3.2.13 Status

This topic provides the systematic instructions to capture the Status details.

Navigate to Bills and Collections Product Definition screen.

- On Bills and Collections Product Definition screen,

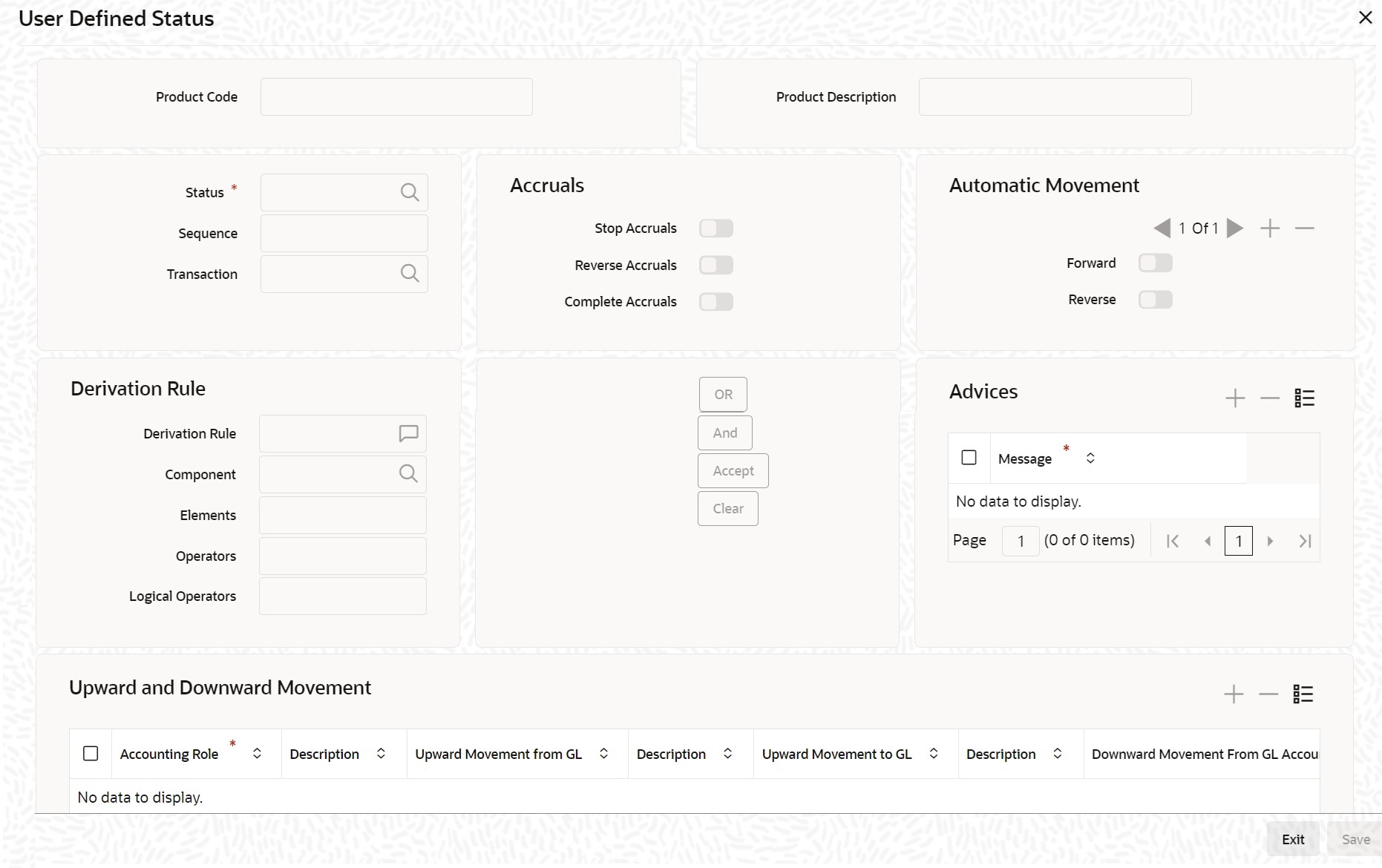

click Status.User Defined Status screen is displayed.

- On User Defined Status screen, define attributes for

each status through the User Defined Status Maintenance screen.These attributes are:

- The number of days for which a bill should stay in a particular status, after its repayment date has been reached.

- Whether the GL under which it is reported should be changed when there is a status change.

- The new GL under which it should be reported.

For information on fields, refer to: Table 3-21Table 3-21 User Defined Status - Field Description

Field Description Status This is the sequence in which, a bill should move to the status you are defining. Usually, more than one status is defined for a product. In this context, you should indicate the sequence in which a bill moves from status to status. You Can specify the number of days after a repayment falls due that a component has to be moved to the status you are defining.

Incase of a component for which repayment is due, specify the number of days after the Maturity date, on which the component should be moved, to the status being defined.

For example, you define the following status for the product, Export Bills Discounted - 45 days:- Past Due Obligation (PDO)

- Non-accrual basis (NAB)

- Write-off (WO)

You want a bill under this product, to move from one status to another in the order in which they are listed above.

For such a condition, the status sequence has to be defined as follows:- PDO - 1

- NAB - 2

- WO - 3

Based on the default number of days defined for each component, a bill will first move from Active status to PDO, then to NAB and lastly to WO status.

Transaction When the GL under which a component is reported is changed along with the status of a bill, an accounting entry is passed. This accounting entry will be to transfer the component from one GL to another. A Transaction Code is associated with every accounting entry in Oracle Banking Trade Finance. You should indicate the Transaction Code to be used for the GL transfer entries, involved in the status change.

Stop Accrual Indicate that accruals (on all accruable components of the bill), should be stopped, when the bill moves to the status being defined. By doing so, ensure that your Receivable accounts, for interest and other components, are not updated for a bill on which repayment has been defaulted. For example,

In our example of Export Bills Discounted - 45 days, the following status codes are involved:- Past Due Obligation (PDO).

- Non-accrual basis (NAB).

- Write-off (WO).

For this product, specify that when the bill moves to PDO status, accruals can continue. Accruals have to stop when the bill moves to NAB status.

Reverse Accrual Indicate that the outstanding accruals (where a component has been accrued but not paid) on the bill should be reversed when it moves to the status that you are defining. If you specify so, the accrual entries passed on the bill, will be reversed when the status change is carried out. Future accruals should necessarily be stopped if accruals, done till the date of status change, have to be reversed.

For example,

In our example of the product for Export Bills Discounted - 45 days, the following status are involved:- Past Due Obligation (PDO)

- Non-accrual basis (NAB)

- Write-off (WO)

Accruals on a bill should be stopped when it moves to NAB. We can specify that, besides stopping accruals, the accruals done so far have to be reversed. In such a case, the accruals

Accruals on a bill should be stopped when it moves to NAB. We can specify that, besides stopping accruals, the accruals done so far have to be reversed. In such a case, the accruals done on the bill (for all accruable components), on which a payment has not been made, will be reversed.

Suppose a bill under this product was iated on 01 June 1999, with the following details:- Value (iation) Date - 01 June 1999

- Maturity Date - 14 July 2000

- Interest Rate - 20%

Repayment - Payment of principal and interest, on the maturity date.

In this case, there is a default on the repayment. The bill moves to PDO status on 1 March 1999 (15 days after the maturity date) and to NAB status on 16 March 1999 (30 days from the maturity date). Since the product has been defined for reversal of accruals along with status movement to NAB, the accruals for the 30 days of default will be reversed.

Complete Accrual Check this option to complete accruals. Indicating if status changes have to be carried out automatically.

Indicate the movement preference for statuses.Forward A forward status change is one in which the status changes from one to the next. In our example, the movement from Active to PDO, PDO to NAB and NAB to Write Off are forward changes. Reverse A reverse status change is one in which the status changes from present status to the previous. Such a situation arises when a payment is made on a bill with a status other than Active. If you specify that forward changes have to be carried out automatically, the status of the bill will be changed, after the specified number of days. If not, you have to change the status of a bill through the bill processing function. Even if automatic status change has been specified for a product and therefore a bill involving it, manually change the status of a bill before the automatic change is due, through the Contract On-line Details screen.

If a product has been specified with manual status change, then you cannot specify automatic status change for a bill involving the product.

If you specify, that reverse changes have to be carried out automatically, the status will be changed when a payment is made on a bill with a status, other than Active. If you specify that reverse changes should not be automatic, the status remains unchanged, even if a repayment is made on the bill. The status has to be changed by you through the, Contract Processing function.

A reverse change may also become necessary, when the number of days of default is increased for a product.

Specify that forward changes or reverse changes have to be carried out automatically, the status changes will be carried out by the Automatic Contract Update function during BOD processing. This is done on the day the change falls due. If the day on which the forward or reverse status change is due happens to be a holiday, then, the processing would depend upon your specifications in the Branch Parameters screen.

If you have not specified that the forward or reverse changes should be carried out automatically, the status remains unchanged till you change it for a bill, through the Contract Processing function.

Advices to be generated for a status change Specify whether an advice has to be generated to inform the customer about the status change of the bill. Message Specify the kind of advices, to be generated. Generate advices to notify the customer of the forward status change and possibly urge him to take action, to make the payments for liquidating the outstanding components. Specify the advice or message that you want sent to the customer, when a bill moves automatically (forward) into the status you are defining. These messages or advices are maintained by the messaging sub-system of Oracle Banking Trade Finance.

Derivation Rule Use the following fields to define derivation rules: Derivation Rule If you have opted for automatic status change, specify the criteria (rules) based on which the system will perform the status change. A bill is said to be in a specific status if any one of the five conditions associated with the status holds true. If all the conditions are false, the bill will automatically move to the next available status for which the condition is true. Define five conditions for each status. The conjunctions ‘AND’ and ‘OR’ used to create multiple conditions. Use those buttons appropriately between each condition.

Elements Select element based on which you need to build a condition for automatic status change of bill. The drop-down list displays the following elements: - Credit Rating

- Transfer Days

- Maturity Days

Operators Select the operator for building a condition for automatic status change.Use multiple elements, in conjunction with the functions and arithmetic operators. The drop-down list displays the following operators: - + (add)

- - (subtract)

- * (multiply)

- / (divide)

Logical Operators Select the logical operator for building a condition for automatic status change. The system uses the logical operators in combination with the elements for creating derivation rules. The drop-down list displays the following logical operators: - > (greater than)

- >= (greater than or equal to)

- < (less than)

- <= (less than or equal to)

- = (equal to)

- < > (not equal to)

Choose the appropriate one.

The ‘Customer Credit Rating’ field at the Customer level will be used as a SDE CUSTOMER_CREDIT_RATING for defining status change rules. This will also be available for provision rule definition at the Loan product level.

Enter the following details.

Component Specify the component for which the status is being defined. Transfer Days The number of days after which, a component should be moved to a particular status can vary for each of the components of the bill. The number of days is always counted as calendar days, from the maturity date specified for the bill. The following example illustrates how this concept works: For example,

In the example of Export Bills Discounted - 45 days, the following status are involved:- Past Due Obligation (PDO).

- Non-accrual basis (NAB).

- Write-off (WO).

For PDO status, the number of days that should result in a status change, for the different components is defined as follows:- Interest -> 15 days

- Principal -> 30 days

- Charges and Fees -> 45 days

You enter a bill involving the product. The repayment on this bill is defaulted. The status of the bill moves to PDO status after 15 days of default, in interest payment. A bill involving this product is moved to PDO status after 15 days of default in interest payment. The report on the bills with PDO status will indicate that for this bill only the interest component is in PDO status.

The principal, of the bill will be reported to PDO for both interest and principal 30 days after the maturity date. Similarly, for charge and fees, it will be reported after 45 days.

If the customer pays back the interest and keeps the principal outstanding, the bill will be moved to PDO only after 30 days of default, in principal repayment.

Define the varying number of days for the different components to move into a particular status, each component will be in a different status at a given time. You may tend to be more lenient with the repayment of the principal (since the principal earns interest). Specify a greater number of days for the principal to move from Active to PDO, than you would, for the main interest component. You may specify 15 days for the principal to move from Active status to PDO, while you specify just 5 days for the interest to move from Active to PDO. Indicating Movement Details You may have a GL structure under, which bills in the Active status are reported in on GL, while those with defaulted payments are in different GLs, depending on their status. For example, the GL structure for discounted bills for 45 days could be as follows: - Active -- 1001ASSF

- PDO -- 1001ASSF

- NAB -- 1110ASSC

- WO -- 1111ASSE

Upward/Downwar d Movement From GL and Description For each component, you should indicate the GL from which it has to be moved, when there is a status change Upward/Downwar d Movement To GL and Description For each component, you should indicate the GL to which it has to be moved, when there is a status change. For principal, the GL will be changed, while for the other components, the receivable accounts will be moved to the new GL. Accounting Role and Description Specify the accounting role (asset, liability, contingent asset, etc), for the GL into which the bill has to be transferred, when its status changes. Account Head Also specify the new GL (accounting head), under which the bill has to be reported. Select an option from the option list, which displays the description of the GL.

Parent topic: Bills and Collections Product Definition