2.4.2 Guarantee Preferences

This topic provides the systematic instructions to capture the Guarantee preference details in Scrutiny tage.

- On Scrutiny - Guarantee Preferences screen, specify the

fields.

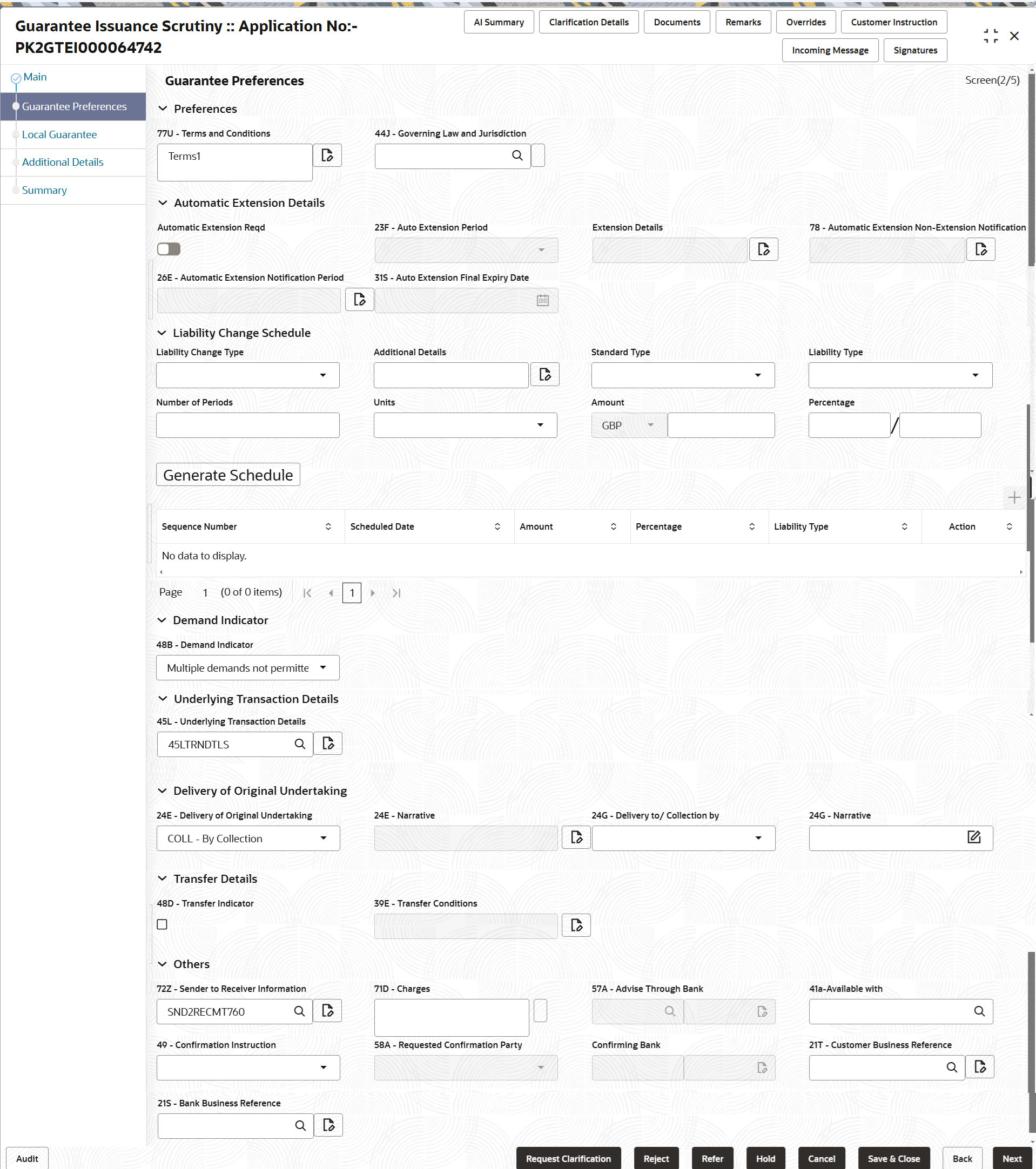

Figure 2-9 Scrutiny - Guarantee Preferences

Description of the illustration scrutinyguaranteepreferences.pngFor more information on fields, refer to the field description table below.

Table 2-10 Guarantee Preferences - Field Description

Field Description Preferences Specify the preference details based on following table. Terms and Conditions Specify the terms and conditions that are not already mentioned. If the Guarantee Issuance is at Counter Issuing Bank (CIB), the field is read only and populated from Incoming MT 760.

If the Guarantee Issuance is at Local Issuing Bank (LIB), the field is read only and populated from Incoming MT 760.

The field displays the content from MT760 and all the applicable MT 761.

Governing Law and Jurisdiction Click Search to search and select the applicable governing law and jurisdiction for the undertaking. If the Guarantee Issuance is at Counter Issuing Bank (CIB), the field is read only and populated from Incoming MT 760.

If the Guarantee Issuance is at Local Issuing Bank (LIB), the field is read only and populated from Incoming MT 760.

Automatic Extension Details Specify the Automatic Extension Details details based on following table. Automatic Extension Required Enable the option, if automatic extension for expiry date is required. Disable the option, if automatic extension for expiry date is not required.Note:

This field is not applicable if, Expiry Type field in registration stage has value as Open.If the Guarantee Issuance is at Counter Issuing Bank (CIB), the field is read only and populated from Incoming MT 760.

If the Guarantee Issuance is at Local Issuing Bank (LIB), this button is enabled if 23F field has value.

Auto Extension Period Select the auto extension period for expiry date from the following options. This field is enabled, if Auto Extension Required toggle is set On.- Days

- One year

- Others

If the Guarantee Issuance is at Local Issuing Bank (LIB), the field is read only and populated from Incoming MT 760.

The field displays the content from MT760 and all the applicable MT 761.

Extension Details Specify the extension details for the expiry date. This field is enabled if Auto Extension Required toggle is 'On' and Auto Extension Period field value is Days/Others.

If the Guarantee Issuance is at Counter Issuing Bank (CIB), the field is read only and populated from Incoming MT 760.

If the Guarantee Issuance is at Local Issuing Bank (LIB), the field is read only and populated from Incoming MT 760.

Non-Extension Details Specify the non-extension details for automatic expiry date extension such as notification methods or notification recipient details. This field is enabled if Auto Extension Required toggle is 'On' and Auto Extension Period field has values.

If the Guarantee Issuance is at Counter Issuing Bank (CIB), the field is read only and populated from Incoming MT 760.

If the Guarantee Issuance is at Local Issuing Bank (LIB), the field is read only and populated from Incoming MT 760.

Non-Extension Notice Period Specify the non-extension notice days. This field is enabled if Auto Extension Required toggle is 'On' and Auto Extension Period field has values.

If the Guarantee Issuance is at Counter Issuing Bank (CIB), the field is read only and populated from Incoming MT 760.

If the Guarantee Issuance is at Local Issuing Bank (LIB), the field is read only and populated from Incoming MT 760.

Auto Extension Final Expiry Date Specify the final extension date for automatic expiry date extension after which no automatic extension is allowed. This field is enabled if Auto Extension Required toggle is 'On' and Auto Extension Period field has values.

The user can manually enter the value. This date/duration can be beyond the calculated value provided in the “Auto Extension Period”.

If the Guarantee Issuance is at Counter Issuing Bank (CIB), the field is read only and populated from Incoming MT 760.

If the Guarantee Issuance is at Local Issuing Bank (LIB), the field is read only and populated from Incoming MT 760.

Liability Change Schedule Specify the details of increase or decrease of liability on a pre-scheduled date as applicable.

Liability Change Type Select the liability change type. This field describes the basis for liability change. The options are:- Event Based - User can enter the Event details in “Additional Details” field. The actual liability change for Event based type should be operationally handled by the user based on the event details

- Time Based - The liability change should happen automatically on the pre-scheduled date as given.

Additional Details Specify the additional details to increase or decrease of liability or both are involved. Standard Type Select whether liability change is standard or non-standard. The options are:- Standard

- Non-standard

This field is disable if, Liability Change Type is Event Based.

Liability Type Select whether increase or decrease of liability or both are involved. The options are:- Increase

- Decrease

- Boths

Number of Periods Specify the numeric value of the period corresponding to the units. Units Select the unit value. The options are:- Monthly

- Quarterly

- Half Yearly

- Yearly

Amount Specify the liability amount that should be increased or decreased on the liability change date. Percentage Specify the amount of liability to be changed or percentage of liability to be changed. If percentage is chosen, then system should calculate the equivalent amount of liability to be changed. Schedule Grid If the Liability Change Type is Time Based, and Standard Type is Non-standard, the user can input the details in the schedule grid.

Click '+' sign to add the records in Schedule Grid.

Sequence Number Displays the serial number of the liability change. Scheduled Date Specify the date on which liability change to happen or select the date from the date picker. Amount Specify the liability Amount that should be increased or decreased on the liability change date. Percentage Specify the amount of liability to be changed or percentage of liability to be changed. If percentage is chosen, then system should calculate the equivalent amount of liability to be changed.

Liability Type Select whether increase or decrease of liability or both are involved. The options are:- Increase

- Decrease

- Boths

Action Click Edit icon to edit the schedule record. Click Delete icon to delete the schedule record.

Demand Indicator Specify the Demand Indicator details Demand Indicator Select the demand indicator from the drop-down. This field specifies whether partial and/or multiple demands are not permitted.

The options are:- Multiple demands not permitted - Partial amount can be claimed

- Multiple and partial demands not permitted- Entire amount can be claimed.

- Partial demands not permitted - Entire amount can be claimed.

If the Guarantee Issuance is at Counter Issuing Bank (CIB), the field is read only and populated from Incoming MT 760.

If the Guarantee Issuance is at Local Issuing Bank (LIB), the field is read only and populated from Incoming MT 760.

Underlying Transaction Details Specify the Underlying Transaction Details. Underlying Transaction Details Click Search to search and select the underlying business transaction details (for which the undertaking is issued) from the look-up. If the Guarantee Issuance is at Counter Issuing Bank (CIB), the field is read only and populated from Incoming MT 760.

If the Guarantee Issuance is at Local Issuing Bank (LIB), the field is read only and populated from Incoming MT 760.

Delivery of Loacal Undertaking Specify the Delivery of Loacal Undertaking details. Delivery of Loacal Undertaking Select the method of the delivery from the following options by which the original local undertaking needs to be delivered. The options are:- COLL - By Collection

- COUR - By Courier

- MAIL - By Mail

- MESS - By Messenger - Hand Deliver

- OTHR - Other Method

- REGM - By Registered Mail or Airmail

This field is not applicable, if Purpose of Message field value is ICCO/ISCO.

If the Guarantee Issuance is at Counter Issuing Bank (CIB), the field is read only and populated from Incoming MT 760.

If the Guarantee Issuance is at Local Issuing Bank (LIB), the field is read only and populated from Incoming MT 760.

Narrative Specify the description of method of delivery of original undertaking. This field is not applicable, if Delivery of Local Undertaking field value is COUR/OTHR.

If the Guarantee Issuance is at Counter Issuing Bank (CIB), the field is read only and populated from Incoming MT 760.

If the Guarantee Issuance is at Local Issuing Bank (LIB), the field is read only and populated from Incoming MT 760.

Delivery to/Collection by Select the details of to whom the original local undertaking is to be delivered or by whom the original local undertaking is to be collected. The options are:- BENE - Beneficiary

- OTHR - Other Method

This field is enabled, if Purpose of Message field value is ICCO/ISCO.

If the Guarantee Issuance is at Counter Issuing Bank (CIB), the field is read only and populated from Incoming MT 760.

If the Guarantee Issuance is at Local Issuing Bank (LIB), the field is read only and populated from Incoming MT 760.

Narrative Specify the description of method of delivery of original undertaking. This field is not applicable, if Delivery to/Collection by field value is OTHR.

If the Guarantee Issuance is at Counter Issuing Bank (CIB), the field is read only and populated from Incoming MT 760.

If the Guarantee Issuance is at Local Issuing Bank (LIB), the field is read only and populated from Incoming MT 760.

Transfer Details Specify the Transfer Details. Transfer Indicator Select the check box if the undertaking is transferable. If the Guarantee Issuance is at Counter Issuing Bank (CIB), the field is read only and populated from Incoming MT 760.

If the Guarantee Issuance is at Local Issuing Bank (LIB), the field is read only and populated from Incoming MT 760.

Transfer Conditions Specify the conditions to transfer the undertaking.. This field is available, if Transfer Indicator check box is selected.

If the Guarantee Issuance is at Counter Issuing Bank (CIB), the field is read only and populated from Incoming MT 760.

If the Guarantee Issuance is at Local Issuing Bank (LIB), the field is read only and populated from Incoming MT 760.

Others Specify the Others detail. Sender to Receiver Information Click Search to search and select the additional information for receiver from the look-up. If the Guarantee Issuance is at Counter Issuing Bank (CIB), the field is read only and populated from Incoming MT 760.

If the Guarantee Issuance is at Local Issuing Bank (LIB), the field is read only and populated from Incoming MT 760.

Charges Specify the value for the charger for the undertaking. If the Guarantee Issuance is at Counter Issuing Bank (CIB), the field is read only and populated from Incoming MT 760.

If the Guarantee Issuance is at Local Issuing Bank (LIB), the field is read only and populated from Incoming MT 760.

Advice Through Bank Specify the additional bank to advice the undertaking. This field is enabled only if Advising Bank in Main Details hop has value.

If the Guarantee Issuance is at Local Issuing Bank (LIB), the field is read only and populated from Incoming MT 760.

The field displays the content from MT760 and all the applicable MT 761.

Available With This field identifies the bank with which the credit is available of the issued LC. User must capture the bank details or any free text. Search the bank with SWIFT code (BIC) or Bank Name.

On selection of the record if SWIFT code is available, then SWIFT code will be defaulted. If SWIFT code is not available then the bank's name and address gets defaulted.Note:

This field is applicable only for SBLC.If the Guarantee Issuance is at Counter Issuing Bank (CIB), the field is read only and populated from Incoming MT 760.

If the Guarantee Issuance is at Local Issuing Bank (LIB), the field is read only and populated from Incoming MT 760.

The field displays the content from MT760 and all the applicable MT 761.

Confirmation Instructions Select the confirmation instruction from the available values. The options are:- CONFIRM

- MAY ADD

- WITHOUT

Note:

This field is applicable, if Form of Undertaking field value is STBY - Standby LC.If the Guarantee Issuance is at Counter Issuing Bank (CIB), the field is read only and populated from Incoming MT 760.

If the Guarantee Issuance is at Local Issuing Bank (LIB), the field is read only and populated from Incoming MT 760.

Requested Confirmation Party Select the requested confirmation party from the available options. The options are:- Advising Bank

- Advise Through Bank

- Others

This field is not enabled, if Confirmation Instructions field value is Confirm or May Add.

Note:

This field is applicable only for SBLC.If the Guarantee Issuance is at Counter Issuing Bank (CIB), the field is read only and populated from Incoming MT 760.

If the Guarantee Issuance is at Local Issuing Bank (LIB), the field is read only and populated from Incoming MT 760.

Confirming Bank Specify the name of confirming bank . This field is not enabled, if Requested Confirmation Party field value is Others.

Note:

This field is applicable only for SBLC.If the Guarantee Issuance is at Counter Issuing Bank (CIB), the field is read only and populated from Incoming MT 760.

If the Guarantee Issuance is at Local Issuing Bank (LIB), the field is read only and populated from Incoming MT 760.

The field displays the content from MT760 and all the applicable MT 761.

- Click Next.The task will move to next data segment.

Table 2-11 Guarantee Preferences - Action Buttons - Field Description

Field Description AI Summary Documents for Export LC are scanned, and their data is automatically filled into the appropriate fields on the user interface. - OBTFPM user uploads documents for Guarantee Application/Guarantee text at Registration stage.

- Task moves to Scrutiny stage after basic details including product code are entered.

- Data extraction occurs upon Registration submission.

- Scrutiny user verifies extracted data prompted by system.

- AI reads documents uploaded based on their classification in DMS, scrutiny ensures accuracy, user updates the data if necessary, confirms and updates findings.

- The extracted details will then be captured in the respective UI fields.

Scrutiny user will verify the standard data along with the data available in the document uploaded to ensure that data check is correct.- The AI summary screen should display the Application Number with consolidated Result 'Pass' or 'Fail'.

- User can click Details button to see the detailed questionnaire and the response

- Click Close button to close the AI summary screen and proceed with the transaction processing.

- Once the data check is done the findings will be updated in the AI Summary section.

- The system should be able to read both structured and unstructured data within documents.

Clarification Details Clicking the button opens a detailed screen, user can see the clarification details in the window and the status will be ‘Clarification Requested’. Documents Click to View/Upload the required document. Application displays the mandatory and optional documents.

The user can view and input/view application details simultaneously.

When a user clicks on the uploaded document, Document window get opened and on clicking the view icon of the uploaded document, Application screen should get split into two. The one side of the document allows to view and on the other side allows to input/view the details in the applicationRemarks Specify any additional information regarding the guarantee. This information can be viewed by other users processing the request. Content from Remarks field should be handed off to Remarks field in Backend application.

Overrides Click to view the overrides accepted by the user. Customer Instruction Click to view/ input the following - Standard Instructions – In this section, the system will populate the details of Standard Instructions maintained for the customer. User will not be able to edit this.

- Transaction Level Instructions – In this section, OBTFPM user can input any Customer Instructions received as part of transaction processing. This section will be enabled only for customer initiated transactions.

Incoming Message This button displays the multiple messages (MT760 + up to 7 MT761. Click to allow parsing of MT 760 along with MT761(up to 7) messages together to create a Guarantee Issuance.

In case of MT798, the User can click and view the MT798 message(784,760/761).

In case of MT798-MT726-MT759 request, user can view MT798 message(726-759) in this placeholder in Header of the task.

In case of MT798_MT788-MT799 request, user can view MT798 message (788-799) in this placeholder in Header of the process-task..

Signatures Click the Signature button to verify the signature of the customer/ bank if required. The user can view the Customer Number and Name of the signatory, Signature image and the applicable operation instructions if any available in the back-office system.

If more than one signature is available, system should display all the signatures.

Request Clarification User should be able to submit the request for clarification to the “Trade Finance Portal” User for the transactions initiated offline. Save & Close Save the details provided and holds the task in ‘My Task’ queue for further update. This option will not submit the request. Cancel Cancel the Scrutiny stage inputs. The details updated in this stage are not saved. The task will be available in 'My Task' queue. Hold The details provided will be saved and status will be on hold.User must update the remarks on the reason for holding the task. This option is used, if there are any pending information yet to be received from applicant.

Reject On click of Reject, user must select a Reject Reason from a list displayed by the system. Reject Codes are:

- R1- Documents missing

- R2- Signature Missing

- R3- Input Error

- R4- Insufficient Balance/Limits

- R5 - Others

Select a Reject code and give a Reject Description.

This reject reason will be available in the remarks window throughout the process.

Refer Select a Refer Reason from the values displayed by the system. Refer Codes are:

- R1- Documents missing

- R2- Signature Missing

- R3- Input Error

- R4- Insufficient Balance/Limits

- R5 - Others

Back Click Back button to navigate to the previous screen. Next On click of Next, system validates if all the mandatory fields have been captured. Necessary error and override messages to be displayed. On successful validation, system moves the task to the next data segment.

Parent topic: Scrutiny