2.6.1.3 Preferences

This section describes adding transaction level preferences for the product segment.

Preferences is about associating supported currencies to the segment along with defining a range for the loan amount to be disbursed and its term. Additional aspects like exchange rates for foreign currency products and miscellaneous features can also be defined, as applicable

- Click Next in the Component Linkage

screen to add the Preferences.The Preferences screen displays.

- Specify the fields on Preferences screen.For more information on fields, refer to the field description table.

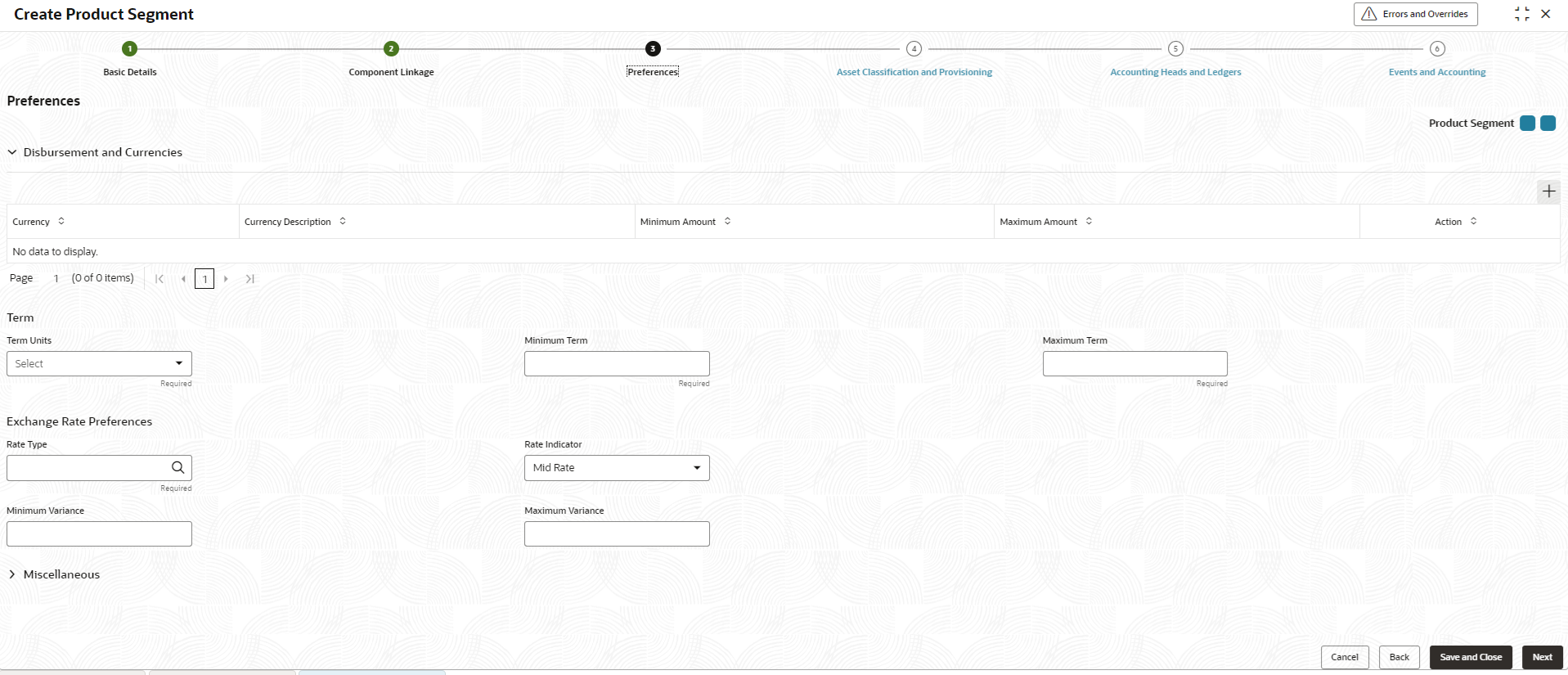

Figure 2-21 Disbursement and Currencies

This section is about permissible currencies for disbursement along with a range for amount and tenor combinations. The range as defined in this section will be validated during account opening and related life cycle events.

Table 2-19 Disbursement and Currencies - Field Description

Field Description Currency Click  icon and select the currency from the list.

icon and select the currency from the list.

Note: One Currency to be selected from the list. The currency linked in the component and in disbursement ought to be same.

Currency Description Displays the description of the currency selected. Minimum Amount Specify the minimum amount for loan account opened under the product segment in the specified currency. Maximum Amount Specify the maximum amount for the loan account opened under the product segment in the specified currency. Term Units Select the term units as either of Months, YEARS, or SCHEDULE from the drop-down list. The term of the loan account will be specified in this term unit for the accounts opened under this product segment. Minimum Term Specify the minimum term for the loan account opened under the product segment. Maximum Term Specify the maximum term for the loan account opened under the product segment. Rate Type The rate type is referred for currency conversion when account currency is different from local currency. Click  icon and select the type from the list.

icon and select the type from the list.

The rate types maintained are displayed in the list. This section is for products that supports the lending life-cycle for currencies in addition to or other than the local currency. The rate types as defined in the common core will be available for the user to choose.

Note: Currently, Loan accounts can be opened only in local currency.

Rate Indicator The rate indicator refers to the value of rate to be considered while currency conversion in case of loan account currency being different from local currency. The available options are: - Mid Rate

- Buy Rate

- Sell Rate

Minimum Variance Specify the minimum variance for the loan account. This field determines the minimum deviation in absolute terms that the user can opt for, as compared to the actual exchange rate, during account disbursement.

Maximum Variance Specify the maximum variance for the loan account. This field determines the maximum deviation in absolute terms that the user can opt for, as compared to the actual exchange rate, during account disbursement.

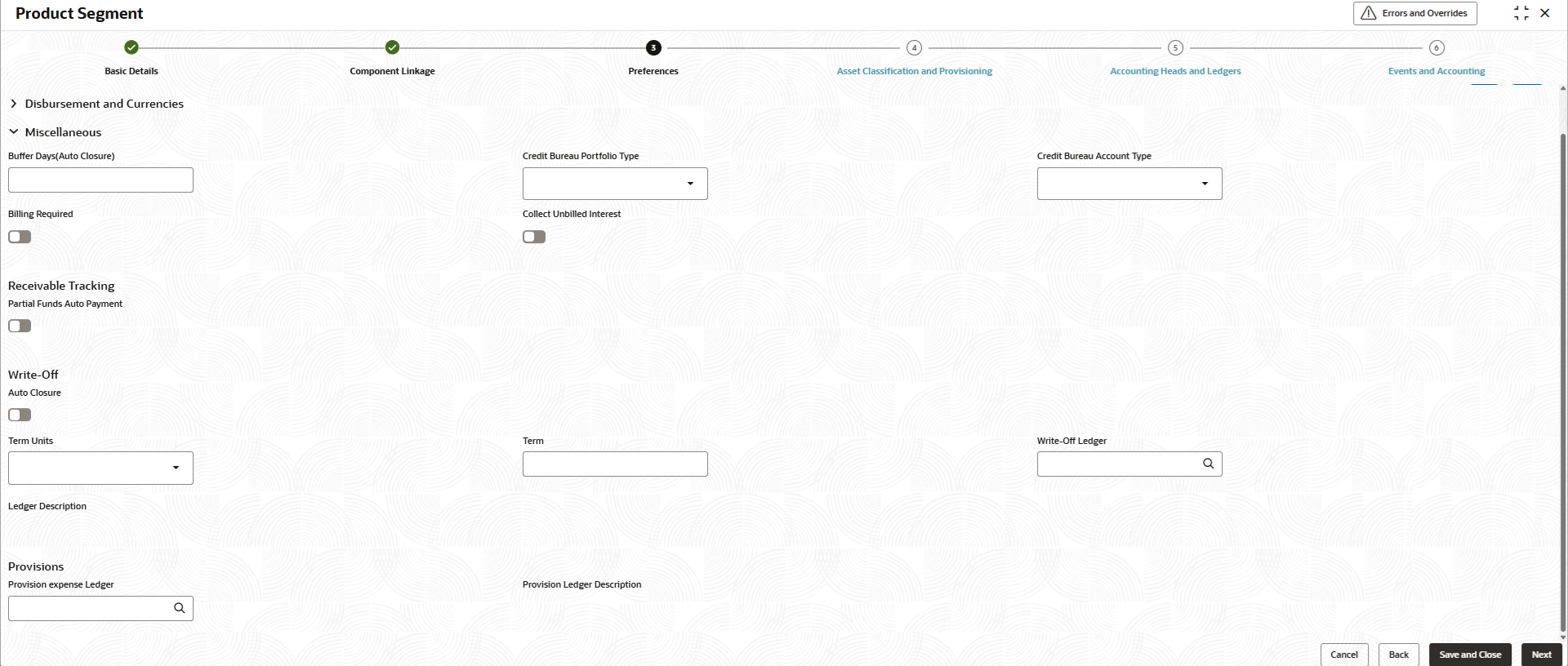

For more information on fields, refer to the field description table.Figure 2-22 Miscellaneous

The section on miscellaneous is about certain aspects that are related to the servicing of the loan accounts.

This feature allows defining whether revision of sanctioned amount upwards/downwards is allowed.

Table 2-20 Miscellaneous - Field Description

Field Description Buffer Days(Auto Closure) This field refers to the period required to complete the formalities related to loan account closure post the full repayment of loan by the borrower. Specify the number of days after which loan account will be marked as closed, following the full repayment of loan.

Credit Bureau Portfolio Type Select the portfolio type from the drop-down list. This field is currently disabled and is for future use.

Credit Bureau Account Type Select the account type from the drop-down list. This field is currently disabled and is for future use.

Billing Required Click the toggle status to enable, if billing advices/notices to be generated for the product. Note: Billing advice includes due details of business components with Include in Installment enabled.

Collect Unbilled Interest Click the toggle status to enable, to consider unbilled interest along with installment due for payment during manual and auto payments. Note: On manual payment, flag on UI will be defaulted as per this field and will be allowed to modify.

Note: This field is only applicable if Billing Required is selected.

Receivable Tracking Specify the fields under this section. Partial Funds Auto Payment Click the toggle status to enable this feature. Enable this feature if the lender intends to collect partial funds from the borrower’s savings account during auto-payment in event of the account not having adequate funds to collect the entire dues

Write-Off Specify the fields under this section. The account can be written off if the lender does not expect the borrower to repay his obligations. Where the account has been fully written-off, the lender can choose to wait for a pre-configured term before it can be marked as closed.

Term Units Select the term after write-off after which the account can be closed from the drop-down list. The available options are: - Months

- Years

Term Specify the term. Write-Off Ledger Click  icon and define a expense ledger for write-off processing.

icon and define a expense ledger for write-off processing.

Ledger Description Displays the description of the ledger selected. Provisions The lender can define component and status-wise provisions for a loan account. Provision expense Ledger Click  icon and define a expense ledger for provisions processing.

icon and define a expense ledger for provisions processing.

Provision Ledger Description Displays the description of the expense ledger selected. - Click Cancel to close the details without saving.

- Click Back to navigate to previous screen (Business Components).

- Click Save and Close to save the details.

- Click Next to save and navigate to the next screen (Asset Classification and Provisioning).

Parent topic: Create Product Segment