- Import Documentary Collection Liquidation - Islamic User Guide

- Import Documentary Collection Liquidation - Islamic

- Data Enrichment

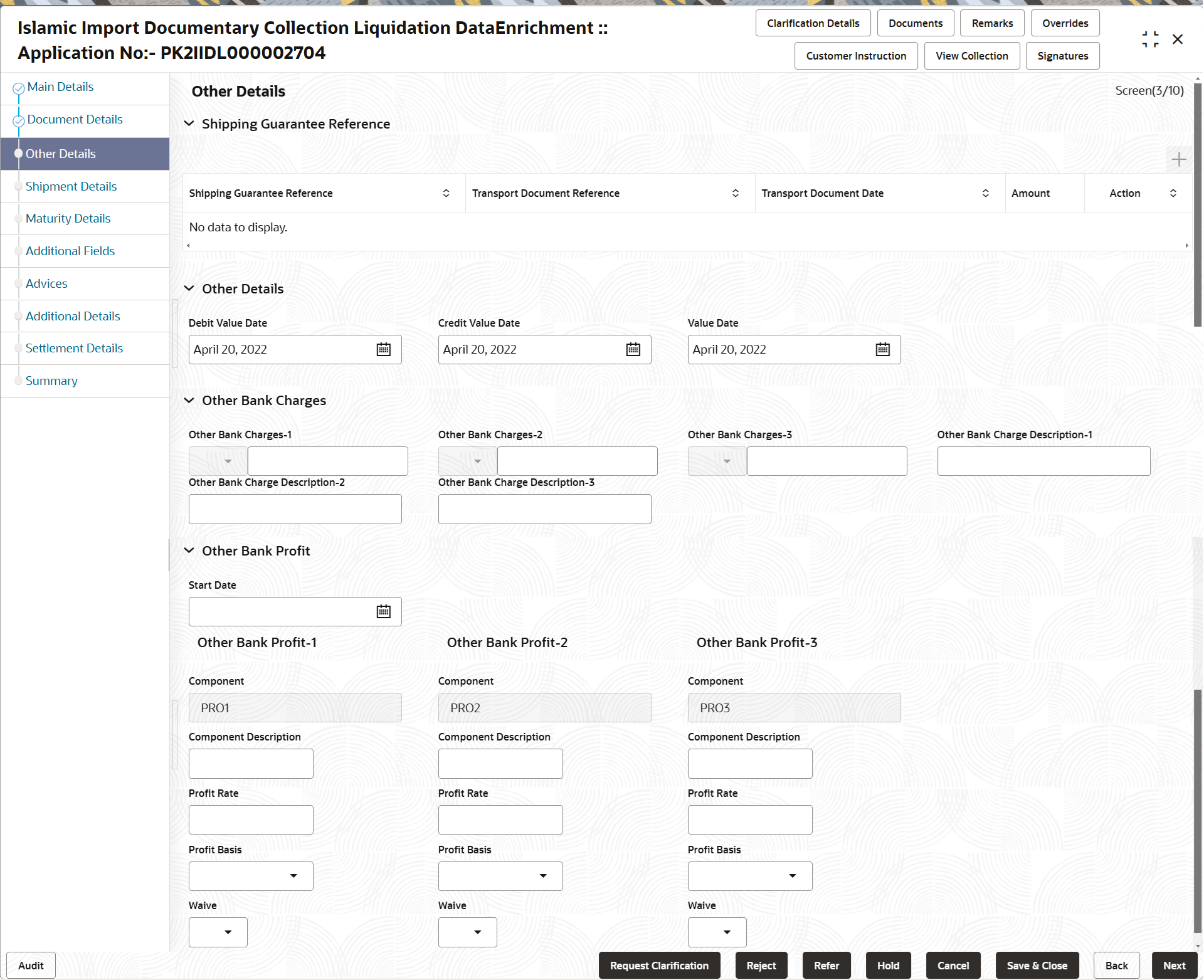

- Other Details

2.3.3 Other Details

This topic provides the systematic instructions to capture the other details like Credit Value Date, Debit Value Date, Other Bank charges etc.

- On Other Details screen, specify the fields that were

not entered at Registration stage.

For more information on fields, refer to the field description table below.

Table 2-11 Other Details - Field Description

Field Description Shipping Guarantee Reference Shipping Guarantee Reference Shipping Guarantee Reference is auto populated from the underlying Shipping Guarantee details, if the Transport Reference Number in the Collection document is same as the Transport Document reference in the Shipping Guarantee. Transport Document Reference Transport Document Reference is auto populated from the underlying Shipping Guarantee details. System validates the Shipping Guarantee Transport Document reference number with Transport Document Reference number in a Bill, if user manually provides the Shipping Guarantee detail.

Transport Document Date Transport Document Date is auto populated based on the date provided in Bill. Amount Shipping Guarantee amount is displayed in this field. Action Edit: This button is disabled. Delete: This button is disabled.

Other Details Debit Value Date Debit Value Date is auto-populated from the system. The user can change the date.

Credit Value Date Credit Value Date is auto-populated from the system. The user can change the date.

Value Date Value Date is auto-populated from the system. The user can change the date.

Other Bank Charges Specify the other bank charges based on the description in the following table.

Other Bank Charges - 1 Specify the charges to be collected for the other bank as part of the collection transaction. Other Bank Charges - 2 Specify the charges to be collected for the other bank as part of the collection transaction. Other Bank Charges - 3 Specify the charges to be collected for the other bank as part of the collection transaction. Other Bank Description - 1 Specify the description of charges to be collected for the other bank as part of the drawings transaction. Other Bank Description - 2 Specify the description of charges to be collected for the other bank as part of the drawings transaction. Other Bank Description - 3 Specify the description of charges to be collected for the other bank as part of the drawings transaction. Other Bank Profit The user can enter the Interest details to be captured as a part of “Other Bank Profit” details section.

Start Date Specify the date from which the system starts calculating the profit. Other Bank Profit-1, 2 and 3 Component Read only field. This field displays the name of the profit Component.

Component Description Specify the description of the profit component. Profit Rate Specify the rate to be applied for the profit component. Profit Basis Select the calculation basis on which the profit to be computed from the drop-down list. Waive Select whether the profit to be waived off. The options are:

- Yes

- No

- Click Next.The task will move to next data segment.

For more information on action buttons, refer to the field description table below.

Table 2-12 Other Details - Action Buttons - Field Description

Field Description Clarification Details Clicking the button opens a detailed screen, user can see the clarification details in the window and the status will be 'Clarification Requested'. Documents View/Upload the required document. Application displays the mandatory and optional documents.

The user can view and input/view application details simultaneously.

When a user clicks on the uploaded document, Document window get opened and on clicking the view icon of the uploaded document, Application screen should get split into two. The one side of the document allows to view and on the other side allows to input/view the details in the applicationRemarks Specify any additional information regarding the collection. This information can be viewed by other users processing the request. Content from Remarks field should be handed off to Remarks field in Backend application.

Overrides Click to view the overrides accepted by the user. Customer Instruction Click to view/ input the following - Standard Instructions – In this section, the system will populate the details of Standard Instructions maintained for the customer. User will not be able to edit this.

- Transaction Level Instructions – In this section, OBTFPM user can input any Customer Instructions received as part of transaction processing. This section will be enabled only for customer initiated transactions.

View Collection Enables the user to view the latest collection values displayed in the respective fields. Signatures Click the Signature button to verify the signature of the customer/ bank if required. The user can view the Customer Number and Name of the signatory, Signature image and the applicable operation instructions if any available in the back-office system.

If more than one signature is required, system should display all the signatures.

Request Clarification User can specify the clarification details for requests received online. Save & Close Save the details provided and holds the task in ‘My Task’ queue for further update. This option will not submit the request. Cancel Cancel the Data Enrichment stage inputs. The details updated in this stage are not saved. The task will be available in 'My Task' queue. Hold The details provided will be saved and status will be on hold.User must update the remarks on the reason for holding the task. This option is used, if there are any pending information yet to be received from applicant.

Reject On click of Reject, user must select a Reject Reason from a list displayed by the system. Reject Codes are:

- R1- Documents missing

- R2- Signature Missing

- R3- Input Error

- R4- Insufficient Balance/Limits

- R5 - Others

Select a Reject code and give a Reject Description.

This reject reason will be available in the remarks window throughout the process.

Refer Select a Refer Reason from the values displayed by the system. Refer Codes are:

- R1- Documents missing

- R2- Signature Missing

- R3- Input Error

- R4- Insufficient Balance/Limits

- R5 - Others

Next On click of Next, system validates if all the mandatory fields have been captured. Necessary error and override messages to be displayed. On successful validation, system moves the task to the next data segment.

Parent topic: Data Enrichment