6.1.4 Confirm LC Amendment

This topic provides the systematic instruction to confirm LC amendment.

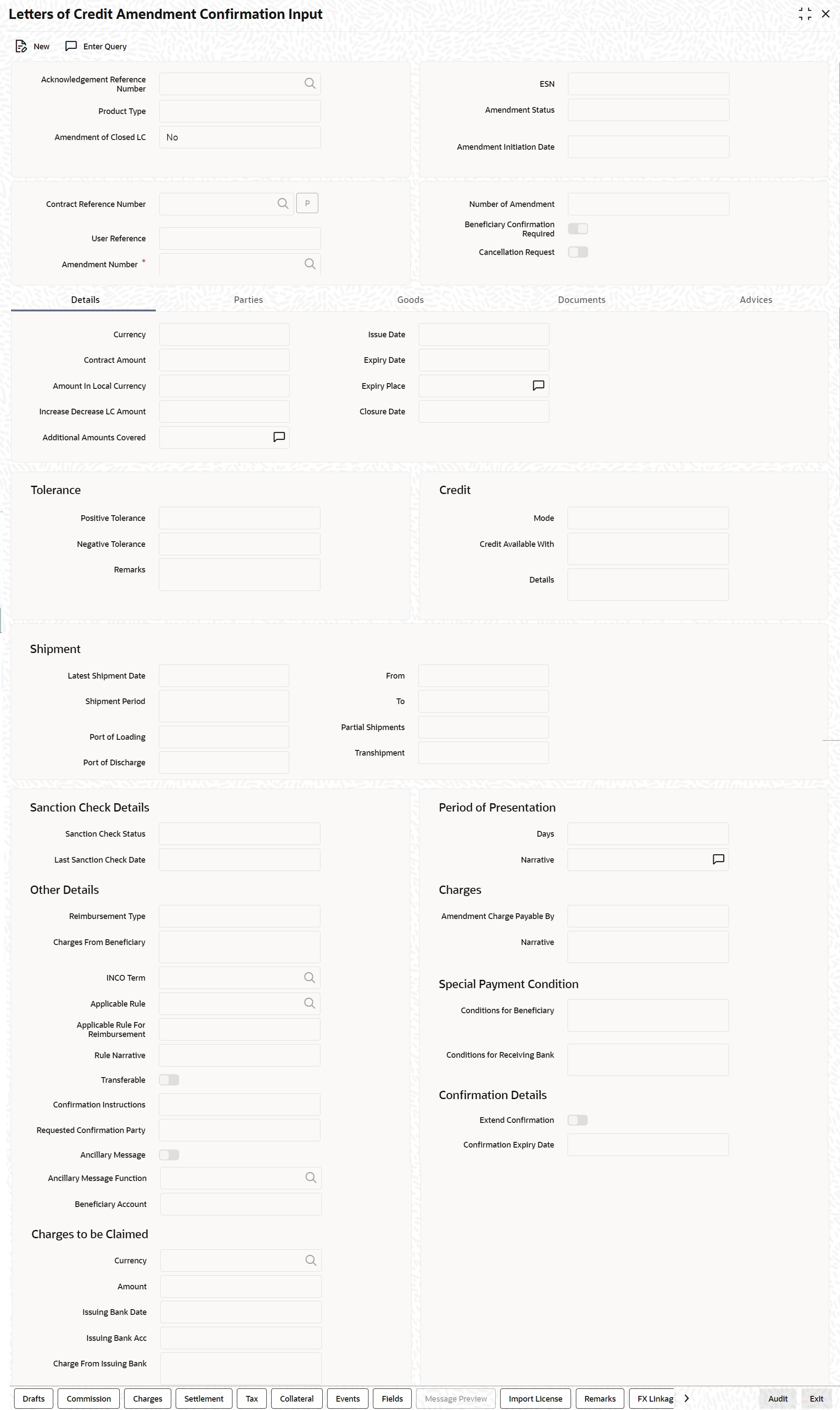

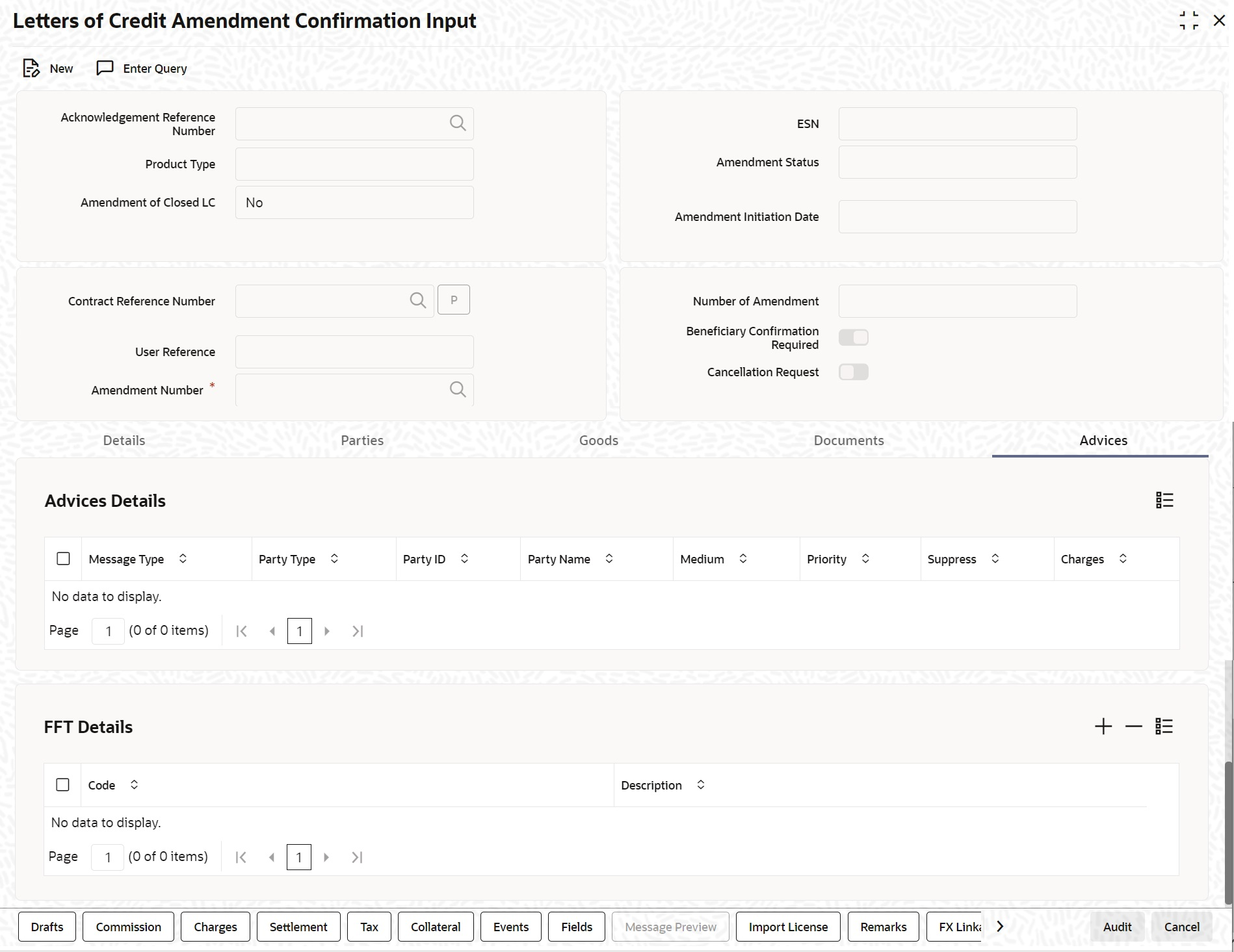

- On the Homepage, type LCDAMEND in the text box, and click next arrow. The Letters of Credit Amendment Confirmation Input is displayed.

Figure 6-2 Letters of Credit Amendment Confirmation Input

- On the Letters of Credit Amendment Confirmation Input screen, click New and specify the field details.The screen is displayed without any details.For more information on the fields, refer the Field Description table:

Table 6-1 Letters of Credit Amendment Confirmation Input - Field Description

Field Description Acknowledgment Reference Number Specify the acknowledgment reference number. Alternatively, you can select the reference number from the option list. The list displays all the acknowledgment reference numbers for contract amendment registered in the system. This field is mandatory.Note:

Registration status will be updated as Processed when the amendment request is processed by selecting Acknowledgment Reference Number.Product Type Select the type of product from the option list provided. This option list will display all the product types. This field is optional.

Contract Reference Number Select the reference number of the contract to be amended from the option list provided. This option list will display all contracts that are authorized. This field is mandatory.

Note:

Once you have specified the contract reference number, click ‘P’ button. The system displays the details of the contract under three tabs viz. Details, Parties and Advices.Amendment Initiation Date The system defaults the application date in the amendment initiation date. This field is mandatory. Cancellation Request Select this check box to request cancellation. If Cancel flag is checked, only cancel information shows a message on authorization of amendment. If Cancel flag is enabled, other field amendments are not considered and CANCEL event is triggered on amendment confirmation. An override message “Cancellation Request flag is checked, LC is cancelled on Confirmation” is displayed on confirmation.

This field is mandatory.Reopen Request Reopen request is enable only for the close import LC's. If the reopen is initiated with beneficiary confirmation AMNV event is triggered. After beneficiary confirmation ACON and ROPN event is triggered.

If the reopen is initiated without beneficiary confirmation ROPN event will get triggered.Number of Amendment The system displays the number of amendments based on the contract reference number. You can amend an LC multiple times before the previous amendment is confirmed or rejected. This field is optional.

Beneficiary Confirmation Required The system checks this box by default. When amendment is initiated with ‘Beneficiary Confirmation Required’ enabled, then the event AMNV is triggered and MT 707 is generated. If amendment is initiated without enabling ‘Beneficiary Confirmation Required’, then the system triggers AMND on save.

This field is optional.ESN The system displays the event sequence number. Amendment Status The system displays the amendment status. - If the following data elements are amended during the previous amendments and the beneficiary consent has not been updated in the system for these amendment, then the system will not allow to proceed with the current amendment:

- Expiry Date

- Remarks

- Credit Mode

- Credit Details

- Credit Available With

- Partial Shipments

- Transhipment

- Charges From Beneficiary

- INCO Term

- Applicable Rule

- Rule Narrative

- Transferable

- Confirmation Instructions

- Requested Confirmation Party

- Period of Presentation Days

- Period of Presentation Narrative

- Contract Amount

- Positive Tolerance/Negative Tolerance

- Additional Amounts Covered

- From Place

- Port of Loading

- Port of Discharge

- Latest Shipment Date

- Shipment Period

- If beneficiary confirmation is pending for an amendment and LC amount is modified for that amendment and if the user is initiating a fresh amendment with a change in tolerance value.

- If beneficiary confirmation is pending for an amendment and Expiry Date is modified for that amendment and if the user is initiating a fresh amendment with a change in Latest Shipment Date or Shipment Period.

- If beneficiary confirmation is pending for an amendment and Latest Shipment Date is modified for that amendment and if the user is initiating a fresh amendment with a change in Expiry date.

The amendment of LC can be simulated only through gateway. The LC Amendment Simulation does not have screen, so user cannot invoke LC Amendment Simulation from the application front. All operations are supported for LC Amendment Simulation same as LC Amendment. Amount in Local Currency When FCY amount is given in 'Contract Amount' field for LC during Amendment, system converts in local currency and respective value is displayed in this screen. This field is mandatory for FCY contracts. If amendment is initiated without enabling ‘Beneficiary Confirmation Required’, then the system displays an error message in the following cases.

In Import LC amendment if the expiry date greater than expiry date of Export LC linked.

In Import LC amendment if the contract amount is greater than the linked Export LC Contract Amount.

In Import LC amendment if the maximum contract amount is greater than the linked Export LC maximum contract amount.

In Import LC amendment if the contract amount is greater than the linked Export LC contract amount.

In Export LC amendment if the contract amount is lesser than the linked Import LC contract amount.

In Export LC amendment if the expiry date is lesser than the linked Import LC contract amount. - On the Letters of Credit Amendment Confirmation Input screen, click Hold button.You can support Financial Amendment during amendment initiation from LCDAMEND for the below scenarios.

- Amendment without beneficiary confirmation

- Amendment with beneficiary confirmation

- Deletion of Hold will be supported. Contract to be Active and in Authorized status

- ‘Hold of Hold’ will be supported. Contract to be Hold and in unauthorized status

- Authorization is not supported for Contracts put on Hold

- Amendment on Hold is restricted when there are previous unconfirmed amendments

Note:

Hold will not be supported for amendment with Cancellation flag or Confirmation / Rejection of amendment. - On the Letters of Credit Amendment Confirmation Input screen, specify the field details of Details tab. You can view and modify the details pertaining to shipment and tolerance of the letter of credit. Upon selection of the contract, the following details will be displayed in editable mode:For more information on fields, refer the Field Description table:

Table 6-2 Details - Field Description

Field Description Currency The contract currency. Contract Amount The amount that is availed under the LC. Increase Decrease of LC Amount A display field which indicates the amount of LC increased or decreased. Additional Amounts Covered This indicates the value to be carried in field 39C of the SWIFT messages MT700 and MT740. Issue Date The date on which the LC is issued. You cannot specify a future date here. Expiry Date The date on which the LC is scheduled to expire. On confirmation of guarantee amendment, revised Expiry Date is propagated to LCDTRONL. System derives Claim Expiry date based on the new Expiry Date. Expiry Place The system displays the expiry place details. Closure Date This the date LC is scheduled to be closed. You can modify this particular value. Tolerance - Positive Tolerance% - The percentage that is to be added to the LC amount to arrive at the Maximum LC amount.

- Negative Tolerance% - The percentage that should be subtracted from the LC amount.

- Remarks: Provide additional details if any.

Credit Specify the credit details: Modes This indicates the mode of payment through which the LC will be settled - Sight, Acceptance, Negotiation or Deferred.

This field is mandatory.Credit Available With Specify details of the party with whom the credit will be available.

This field is optional.Details Specify the details of the credit.

This field is mandatory.Shipment Latest Shipment Date - The last date by which the shipment of the goods has to take place. This date should not be earlier than the Issue Date of the LC or later than the expiry date. If you modify the latest shipment date, the system will recalculate the shipment days on confirmation of the amendment. - Shipment Period - The extension of the shipping period. You can enter the Shipment Period only if you have not specified the Latest Shipment Date

- Port of Loading – The port from where the goods transacted under the LC will be loaded

- Port of Discharge – The destination port to which the goods transacted under LC should be sent

- From - The place from where goods are to be dispatched or transported

- To - The final destination to which goods are to be transported/delivered

- Partial Shipments - You can select ‘Allowed’, ‘Not Allowed’, ‘Conditional’ or Blank as partial shipment.

- Transhipment - You can select Allowed, Not Allowed, Conditional or Blank as trans shipment.

Other Details Charges From Beneficiary - Specify the charge amount borne by the beneficiary. - INCO Term - Specify the INCO term related to goods that are a part of the LC instrument.

- Applicable Rule - The system defaults the applicable rule.

- Applicable Rule For Reimbursement - Select the applicable rule for reimbursement.

- Rule Narrative - This is enabled only if Applicable Rule is set to OTHR.

- Transferable - To indicate LC is transferable or not.

- Confirmation Instructions - Select the confirmation option to indicate that the LC can have an associated confirmation message. In LC if Confirm/May Confirm option is checked cannot be amended to uncheck.

- Requested Confirmation Party - Specify the confirmation party type (Advising Bank, Advice Through Bank or Confirming Bank).

- Ancillary Message - Check this box to generate MT 759 on contract authorization.

- Ancillary Message Function- Specify the ancillary message function. Alternatively, you can select the ancillary message from the option list. The list displays all valid options maintained in the system. Ancillary Message Function is mandatory if ‘Ancillary Message’ is checked.

Period of Presentation - Days - This system specifies the number of calendar days after the date of shipment within which the documents must be presented for payment, acceptance or negotiation.

- Narrative - The system specifies the details of the date after which the documents must be submitted. Eg: Invoice date, Shipment date

Charges - Amendment Charge Payable by - Select the type of amendment charge payable by from the drop-down list.

- Narrative - The system specifies the details of the date after which the documents must be submitted. Eg:Invoice date, Shipment date

Sanction Check Details - Sanction Check Status - The system displays the sanction check status.

- Last Sanction Check Date - The system displays the last sanction check date.

Special Payment Condition - Conditions for Beneficiary - Specify the payment conditions for beneficiary.

- Conditions for Receiving Bank - Specify the payment conditions for receiving bank.

Note:

For more information on processing sanction check refer ‘Processing Sanction Check’ section in this user manual.

Make the necessary amendments. Save the changes. To save, click save icon in the toolbar of the screen. On Save system validates if there are any unsettled claims and provides appropriate override.

The system will update the following details in the audit trail of the screen:- Input By – Your login id

- Date Stamp – The date and time at which you saved the contract

- Amendment Status – The status will always be Unconfirmed

- Auth Status – The status will always be ‘Unauthorized’

Note:

For details on the amendable fields, refer the topic ‘Processing an LC contract’ in this User Manual.Confirmation Expiry Date The system displays the confirmation expiry date for the confirmed or silent confirmed Export contracts.

System populates this field as below

For the confirmed or silent confirmed Export LC contracts,

- If the Extend Confirmation is checked and if the expiry date is modified then it will display the modified expiry date in Subsystem pickup or save.

- If the Extend Confirmation is unchecked and if the expiry is modified it will display the old expiry date in Subsystem pickup or save.

Extend Confirmation This option indicates to extend the confirmation for confirmed or silent confirmed Export LC. By default this checkbox will be enabled for confirmed export LC. User can uncheck the same.

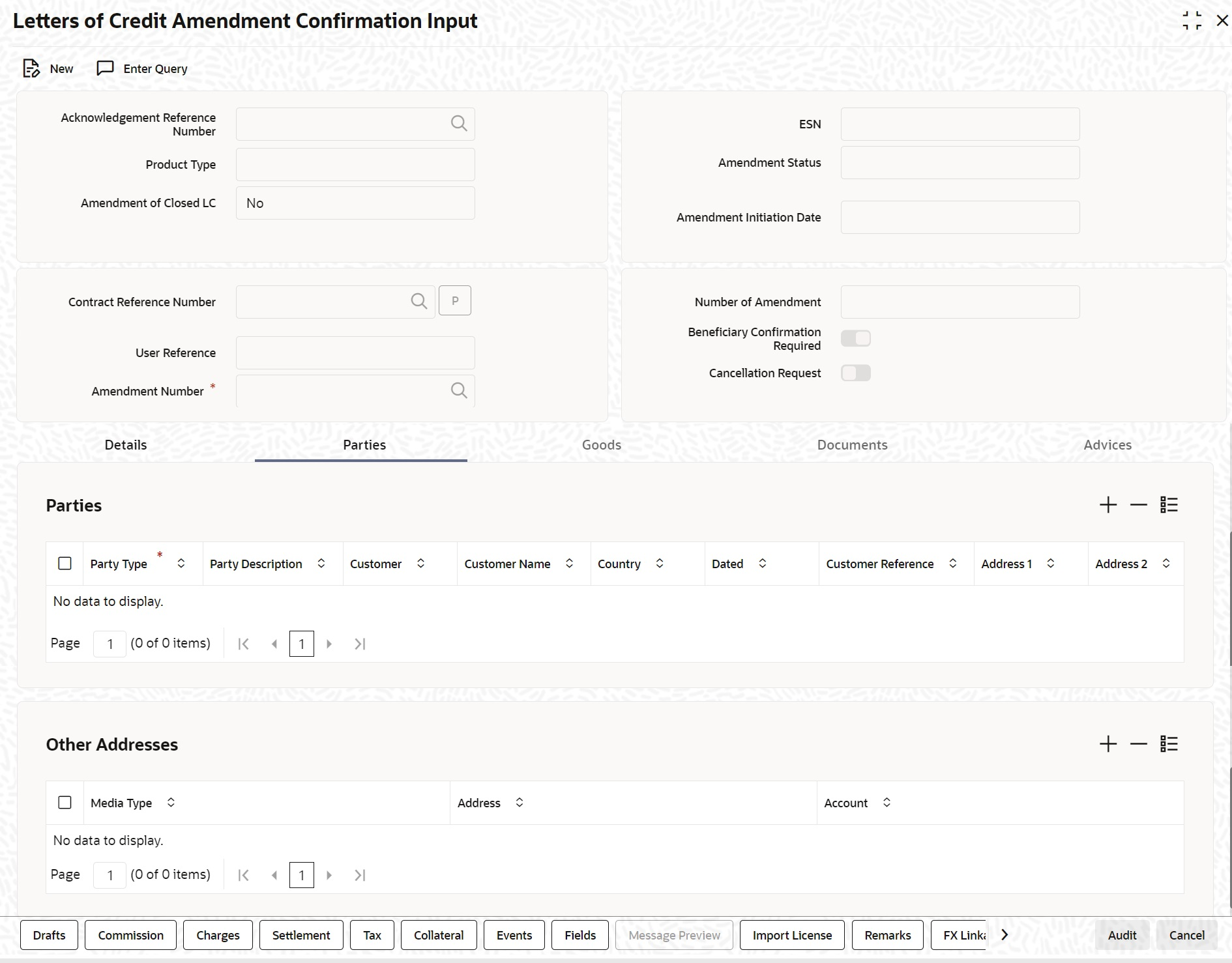

- On the Letters of Credit Amendment Confirmation Input screen, click the Parties tab. The Parties details is displayed. For more information on the fields, refer the Field Description table given below:

Table 6-3 Parties- Field Description

Field Description Confirm Parties Specify the Confirm Parties details: Party Type Specify the party type. Alternatively, you can select the party type from the option list. The list displays all valid party types maintained in the system. The system defaults the existing party details from LC contract. You can add a new party 'REB' however you cannot remove existing party type other than REB. If 'REB' is added as the party type in LC amendment confirmation screen, MT 740 will be generated along with amendment message MT707. If 'REB' party is amended in LC amendment confirmation screen, MT 747 will be generated along with amendment message MT707 and MT740. Amendment with new Party Id REB by enabling cancellation request should not process or generate MT740 and MT747 messages.

If 'REB' is deleted from the party type in LC

amendment confirmation screen, MT747

will be generated to Reimbursing Bank

Party along with MT707 and MT740 will be

automatically suppressed.

CANC has to be provided against MT747 for message generation. This field is mandatory.Customer The system defaults the customer number. However, you can modify it. Specify the Customer for which you need to maintain. Alternatively, you can select the Customer No from the option list also.

Note:

BIC Code appears next to the ‘Customer No’ only if the BIC Code is mapped with that customer number. If the BIC Code is not mapped with that customer number, then the BIC code will not appear next to the ‘Customer No’ in the option list.Customer Name The system defaults the customer name. However, you can modify it. This field is optional.

Address 1 to 4 The system defaults the address of the party. This field is mandatory.

Country The system defaults the country of the customer. This field is optional.

Customer Reference The system defaults the customer reference number. However, you can modify it. Party Description The system defaults the party description. Confirmation Charges Payable By - Select the type of confirmation charges payable by from the drop-down list. Party details in the Parties tab of the screen You can amend ‘Their Reference Number’ and the ‘Dated’ fields values only.

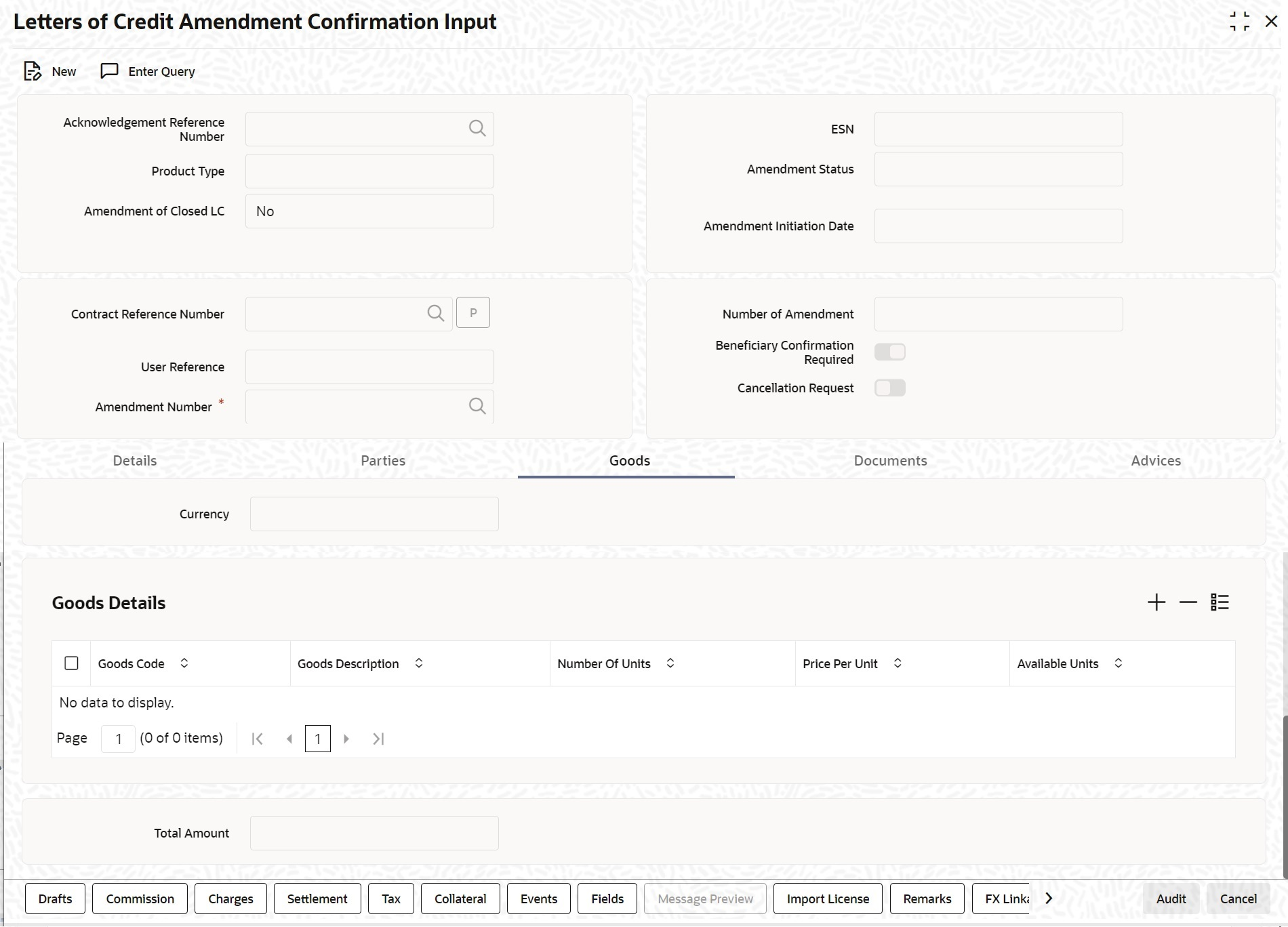

Free Format Text details in the ‘FFT’ tab of the screen.Dated The system defaults the date on which the party joined. However, you can modify it. Language The system defaults the language in which advices are sent to the customer. Issuer Bank The system defaults the option, the issuer is a bank. Template ID Specify the template ID related to MT799 message types from the option list. Other Addresses Specify Other Addresses Media Type The system defaults the media type. You can select a different medium from the adjoining option list. Address The system defaults the other address of the party. However, you can edit this field. Account The system defaults the account number. However, you can edit this field. - On the Letters of Credit Amendment Confirmation Input screen, click the Goods tab. The Goods Details is displayed. The Goods tab maintains multiple goods details.

- Click on add icon to add the Goods Details. A new row is added. You can specify the goods details.For more information on the fields, refer the Field Description table given below:

Table 6-4 Goods- Field Description

Field Description Currency The system displays the currency by default once you select the contract reference number. Goods Details Specify the Goods Details: This field is optional.

Goods Code Select the Goods Code from the list provided. This field is optional.

Goods Description The system displays the description of the Goods. This field is optional.

Number of Units The system displays the number of units. This field is optional.

Price Per Unit The system displays the price per unit. This field is optional.

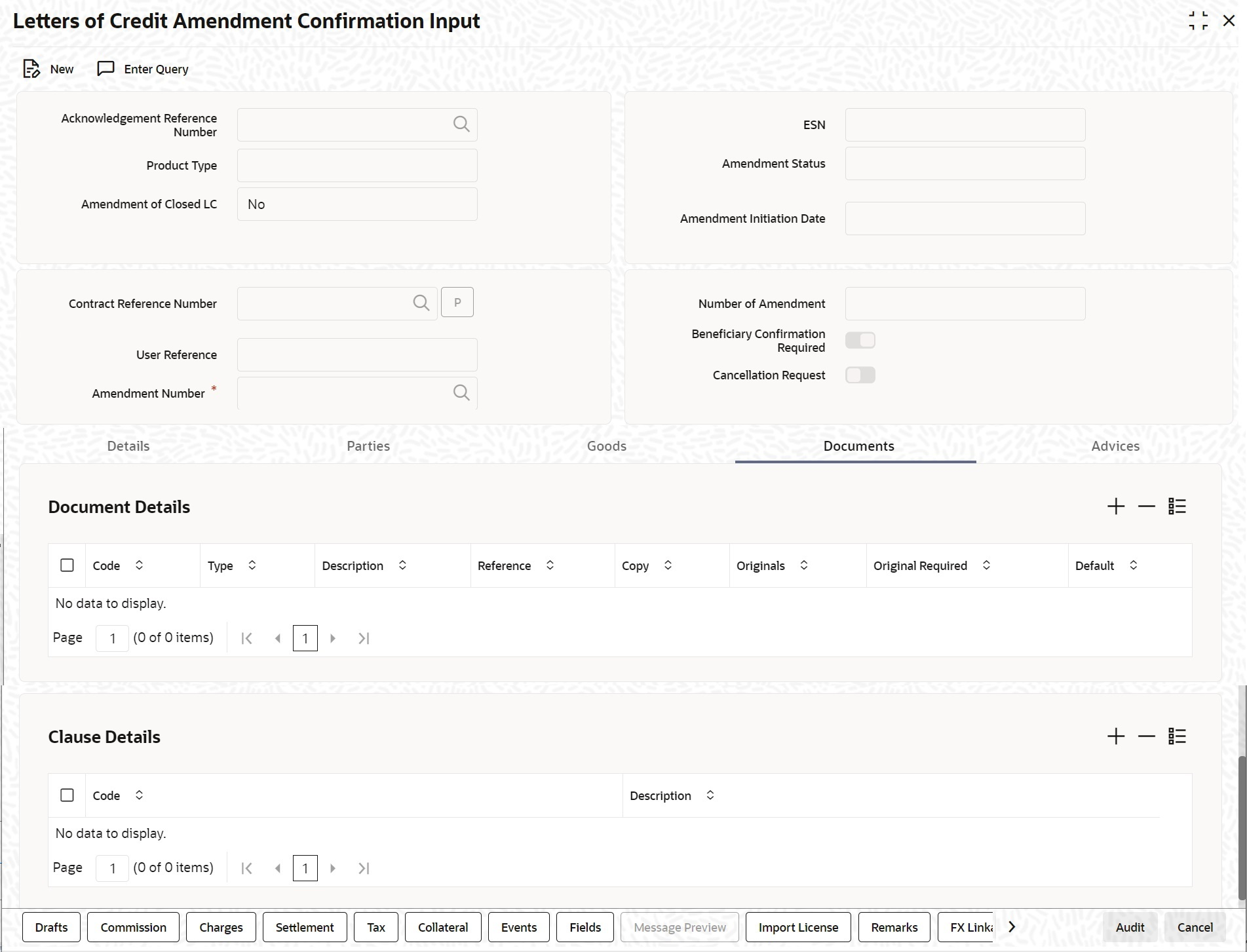

Available Units The system displays the available units of the goods. - On the Letters of Credit Amendment Confirmation Input screen, click the Documents tab. The Documents Details is displayed.There are some standard documents required under a documentary LC. In this screen you can specify the documents that are required under the LC being processed. These details will be a part of the LC instrument sent to the advising bank, the advice through bank or the beneficiary. All the documents specified for the product to which the LC is linked will be defaulted to this screen.

For more information on the fields, refer the Field Description table:

Table 6-5 Documents- Field Description

Field Description Contract Reference Enter the contract reference number based on which the shipping guarantee issued. Code Enter the document code. This field is optional.

Type Enter the document type. This field is optional.

Description Enter the document description of the document that is defaulted to suit the LC you are processing. This field will be enabled only if the LC type is Shipping Guarantee, but not mandatory. During copy operation, the value of this field will not be copied to the new contract.

This field is optional.Reference Enter the document reference number based on which the Shipping Guarantee issued. This field is optional.

Copy Enter the number of copies of the document. This field is optional.

Originals Enter the originals details. Original Required Select this box to generate the original receipts. Default Check the default button for default generation. - On the Letters of Credit Amendment Confirmation Input screen, click the Advices tab. The Advices details is displayed.For more information on the fields, refer the Field Description table given below:

Table 6-6 Advices- Field Description

Field Description Advices Details Specify the advices details. Message type Check the box to view the advice details. This field is optional.

Party Type The system displays the party type for which the advice is generated. This field is optional.

Party ID The system displays the party id for which the advice is generated. During copy operation, the value of this field will not be copied to the new contract.

This field is optional.Party Name The system displays the name of the party for which the advice is generated. This field is optional.

Medium The system displays the medium through which the advice is sent. The user can select a different medium from the list. If the medium is modified, the user must provide the new address in the Other Addresses section, in the ‘Parties’ tab. This field is optional.

Priority The system displays the priority of sending the advice. However, you can change the priority. Suppress The system displays if the advice is suppressed or not. However, you can edit this field. Charges The system displays the charges involved. However, you can edit the charges. FFT Details The user can select a message from the Advices Details section and associate a code and a description to it. Code The user can select the appropriate code from the option list. Description The system displays the description of the selected code. However, you can modify this description. Note:

Advices for a party are sent to the default media maintained in the Customer Addresses table. However, you can send the advices through a different medium by doing the following:- Maintaining media details in Other Address in Parties screen

- Indicating the medium in the Advices screen

- Suppressing the Advices which is ‘N’ by default.

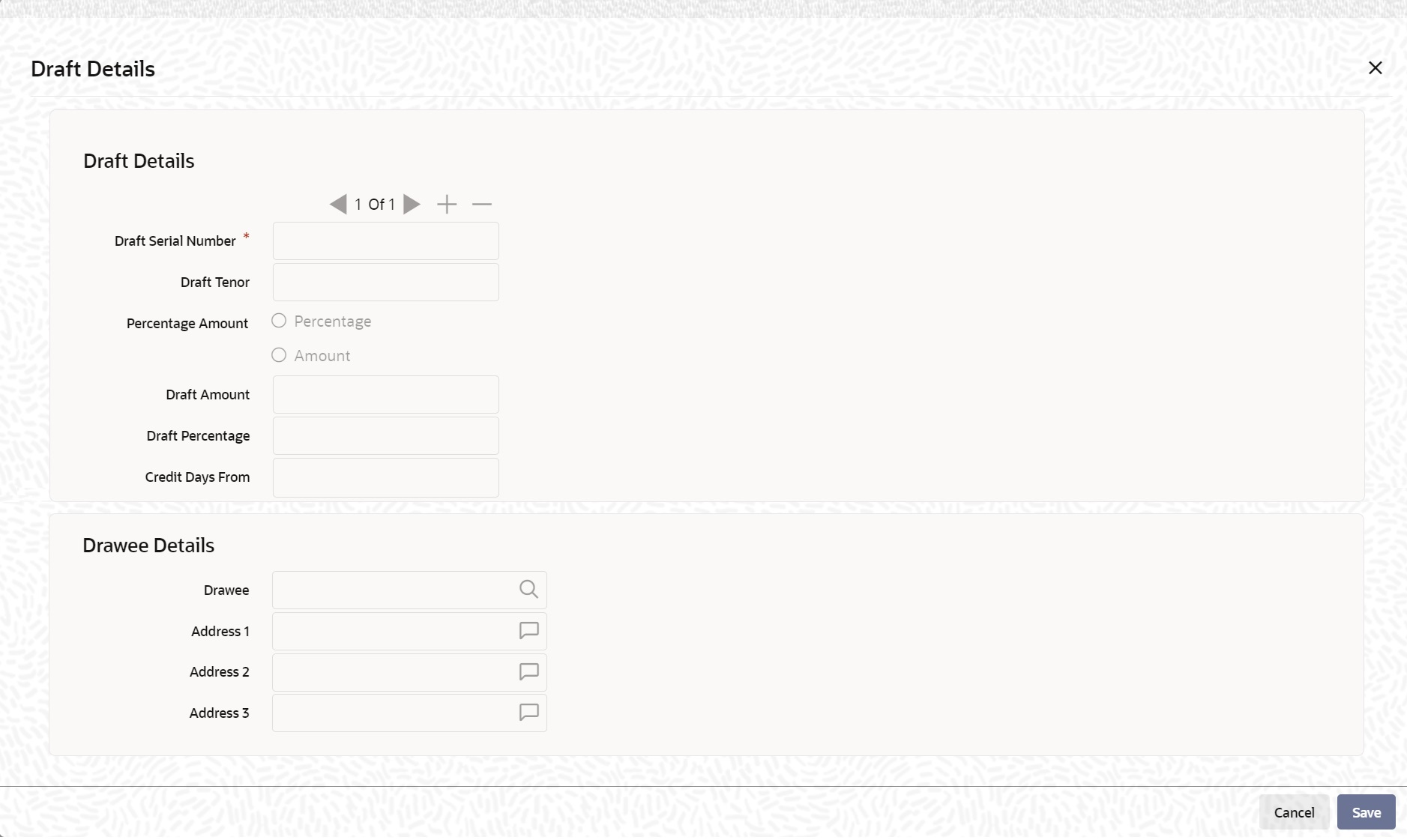

- On the Letters of Credit Amendment Confirmation Input screen, click the Drafts button. The Draft Details is displayed.For more information on the fields, refer the Field Description table given below:

Table 6-7 Draft Details - Field Description

Field Description Draft Details Specify the draft details. Draft Serial Number The system display the draft serial number here. This field is optional.

Draft Tenor Specify the details of the draft tenor. This field is optional.

Party ID Specify the credit days from details here. This field is optional.

Drawee Details Specify the drawee details: This field is optional.

Drawee Specify the drawee details here. This field is optional.

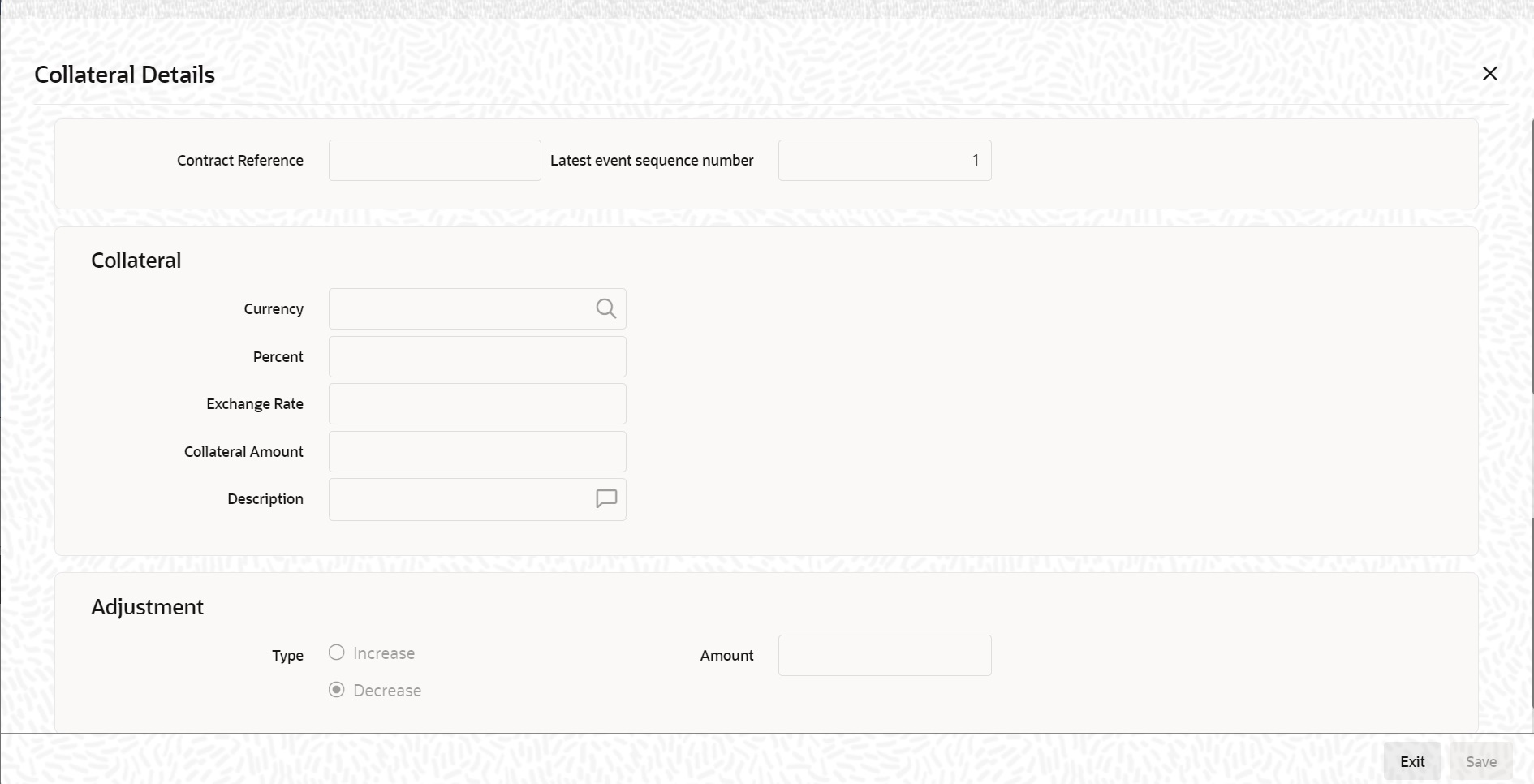

Address 1 Specify the address details. This field can be modified. Address 2 Specify the address details. This field can be modified. Address 3 Specify the address details. This field can be modified. - On the Letters of Credit Amendment Confirmation Input screen, click the Collateral button. The Collateral Details is displayed.For more information on the fields, refer the Field Description table given below:

Table 6-8 Collateral - Field Description

Field Description Contract Reference Number The contract reference number is displayed here. Latest Event Sequence Number The system displays the event sequence number. This field is optional.

Collateral Specify the following details here. Currency The currency is displayed here. This field is optional.

Percent The percentage is displayed here. However, you can modify it. An override message will be displayed when you modify the percentage. This field is optional.

Exchange Rate This field is optional. This field is optional.

Collateral Amount The collateral amount is displayed here. However, you can modify it. An override message will be displayed when you modify the collateral amount. Description The amount description is displayed here. Adjustment Specify the adjustment details: Type Choose ‘increase’ if you want to increase the percentage of the collateral amount or ‘decrease’ to decrease the percentage of the collateral amount. Amount The new amended amount after calculation is displayed here. Note:

The system prompts override messages:

If the LC expiry date is later than any linked collateral’s expiry date.

If the LC expiry date extended as part of amendment is later than any limit line’s expiry date.

The system will validate when a new limit line is attached during actions other than New.Description The system displays the description of the selected code. However, you can modify this description. Note:

Advices for a party are sent to the default media maintained in the Customer Addresses table. However, you can send the advices through a different medium by doing the following:- Maintaining media details in Other Address in Parties screen

- Indicating the medium in the Advices screen

- Suppressing the Advices which is ‘N’ by default.

- Specify the collateral details and click Ok.

Note:

You will be allowed to amend the percentage, collateral amount, and adjustment type.Specify details of the cash that you collect as collateral from a customer for the LC that you process.Table 6-9 Collateral - Field Description

Field Description Contract Reference Number The contract reference number is displayed here. Latest Event Sequence Number The system displays the event sequence number. This field is optional.

Collateral Specify the following details here. Currency The currency is displayed here. This field is optional.

Percent The percentage is displayed here. However, you can modify it. An override message will be displayed when you modify the percentage. This field is optional.

Exchange Rate This field is optional. This field is optional.

Collateral Amount The collateral amount is displayed here. However, you can modify it. An override message will be displayed when you modify the collateral amount. Description The amount description is displayed here. Adjustment Specify the adjustment details: Type Choose ‘increase’ if you want to increase the percentage of the collateral amount or ‘decrease’ to decrease the percentage of the collateral amount. Amount The new amended amount after calculation is displayed here. Note:

The system prompts override messages: If the LC expiry date is later than any linked collateral’s expiry date.If the LC expiry date extended as part of amendment is later than any limit line’s expiry date.

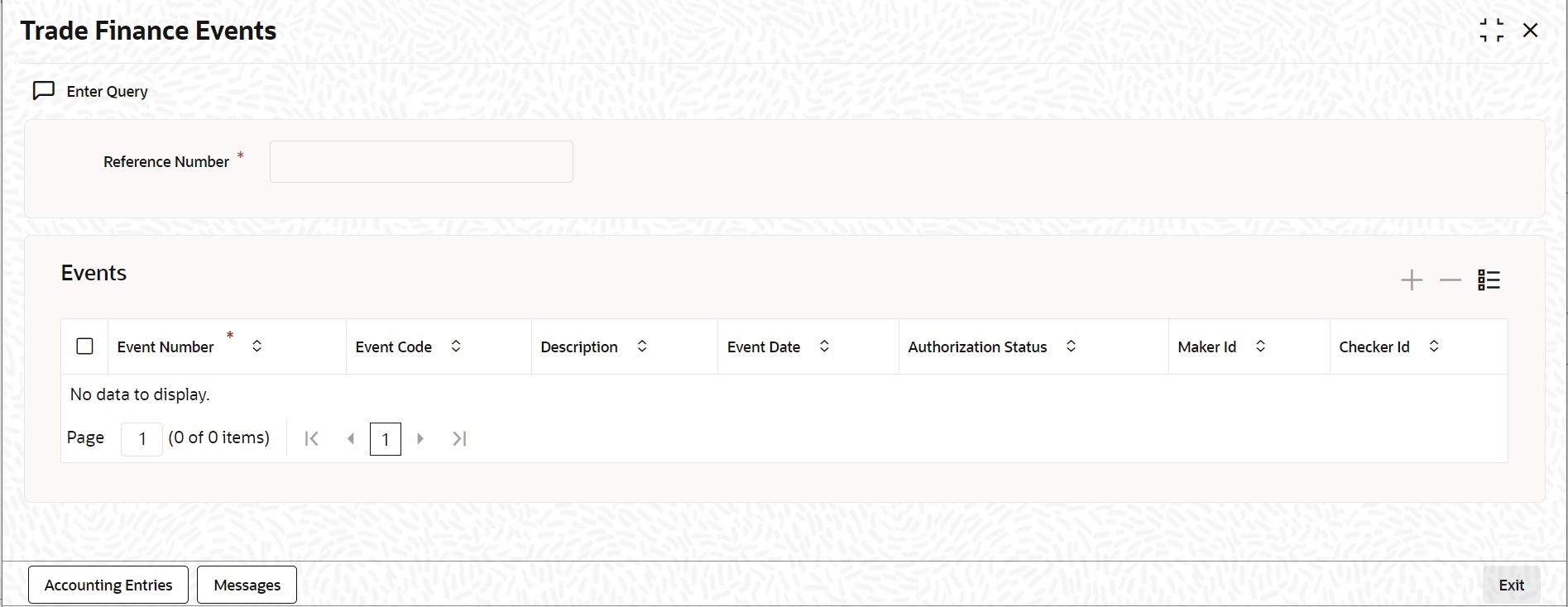

The system will validate when a new limit line is attached during actions other than New. - On the Letters of Credit Amendment Confirmation Input screen, click the Events button.The Trade Finance Events screen is displayed. The details of events that have already taken place on the contract will be displayed, along with the date on which the event took place.

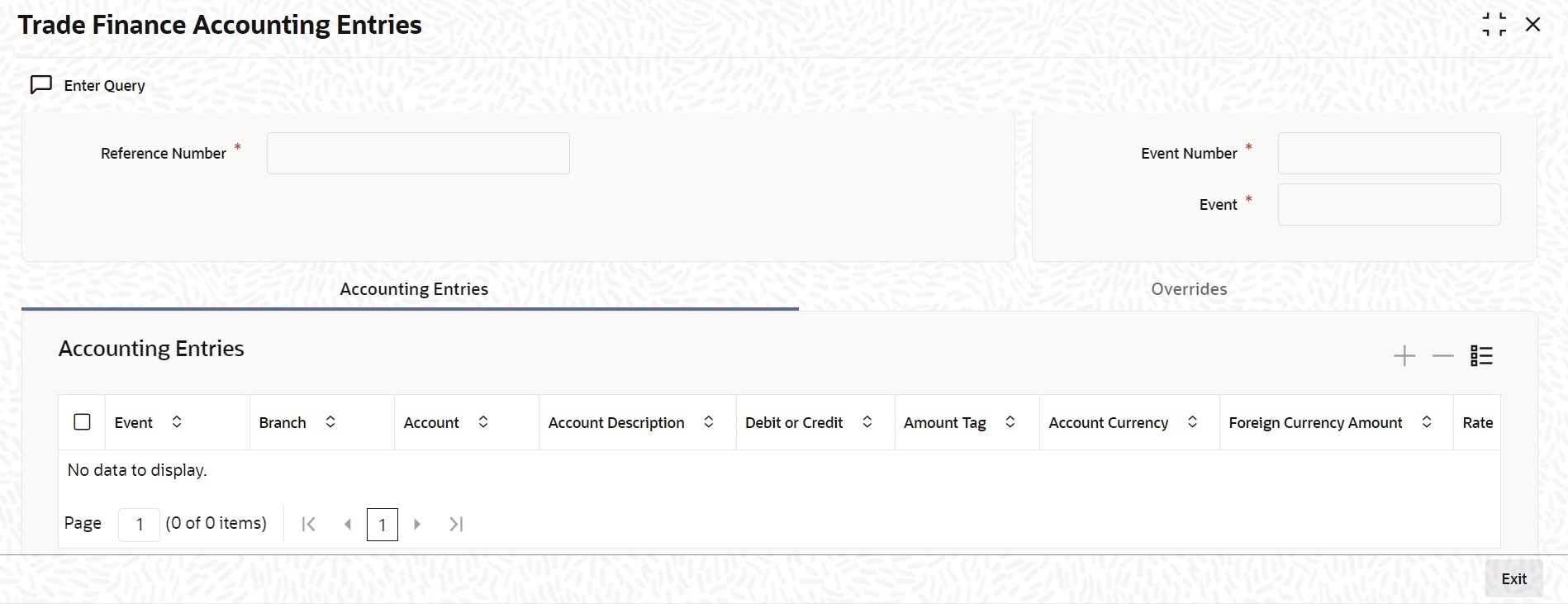

- On the Trade Finance Events screen, click the Accounting Entries button. The Trade Finance Accounting Entries is displayed. You can view the accounting entries for the event that is highlighted.

Note:

The accounting entries that are passed depends on the type of LC contract that you are processing.The following information is provided for each event:Figure 6-10 Trade Finance Accounting Entries

- Event

- Branch

- Account

- Account Description

- Debit or Credit

- Amount Tag

- Account Currency

- Foreign Currency Amount

- Rate

- Local Currency Amount

- Date

- Value Date

- Txn Code

- All the overrides that were given for an event will also be displayed

- Click Exit button to go back to Accounting Entries screen.

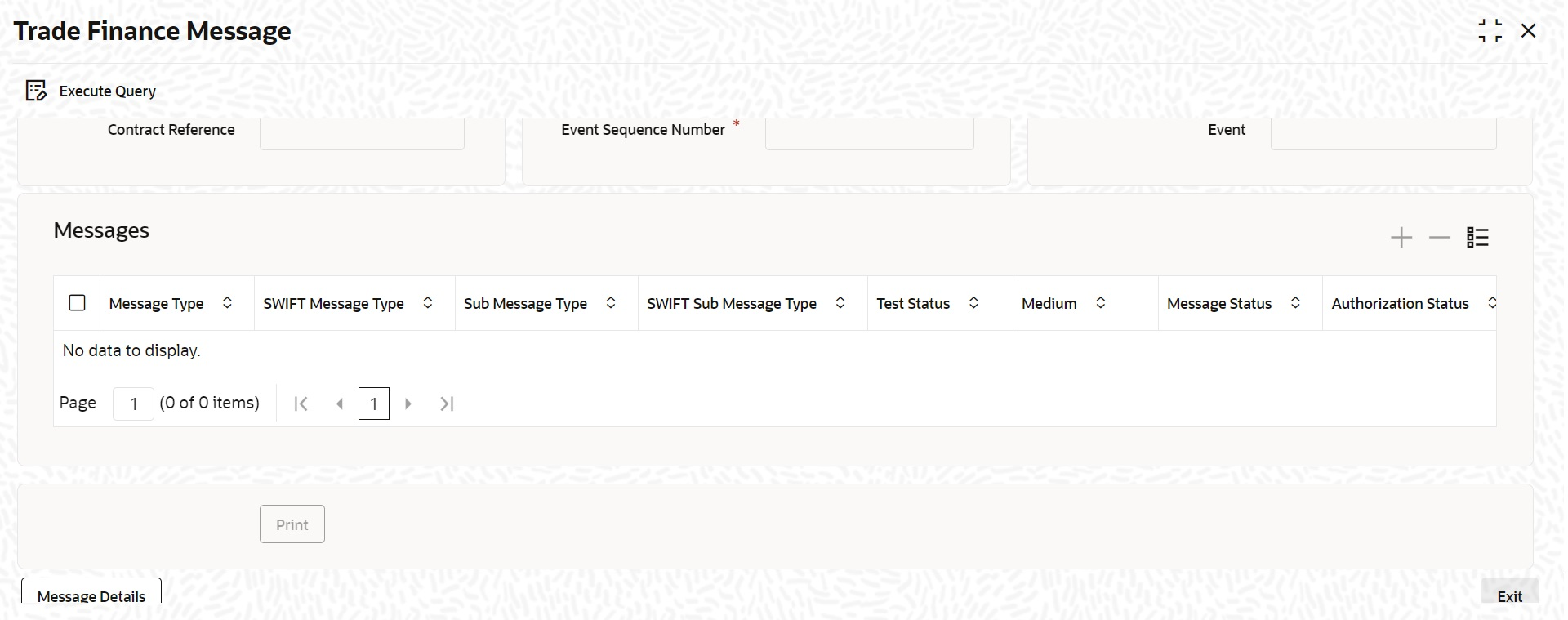

- On the Trade Finance Events screen, click the Messages button.The Trade Finance Message screen is displayed. The following details of a message are displayed:

- The message type

- The Name and ID of the recipient of the message

- The status of the message

Note:

To view the text of a message, highlight the message and click on the Message Details button. - Click Exit button to exit the screen.

- On the Letters of Credit Amendment Confirmation Input screen, select the Fields button. The Fields screen is displayed.

- On the Fields screen, specify the details and click Ok.It allows you to enter the field details.

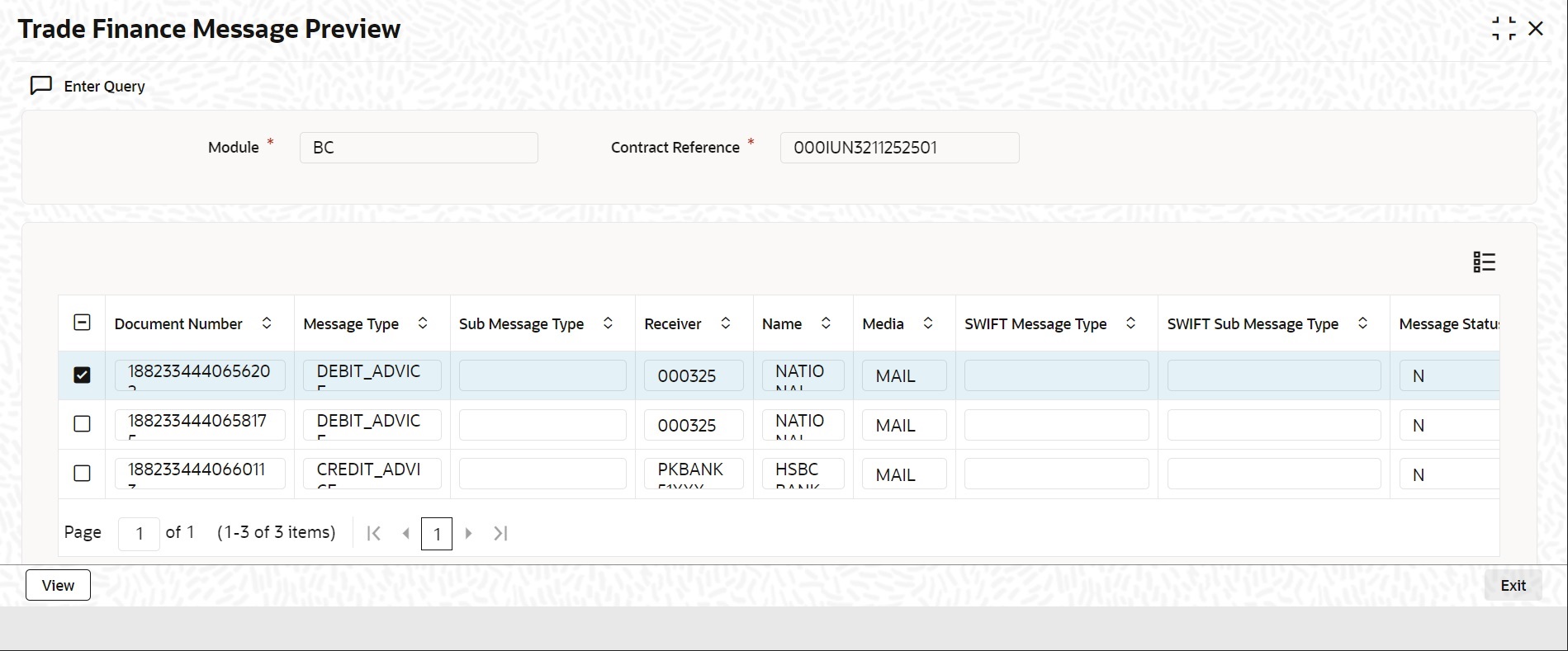

- On the Letters of Credit Amendment Confirmation Input screen, click the Message Preview button.You can preview the messages or advices that will be generated for the contract using Message Preview screen.For the contract, you can view the following details of the messages:

- The document number generated for the message/advice

- Type of message generated for the event

- Customer ID of the receiver of the message/advice

- Name of the receiver of the message/advice

- Media of transmitting the message/advice (Mail/SWIFT)

- SWIFT message type of the message

- Status of the message/advice

- On the Message Preview screen, click the View button. You can view the complete message/advice. The system will display the following details in a new window.You can view the following details:

- Reference number of the message/advice

- Document number generated for the message/advice

- Version number of the message/advice

- Complete text of the message/advice

- Remarks, if any

- Reject reason, if any

- Message trailer

- On the Message Preview screen, click Print/Spool button.You can print or spool a message using Reports option screen.

Table 6-10 Message Preview - Field Description

Field Description Format Select the format in which the message/advice needs to be printed. You can select one of the following options: - HTML

- RTF

- Excel

Output Select the output type. You may print, view or spool the message/advice. Print At Specify whether the message will be printed at the server or client. This field is optional. Printer Specify the path and the name of the printer. Set the print options and click ‘OK’ button to print or spool the message/advice.

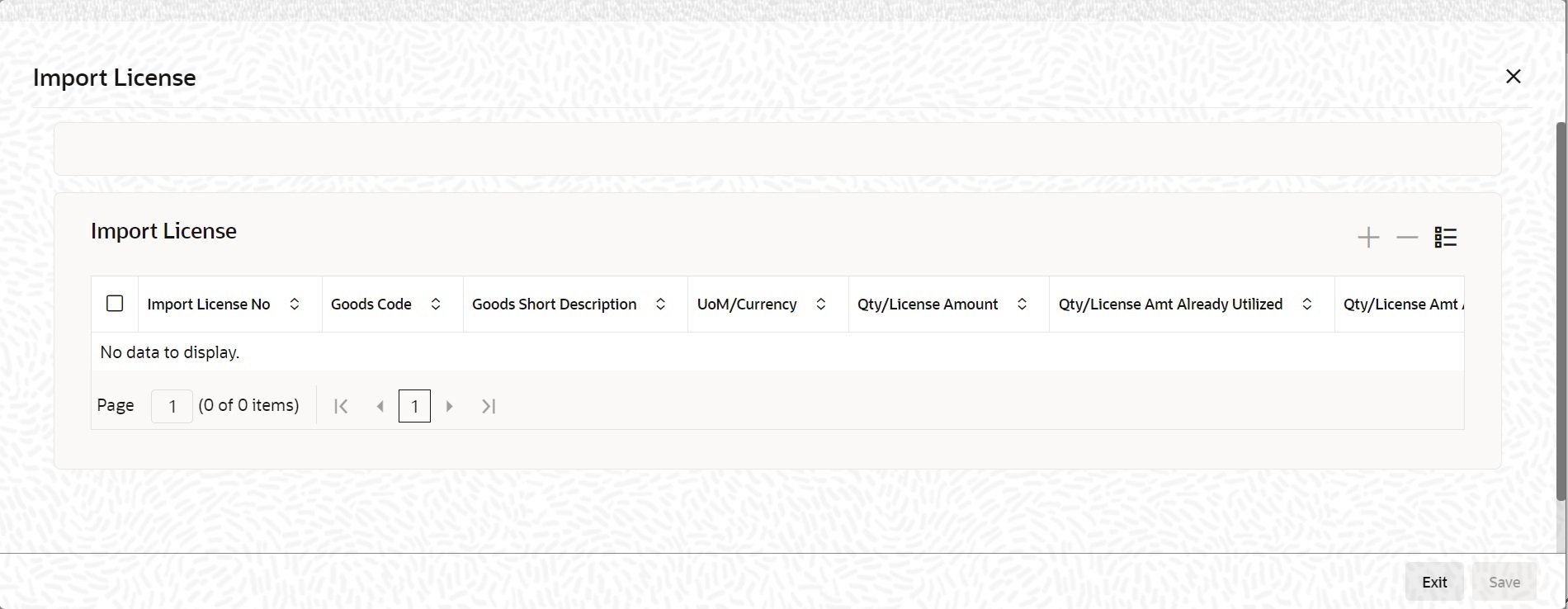

- On the Letters of Credit Amendment Confirmation Input screen, click Import License button.The Import License screen is displayed.

- Specify the field details and click Ok.You can view the field values against the field names.For more information on the table, refer the Field Description table given below:

Table 6-11 Import License

Field Description Import License No Select the import license number from the option list. The import licenses maintained for the party type Applicant in the Import License Maintenance screen is displayed in the option list. Goods Code Select the goods code from the option list. Goods Short Description The system displays the goods short description maintained in the Bills and Collections Commodity Code Maintenance screen. UoM/Currency The system displays the unit of measurement or currency captured for the goods code of import license. Note:

If the basis is Quantity, then the system displays the UoM maintained for the goods code. If the basis is Amount, then the system displays the currency maintained for the import license.Qty/License Amount The system displays the Quantity or License Amount captured for the goods code of import license. Qty/License Amt Already Utilized The system displays the sum total of Quantity or License Amount already utilized for the goods code. Qty/License Amt Already Reinstated The system displays the sum total of Quantity or License Amount already reinstated for the goods code. Available Qty/License Amt The system displays either the Available Quantity or Available License Amount for the goods code. Qty/License Amt Utilized Specify the quantity or the license amount utilized. Note:

If the license utilization basis is Quantity, then the system defaults the License Amount Utilized as Quantity Utilized * Rate/Unit.Qty/License Amt Reinstated Specify the quantity or the license amount reinstated. Note:

If the License Amount Utilized is maintained for an goods code of an import license, then the system allows reinstatement of the license amount.- The ‘Qty/License Amt Reinstated’ should be less than or equal to the sum total of Qty/License Amount Utilized - Qty/License Amt Reinstated.

- You can enter either Qty/License Amount Utilized or Qty/License Amt Reinstated for a goods code.

The utilizations and re-instatements maintained for an import license in Import License Utilization Screen and Import License sub-system will be differentiated by the system based on the ‘Transaction Reference Number’.

On authorization of reversal of a contract, the utilizations of all linked import licenses will also be reversed i.e. the value of Qty / License Amt Already Utilized - Qty / License Amt Already Reinstated will be posted as Qty / License Amt Reinstated for the respective goods codes and Available Qty / Available License Amt values will be re-computed.

If an import licenses linked to an Islamic import LC contract is not completely availed i.e. sum total of availments are less than the liability amount of Islamic import LC, then at the time of closure of Islamic LC contract, the system will give an alert to reinstate un-utilized quantity / license amount of linked import licenses. If auto closure is enabled for such Islamic import LC contracts, then system will not perform the auto-closure.For import LC contract, the effective date should be between the effective date and expiry date of the linked import license.Note:

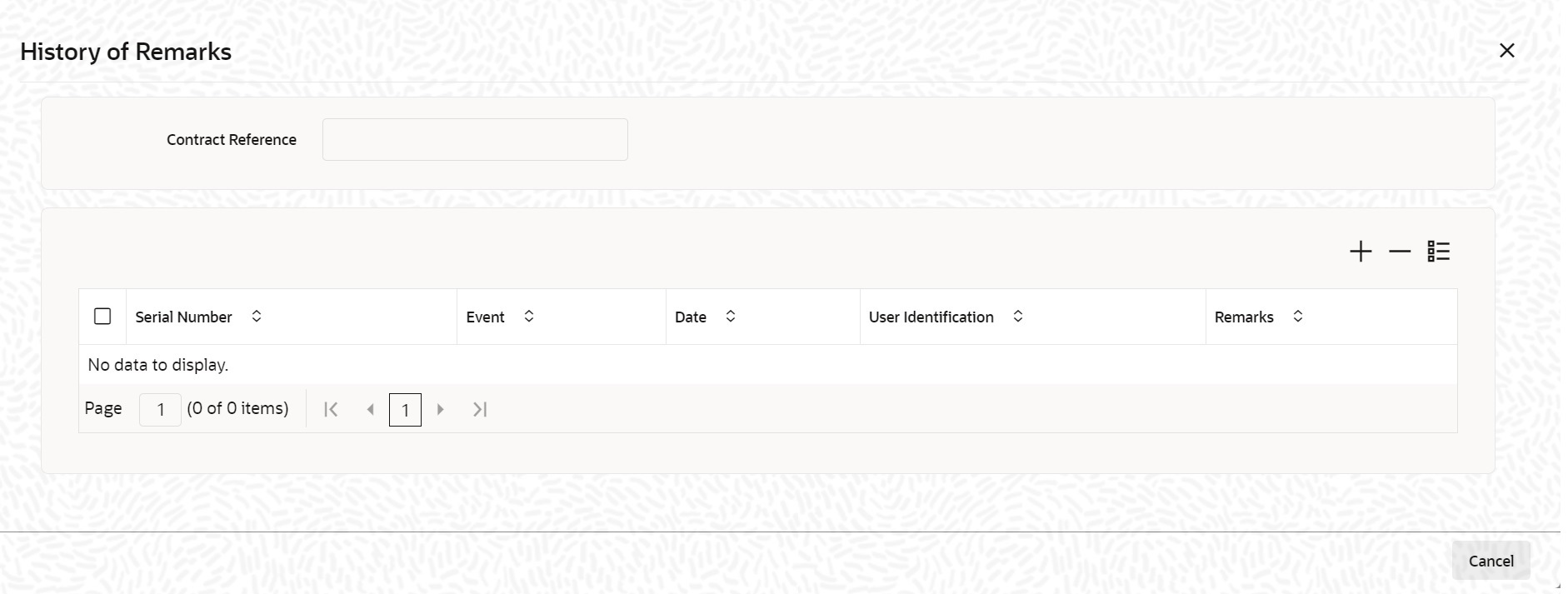

If the good is classified either as Licensed or as Prohibited and the import license details are not entered in the LC or BC contract screens, then the system displays an override message as “Import license details are not entered for the contract.” - On the Letters of Credit Amendment Confirmation Input screen, click Remarks button.The History of Remarks screen is displayed. You can view all the instructions captured on authorization of the contract.

Note:

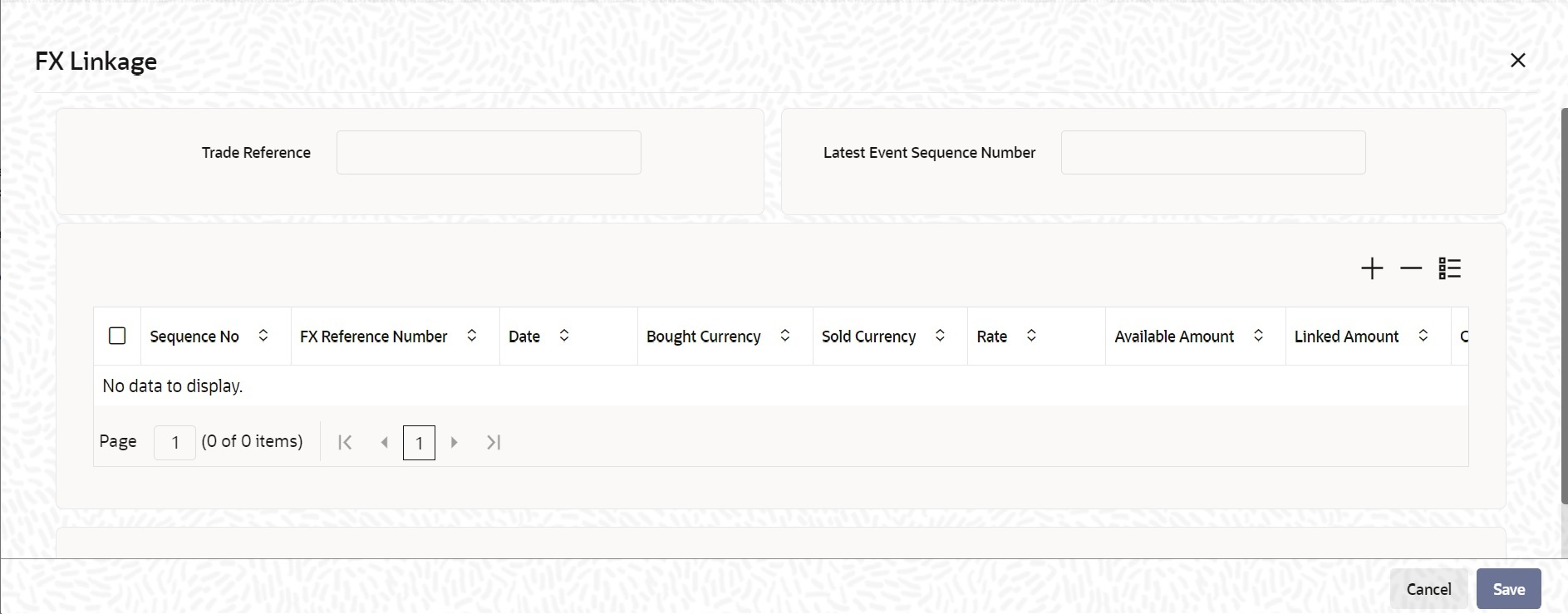

For more details on this screen refer to the section titled Remarks in this user manual. - On the Letters of Credit Contract Amendment Confirmation screen, click the FX Linkage button.The FX Linkage screen is displayed.

This link loads a screen in which you can link a LC involving a specific counterparty with FX deals involving the same counterparty.

You can link one or more FX deals to a bill. The value of an FX deal should not exceed the value of the bill it hedges. If you link several FX deals to a bill, the total value of all the deals should not exceed the bill amount.Table 6-12 FX Linkage - Field Description

Field Description Sequence No System generates the ‘Sequence No’ for linked FX contracts sequentially. FX Reference no Indicates FX deal reference no. from treasury system. Date Indicates FX deal value date. FX Value date should be greater or equal to LC Expiry Date. BOT/SOLD Currency LC contract currency should be BOT currency of the FX transaction in case of an export LC or the SOLD currency in case of an Import LC. Bought Currency: Presents FX Deal Bought Currency. Incase of export contract, LC contract currency should be same FX Bought Currency.

Sold Currency: Presents FX Deal Bought Currency. Incase of import contract, LC contract currency should be same FX Sold Currency.Rate Presents FX deal Exchange rate. Available Amount Present FX available amount (i.e) FX contract amount minus total linked FX amount. Linked Amount User will capture Linked amount at FX Linkage screen. Sum of Linked amount will not be greater than LC contract amount. Linked amount will not be greater than the available amount for linkage.

Current Utilized amount Current Utilized amount will display the current amount utilized of the event. Total Utilized amount Total Utilized amount will display the total amount utilized of the contract. - OBTF system initiates link/ delnik

- During creation of an LC,OBTF system initiates Link request

- During manual delink of FX at LC,OBTF system initiates delink request

Delink of linked FX/Reduction of linked amount from the LC is allowed if the same is not attached to a BC contract. Reduction of LC contract amount is restricted, when the contract amount goes below the FX linkage amount.

- If LC Amendment is pending for beneficiary confirmation with FX changes and system, will not allow another amendment and only during amendment confirmation FX request will be processed in external system.

- OBTF system initiates link/ delnik

- On the Letters of Credit Contract Amendment Detailed screen, click the Split Settlement button.Split Settlement Master and details get populated for the Cash collateral based upon on the LC Issuance collateral split details. User can modify the details. For subsequent amendments split details get populated for the Cash collateral based upon on the consolidated collateral split details. User can modify the details.

Split Settlement Master and Split Settlement Details get populated for the Charge and Commission component based upon LC Issuance split details if split details available for the charges and commission component during LC Issuance or Advise.

If Split details is not available for Issuance or Advice then Split Settlement Master and Split Settlement Details get populated for the Charges and Commission component if split flag is checked in the respective subsystems. System will default the split settlement details with two splits for a charge/commission component one for counterparty and another one for Other party. System will default split amount 50% of charge/commission component between parties. User can modify the amount and percentage will be derived based on modified amount. If AR-AP is unchecked for a component then Split account will default with settlement instructions of Customer and Split Account can be modified to another valid account of the Customer. If AR-AP is checked then Split account will be defaulted with AR-AP GL and Split account cannot be modified. Maximum of two splits is allowed for Charges and Commission components.Table 6-13 Party Type Derivation for Charges and Commission

Category Counter Party Other Party Other Party Resolution Import LC Amendment APP/APB/ACC BEN/ABK If Beneficiary is a bank customer else Advising bank. Export LC Amendment BEN APP/ISB If Applicant is a bank customer else Issuing bank. The Split Settlement screen is displayed. For more information on the fields, refer to Table 6-14:Table 6-14 Split Settlement - Field Description

Field Description Specify Settlement Split Master You can specify the details of the settlement split master in the following fields: Basis Amount Tag Specify the amount tag involved in the contract. The option list displays all valid amount tags maintained in the system. You can choose the appropriate one. For example, on booking a new contract, the only tag allowed is PRINCIPAL. This is referred to as the basis amount tag.

This field is optional.Currency The system displays the currency associated with the amount tag. This field is optional.

Basis Amount The system displays the basis amount associated with the amount tag. For example, the amount involved in the contract would be displayed against the amount tag PRINCIPAL. The amount is in terms of the currency associated with the amount tag.

You can use Get Exchange Rate button to get the original exchange rates defaulted in the screen.

This field is optional.Specify Settlement Split Details For each split amount tag, you need to specify the following details:

This field is optional.Amount Specify the amount for the split amount tag. This amount should not be greater than the amount of the corresponding basis amount tag. The split amount is in the currency of the basis amount tag. This is a mandatory field and you will not be allowed to save the details if you do not specify the amount. This field is optional, if percentage of proceeds is provided. Amount will be derived based upon the percentage.

Branch Specify the branch. The list displays all valid values. This field is mandatory.

Account Currency Specify the account currency. This field is mandatory.

Account Specify the account. This list displays all the accounts. For Cash Collateral the account should be account of the counterparty. If the account selected is other than counterparty account, then system will throw error. This field is mandatory.

Loan/Finance Account Check this box to indicate that the specified account should be the loan account. This field is optional.

Exchange Rate Specify the exchange rate that must be used for the currency conversion.

Specify the destination to which the goods transacted under the LC should be sent by selecting the appropriate option from the list of values.

This field is optional.Original Exchange Rate The base or the actual exchange rate between the contract currency and collateral currency gets displayed here. Party Type System defaults this field for Charges and Commission components if split flag is checked in respective components.

This field is applicable only for charges and commission components.

AR-AP Tracking System defaults this field for charges and commission components based upon the AR-AP tracking selection in charges and commission component when split flag is checked in respective components.

This field is applicable only for Charges and Commission components.

Customer Select the customer number from the list. Percentage of Proceeds Specify the percentage of proceeds. Negotiated Rate Specify the negotiated cost rate that should be used for foreign currency transactions between the treasury and the branch. You need to specify the rate only when the currencies involved in the transaction are different. Otherwise, it will be a normal transaction. The system will display an override message if the negotiated rate is not within the exchange rate variance maintained at the product.

This field is optional.Negotiated Reference Specify the reference number that should be used for negotiation of cost rate, in foreign currency transaction. If you have specified the negotiated cost rate, then you need to specify the negotiated reference number also. This field is optional.Note:

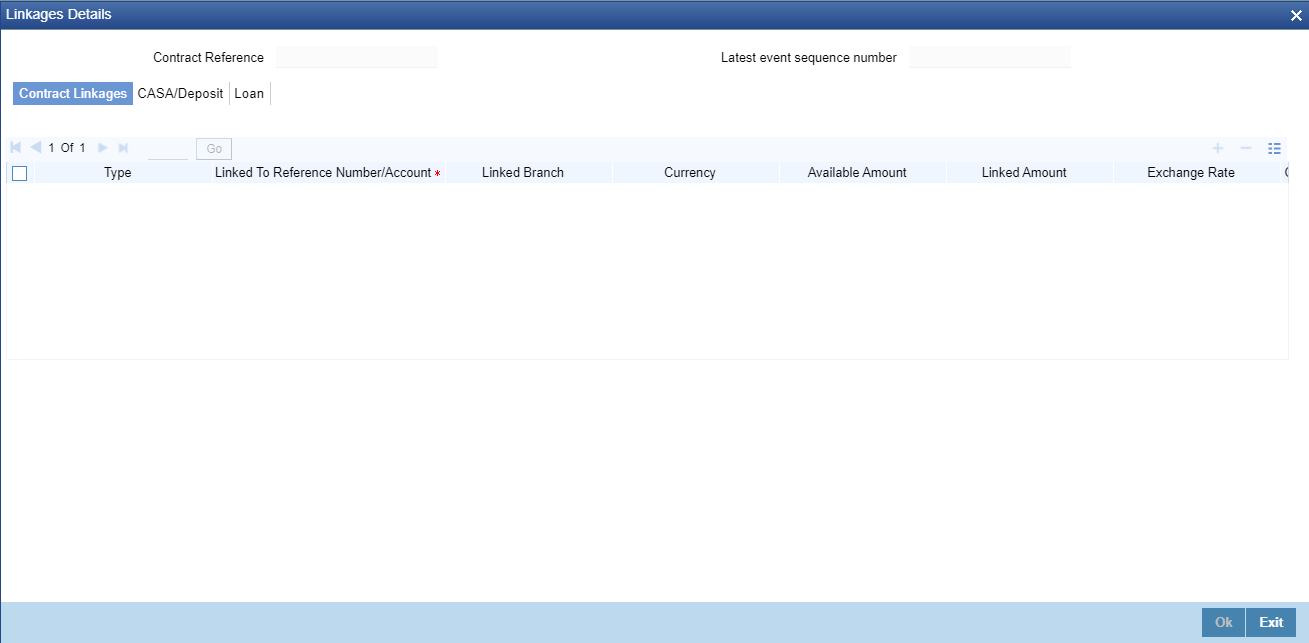

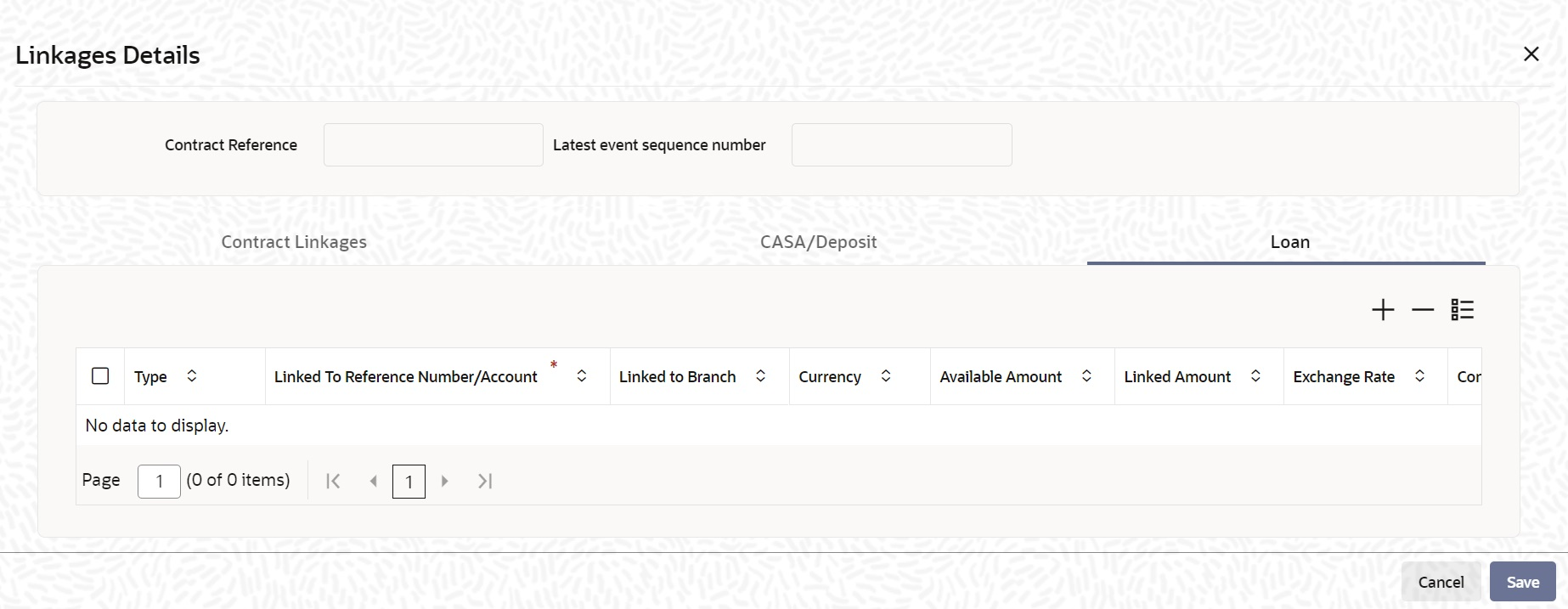

Oracle Banking Trade Finance books then online revaluation entries based on the difference in exchange rate between the negotiated cost rate and transaction rate. - On the Letters of Credit Contract Amendment Detailed screen, click the Linkage Details button.The Linkage Details screen is displayed.In the Linkage Details screen, specify the type of linkage:

- Contract Linkage

Linkage type grouped under contract linkages are:

Shipping guarantee

- LI

- EL

Figure 6-18 Linkage Details

Contract Details

For export LC, note the following:- Export type of LC is the only option displayed in the option-list.

- The system allows Export LC for linkage only for bills under reimbursement type of LC.

- An overriding message is displayed if any outstanding advising charges are collected at the time of bill lodgement or liquidation. This override message is only for Import Bills under LC. Link the export LC from the Linkages Details screen and perform the charges transfer.

Note:

For shipping guarantee, if the bill amount is less than the shipping guarantee amount, an error will be displayed. In case the bill amount is more than the shipping guarantee amount, an overriding message is displayed.

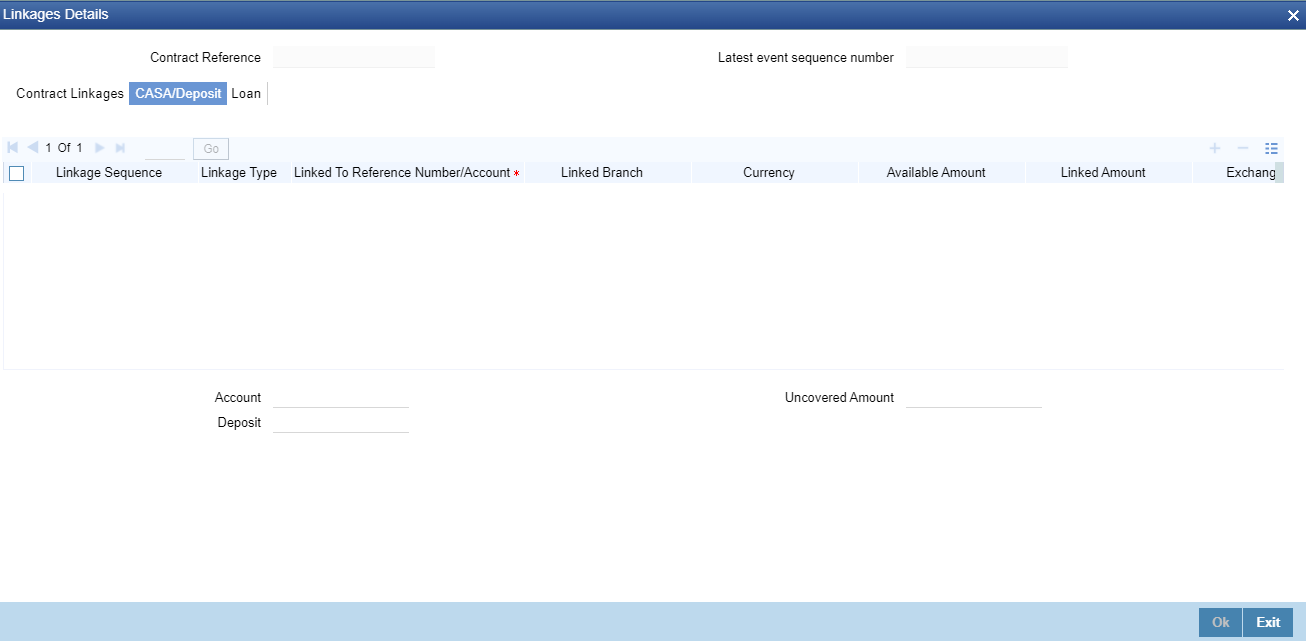

- CASA/Deposit

Linkage type grouped under CASA/ Deposit linkages are:

CASA

- CD

CASA/Deposit tab links one or more active, authorized deposit or CASA accounts.Figure 6-19 CASA/Deposit

- Loan

Linkage type grouped under Loans linkages are:

- OL

- Buyers Credit Reference

For more information on the fields, refer the Table 6-15 table given below:Figure 6-20 Loans

Table 6-15 Linkage Details - Contracts Amendment Linkages - Field Description

Field Description Linkage Sequence The Linkage Sequence number of a linked type. Type In the Contract Linkages screen, you can specify the type of linkage. The possible values are:

Linkage Type grouped under contract linkages are:- Shipping Guarantee

- LC

- LI

- EL

- CASA

- CD

- OL

- CL

- CI

- Buyers Credit Reference

Linked To Reference Number/Account Specify the contract/account to which you wish to link the LC. Currency The currency of the linkage type to which the LC is linked is displayed once the linkage details are specified. Available Amount The system displays the amount available against the linked contract or account. Linked Amount Specify the linked amount linked to trade contract. Exchange Rate Exchange rate denotes the rate applied to convert the linked amount in trade currency. Converted Linked Amount If the linked contract is in a different currency (than that of the bill), the system will convert the account/contract amount into the billing currency and display it here. Account/Deposit The system displays the amount linked to each contract or account. This displays only for CASA/Deposit.

Uncovered Amount The system displays the contract amount that has not been linked, in the case of a partial linkage. This displays only for CASA/Deposit.

- Create Deposit/Create amount block request is send on linking the Deposit contract or CASA accounts.

- Close Deposit/Close amount block request is send on delinking the deposit contracts or CASA accounts.

- Linkages will be delinked automatically during Closure/Cancel/Rollover/Contract reversal.

- Close Deposit /Close amount block followed by Create Deposit/Create amount block is send when there is change in linked amount either manually or proportionate change based on events(availment/amendment/ claim lodgement of LC/Guarantee)

- Contract Linkage

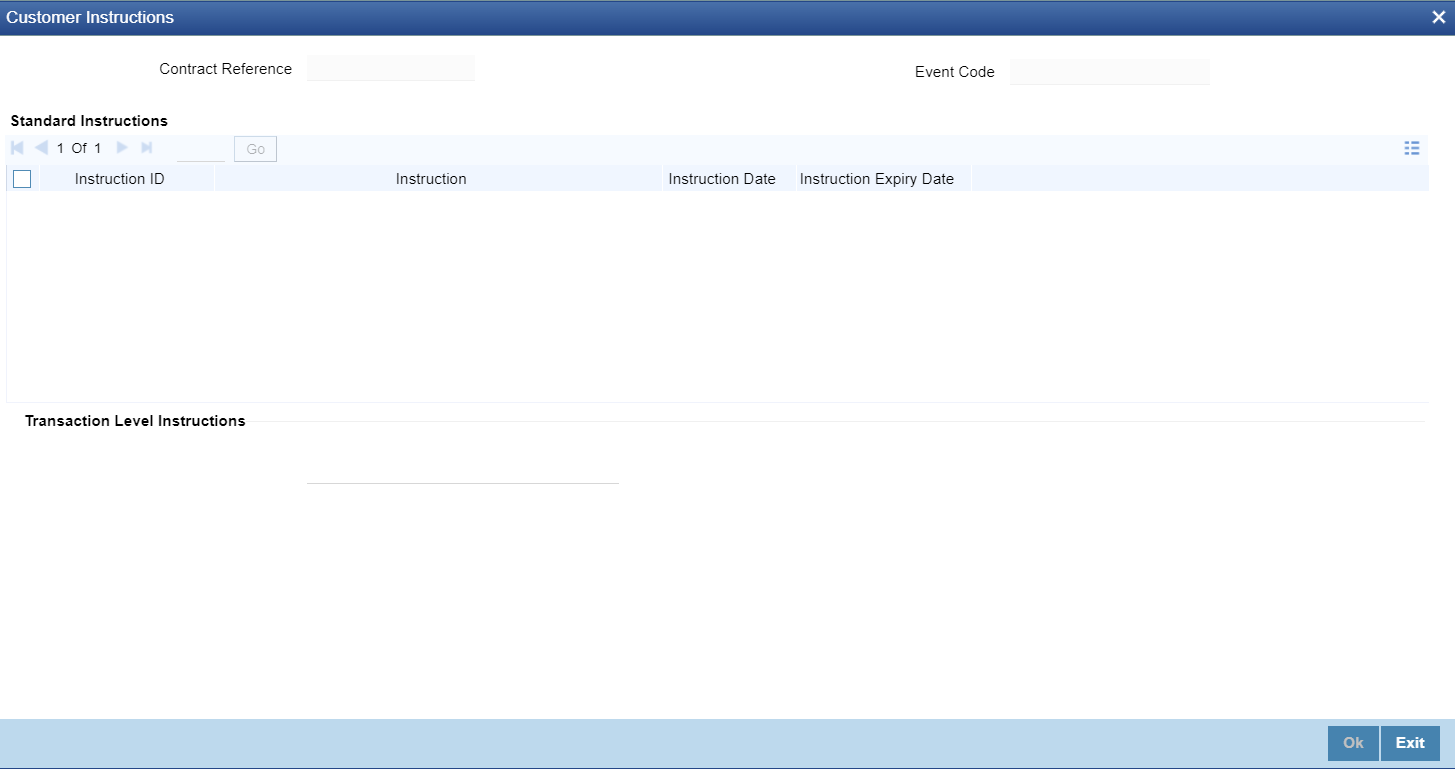

- On the Letters of Credit Contract Amendment Detailed screen, click the Customer Instructions tab.The Customer Instructions screen is displayed.

Table 6-16 Customer Instructions - Field Description

Field Description Contract Reference Number System displays the contract reference number. Event Code System displays the Event Code of the contract. Standard Instructions Customer would want to give Standard instructions in advance to the bank that need to be referred by the bank while processing certain type of transactions.

Instruction ID System displays the Instruction ID. Instruction System displays the customer standard instruction. Instruction Date System displays the start date of the customer instruction. Instruction Expiry Date System displays the expiry date of the customer instruction. Transaction Level Instruction Enter the transaction level instructions for the event.