1.3.3 Build Charge Rule

This topic provides systematic instructions to build charge rule.

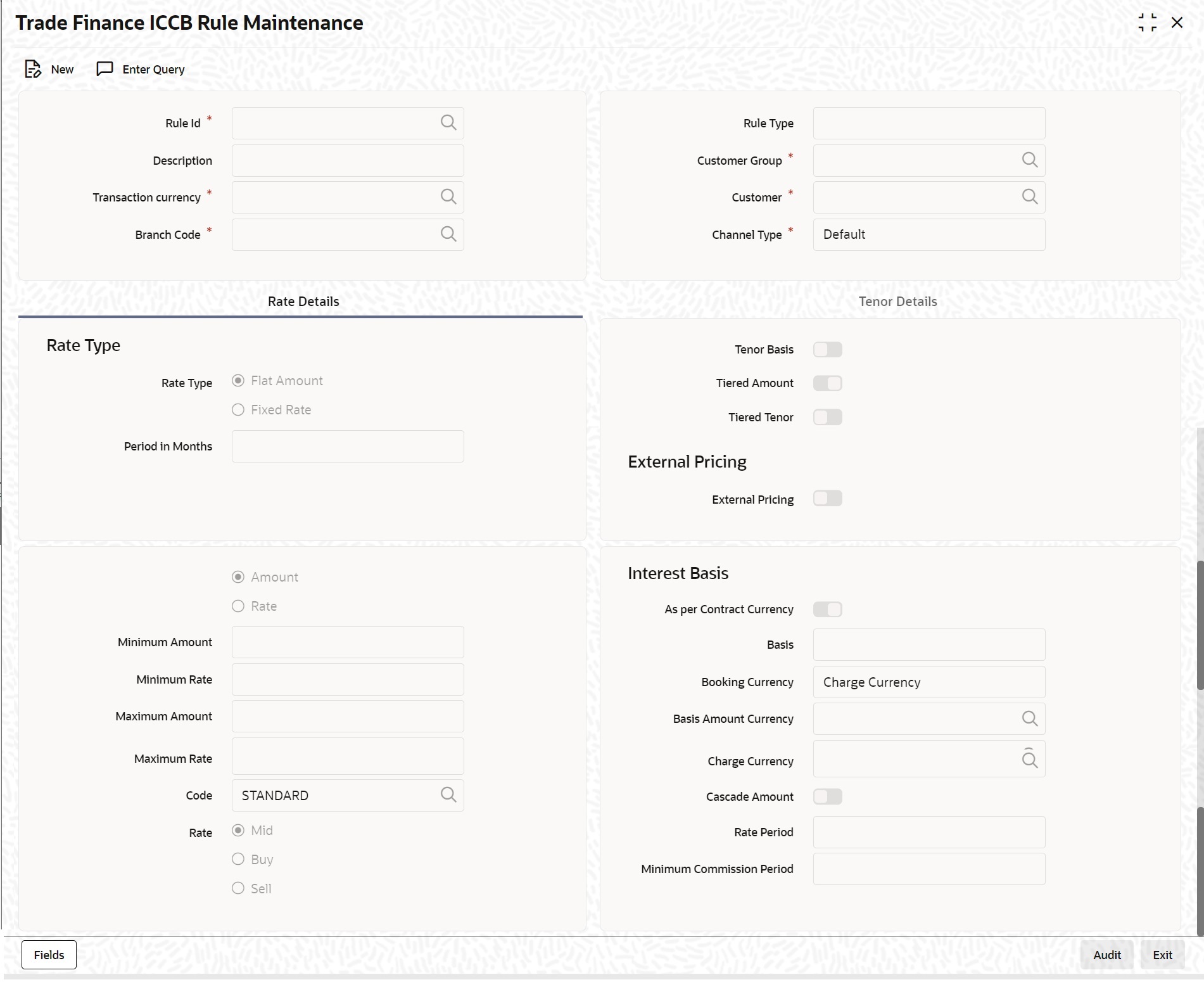

- On Homepage, type 'CFDTFRLM' in the text box, and click next arrow.A charge rule is built with the logic to calculate a specific type of charge component. You can maintain this logic in the ‘Trade Finance ICCB Rule Maintenance’ screen.The ‘Trade Finance ICCB Rule Maintenance’ screen is displayed:

- On ‘Trade Finance ICCB Rule Maintenance’ screen, specify the fields.For more information about the fields, refer to Table 1-3:

Table 1-3 Trade Finance ICCB Rule Maintenance - Field Description

Field Description Rule Type The Rule Type identifies the type of component you are defining. The attributes applicable for a component depend on the Rule Type. In this chapter, we shall discuss the procedure for setting up rules for charge components.

For every rule that you define, you can enter a description. Specifying a description helps identify a rule.

Rule Identification Every charge rule is identified by a unique ten-character code, called a Rule ID. You can link a valid Charge Rule ID to the charge classes that you maintain in your bank. Charges or fees for all products with which you associate a charge class, will be calculated on the basis of the Rule ID that is associated with the class.

To recall, the Rule ID for a charge rule is specified in the ICCB Rule Branch Availability maintenance. Accordingly, in the Rule ID field in this screen, you must select the ID of the charge rule that you wish to build by maintaining the attributes.

The option list in the Rule ID field is populated based on the following conditions:

- Only those Rule IDs that are available for users at the current branch according to the ICCB Rule Branch Availability maintenance are displayed

- The maintenance of ICCB rules must be allowed for users at the current branch, according to the restrictions maintained in the Common Branch Restrictions maintenance for the restriction type ICCBRULE.

Rule Application Conditions By default, a charge rule that you define can be applied on transactions in:

- All currencies

- All customers

- All customer groups

- All branches

- Default Channel Type

However, to restrict the application of a rule to transactions involving a specific customer, customer group, currency, and / or channel type, you can specify the same in the respective fields.

Thus, the most generally applied condition can be that a charge rule is applicable to contracts in any currency, involving any customer, customer group or branch and default channel type. An interim condition is that a charge rule is applied on contracts in a specific currency but involving any customer, customer group or branch.

Note:

You will not be allowed to define an ICCB Rule for a specific combination unless you maintain

a record for the same Rule at the generic level. For instance, while creating the Rule ID SPlWDCHGS for the very first time the system defaults the values in the Transaction Currency, Branch, Account Category, Customer, Customer Group, Branch, Account fields to ‘All’ and channel type to ‘Default’. Only after saving this record you will be allowed to create a second record for a specific combination for the same Rule ID. Defining a rule at a generic level is mandatory. The significance of this can be understood by the following example:You can only define the attributes for an ICCB Rule to be applicable for all branches, from the head office branch.

You can create ICCB rules to be applicable for transactions with the following specific

combinations:- A specific branch, customer category, customer, currency and channel type ‘Default’

- A specific branch, customer category, customer, all currencies and channel type ‘Default’

- A specific branch, customer category, currency all customers and channel type ‘Default’

- A specific branch, currency and all customer categories and customers and channel type ‘Default’

- A specific branch, customer categories and all currencies and customers and channel type ‘Default’

- A specific branch and all customer categories, customers and currencies and channel type ‘Default’

- A specific customer category, customer, currency, and all branches and channel type ‘Default’

- A specific customer category, customer and all currencies and branches and channel type ‘Default’

- A specific customer category, currency and all customers and branches and channel type ‘Default’

- A specific currency and all customer categories, customers and branches and channel type ‘Default’

- A specific customer category and all customers, currencies and branches and channel type ‘Default’

- All branches, customer categories, customers and currencies and channel type ‘Default’

- A specific branch, customer category, customer, currency and channel type ‘Online’

- A specific branch, customer category, customer, all currencies and channel type ‘Online’

- A specific branch, customer category, currency, all customers and channel type ‘Online’

- A specific branch, currency and all customer categories and customers and channel type ‘Online’

- A specific branch, customer categories and all currencies and customers and channel type ‘Online’

- A specific branch and all customer categories, customers and currencies and channel type ‘Online’

- A specific customer category, customer, currency, and all branches and channel type ‘Online’

- A specific customer category, customer and all currencies and branches and channel type ‘Online’

- A specific customer category, currency and all customers and branches and channel type ‘Online’

- A specific currency and all customer categories, customers and branches and channel type ‘Online’

- A specific customer category and all customers, currencies and branches and channel type ‘Online’

- All branches, customer categories, customers and currencies and channel type ‘Online’

Note:

As mentioned earlier, the rules applicable for combinations involving all branches (the ALL option in the Branch Code field) can be maintained only from the head office branch.Transaction Currency If you wish to define the attributes for all currencies, you can select the ALL option in the Currency Code field to indicate this. If you are maintaining the attributes for the selected ICCB rule in specific currency other than the ALL, select the Transaction Currency on which the rule mapping maintenance is to be made applicable.

Customer Group Select the customer group on which the rule mapping maintenance is to be made applicable.

Note:

You can create a generalized charge rule mapping record by selecting the ALL option in the Customer Group field. This specification is defaulted to the Customer and Customer Account fields. You will not be allowed to change the specification.

Customer Specify the customer identification number (CIF) of the customer for whom you are maintaining the rule mapping.

Branch Code If you are maintaining the attributes for the selected ICCB rule from the head office branch,you can select the branch for which the attributes are being defined. If you wish to define the attributes for all branches, you can select the ALL option in the Branch Code field to indicate

this.If you are maintaining the attributes for the selected ICCB rule from a branch other than the head office, you can only select those branches that are found in the allowed list of branches for:

- The ICCB rule definition Restriction Type (ICCBRULE), in the Common Branch Restrictions maintenance for the current branch

- The selected rule being built, according to the ICCB Rule Availability maintenance.

In other words, the option list in the Branch Code field would display only those branches that are allowed both for the rule and the current branch.

The following example illustrates how the option lists in the Rule ID and Branch Code fields are populated:

Channel Type Select the channel type from the drop down. By default, the selected channel type will be 'Default'. Rate Type The rate type indicates whether the charge or fee to be applied for the Rule ID is a flat amount or a percentage of the basis amount. Basis amount here refers to:

- Principal amount or commitment

- Transaction amount in the case of a teller entry

- Transfer amount in case of a Remittance

- LC amount in the case of a Letter of Credit

- Bill amount in the case of a Bill

If the Charge Rule that you are defining calculates charges on a rate basis, choose the Fixed Rate option. To levy a flat amount as charge, say a postal charge on the products that are associated with the Charge Class, choose the ‘Flat Amount’ option.

You can choose to indicate the Rate Code and whether the rate is Mid, Buy or Sell only when the basis amount currency and the rate currency is different from the contract currency. The rate code is used to arrive at the exchange rate if the rate currency is different from the contract currency. The system arrives at the exchange rate from the parameters specified for the currency pair in the Currency Pair Definition table.

Note:

If the charge is based on the Flat Amount, 'Min Amount' and 'Max Amount' are not applicable.

Refer to the chapter on ‘Currency Maintenance’ in the Core Services User Manual for more information on parameters of currency pairs.

Tenor Basis You can create a charge rule that would calculate charges on the basis of Tenor slabs. Check the ‘Tenor Basis’ check box if the Charge is calculated based on the Tenor.

Tiered Tenor Charges calculated on the basis of Charge Rates for different layers of the Tenor.

Booking Currency Select the booking currency from the drop-down list. You can choose one of the following options:

- Contract Currency - If you select this, the system will calculate the charge in the currency specified in the field 'Contract Currency'.

- Charge Currency - If you select this, the system will calculate the charge in the currency specified in ‘Charge Currency’.

Basis Amount and the Charge Currencies The charge currency is the currency, which will be associated with the charge that is calculated or the flat charge amount.

When building a charge rule, if the Rate Type is a Flat Amount, you have to indicate the currency of the charge or fee. The charge or fee when applied on a transaction will be collected in this currency. The input to this field can be any currency that is maintained as part of Currency Definition in Oracle Banking Trade Finance Cloud

Service.The amount itself is specified subsequently through this screen. This amount can be changed during contract processing.

Charges or fees can be calculated for a transaction on the basis of tiers or slabs. When building a charge rule, you should also indicate the currency of the tiers or slabs based on which you levy the charge. This is the Basis Amount Currency. If the transaction is in a different currency, then the charge is calculated after converting it to the currency of the tiers and slabs.

Maximum and Minimum Charge Amount Specify the following details.

Maximum Amount If the charge is based on a fixed rate, you should specify the maximum amount that can be applied on a contract involving the Rule ID. If the charge calculated using this Rule ID exceeds this amount for a contract, the maximum amount specified in this field will be applied instead of the amount calculated using the fixed rate.

Maximum Rate If the charge is based on a fixed rate, you should specify the maximum rate that can be applied on a contract involving the Rule ID. If the charge calculated using this Rule ID falls above the amount which is computed using the maximum rate defined in the rule, then the amount which is computed using the maximum rate will be collected.

Minimum Amount If the charge is based on a fixed rate, you should specify the minimum amount that can be applied on a contract involving the Rule ID. If the charge calculated using this Rule ID falls below this amount for a contract, the minimum amount specified in this field will be applied instead of the amount calculated using the fixed rate.

Minimum Rate If the charge is based on a fixed rate, you should specify the minimum rate that can be applied on a contract involving the Rule ID. If the charge calculated using this Rule ID falls below the amount which is computed using the minimum rate defined in the rule, then the amount which is computed using the minimum rate will be collected.

Tiered Amount You can create a Charge Rule that would calculate charges on the basis of an amount structure. This structure could be in tiers or in slabs. Check against ‘Tiered Amount’ if the Basis Amount structure will be Tiers. Leave it blank if the Basis Amount structure is Slab.

Bracket Tenor You can create a Charge Rule which calculates charges on the basis of an amount structure. In this table you define the different attributes of amount structure based on which the charges are calculated.

Basis Amount To You should specify the upper limit of the slab or tier to which a particular rate or amount should be applied as a charge.

Fixed Rate If the charge is a percentage of an amount, specify the applicable rate. This rate will be applied on the Basis Amount To, depending on whether you have defined the application basis, as a slab or a tier.

Charge Unit The Charge Unit specifies the unit for rounding up a charge basis amount or fee basis amount to the nearest amount. The charge or fee will be calculated on the rounded basis amount.

Flat (CCF) Amount To levy a flat charge, specify the flat amount. This amount will be applied on the Basis Amount, depending on whether you have defined the application basis as a slab or a tier.

Floor Basis Amount You should specify this only if the Amount Basis is a Tier. This will be the upper limit of the previous tier limit. By default, the amount specified as the ‘Basis Amount To’ for the previous tier limit will be displayed. For the first limit in the tier do not specify this.

This amount, along with the Floor CCF Amount, is used to calculate the charge.

Floor CCF Amount You should specify this only if the Rule Type is a Commission.

Tenor Details – Tenor From and Tenor To The tenor is in days. For instance, If Tenor from and Tenor to are given as '0' and 91, the tenor slab is from '0' days to '91' days.

Parent topic: Charge Rules