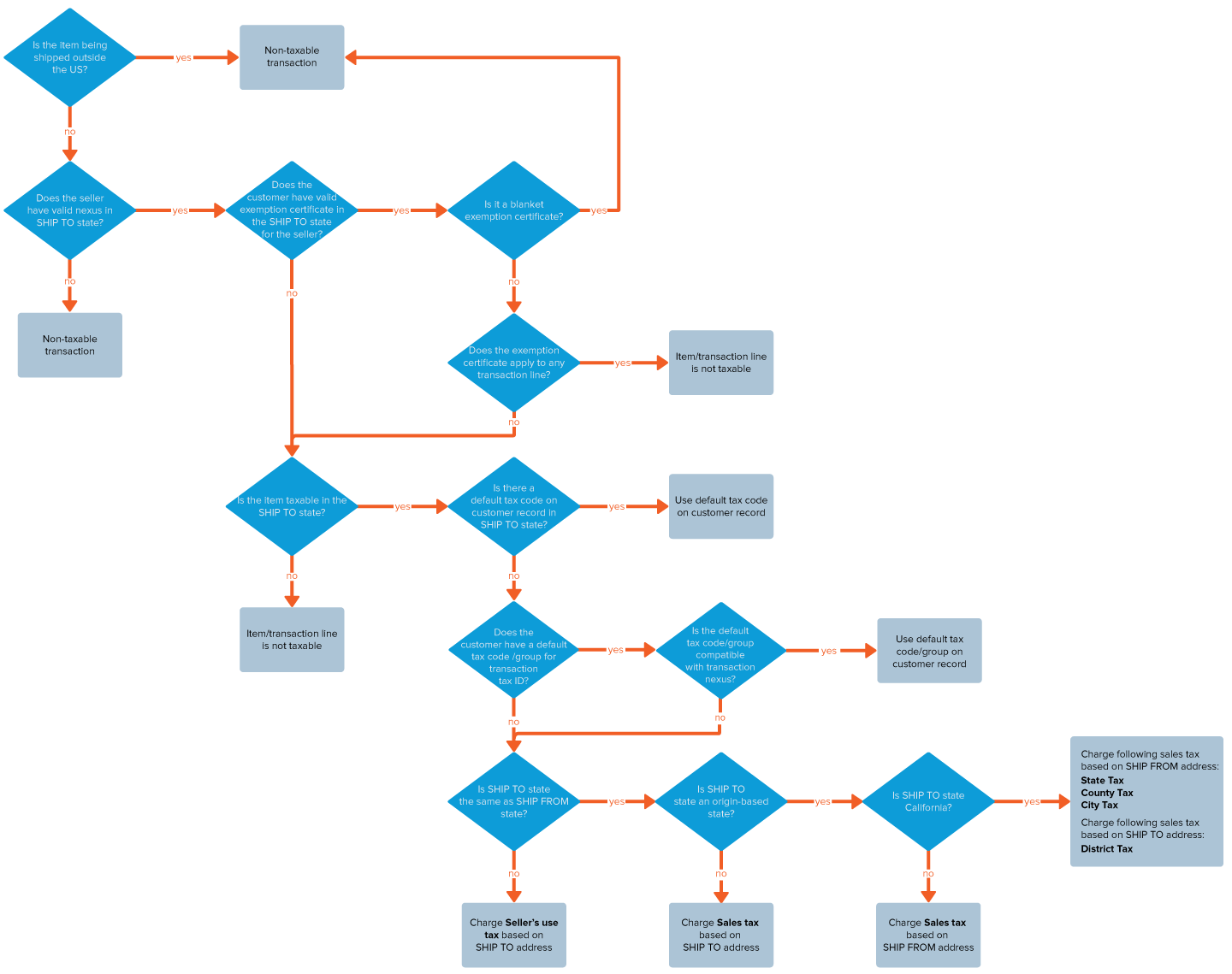

Tax Code Lookup Logic for United States

For each sales or purchase transaction, the SuiteTax Engine determines what tax code and rate to use for each item and calculates the tax amounts.

The SuiteTax Engine makes use of SuiteTax nexus lookup logic by automatically determining nexuses for every transaction. For more information, see Nexus Determination Lookup Logic in SuiteTax.

Sales and purchases tax determination lookup logic is based on ZIP+4 accuracy:

-

Address contains ZIP+4 - the tax group is set according to valid ZIP+4.

-

Address contains ZIP (not ZIP+4), city and state - tax group is set according to valid ZIP. If more than one tax group exists for the given zip, the group with the widest range is used.

-

If no ZIP code is provided in the address used for the tax determination, the taxes are not calculated for this address.