- Settlements User Guide

- The Settlements Service

- Process Settlements

- Settlement Details

1.4.1 Settlement Details

This topic provides the systematic instructions to capture the settlement details.

Navigate to Contract Main screen

- On the Contract Main screen, click Settlement.The Settlement Details screen is displayed.

- On the Settlement Details screen, specify the details as required.By default, the settlement details of all components of a contract affecting the customer type of account are displayed in this screen. The following are the Role Types:

- Customer

- Remitter

- Beneficiary

FOR EXAMPLE:As per the maintenance done for a Product the following accounting entries is posted during the initiation of a contract.Accounting entries

Accounting Role Amount Tag Dr/ Cr Indicator ASSETGL PRINCIPAL Debit CUSTOMER PRINCIPAL Debit To achieve this, in the Role to Head mapping sub-screen of the Product Definition screen, you would have mapped the Accounting Role ASSETGL to an actual internal leaf GL of your Chart of Accounts.

However, you would not have maintained such a mapping for CUSTOMER since this is a role whose value gets defined at the contract level based on the counterparty involved in the contract.

While processing a contract, you can modify the following information about Settlements:- Account Details, (details about the accounts involved in the contract or deal; that have to be either debited or credited in your branch)

- Message Details (payment details -- whether settled by an instrument or a messaging service such as SWIFT)

- Party Details, (details about the various parties/banks involved in the transfer of funds to the Ultimate Beneficiary).

- Other Details, (the default values for fields in MT 103 messages for the contract).

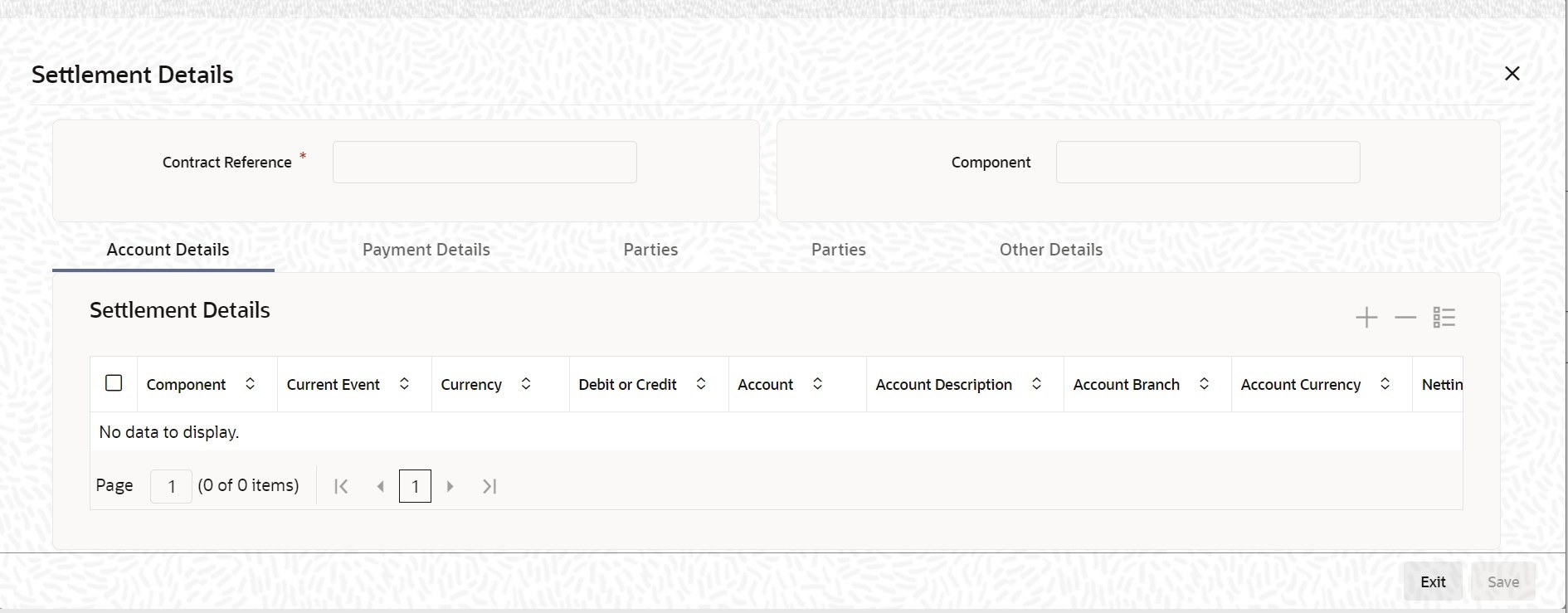

- On the Settlement Details screen, click Accounting Details.The Settlement Details screen with Accounting tab details is displayed.

Figure 1-8 Settlement Details - Accounting Details

- On the Accounting Details tab, specify the details as required.

- Click Ok to save the details OR Exit to close the screen.The Account Details that get defaulted include the following:

- Component and its Currency

- Payment Account and its Currency

- Branch of your bank to which the account belongs.

For information on fields, refer to Table 1-8:Note:

If settlement instruction is not defined for the customer, then the system will always default the Nostro accounts based on the settlement instruction set. Change the settlement account branch and settlement account for charge component in case change or waiver at the contract level.Table 1-8 Account Details - Field Description

Field Description Current Event Current event of settlements will be checked for the amount tags pertaining to the current event and will be unchecked for the amount tags not pertaining to the current event. Account Description The system displays a brief description on account. Netting Indicator In addition to maintaining a netting agreement for each counterparty, you have to specify whether or not the contract is under the netting agreement for each contract involving the counterparty. Check this box to indicate that you would like to enable the Netting option for the various components (Amount Tags) involved in the transaction. These components could be commission, interest, tax, charges etc.

Rate Code Specify rate code by selecting the appropriate rate code from the selection list. Following values are available: - Buy

- Sell

- Mid

Note:

In case of charges, if charge currency and settlement currency are different, the system applies mid-rate.Spread Definition Select the spread definition from the adjoining drop-down list. The options available are: - Point

- Percentage

Customer Spread This defaults from your specification of tenor-wise spread for the relevant Currency Pair in the Customer Spread Maintenance screen. You can change this for a specific contract. Original Exchange Rate If the component currency is different from the account currency, the system requires an exchange rate for the conversion. The components of the final exchange rate used for conversion are: - The Base Rate – this defaults from the exchange rate that you have maintained for the currency pair involved. It computes as Mid Rate +/- Spread (depending on whether it is the Buy Spread or the Sell Spread).

- The Customer Spread - the spread that you have maintained for the specified Counterparty, Currency Pair and Tenor combination in the Customer Spread Maintenance screen is picked up and applied for the customer involved in the deal.

The method of spread definition, whether percentage or points is also displayed.Note:

If Customer Spread details for a specific counterparty (for the currency pair) are unavailable, the System looks for the customer spread maintained for the wild card ALL entry. If even that is not available, then the Customer Spread defaults to zero.Note:

If you have specified an account that uses an accounting class that is restricted for the product, an override is sought when you attempt to save the contract.Exchange Rate For transactions involving any relationship pricing benefit scheme, the customer-specific exchange rate derived by adding the original exchange rate and the customer spread maintained for the relationship pricing scheme, gets displayed here. If Relationship Pricing is not applicable, Exchange Rate will be the same as the Original Exchange Rate.

For more details on customer-specific exchange rates, refer to the section titled ‘Specifying Pricing Benefit Details’ in the Relationship Pricing user manual.

Negotiated Cost Rate The system defaults the negotiated cost rate. Negotiation Reference The system displays the negotiation reference here. Generate Message Enable this option if a payment message has to be generated for the settlement instruction. IBAN Account Number The system displays the IBAN Account Number. Euro Currency and Euro Amount SWIFT messages (MT103/MT202) generated towards a settlement can furnish the value of the settlement amount in both the settlement account currency and a Euro Related Information (ERI) currency of your choice. If you opt to furnish the ERI value of the amount, you have to enter the following in this screen:- The ERI currency

- The ERI Amount

You can change the default ERI currency. The ERI amount that you specify will be validated against the Tolerance Limit specified for the ERI currency (in the Currency Maintenance screen).

Suppressing Settlement Messages Settlement messages, defined for components that fall due, will be generated automatically when the settlement happens for the respective component. You can delete the generation of the settlement message, defined for a component, by clearing the check-box in the ‘Gen Message’ field. Note:

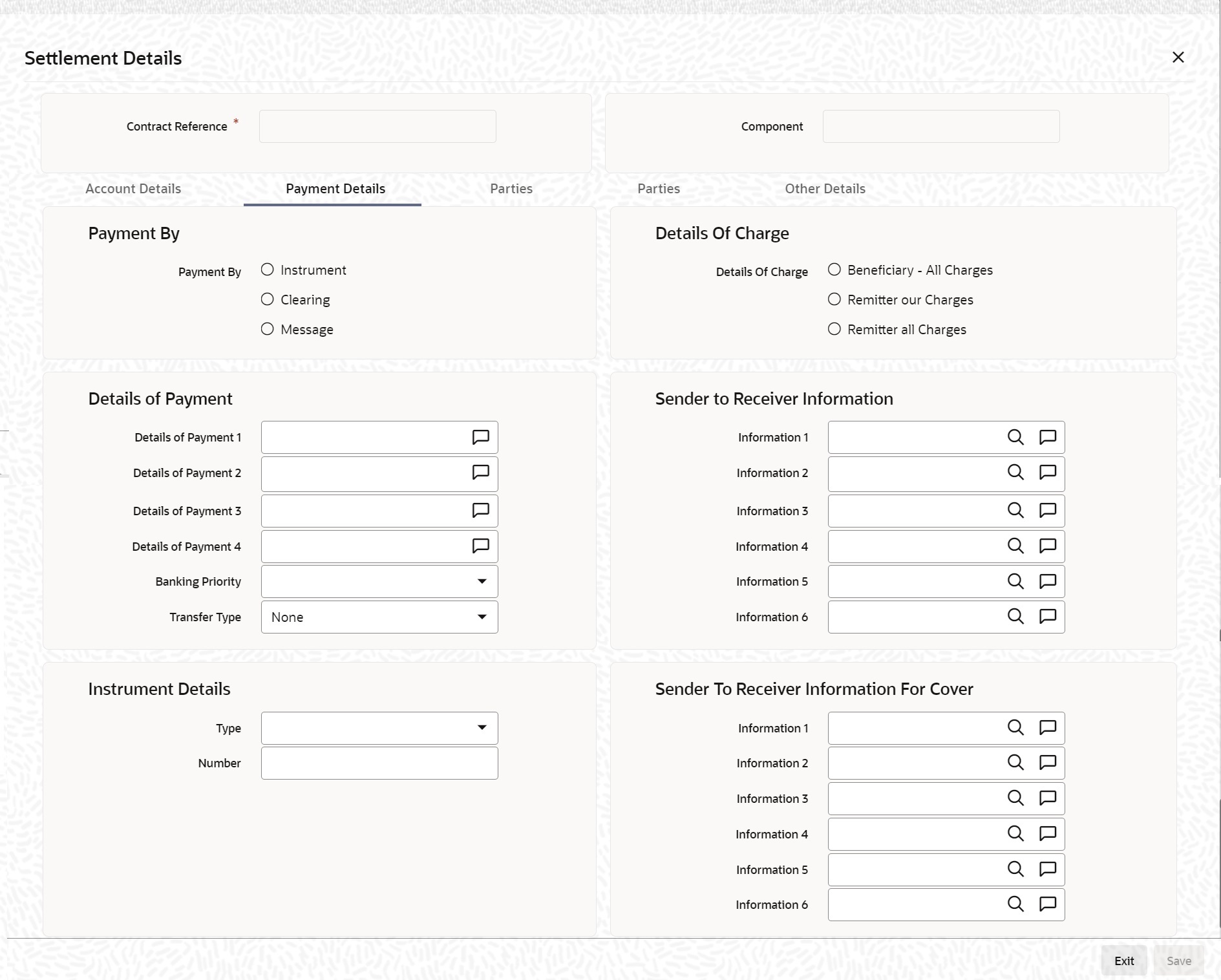

If a paid component in the credit account chosen becomes the paid account. Similarly, if a component is to be received, the debit account chosen becomes the receiving account in the settlement maintenance. - On the Settlement Details screen, click Payment Details.The Settlement Details with Payment Details is displayed.

Figure 1-9 Settlement Details - Payment Details

- On Payment Details tab, specify the details as required.

- Click Ok to save the details OR Exit to close the screen.

For information on fields, refer to Table 1-9:

Table 1-9 Payment Details - Field Description

Field Description Payment By Indicate the method of payment for both Outgoing as well as Incoming Payments, for a Branch, Account and Currency combination. The following options are available: - Instrument (settlement is done through a Check, MCK etc.)

- Message (payment is made utilizing a SWIFT Message)

- Clearing (the transaction is a local payment transaction, and the settlement is routed through the Clearing House of the bank)

No payment message is generated for settlements routed through a Clearing House.Note:

You can indicate the payment method as ‘Clearing’ only, If the payment currency is the local currency of the branch, If it is one of the clearing currencies defined for the branch, If you have selected ‘*.*’ in the currency field.Depending on the method in which you want to settle the contract, you

should specify either Instrument or Message details.Details of Charge In this section, you can maintain details of the party who will bear the charges incurred in processing the transaction. It could be either: - Remitter – All Charges

- Beneficiary – All Charges

- Remitter – Our Charges

Note:

Remitter – All Charges - Corresponds to ‘OURS’ in Field 71 A of SWIFT MT 103 /103+.

Beneficiary – All Charges - Corresponds to ‘BEN’ in Field 71 A of SWIFT MT 103 /103+.

Remitter – Our Charges - Corresponds to ‘SHA’ in Field 71 A of SWIFT MT 103 /103+.

Details of Payment Here you can specify the information, from the Ordering Party to the Beneficiary Customer, about the reason for the payment. This field can contain reference numbers, invoice numbers or any other details, which will enable the Beneficiary to identify the transaction. This information is passed through the payment chain to the Beneficiary. This field corresponds to field 70 of S.W.I.F.T. Refer to the S.W.I.F.T. manual for details on the code words and the format of the message you can input. Banking Priority Select the priority of the payment messages from the drop-down list. The options available are: - Highly Urgent

- Urgent

- Normal

Sender to Receiver Information (Information 1,2,3,4,5 and 6) This could be instructions or additional information for the Receiver, Intermediary, Account with Institution or Beneficiary Institution. This field corresponds to field 72 of the S.W.I.F.T. message. The format of

the message depends on the type of S.W.I.F.T. message that is generated.Refer to the S.W.I.F.T. manual for details on the format of the message and

the code words to be used.Instrument Details If you opt to settle a contract with an instrument, you should specify the type of instrument that you would use. For example, you could settle a contract using a Manager’s Check, a Check or a Demand Draft. You should also specify the number that identifies the instrument. This number is printed on the instrument. If the settlement is through an instrument, you cannot specify party details.

Sender to Receiver Information for Cover (Information 1,2,3,4,5 and 6) This could be instructions or additional information for the Receiver, Intermediary, Account with Institution or Beneficiary Institution. This field corresponds to field 72 of the S.W.I.F.T. message. The format of the message depends on the type of S.W.I.F.T. message that is generated.

Refer to the S.W.I.F.T. manual for details on the format of the message and the code words to be used.

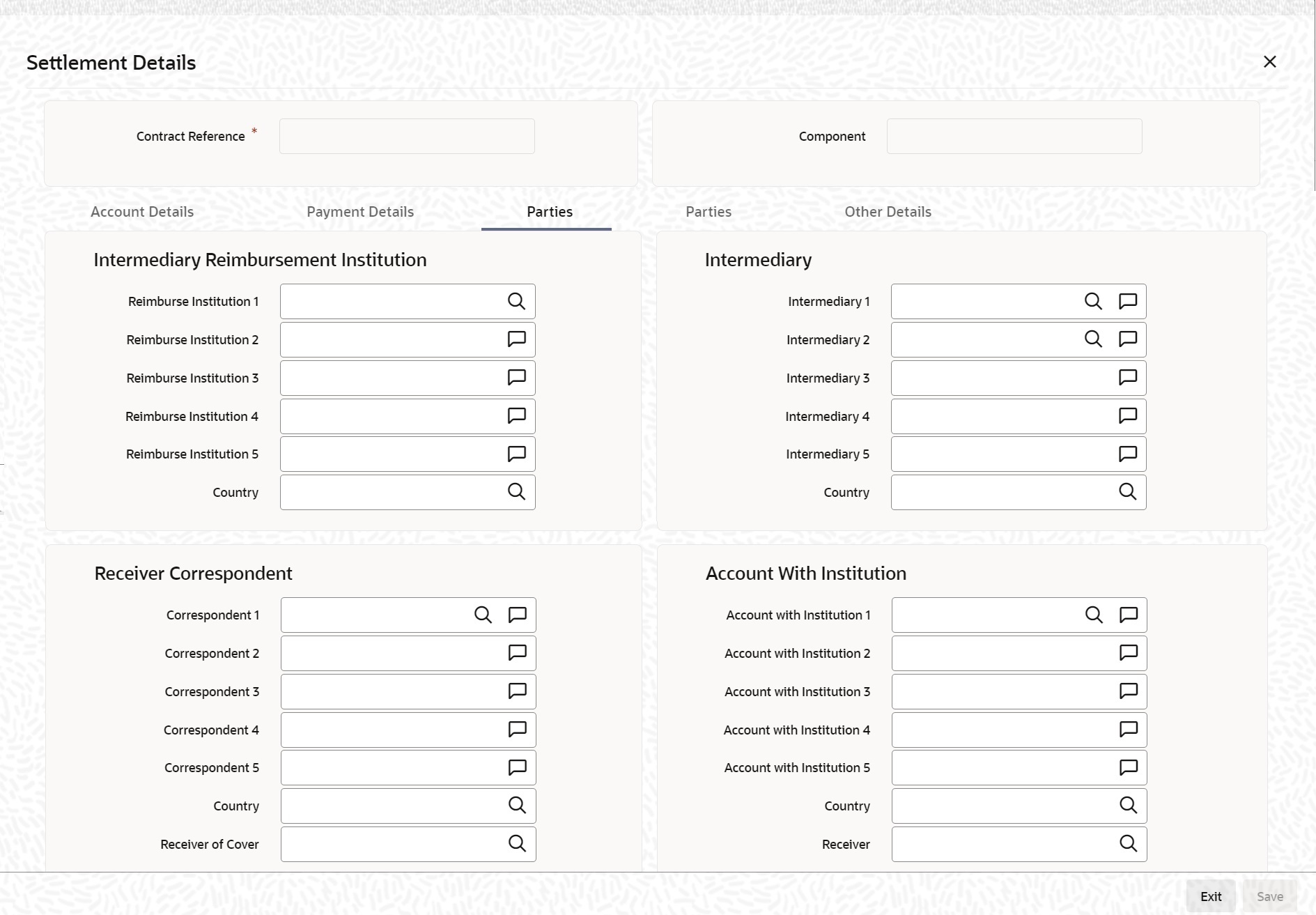

- On the Settlement Details screen, click Parties.The Settlement Details screen - Parties Tab details is displayed.

Figure 1-10 Settlement Details Screen - Parties Tab

- On the Parties tab, specify the details as required.

- Click Ok to save the details OR Exit to close the screen.

When you settle a contract, funds may have to pass through a series of banks before it reaches the Ultimate Beneficiary. In the Parties screen, you can capture details of all parties involved in a contract.

These screens contain fields that can capture details of all the possible parties through whom the funds involved in a contract can pass. Depending on the type of contract you are processing, and the number of banks involved, you should enter details in these screens.

For information on fields, refer to: Table 1-10.

Table 1-10 Parties Tab - Field Description

Field Description Intermediary Reimbursement Institution An Intermediary Reimbursement Institution is a financial institution between the Sender’s Correspondent and the Receiver’s Correspondent, through which the reimbursement of the funds will take place. Country Specify the country of the intermediary reimbursement institution. This adjoining option list displays all valid country codes maintained in the system. You can choose the appropriate one. Intermediary The Intermediary contract refers to the financial institution, between the Receiver and the ‘Account with Institution’, through which the funds must pass. The Intermediary may be a branch or affiliate of the Receiver or the ‘Account With Institution’, or an entirely different financial institution. This field corresponds to field 56a of SWIFT. Here you can enter either the:

- ISO Bank Identifier Code of the bank

- Name and address of the Bank

Country Specify the country of the intermediary institution. This adjoining option list displays all valid country codes maintained in the system. You can choose the appropriate one. Receiver Correspondent The Receiver’s Correspondent is the branch of the Receiver or another financial institution at which the funds will be made available to the Receiver. This field corresponds to field 54a of SWIFT. You can enter one of the following: - ISO Bank Identifier Code of the bank

- The branch of the Receiver’s Correspondent

- Name and address of the Receiver’s Correspondent

Country Specify the country of the Receiver’s correspondent. This adjoining option list displays all valid country codes maintained in the system. You can choose the appropriate one. Account with Institution An Account with Institution refers to the financial institution, at which the ordering party requests the Beneficiary to be paid. The ‘Account with Institution’ may be a branch or affiliate of the Receiver, or the Intermediary, or of the Beneficiary Institution, or an entirely different financial institution. This field corresponds to field 57a of SWIFT. You can enter one of the following: - ISO Bank Identifier Code of the bank

- The branch of the Receiver’s Correspondent

- Name and address of the Receiver’s Correspondent

- Other identification codes (for example, account number)

Country Specify the country of the account with the institution. This adjoining option list displays all valid country codes maintained in the system. You can choose the appropriate one. Note:

The country information is captured to enable Mantas to analyze the transactions for possible money laundering activities. For more details on Mantas, refer 'Mantas' interface document.Receiver of Cover Specify the details of the Receiver of the cover message, which can be any one of the following: - ISO Bank Identifier Code of the bank

- Branch of the Receiver

- Name and address of the Receiver

- Other identification codes (for example, account number)

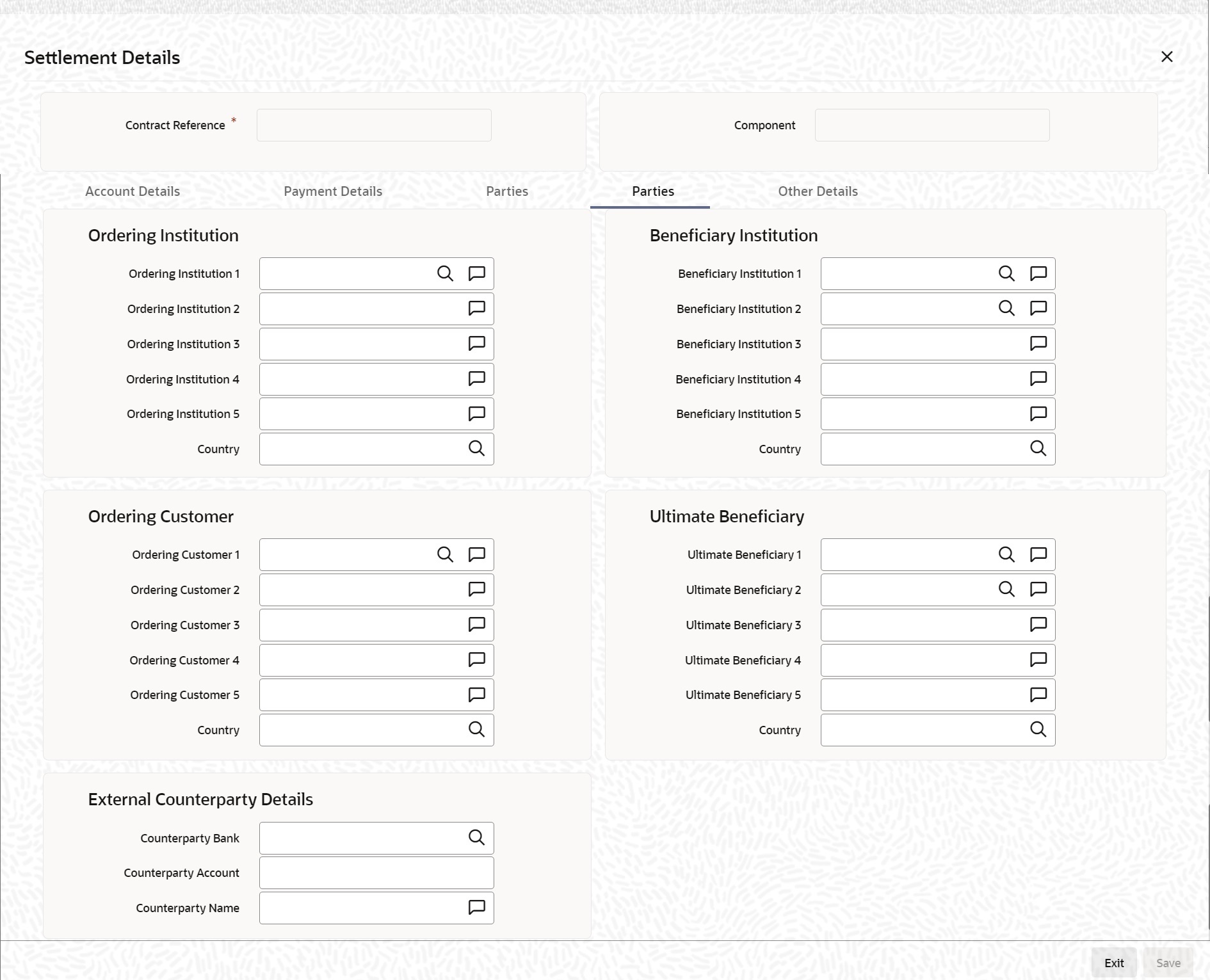

- On the Settlement Details screen, click Parties.The Settlement Details screen with Parties tab details is displayed:

Figure 1-11 Settlement Details Screen - Parties Tab

- On the Parties tab, specify the details as required.

- Click Ok to save the details OR Exit to close the screen.For information on fields, refer to Table 1-11:

Table 1-11 Parties - Field Description

Field Description Ordering Institution The Ordering Institution is the Financial Institution, which is acting on behalf of itself, or a customer, initiating the transaction. This field corresponds to 52a of SWIFT. In this field, you can enter one of the following: - The ISO Bank Identifier Code of the Ordering Institution

- The branch or city of the Ordering Institution

- The Name and address of the Bank

Country Specify the country of the ordering institution. This adjoining option list displays all valid country codes maintained in the system. You can choose the appropriate one. Ordering Customer The Ordering Customer refers to the Customer ordering the transfer. Here, you can enter the name and address or the account number of the Customer, ordering the transaction. This field corresponds to field 50 of SWIFT. You will be allowed to enter details in this field only if you have initiated a customer transfer (MT 103 and MT 102). In case of a MT 910, a credit confirmation message, the first line should contain number ‘1’ in option F of field 50. Country Specify the country of the ordering customer. This adjoining option list displays all valid country codes maintained in the system. You can choose the appropriate one. Beneficiary Institution Here, you can enter details of the institution in favor of which the payment is made. It is, in reality, the bank, which services the account of the Ultimate Beneficiary. This is applicable only in the case of bank transfers and not for customer transfers. This field corresponds to field 58a of SWIFT. You will be allowed to make entries into this field only for Bank Transfers (when the remitter and beneficiary of the transfer are financial institutions –MT 202). Here you can enter either:- The ISO Bank Identifier Code of the Beneficiary Institution

- The Name and Address of the Beneficiary Institution

Country Specify the country of the beneficiary institution. This adjoining option list displays all valid country codes maintained in the system. You can choose the appropriate one. Ultimate Beneficiary The Ultimate Beneficiary refers to the Customer to whom the amount of the component paid. This field refers to field 59 (is this now 59A) of SWIFT. You can make entries into this field only for a customer transfer (MT 103 or MT 100). This would not be applicable for Bank Transfers, only for Customer Transfers. You can also select an ultimate beneficiary account from the option list provided. Upon selection of the account, the Account with Institution of the selected ultimate beneficiary will appear by default in the AWI field in the Parties 1 tab. If no selection is made for AWI in the Parties tab one screen, then all accounts of ultimate beneficiaries existing in the system appear for selection.

Country Specify the country of the ultimate beneficiary. This adjoining option list displays all valid country codes maintained in the system. You can choose the appropriate one. The country information is captured to enable Mantas to analyze the transactions for possible money laundering activities.

External Counterparty Details Select the Counterparty Bank from the option list provided. All the Counterparty Accounts about this Bank will appear for selection. On selecting the Counterparty Account, the system will default the Counterparty Name as maintained for that account. If at the time of selecting Counterparty Account, Counterparty Bank is Null, then the Counterparty Bank will also appear by default. For processing direct debits, you will also need to capture the Agreement ID of the counterparty to facilitate a cross-referencing between the Payment and the Direct Debit instruction when a reversal of Payment is carried out due to rejection of the outbound DD.

For more details on Mantas, refer 'Mantas' interface document.

When the SWIFT message is captured in the 'Settlement Message Details – Parties' screen, the system will display the parties involved in the transaction based on the values that come in the fields 52, 54, 55, 56, 57 58 etc. However, you can change the parties by choosing the appropriate value from the respective option lists. In case of the messages MT 103, MT202 and MT210, the option lists will display only those BICs for which the option 'BEI Indicator' is unchecked in the 'BIC Code Maintenance' screen. However, you can manually enter a BIC for which the option 'BEI Indicator' is checked. During message generation, the system will replace the BIC with the corresponding name and address of the party.

The number of banks/intermediaries involved in the transfer would, in practice depend on the:- Relationships and arrangements between the sending and receiving banks

- Customer instructions

- Location of parties

- The banking regulations of a country

Note:

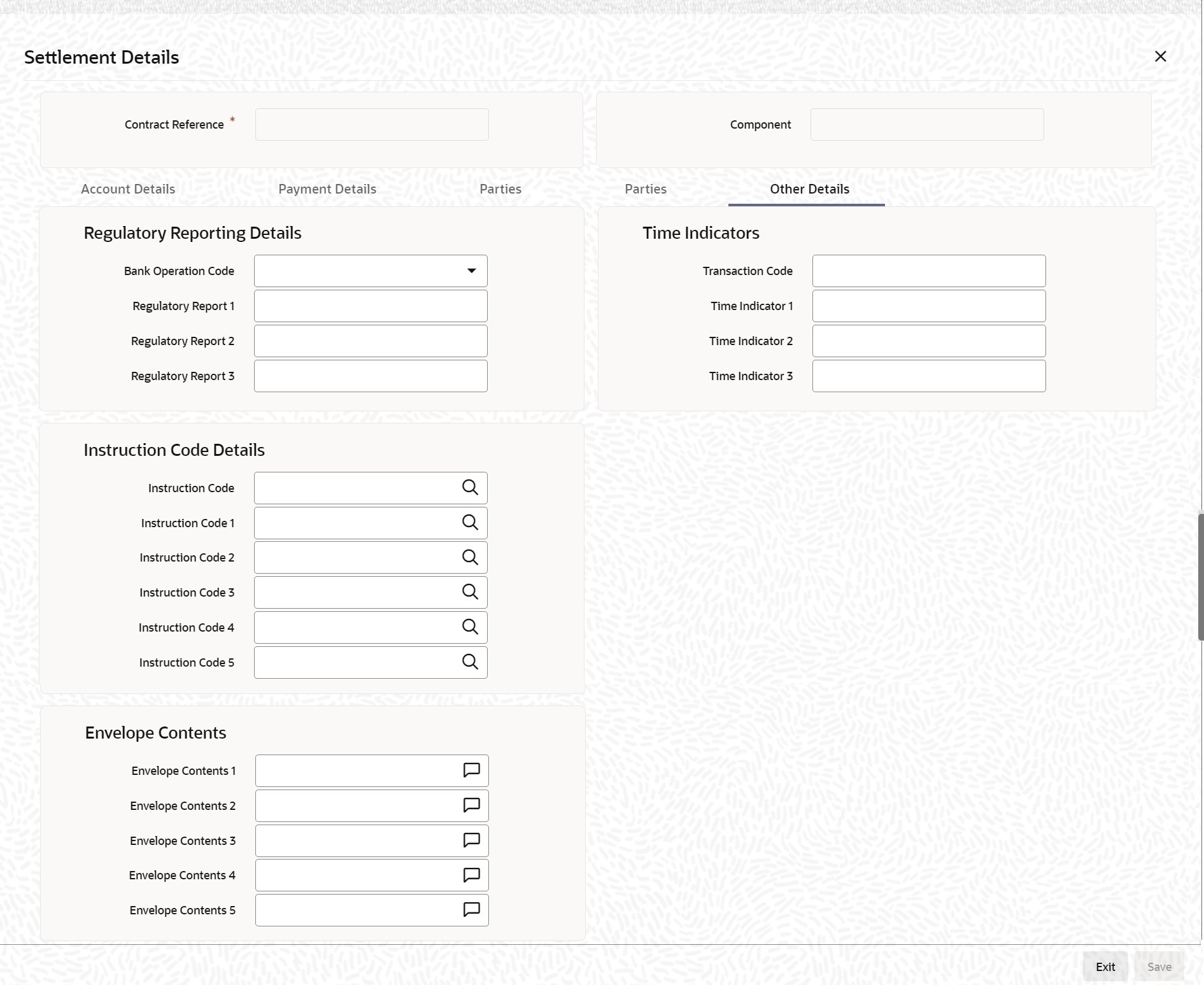

During the life-cycle of a contract, you will be allowed to amend the details of a Settlement. Instruction only for those components which are yet to be settled. - On Settlement details screen, click Other details.Settlements details with Other details is displayed.

Figure 1-12 Settlements details - Other details

- On the Other details tab, specify the details as required.

- Click Ok to Save the details OR click Exit to close the screen.For information on fields, refer to Table 1-12:

Table 1-12 Other Details - Field Description

Field Description Bank Operation Code You can indicate the bank operation code inserted in Field 23B of the MT 103 message. The options available are SPRI, SSTD, SPAY and CRED. Transaction Code This is the code for the transaction type. This field corresponds to field 26T of the MT103 message. Instruction Code 1, 2, 3, 4 and 5 You can indicate the Instruction code inserted in Field 23E of the MT103 message. You can specify a maximum of six instructions codes here. However, you cannot repeat any code that has already been specified. The options available are:- CHBQ

- TELE

- PHON

- PHOI

- REPA

- INTC

- TELI

- SDVA

- PHOB

- TELB

- HOLD

- CORT

Instruction Code Description You can specify the additional information, if any, which is inserted to qualify multiple Instruction Codes in Field 23E of the MT103 message. The instruction code description is maintained for the following instruction codes: - PHON

- PHOB

- PHOI

- TELE

- TELB

- TELI

- HOLD

- REPA

For instance, if the Instruction Code is REPA and the description is ‘Repayment’ then the text ‘REPA/Repayment’ is inserted in Field 23E.

Regulatory Reporting Details Specify the Regulatory Reporting Details. The entered value is inserted in Field 77B of the MT103 message. Time Indicators Time Indication, specifies one or several time indication(s) related to the processing of the payment instruction. Select the time indication code from the following values available in the options list: - /CLSTIME/ - Time by which funding payment must be credited, with confirmation, to the CLS Bank's account at the central bank, expressed in CET

- /RNCTIME/ - Time at which a TARGET payment is credited at the receiving central bank, expressed in CET

- /SNDTIME/ - Time at which a TARGET payment is debited at the sending central bank, expressed in CET

Parent topic: Process Settlements