4.8.1 Customer sub tab

Using the Customer sub tab, you can view and update the existing Customer details. When an existing record is updated and saved, the same becomes the current/primary details of the customer and the current indicator is set to Y by default. In such a case, the previous customer details are disabled (set to N). You can select the Show All check box in Customer Information section to view the disabled records along with current record.

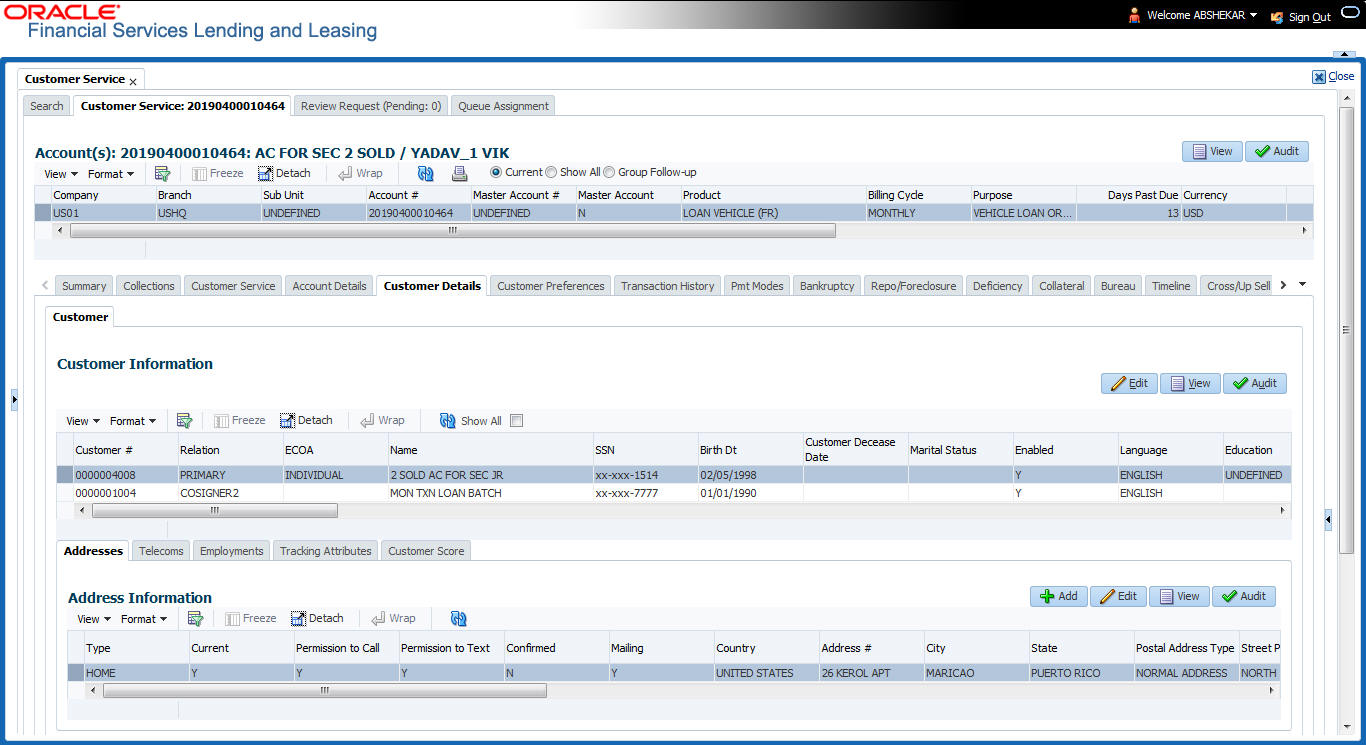

- Open the Customer Service screen and load the account you want to work with.

- Click Customer Details sub tab.

- In the Customer Information section, click Edit. You can also perform any of the Basic Operations mentioned in Navigation chapter. A brief description of the fields are given below:

Table 4-59 Customer Information

In this field View this Customer Information section Customer # Customer number. Relation Customer’s relation with the bank. ECOA The Equal Credit Opportunity Act code. Name Customer’s name. Birth Dt Customer’s date of birth. Marital Status Customer’s marital status. Enabled Status of the account. Language Customer’s language. Education Customer’s education. Mother’s Maiden Name Customer’s mother’s maiden name. Class Type Customer’s class type. Email Customer’s e-mail address. Stop Correspondence Customer’s stop correspondence indicator. If selected, this indicates that the system will not send the customer any correspondence, such as monthly statements. This is selected using the Maintenance screen. Disability Customer’s disability indicator. Skip Customer’s skip indicator. If selected, this indicates that the customer is a skip debtor. This is selected using the Maintenance screen. Bankruptcy Customer’s bankruptcy indicator. Privacy Opt-Out Privacy opt-out indicator. If selected, indicates that the applicant has elected to refrain from the non-public sharing of information. Insurance Opt Out Insurance Opt Out indicator. If selected, indicates that the applicant has elected to refrain from insurance related inquiries. Marketing Opt Out Marketing Opt Out indicator. If selected, indicates that the applicant has elected to refrain from marketing related inquiries. Share Credit Opt Out Share Credit Opt Out indicator. If selected, indicates that the applicant has elected to refrain from financial information and share credit related inquiries. Existing CIF If selected, indicates that the customer is an existing CIF. Update Customer Info If selected, indicates that the system was allowed to override the existing customer information with the latest address and communication details during account creation. Identification Details section Passport # Customer’s passport number. Issue Dt Passport issue date. Expiry Dt Passport expiry date. Visa # Customer’s visa number. Nationality Customer’s nationality. National ID Customer’s national identification. SSN Customer’s social security number. If the organizational parameter UIX_HIDE_RESTRICTED_DATA is set to Y, this appears as a masked number; for example, XXX-XX-1234. License # Customer’s licence number. License State State where the licence was issued. Payment Hierarchy The payment hierarchy is auto-populated by the system based on following conditions:- While funding an application with new customer details, the payment hierarchy is populated with value specified in system parameter PMT_HIERARCHY_CODE.

- While funding an application with existing customer details, the same payment hierarchy selected for existing customer record is populated.

The auto populated payment hierarchy can be modified by selecting the required value from the drop-down list. This list is populated based on the hierarchy definitions maintained in Setup > Administration > User > Payment Hierarchy screen.

Military Service Active Military Duty Active military duty indicator. If selected, indicates that customer is on active military duty and may qualify for rates in accordance with the Service members Civil Relief Act of 2003 (SCRA). Effective Dt The effective date Order Ref # The order reference number. Release Dt The release date. Customer Decease Date The deceased date of the customer. You can also post a non monetary transaction to indicate if a customer is deceased. Refer to section Mark Customer as Deceased for more information. KYC section Reference # Specify the reference number of KYC document. Status Select the status of KYC document from drop-down list. FATCA section Birth Place Specify the birth place of the applicant. Birth Country Select the country of birth of the applicant from drop-down list. Permanent US Resident Status Check the box to indicate if the applicant has permanent US resident status. Power of Attorney section Power of Attorney Check the box to indicate that the applicant holds Power if Attorney. Holder Name Specify the holder name of the power of attorney. Address Specify the address of the attorney holder. Country Select the country of the power of attorney holder from drop-down list. Nationality Select the country of the power of attorney holder from drop-down list. Telephone Number Specify the telephone number of the power of attorney holder. Credit Limit Details section Max Limit View the maximum credit limit amount sanctioned for this customer. Total Utilized Amt View the total credit limit amount utilized. Available Amt View the credit limit available amount from the sanctioned limit. Hold Amt View the credit limit amount on Hold. Suspended Amt View the credit limit amount suspended. Grade View the grade of the customer. Max Late Charge View the maximum amount of late charge that can be levied for this customer. However, there is no system validation performed based on the amount specified. Limit Expiry View the credit limit expiry date. Limit Next Renewal View the date when credit limit has to be renewed. Utilization Details % of Utilization View the percentage of credit limit used to fund the account against the customer. Utilization Amount View the amount of credit limit contribution of customer towards Account current balance. - Perform any of the Basic Actions mentioned in Navigation chapter.

When military duty transaction is posted on an account, the system does the following:

- Restricts the user from posting repossession/ foreclosure and bankruptcy activities on the account.

- Posts DO NOT CHARGE OFF condition on that account to exclude the account from Auto Charge Off process.

This section consists of the following topics: