Download Form W-2 and Form W-2 C

About Form W-2 and Form W-2 C

At the end of each financial year, every employer submits Form W-2 for all paid employees (current and terminated) during the calendar year. The Form W-2 is submitted to the Social Security Agency (SSA). This needs to be done for each employee who is paid a salary, wage, or other compensation as part of the employment relationship. The form shows a breakdown of an employee's gross taxable annual wages paid and withholding information. The withholding information includes any amount withheld toward:

-

Federal, Social Security, Medicare, State and other taxes (as applicable)

-

Medical insurance provided by the employer for the employee and their dependents

-

401k, Roth 401k, and Individual Retirement Account (IRA) contributions by an employee, including any matching 401k contribution by the employer

-

Bankruptcy claims (if any)

-

Child Support, Alimony, Federal and State tax levies, unpaid taxes or incorrect tax amount filed with IRS, bankruptcy, student loans, and other court-ordered garnishments

There can only be a single Form W-2 generated for each employee in a financial year. However, there can be multiple amendments made to it. Each time an amendment is made to Form W-2, a Form W-2 C will be generated. For example, correcting details like address, name, or Social Security Number (SSN) for an employee.

There can be more than one Form W-2 C issued for an employee in a financial year. If there are multiple amendments to Form W-2, only the latest amendment will be displayed.

If you notice any inaccuracy in your W-2, you need to inform your payroll team. In such cases, the necessary corrections will be made and a Form W-2 C will be issued. The C added to a W-2 means it's an amendment to the original W-2 issued by the IRS.

For more information about Form W-2 and the fields in the form, see About Form W-2, Wage and Tax Statement. For more information about Form W-2 C and the fields in the form, see About Form W-2 C, Corrected Wage and Tax Statements.

View your Form W-2 and Form W-2 C

If you don't see the Payroll portlet, you can't view Form W-2 and Form W-2 C in NetSuite.

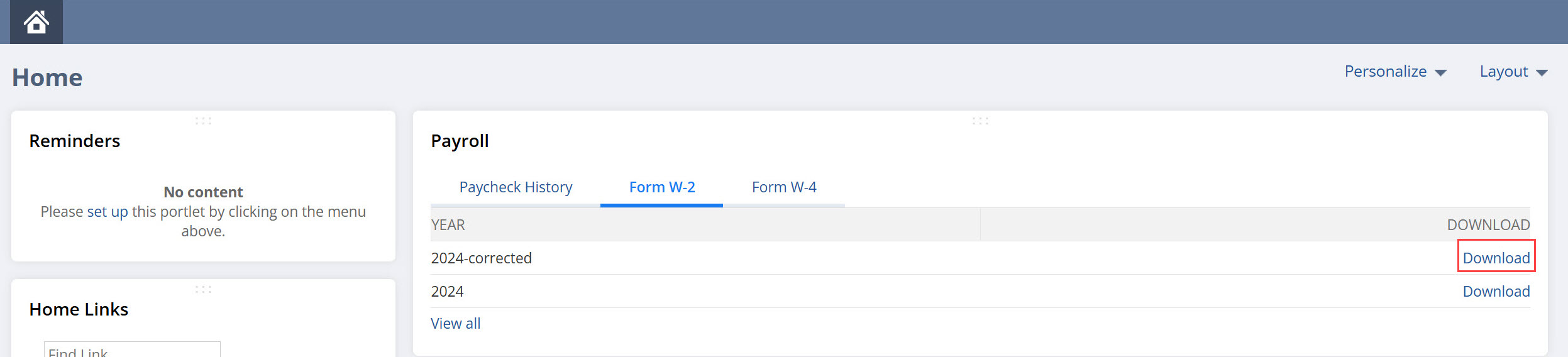

You can view your Form W-2 and Form W-2 C only when you choose Employee Center from the list of assigned roles. To know more about how to switch the roles, see Roles and Accounts. The latest five records for Form W-2 and Form W-2 C can be viewed under the Form W-2 subtab of the Payroll portlet. Click View All in the Form W-2 subtab to view all the forms that have been uploaded to NetSuite for your organization.

The Form W-2 and Form W-2 C will be available for download effective from the financial year of 2024 onward. The forms for 2024 will be available for download from the Employee Center at a later date. If you want to download the forms for 2024 before that date, contact your payroll team.

In NetSuite, Form W-2 will be shown in the YYYY format and Form W-2 C will be shown in the YYYY-corrected format. For example, Form W-2 and Form W-2 C for the year 2024 will be shown as 2024 and 2024-corrected.

Download Your Form W-2 and Form W-2 C as a PDF Document

If you don't see the Payroll portlet, you can't view Form W-2 and Form W-2 C in NetSuite.

To download your Form W-2 and Form W-2 C for a financial year,

-

Log in to NetSuite using your credentials.

-

Change your role to Employee Center if you are logged in to a different role. To know more about how to switch the roles, see Roles and Accounts.

-

In the Payroll portlet, go to the Form W-2 subtab.

Note:

Note:The latest five forms will be displayed in the portlet. To view W-2 and W-2 C forms for all the years, click View All.

-

Click the Download link next to the year for which you want to download the W-2 form. For example, if you want to download the W-2 form for 2024, click the Download link next to it.

-

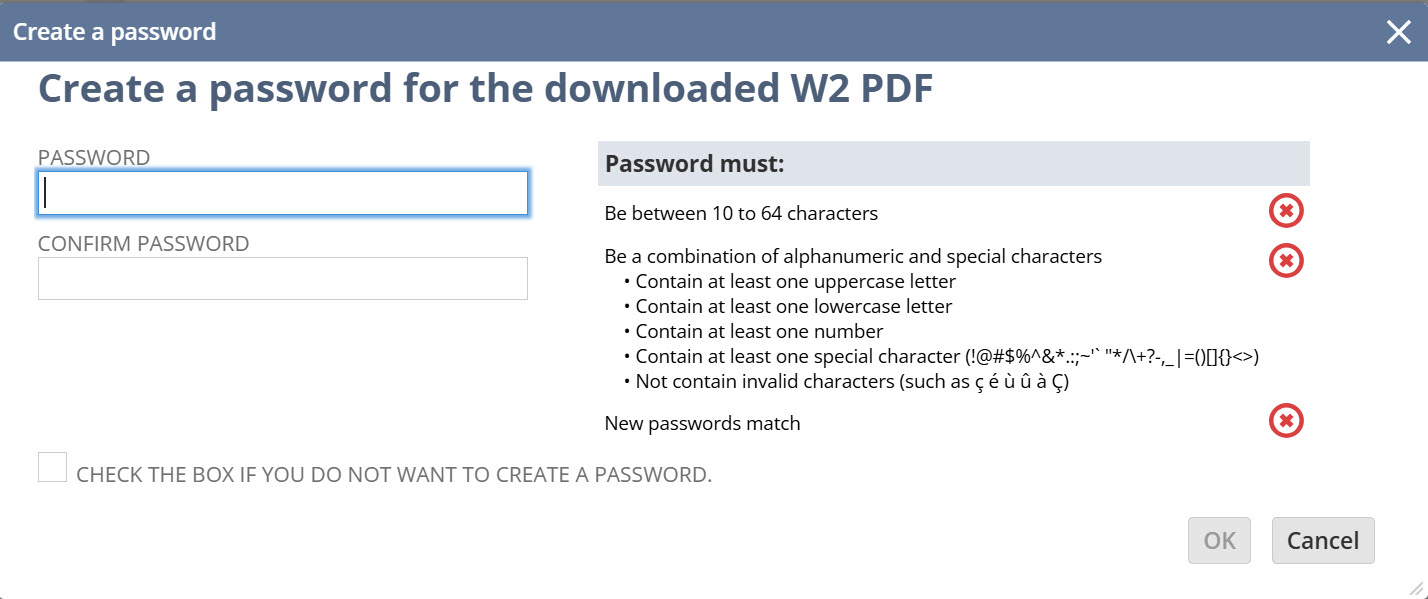

A pop-up appears asking you to create a password for the downloaded PDF.

Note:

Note:The pop-up will appear every time you try to download the form from NetSuite.

-

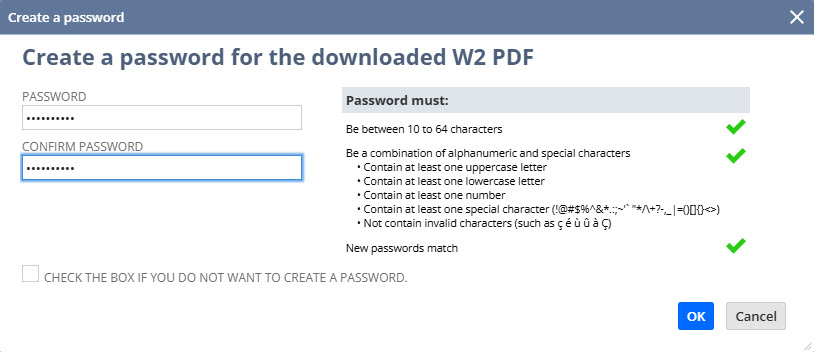

Enter a password that meets all the validation criteria mentioned in the pop-up in the Password field. As you type, the characters are validated against password policy criteria and the results are displayed.

-

Re-enter the same password in the Confirm Password field.

-

-

Click OK to save the form as a PDF document to the default downloads folder on your device. You can only save the form if you meet the password policy criteria mentioned in the pop-up.

Note:

Note:The password you created needs to be entered every time you try to access the PDF from your device.

-

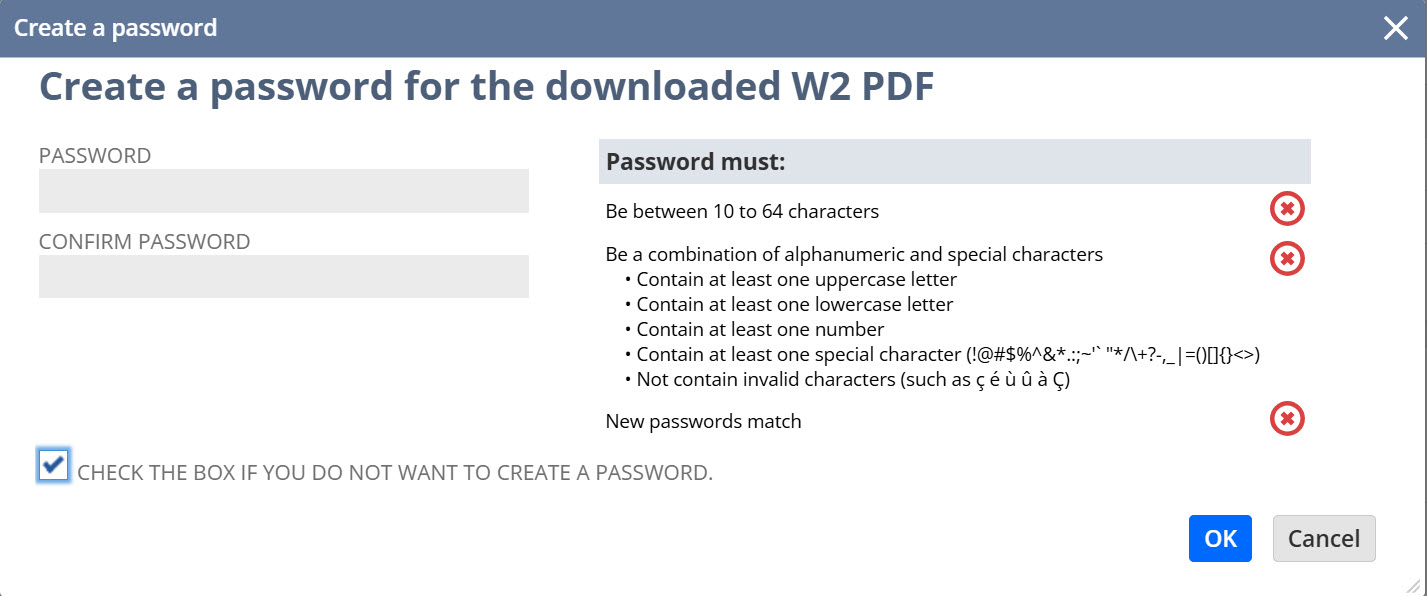

If you don't want to create a password, check the box as shown and click OK to save the form as a PDF document.

Employee Rehire

There may be certain scenarios when an employee quits an organization and rejoins after a certain time. If the NetSuite Administrator updates the employee's details in the same Employee record when they rejoin, they can view all the historical W-2s. If the NetSuite Administrator creates a new Employee record when the employee rejoins the company, they can't view historical W-2s. However, the employee will be able to view the W-2s from the financial year of the year they rejoin the organization. If the employee needs to view historical W-2s, they need to raise a request with the payroll team. In such cases, the payroll team will download the W-2s and share it with them.