Define Lease Payments in Arrears

Define lease payments in arrears where the payment is due and payable at the end of day of the scheduled payment date. You can generate amortization schedules for liability and interest expenses considering payment timing to be the end of day of the scheduled payment date and including the payment day in the interest expense calculations. This feature enables accurate calculation of interest expense and liability amortization, and timely payment to lessors, suppliers and billings to lessees based on contractual terms. Prior to Release 12.2.15, the lease payments could only be scheduled in advance and the payment timing was considered as the beginning of day.

This document describes the process you must follow for both Property and Equipment Leases. The forms and pages that have been modified for this feature are provided as applicable.

You can create payments in arrears for Expense Leases using the following process:

- Create Lease with all the required information. Enter property or asset details and Save.

- Define payment terms. While defining the payment term, enable Arrears checkbox and provide Schedule Date as the last day of the frequency period. With this definition, payment is considered to be made at the end of the frequency period. Interest will be calculated for the complete period before payment.

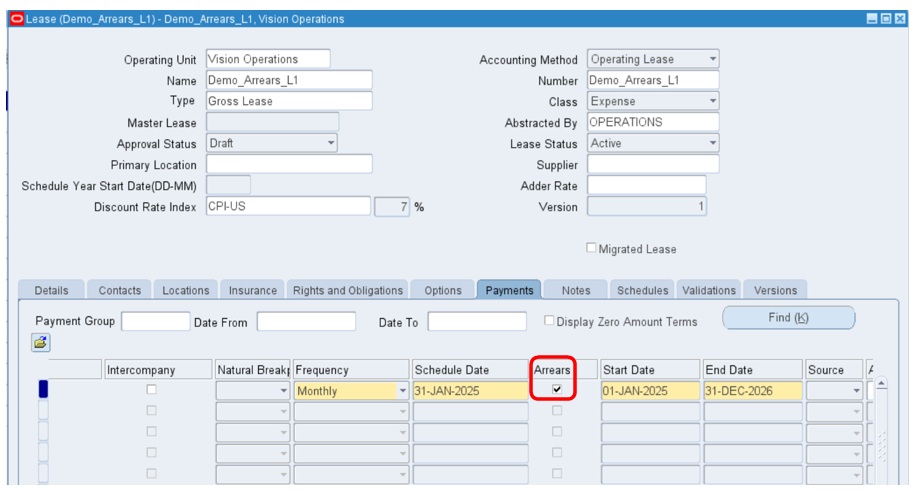

Property Lease

The following diagram displays the new option in the Property Lease form:

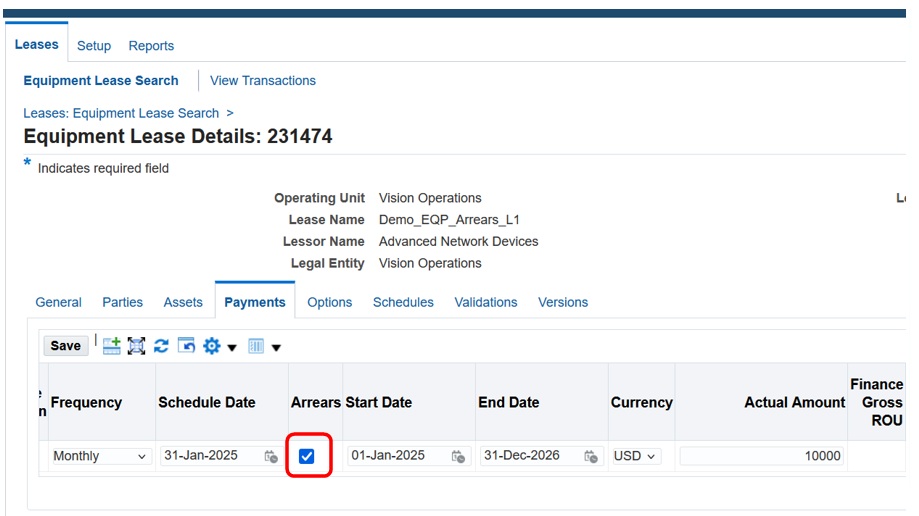

Equipment Lease

The following diagram displays the new options in the Equipment Lease Details page:

3. Generate Balances and Finalize the Lease.

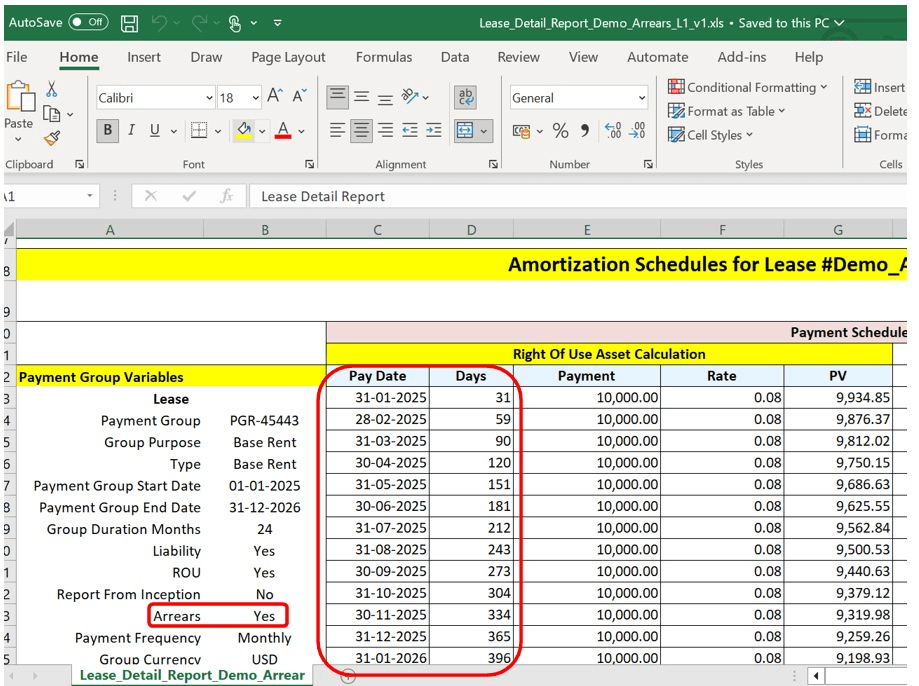

4. Verify the Lease Details Report.

-

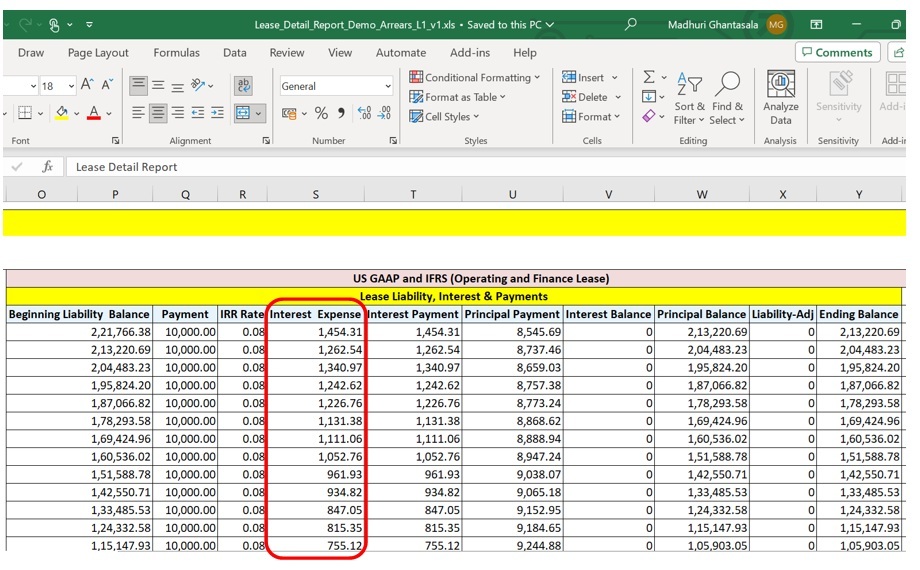

- Present Value is calculated for the complete month as the payment is made at the end of the month.

- Interest Expense is calculated as interest before the payment for the complete period.as shown in the following diagram:.

Steps to Enable

You don't need to do anything to enable this feature.