Fields and Placeholders in ALF Templates

The templates provided by the Advanced Localization Features SuiteApp contain FreeMarker placeholder tags for sourcing and displaying required information as well as setting the layout of the transaction document when printed. The following information is available when printed to PDF or HTML.

The Advanced Localization Features SuiteApp enables you to customize the invoice, credit memo, and sales order default labels. To learn more about this feature, see Labels and Notes Customization.

Header Area:

|

Field |

Default Label |

Placeholder or Value in Default Template |

Invoice, Credit Memo, Sales Order, or Purchase Order |

Description |

|---|---|---|---|---|

|

Title |

- |

The applicable transaction type is displayed on the template header area.

|

All |

The document type. |

|

Logo |

- |

${subsidiary. If you're not using a OneWorld account, the placeholder is $ |

All |

Reference to the image that you want to place as the company logo. |

|

Customer name and address |

Bill To |

${record.billaddress} |

All |

The name and the billing address of the customer. |

|

Customer VAT Registration Number |

VAT/TAX/GST Reg. Number: |

If you're using Legacy Tax: ${record. If you're using SuiteTax: ${record. |

All |

Displays the following tax type registration number that you select for your customer.

If you're using Legacy Tax, it is sourced from the Customer record (Financial subtab, Tax Information section). If you are using SuiteTax, it is sourced from the Customer record (Tax Registrations subtab under the Financial subtab). |

|

Invoice Number |

Invoice Number: |

${record.tranid} |

All |

The invoice number sourced from the transaction. |

|

Subsidiary name and address |

Issuer: |

${subsidiary.legalname} or ${subsidiary.name} |

All |

The name and address of the subsidiary that issued the invoice.

Important:

If you print an invoice, credit memo, or sales order created before the Advanced Localization Features SuiteApp installation, this entry will remain empty. The SuiteApp can't identify the issuers retrospectively. |

|

Subsidiary VAT Registration Number |

VAT/TAX/GST Reg. Number: |

If you're using Legacy Tax: ${subsidiary. If you're using SuiteTax: $ |

All |

Displays the following tax type registration number that you select for a subsidiary.

If you're using Legacy Tax, it is sourced from the subsidiary VAT Registration No. If you you're using SuiteTax, it is sourced from the transaction record (Tax Details subtab). |

|

Customer Name |

Name |

${entity. |

Sales order |

Name of the customer. |

|

Vendor Name |

Name |

${ entity.firstname}+${ entity.middlename}+${ entity.lastname} |

Purchase order |

Name of the vendor. |

|

Company |

Company Name |

${entity.companyname} |

Sales order and purchase order |

Company Name of the customer or vendor. |

|

Subsidiary Email |

|

${subsidiary.email} |

Sales order and purchase order |

Return email address of the subsidiary. |

|

Subsidiary Address |

Address |

${subsidiary.address} |

Sales order and purchase order |

Address of the subsidiary. |

|

Subsidiary VAT Registration Number |

VAT/TAX/GST Reg. Number: |

If you're using Legacy Tax: ${subsidiary. If you're using SuiteTax: $ |

All |

Displays the following tax type registration number that you select for a subsidiary.

If you're using Legacy Tax, it is sourced from the subsidiary VAT Registration No. If you you're using SuiteTax, it is sourced from the transaction record (Tax Details subtab). |

|

Transaction Date |

Date: |

${record.trandate} |

All |

The transaction date, in DD/MM/YYYY format. |

|

Due Date |

Due Date: |

${record.duedate} |

Invoice and purchase order |

The due date of the invoice, in DD/MM/YYYY format. |

|

Currency |

Currency: |

${record. If you're not using a OneWorld account, the placeholder is $ |

All |

The code of the currency used by the customer (for example, EUR). |

|

Customer Number |

Customer Number: |

${record.entity.entityid} |

All |

The number set for the customer. This only prints if Auto-Numbering is enabled for customers. |

|

Project Reference |

Project: |

${record.job} |

All |

The project that this invoice, credit memo, or sales order applies to. It is only printed if you're using the Projects feature and this customer is assigned to a specific project. |

|

Credit - Applied Invoice |

Applied To: |

${record.apply.refnum} |

Credit memo |

The number of an invoice that this credit memo applies to. If it applies to multiple invoices, their names are all listed, separated by a comma. |

|

Purchase Order # |

Purchase Order: |

${record.otherrefnum} |

Invoice, credit memo, and sales order |

The number of a purchase order assigned to this invoice, credit memo, or sales order (if any such purchase order exists). For more information, see Purchase Order Management. |

|

Sales Order # |

Sales Order: |

${record.createdfrom} |

Invoice |

The number of sales orders assigned to this invoice (if any such sales order exists). For more information, see Sales Orders. |

|

Customer Company registration number |

Registration Number: |

${record. |

All |

The registration number for this customer (for example, it can the Chamber of Commerce registration number, SIRET, or HVB number). For more information, see List of Fields Added to the Customer or Vendor Record. |

|

Shipping Address |

Ship To |

${record.shipaddress} |

All |

The shipping address sourced from the transaction record (Shipping subtab).

Note:

If the shipping address is the same as the billing address (Customer name and address) or if it is not filled, the placeholder remains hidden and this section is not printed. |

|

Total |

Total |

${record.total} |

All |

The total invoice, credit memo, or sales order amount. The same value is also displayed in the Subtotals area of the template. |

Lines Area:

|

Field |

Default Label |

Placeholder or Value in Default Template |

Invoice, Credit Memo, Sales Order, or Purchase Order |

Description |

|---|---|---|---|---|

|

Line # |

Ln. |

- |

All |

The line counter. |

|

Item # |

Item |

${item.item} |

All |

Line item name. |

|

Item description |

Description |

${item.description} |

All |

Transaction line description. |

|

Quantity |

Qty. |

${item.quantity} |

All |

Line item quantity. |

|

Unit of Measure |

U.M. |

${item.units} |

All |

Line item unit of measure. |

|

Rate |

Unit Price |

${item.rate} |

All |

Line item rate. |

|

Line Amount Excluding VAT |

Net Amount |

${item.amount} |

All |

Line item amount. |

|

VAT or TAX or GST % |

VAT or TAX or GST % |

If you're using Legacy Tax: ${item.taxrate1} If you're using SuiteTax: ${item.taxrate} |

All |

VAT, TAX or GST rate for this line item. See tables below for US and Canada-specific information. |

|

VAT or TAX or GST Amount |

VAT or TAX or GST |

If you're using Legacy Tax: ${item.tax1amt} If you're using SuiteTax: ${item.taxamount} |

All |

VAT, TAX or GST amount for this line item (calculated from the Line Amount and VAT %). |

|

Lot Number |

Lot Number |

- |

All |

Lot number of the lot inventory type item. |

|

Serial Number |

Serial Number |

- |

All |

Serial number of the serialized inventory type item. |

|

Expiration Date |

Expiration Date |

- |

All |

Expiration Date of the lot inventory type item. |

|

Total Line Amount |

Total incl. VAT or TAX or GST |

${item.grossamt} or ${item.grossamt} plus the discount (see below) |

All |

The total amount for this line item (calculated from the Line Amount, VAT, TAX or GST Amount, and the discount). |

|

Discounts |

Discount |

${item.grossamt} (calculated as sum of record.item[i].grossamt in which record.item[i]itemtype is the value of the discount) |

All |

The discount assigned to this line item. Only printed when Print Discounts in separate column option is checked in Invoice Customization. |

Subtotals Area

|

Field |

Default Label |

Placeholder or Value in Default Template |

Invoice, Credit Memo, Sales Order, or Purchase Order |

Description |

|---|---|---|---|---|

|

Shipping and Handling |

Shipping |

${record.shippingcost} |

All |

Sum of the shipping cost and the handling cost (excluding VAT). |

|

Header Discounts |

Invoice Discount |

${record.discounttotal} |

All |

Transaction discount as entered into discount body field. |

|

Exchange Rate |

Exchange Rate |

${record.exchangerate} |

All |

This amount is displayed if the transaction is in a foreign currency. Foreign currency is converted to the base currency. |

|

Tax Total |

VAT or TAX or GST Amount |

${record.taxtotal} |

All |

This amount includes VAT, TAX or GST on discounts and additional costs (like shipping and handling). |

|

GST/HST |

GST or HST |

${record.taxtotal} |

All |

This amount includes the tax amount attributed to GST or HST. This is specific for Canada nexus. |

|

PST |

PST |

${record.tax2total} |

All |

This amount includes the tax amount attributed to PST. This is specific for Canada nexus. |

|

Amount Due |

Amount Due |

$ |

Invoice |

The remaining amount to be paid in the invoice. This will only be printed if there already has been some amount paid on the invoice. If the due amount equals the total amount, this placeholder will not be used. |

|

VAT or TAX or GST Summary |

VAT or TAX or GST Summary |

VAT or TAX or GST %: ${tax.taxrate} Net Amount: ${exchrate} * ${tax.taxbasis} VAT or TAX or GST Amount: ${exchrate} * ${tax.taxamount} Amount incl. VAT or TAX or GST: ${exchrate} * (${tax.taxbasis} + ${tax.taxamount}) |

All |

This table indicates the amounts with applied tax rates. This table contains one line per each tax rate in the VAT % column. For each rate, you will also see the net amount, VAT amount, and the total amount including VAT.

Note:

To display VAT Summary of an individual item's VAT in a template, check the Display Components on Transactions box under the Purchasing/Inventory subtab on the Item Group page.

Note:

For the VAT %, VAT Amount and Amount incl. VAT columns, VAT is replaced with one of the following tax types based on the type of tax selected in a subsidiary:

|

|

Subtotal |

Subtotal |

${record.subtotal} |

All |

The sum of all invoice lines. If any line discounts exist, they are already reflected in the subtotal. |

|

Total (excluding VAT) |

Total (exc. VAT) |

${record.total} minus ${record.taxtotal} |

All |

Sum of the subtotal, shipping and handling costs, and the discounts (excluding VAT). |

|

Total |

Total |

${record.total} |

All |

The total invoice, credit memo, or sales order amount. The same value is also displayed in the Header area of the template. |

Notes Area

|

Field |

Default Label |

Placeholder or Value in Default Template |

Invoice, Credit Memo, Sales Order, or Purchase Order |

Description |

|---|---|---|---|---|

|

Method of Payment |

Method of Payment: |

${record. |

All |

The method of payment used for this invoice, credit memo, or sales order. To learn more about setting the methods of payment in the Advanced Localization Features SuiteApp, see Method of Payment. |

|

Payment Reference |

Payment Reference: |

${record. |

Invoice, sales order, and purchase order |

A specific reference that your customer should add to the payment. It is sourced from the Invoice Configuration subtab of the Invoice record. |

|

Payment Terms |

Payment Terms: |

${record.terms} |

Invoice |

The payment terms that apply to this invoice. They are sourced from the Billing subtab of the Invoice Record. |

|

Installment Number |

Installment Number |

- |

Invoice |

The installment number of the installment payment term. |

|

Amount |

Amount |

- |

Invoice |

The installment amount of the installment payment term. |

|

Due Date |

Due Date |

- |

Invoice |

The installment due date of the installment payment term. |

|

Due Amount |

Due Amount |

- |

Invoice |

The installment due amount of the installment payment term. |

|

Status |

Status |

- |

Invoice |

The installment status of the installment payment term. |

|

Payment Discount Amount |

Payment Disc. Amount: |

$ |

Invoice |

The discount amount. This will only be printed if the discount amount is filled for this invoice. |

|

Payment Discount Date |

Payment Disc. Date: |

${record.discountdate} |

Invoice |

The discount date. This will only be printed if the discount date is filled for this invoice. |

|

Tax Compliance Text |

- |

${record. |

All |

The tax-related text to be printed on this invoice, credit memo, or sales order. To learn more about creating the tax compliance texts in the Advanced Localization Features SuiteApp, see Tax Compliance Text. |

|

Invoice/Credit Memo Notes |

- |

${subsidiary. |

Invoice and credit memo |

The subsidiary-related notes. This text is sourced from the Subsidiary record (Invoice Configuration subtab). For more information, see List of Fields Added to the Subsidiary Record. |

|

Sales Order Notes |

- |

${{subsidiary. |

Sales Order |

The subsidiary-related notes. This text is sourced from the Subsidiary record (Invoice Configuration subtab). For more information, see List of Fields Added to the Subsidiary Record. |

|

Proforma Invoice Notes |

- |

${subsidiary. |

Sales Order |

The subsidiary-related notes. This text is sourced from the subsidiary record (Invoice Configuration subtab). For more information, see List of Fields Added to the Subsidiary Record. |

|

Purchase Order Notes |

- |

${subsidiary. |

Purchase Order |

The subsidiary-related notes. This text is sourced from the subsidiary record (Invoice Configuration subtab). For more information, see List of Fields Added to the Subsidiary Record. |

|

Late Payment Note |

Late Payment: |

${subsidiary. |

Invoice |

Notes regarding the late payment policy of this subsidiary. This text is sourced from the Subsidiary record (Invoice Configuration subtab). Field not translated. For more information, see List of Fields Added to the Subsidiary Record. |

|

No prompt payment discount applies |

No payment discount |

${subsidiary. |

Invoice |

Note added if no discount applies to invoice. Automatically added upon checking the Print Note if There's no Payment Discount box is checked. This text is sourced from the Subsidiary record (Invoice Configuration subtab). Field not translated. For more information, see List of Fields Added to the Subsidiary Record |

Quick Response Code

The Quick Response (QR) code on the ALF invoice PDF/HTML file enables the customers to scan and access additional details related to the invoice. You can also add payment resources using a QR code.

To include QR code on an invoice template, the hidden transaction body field custbody_alf_qr_code must be populated to have QR code on the generated Invoice PDF file. Users can populate the field using scripts or workflows

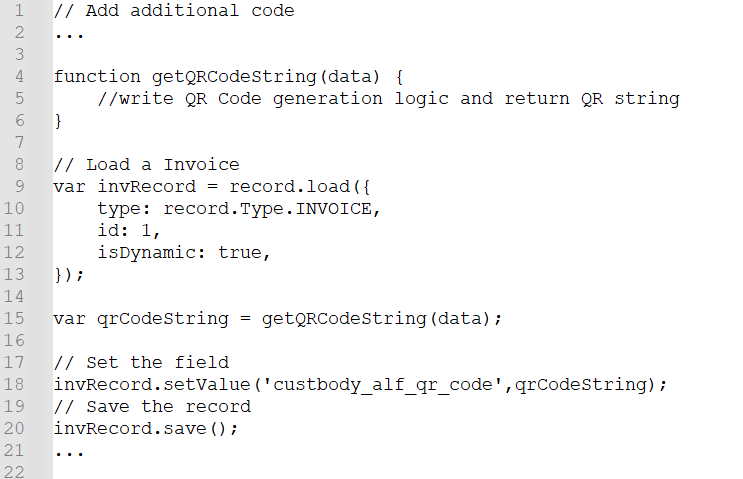

Here is the code sample with the QR code string:

For assistance on QR code string details, contact NetSuite Technical Support.

The QR Code feature is available only for ALF Invoice template.

Footer Area

If the fields are left unpopulated, they will not be included in the printout.

|

Field |

Default Label |

Placeholder or Value in Default Template |

Invoice, Credit Memo, Sales Order, or Purchase Order |

Description |

|---|---|---|---|---|

|

Bank Details |

- |

${record. or ${record. |

All |

Company bank details or direct debit details to be printed on this transaction. To be used by the customer when processing a payment. To learn more about setting the transaction bank details in the Advanced Localization Features SuiteApp, see Transaction Bank Details. |

|

Company Details |

- |

${subsidiary. ${subsidiary. ${subsidiary. ${record. |

All |

The phone number, the fax number, the email address, and the web site of the company that issued the transaction. |

|

Other Legal Info |

- |

${record. |

All |

Additional information to be printed (typically, it can be the legal information of this company's tax registration). For more information, see List of Fields Added to the Subsidiary Record. |

|

Share Capital |

Share Capital: |

${subsidiary. |

All |

The value and the currency of the company share capital. For more information, see List of Fields Added to the Subsidiary Record. |

|

Managing Director |

Managing Director: |

${subsidiary. |

All |

Name of the managing director of this company. For more information, see List of Fields Added to the Subsidiary Record. |

|

SIC Code |

SIC Code: |

${subsidiary. |

All |

The Standard Industrial Classification (SIC) code of this company. For more information, see List of Fields Added to the Subsidiary Record. |

|

Page Numbering |

- |

- |

All |

A counter for numbering the pages of this invoice, credit memo, or sales order. |