Creating Distribution Templates

Creating a distribution template is optional, as a user can create line-level quick rule for distributions. For more information, see Applying Quick Distribution Rule.

Only users with assigned Custom CFO role can create a transaction distribution template in the account.

To create a transaction distribution template:

-

Go to Setup > Accounting > Transaction Distribution Templates > New.

-

In the Template Name field, enter a unique name for your template.

-

From the Source Subsidiary list, select the subsidiary to which the distribution template will be applied.

-

From the Dist. Rate Type list, select one of the following:

-

Amount - if the basis for the distribution is amount

-

Distribution weight - if the basis for the distribution is percentage

-

-

From the Type list, select one of the following:

-

Intercompany - if the transaction is between two or more companies.

-

Intracompany - if the transaction is across the subsidiaries.

-

-

(Optional) You can check the following boxes based on your template preferences:

-

Distribute Taxes - to distribute the transaction line tax amount in the template lines

-

Use Source Account - to use the accounts from the source transaction on the journal entry

-

Use Source Custom Segments - to use the custom segments from the source transaction on the journal entry

-

Use Source Class - to use the class segment from the source transaction on the journal entry

-

Use Source Department - to use the department segment from the source transaction on the journal entry

-

Use Source Location - to use the location segment from the source transaction on the journal entry

-

-

To add a line to the distribution template:

-

From the Destination Subsidiary field, select the subsidiary where the amount will be distributed.

If you selected Intracompany in the Type field, the Destination Subsidiary field will be dimmed.

-

From the Destination Account list, select the account to which the transaction line amount will be distributed.

-

If the rate type selected is Amount, in the Distribution Amount field, enter the amount applied to the line distribution.

-

If the rate type selected is Distribution Weight, in the Distribution Weight field, enter the percentage of the amount applied to the line distribution.

Note:If Distribution Weight is selected in the Rate Type field, the total of the distribution percentage must be 100%. Otherwise, the template cannot be used in transactions.

-

(Optional) Select an appropriate value in the following fields:

-

Destination Class

-

Destination Department

-

Destination Location

-

Other custom segments

-

-

Click Add.

-

To add more lines as needed in the template, repeat steps 7(1) to 7(6).

You must ensure that no duplicate lines will be added.

Note:After a line has been added to the template, the body fields will be dimmed and no changes can be made to the template. To change values from the body fields, you must first clear all the lines.

-

Click Save.

-

-

Click Save.

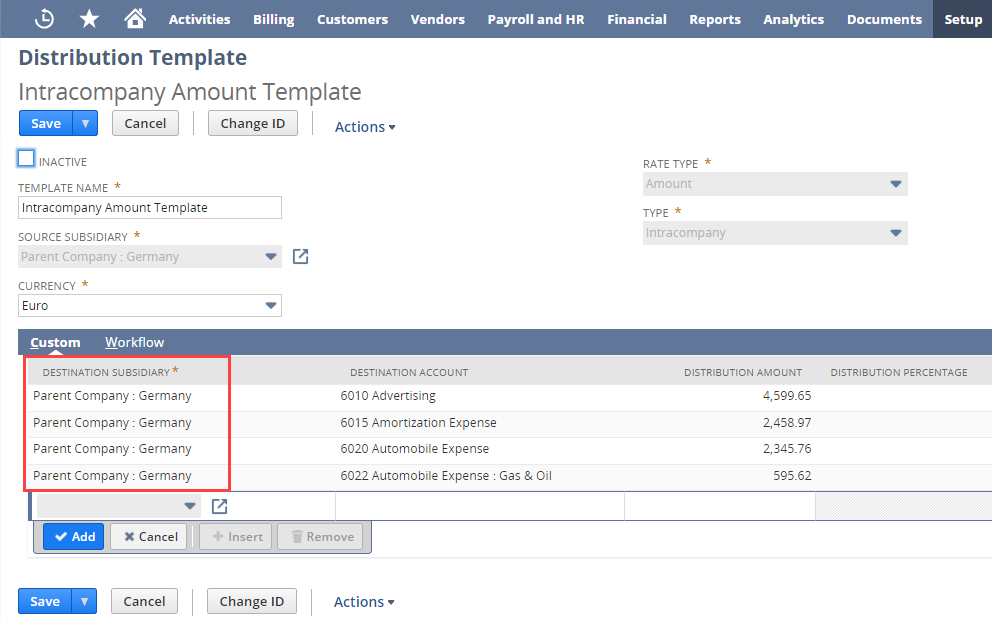

If you create an intracompany distribution template, the destination subsidiary fields will show the same values. See the following screenshot for reference.

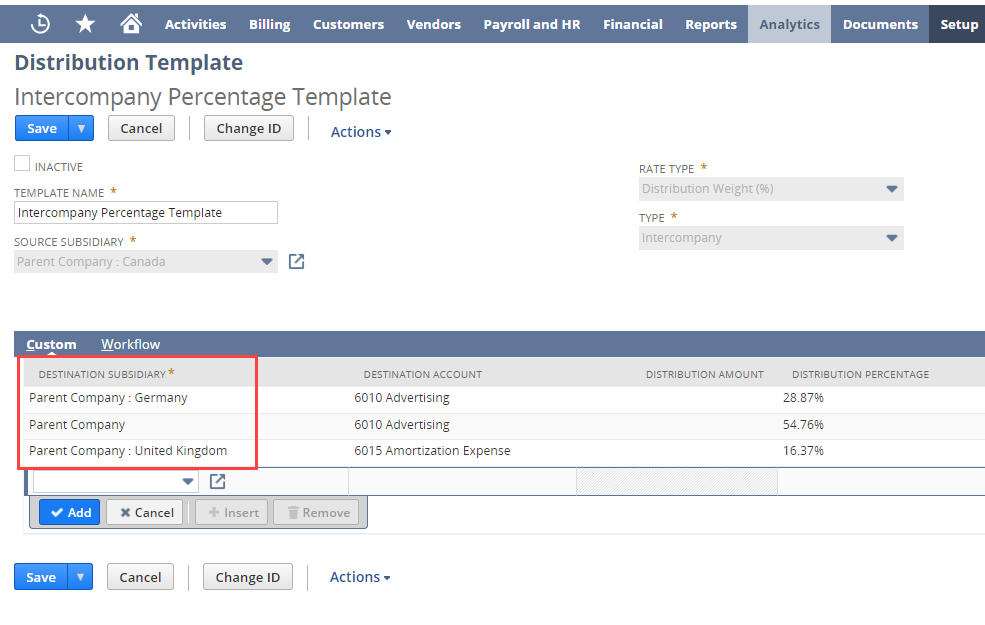

If you create an intercompany distribution template, the destination subsidiary fields can show different values, depending on the subsidiaries selected during the template creation. See the following screenshot for reference.