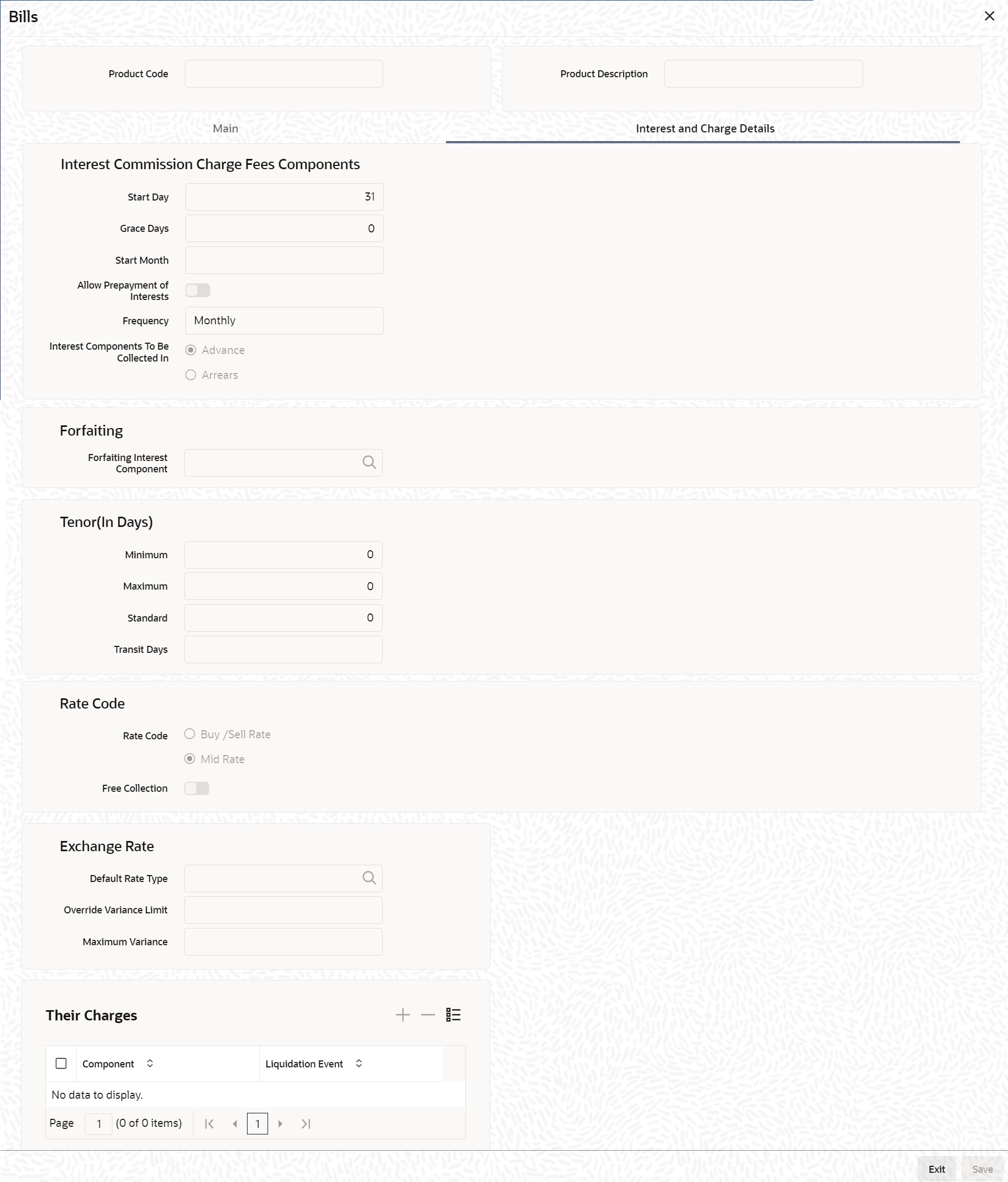

3.2.5.1 Interest and Charge Details Tab

This topic provides the systematic instructions to capture the interest and charge details.

Navigate to Preference screen under Bills and Collections Product Definition screen.

- On Preference screen, click Interest and

Charge Details tab.Bills and Collections Product Definition screen with the Interest and Charge Details tab is displayed.

- On Interest and charges Details screen, specify the details as required.

- Click Ok to save the details or

Exit to close the screen.For information on fields, refer to: Table 3-16

Table 3-16 Interest and charges Details - Field Description

Field Description Frequency Apart from the bill amount, a bill can have other components, such as interest, charges. They accrue over the tenor of the bill. The frequency, at which these components are accrued, specified as a Product Preference. The attributes of the other components are defined in the ICCB sub-system of Oracle Banking Trade Finance. The frequency with which the components are accrued specified in this screen.

The system carries out automatic accruals at the frequency specified by you, as part of the End of Cycle processing. If the accrual date falls on a holiday, the accruals are done as per your holiday handling specifications in the Branch Parameters screen:

You could have specified that automatic events for a holiday(s) are processed on a working day before the holiday. The accruals falling due on holiday (s) is processed during End of Day processing on the last working day before the holiday.

You could have specified that the automatic events for a holiday(s) are processed on a working day following the holiday; the automatic events falling due on holiday (s) will be processed on the next working day, during the Beginning of Day processing.The one of the following frequency:- Daily

- Monthly

- Quarterly

- Half yearly

- Yearly

In the case of monthly, quarterly, half-yearly or yearly accruals, you should specify the date on which the accruals are done during the month. For example, if you specify the date as 30, accruals will be carried out on that day of the month, depending on the frequency.

Fix the accrual date for the last working day of the month, you should specify the date as 31 and indicate the frequency. If you indicate the frequency as monthly, the accruals are done at the end of every month. That is, on 31st for months with 31 days, on 30th with 30 days and 28th or 29th, as the case, for February.

Specify the frequency as quarterly and fix the accrual date as 31, the accruals are done on the last day of the month at the end of every quarter. It works similarly for half-yearly and yearly accrual frequency.

If you set the accrual frequency as quarterly, half-yearly or yearly, you have to specify the month in which the first accrual has to begin along with the date.

For example, you have selected the half-yearly option, specified the start date as 31 and the start month as of June. In this case, the system will make the first accrual on June 30, 1999, for the period from January 1 to June 30, 1999. The second accrual will be on December 31, 1999, for the period from July 1, 1999, to December 31, 1999.

Start Day In the case of monthly, quarterly, half-yearly or yearly accruals, you should specify the date on which the accruals are done during the month. For example, if you specify the date as 30, accruals will be carried out on that day of the month, depending on the frequency Start Month Set the accrual frequency as quarterly, half-yearly or yearly, and specify the month in which the first accrual has to begin along with the date. Grace Days The grace period specifies the period after the repayment date, within which the penalty interest (if defined for the product) will not be applied, even if the repayment is made after the due date. This period is defined as a specific number of days and will begin from the date the repayment becomes due. Penalty interest will be applied, on a repayment made after the grace period. The penalty interest will be calculated for the entire period it has been outstanding (that is, from the date the payment was due). For example, The repayment on Mr Sam Brown’s bill is due on June 15, 1999. You have specified a grace period of 5 days, after which a penalty interest of 2% will be imposed.

Bill repayment made within the grace period

Now, if Mr Brown makes the payment on June 18, which falls within the grace period, he will not have to pay penal interest

Bill repayment made after the grace period

But if he makes the payment after the expiry of the grace period, that is, after June 20, then he will be charged penal interest starting from June 16 (the repayment date) and not from June 20, the day the grace period expires.

Interest Components to be collected in Specify the interest collected in one of the following ways: Advance - When interest is to be collected in advance, it will be collected at the time of initiating the bill.

For example, you have purchased a bill on Jan 10th and set it up as having interest to be collected in advance.

In this case 10th is the transaction date of the bill. Therefore, the interest amount due on the bill is collected on Jan 10th.Note:

If you opt to collect interest in advance; Also, specify the discounting method applicable on the bill. This is discussed in the section titled Specifying the Discounting Method of this chapter.Arrears - If the interest component of a bill is to be collected in arrears, the interest is collected on the maturity date of the bill.

For example, you have discounted a bill on 10 January 1999, which matures on 31 April 1999. You have specified that the bill is to be collected in arrears.

In this case, on 31 April 1999, which is the expiry date of the bill, the interest amount due on the bill, will be collected.

Allow Prepayment of Interest If this option is checked at the product level, payment of interest is allowed even before the due date is reached. Capturing Forfaiting Details Here you need to capture the interest component.

Forfaiting Interest Component For bills that forfaite, you need to specify the interest component at the product preference level. The adjoining option list displays all the interest components (except the main interest component) attached to the product. Select the appropriate one. Specify the interest collection preference in the Interest Component screen. To invoke this screen, click the Interest button in the Bills and Collections – Product Preferences screen.

Specifying Tenor Details Set the Standard, Minimum and the Maximum limits for tenor based bills. The tenor details specified for a bill product, is always expressed in days. Maximum Fix the maximum tenor of a product; The tenor of the bills involving the product should be less than or equal to the Maximum tenor specified Minimum Fix the minimum tenor of a product; The tenor of the bills involving the product should be greater than or equal to the Minimum tenor specified. Standard The standard tenor is the tenor that is normally associated with a bill, involving a product. The standard tenor of a bill is always expressed in days and will apply to all bills involving the product. If you do not specify any specific tenor while processing a bill, the standard tenor applies to it. The standard tenor applied on a bill changed during bill processing. Create a product with the standard tenor as zero. While processing a bill involving such a product, you will need to specify the maturity and the expiry date of the bill.

If you attempt to save the bill without entering the expiry or maturity date, prompted for an override.

For example, you have defined a billing product to cater to tenor based discounted bills. The minimum tenor specified for this product is 100 days, and the maximum tenor is 1000 days. You have also specified a standard tenor that is 500 days.

For this product, process bills with a tenor between 100 and 1000 days. As you have specified the standard tenor as 500 days, by default, a bill involving this product will have a 500-day tenor. At the time of processing the bill, change this tenor to any period between the Minimum and Maximum tenor limits specified.

Transit Days The transit days used to compute the maturity date of the bill. Enter the transit days for the bill. The system does not allow you to save the record in case the transit day exceeds the standard tenor. Specifying Rate Code Details Enter the following details:

Mid Rate or Buy/ Sell Rate If it is a cross currency bill the exchange rate that has to be used for conversion mentioned as MID/BUY/SELL rate. Select Mid Rate option if you want to specify the exchange rate as Mid rate. Select ‘Buy/Sell Rate’ option if you want to specify Buy/Sell rate for exchange. Note:

In case of charges, if the charge currency and the settlement currency are different, system applies ‘Mid Rate’.Free Collection Check this option if you wish to use the product for free collection. Specifying Exchange Rate Related Details Capture the details regarding the exchange rate here.

Default Rate type Specify the exchange rates that are to be picked up and used for, liquidating the Bill Amount, Interest and Charge components of a bill. Indicate that the standard rate prevailing, as of the issue date of the bill used. Also, specify an exchange rate of your choice. The possible values for the rate pickup are:- As per Standard rate

- As input in the contract

If you specify as input in the contract, then the system computes the components of the bill, based on your input in the Exchange rate field, in the Bills Contract Main screen.

If you choose as per standard rate, the system computes the applicable components, by picking up the exchange rates as of the transaction date, from the Currency table maintained in the Core Services module of Oracle Banking Trade Finance.

Override Variance Limit For a Bills product, specify the exchange rate type to be used to process the bill amount, the interest, charge or fee components of the bill. At the time of entering a contract involving a product, you have the option of, changing the exchange rate defaulted from the product and specifying an exchange rate, of your choice. The exchange rate variance is applicable only if you have decided to change the standard rate defaulted from the currency table, and if the contracts linked to the product involve foreign currency. Specify the minimum and maximum limit by which the exchange rate entered for contracts involving this product can exceed the standard exchange rate. In the Override Variance, Limit field specifies the minimum percentage over which exceed the normal exchange rates.

Maximum Variance In the Maximum Variance, field specifies the maximum percentage upto, which can exceed the normal exchange rate. For example, let us assume that for a product you have specified the override range to be between 7% and 30%. In such a case the entries in these fields would read:- Rate Override Limit - 7%

- Rate Stop Limit - 30%

You enter a bill involving this product. This is a cross currency contract and involves the American and the Australian dollar. Also assume that the Standard mid-rate for the currency pair is 1.25. If you wish to override the existing rates for the currency pair, the permissible override would range between 7% and 30%. We shall examine the three possible situations that encounter.

Below the override limit - Let us assume that for the bill, you have specified the exchange rate as1.2. Here the exchange rate exceeds the standard rate by 4%. The bill will be processed.

Within the override limit - In this case, let us now assume that you had specified the exchange rate to be 2.0. Here you have exceeded the standard rate by 20%. You will be prompted to confirm the override. If you confirm the override, the bill will be processed using these rates.

Above the override limit - Let us assume a situation in which you have specified the exchange rates to be 2.5. In this case you have exceeded the standard rate by 100%. An error message will be displayed and you will not be allowed to continue with processing the bill, until the exchange rate you specify is within the permissible limit of 7-30%.

Their Charges Define the charge component for the charges that are due to the counterparty bank.

Parent topic: Preferences