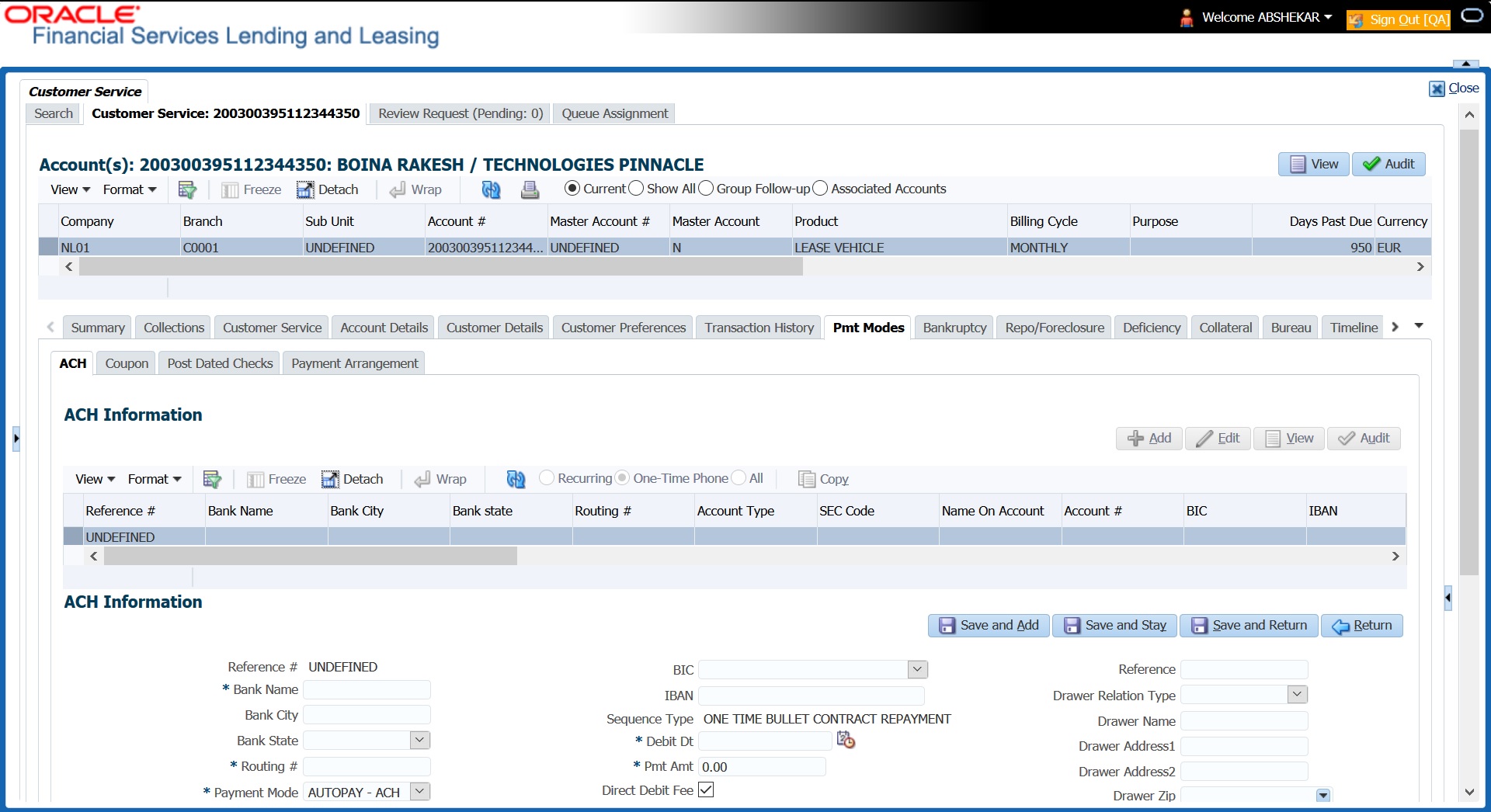

4.11.1 ACH sub tab

If used, the ACH section displays information about automated clearing house and electronic fund transfers.

- Open the Customer Service screen and load the account you want to work with.

- Click Pmt Modes tab, then click ACH sub tab.

- Recurring - Select Recurring to display all the Recurring ACH details.

- One-Time Phone - Select this option to display one time ACH details.

- All - Select All to display both recurring and one-time phone ACH details.

If you have selected Recurring or One-Time Phone option, you can further Add, Edit, or Copy the details and perform any of the Basic Operations mentioned in Navigation chapter. On save, the system will automatically post the transaction capturing the current transaction date along with a comment as Direct Record Update for the particular ACH transactions.

Table 4-81 ACH details - Recurring

| In this field | View this |

|---|---|

| Reference # | The unique reference number. |

| Bank Name | The bank name. |

| Bank City | Specify the city where the bank exist. |

| Bank State | Select the state where the bank exist form the drop-down list. |

| Routing # | The routing number. |

| Payment Mode |

For an active Recurring ACH record, the payment mode selected in Contract tab is automatically populated. If not, select the type of repayment mode to indicate the type of Autopay/Direct Debit using any of the following option from the drop-down list. The list is populated from REPAYMENT_PMT_MODE_CD lookup code.

For an AUTO PAY type of Payment Mode, ensure that at least one active ACH record exist and for CHECK type of Payment Mode, there are NO active ACH records. |

| Account Type | The type of account. |

| Name On Account | Specify the name of the account. |

| Account # | The account number. If the organizational parameter UIX_HIDE_RESTRICTED_ DATA is set to Y, this appears as a masked number; for example, XXXXX1234. |

| BIC | Select the Business Identifier Code from the drop-down list. The list displays the BIC codes defined in the system. |

| IBAN |

Specify the IBAN (International Bank Account Number). IBAN is used for identifying bank accounts across national borders with a minimal of risk of propagating transcription errors. Ensure that value entered satisfies the check-digit validation based on modulo 97. On save, system automatically validates the IBAN number length based on country code, characters, white spaces, and checksum. Validation is also done during posting non-monetary transaction (ACH Maintenance). You can maintain the IBAN length and other details required as per the country code in the user defined table (Setup > Administration > System > User Defined Tables). Note: IBAN for 'NL' country code (IBAN_FORMAT_NL) is defined by default with length of IBAN as 18. |

| Sequence Type |

System displays the current Sequence Type of the selected account. Depending on the nature of direct debit, the sequence type can be one of the following:

However, during the life cycle of the payment processing, the direct debit sequence type for an account can change. |

| Pmt Day | The payment day. |

| Pmt Amt | The Payment amount. |

| Pmt Amt Excess | The excess payment. |

| Pmt Freq | The payment frequency. |

| Fee Amt | The amount charged as fees. |

| Direct Debit Fee | If selected indicates that the fees is debited directly. |

| Start Dt | The date the system began using ACH payments for this account |

| End Dt | The ACH end date. |

| Default | If selected indicates that this ACH is the default ACH for the account. |

| Status | The status of the account. |

Note:

This information can be edited using the Maintenance screen and the non monetary transaction ACH MAINTENANCE.Table 4-82 ACH details - One-Time Phone or All option

| In this field | View this |

|---|---|

| Reference # | The unique reference number. |

| Bank Name | The bank name. |

| Bank City | The bank city. |

| Bank State | List of available states. |

| Routing # | The routing number. |

| Payment Mode |

For an active One-Time Phone or All ACH record, the payment mode selected in Contract tab is automatically populated. If not, select the type of repayment mode to indicate the type of Autopay/Direct Debit using any of the following option from the drop-down list. The list is populated from REPAYMENT_PMT_MODE_CD lookup code.

For an AUTO PAY type of Payment Mode, ensure that at least one active ACH record exist and for CHECK type of Payment Mode, there are NO active ACH records |

| Account Type | The type of account. |

| Name On Account | The account name. |

| Account # | The account number. If the organizational parameter UIX_HIDE_RESTRICTED_ DATA is set to Y, this appears as a masked number; for example, XXXXX1234. |

| BIC | Select the Business Identifier Code from the drop-down list. The list displays the BIC codes defined in the system. |

| IBAN |

Specify the IBAN (International Bank Account Number). IBAN is used for identifying bank accounts across national borders with a minimal of risk of propagating transcription errors. Ensure that value entered satisfies the check-digit validation based on modulo 97. On save, system automatically validates the IBAN number length based on country code, characters, white spaces, and checksum. Validation is also done during posting non-monetary transaction (ACH Maintenance). You can maintain the IBAN length and other details required as per the country code in the user defined table (Setup > Administration > System > User Defined Tables). Note: IBAN for 'NL' country code (IBAN_FORMAT_NL) is defined by default with length of IBAN as 18. |

| Sequence Type |

System displays the current Sequence Type of the selected account.

However, during the life cycle of the payment processing, the direct debit sequence type for an account can change. |

| Debit Dt | The debit date. |

| Pmt Amt | The Payment amount. |

| Direct Debit Fee | If selected indicates that the fees is debited directly. |

| Secret Question | Select the secret question from the drop down list. |

| Provided To Whom | The person to whom the ACH is concerned. |

| Reference | Additional reference if any. |

| Drawer Relation Type | The withdrawer relation to ACH. |

| Drawer Name | The name of withdrawer. |

| Drawer Address1 | Address of withdrawer |

| Drawer Address2 | Address of withdrawer |

| Drawer City | City of withdrawer |

| Drawer State | State of withdrawer |

| Drawer Zip | Zip of withdrawer |

| Status | The status of the account. |

Note:

This information can be edited using the Maintenance screen and the non monetary transaction ACH MAINTENANCE.Copying ACH Details

You can copy and maintain ACH details from Pmt Modes sub tab of Customer Service screen. Copy option is available only when you have selected the ACH option as either Recurring or One-Time Phone.

- Select a record and click Copy.

- A confirmation message is displayed as Do you want to Copy ACH Record?. Click OK to copy and create a new record.

On confirmation, the system creates a new row with new reference number, Status as Active, Default as N, Start Dt as System Dt + Pre note days and all the other details as maintained in the copied record. When a new record is created using the Copy function, the system will post a New ACH Transaction capturing the current transaction date along with a comment as Direct Record Update.

Parent topic: Customer Service screen’s Pmt Modes tab