9.7 Guarantee Claim Settlement

This topic describes the procedure to settle guarantee claims.

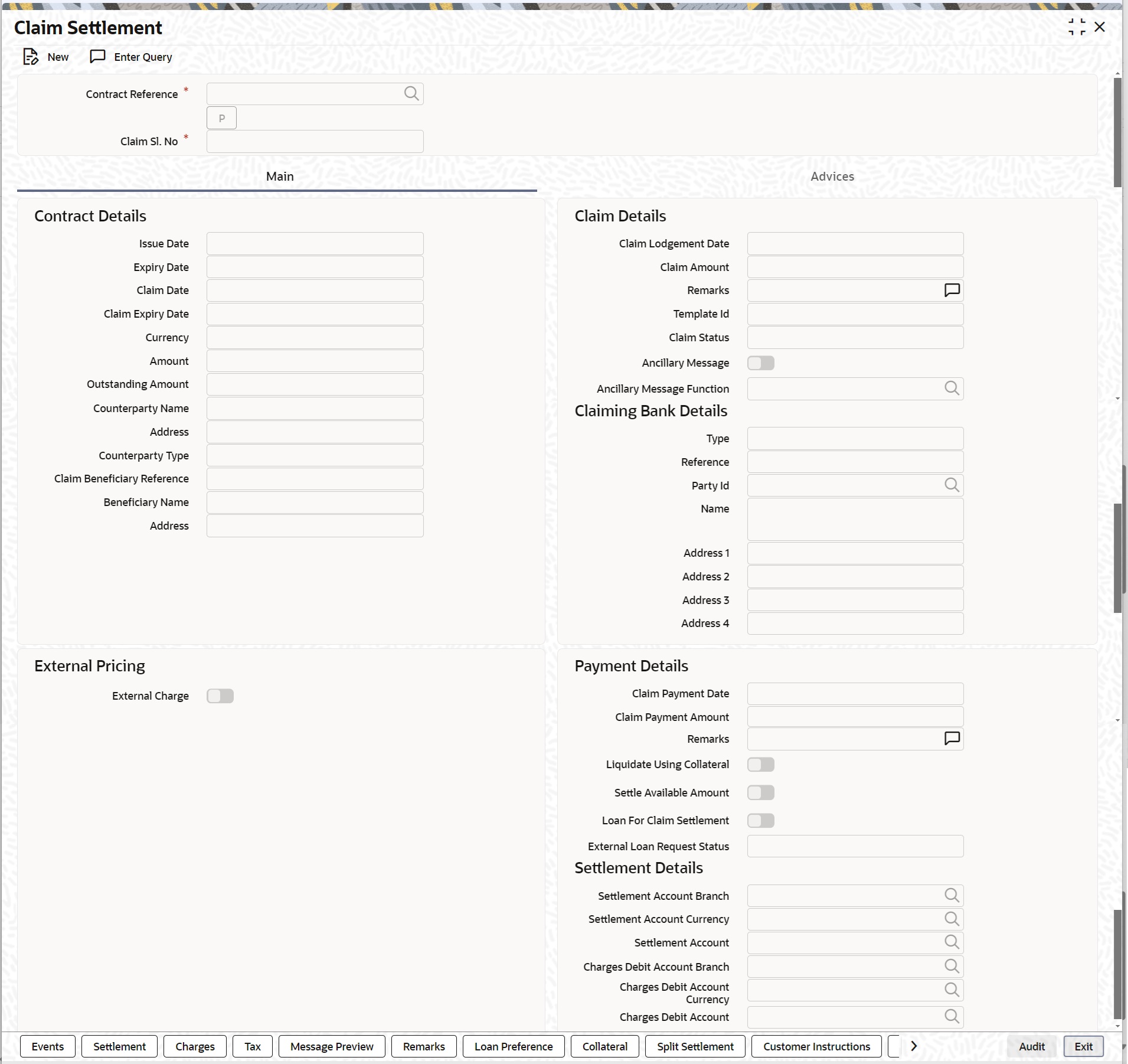

- On the Homepage, type LCDGCLP in the text box, and click next arrow. The Claim Settlement screen is displayed.

- On the Claim Settlement screen, click New. The Claim Settlement screen is displayed with no details.For more information on fields, refer the Field Description table.

Note:

Specify the claim settlement details.Table 9-39 Claim Settlement - Field Description

Field Description Contract Reference Specify the Guarantee Contract Reference against which the claim is received by the bank and settlement needs to be done. Select the contract reference from the drop-down list. The list displays only claims for which the status is Lodged. Click Populate P button to generate the contract details.

This field is mandatory.Claim Serial No Specify the claim serial no. for which settlement needs to be done. System validates that the entered unsettled claim is as per the sequential order of lodgement and status of the claim is Lodged.

This field is mandatory.Issue Date Date on which the guarantee is issued Expiry Date Date of expiry of the guarantee Claim Date Date for claiming the guarantee Claim Expiry Date End date for settling the claim Currency Currency of the guarantee Amount Amount of the guarantee Outstanding Amount The system displays the outstanding amount of the guarantee by default. Applicant Name The system defaults the applicant name Address Address of the counterparty. Counterparty Type Party type of the counterparty Counterparty Reference Reference Number of the counterparty. Beneficiary Name Name of the beneficiary. Address Specify the address of the beneficiary. Claim Details Specify the claim details: - Click Save. The Claim Settlement details are saved.

- Click Main tab. The Main details are displayed.

For more information on the fields, refer the following table.

Table 9-40 Main - Field Description

Field Description Issue Date Date on which the guarantee is issued The system displays the Issue Date by default. Expiry Date Date of expiry of the guarantee The system displays the Expiry Date by default. Claim Date Date for claiming the guarantee The system displays the Claim Date by default. Claim Expiry Date End date for settling the claim The system displays the Claim Expiry Date by default. Currency Currency of the guarantee The system displays the Currency by default. Amount Amount of the guarantee The system displays the Amount by default. Outstanding Amount The system displays the outstanding amount of the guarantee by default. Counterparty Name The system displays the counterparty name. Address Address of the counterparty. The system displays the counterparty address. Counterparty Type Party type of the counterparty The system displays the counterparty type. Counterparty Reference Reference Number of the counterparty. The system displays the counterparty reference by default. Beneficiary Name Name of the beneficiary. The system displays the beneficiary name by default. Address Specify the address of the beneficiary. The system displays the address of the beneficiary. by default Claim Details Specify the claim details: Claim Lodgement Date The system displays the claim lodgement date by default. Claim Amount The system displays the claim amount by default. Remarks Specify remarks if any in the text box and click Ok. Template Id Select the template ID from the option. list. Template ID is applicable only when the party type is applicant bank or issuing bank. Template ID is applicable only if SWIFT 2018 is enabled. Note:

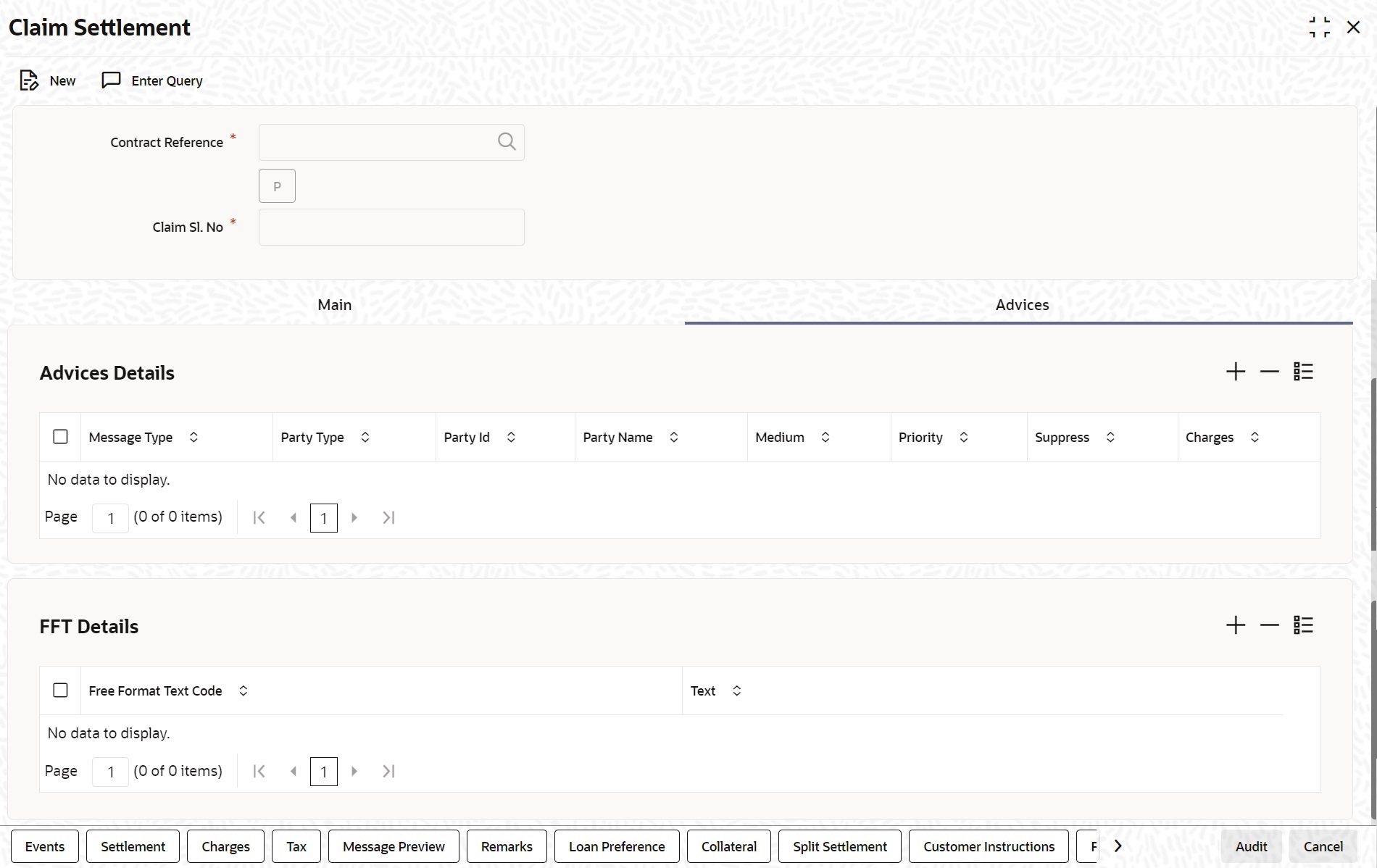

The claim message is generated only if the template is selected.Claim Status The status of the claim is displayed here. Ancillary Message Check this box to generate MT 759 on contract authorization. Ancillary Message Function Specify the ancillary message function. Alternatively, you can select the ancillary message from the option list. The list displays all valid options maintained in the system. Ancillary Message Function is mandatory if Ancillary Message is checked. Payment Details Specify the payment details: Claim Payment Date The system displays the claim payment date by default. Claim Payment Amount The system displays the claim payment amount by default. Remarks Specify remarks, if any. Liquidate using Collateral Check this box to indicate if the collateral needs to be utilized for the settlement of the claim. Settle Available Amount Check this option to debit the available amount from applicant and then create loan for the remaining amount during claim settlement. Settle Available Amount can be selected only when you select the Loan for Claim Settlement, else the system will validate the same. Loan for Claim Settlement System defaults the value maintained at product level. You can check/un-check this box to indicate that loan needs to be created or not for this claim settlement. External Loan Request Status The system displays the external loan request status. Claiming Bank Details Display Claiming Bank Details – Based on the details provided in LCDGCLM screen this section will be populated. It is not editable section (only view). Type Displays the Claiming Bank Party Type. Reference Displays the Claiming Bank Party Reference. Party Id Displays the Claiming Bank Party ID. Name Displays the Claiming Bank Party Name. Address 1 Displays the Claiming Bank Party Address 1. Address 2 Displays the Claiming Bank Party Address 2. Address 3 Displays the Claiming Bank Party Address 3. Address 4 Displays the Claiming Bank Party Address 4. Settlement Details Specify the settlement details: Settlement Account Branch The system displays the settlement account branch on selection of the debit account number: Settlement Account Currency The system displays the settlement account currency on selection of the debit account number. Settlement Account The system displays the settlement account details. Charges Debit Account Branch The system displays the charges debit account branch on selection of the charges debit account number. Charges Debit Account Currency The system displays the charges debit account currency on selection of the charges debit account number. Charges Debit Account The system displays the charge debit account details. External Pricing Specify the External Pricing details. External Charge Check this box to indicate that external charges can be fetched from external pricing and billing engine for contracts created under this product. External Charge is enabled only when the system integrates with external pricing and billing engine (PRICING_INTEGRATION = Y at CSTB_PARAM level). - On the Claim Settlement screen, click Advices tab. The Advices is displayed.For more information on the fields, refer the Field Description table given below:

Note:

The system displays the advises in the following fields:Table 9-41 Advices - Field Description

Field Description Message Type System displays the message type of the

message/advice generated.

This field is optional.Party Type System displays the party type for which the message/advice is generated.

This field is optional.Party ID System displays the party id for which the message/advice is generated.

This field is optional.Party Name System displays the party name for which the message/advice is generated.

This field is optional.Medium System defaults the medium in which the message has to be sent for the party. You can modify this.

This field is optional.Priority System defaults the priority value of sending the message maintained at product level. You can modify this.

This field is optional.Suppress Check this box to suppress the message.

This field is optional.Charges System displays the charges for the claim.

This field is optional.FFT Details Specify the FFT Details: Free Format Text Code Specify the free format text code.

This field is optional.Text Specify the free format text here.

The details for the following subsystems are defaulted from Guarantee/SBLC contract level.- Event Details

- Settlement Details

- Charge Details

- Tax Details

- Message Preview

- Remarks

- Loan Preferences

- Collateral Details

- Split Settlement

Accounting entries are posted for below:- Reversal Contingent entries are not applicable for issuance

- Collateral Utilization

- Adjustment from Customer Account

- Loan Creation

- Guarantee claim advice GUA_CLAIM_ADV/MT799 is generated during claim lodgement.

- MT202 / Payment Advice is generated on Claim Settlement.

- Rejection advice GUA_CLAIM_REJ/MT799 is generated during claim rejection

- Guarantee advice /MT760 is generated during guarantee issuance.

- Guarantee amendment GUA_AMD_INSTR/MT767 is generated during amendment.

- If Ancillary Message is checked then Guarantee claim settlement advice GUA_PAY_ADV/MT759 is generated during claim Settlement if SWIFT 2018 is enabled.

- Guarantee claim settlement advice GUA_PAY_ADV/MT799 is generated during claim Settlement if SWIFT 2018 is enabled.

- On the Claim Settlement screen, click Hold button. You can hold the data entered. On hold of the contract, the status of the contract will be updated as Hold and the system will not do any mandatory validation on the data.

In auto-auth case, if hold is selected, then the contract will be in unauthorized status. System will not consider the contract which is on hold for any other processing. During EOD, system will not consider the records which are on hold as pending transactions.

Parent topic: Guarantees and Standby Letters of Credit