- Loan Servicing User Guide

- Tools

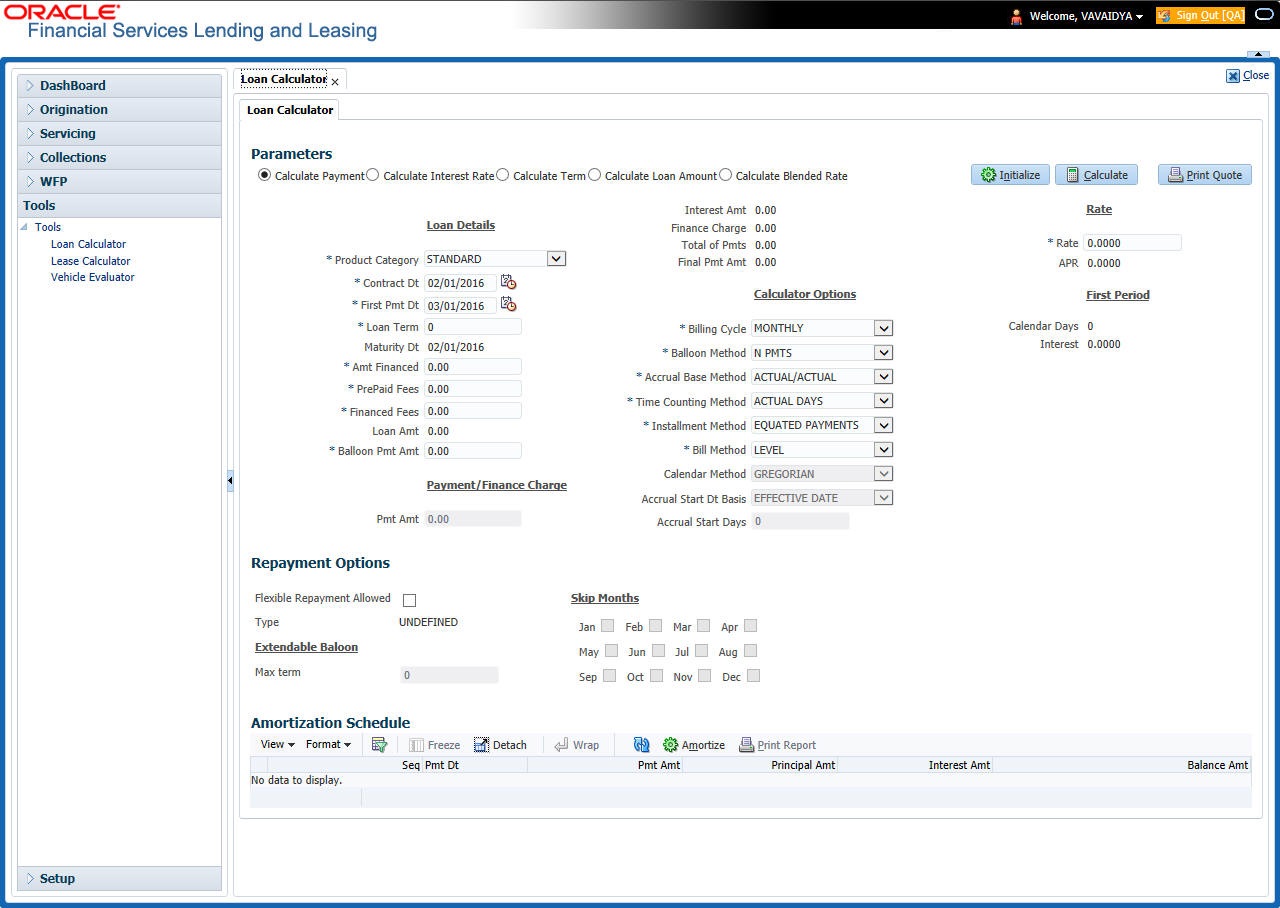

- Loan Calculator

- Parameters

- Calculating Payments

12.1.1.1 Calculating Payments

- Click Tools > Tools > Loan Calculator.

- Click Initialize and maintain the following fields.

Table 12-1 Calculating Payments

Field Do this Loan Details Section Product Category Select the category as Standard for conventional loan product and Islamic for the Islamic loan product. Contract Dt Specify the contract date. The system displays current date as the default value. First Pmt Dt Specify the first payment date. The system displays the date one month from today as default value. Loan Term Specify the number of payments. Maturity Dt System automatically displays the maturity date based on the values entered for first payment date, term and billing cycle (i.e. Maturity Date = First Payment Date + Term (based on billing cycle). Amt Financed Specify the amount financed. Pre Paid Fees Specify the prepaid fees, if any exist. Financed Fees Specify the financed fees, if any exist. Loan Amt View the estimated loan amount: amount financed plus the prepaid fees. Balloon Pmt Amt Specify the balloon payment amount, if any exist. Payment/Finance Charge Pmt Amt View the payment amount. Interest Amt View the profit amount. Finance Charge View the finance charged. Total of Pmts View the payment amount. Final Pmt Amount View the final payment amount. Calculator Options Billing Cycle Select the payment frequency.

System supports Biennial (once every 2 years) and Triennial (once every 3 years) type of billing cycles. Based on BILL_CYCLE_ CD lookup, the billing cycle frequency can be defined.

Balloon Method Select the balloon method. Accrual Base Method Select the accrual base. Time Counting Method Select the time counting method. Installment Method Select the installment method: EQUAL PAYMENTS or FINAL PAYMENT DIFFERS. For more information, see Installment method section in this chapter. Bill Method Select the billing method as either LEVEL, PERCENTAGE OF PRINCIPAL PLUS INTEREST, INTEREST ONLY, FIXED PRINCIPAL PLUS INTEREST, PERCENTAGE OF OUTSTANDING BALANCE. Calendar Method Select the calendar method as Hijri or Gregorian for this loan contract. This field will be enabled only if the product category is selected as Islamic. Accrual Start Dt Basis Select to define the start date from when the interest accrual is to be calculated for this instrument from the drop-down list.

Note:

If you select the Effective Date, then the interest is calculated from the Contract date + Start Days (indicated below).

If you select the Payment Date, then the interest is calculated based on (first payment date + Start Days (indicated below) minus one billing cycle).

Accrual Start Days Specify the number of grace days after which the interest accrual is to be calculated. Ensure that the number of grace days is less than first payment date. Rate Rate Specify the interest rate.

Note: For Islamic products this field is displayed as Profit Rate.

APR View the system calculated the Annual Percentage Rate. First Period section Calendar Days View the number of calendar days between contract date and the first payment date. The calendar days will differ based on the calendar method selected. Interest View the profit accrued for the calendar days. - Specify the required information and click Calculate.The system computes the standard loan payments with the details specified.Installment Methods

- Equal Payments: If you select Equal Payment option, then the repayment amount will be equal for all installments including the final installment.

- Final Payment Differs: If you select Final Payment Differs option, then the final repayment amount may be slightly more or less than the outstanding loan amount due to precise rounding calculations. The final payment amount will be equal to the outstanding loan amount.

When completing Frequency fields, note the following:

- Biweekly in the system means ‘once every two weeks’ and not ‘twice a week’.

- Bimonthly in the system means ‘once every two months’ and not ‘twice a month’.

For more information on frequency, see Appendix : Payment Amount Conversions section.

Parent topic: Parameters