4.1.1 Capture LC Contract Details

This topic provides the systematic instruction to capture the LC contract details.

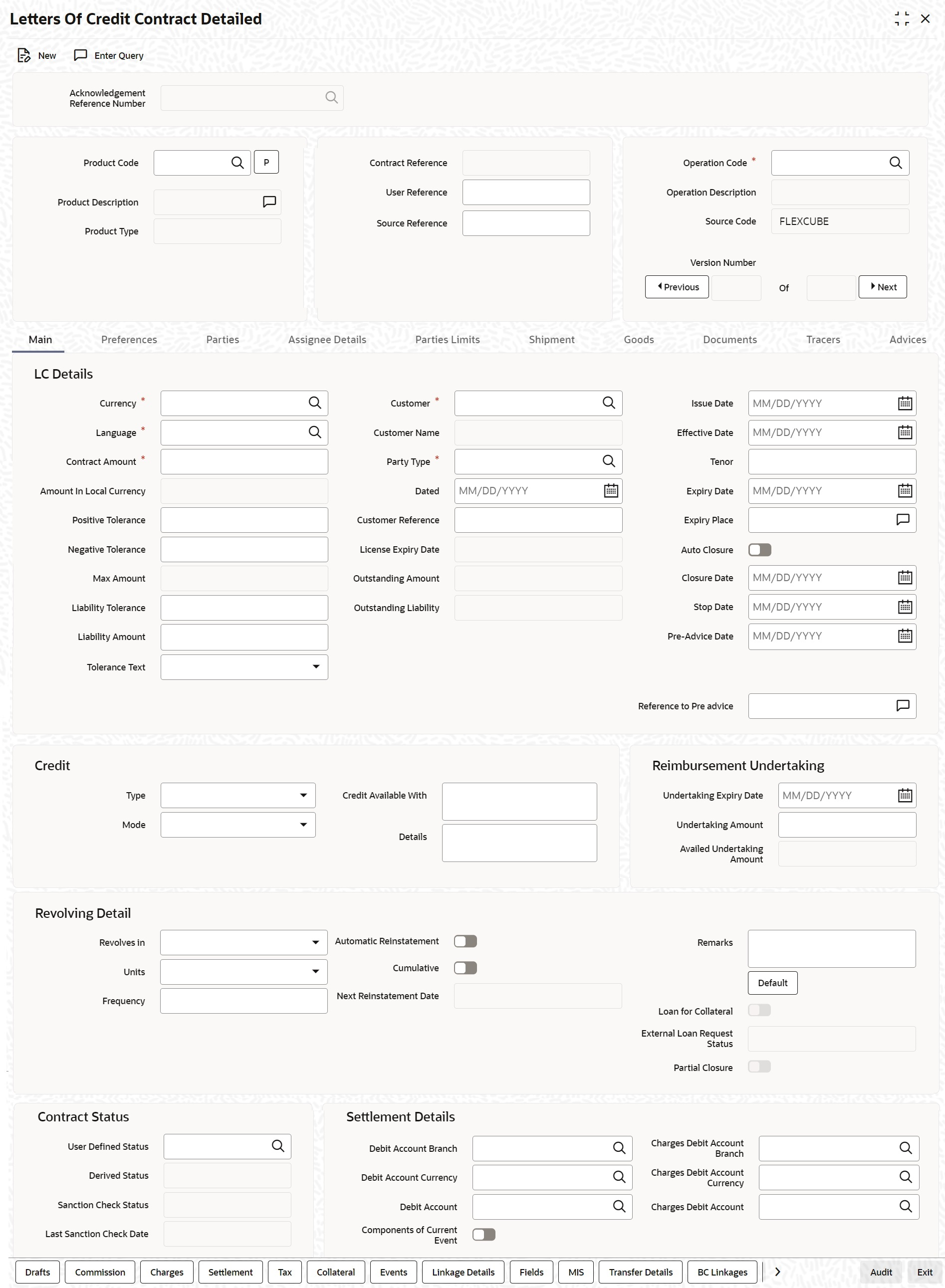

- On the home page, type LCDTRONL in the text box, click New.The Letters of Credit Contract Detailed screen is displayed with no values in the fields.

Specify the field details.

For more information on fields, refer the Field Description table given below:Figure 4-1 Letters of Credit Contract Detailed

This information is captured through the LC Contract Details Main screen. The following are the features of the contract details main screen.Table 4-1 Letters of Credit Contract Detailed - Field Description

Field Description Acknowledgement Reference Number Specify the acknowledgement reference number or you can select the reference number from the option list. The list displays all the acknowledgement reference numbers and type of registration maintained at LC registration screen which are authorized and unprocessed.

The system defaults the details captured in registration screen if acknowledgement is captured on clicking populate (P) button beside Product Code.

If Registration is for LC issuance and product code is selected BG Issue/SG issue, then the system displays configurable override on product default.Note:

System will update the status of registration as ‘Processed’ and contract reference no at registration screen, if acknowledgement reference number is captured at contract screen and (new) contract is created.This field is optional.

Product Code Select the product from the list of products created in the LC. Click populate button for details of this product to get defaulted from the Product screen.

This field is mandatory.Product Description Product description given for this product gets defaulted from the Product screen.

This field is optional.Product Type The type of product gets displayed here from the product screen, specifying if the product is of type import/export or revolving or non-revolving.

An arrangement, in which the continuing availability of the LC revolves upon shipment and/or presentation of documents and not upon specific amendment, is known as a Revolving LC.Following are the product types:- Import

- Export

- Standby (if SWIFT 2018 is enabled)

- Shipping Guarantee

Contract Reference Number The Contract Reference Number identifies a contract uniquely. It is automatically generated by the system for each contract. The contract reference number generation is based on the value of parameter REF_NUM_GEN_FORMAT in CSTB_PARAM level. If REF_NUM_GEN_FORMAT = 'O' (Old format), then contract reference number is a combinaion of the branch code(3 character), the product code(4 character), Julian date(5 digit) and a running serial number sequence(4 digit).

If REF_NUM_GEN_FORMAT = 'N' (New Format), then contract reference number is a combination of the product code(4 character), Julian date(5 digit), and a running number sequence(7 digit).

In both formats, the Contract reference number is of 16 Characters.

The Julian Date has the following format:

YYDDD Here, YY stands for the last two digits of the year and DDD for the number of day(s) that has/have elapsed, in the year.This field is optional.

User Reference Number A contract is identified by a unique User Reference Number. By default, the system generates the Contract Reference Number. This number is taken as the User Reference Number. But, you have the option to change the User Ref Number. Oracle Banking Trade Finance provides you the facility to generate the user reference number in a specific format. Refer to the Core Services User Manual for details on maintaining a sequence format.Note:

You can specify a format for the generation of the User Reference Number in the Sequence Generation screen available in the Application Browser.Source Reference The system automatically generates the Source Reference number. You can change it if required.

This message identification number is used to identify an incoming message coming from an external system. This is defined as the ICN number. On upload of an incoming message into Oracle Banking Trade Finance, this number, given by the external system, will be stored in Oracle Banking Trade Finance and passed on to the contract generated as a result of the incoming message. If the incoming message results in an outgoing message, the ICN number will be linked to the outgoing message also. This number will help you in creating a relationship between the incoming message, the resultant contract in Oracle Banking Trade Finance, and the outgoing message, if any. If an Incoming message results in an outgoing contract (outgoing message), Oracle Banking Trade Finance will store the source reference number (ICN Number) at the following levels.- Incoming Message Level

- Contract Level (Resulted due to the Incoming message)

- Outgoing message (As a result of the above contract)

Note:

The system will not allow to capture, the same source reference number for more than one advising or reimbursing contracts.This field is optional.

Operation Code The operations that you can perform on an LC are determined by the type of LC being processed. The operation that you specify will determine the accounting entries that are passed and the messages that will be generated. Select the operation code from the list based on Product Type. The type of operations that you can perform on an LC has been listed below: - Advice

- Advice and Confirm

- Confirm

- Open

- Open and Confirm

- Pre-advice

- Reimbursement

- Silent Confirmation

Note:

Silent Confirmation is applicable for export letters of credits, where the bank adds the confirmation to the letters of credit at the request of the beneficiary without the knowledge of issuing bank. Letters of credit with current operation as Advice can be modified to silent confirmation.This field is mandatory.

Version Number To navigate between the different versions, use the arrow buttons to view the previous and next version. While viewing the Detailed View screen for a contract, the latest version will be displayed. To navigate between the different versions, use the arrow buttons to view the previous and next version.Note:

When you enter a contract, it is allotted the version number, 1.Every amendment and reinstatement results in the next version of the contract being created.The LC contract will become effective in the system only after you Save the details and your supervisor authorizes it.

The system will display an override message if you save the contract with the drawee and applicant being the same. You may use your discretion to proceed or cancel the contract. You can also have this override configured as an error message in which case, the system will not allow you to proceed until you make the necessary changes.

You can view the changes made in a specific version of an LC contract. To do this, navigate to the version of the contract that you would like to view in the Contract Details screen. Click Change Log in the vertical array of buttons on the Contract Details screen. The fields that were modified in the version will be displayed along with the old (inherited) and the changed values.This field is optional.

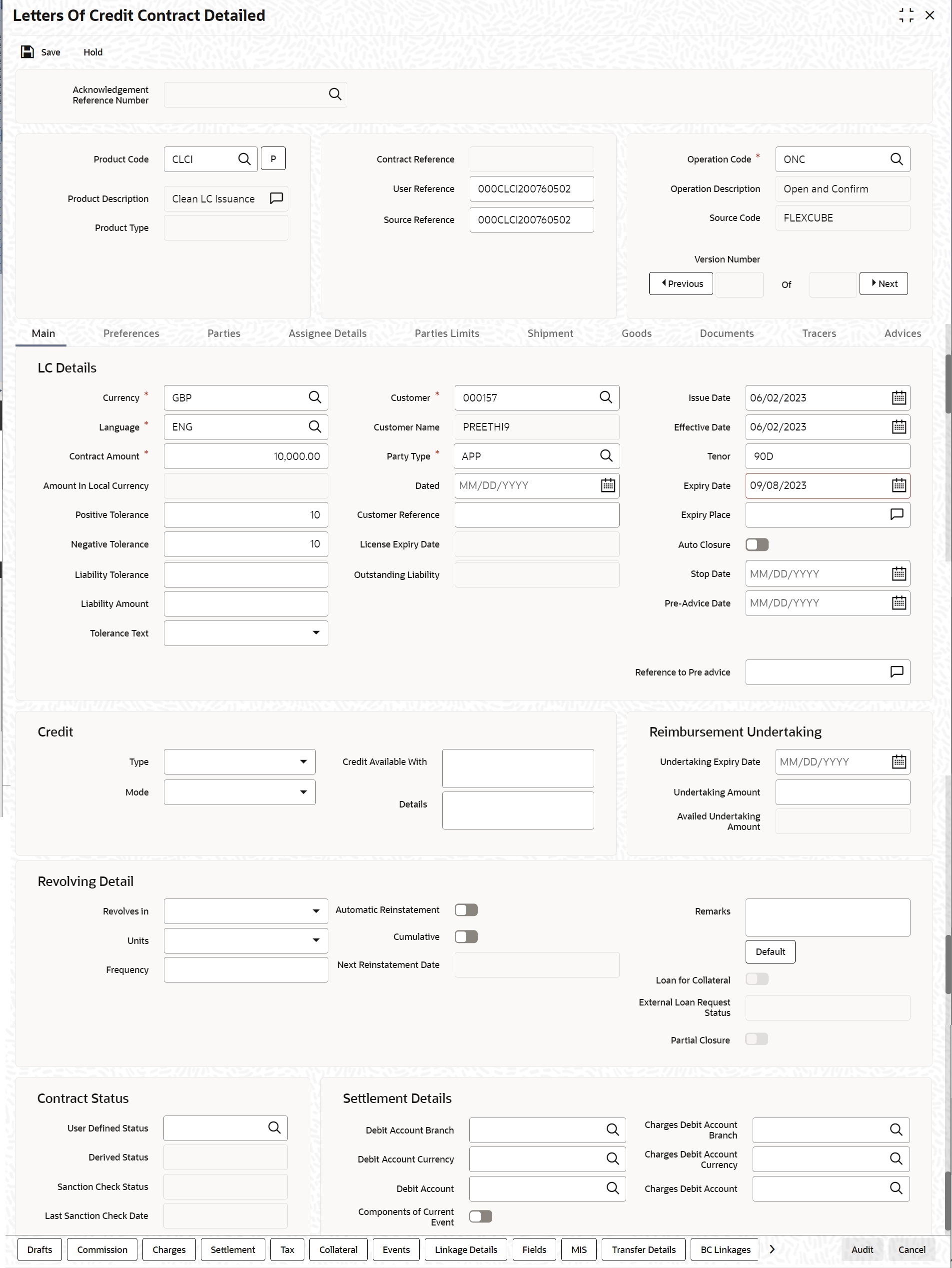

Figure 4-2 Letters of Credit Contract Input - Main

Table 4-2 Letters of Credit Contract Detailed - Main

Field Description LC Details The terms defined for an LC, form the basis on which the LC will be processed. This field is optional.

Currency The currency in which it is drawn. This field is mandatory.

Language The language to be used for the LC instrument. This field is mandatory.

Contract Amount Specify the amount for which the LC is drawn. If the contract is linked to an open insurance policy and the amount is greater than the available amount on the linked policy, the system will display an override/error message. Similarly, if the amount is greater than the limit specified for every conveyance of the linked policy, the system will display an override. This field is mandatory.

Amount in Local Currency When FCY amount is given in 'Contract Amount' field for LC, system converts in local currency and respective value is displayed in this screen. This field is mandatory for FCY contracts. Positive Tolerance The positive tolerance is the percentage that must be added to the LC amount, to arrive at the Maximum LC Amount. This amount will be considered as the LC outstanding LC amount. This field is optional.

Negative Tolerance The negative tolerance is the percentage that must be subtracted from the LC amount, to arrive at the Minimum LC Amount. The negative tolerance is captured for information purposes only. It will form part of the LC and amendment instruments. The positive and negative tolerance specified for the product associated with the LC is defaulted. If you change the defaulted Positive Tolerance, an override message is displayed.

This field is optional.

Maximum Amount The Maximum LC Amount indicates the maximum amount that can be availed under the LC. This amount is arrived at, by adding the positive tolerance to the LC amount.000 Max. LC Amount = LC Amount + Positive Tolerance If you have indicated the positive tolerance to be zero then: Max. LC Amount = LC Amount

A customer cannot, at any point in time, avail more than the Maximum LC amount.

This field is optional.

Liability Tolerance The liability percentage is used to track the maximum LC amount against a given percentage. A bank would like to limit its exposure to a new or existing customer as LC is a commitment given by the bank. Although the bank sanctions an LC limit (a maximum LC amount which includes tolerance) to a customer it may like to specify a percentage over and above this limit. This will result in the customer being shown to be liable or tracked for a higher amount. Specifying a liability percentage is from the perspective of risk management and provides a cushion to the bank. The liability amount is arrived at in the following manner:

Liability Amount = Maximum LC Amount + Liability % of the LC amount If you have indicated the liability percentage to be zero then,

Liability Amount = Maximum LC Amount This amount is computed by the system using the method indicated above, only if you have specified a liability tolerance. If a Liability tolerance has not been specified, you can enter a liability amount of your choice. However, the liability amount that you can enter should be at least equal to the maximum LC amount

Under the following circumstances, system will display an error message:- Latest shipment date of the import LC is greater than the latest shipment date of export LC.

- Expiry date of import LC is greater than expiry date of export LC.

- Import LC amount is greater than export LC amount

- If you check the option Back to Back LC for an export LC.

Liability Amount Based on the value you specify in Revolves In field, the LC Liability Amount is computed and displayed. This field is optional.

Tolerance Text Select the tolerance text from the option list. The available options are - None

- About

- Approximately

Reference to Pre-advice Specify reference to the pre-advice, if any, generated for the LC contract. A pre-advice is a brief advice of documentary credit sent by the Issuing Bank to the Advising Bank. This is to be followed by the LC instrument that contains all the details of the LC. It notifies the recipient that the named buyer has opened an LC for a specified amount on a named seller (beneficiary).

This field is optional.Note:

Modifications are not allowed after first authorization.Customer If the applicant is a customer of your bank, specify the CIF ID assigned to the customer, the related details of the customer will be automatically picked up. Specify the Customer for which you need to maintain. Select the Customer from the option list also. Third Party Customer will also be listed under list of values customer.

Note:

BIC Code appears next to the Customer only if the BIC Code is mapped with that Customer Number. If the BIC Code is not mapped with that Customer Number then the BIC Code will not appear next to the Customer in the list. If you are processing an Export LC, you must typically specify details of the beneficiary.This field is mandatory.

Customer Name If none of the parties in the LC is a customer of the bank, you must enter the CIF ID defined for the walk-in customer and give the details of one of the parties for it. The party type of the counterparty of the LC is defaulted based on the type of LC you are processing. If you process an import LC APP (indicating applicant) is defaulted. We can modify either APB or ACC for an import LC. So the accounting entires and advices will get generated for the counter party. If you process an export LC ‘BEN’ (indicating beneficiary) is defaulted. You can change the default.

This field is optional.

Party Type Indicate the party type of the customer who is the counter party of the LC. You can select the valid party type from the option list. The details of the other parties involved in the LC are captured in the Parties screen. The Customer Details specified in this screen will be defaulted to the Parties screen.

This field is mandatory.

Dated Enter the date of the Their Reference. This would normally be the date on which you have a correspondence from the party regarding the LC. This field is optional.

Customer Reference This is the reference of the party whose CIF ID you have provided. Customer Reference will be picked up appropriately in the correspondence sent for the LC. For an export LC, a reference for the Issuing Bank is mandatory. It is optional for other parties.This field is optional.

License Expiry Date By default, the Import License Expiry Date of the selected customer is displayed on the screen once you capture the CIF ID of the customer involved in the contract. The system does not do any validations based on the Expiry Date. It is used only for information purpose. This field is optional.

Outstanding Amount The balance amount available after the availment of an LC is displayed here. This field is optional.

Outstanding Liability The system displays the liability amount. This field is optional.

Issue Date Enter the date on which the LC is issued. This field is optional.

Effective Date In the LC Contract Details screen, you can capture the Effective Date of an LC. This field is optional.

Tenor All LC contracts will be associated with the standard tenor maintained for the product under which the contract is being processed. The tenor of the LC will be used in combination with the Effective Date to arrive at the Expiry Date of the LC, as follows:

LC Expiry Date = Effective Date + Tenor

In case both the tenor and the expiry date are specified, the system will ignore the tenor that is manually entered and recalculate it based on the expiry date.However, for a specific LC contract, you can choose to maintain a different tenor. The tenor of an LC can be expressed in one of the following units:- Days (D)

- Months (M)

- Years

When you change the tenor and move to the next field, the system automatically updates the expiry date based on the tenor specified.This field is optional.

Expiry Date Specify the date on which the LC contract expires. If you leave this field blank, the system will calculate the expiry date based on the tenor. Now, suppose that you have specified both the tenor and the expiry date. In that case, the system ignores the tenor and recalculates it based on the expiry date. You can modify the expiry date. When you change the expiry date and move to the next field, the system automatically updates the tenor based on the expiry date specified. The closure date, which is dependent on the expiry date, will also be recalculated. You can modify the expiry date. When you change the expiry date and move to the next field, the system automatically updates the tenor based on the expiry date specified. The closure date, which is dependent on the expiry date, will also be recalculated.

The system prompts override messages:- If the LC expiry date is later than any linked collateral’s expiry date

- If the LC expiry date extended as part of amendment is later than any limit line’s expiry date.

Note:

The system will validate when a new limit line is attached during actions other than New.This field is optional.

Expiry Place Specify the city, country, or the bank where the LC expires. This field is optional.

Auto Closure Check this option to indicate that the LC should be automatically closed. This field is optional.

Closure Date The date of closure is based on the Closure Days maintained for the product involved in the LC. The number of days specified as the Closure Days is calculated from the expiry date of the LC, to arrive at the Closure Date. LC Closure Date = LC Expiry Date + Closure Days If the ‘Closure Days’ are not maintained at the Product level, then the Closure Date is calculated as follows:

LC Closure Date = LC Expiry Date + 30 However, you can change the closure date, thus calculated, to any date after the expiry date.Note:

If the closure date falls on a holiday, the system will prompt you with an override message.This field is optional.

Stop Date This date will be defaulted to LC Expiry date. Stop date cannot be earlier than Issue date and later than expiry date. This field is optional.

Pre Advice Date Specify date on which the pre-advice was initiated using the calendar. The current date is defaulted as pre-advice date, if the operation is Pre-advice LC; however you can change to an earlier date This field is optional.Note:

Modifications are not allowed after first authorization.Credit Capture the following details Type Indicate the type of credit for which the LC is being processed. This field is optional.

Mode Indicate the mode of payment through which the LC will be settled. If you indicate the LC type as sight in the LC Product Definition screen, then you can select the credit mode as- Sight Payment

- Negotiation

- Acceptance

- Deferred Payment

- Mixed Payment

- Negotiation

This field is optional.

Credit Available With Specify details of the party with whom the credit will be available. This field is optional.

Details Specify the details of the credit. This field is optional.

Reimbursement Undertaking You can capture the following details. Undertaking Expiry Date Specify the undertaking expiry date. You can claim the reimbursement only till the undertaking expiry date, else, the system will display the following error message “The undertaking has been expired”.

This field is optional.

Undertaking Amount Specify the amount that can be reimbursed. It can be less than or equal to contract amount. The system will default the Undertaking Amount value with the Max LC Amount initially when it is created through the incoming MT740. However you can amend this field by adding the undertaking amount.

This field is optional.

Availed Undertaking Amount The system displays the availed portion of undertaken amount. - Undertaking Expiry Date and Undertaking Amount fields can be entered for reimbursement contracts only

- Undertaking Expiry date can be entered only when Undertaking Amount has been specified.

- Undertaking Expiry date cannot be earlier than the issue date or later than the LC Expiry date

- In case when LC Expiry date is not input then Undertaking Expiry date cannot be greater than the LC closure date.

This field is optional.

Revolving Detail You can capture the following details: Revolves In LCs can revolve in Time or in Value. Select the appropriate option from the drop-down list. This field is optional.

Units For LCs, which revolve in time, the maximum number of reinstatements is calculated based on the Reinstatement Frequency you specify. In the Units field, you can choose one of the following: - Months

- Days

Frequency For the letters of credit that revolve in time, you can specify the reinstatement frequency. This frequency represents the maximum number of reinstatements applicable to the LC. Based on the value you specify, the LC Liability Amount is computed and displayed. During LC reinstatement, the system calculates the next reinstatement date based on the units and the current reinstatement date. If the number of reinstatements exceeds the frequency set here, the system displays an override message when you save the LC. You need to ratify this override at the time of contract authorization.

This field is optional.Note:

Frequency is not applicable to the LCs that revolve in value. In such cases, once the LC is availed, the system reinstates it with the maximum contract amount during end of day operations. For this, the reinstatement option must be set to Automatic.Automatic Reinstatement The mode of reinstatement for a revolving LC can be either automatic or manual. Check against this field to indicate that the mode of reinstatement is automatic. This field is applicable only for an LC revolving in time.

This field is optional.

Cumulative Select cumulative check box to indicate that the LC is cumulative. Leave it unchecked to indicate otherwise. This field is optional.

Next Reinstatement Date The system computes and displays the date of next reinstatement based on the value in ‘Units’ field. This field is optional.

Remarks Specify remarks, if any. This field is optional.

Loan for Collateral Select Loan for Collateral check box to indicate that you need loans for collateral. This field is optional.

External Loan Request Status The system displays external loan request status. This field is optional.

Partial Closure The system displays partial closure status. You can check this box during the following conditions: - Unlock Operation

- If the product is not of Revolving type

- On or before the Expiry date of the LC

For Amendment of Expiry Date alone- Current Availability to be reversed to Availability before PCLS

- OS Liability to be reversed to OS Liability before PCLS

For Internal Amendment after Partial Closure,- OS Liability, Collateral and Limits to be reversed as before PCLS

- Partial Closure flag to be unchecked manually

Contract Status Specify the following details: User Defined Status Specify the status of the LC contract. The option list displays all valid statuses that are applicable. Choose the appropriate one. Derived Status The system displays the derived status of the LC contract. You cannot modify this. This field is optional.

Sanction Check Status The system displays the sanction check status once the sanction check is performed. Note:

For more information, refer the topic Process Sanction Check during Save of a Transaction The system displays any of the following statuses:- P - Pending

- A- Approved

- R- Rejected

- N - Not Required

This field is optional.

Last Sanction Check Date The system displays the last sanction check date. This field is optional.

Debit Account Branch The system defaults the details of debit account branch. The values can be modified. This field is optional.

Debit Account Currency The system defaults the details of debit account currency. The values can be modified. This field is optional.

Debit Account The system defaults the debit account. The values can be modified. This field is optional.

Charges Debit Account Branch The system defaults the details of charges debit account branch. The values can be modified. This field is optional.

Charges Debit Account Currency The system defaults the details of charges debit account currency. The values can be modified. This field is optional.

Charges Debit Account The system defaults the details of charges debit account. The values can be modified. This field is optional.

Components of Current Event System enhanced to show the amount tags pertaining to the current event in settlement screen for LC contracts. - During settlement pickup of LC contract input screen, current value of components of current event on contract input screen is considered to show the amount tags in ‘Settlements’ screen.

- If the flag is checked at contract input screen, the amount tags pertaining only to the current event will be available in settlement screen with ‘Current event’ checked.

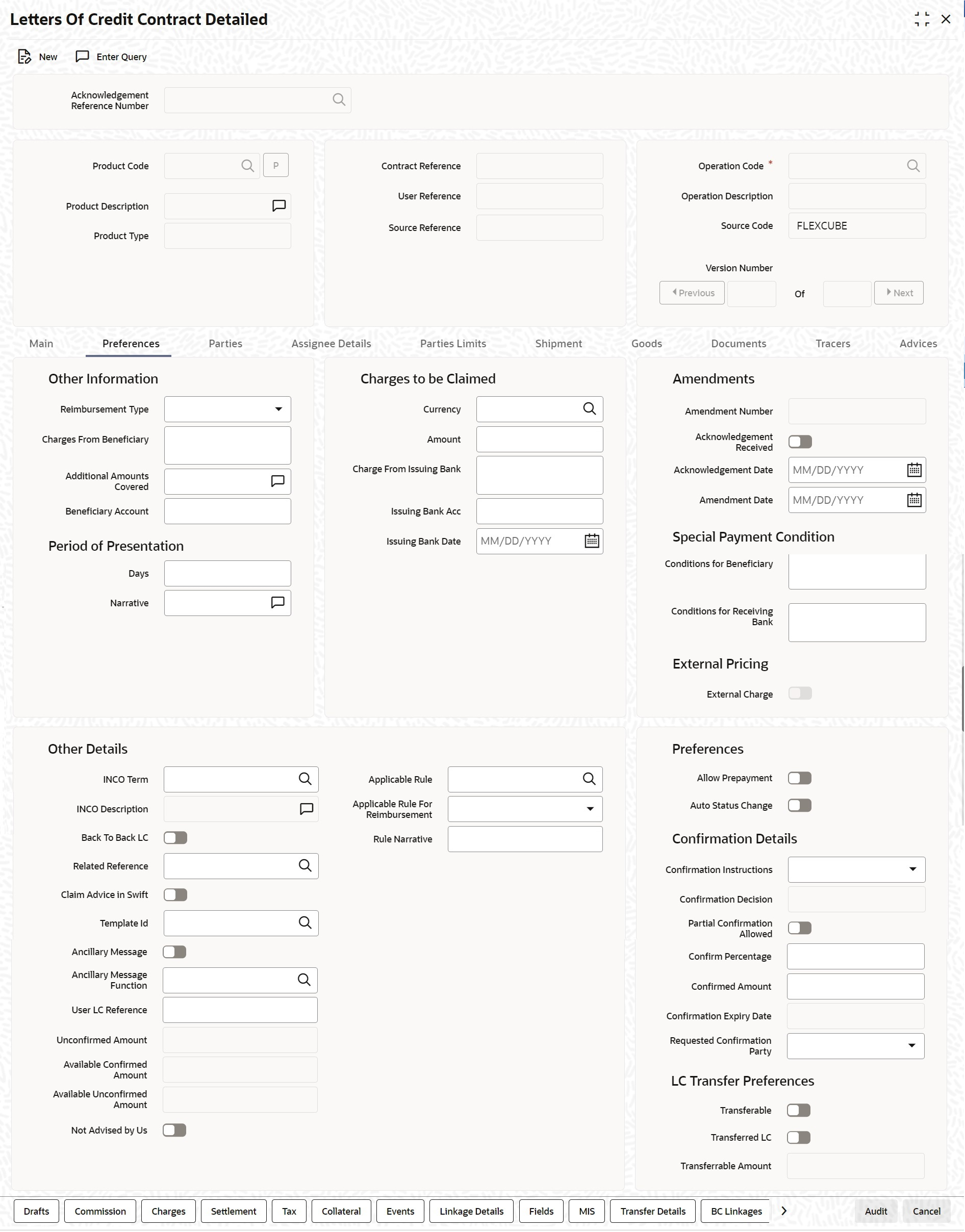

- On the Letters of Credit Contract Detailed screen, click the Preferences tab. The Other Information details is displayed.

Figure 4-3 Letters of Credit Contract Detailed - Preferences

- On the Preferences tab, specify the fields, and click Ok.You can specify certain details for SWIFT messages specific to LC and set the preferences.

Note:

The details that you specify in the fields of this screen are picked up for SWIFT messages. The SWIFT message that utilizes the information that you specify in this screen and the corresponding field of the SWIFT message which carries the input, has been listed below:For more information on these fields, refer the Field Description table given below:Table 4-3 SWIFT Messages specific to LC

Field in Oracle Banking Trade Finance SWIFT Message Field of the SWIFT message Charges From Beneficiary MT700 Field 71B Additional Amounts Covered MT 700 & MT 740 Field 39C Period For Presentation MT 700 Field 48 Charges From Issuing Bank MT 730 Field 71B Account For Issuing Bank MT 730 Field 57A Date MT 730 Field 32D Amendment Date MT707 Tag 30 Acknowledgement Received and Date MT768 Field 30 Template ID MT799 Field 79 Table 4-4 Preferences - Field Description

Field Description Other Information Capture the following details: Reimbursement Type Specify the type of reimbursement. Choose the appropriate one from the drop-down list. This field is optional.

Charges From Beneficiary The system displays the issuance charges from beneficiary. This field is optional.

Additional Amounts Covered Specify the additional amount covered. This field is optional.

Beneficiary Account Specify the account details of beneficiary. This field is read only

Charges to be claimed Specify the following details. Currency Specify the currency of the charge. This field is optional.

Amount Specify the charge amount. This field is optional.

Charge From Issuing Bank Give a brief description of the charge. This field is optional.

Issuing Bank Account Specify the account from which charge should be collected. This field is optional.

Issuing Bank Date Specify the date of charge collection. This field is optional.

Amendments Specify the following details. This field is optional.

Amendment Number The system displays the amendment number. This field is optional.

Acknowledgement Received Select this check box to indicate that the acknowledgment has received. This field is optional.

Acknowledgement Date Specify the date on which the acknowledgement is received. This field is optional.

Amendment Date The date of amendment is displayed here. This field is optional.

Period of Presentation The period of presentation defined for the product can be specified. The system uses the Expiry Date and the Last Shipment Date specified for the LC you are processing, and arrives at the period of presentation.

If the sum of the latest shipment date and period for presentation is greater that the expiry date of an import LC, the system will display an override message. This is true only in cases where the Latest Shipment Date field is not blank.

This field is optional.

Days Specify the number of calendar days after the date of shipment within which the documents must be presented for payment, acceptance or negotiation. This field is optional.

Narrative Specify the details of date of document submission. This field is optional.Note:

For details, refer the heading Specifying the Period of Presentation’ in chapter Creating Products, in the LC User Manual.Conditions For Beneficiary Specify the payment conditions for beneficiary. Specify the payment conditions for receiving bank. This field is optional.

Conditions for Receiving Bank Type the conditions for the receiving bank in the text box and click Ok. Specify the payment conditions for receiving bank. Note:

The typed text is displayed against the Conditions for Receiving Bank field.Other Details Specify the following details: INCO Term Specify the INCO term related to goods that are a part of the LC instrument. You can select one of the following values from the option list: - EXW - EX Works (…named place)

- FCA - Free Carrier (…named place)

- FAS - Free Alongside Ship (…named port of shipment)

- FOB - Free On-Board (…named port of shipment)

- CFR - Cost and Freight (…named port of destination)

- CIF - Cost Insurance Freight (…named port of destination)

- CPT - Carriage Paid to (…named place of destination)

- CIP - Cost Insurance Paid (…named place of destination)

- DAF - Delivered at Frontier (…named place)

- DES - Deliver Ex Ship (…named port of destination)

- DEQ - Delivered Ex Quay (…named port of destination)

- DDU - Delivered Duty Unpaid (…named place of destination)

- DDP - Delivered Duty Paid (…named place)

- DPU - Delivered at Place Unloaded

Once you choose the INCO Term, the documents and clause details will be displayed based on the maintenance for the chosen INCO term in the INCO Terms Maintenance screen. However, if you change the INCO term, the document and clause details will be not be updated automatically. You will have to manually change them if required. However, the system will check whether the document and clauses details are the same as those defined in the INCO Term Maintenance screen.The INCO term is picked up and displayed in field 45A of MT700.

This field is optional.Back to Back LC Check this option if you want to link an export LC to an import LC. This field is applicable only for import LCs. If you check this option, you will have to specify the export LC which you want to link to the import LC in the Reference Number field. All active and authorized export LCs of the same counterparty will be available for selection in the option list Reference Number. An export LC can be linked to only one import LC.

This field is optional.Related Reference Number Specify the related reference number. Choose the appropriate one from the option list. While issuing a guarantee, the option list displays all valid bill of lading reference numbers and import LCs. Similarly, while issuing a back to back LC, the option list displays all valid export LCs maintained in the system. You can choose the appropriate one.

This field is optional.Claim Advice in Swift Check this box to generate the charge claim advice in MT799 SWIFT format. This field is initially defaulted from product level. However, you can then check or uncheck it at the contract level.

This field is optional.Template ID Specify the template ID related to MT799 message types from the option list. This field is optional.Note:

You can enter the values only if the Claim Advice in Swift field is checked.Ancillary Message Check this box to generate MT 759 on contract authorization. This field is optional.

Ancillary Message Function Specify the ancillary message function. Alternatively, you can select the ancillary message from the option list. The list displays all valid options maintained in the system. Ancillary Message Function is mandatory if Ancillary Message is checked. This field is optional.

User LC Reference Number System displays the Contract User Reference as the User LC Reference Number. The reimbursement LC, under which the bill is availed, and the Export LC linked to the bill, should contain the same User LC Reference Number. This field is optional.

Applicable Rule The system defaults the applicable rule from the product level. However, you can modify this. Please refer to the section Specifying the Applicable Rules under chapter Defining Product Attributes in this user manual. This field is optional.

Applicable Rule For Reimbursement Select the applicable rule for reimbursement from the drop-down list. The available options are :- URR Latest Version

- Not URR

Rule Narrative This is enabled only if Applicable Rule is set to OTHR. The system defaults the rule narrative from the product level. However, you can modify this. Please refer to the section Specifying the Applicable Rules under chapter Defining Product Attributes in this user manual. Unconfirmed Amount The system displays the current maximum unconfirmed LC amount. This amount is derived by deducting the confirmed amount from the maximum LC amount. This field is optional.

Available Confirmed Amount The system displays the available confirmed portion of the maximum LC amount. This field is optional.

Available Unconfirmed Amount The system displays the available unconfirmed portion of the maximum LC amount. This field is optional.

Not Advised by Us Select this check box to indicate that contract is advised by other bank. This field is optional.

External Charge While booking a contract under a product for which External Charges is enabled at product level, it defaults the same value for contract also which fetches external charges from external pricing and billing engine. Preferences You can set the preferences for the following fields. Allow Prepayment Select Allow Prepayment check box to indicate that the customer can make a prepayment on the contract.

This field is optional.Confirmation Instructions Specify the confirmation option to indicate that the LC can have an associated confirmation message. You can select one of the following options from the option list: - Null

- May Confirm

- Confirm

Specify the type of the confirmation instruction that should be sent to the advising/confirming bank if you are issuing the LC (whether Field 49 of MT 700 should be ‘Null’, ‘Confirm’, or ‘May Confirm’).

This field is optional.Confirmation Decision Confirmation decision will be display only field, which will be defaulted with the value as, - Confirm - When the ‘Operation’ of LC is ‘CNF’ and ‘ANC'

- Silent Confirmation – When the operation of LC is SCF

- Blank – When the operation of LC is other than CNF, ANC and SCF.

Partial Confirmation Allowed Select Partial Confirmation Allowed check box to confirm the partial amount. The remaining amount can be confirmed after you receive the approval from the external agent. Note:

This field is initially defaulted from product level. However, you can then check or uncheck it at the contract level.Auto Status Change The system defaults the status of the checkbox based on the product maintenance. However, you can modify this. If you check this box, the system picks up the contract during EOD operations for status processing. If you do not check this, the system will not consider the LC contract for automatic status processing.

This field is optional.Confirm Percentage Specify the percentage of LC Amount to be confirmed or silent confirmed. If percentage is not specified, the system will calculate the percentage based on the confirm Amount specified.

Confirmation percentage will be defaulted to 100%

during silent confirmation change of operation.This field is optional.

Confirmed Amount Specify the amount to be confirmed or silent confirmed. If Confirm Amount is not specified, the system will calculate the confirmed amount based on the Confirm Percentage specified. If both Confirm Amount and Confirm Percent are specified then the system will display an override message as “Both Confirm Amount and Confirm Percent are entered. Confirm Percent is considered for calculation.”

The system will calculate and display the Confirm Amount based on the confirm percentage specified. Confirm Percentage and Confirm Amount can be changed or recalculated either on save or on pressing LC Default Button available in Main tab of LC Online screen.

During silent confirmation change of operation, confirm percentage and confirmed amount will be defaulted to 100% and LC outstanding amount respectively.

The system will display an error message for the following conditions:

- If Partial Confirmation Allowed check box is unchecked and if you specify the values in Confirmation Percentage and Confirmation Amount fields.

- If the value of the amount confirmed is greater than the unconfirmed unavailed amount.

- If the value of the confirm amount is lower than the availed confirmed amount.

- If Operation is confirm or advice and confirm and confirm or silent confirmation percent is greater than 100 or confirm Amount is greater than LC current availability.

- If the operation code is set to Advice or Pre-Advice and if you specify the Amount Confirmed and ‘Confirmation Percentage’.

- If the operation code is set to Confirm or Advice and Confirm and if you have not specified the values of the amount confirmed and the percentage of confirmation, then the system will default the percentage as 100, value of LC maximum amount.

- If Partial Confirmation Allow flag is checked for product other than Export.

- If Partial Confirmation Allow flag is checked when LC Operation is other than Advice, Pre-advice, Confirm or Advice and Confirm. Requested Confirmation Party.

- Null

- Advising Bank

- Advice Through Bank

- Confirming Bank

Requested Confirmation Party Select the Requested Confirmation Party from the drop-down list. The available options are: - Advising Bank

- Advice Through Bank

- Confirming Bank

LC Transfer Preferences You can set the preferences. Transferable Check this option to indicate that the LC is transferable. This field is optional. Transferred LC Check this option for indicating the given LC is transferred LC.

This field is optional.Transferable Amount This field displays the transferable amount calculated using the LC amount.

This field is optional.Assignee Details Assignee can be walk-in customers, Bank customers and Third Party customers. For Third Party Customers,user must maintain those parties in Third Party screen (TFDTPMNT) It will be possible to maintain assignee details in export type of letter of credit contract. Assignee can be added/modified/deleted in LC during internal amendment if Bill is not booked under LC with assignee details else system will provide appropriate error message. You can set the following assignee details: Sequence Sequence in which the assignee details are maintained. Value for this should be greater than or equal to zero. Sequence will not accept any decimal points. This should be unique.

This field is mandatory.Assignee Id To maintain the party ID. This will fetch all the parties maintained in Other Party screen. It will not be possible to maintain the same assignee multiple times.

This field is mandatory.Assignee Name Assignee name will be displayed based on the Assignee Id.

Assignee name can be modified only Walk-in Customer.

This field is optional.Assignee Address Line 1 Address Line 1 will be displayed based on the Assignee ID. Address Line 1 can be modified only for Walk in customer.

This field is optional.Assignee Address Line 2 Address Line 2 will be displayed based on the Assignee ID. Address Line 2 can be modified only for Walk in customer.

This field is optional.Assignee Address Line 3 Address Line 3 will be displayed based on the Assignee ID. Address Line 3 can be modified only for Walk in customer.

This field is optional.Assignee Address Line 4 Address Line 4 will be displayed based on the Assignee ID. Address Line 4 can be modified only for Walk in customer. This field is optional. Account Currency Specify the currency of the account of the assignee. This field is mandatory.

Account Specify the account to which the amount should be credited. This can be the account of the assignee with the bank if he is a customer of the bank. If he is not the customer of the bank then this can be the Nostro account of his bank maintained in the current bank. If Assignee is a bank customer ( Individual/Corporate/Bank customer) then Account LOV will provide customer accounts maintained in External Customer Account for the selected bank customer. If Assignee is a Third party or Walk in customer then Account LOV will display the NOSTRO accounts for the currency.

This field is mandatory.Assigned Percentage Specify the percentage of assignment to the assignee. Sum of assignee percentage should not exceed 100 percent. Either Assigned Percentage or Assigned Amount should be entered. If assigned percentage is provided and assigned amount is not provided, system will compute assigned amount based on assigned percent of contract amount. If assigned amount is provided and assigned percentage is not provided, system will compute assigned percentage based on assigned amount. If both assigned percentage and assigned amount is provided, system will compute assigned amount based on assigned percentage.

If both assigned percentage and assignment amount is not provided, system will provide error message.Assigned Amount Specify the amount of assignment to the assignee in LC currency. This should be greater than zero. Decimal points will be based on the LC currency. If assignment details are maintained for any product type other than export type, system will throw an error message. It will be possible to amend these values. If the amendment amount is reduced, there will be a validation to check whether it goes below from that used already in BC contract. If yes, system will throw an error. Also if the assignment details are already used in any BC contract, system will not allow to add or delete new assignees or amend party details such as Assignee Id, Account etc.

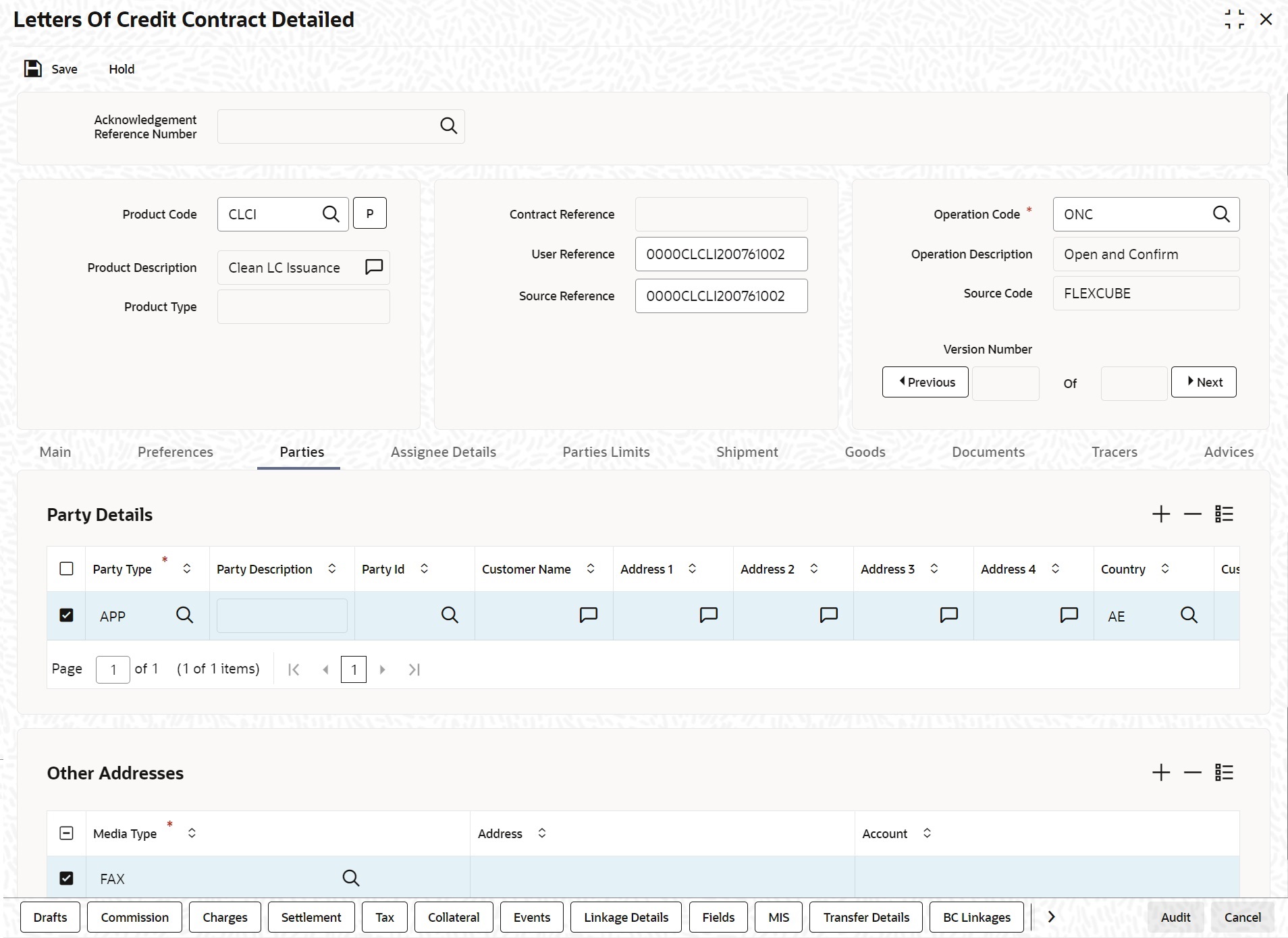

Assignment details can be added through excel upload. - On the Letters of Credit Contract Detailed screen, click the Parties tab.The Parties Details is displayed.

Note:

The Parties screen can be used to record the details related to all the parties involved in the LC.Figure 4-4 Letters of Credit Contract Detailed - Parties

- On the Parties tab, specify the fields, and click Ok.Based on the details you specify for the fields in this screen, the documents, tracers and messages are generated and is sent to the parties concerned.

For more information on the fields, refer the Field Description table given below:

Table 4-5 Parties - Field Description

Field Description Party Details Specify the following for each of the parties involved in the LC. Party Type Specify the party type (beneficiary, accountee, applicant, advising bank, issuing bank, reimbursing bank, advice through a bank, confirming bank, claiming bank). The option list displays all party types available for the LC. Select the appropriate party type from the list. If the operation code of the LC is ‘Reimbursement’ the system will default the CIF party type as ‘ISB’ (issuing bank). The party type ‘CLB’ (claiming bank) will be available only if the LC is linked to a ‘Reimbursement’ type of product.

Once the record has been saved, you can change party names by amending the record, provided the LC is not linked to a bill. Also, you cannot change party names for a transferred or an availed LC.Note:

You can change the following party types:- REB

- ABK

- BEN

For more information, refer Table 4-6

This field is mandatory.Party Description You can provide the description for the party type here. This field is optional.

Party ID Specify a Party ID for which you need to maintain. Alternatively, you can select the Customer No from the List of Values Party Id. . Third Party Customer details is also listed under List of Values Party Id. Oracle Banking Trade Finance validates ADB Member Status for a Bank, which is an ADB member, at each scenario with a different logic. The system will not validate ‘ADB Member Status’ when the changed ADB Member Status’ is maintained as Not applicable in the following scenarios:Note:

BIC Code appears next to the ‘Customer No’ only if the BIC Code is mapped with that customer number. If the BIC code is not mapped with that customer number then the BIC Code will not appear next to the ‘Customer No’ in the option list. Validations for ADB Member Status- When BIC is uploaded without maintaining initial status

- When a default value is maintained at BIC Code Maintenance level and initial status is not maintained

- When an initial status is changed from Yes to Not Applicable

- When an initial status is changed from ‘No’ to ‘Not Applicable’

The system validates and displays an override message when the changed ADB Member Status is maintained as No in the following scenarios:

This field is optional- When the initial status is changed from Not Applicable to No

- When the initial status is changed from No to Yes

This field is optional.Note:

If the Advising Bank or the Issuing Bank is not a customer of the Bank, then the system validates the BIC maintained in Address 1 field of the Advising Bank or the Issuing Bank.Customer Name Enter the name of the Customer. The party name can be 150 characters in length. However, please note that in the SWIFT messages that you generate only 35 characters will be included.

This field is optional.Address 1 to Address 4 Enter the address of the customer who has initiated the transaction. This field is optional.

Country Enter the country of the customer. This field is optional.

Customer Reference Specify the sender’s reference number. In case of an upload of MT768, the value in field 20 of the message is displayed here. Input to this field will be mandatory for the party type ISB.

This field is optionalDated Specify the date of transaction initiation. This field is optional

Language Specify the language in which advices should be sent to the customer. This field is optional

Issuer Check this option to indicate that the issuer is a bank.

The issuer of LC is a bank or an individual. This is enabled only for the party type ISB (issuing Bank). The party type is defaulted from CIF maintenance. However, you can amend the value before authorizing the contract.

If issuer of LC is a bank, tags 52A and 52D will be populated. The message Types supported by these tags are MT710/MT720. If issuer of LC is not a bank, 52B tag will be populated.

This field is optional.Template Id Specify the template ID. If you change REB party, then a template ID needs to be attached to send MT799 to Advising bank. This field is optional

Account Specify the account number.This field is optional Other Addresses It includes details about the following: - The media type

- The party’s mail address

- The account

The advices for a party will be sent to the default media maintained in the Customer Addresses table. If you want to send the advices through another medium, you should indicate it in the Parties screen. The address should be also indicated. The advices will be sent through the new medium, only if you indicate so in the Advices screen of contract processing. If not, the advice will continue to be sent to the default address defined for the party.

You can use this feature to send a one-off advice, through a different medium. For example, for a particular customer, you normally send all advices through mail and hence haven’t defined SWIFT or TELEX advices. For an LC involving a customer, you want to send the advices through SWIFT. In such a case, you can specify the medium as SWIFT and specify the address only for the LC you are processing.

The issuer of LC is a bank or an individual. This is enabled only for the party type ISB (issuing Bank). The party type is defaulted from CIF maintenance. However, you can amend the value before authorizing the contract.

If issuer of LC is a bank, tags 52A and 52D will be populated. The message Types supported by these tags are MT710/MT720.

If issuer of LC is not a bank, 52B tag will be populated.

This field is optional

Media Type Select the Media Type from the option list. The media type through which the advises must be routed and the respective address(es) The advices for a party will be sent to the default media maintained in the Customer Addresses table. If you want to send the advices through another medium, you should indicate it in the Parties screen. The address should be also indicated. The advices will be sent through the new medium, only if you indicate so in the Advices screen of contract processing. If not, the advice will continue to be sent to the default address defined for the party. You can use this feature to send a one-off advice, through a different medium. For example, for a particular customer, you normally send all advices through mail and hence haven’t defined SWIFT or TELEX advices. For an LC involving a customer, you want to send the advices through SWIFT. In such a case, you can specify the medium as SWIFT and specify the address only for the LC you are processing. This field is mandatory.

Address Type the party’s mail address. Account Specify the account number. Table 4-6 Message Details when there is change in Parties - Field Description

Changed Party Name Messages Beneficiary party (BEN)

(in case of import LC)MT707 will be sent to the advising bank. New party BEN will be sent in tag 79 of 707. If MT740 has been already sent to Reimbursing bank, then MT747 will be sent to the Reimbursing bank for intimating change of Beneficiary.

Reimbursing bank (REB) (in case of import LC) MT799 will be sent to Advising bank. MT747 will be sent to old Reimbursing Bank Party. MT740 is sent to new REB party. FFT code ‘CANC’ must be attached manually to advice ‘LC_AMND_AUTH_REIMB’ (747), at contract level.

Advising Bank (ABK) (in case of import LC) MT707 will be sent to the old Advising bank. MT700 will be sent to the new Advising bank. Also, FFT code ‘CANC’ must be attached to advices to 707 or 767 manually. BEN (in case of export LC) Counterparty will be changed and the limits, if any, for the old Beneficiary will be reinstated and will be tracked against the new Beneficiary. ABK (in case of export LC) You can change the ABK. BEN, REB, and ABK MT707 will be sent to the old Advising Bank intimating the change of Advising Bank.

MT700 will be sent to the new Advising Bank with the new parties for REB and BEN.

MT747 will be sent to old REB and MT740 will be sent to the new REB party.BEN and REB MT707 will be sent to the Advising bank intimating the change of Beneficiary and Reimbursing bank. MT700 will be sent to the new Advising Bank with new Beneficiary.

If MT740 has already been sent to the REB, MT747 will be sent to the REB for intimating change of BEN.REB and ABK MT707 will be sent to the old ABK intimating the change of ABK. MT700 will be sent to the new ABK.

MT747 will be sent to the old REB.

MT740 will be sent to the new REB.REB and ABK MT707 will be sent to the old ABK intimating the change of ABK. MT700 will be sent to the new ABK.

MT747 will be sent to the old REB.

MT740 will be sent to the new REB.

Reimbursing bank (REB) MT707 will be generated to the Advising bank. (Deletion of REB) MT747 will be sent to old Reimbursing Bank Party. MT740 will be automatically suppressed. FFT code ‘CANC’ must be attached manually to advice

‘LC_AMND_AUTH_REIMB’ (747), at contract level.

(Deletion of ATB) During Export LC amendment(AMNV or AMND based on Beneficiary Confirmation): MT707 to be sent to ATB.

Deletion of ATB details to be provided in 47B. Details should be input manually with FFT.

57A should not be available in MT707

System will display an override “Advise Through Bank Party has been deleted, Additional condition to be provided for advice LC_AMND_INSTR”.

Amendment to delete ATB is initiated and not confirmed then system should not allow further amendments with or without Beneficiary Confirmation. Error message to be displayed like "Previous unconfirmed amendments exists for ATB deletion. Cannot initiate a new amendment". Amendment to delete ATB is rejected, 57A should be available in subsequent amendments.

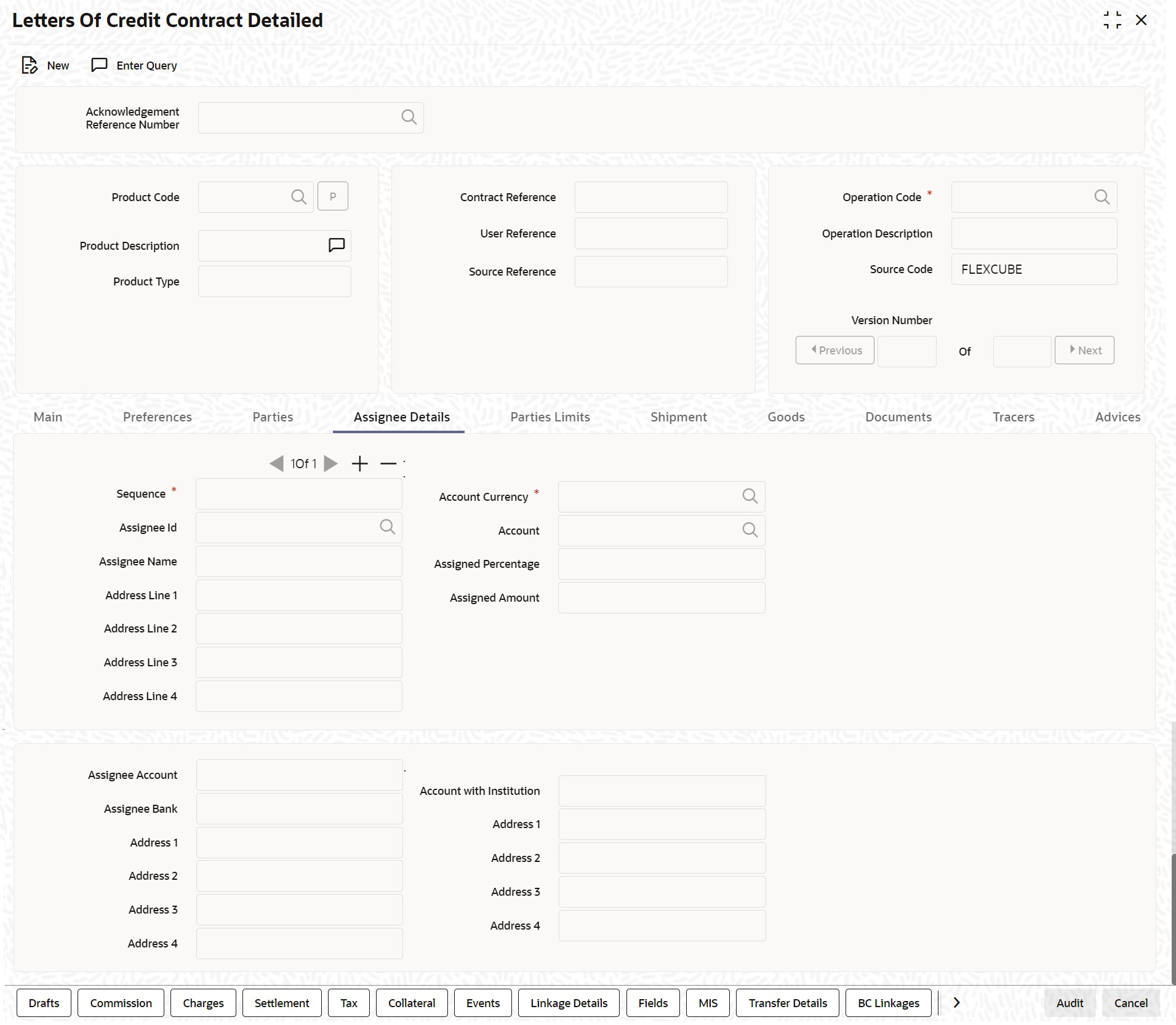

- On the Letters of Credit Contract Detailed screen, click the Assignee Details tab.The Assignee Details is displayed.

Figure 4-5 Letters of Credit Contract Detailed - Assignee Details

- On the Assignee Details tab, specify the fields, and click Ok.For more information on these fields, refer the Field Description table given below:Account details provided from External system to be mapped to Assignee Account field which is newly introduced.

Table 4-7 Assignee Details - Field Description

Field Description Assignee Details Assignee can be walk-in customers, Bank customers and Third Party customers. For Third Party Customers, user must maintain those parties in Third Party screen (TFDTPMNT) It will be possible to maintain assignee details in export type of letter of credit contract. Assignee can be added/modified/deleted in LC during internal amendment if Bill is not booked under LC with assignee details else system will provide appropriate error message. You can set the following assignee details: Sequence Sequence in which the assignee details are maintained. Value for this should be greater than or equal to zero. Sequence will not accept any decimal points. This should be unique. This field is mandatory.

Assignee Id To maintain the party ID. This will fetch all the parties maintained in Third party maintenance screen and walkin customer along with Bank customer. It will not be possible to maintain the same assignee multiple times other than walkin customer. This field is optional.

Assignee Name Assignee name will be displayed based on the Assignee Id. Assignee name can be modified only Walk-in Customer.

This field is optional.Assignee Address Line 1 Address Line 1 will be displayed based on the Assignee ID. Address Line 1 can be modified only for Walk in customer. This field is optional.

Assignee Address Line 2 Address Line 2 will be displayed based on the Assignee ID. Address Line 2 can be modified only for Walk in customer. This field is optional.

Assignee Address Line 3 Address Line 3 will be displayed based on the Assignee ID. Address Line 3 can be modified only for Walk in customer. This field is optional.

Assignee Address Line 4 Address Line 4 will be displayed based on the Assignee ID. Address Line 4 can be modified only for Walk in customer. This field is optional.

Account Currency Specify the currency of the account of the assignee. This field is mandatory.

Account Specify the account to which the amount should be credited. This can be the account of the assignee with the bank if he is a customer of the bank. If he is not the customer of the bank then this can be the Nostro account of his bank maintained in the current bank. If Assignee is a bank customer ( Individual /Corporate/Bank customer) then Account LOV will provide customer accounts maintained in External Customer Account for the selected bank customer. If Assignee is a Third party or Walk in customer then Account LOV will display the NOSTRO accounts for the currency. If Assignee id is not provided then Account LOV will provide customer Accounts and Nostro Accounts. Either Account or Assignee account is mandatory.

Assigned Percentage Specify the percentage of assignment to the assignee. Sum of assignee percentage should not exceed 100 percent. Either Assigned Percentage or Assigned Amount should be entered. If assigned percentage is provided and assigned amount is not provided, system will compute assigned amount based on assigned percent of contract amount. If assigned amount is provided and assigned percentage is not provided, system will compute assigned percentage based on assigned amount. If both assigned percentage and assigned amount is provided, system will compute assigned amount based on assigned percentage. If both assigned percentage and assignment amount is not provided, system will provide error message.

Assigned Amount Specify the amount of assignment to the assignee in LC currency. This should be greater than zero. Decimal points will be based on the LC currency. If assignment details are maintained for any product type other than export type, system will throw an error message. It will be possible to amend these values. If the amendment amount is reduced, there will be a validation to check whether it goes below from that used already in BC contract. If yes, system will throw an error. Also if the assignment details are already used in any BC contract, system will not allow to add or delete new assignees or amend party details such as Assignee Id, Account etc.

Assignment details can be added through excel upload.

Assignee Account Indicates Account of Assignee which is Ultimate Beneficiary Account. If user provides Invalid Accounts then system will assign walkin customer to Assignee id and Nostro Account to Account field.

Assignee Bank Indicates Bank of Assignee Address Line 1 Indicates Assignee Bank address details. Address Line 2 Indicates Assignee Bank address details. Address Line 3 Indicates Assignee Bank address details. Address Line 4 Indicates Assignee Bank address details. Account with Institution Indicates Account with Institution. Address Line 1 Indicates Assignee Bank address details. Address Line 2 Indicates Assignee Bank address details. Address Line 3 Indicates Assignee Bank address details. Address Line 4 Indicates Assignee Bank address details. Assignee ID, Account and Assignee Account derivation will be as below:During Bill liquidation, assignee details to be defaulted to Settlement subsystem as below:Table 4-8 Table Assignee Details

Assignee Id Account Assignee Account Processing on Save Customer selected from LOV Customer Account selected from LOV Not provided Assignee account to be defaulted with Account on Save Not provided Customer Account selected from LOV Not provided Customer id to be derived and Assignee Account to be defaulted with Account Not provided Not provided Valid Customer account provided Customer id to be derived and Account to be defaulted with Assignee Account Not provided Not provided Valid Customer account provided Walk in customer and Nostro account of the walk in customer to be defaulted Table 4-9 Assignee Details

Assignee Details Settlement Subsystem Assignee Account Ultimate Beneficiary 1 Assignee Name Ultimate Beneficiary 2 Assignee Address 1 Ultimate Beneficiary 3 Assignee Address 2 Ultimate Beneficiary 4 Assignee Address 3 Ultimate Beneficiary 5 Assignee Bank Beneficiary Institution 1 Assignee Bank Address Line 1 Beneficiary Institution 2 Assignee Bank Address Line 2 Beneficiary Institution 3 Assignee Bank Address Line 3 Beneficiary Institution 4 Assignee Bank Address Line 4 Beneficiary Institution 5 Account with Institution Account with Institution 1 Address Line 1 Account with Institution 2 Address Line 2 Account with Institution 3 Address Line 3 Account with Institution 4 Address Line 4 Account with Institution 5 - Click Save to save the details or Cancel to exit from the screen.

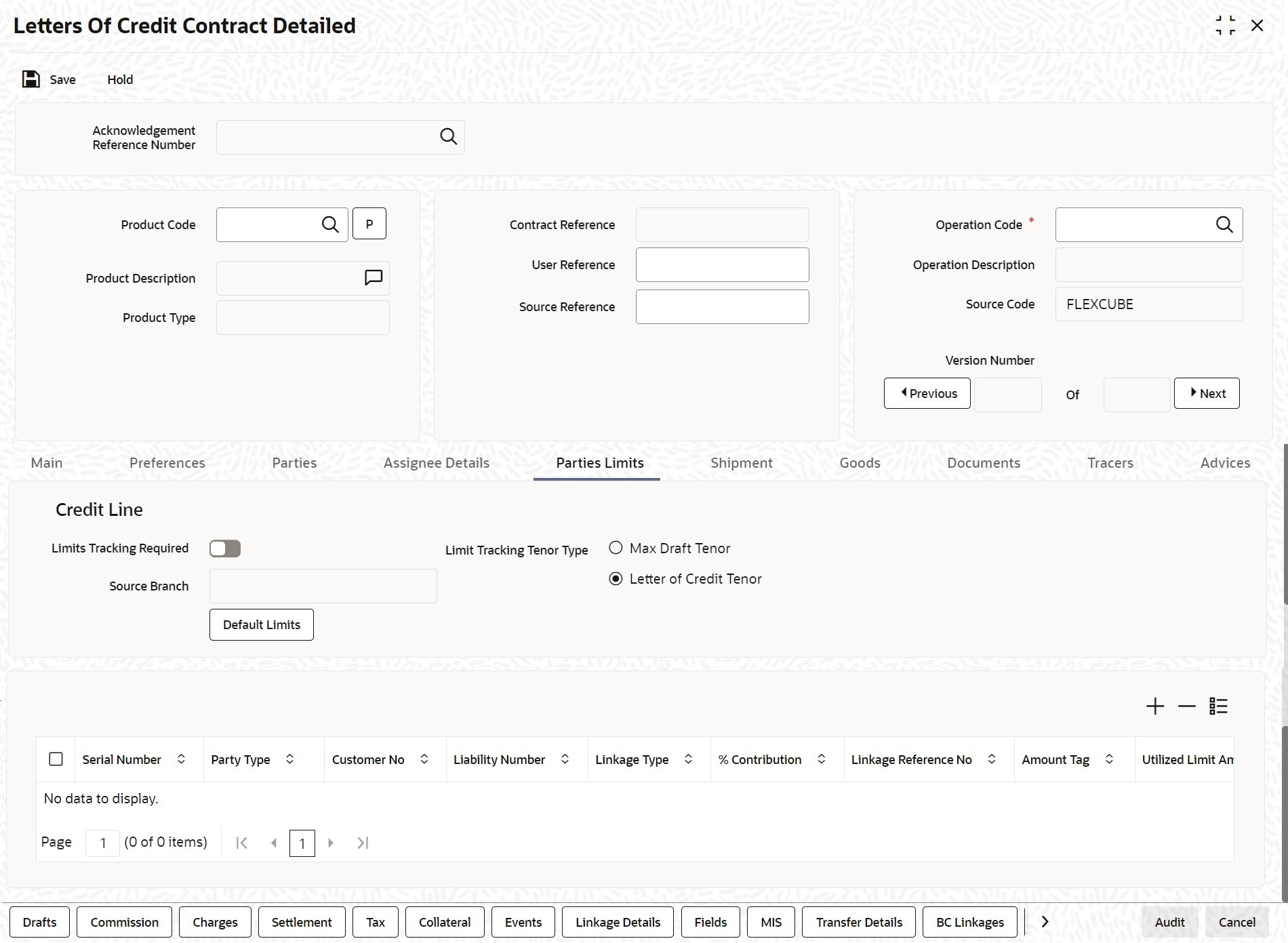

- On the Letters of Credit Contract Detailed screen, click the Parties Limits tab.The Parties Limits is displayed.

- On the Parties Limits tab, specify the fields and click Ok.You can track the limits of multiple credit lines in an LC contract.For more information on the fields, refer the Field Description table given below:

Note:

You can add new records or delete the defaulted record for limits and then click the save button. The details are saved.Table 4-10 Parties Limits - Field Description

Field Description Limits Tracking Required Select the Limits Tracking Required check box to indicate that limit tracking is required for the parties to the LC contract. If you check this box, the system will let you set the limits for multiple credit lines in the contract. If you do not check this box, the system will not track the parties limits.

On checking this box, the system enables Default Limits button. You can use this button to get the default values for the parties in the credit lines.

This field is optional.Default Limits Click the Default Limits button. The system displays the default values for the parties limits: Limit Tracking Tenor Type Click the Limit Tracking Tenor Type either as Max Draft Tenor or Letter as Credit Tenor. This field is optional.

Serial Number On click of Save button, the system displays the serial number. This field is optional.

Party Type The system displays the Party Type of the counterparty of the contract by default. This field is optional.

Customer No The system defaults the CIF Id or Customer No. of the counterparty. This field is optional.

Liability Number The system defaults the Liability Number of the counterparty. This field is optional.

Linkage Type The system defaults the fy the linkage type as Facility. This field is optional.

% Contribution The system defaults the % Contribution as 100. This field is optional.

Linkage Reference No Select the Linkage Reference Number from the list. Specify the reference number that identifies the facility, collateral pool or collateral. The option list displays all valid facilities and collateral pools specific to the liability. Choose the appropriate one. In case you choose the same linkage reference for more than one record in the list, the system displays an override message. You may choose to cancel or proceed with the selection. This field is optional.

Amount Tag The system displays the Liability Amount by default. Limit Amount The system calculates and displays the limit amount for each credit line on click of save button. The amount is derived based on the amount tag specified above. You can add more rows to the list of credit lines using add button. Remove a selected row from the list using delete button. Once you have specified the details, save the contract. In case the limit for a credit line has been completely exhausted, the system displays a configurable override message

This field is optional.

JV Parent When you click ‘Default Limits’ button, the system defaults the joint venture customer number of the party. This customer number is defaulted based on the details maintained in ‘Joint Venture’ sub-screen of ‘Customer Maintenance’ screen.

If limits Earmarking is done by an External system. OBTF can release the Earmarking details by following below steps:- Enable the flag “Release ELCM Earmarking” at Trade Finance Bank Preference Maintenance.

- External system has to send the Earmarking details to OBTF through the service – OBTFIFService and Operation – CreateLmtEARDtls, before calling handoff request.

- When OBTF initiates utilization service call to limits system, we will send the Earmarking reference received from external system in block reference no tag to release the earmarking details.

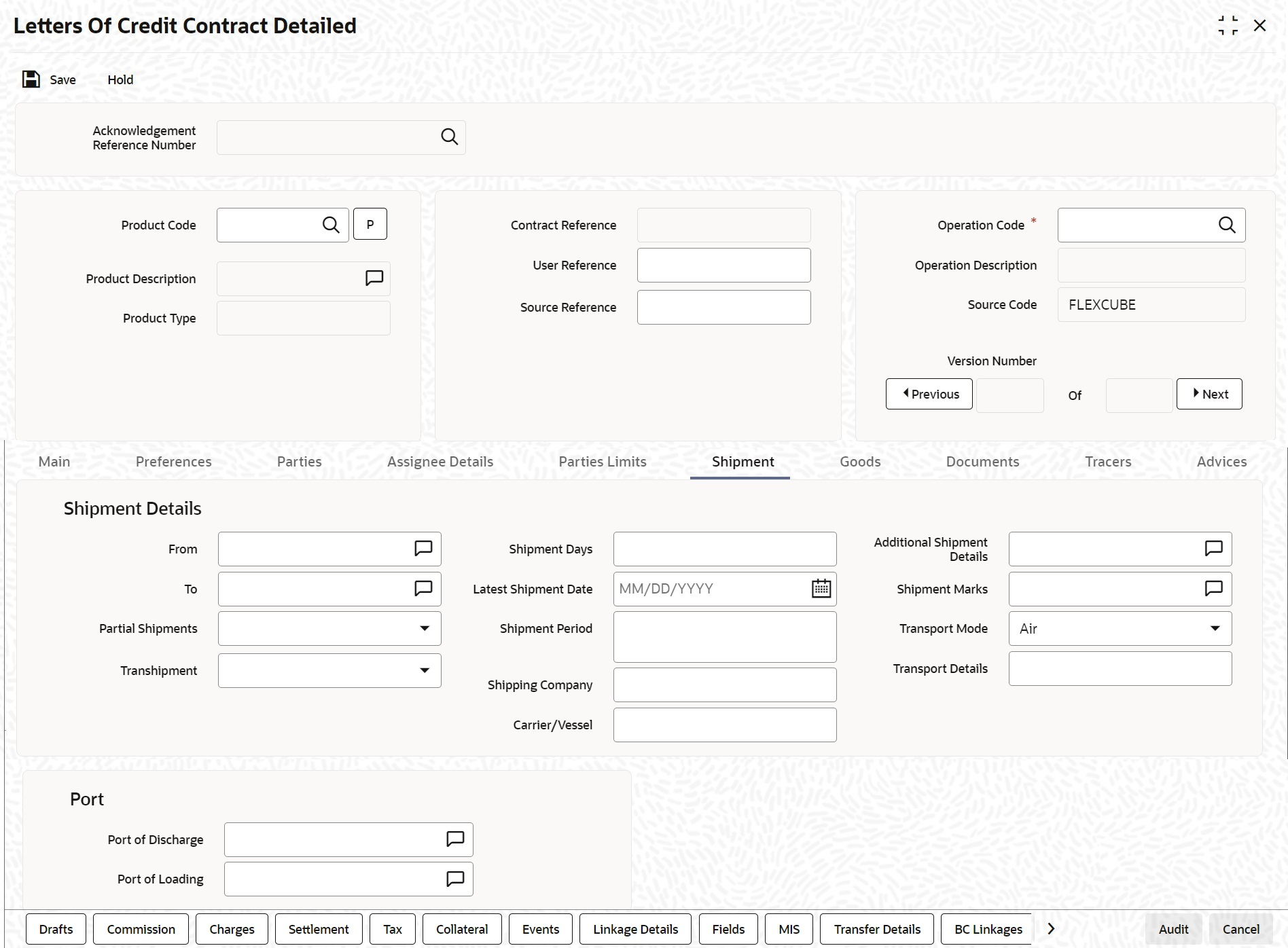

- On the Letters of Credit Contract Detailed screen, click the Shipment tab.The Shipment Details is displayed.

- On the Shipment tab, specify the fields and click Ok.An LC instrument, which is an instrument of trade finance, involves details of merchandise. Hence, you will need to specify the following details for the LC:

- Details of the merchandise

- Details of the mode of transportation

Note:

You will not be able to save shipment and goods related details for an LC under the operation code ‘Reimbursement’.There are certain standard clauses and conditions, associated with the shipment of the merchandise traded under an LC. You can specify the following shipping details for an LC that you process.

For more information on the fields, refer the Field Description table given below:Table 4-11 Shipment - Field Description

Field Description From The location from which the goods transacted under the LC should be shipped. In international trading parlance, this is called the Loading on board/Dispatch/Taking in charge at/from. This field is optional.

To The destination to which the goods transacted under the LC should be sent. In international trading parlance, this is called the ‘For transportation’ to. Shipment From and Shipment To are linked to the tags 44A and 44 B respectively. These tags are applicable to the following message types:

- MT700

- MT705

- MT707

- MT710

- MT720

Partial Shipments Select an option for partial shipment of the goods allowed under the LC from the drop-down list. The options available are: - Allowed

- Not Allowed

- Conditional

- Blank

By default Partial Shipment will be blank. If Partial Shipment Allowed is blank, then the tag 43P is not applicable for SWIFT messages.

This field is optional.Transhipment Select an option for Transhipment under the LC from the drop-down list. The options available are: - Allowed

- Not Allowed

- Conditional

- Blank

By default, the Transhipment will be blank. If ‘Transhipment’ is blank, then the tag 43T is not applicable for SWIFT messages.

This field is optional.Shipment Days Specify the number of shipment days. If you enter the shipment days and leave the field Latest Shipment Date blank, on saving the contract, the system calculates the latest shipment date based on the number of shipment days and the effective date. However, if you specify the latest shipment date, the system ignores the shipment days specified here. Instead, it recalculates the shipment days based on the latest shipment date and the effective date.

This field is optional.Latest Shipment Date Specify the latest date for loading on board/despatch/taking in charge. If this date is greater than the linked policy expiry date, the system will display an override/error message. This corresponds to the field 44C in MT 700 and is a conditional field. Either field 44C (Latest Shipment date) or 44D (Shipment Period) will be present in the message, but not both. In case you do not specify the latest shipment date, the system automatically calculates the date based on the number of shipment days and the effective date specified above.

Now, suppose that you have specified both the shipment days and the latest shipment date. In that case, the system ignores the shipment days and recalculates it based on the latest shipment date and the effective date.

If you modify the latest shipment date during amendment, the system recalculates the number of shipment days.

This field is optional.Shipment Period Specify the period of time during which the goods are to be loaded on board/despatched/taken in charge. This corresponds to field 44D in MT 700 and is a conditional field. Either field 44C (Latest Shipment date) or 44D (Shipment Period) will be present in the message, but not both. This field is optional.

Shipping Company Indicates the name of the shipping company. Carrier/Vessel Indicates Carrier / Vessel Name. Additional Shipment Details Specify additional shipment details. This field is optional.

Shipment Marks Specify shipping marks. This field is optional

Transport Mode Select the mode of transport from the drop-down list. This field is optional.

Transport Details Specify the details of transport. Port of Discharge You can also specify the name of the destination port to which the goods transacted under LC should be sent. This is called the Port of Discharge. ‘Port of Loading and ‘Port of Discharge’ are linked to the 44E and 44F tags respectively. These tags are applicable to the following message types: - MT700

- MT705

- MT707

- MT710

- MT720

Port of Loading You can specify the name of the airport from where the goods transacted under the LC are loaded for shipping. This is called the Port of Loading. This field is optional.

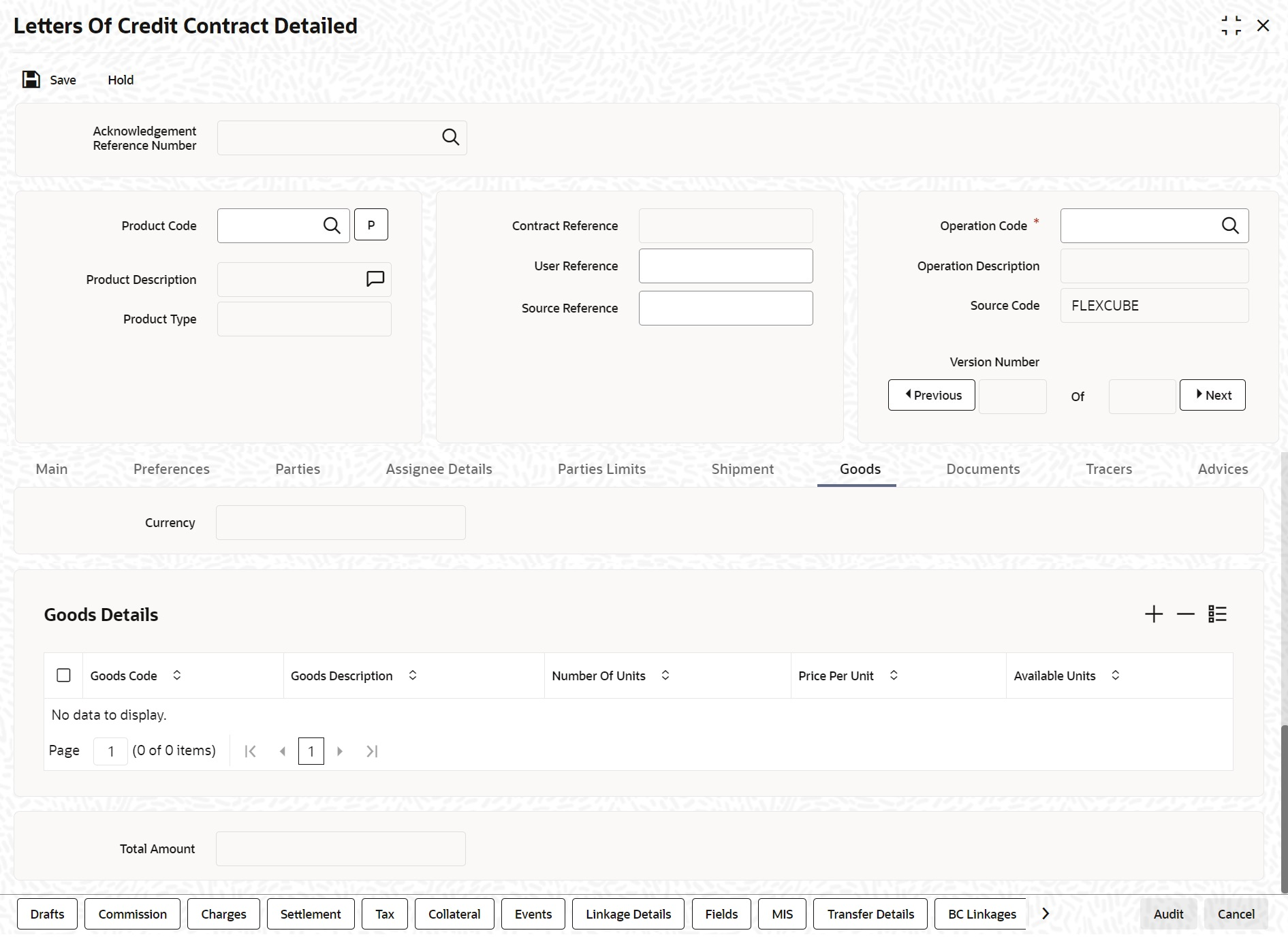

- On the Letters of Credit Contract Detailed screen, click the Goods tab.The Goods Details is displayed.

- On the Goods tab, specify the fields, and click Ok.For more description on the fields, refer the Field Description table given below:

Table 4-12 Goods - Field Description

Field Description Currency The system displays the currency by default. Goods Code Select the Goods Code from the option list. Goods Description The goods description is displayed here based on the goods code you select. Number of Units Type the number of units. Price Per Unit Type the price per unit. Available Units The system displays the available units of the goods. Total Amount The total contract amount must match with the total goods value during contract amendment. Note:

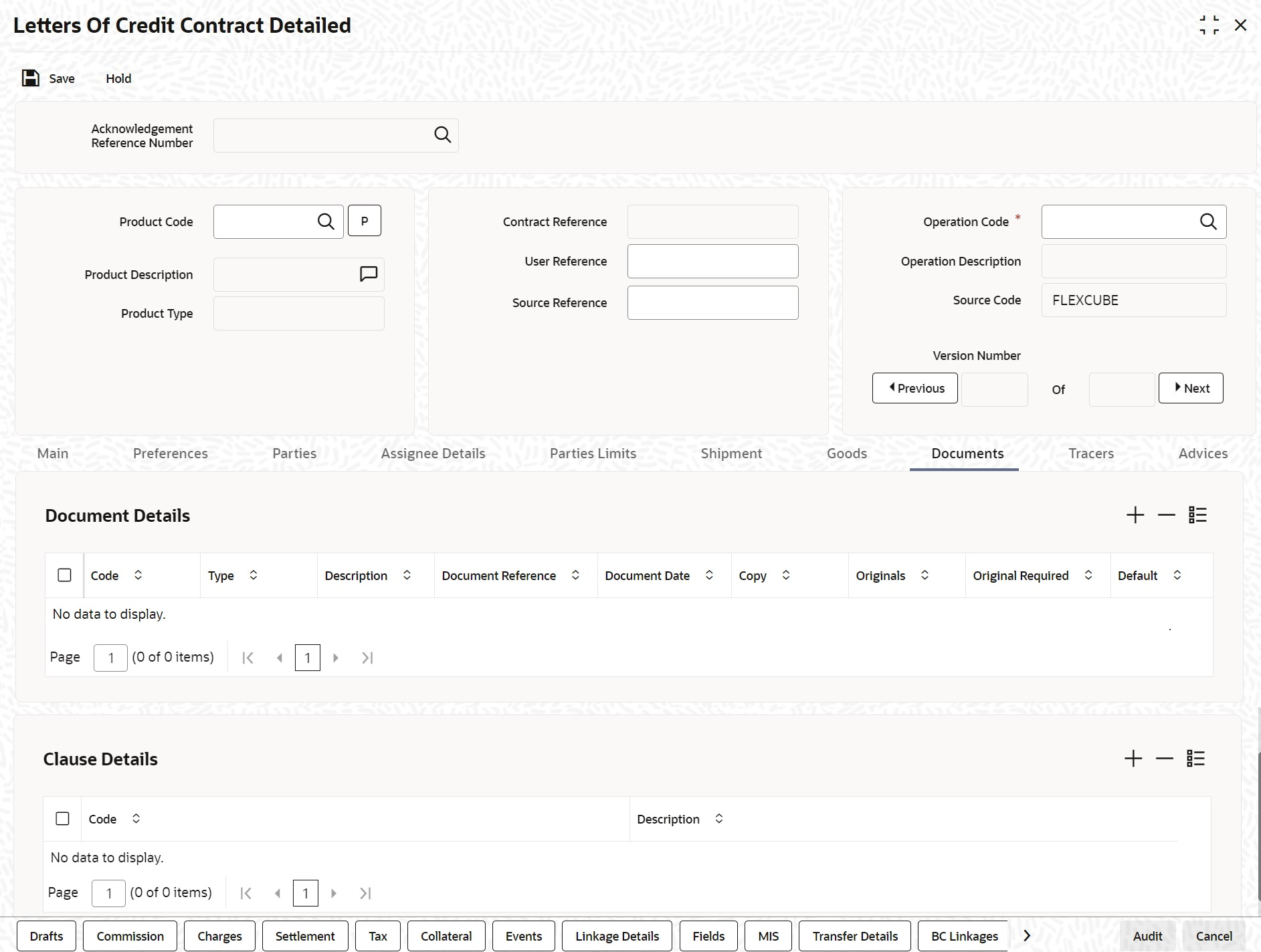

Check the total contract amount to match with the total goods value during contract amendment. - On the Letters of Credit Contract Detailed screen, click the Documents tab.The Document Details is displayed.

Note:

There are some standard documents required under a documentary LC. In this screen, you can specify the documents that are required under the LC being processed. - On the Documents tab, specify the fields, and click Ok.

All the documents specified for the product to which the LC is linked is defaulted to this screen.

For more description on fields, refer the Field Description table given below:Note:

These details will be a part of the LC instrument sent to the advising bank, the advice through bank or the beneficiary.Validation for Shipping Guarantee:Table 4-13 Documents - Field Description

Field Description Code Enter the document code. This field is optional.

Type Enter the document type This field is optional.

Description Enter the document description of the document that is defaulted to suit the LC you are processing. This field is optional.

Reference Enter the document reference number based on which the Shipping Guarantee issued. This field is optional.

Copy Enter the number of copies of the document. This field is optional.

Originals Enter the number of Original documents here. This field is optional.

Original Required Select Original Required check box if original document is required.

You can add to or delete from the list of documents that are defaulted. To add a document for the LC, click add icon and then on option list positioned next to the Code field. Select the code of the appropriate document from the list of document codes maintained in the Documents Maintenance screen. The other details of the document will be defaulted to this screen.

To delete a document that is not required for the LC, highlight the document code and click on the delete icon. Type the price per unit.

This field is optional.Clauses Details In addition to the other details, the clauses specified for a document while defining the product, are also defaulted to this screen. This field is optional.

Code When you highlight a document code, all the clauses defined for the document are displayed in the Clauses window. You can add to or delete from, the list of clauses that are defaulted. To add a clause to a document for the LC, click add icon. Then, click adjoining option list. Select the code of the applicable clause from the list of clause codes maintained, in the Clause Maintenance screen. This field is optional.

Description By default, you can view the description of the clause code based on the clause code that you have selected. This field is optional.Note:

To delete a clause that is not required for the LC, highlight the Clause code and click delete icon.If No document is attached in the document section, then override message ‘Bill of Lading document to be attached for Shipping Guarantee’ should get displayed while saving the contract.

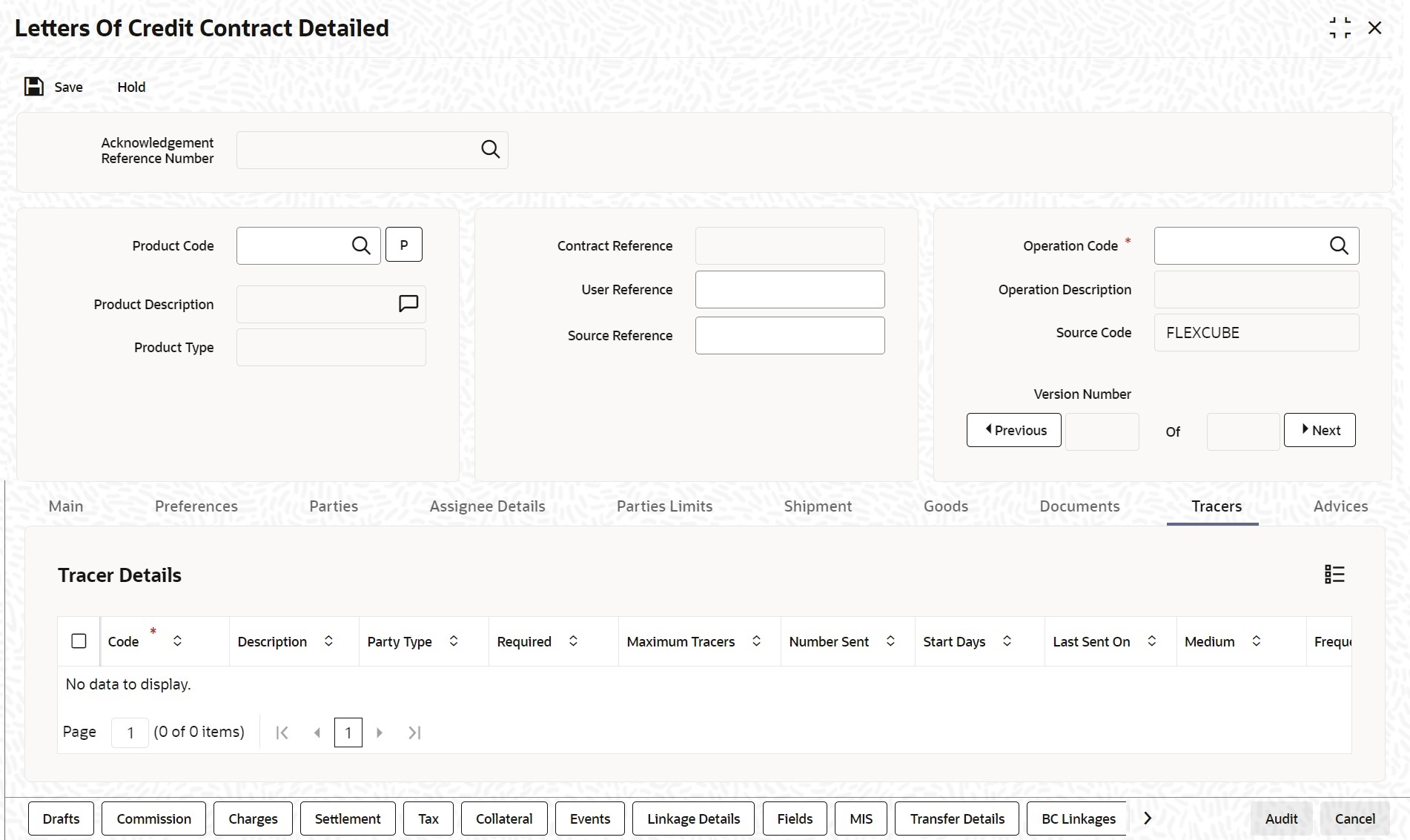

If document is attached but none of them are bill of lading type document in the document section, override message ‘Bill of Lading document to be attached for Shipping Guarantee’ should get displayed while saving the contract. If multiple documents are attached in that at least one document belongs to Bill of lading type, then above-mentioned override message should not get displayed while saving the contract. - On the Letters of Credit Contract Detailed screen, click the Tracers tab.The Tracer Details is displayed.The list of tracers that you can send for an LC is predefined (hard coded in the system) and can be classified into the following types:

Note:

Tracers are reminders that can be sent to various parties involved in an LC.- The acknowledgement tracer (sent to the advising bank when an import LC is issued and an acknowledgement is sought

- The charge-commission tracer (sent to the party who has to bear the commission or charges for an LC, pending the payment of the charge or commission)

- The confirmation tracer (sent to the confirming bank, seeking a letter of confirmation).

- On the Tracer tab, specify the fields, and click Ok.By default, you can view the tracers specified for an LC.For more description on fields, refer the Field Description table given below:

Table 4-14 Tracers - Field Description

Field Description Code For the tracer code that is highlighted, the details are defaulted from the product and can be changed to suit the LC you are processing.

This field is mandatory.Description Enter the document description of the document that is defaulted to suit the LC you are processing.

This field is optional.Party Type Enter the document reference number based on which the Shipping Guarantee issued.

This field is optional.Required You can stop the generation of a tracer at any point during the life cycle of an LC contract.

For instance, you had specified that an acknowledgement tracer is to be generated for a contract. When you receive the acknowledgement from the concerned party, you can disable its generation. At a later stage when you wish to generate the tracer again, you only need to enable it for the LC by using this facility.

If this box is checked, it means that the tracer should be applied for all new LCs involving the product. If not, it means that it should not be applied for new LCs involving the product. Amen If for some reason you want to stop generating the tracer for a product, uncheck this box through the product modification operation. The tracer will not be generated for new LCs involving the product.

This field is optional.Maximum Tracers You can specify the maximum number of tracers that should be sent for the LC. The value is defaulted from the product under which you are processing the LC.

This field is optional.Number Sent Number of tracers sent to the party. This field is optional.

Start Date The tracers that you specify for an LC can be generated only after it has been authorized. Specify the default number of days that should elapse after an LC has been authorized, on which the first tracer should be sent.

By default, the first tracer for an authorized LC contract will be sent, after the number of days prescribed for the product under which it is processed.

This field is optional.Last Sent On Date on which the tracer was last sent to the party.

This field is optional.Medium If you have specified that tracers should be generated for an LC, you should also specify the medium through which it is to be generated. A tracer for an LC can be sent through Mail, Telex or other compatible media.

This field is optional.Frequency You can specify the frequency (in days) with which the tracer should be re-sent, for the LC you are processing.

This field is optional.Template ID Specify the template ID for the SWIFT message type.

If the medium is SWIFT, then the system will generate the tracers in the SWIFT MT799 format based on the template ID mentioned at the LC Contract level for populating the tag 79.

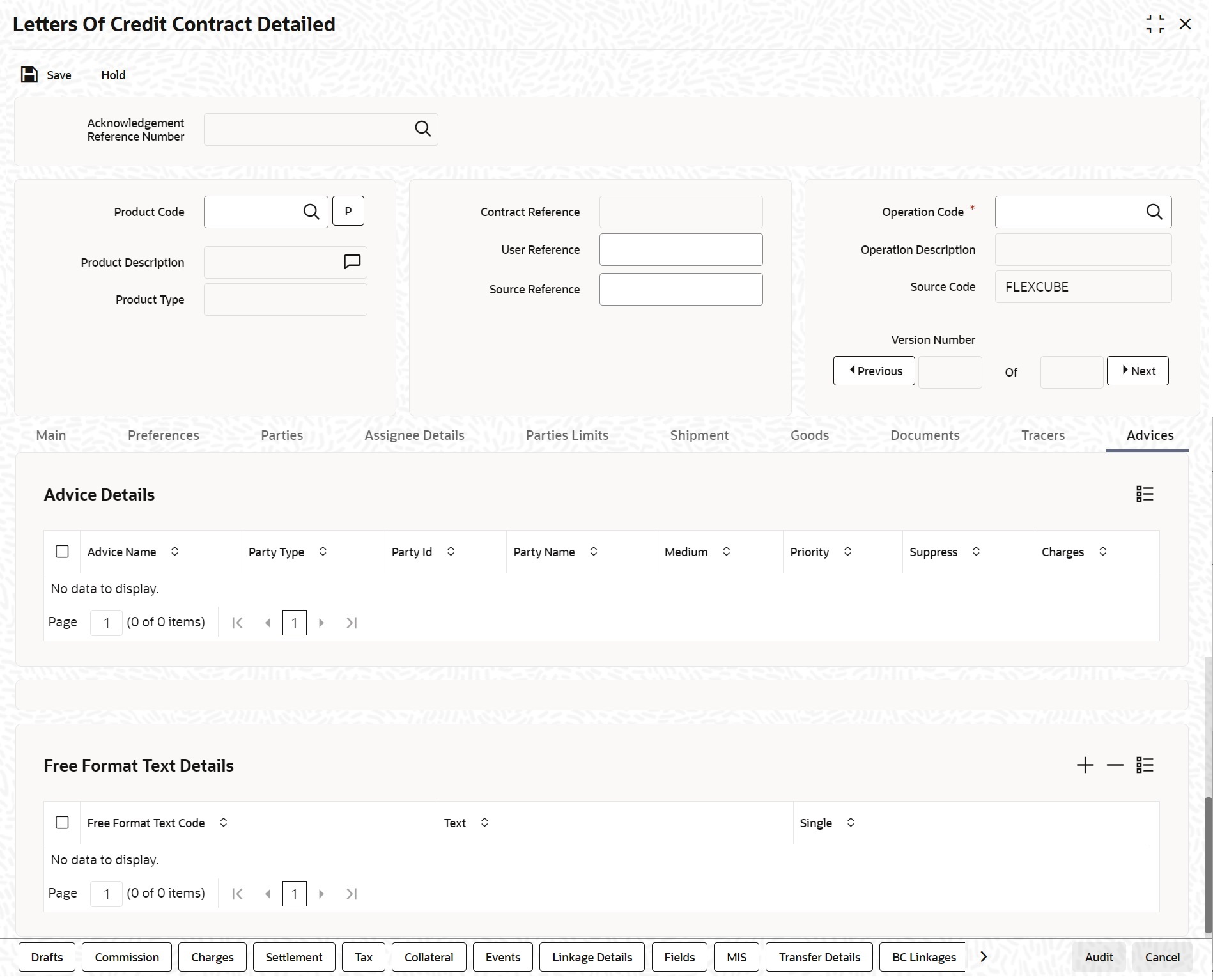

This field is optional. - On the Letters of Credit Contract Detailed screen, click the Advices tab.The Advices Details for an event is displayed.The advices that can be generated for the events that occur during the lifecycle of an LC are defined for the product, to which the LC is linked. For example, you may have specified the following advices for a product:

- Issue of an import LC: pre-advice by SWIFT and LC instrument by mail to the advising bank, the authorization to reimburse to the reimbursing bank.

- Advice of an export LC: the acknowledgement advice to the advising bank.

- On the Advices tab, specify the fields, and click Ok.The party type to whom a specific advice must be sent is picked up automatically based on the type of LC being processed and the parties involved. For more description on fields, refer the Field Description table given below:

Table 4-15 Advices - Field Description

Field Description Advice Name Specify the advice name. This field is optional.

Party Type The system displays the party type for which the message is generated. This field is optional.

Party Id The system displays the Party ID for which the message is generated. This field is optional.

Party Name The system displays the name of the party for which the advice is generated. This field is optional.

Medium The medium by which an advice will be transmitted and the corresponding address will be picked up based on the media and address maintenance for a customer. You can, however, change either of these while processing the LC. Typically, if changed, both of them will be changed.

After selecting the advices to be generated for the LC, click on Ok to save it. Click Exit or ‘Cancel’ button to reject the inputs you have made. In either case, you will be taken to the Contract Main screen.

This field is optional.Priority For a payment message by SWIFT, you also have the option to change the priority of the message. By default, the priority of all advices is marked as Normal. The priority of a payment message can be changed to one of the following: - Low

- Medium

- High

Suppress By default, all the advices that have been defined for a product will be generated for the LCs involving it. If any of the advices are not applicable to the LC you are processing, you can suppress its generation by Checking against the suppress field. This field is optional.

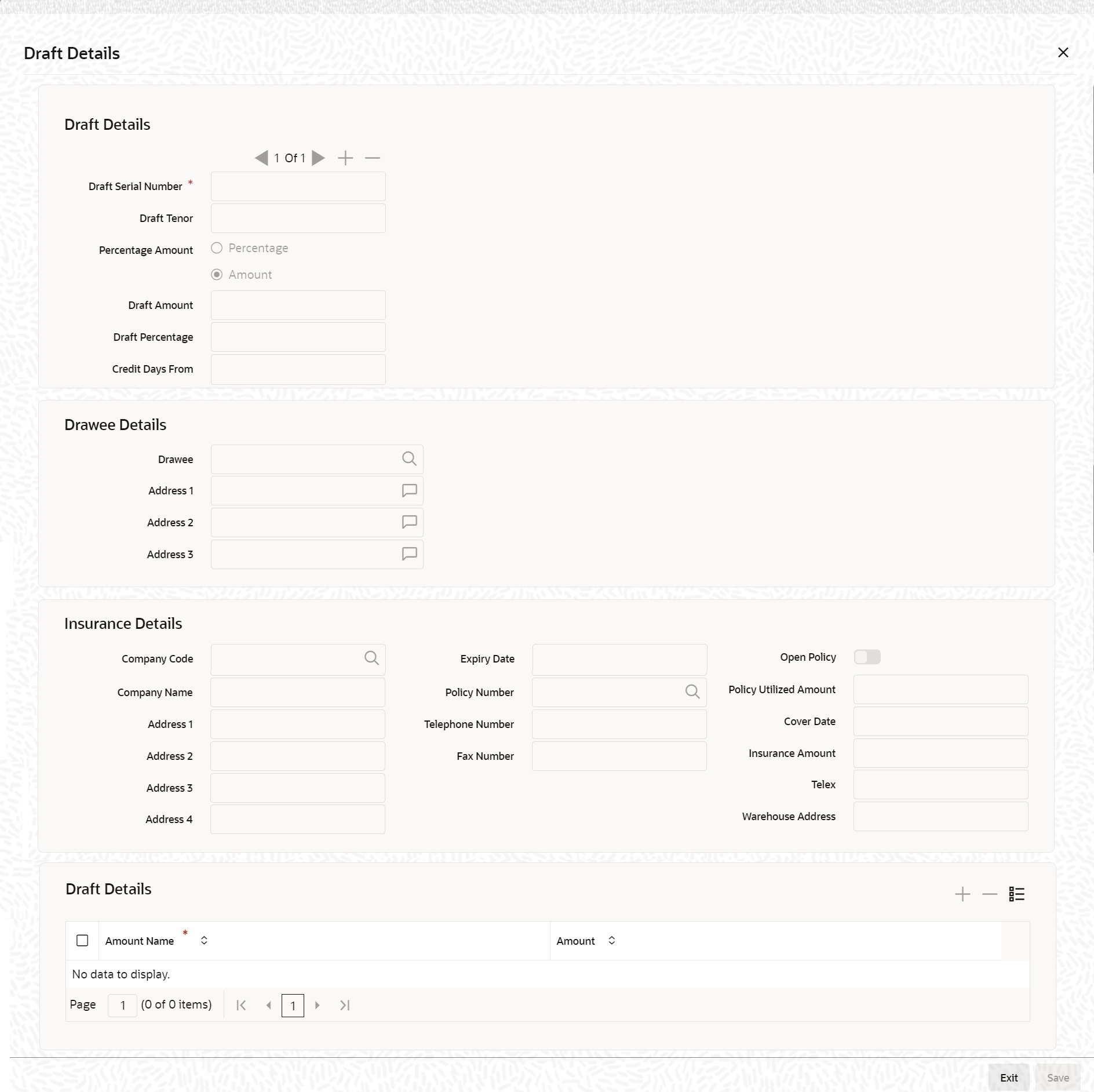

Charges The system displays the charges configured. This field is optional.