7.4 Bill Discrepancy Acceptance - Charges and Taxes

This topic provides the systematic instructions to view the Charges and Taxes details against the import bill in the application.

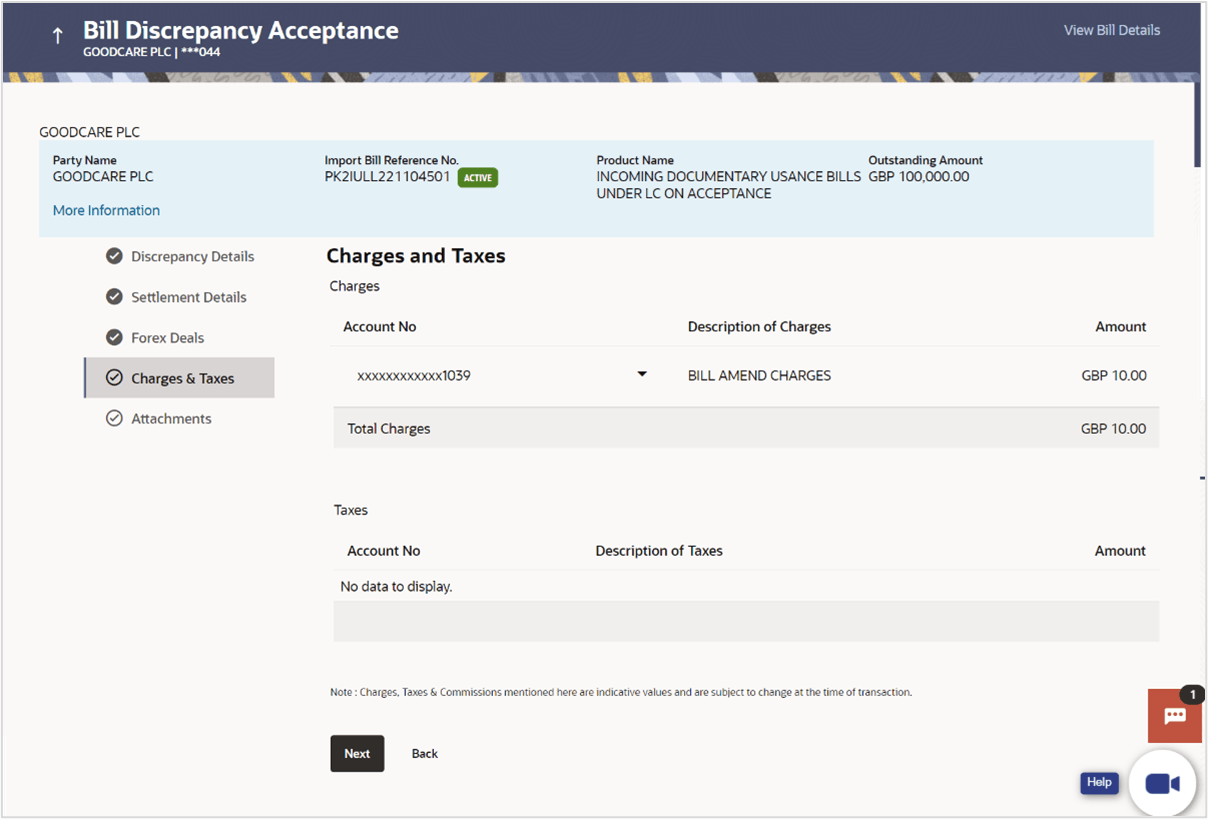

This tab lists charges and Taxes against a Bill.

- Navigate to the Charges and Taxes tab.

Figure 7-5 Bill Discrepancy Acceptance - Charges and Taxes tab

Description of the illustration bill-discrepancy-acceptance-charges-and-taxes.pngFor more information refer to the field description table below:

Table 7-5 Bill Discrepancy Acceptance - Charges and Taxes - Field Description

Field Name Description Charges This section displays the Charges details. Account No Displays the debit account number of the applicant. Description of Charges Displays the description of the charges. Amount Displays the amount of charges. Total Charges Displays the total charge amount. Taxes This section displays the Taxes details. Account No Displays the debit account number of the applicant. Description of Taxes Displays the description of taxes applicable. Value Date Displays the value date of the taxes. Amount Displays the amount of taxes. Equivalent Amount Displays the equivalent amount of taxes. Total Taxes Displays the total Taxes amount. Note:

If there is a Relationship pricing maintained for the customer, the same would be reflected in the charges instead of the standard pricing. - From the Account No list, select the applicant account.

- Perform any one of the following actions:

- Click View Bill Details link at top right corner of the screen to view the

bill

details.

The View Import Bill Under LC screen appears.

- Click Next to save the entered details and proceed to the next level.

- Click Back to navigate back to previous screen.

Note:

If there is a Relationship pricing maintained for the customer, the same would be reflected in the charges instead of the standard pricing. - Click View Bill Details link at top right corner of the screen to view the

bill

details.

Parent topic: Bill Discrepancy Acceptance