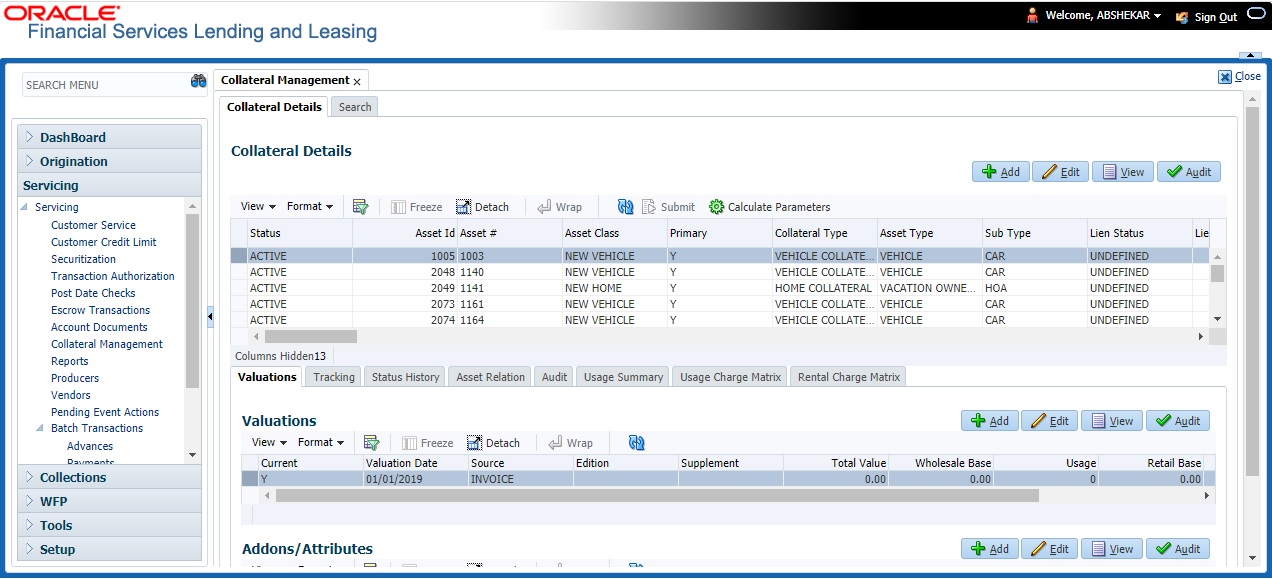

11.1 Collateral Tab

Using the Collateral screen, you can record a new collateral, view the valuation of collateral, and re-evaluate the existing collateral.

The collateral details can also be defined in the collateral screen of Application Entry screen.

- Undefined- When the collateral is created for the first time.

- New- When an undefined collateral/ asset gets validated, its status is changed to New. This collateral can only be used for Substitution in Servicing.

- Inactive- When an asset/collateral from Released, Sold or Inventory status is attached to application, it becomes Inactive.

- Active- When the application gets funded, inactive collateral gets associated with the account in Servicing and gets activated. The status of the collateral then becomes Active.

- Released- The Loan collateral can move to Released when the collateral is no more attached to any account.

- Substituted- When collateral with the status active is replaced with different collateral, the active status is changed to SUBSTITUTED.

Calculate Parameters

The Calculate Parameters button is available in the Collateral Details header. Clicking on it calculates the Target parameters for the selected Collateral and populates the computed values in the custom user defined fields.

- The custom user defined fields have to be enabled in Setup > Administration > User > Access > Field Access Definition tab.

- User access to these custom fields are to be granted in Security User Access Definition Details sub tab.

- If required, these fields can be customized in the Label Configuration tab in Setup > Administration > System > Label Configuration screen.

- Further, the custom fields are to be configured to compute specific business calculations at Account level in Setup > Administration > System > User Defined Parameters screen.

For more information, refer to specific section in Setup guides.

- On the application master screen, click Servicing > Servicing > Collateral Management > Collateral Details.

- In this section, you can perform any of the Basic Operations mentioned in Navigation chapter.

A brief description of the fields is given below:

Table 11-1 Collateral Details

Field Do this Type and Description section Collateral Type Select the collateral type. Primary Select the check box if this property is the primary collateral. Asset ID View the asset identification number. Asset # View the asset number which is automatically generated. Asset Class Select the asset Class. Asset Type Select the asset type. Sub Type Select the asset sub type. Registration # Enter the vehicle registration number. Status View the vehicle status. Select Make and Model Select the Make and Model number of asset from the drop down list. You can use the search option to select the details. Year Specify the year of the vehicle. Estimated Life Specify the estimated life of the asset. Make Specify the make of the vehicle. Model Specify the model of the vehicle. Identification # Specify the vehicle identification number. Body Specify the body of the vehicle. Description Specify the description of the asset. Condition Select the condition of the asset from drop-down list. Lien Details Lien Status Select the type of Lien action. Lien Event Dt Select the lien event date from the calendar. Second Lien Holder Specify the name of second lien holder. Comments Specify additional details if any. Lien Release Entity Select the lien release entity from the drop-down list. The list displays the following values:- Customer

- Producer

- Others

- Business

Note: If Others is selected as the Lien Release Entity, ensure that the Entity Name and Address details are updated correctly since the same is not auto-validated with the data maintained in the system.

Entity Name If you have selected the lien release entity as Customer or Producer, system automatically filters entity name list with corresponding customer accounts or producers. Similarly, if the lien release entity is selected as Business system displays the Business name if the asset is linked to Business account. Select the required entity name from the drop-down list.

If you have selected the lien release entity as Others specify the entity name.

Address section Country Select the country. County Select the county. Address # Specify the address number. Address Line 1 Specify the first address line. Address Line 2 Specify the second address line. Zip Select the zip code. Zip Extn Specify the zip extension. City Specify the city. State Select the state. Usage Details (Life)

The details maintained in this section is used to calculate EXCESS USAGE FEE in payoff quote and termination transactions.

Start View/specify the start unit of asset usage. Base View/specify the base units. Extra View/specify the extra usage units. Total View/specify the total usage units. Vacation Ownership Details Billing Check this box to indicate if the asset is considered for billing. Due Amt Account Type Select one of the following account type from the drop-down list to indicate on which account this asset is to be considered for billing.- Current Account

- Linked Account

- Master Account

Note: If Billing option is checked and the Due Amt Account Type is selected as Current/Linked/Master Account, then the billing batch job posts the transactions based on Asset Billing Rate setup in Current account / Linked Account of current Account / Master Account of current Account respectively.

Trade Eligible This check box is selected by default and indicates that the asset is eligible for trade.

If checked (Trade Eligible = Y) then Asset Status is marked as INACTIVE during Trade. If unchecked (Trade Eligible = N) Asset status is marked as ACTIVE.

Consolidate Points at Master Check this box to indicate that point can be consolidated at master account level. For more information, refer to Actual Points and Billing Points Consolidation section. Points Consolidation Type Select the type of points consolidation option from drop-down list. This field is used to identify the assets at Associated accounts to consolidate the points. Exchange Indicator Check this box to indicate if this asset is created as exchange to an old asset.

This is applicable only for Vehicle and Home collateral.

Shipment Date Select the asset shipment date from the adjoining calendar.

This is applicable only for Vehicle and Home collateral.

Block Indicator Check this box to indicate if this asset is blocked to a particular account.

In case of assets like mobile handsets, the IMEI Block/ Unblock functionality is used to block asset so that during cancellations, customer does not use the asset through any other service provider.

This is applicable only for Vehicle and Home collateral.

Custom Fields - This section displays the custom User Defined Fields if enabled in Setup and if configured, populates specific business computation values. - Perform any of the Basic Actions mentioned in Navigation chapter.

- Click Submit.

Actual Points and Billing Points Consolidation

Consolidate Actual Points at Master

- If Consolidate Points at Master option is checked, system consolidates the asset level points at Master Account of the associated account provided the following conditions are satisfied:

- The same Points Consolidation Type is selected for associated account.

- The status of asset is ACTIVE.

- The status of account is available and enabled in ACC_STATUS_POINT_CONS_CD lookup type.

- The asset expiry date is greater than GL date (asset is not expired).

- If Consolidate Points at Master option is not selected at Master Account > Asset Level, then system considers only the asset level points at Master Account and does not consolidate the asset level points of its associated account(s). Only the standalone points of Master Account is considered. Even if the Consolidate Points at Master option is selected at later point at Master Account > Asset Level, the points consolidation of associated account(s) will not be triggered until an update happens on Associated Accounts > Asset which is eligible for Consolidation.

- When new account is added under a Master Account by UI, Funding process, API, Account Onboarding, Multi Account onboarding, and/or Master Account Maintenance Transaction.

- Account Status Change

- During Current Account Level Asset Maintenance updates.

- Collateral POST/PUT/GET Web Services

- Collateral Create/Update File uploads

- Collateral Maintenance from UI

- Add New Asset Transaction

- Substitution of asset Transaction

- Lookup code Account Statuses for Points Consolidation determines which Accounts with which status are to be considered for point's consolidation.

- Batch job which updates the consolidated points at Master Account level only if the Expiration Date of Asset of Actual Asset at associated account is less than the GL date. This batch job is scheduled to run before the billing batch job to update the actual points that needs to be considered for Billing.

- Points are maintained at actual asset level and any changes done at Master account level asset points does not flow down to the Actual Asset.

- In case of an update at Master Account level Asset Point's and subsequently any change in actual asset at current account, system recalculates the points and overrides the points at master account.

Billing Points Consolidation

OFSLL uses Billing Points for Asset Billing calculations to derive the transaction amount using different asset billing rates. For more information, refer to Setup > Asset Billing Rate screen.

- If Consolidate Points at Master = N, consolidation is not done and Billing points for Master account is derived based on Asset Usage Type (i.e. either FULL or HALF).

- If Consolidate Points at Master = Y, Billing points consolidation is done at Master Account considering the Associated Account level billing Points (which are derived considering Asset Usage Type i.e. either FULL or HALF).

Note:

If the Consolidate Points at Master option is changed from N to Y at later point, then points consolidation of Master account is not done. However, consolidation is still done if there is a change in associated account(s).

The consolidated billing points are populated in Vacation Ownership sub tab available in Customer Service screen > Collateral tab > Home sub tab.

Following examples illustrates on how Actual and billing points are consolidated.

Scenario 1: Consolidate Points at Master = N

Table 11-2 Scenario 1

| Account Type | Points on Funding | Actual Points | Asset Usage Type | Billing Points |

|---|---|---|---|---|

| Master M1 | 50 | 50 | Half (total Points/2) | 25 |

| Associated A1 | 100 | 100 | Full | 100 |

| Associated A2 | 100 | 100 | Full | 100 |

Scenario 2: Consolidate Points at Master = Y

Table 11-3 Scenario 2

| Account Type | Points on Funding | Actual Points | Asset Usage Type | Billing Points |

|---|---|---|---|---|

| Master M1 | 50 |

200 (50 points of M1 is overwritten) |

Full (Not considered) |

100 |

| Associated A1 | 100 | 100 | Half (total Points/2) | 50 |

| Associated A2 | 100 | 100 | Half (total Points/2) | 50 |

- Master Account level Consolidate Points at Master = Y and the same Points Consolidation Type is selected for both master and associated account(s).

- The status of associated account(s) is available and enabled in ACC_STATUS_POINT_CONS_CD lookup type.

- Status of assets under the selected accounts must Active (not expired) and Expiry Date of Asset is greater than GL date.

This section consists of the following topics: