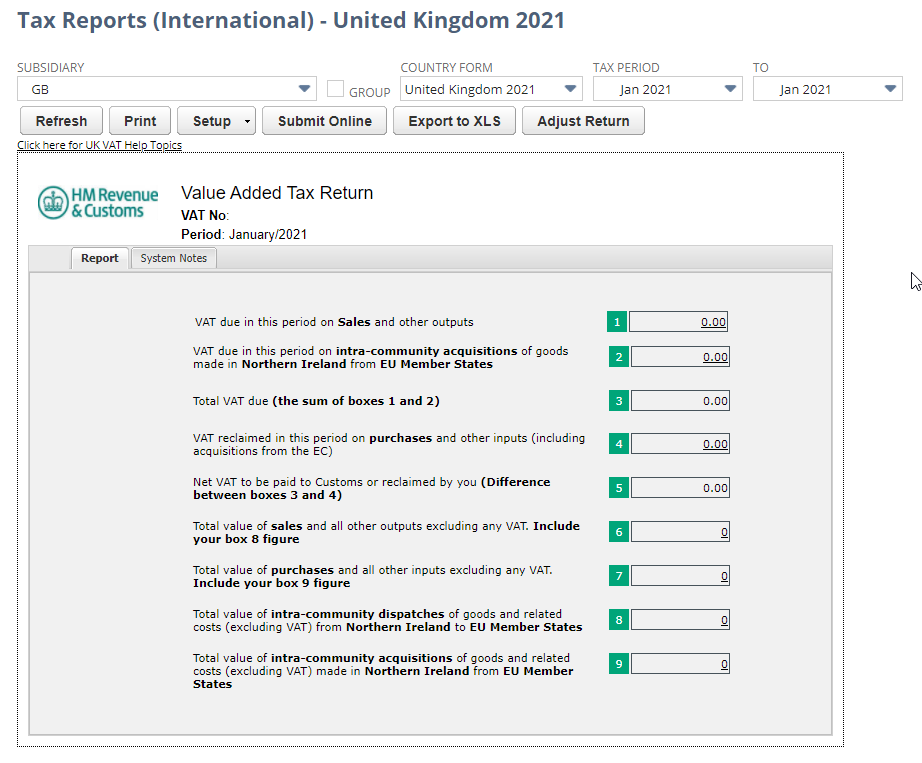

Generating a United Kingdom VAT100 Tax Report

This topic is for NetSuite accounts that use the Tax Reports (International) page to generate the United Kingdom VAT100 Return. If you are using the Country Tax Report page, see Periodic VAT Return - VAT100.

Follow the steps for United Kingdom VAT100 Online Filing Setup if you want to submit your tax reports online directly from NetSuite to His Majesty's Revenue and Customs (HMRC). For more information, see Setting Up Tax Filing for United Kingdom.

To generate a United Kingdom VAT100 Tax Report:

-

Go to Reports > VAT/GST > Tax Reports (International).

-

On the Tax Reports page, select the United Kingdom VAT registered subsidiary.

Note:The dropdown list shows only the subsidiaries that your role has access to.

-

In the Country Form field, select United Kingdom.

-

Check the Group box to view a consolidated report that includes child subsidiaries. Consolidated reporting is used if the company and its child subsidiaries are registered as a single tax entity for VAT purposes (VAT group).

-

In the Tax Period page, select a month or a quarter.

You can create and manage your tax reporting periods at Setup > Accounting > Taxes > Manage Tax Periods (Administrator). Tax periods are usually different from accounting periods. For example, your internal financial reporting (accounting period) is monthly but your tax reporting is quarterly.

In NetSuite, the tax period for a transaction is automatically determined by the date of the transaction.

-

Click Refresh to view the report for the selected tax period. Make sure that you click Refresh each time you change the subsidiary or tax period on the tax form so that the correct values are displayed.

-

Carefully review the values displayed in the report. See Viewing VAT Report Transaction Details.

-

Click one of the following options:

-

Submit Online - to submit the VAT100 form directly to HMRC. For more information, see Submitting a VAT100 Tax Return Online.

-

Print - to print or save a PDF version of the report for your own records.

-

Adjust Return - to adjust the tax amount of any box on the form. For information, see Making Adjustments on a VAT Return.

-

You should review all the values in the report prior to submission. You can visit the HMRC online portal for more information about filling in your VAT form.

You can also use the following customizable saved reports from Reports > VAT/GST:

-

Purchase By Tax Code (Detail)

-

Purchase By Tax Code (Summary)

-

Sales By Tax Code (Detail)

-

Sales By Tax Code (Summary)

For more information, see Sales and Purchase Reports Grouped by Tax Code.

Related Topics:

- International Tax Reports

- Setting Up Tax Filing for United Kingdom

- United Kingdom VAT100 Overview

- What goes into each box - United Kingdom VAT100 report

- Making Tax Digital for VAT

- Making Tax Digital for VAT Overview and Setup

- Submitting MTD VAT Returns to HMRC

- Submitting an MTD VAT Return in a CSV File

- Viewing Previously Submitted MTD VAT Returns

- Viewing the MTD VAT Return Submission History

- Viewing Submission History of United Kingdom MTD CSV Files

- Handling MTD VAT Return Submission Errors

- Exporting a United Kingdom VAT Return to Excel

- United Kingdom Tax Reporting Framework