- US Real-Time Payments User Guide

- US Real -Time Payments

- Outbound US RTP Transactions

- Outbound RTP Transaction Input

- Main Tab

Main Tab

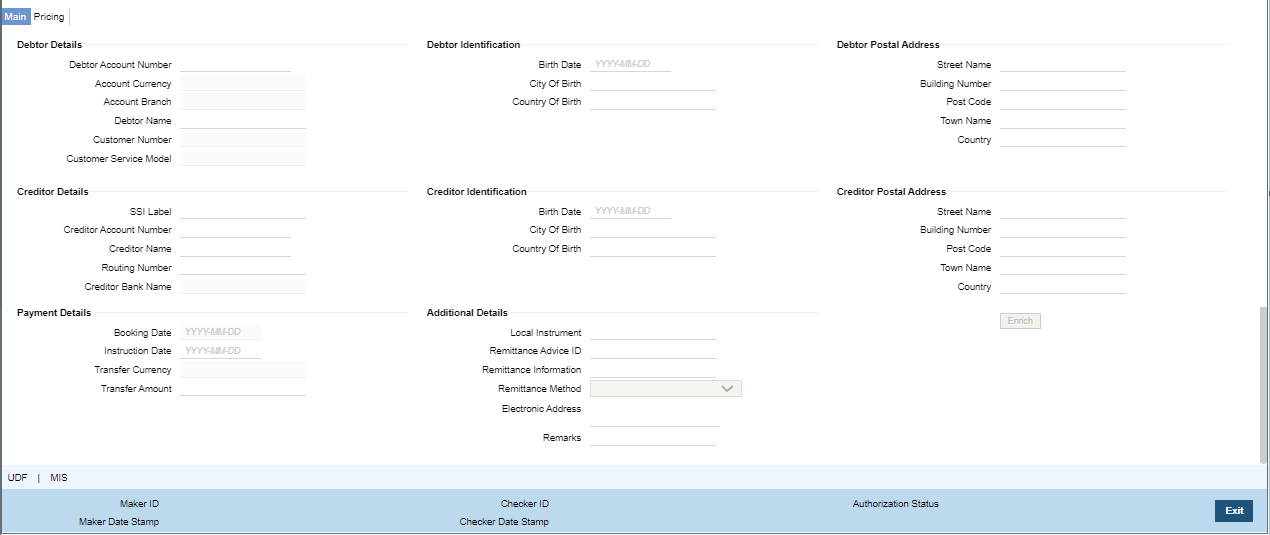

- Click on Main Tab in the Outbound RTP Transaction Input screen.

Figure 2-16 Outbound US RTP Transaction Input - Main Tab

Description of "Figure 2-16 Outbound US RTP Transaction Input - Main Tab" - On Main Tab, specify the fields.For more information on fields, refer to the field description below:

Table 2-9 Outbound US RTP Transaction Input - Main Tab Field Description

Field Description Debtor Details -- Debtor Account Number Select the Debit Account Number from the list of values. All open and authorized accounts maintained in the External Customer Account maintenance (STDCRACC) are listed for this field. System defaults the following details on selecting the Debit Account Number:

- Account Currency

- Account Branch

- Debtor Name

- Customer Number

Customer Service Model The customer service model linked to the customer, if any, is populated. Debtor Identification -- Birth Date Specify the Birth Date of the debtor. City Of Birth Specify the City of Birth of the debtor. Country Of Birth Specify the Country of Birth of the debtor. Note:

Either all the fields in debtor Identification can be null or all the fields must have data. System validates the mandatory data.Debtor Postal Address -- Street Name Specify the Street Name of the debtor. Building Number Specify the Building Number of the debtor. Post Code Specify the Post Code of the debtor. Town Name Specify the Town Name of the debtor. Country Specify the Country of the debtor. Note:

Either all the fields in postal address can be null or all the fields must have data, except Building Number, which is optional. System validates the mandatory data.Creditor Details -- SSI Label If the Creditor details are maintained in PUDCRDTL for the debtor account entered, the same can be selected in this field. Creditor details will be populated based on the SSI label details. Note:

It is optional to maintain SSI labels. User can directly input the beneficiary details if SSI label is not maintained.Creditor Account Number Specify the Beneficiary account in this field. Creditor Name Specify the beneficiary name. Routing Number Select the Routing number from the list of values. All open and authorized Bank Codes available in Routing file Details will be listed in this field. Creditor Bank Name Specify the Beneficiary bank name. Creditor Identification -- Birth Date Specify the Birth Date of the Creditor. City Of Birth Specify the City of Birth of the Creditor. Country Of Birth Specify the Country of Birth of the Creditor. Creditor Postal Address -- Street Name Specify the Street Name of the creditor. Building Number Specify the Building Number of the creditor. Post Code Specify the Post Code of the creditor. Town Name Specify the Town Name of the creditor. Country Specify the Country of the creditor. Payment Details -- Booking Date System defaults the current date as Booking Date. This will be a disabled field for user modification. Instruction Date System defaults the current application server date. This date can be modified by the user. This is the requested execution date by the customer. Back dates are not allowed as instruction date. Transfer Currency System defaults the Transfer currency as ‘USD’. Transfer Amount Specify the Transfer Amount. Additional Details -- Local Instrument Select the Local Instrument from the list of values. All the valid instruments are listed. Identifies the Debtor/Sender as either a business or consumer customer of the Debtor FI. This field also indicates whether the Debtor/Sender is a domestic customer of the Debtor FI or a customer of a foreign branch or affiliate of the Debtor FI.

Local Instrument options listed are as follows:- BUSINESS - Business Initiated Payment (domestic)

- CONSUMER - Consumer Initiated Payment (domestic)

- FABUSINESS - Business Initiated Payment (foreign affiliate)

- FACONSUMER - Consumer Initiated Payment (foreign affiliate)

- INTERMEDIARY - Payment sent through a Payment Service Provider (domestic)

- ZELLE - Zelle Payment (domestic)

Remittance Advice ID Specify the Remittance Advice ID. This field is used, if a separate Remittance Advice is sent via a remt.001 message. The reference in this element, if included, must be identical to the Remittance Identification provided in the remittance advice message.

Remittance Information Specify the Remittance Information. Unstructured information up-to length 140 can be entered in this field. Note:

Structured Remittance information is applicable if the payment is originated as a result of return of a previous payment received.Remittance Method Select the Remittance method from the following: - EMAL - E-Mail

- URID - Uniform Resource Identifier

Electronic Address Specify the electronic address. Electronic address to which, an agent sends the remittance information can be entered in this field. Remarks Specify the internal remarks if any. Enrich Button On clicking the Enrich button, system computes the Charges, and Tax on Charges if applicable, based on the maintenance for Pricing Code specified in Outbound US RTP preferences (PUMNCPRF).

Parent topic: Outbound RTP Transaction Input