G Appendix : Automatic Update of CIIC

OFSLL supports automatic processing of CIIC (Consumer Information Indicator Code) with bankruptcy tracking details and posting on to the respective account relation(s) without manual intervention. This also ensures that there is no dependency on end user’s knowledge on what needs to be reported in Metro II report.

Note:

This feature is applicable only if OFSLL ‘Collections’ module is used. If in case you use only OFSLL ‘Servicing’ module, the CIIC reporting is handled as per the methods explained in following sections of this document:- User has to manually create a Bankruptcy record from ‘Collections > Bankruptcy > Customer Service > Bankruptcy’ or using ‘CUSTOMER BANKRUPTCY REPORTING INDICATOR- CUS_BANKRUPTCY_INFO’ non-monetary transaction. On doing so, system will internally mark the ‘Customer Bankruptcy Indicator’ to ‘Y’ for the corresponding account relation and creates a ‘Bankruptcy’ condition on that account.

- Whenever the system runs the batch job to generate metro 2 data (CBUUTL_BJ_100_02) system will look for the account relations with ‘Bankruptcy Indicator’ as ‘Y’.

- If Bankruptcy records are found, system identifies the appropriate account

relations by verifying details in the following columns of METRO_II_DATA

table:

- ‘MET_BASE_CIIC’ for Primary account relation

- ‘MET_J2_1_CIIC/MET_J2_2_CIIC/MET_J2_3_CIIC/MET_J2_4_CIIC’ columns for non-primary account relation (in a sequence of SPOUSE, 2NDRY, COS, COS_SPOUSE, COS2, COS2_SPOUSE)

- The CIIC is reported based on the following conditions:

- To populate the matching columns of ‘MET_BASE_CIIC/ MET_J2_1_CIIC/ MET_J2_2_CIIC/ MET_J2_3_CIIC/ MET_J2_4_CIIC’ in metro II, system will look into the set of a particular account relation bankruptcy records with Current indicator ‘Y’.

- Based on the ‘Disposition’ and ‘Type’ selected, the

corresponding CIIC (as mentioned in the below table) will be

posted.

Table G-1 CIIC Code Derivation

S.No Disposition Type CIIC Code Derived 1 Petition Chapter 7 A 2 Discharged Chapter 7 E 3 Dismissed Chapter 7 I 4 Withdrawn Chapter 7 M 5 Petition Chapter 11 B 6 Discharged Chapter 11 F 7 Dismissed Chapter 11 J 8 Withdrawn Chapter 11 N 9 Petition Chapter 12 C 10 Dismissed Chapter 12 K 11 Withdrawn Chapter 12 O 12 Discharged Chapter 12 G 13 Petition Chapter 13 D 14 Discharged Chapter 13 H 15 Dismissed Chapter 13 L 16 Withdrawn Chapter 13 P 17 Reaffirmed Reaffirmation of Debt R 18 Reaff Rescinded Chapter 7 Reaffirmation of Debt Rescinded V Note:

If system does not find an appropriate combination of ‘Disposition’ and ‘Type’ to derive the corresponding CIIC in metro II, the CIIC will be reported as BLANK (‘ ’).Subsequently in the next reporting period, if there are no bankruptcy updates in the account, system reports this segment in METRO_II_DATA file as BLANK (‘ ’).

Once customer is out of Bankruptcy protection and status is no more ‘Active Bankruptcy’, user needs to manually post the non-monetary transaction ‘CUS_BANKRUPTCY_INFO’ to mark the bankruptcy status of the customer as ‘No’.

Further, user need not post the QR-QUEUE/CONDITION REQUEST Call Activity to open the CIIC condition to report the same in Metro II. This also means system will not display the text ‘CONSUMER INFORMATION INDICATOR CODE (METRO2 - FCRA)’ under the account conditions table of Customer Service Summary page.

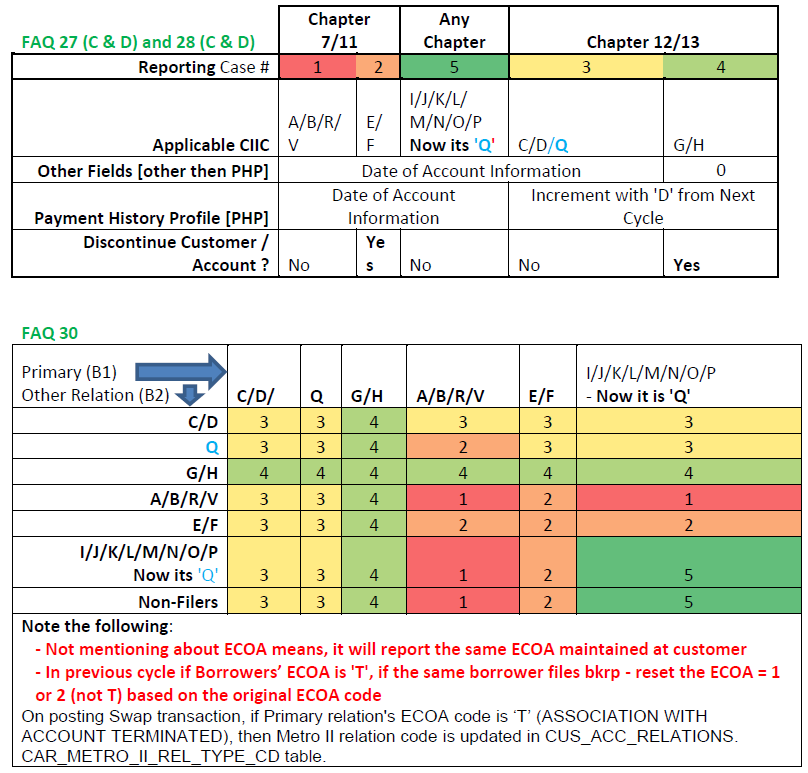

- All associated borrowers filed Bankruptcy Chapter 7 or 11 (FAQ 27

C)

Table G-2 Below is the Behavior

Case # & CRRG Ver 2020 FAQ REF # If CII Code is Reporting Behavior Month BK Filed

"Months Between Petition Filed & BK Resolutions: (Reaffirmation of Debt, Discharged, Dismissed, Withdrawn)

Resolution:

Reaffirmation of Debt

BK Discharged

Reaffirmation of Debt Rescinded

1. A or B (Petition for Chapter 7 or 11 Bankruptcy)

2. E or F (Discharged through BK Chapter 7 or 11)

3. V (Chapter 7 Reaffirmation of Debt Rescinded)

Report as of the Date of Account Information Resolution: BK Dismissed

BK Withdrawn

Q (Removal value) Report the CIIC code ‘Q’ instead of I / J or M / N

Report as of the Date of Account Information

Resolution: Reaffirmation of Debt

R (Reaffirmation of Debt) All other Metro 2® account level field information should be reported as of the Date of Account Information - When one borrower filed Bankruptcy Chapter 7 or 11 and the other borrower did

not (FAQ 27 D)

Table G-3 Below is the Behavior

Case # & CRRG Ver 2020 FAQ REF # If CII Code is Reporting Behavior Resolution: BK Dismissed

BK Withdrawn

Q (Removal value) Report the CIIC code ‘Q’ instead of I / J or M / N

Report as of the Date of Account Information

Month BK Filed

"Months Between Petition Filed & BK Resolutions: (Reaffirmation of Debt, Discharged, Dismissed, Withdrawn)

Resolution:

Reaffirmation of Debt

BK Discharged

Reaffirmation of Debt Rescinded

Reaffirmation of Debt

1. A or B (Petition for Chapter 7 or 11 Bankruptcy)

2. E or F (Discharged through BK Chapter 7 or 11)

3. V (Chapter 7 Reaffirmation of Debt Rescinded)

4. R (Reaffirmation of Debt)

All other Metro 2® account level field information should be reported as of the Date of Account Information - All associated borrowers filed Bankruptcy Chapter 12 or 13 (FAQ

28 C)

Table G-4 Below is the behavior

Case # & CRRG Ver 2020 FAQ REF # If CII Code is Reporting Behavior Month BK Filed

"Months Between Petition Filed & BK Resolutions: (Confirmed Plan, Dismissed, Withdrawn)"

Resolution:

Plan Confirmed

C or D (Petition for Chapter 12 or 13 Bankruptcy) Report as of the Date of Account Information for the following fields - Account Status

- Current Balance

- Scheduled Monthly Payment Amount

- Amount Past Due

- Payment History: will continue report by increment first position with value ‘D’ (plus history reported prior to BK filing)

Resolution:

"Plan Completed – All payments made according to plan – no further obligation"

G or H (Discharged/completed through BK Chapter 12 or 13) ‘Account Status’ as of the Date of Account Information - ‘Payment History’: should continue report as is

- ‘Current Balance = 0

- Schedule Monthly Payment Amount = 0

- Amount Past = 0

Resolution:

BK Dismissed

BK Withdrawn

Q (Removal value) Report the CIIC code ‘Q’ instead of K / L or O / P

Other fields: Report as of the Date of Account Information

Resolution:

Plan Completed – All payments made according to plan – consumer continues to make payments on Secured Debt (example: mortgage)

Q (Removal value) CIIC = Q (Removal value)

All other Metro 2® account level field information should be reported as of the Date of Account Information

Payment Rating should continue report first month, increment first position with value ‘D’; in subsequent months, increment based on prior month’s status

- When one borrower filed Bankruptcy Chapter 12 or 13 and the other borrower

did not (FAQ 28 D)

Table G-5 Below is the behavior

Case # & CRRG Ver 2020 FAQ REF # If CII Code is Reporting Behavior Month BK Filed

"Months Between Petition Filed & BK Resolutions: (Reaffirmation of Debt, Discharged, Dismissed, Withdrawn)

Resolution:

Plan Confirmed

C or D (Petition for Chapter 12 or 13 BK) Report as of the Date of Account Information for the following fields - Account Status

- Current Balance

- Scheduled Monthly Payment Amount

- Amount Past Due

- Payment History: will continue report by increment first position with value ‘D’ (plus history reported prior to BK filing)

Resolution:

"Plan Completed – All payments made according to plan – no further obligation"

G or H (Discharged/completed through BK Chapter 12 or 13) ‘Account Status’ as of the Date of Account Information - ‘Payment History’: should continue report as is

- Current Balance = 0

- Schedule Monthly Payment Amount = 0

- Amount Past = 0

Resolution:

BK Dismissed

BK Withdrawn

Q (Removal value) Report the CIIC code ‘Q’ instead of K / L or O / P

Other fields: Report as of the Date of Account Information

Resolution:

Plan Completed – All payments made according to plan – consumer continues to make payments on Secured Debt (example: mortgage)

Q (Removal value) CIIC = Q (Removal value)

All other Metro 2® account level field information should be reported as of the Date of Account Information

Payment Rating should continue report first month, increment first position with value ‘D’; in subsequent months, increment based on prior month’s status

Notes:- If user is changing the resolution code, say, in cycle 1, user

reported ‘Reaffirmation of Debt’ but later, in cycle 2, user

reported ‘BK Discharged’, then system will follow the reporting

guidelines provided as part of ‘BK Discharged’.

Any corrections to the cycle 1 to be manually handled outside the system.

- If user posted bankruptcy by mistake system would report C / D, then user need to report ‘Q’ in the next cycle and then only user need to close bankruptcy on the account. i.e., system will not report ‘Q’ automatically.

- Exiting other manual steps to be continued like, posting ‘Customer Bankruptcy Reporting’ transaction with ‘Disposition Code’ and ‘Chapter’ when it applicable.

- Multiple bankruptcies (i.e., the same or different chapters) be

reported for the different associated borrowers on an account (FAQ

30)

Note:

If system is trying to re-report the borrower due to filing petition, then system should report as per the original relation.Table G-6 Example:

Reporting period Action Metro II reporting Comments Cycle 1 Co-signer filed Ch 13 System Reports as per FAQ 28 D i.e., ECOA of Primary = T No comments Cycle 2 No resolution for Co-signer

No Petition for Primary

System Reports as per FAQ 28 D i.e., Co-signer moved to Base segment

Discontinued reporting for Primary

No comments Cycle 3 No resolution for Co-signer Primary filed Ch 13 System should report as per FAQ 28 C Here, does system should report Primary should be in Base and Co-signer in J2 segment Termination (ECOA Code: ‘T’) or Deletion (ECOA Code: ‘Z’) of a non-primary account relation as part of bankruptcy processing has been handled as follows:

- To report a non-primary account relation ECOA code change to ‘T’ or ‘Z’, user need to post the non-monetary transaction ‘CUSTOMER MAINTENNACE’ FIRST. Select the new ECOA code from the drop-down of parameter ‘CRB ECOA CODE’ and once transaction has been posted, system updates the ECOA code of the account relation selected and same will be reported in the ECOA Code field (#10) of J2 segment of the next Metro II report to be generated.

- To re-report an account relation again, user need to update the ECOA code accordingly by posting the CUSTOMER MAINTENANCE’ non-monetary transaction so that system will pick that account relation again in the immediate reporting.