For Islamic LCs that revolve in time, the Islamic LC Amount and the Maximum Liability Amount is reset based on the frequency of reinstatement (the value of frequency is either Days or Months depending on the ‘Units’ you specify for the contract). In the case of an Islamic LC, which revolves in value, the Islamic LC amount is reset when the current availability under the Islamic LC is reduced to zero. Thus, the reinstatement for Islamic LCs which revolve in value is done during the beginning of the day on the next day. It is done after the availment that makes the current availability to zero is made.

When Islamic LCs are automatically reinstated, the necessary accounting entries and advices specified for the event code REIN (reinstatement), is passed automatically.

As a part of the BOD process, this function reinstates all the revolving Islamic LCs (specified with automatic reinstatement), which needs to be reinstated. This is determined by two factors:- Whether the Islamic LC revolves in time and the next revolving date is less than or equal to the current date or

- The Islamic LC revolves in value and the unavailed amount under the Islamic LC, is reduced to zero by the availments that were made.

During EOD, the auto reinstatements scheduled for the next day is done under the following conditions:- The next day is a holiday

- You have specified in the Branch Parameters table, that events scheduled for a holiday should be processed, on the working day before the holiday. If the next working day happens to fall in the next month, this function will pick up only Islamic LCs that have their next revolving date within the same month. The processing for such Islamic LCs is done during BOD on the next working day.

All contracts that were automatically reinstated on a day will appear in the Activity Report for the day. The exceptions encountered during the reinstatement i.e. the contracts, which should have got reinstated, but were not, will figure in the Exception Report.

Automatic Closure of an Islamic LC The Batch program when run as part of EOD processes the following events: - Automatic closure of contracts

- Automatic accrual of commissions

Automatic Accrual of Commission All Islamic LC contracts for which you had specified automatic closure and which are due for closure as of today, is automatically closed when the batch processes for the day is run. The accounting entries specified for the closure is passed. Liability Changes Schedule When the batch process is run as part of EOD, the commission components of the active (authorized and not yet liquidated) Islamic LC contracts is accrued. Accrual is usually performed from the last liquidation date to the current date. Since commission is calculated for rounded periods, the final accrual on the expiry date is for the full rounded period. When the accrual is done, the relevant accounting entries for the accrued components is passed. The internal accounts is updated with the accrual related details. Typical accounting entries that are passed include:The level at which accrual entries are passed depends on your definition of branch parameters. To recall, the accrual entries is configured to be passed either at the contract level or the product level.

Either way, the details of accruals for each contract is available in the Accrual Control List.

The details of this report, the procedure for generation and the contents are discussed in the chapter on Reports.- LCEOD Batch enhanced to support

Liability Change Schedule

- To be processed during BOD

- To be processed during previous EOD, if processing date is a holiday

- Guarantees with Liability type as Time based to be processed :

System will initiate Guarantee amendment with decrease in Contract amount when liability type is decrease

System will initiate Guarantee amendment with increase in Contract amount when liability type is increase- New event LAMS introduced to initiate liability change. Processing will be similar to amendment AMND.

- Maintenance:

LAMS event should be defined for applicable products

Accounting entries and Messages should be defined for LAMS event similar to AMND- Processing will be similar to amendment ( AMND ) :

LAMS will be version creation event.

Liability change will be without Beneficiary Confirmation.

Commission will be computed for the increased/decreased ( similar to amendment AMND )

Limit Tracking for increased / decreased amount ( similar to amendment AMND )

Collateral will be collected or refunded ( similar to amendment AMND )

Amendment advice, GUA_AMND_INSTR ( MT767 ) , will be generated

Accounting entries will be generated based on maintenance

Liability change schedules failed will be picked up during subsequent EODs.

Memo Accrual of Commission The memo accrual function does not generate any accounting entries nor does it mark the contracts as accrued. It only computes the accrual amount as it would be computed for a regular accrual and reports the accrued figures, without updating the accrual and P&L accounts. The commission accrued by the function, is reported in the Memo Accrual

Extend Confirmation LCEOD Batch enhanced to support Revoke Confirmation Contigent Entries Reversal - To be processed during EOD

- To be processed during next EOD, if processing date is a holiday

- System will pick the contracts in the EOD which is eligible for revoke confirmation contingent entries reversal.

- Contracts which are eligible is that confirmed contracts which is amended before expiry date and extend confirmation is not checked.

- System also releases the limits for the confirmed amount.

- New event RVCE introduced to initiate Reversal of Conntigent Entries.

- Maintenance:

- RVCE event should be defined for applicable products

- Accounting entries should be defined for RVCE event

- RVCE will be no version creation event.

- Accounting entries will be generated based on maintenance

- For failed contracts it will be picked up during subsequent EODs.

Auto Renewal of Open ended guarantees Open ended guarantees with Auto Renewal enabled will be picked and extended on expiry date as part of LCEOD batch. If the Applicable rule is URDG, the new expiry date is defaulted as 3 years from current expiry date for the islamic guarantees and 3 years 30 days for islamic counter guarantees and 3 years for corresponding local guarantees. If the Applicable rule is not under URDG, the new expiry date is extended by the tenor amount from current expiry date for guarantees, counter guarantees and by local guarantee tenor for corresponding local guarantees. Auto Renewal will be processed similar to amendment of expiry date without beneficiary confirmation. AMND event will be triggered and MT767 will be generated with extension details in 72Z tag.

Figure 13-3 List of values- select functions

Description of "Figure 13-3 List of values- select functions"Table 13-3 Collected in Arrears

Role Role Description Amount Tag Dr/Cr COMM_ CUST_ACC

Customer account Commission Dr CENC Commission Earned Not Collected Commission Cr Table 13-4 Collected in Advance

Role Role Description Amount Tag Dr/Cr COMM_ CUST_ACC

Customer account Accrual amount

Dr COMM_RIA Commission Received in Advance Accrual amount

Cr Table 13-5 Automatic Accrual of Commission - Collected in Arrears

Role Role Description Role Type Amount Tag Dr/Cr CENC Commission earned not collected. Asset Accrual amount

Dr COMM_ INC

Commission earned. P&L Accrual amount

Cr Table 13-6 Automatic Accrual of Commission - Collected in Advance

Role Role Description Role Type Amount Tag Dr/Cr COMM_ RIA

Commission received in advance. Asset Accrual amount

Dr COMM_ INC

Commission earned P&L Accrual amount

Cr

Parent topic: Automatic Processes