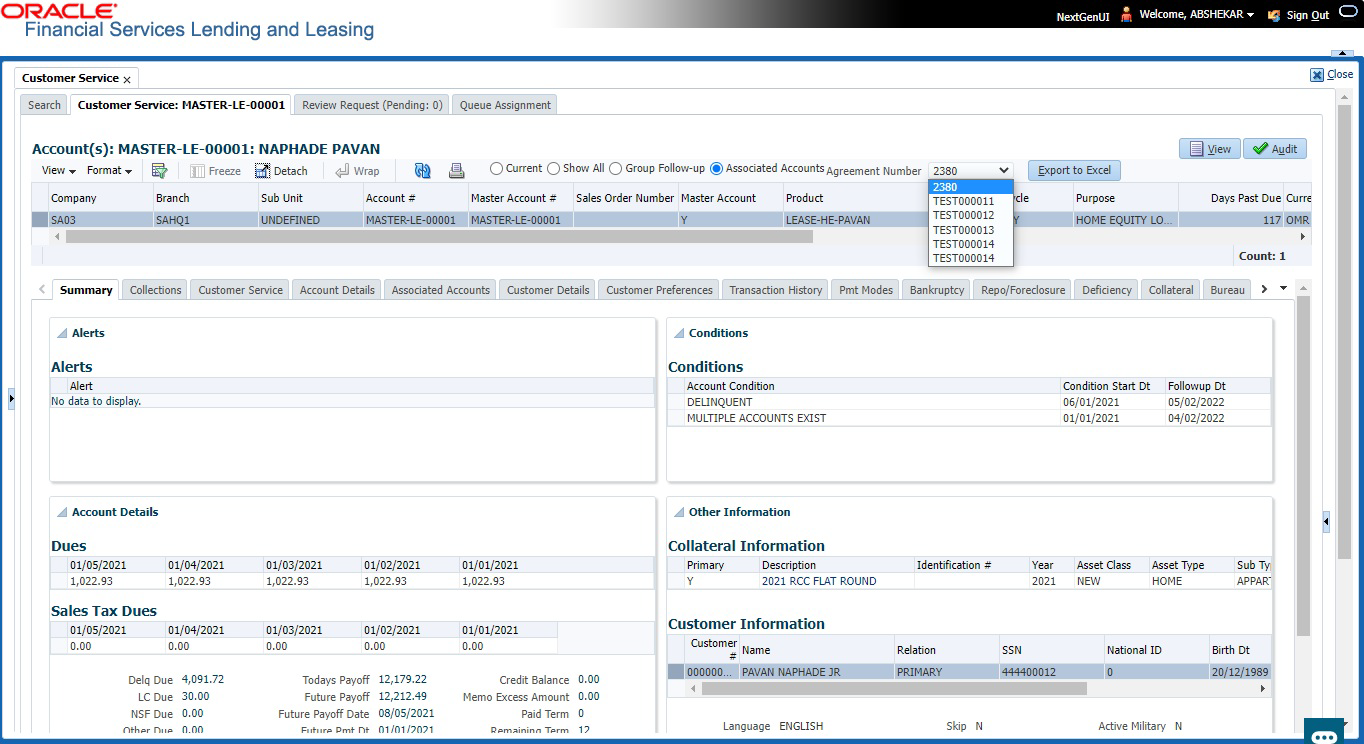

4.3 Customer Service screen’s Summary tab

Open Customer Service screen and load the account you want to work with. By default the Customer Service screen opens the Summary tab.

Alerts section

Any comment posted as an alert, are displayed in the alert section of Summary tab.

Conditions section

You can view any conditions like Bankruptcy, Repossession, Foreclosure etc posted on an account. The condition is posted in the account with a start date which is the effective date and follow up date which indicates the next follow-up date for further process.

For newly funded account, a default condition is posted as NO ACTIVE CONDITION. This condition is available in the Queue Criteria drop-down to create Queue of Accounts with NO ACTIVE CONDITION. On posting any other condition on the account, this default condition is replaced automatically and an entry is updated in Account Details > Condition Details > Condition/Queue History tab.

Dues section

Table 4-3 Dues section

| In this field | View this |

|---|---|

| Delq Due | The total delinquent amount that is due so far in the account. |

| LC Due | The total amount of non-sufficient fee due in the account. |

| NSF Due | The non sufficient funds fee due. |

| Other Due | The total of any other dues pending in the account. |

| Fee Usage | Indicates the lease fee usage amount and this field is displayed only for Usage type lease accounts. |

| Total Due | The total of all dues including payment amount and all applicable fees along with Fee Usage amount. |

| Total Due (incl current due) | The additional due of current month (included based on pre-bill days) along with Fee Usage amount. |

| Today’s Payoff | If the account is to be paid off as per the current date and the amount payable by the borrower. |

| Future payoff | The total Amount due on a future date. The borrower can know the total pay off amount for a future date, say 10 days from today. |

| Future Payoff Date | The date on which the future payoff is due. |

| Future Pmt Dt | The date till which the future payoff quote is valid. |

| Oldest Due Dt | The due date. |

| Amt Paid Excess | The excess amount paid. |

| Memo Excess Amount | The excess amount paid towards the membership fee. |

| Paid Term | The total count of paid dues. |

| Remaining Term | The total count of remaining outstanding dues to be paid. |

| Days to Time Bar | View the total number of days remaining to reach the time bar end date. |

Delinquency Information Section

Table 4-4 Delinquency Information Section

| In this field | View this |

|---|---|

| Late | Total number of times the account was delinquent for less than 30 days since start date. |

| 30 | Total number of times the account was delinquent for over 30 days since start date. |

| 60 | Total number of times the account was delinquent for over 60 days since start date. |

| 90 | Total number of times the account was delinquent for over 90 days since start date. |

| 120 | Total number of times the account was delinquent for over 120 days since start date. |

| 150 | Total number of times the account was delinquent for over 150 days since start date. |

| 180 | Total number of times the account was delinquent for over 180 days since start date. |

| Category | The delinquency category. |

| Days | The number of days delinquent. A negative number in this fields denotes the number of days until a payment is due. |

| Broken Promises (Life) | Total number of broken promises since the account start date. |

| Broken Promises (Year) | Total number of broken promises since this year. |

| Note that, the above fields - Broken Promises (Life) and Broken Promises (Year) are auto-updated at runtime after executing the scheduled batch job CPPPRC_BJ_100_01 (BROKEN PROMISE PROCESSING) with the method of update defined in Company parameter FUTURE PROMISE HANDLING METHOD (CMN_PROMISE_FUTURE_ MTHD). | |

| Kept Promises (Life) | Total number of fulfilled promises since the account start date excluding Broken and Cancelled Promises. |

| Kept Promises (Year) | Total number of fulfilled promises since this year excluding Broken and Cancelled Promises. |

| NSF (Life) | Total number of non sufficient funds since the account start date. |

| NSF (Year) | Total number of non sufficient funds since this year. |

| Collector | The default collector working on the account. |

Activities Section

Table 4-5 Activities Section

| In this field | View this |

|---|---|

| Active Dt | The date account was made active. |

| Last Activity Dt | The date on which most recent activity was performed in the account. |

| Due Day | The due day for payment. |

| Last Pmt Amt | The last payment amount. |

| Customer Grade | The customer grade. |

| App# | The application number from which this account was created. |

| Producer | The producer through which the account was sourced. |

| X-ref | The cross reference number of third party origination system. |

| Paid Off Dt |

The date on which account was paid off. Note: Filed has value only if account has Paid-off condition. |

| Effective Dt | The date account became effective. |

| Current Pmt | The current payment amount. |

| Last Bill Amt | The last bill amount. |

| Last Pmt Amt | The last payment amount. |

| Chargeoff Dt |

The Date on which account was charged off. Note: This is applicable only if account has Charged-off condition. Else, no value displayed. |

| Military Duty | If selected, indicates that at the time of billing, the customer was in active military duty and qualifies for rates in accordance with Service members Civil Relief Act (SCRA) of 2003. |

| Customer Score | The customer score. |

| Behaviour Score | The behavior score. |

Due Date Change section

Table 4-6 Due Date Change section

| In this Field | Do This |

|---|---|

| Last Txn Dt | The last date on which the due date was changed. |

| Rem. Txn. Limit (Life) | Remaining number of due date changes allowed till account closure. |

| Rem. Txn. Limit (Year) | Remaining number of due date changes in the account for current calendar year. |

Extensions section

Table 4-7 Extensions section

| In this Field | Do This |

|---|---|

| Rem. Txn. Limit (Year) | Remaining number of extensions in the account for current calendar year. |

| Rem. Txn. Limit (Life) | Remaining number of extensions in the account till closure. |

| Last Txn Dt | The date when last extension was made. |

| Exten. Gap Rem. (Months) | The number of months remaining before you can post Extensions for an account. |

Contract Information

Table 4-8 Contract Information

| In this Field | Do This |

|---|---|

| Contract Dt | View the contract funded date. |

| Term | View the contract term. |

| Rate |

View the interest rate. |

| Maturity Dt | View the contract maturity date. |

| Adjusted Cap Cost | View the adjusted capitalization cost considering any rebates, trade-ins or down payment. |

Settlement Information

Table 4-9 Settlement Information

| In this Field | Do This |

|---|---|

| Effective Dt | View the settlement agreement start date. |

| Good Through Dt | View the settlement agreement expiry date. |

| Agreed Amt | View the settlement amount agreed by customer to the lender. |

| Paid Till Dt | View the total amount paid by the customer and allocated to account balances during the agreed period (between effective date and Good through date). |

Collateral Information section

Table 4-10 Collateral Information section

| In this field | View this |

|---|---|

| Primary | If selected. indicates that this is the primary collateral. |

| Description |

A brief description on the collateral. This is a hyper-link which when clicked opens Collateral Management screen with relevant collateral details. |

| Identification # |

The identification number of the collateral. This is a hyper-link which when clicked takes you to the collateral management screen with the relevant asset details. |

| Year | The year of manufacture of the collateral. |

| Asset Class | The asset class of the collateral. |

| Asset Type | The type of collateral. |

| Sub Type | The sub type of the collateral. |

Customer/Business Information section

On Customer Service screen’s Customer Information section, select the record you want to work with. Based on type of account selected as either Customer or Business, you can view the related information as indicated below:

Table 4-11 Customer account

| In this field | View this |

|---|---|

| Customer # | Customer identification number (unique customer identifier). |

| Name | Customer’s full name. |

| Relation | Customer’s relationship to the account. |

| SSN |

Customer’s social security number. If the organizational parameter UIX_HIDE_RESTRICTED_DATA is set to Y, this appears as a masked number; for example, XXX-XX-1234. |

| National ID | Customer’s national identification number. |

| Birth Dt | Customer’s date of birth. |

| Gender | Customer’s gender. |

| Customer’s e-mail address. |

Table 4-12 Additional Customer Details

| In this field | View this |

|---|---|

| Customer’s e-mail address. | |

| Language | Language spoken by the customer. |

| Marital Status | Customer’s marital status. |

| Disability | Customer’s disability indicator. If selected, this indicates that the customer is disabled. |

| Skip | Customer’s skip indicator. If selected, this indicates that the customer is a skip debtor. This is selected using the Maintenance screen. |

| Stop Correspondence | Stop correspondence indicator. If selected, Oracle Financial Services Lending and Leasing will not send correspondence to customer. This is selected using the Maintenance screen. |

| Privacy Opt- Out | Privacy opt-out indicator. If selected, indicates that customer does not want the FI to share his /her information with any other body, other than regulatory requirements. (optional). |

| Active Military Duty | Customer’s Active Military Duty indicator. If selected, this indicates that the customer is serving Military Duty. This is selected using the Maintenance screen. |

| Time Zone | Customer’s time zone. |

Table 4-13 Business account

| In this field | View this |

|---|---|

| Business # | The registered business number. |

| Name of the Business | The name of the business. |

| Organization Type | The type of Organization to which the business belongs. |

| Business Category | The type of Category to which the business belongs. |

| Type of Business | The type of business. |

| Legal Name | The legal name of the business. |

| Tax ID # | The taxation identity number of the business. |

Table 4-14 Additional Business Details

| In this field | View this |

|---|---|

| Business e-mail address. | |

| Contact Person | The contact person at the business. |

| Start Dt | The Business start date. |

| Management Since | The year the current management was established. |

| Bankruptcy | Business’s bankruptcy indicator. |

| Skip | Business’s skip indicator. If selected, indicates that the Business has debts and the customer is a skip debtor. |

| Stop Correspondence | Stop correspondence indicator. If selected, Oracle Financial Services Lending and Leasing will not send correspondence to Business. |

| Privacy Opt- Out | Privacy opt-out indicator. If selected, indicates that Business does not want the financial information to share information with any other body, other than regulatory requirements. |

| Time Zone | Business time zone. |

Address Information section

Table 4-15 Address Information section

| In this field | View this |

|---|---|

| Type | Address type. |

| Current | If selected, indicates that this is the current address. |

| Permission to Call | If selected, indicates that you can contact the customer. |

| Mailing | If selected, indicates that this is the mailing address |

| Address | Address details. |

| Phone | Phone number. |

Employment Information section

Table 4-16 Employment Information section

| In this field | View this |

|---|---|

| Type | Type of Employment as PART TIME, FULL TIME and so on. |

| Current | If selected, indicates that this is the current employer. |

| Permission to Call | If selected, indicates that you can contact the employer. |

| Employer | Employer Details. |

| Next Pay Day | The next payment day of the month. |

| Frequency | Frequency of the payment. |

| Address | Address details. |

| Phone | Phone number. |

Telecom Information Section

Table 4-17 Telecom Information Section

| In this field | View this |

|---|---|

| Type | The type of phone contact such as Home / Office / Car / Mobile phone. |

| Current | If selected, indicates that this is the current phone contact. |

| Permission to Call | Permission as either Yes Y or No N to contact the customer over phone. |

| Phone | The customer’s phone number. |

| Extn | The customer’s phone extension. |

| Time Zone | The customer’s time zone. |

| Best day to call | Preferred day of the week to contact the customer, if specified. |

| Best Time To Call | Preferred time to contact the customer, if specified. |

Outbound Call History

Table 4-18 Outbound Call History

| In this field | View this |

|---|---|

| Today | The total number of outbound calls as of today. |

| Last 7 days | The total number of outbound calls in the past 7 days. |

| Last 30 days | The total number of outbound calls in the past 30 days. |

Work Order Details

Table 4-19 Work Order Details

| In this field | View this |

|---|---|

| Work Order # | View the work order number. |

| Case # | View the case number if associated with the work order. |

| Work Order Type | View the type of work order. |

| Vendor | View the vendor to whom the work order is assigned. |

| Status | View the status of work order. |

Parent topic: Customer Service