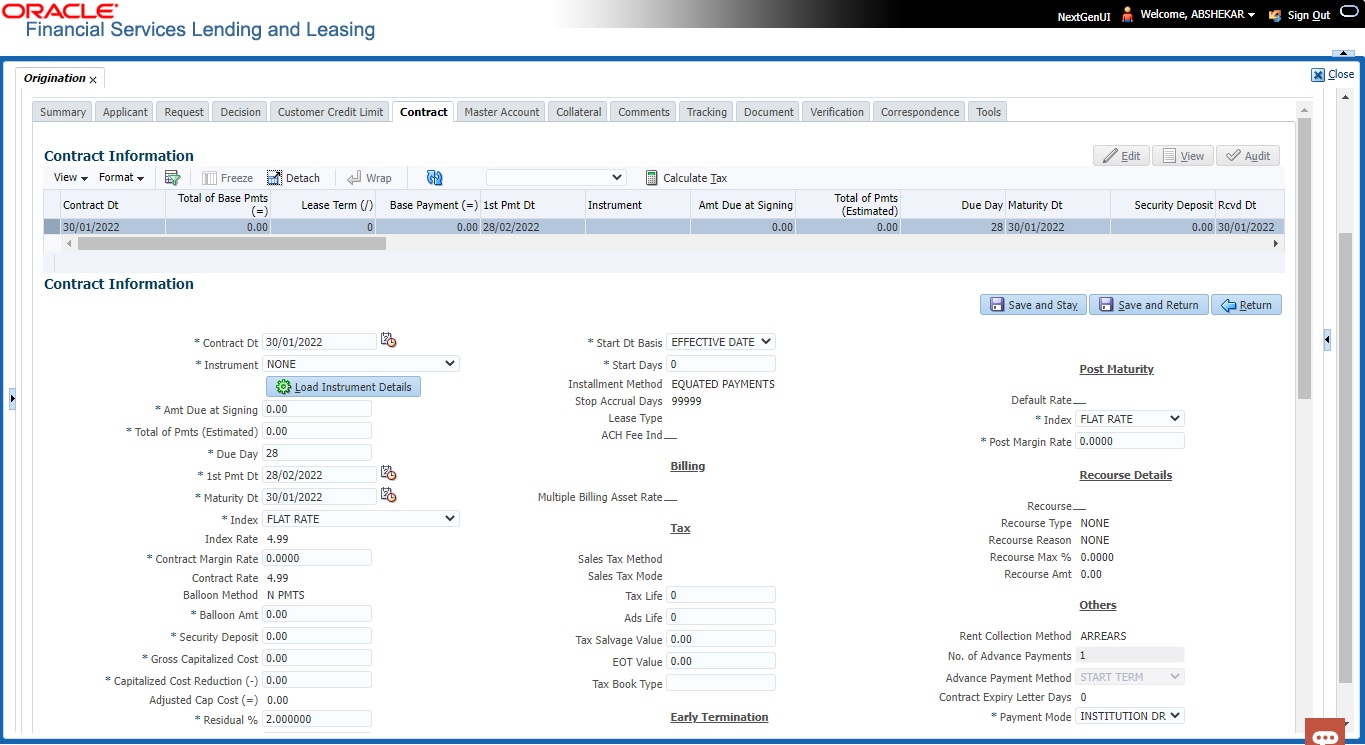

8.12 Contract Tab

The screens associated with the Contract link are the core of the funding process. They allow you to perform the important task of completing the truth-in-lending details. These screens include information mandated by Regulation Z; information about the financed amount, the payment schedule, the total of these payments, the finance charge, the resulting annual percentage rate (calculated according to Federal/Central bank guidelines; that is, within 125% of the Treasury OCC calculated APR) for the conventional Lease, and internal rate of return for Islamic Lease. Use the Lease packet to supply the required information.

In completing the truth-in-lending details on the Contract link, you will enter Lease information. The truth-in-lending details must be completed before a Lease can be funded.

- Contract (2)

- Repayment

- Itemizations

- Trade-In

- Subvention

- Insurances

- ESC

- Escrow

- Compensation

- Proceeds

- Disbursement

- Fees

- ACH

- Coupons

- References

- Real Estate

- PDC

You can use the quick calculator provided with the drop-down list adjacent to the ‘Calculate’ button to calculate the required Lease parameters. You can also use the calculator available in Tools section for completing this step. For detailed information on using the Calculator tools, refer Tools chapter in the document.

While working with the Contract tab for Lease applications, you can either enter the contract details manually or make use of the Suggest option which auto populates the contract and payment details.

- System loads the details of 1st instrument available in Instrument drop-down list.

- Updates the contract date as current GL post date using which all the payment calculations are done.

- Populates decision level contract parameters and Verified By field with User Code.

- Calculates the payment amount and Sales Tax (if the COMPANY parameter XSL_TAX_INTERFACE is INTERNAL). However, the Suggest option is not available for external interface (VERTEX) since the calculation is handled outside the system.

Since in one click all the required contract information is populated to fund the application, this option helps to improve operational efficiency. But however, this option is not available for Rental based lease applications and if the contact instrument is already loaded.

- Open the Funding screen and load the application you want to work with.

- On the Funding screen, click the Contract tab.

- If the application you opened is for a Islamic Lease, the Lease screen appears.

- Using the information in the contract packet, complete the Contract section.

(The system calculator may used when completing this section. For more information, see the Tools chapter.)

- In this section, you can perform any of the Basic Operations mentioned in Navigation chapter.

A brief description of the fields is given below:

Table 8-1 Contract

Field Do this Contract section Contract Dt Specify the contract date. Instrument Select the required instrument from the drop down list and click on Load Instrument Details. Amt Due at Signing Enter the prepaid amount. Total of Pmts (Estimated) Enter the estimated total of payments. Due Day Specify the due day. 1st Pmt Dt Specify the first payment date. Maturity Dt Specify the maturity date. Index Select the applicable index type from drop-down list.

Note: If the lease calculation method is selected as Rent Factor, then Flat Rate Index type is applicable by default.

Index Rate Specify the approved index rate. Contract Margin Rate Specify the contract margin rate. Contract Rate Specify the contract rate. Balloon Method View the balloon payment method.

Note: This field is displayed only if the lease calculation method is Interest Rate.

Balloon Amt Specify the balloon amount.

Note: This field is displayed only if the lease calculation method is Interest Rate.

Security Deposit Specify the security deposit amount. Gross Capitalized Cost Enter the gross capitalized cost. Capitalized Cost Reduction (-) Enter the cap cost reduction. Adjusted Cap Cost (=) Enter the adjusted cap cost. Residual % View the residual percentage. Residual Value (-) Enter the residual value. Depreciation Value (=) Specify the depreciation value. Rent Charge (+) Enter the rent. Rent Factor View the rent factor.

Note: This field is applicable only if the lease calculation method is selected as Rent Factor.

Total of Base Pmts (=) Enter the total of payments. Lease Term (/) Enter the term. Base Payment (=) Enter the payment amount. Estimated Sales Tax (+) Enter the sales tax amount. Sales Tax View the sales tax percentage. Estimated Pmt (=) Enter the payment amount percentage. Rcvd Dt Specify the date on which deposit is received. Verified Dt Specify the contract verification date. Verified By View the user id who verified the contract. Depreciation section

The depreciation details defined in Setup > Contract > Lease screen are auto populated in this section and can be modified as required. The same is used for asset depreciation calculation when the batch job TAMDEP_BJ_121_01 (DEPRECIATION RATE PROCESSING) is executed.

Depreciation Start Dt System auto populates the contract date as the default date for Depreciation Start Date. You can enter the required depreciation start date from the adjoining calendar. Ensure that date selected is not earlier than lease contract date or greater than account maturity date.

Depreciation accounting is done from this date onwards and is calculated till the time asset is associated with this Account.

Depreciation Method View / Select the asset depreciation method to be used for calculation as one of the following from the drop-down list.- FLAT RATE: This method is used to depreciate the asset over a fixed time using a fixed rate. This method of calculation is similar to Written Down Value Method (Diminishing Balance Method / Reducing Installment Method). On selecting this option, the details specified in Contract Setup screen for the following fields - Base Rate, Adjusting Rate and Bonus Rate are considered for calculation.

- LIFE BASED: This method is used to depreciate the asset over a fixed time using the specified rates. This method of calculation is similar to Straight Line Method (Original Cost Method / Fixed Installment Method). On selecting this option the details specified in Depreciation Rate Schedule sub tab of Contract Setup screen is considered for calculation.

Depreciation Convention View / Select the frequency at which the leased account should be updated with depreciation details from the drop-down list. The list is populated with frequency details (i.e. monthly, weekly, and so on) maintained in ‘FIRST_LAST_YEAR_CONVENTION_CD’ lookup code. Payment Caps Max Pmt Increase / Year The maximum payment that can be increased for the year. Max Pmt Increase / Life The maximum payment that can be increased in the life of an application. Instrument Details – An instrument is a contract with specific rules tied to it. An instrument associated with the application indicates OFSLL of the type of contract being used for the approved lease. Items defined in the contract are locked in when you select the instrument from drop down list and click on Load Instrument. These values cannot be changed on the funding screen.

Any changes to the instrument in account will be handled by monetary/non-monetary transactions.

The system loads all the rules established by the company that are required at the time of funding; for example, the accrual method, billing method, type of billing, tolerance, due dates, extensions and so on.

Calculation Method View the type of interest calculation method used for the selected instrument. Accrual Method View the accrual calculation method. Base Method View the accrual base method. Bill Method View the billing method. Bill Type View the billing type. Time Counting Method View the time counting method. Calendar Method View the Calendar Method. Start Dt Basis Select to define the start date from when the interest accrual is to be calculated for this instrument from the drop-down list.

Note:

If you select the Effective Date, then the interest is calculated from the Contract date + Start Days (indicated below).

If you select the Payment Date, then the interest is calculated based on (first payment date + Start Days (indicated below) minus one billing cycle).

Start Days Specify the number of grace days after which the interest accrual is to be calculated. Ensure that the number of grace days is less than first payment date. Installment Method View the installment methods. Stop Accrual Days View the accrual stop days. Lease Type View the type of lease such as Direct Finance or Operating Lease. ACH Fee Ind Indicates that the ACH fee should be applied or not. Depending on the status of check box, the ACH fee is applied based following conditions:- When the check box is selected and the fee amount is ZERO, system will not apply the ACH fee.

- When the check box is selected and the fee amount is BLANK, system will apply the ACH fee from Contract setup.

- When the check box is selected and the fee amount is specified, system will apply the specified amount and overrides the ACH fee amount mentioned in Contract Setup.

- When the check box is not selected, system will apply the ACH fee amount mentioned in Contract Setup.

Billing section Multiple Billing Asset Rate Check this box to indicate if multiple asset rates are applicable for one billing period.

System considers billing period from current due date to the next due date. Multiple rates are fetched only when rate end date (rate start date + rate frequency) ends one or more cycle(s) before the next due date i.e. current rate record does not cover the entire billing period.

Tax section Sales Tax Method View the sales tax method used for tax calculation. Sales Tax Mode View the sales tax mode. Tax Life View the tax life. Ads Life View the ads life. Tax Salvage Value View the tax salvage value. EOT Value View the EOT value. Tax Book Type View the tax book type. Early Termination section Allowed To Terminate If checked, indicates that early termination of lease contract is allowed. Billed Term View the total billed amount on the lease contract. Lease Amt Recovered % View the percentage of lease amount recovered against the lease contract amount during early termination. Residual Details section Minimum Residual % View the minimum residual percentage valid with lease contract. Maximum Residual % View the maximum residual percentage valid with lease contract. Residual Value In Final Bill If checked, indicates that residual amount (if exist) can be included in the final bill. Residual Valuation View the type of residual valuation method. PDC section PDC Ind If selected, indicates that the customer has opted for PDC. PDC Security Ind If selected, indicates that the customer has submitted the PDC as a security. Rate Caps and Adjustments section

Note: This section is displayed for Interest Rate type of lease calculation method.

Increase Per Year View the maximum rate increase allowed in a year. Increase Max Lifetime View the maximum rate increase allowed in the life of the Lease. Increase Floor View the rate cap (minimum). Increase Ceiling View the rate cap (maximum). Decrease Per Year View the maximum rate decrease allowed in a year. Decrease Max Lifetime View the maximum rate decrease allowed in the life of the Lease. # of Adjs / Year View the maximum number rate changes allowed in a year. # of Adjs / Life View the maximum number of rate changes allowed in the life of the Lease. Post Maturity section

Note: This section is displayed for Interest Rate type of lease calculation method.

Default Rate If selected, indicates the default rate is available. Index Select the post maturity index. Post Margin Rate Specify the past maturity rate. Recourse Details Recourse View the recourse indicator. If selected, it indicates that there is a recourse associated with the Lease and the following recourse details can be specified. Recourse Type Select the recourse type as either Partial or Full from the drop-down list. Recourse Reason Depending on the type of recourse selected, you can select the following type of recourse reason from the drop-down list.

For recourse type as Partial, system defaults the recourse reason as Partial.

For recourse type as Full, you can select one of the following options:- Fraud

- Titles

- Fraud and Titles

- Full

- Full and Titles

Recourse Max % Specify the maximum percentage of recourse allowed. Ensure that the specified amount does not exceed 100% or the amount defined at Contract.

Note: You can specify the recourse either in percentage or as flat amount in the below field.

Recourse Amt If Recourse Max % is not specified, you can specify a flat amount to be allowed for recourse. Others Rent Collection Method View the type of rent collection method as either Advance or Arrears.

For Interest Rate type of lease calculation, both Advance and Arrears are applicable. For Rent Factor, only Advance method is applicable.

Contract Expiry Letter Days View the total number of days the lease contract is valid after the contract expiry. Payment Mode Select the type of repayment mode to indicate if it is Autopay/ Direct Debit or not using any of the following option from the drop-down list. The list is populated from REPAYMENT_PMT_ MODE_CD lookup code.- INSTITUTION DRAFT / CHECK (default)

- AUTOPAY (ACH)

- AUTOPAY (CREDIT CARD)

- AUTOPAY (DEBIT CARD)

- POST DATED CHECKS

For an AUTO PAY type of Payment Mode, ensure that at least one active ACH record exist and for CHECK type of Payment Mode, there are NO active ACH records.

Statement section

This section allows to define the preferences for Mock Statement generation at Master Account level. Generating a Mock Statement helps to mock the asset billing process with a future date and to get an upfront statement indicating future dues of Master and Associated Accounts. In Vacation Ownership industry, such statements are required to forecast future dues based on current Timeshare holdings.

The default populated preference here are propagated from Setup > Administration > Products > Contract screen when the instrument is loaded.

Note: These fields are enabled only for Master Account, i.e. only if the Master Account check box is selected in Origination > Master Account tab. If the option is unchecked even at a later point, system refreshes these fields making them as Read-Only.

Stmt Preference Mode Select the account statement preference mode as either Email or PHYSICAL from the drop-down list. Mock Statement Req Select this check box to indicate if the account is to be included in Mock statement Generation.

Note: Based on this selection, others fields related to Mock Statement below are enabled and becomes mandatory for providing details.

Mock Start Month Select the start month of Mock Statements period from the drop-down list. Mock Statement Cycles Select the total number of billings (between 1-12) that are to be generated post Mock Statement Start Date. Mock Pre Statement Days Specify the number of Pre bill days for Mock Statements generation. Capitalization section

This section displays the capitalization parameters pre-defined at Setup > Contract screen and allows you to modify only the Grace Days value for balance capitalization.

Capitalize If selected, indicates that the capitalization of balances is enabled while funding the application. Frequency View the capitalization frequency defined at Contract level.

After funding, all the account balances are capitalized to principal in the same frequency except for Balance Frequency where different frequency may be defined for each balance type.

Capitalization Start Basis View the capitalization start date as either Contract Date or First Payment Date on which capitalization next date is calculated. Grace Days View or Modify the grace days allowed in the frequency (minimum 0, maximum 31) before capitalizing the balances to account. This is also the deciding factor for executing the capitalization batch job which is based on Capitalization Frequency + Grace Days.

However, note that Grace Days are not accounted for Month End type of capitalization frequency and is ignored even if specified.

Cap Tolerance Amt View the capitalization tolerance amount which is the minimum amount to qualify for capitalization. Promotion Details – If applicable, enter information regarding any promotion associated with the application in the Promotion section. The Promotion details maintained in Setup > Products > Promotions are populated here. Promotion Select the promotion. Type View the promotion type. Dlq Days View the delinquency days. Period Type View the period type. Period View the promotion period. Tolerance Amt View the tolerance amount (displays only). Index View the promotion index (displays only). Index Rate View the promotion index rate (displays only). Promotion Margin Rate View the promotion margin rate (displays only). Promotion Rate View the promotion rate. Agreement Details Agreement Number Specify the agreement number which is to be associated to the application.

Note: On funding, this agreement number is also associated to the account and in-turn helps to group all those accounts with a particular agreement number.

- Perform any of the Basic Actions mentioned in Navigation chapter.

- Quick Calculate

In the Contract Information section, there is a drop-down list adjacent to the Calculate button with following options to auto calculate different Lease parameters based on the data provided. Select the required option from the drop-down list and click Calculate:

System displays the requested calculation in the respective field.Table 8-2 Contract Information

Lease Type Calculate Option Rent Factor Calculate Payment

Calculate Residual Percent

Calculate Gross Capitalized Cost

Interest Rate Calculate Payment

Calculate Interest Rate

Calculate Term

Calculate Lease Amount

- Click Calculate Tax. System calculates the Lease Sales and Usage tax for upfront category which is billed during application funding. For more details, refer to Sales Tax Calculation at Origination in Origination section in Appendix chapter.

This section consists of the following topics:

- Contract (2) Sub Tab

- Repayment Sub Tab

- Itemizations Sub Tab

- Trade-In Sub Tab

- Subvention Sub Tab

- Insurance Sub Tab

- ESC Sub Tab

- Escrow Sub Tab

- Compensation Sub Tab

- Proceeds Sub Tab

- Disbursement Sub Tab

- Fee Sub Tab

- ACH Sub Tab

- Coupon Sub Tab

- References Sub Tab

- Real Estate Sub Tab

- PDC Sub Tab

Parent topic: Funding