9.2 Guarantees and Standby Letters of Credit Contract Input

This topic provides the systematic instruction to process Guarantees and SBLC contract input details.

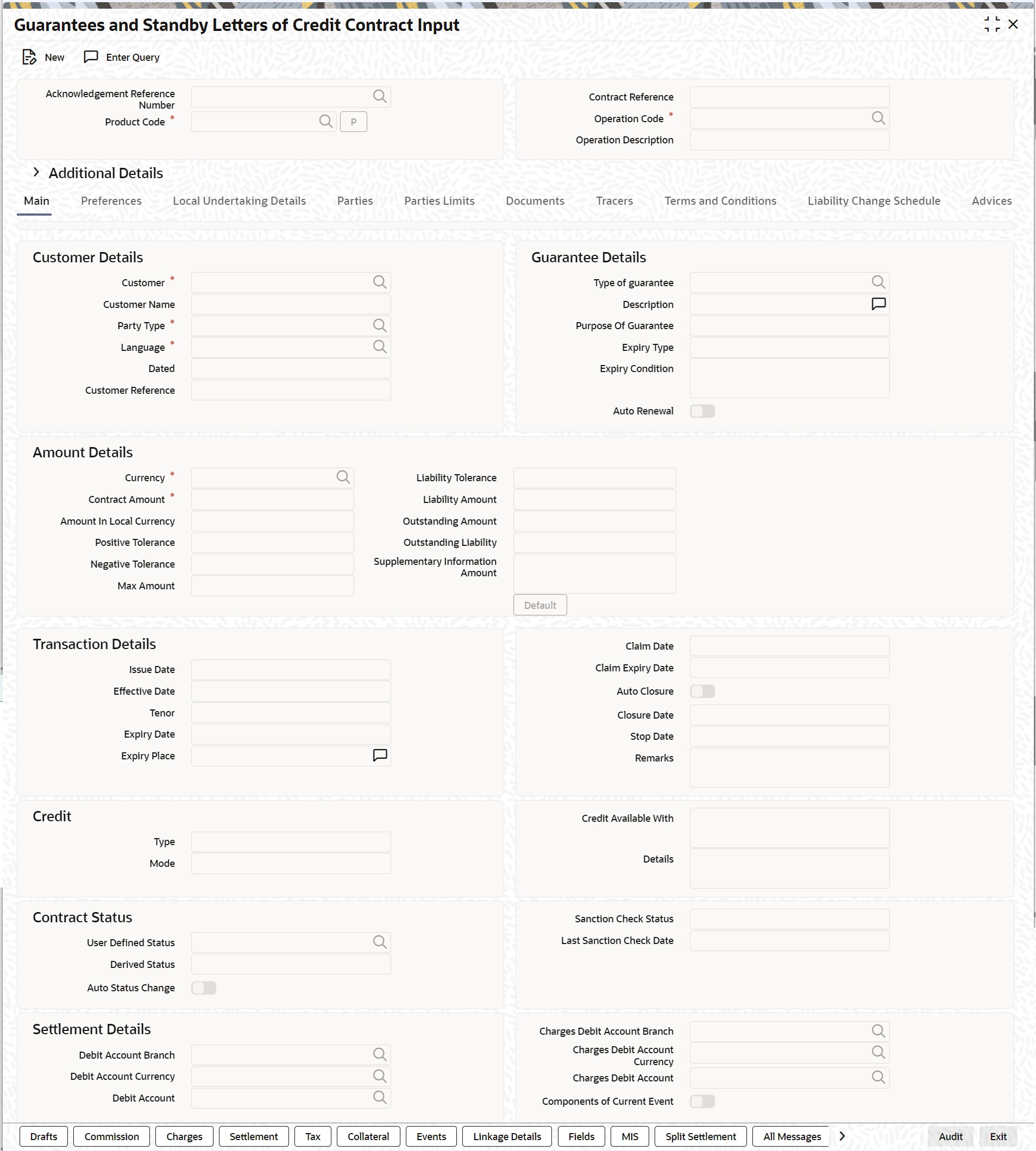

- On the Homepage, type LCDGUONL in the text box, and then click the next arrow.The Guarantees and Standby Letters of Credit Contract Input screen is displayed.

Figure 9-1 Guarantees and Standby Letters of Credit Contract Input

- On the Guarantees and Standby Letters of Credit Contract Input screen, click New.The Guarantees and Standby Letters of Credit Contract Input screen is displayed without any details.For more information on the fields, refer the Field Description table given below:

Note:

Select the Product Code and Operation Code from the option list and click on the Populate button.Table 9-1 Guarantees and Standby Letters of Credit Contract Input - Field Description

Field Description Acknowledgment Reference Number Specify the acknowledgment reference number or you can select the reference number from the option list. The list displays all the Guarantees and SBLCs related acknowledgement reference numbers. This field is optional.

Contract Reference The system displays the contract reference number. This field is optional.

Product Code Select the product code from the list of products created in the LC. Guarantees, Advice of Guarantees, SBLCs, Advice of SBLC Product codes are displayed in the option list. Click ‘Populate’ button for details of this product to get defaulted from the Product screen. This field is mandatory. Operation Code You can select operation code from the list of valid operation code value based on Product Type. The list displays the following options: - Advice

- Open

- Open and Confirm

- Advice and Confirm

Note:

Advice and Confirm is applicable for Guarantees if SWIFT 2019 is enabled. This field is mandatory.Operation Description The system displays the product description based on the operation code you select. Additional Details Enter the additional details: Product Description The system displays the product description. Source Code The system displays the source code. Source Reference This system displays the source reference number. Product Type The type of product gets displayed here from the product screen, specifying if the product is of type import/export or revolving or non-revolving. User Reference The system displays the contract reference number as user reference number. Version Number Specify the version number. The Guarantees and SBLC contract processes can be simulated only through gateway. The Guarantee Issuance Simulation does not have screen, so user cannot process the Guarantee Issuance Simulation from the application front. All operations are supported for Guarantee Issuance Simulation same as Guarantees and Standby Letters of Credit Contract Input screen.

This field is optional. - Specify the field details in the Main tab. For more information on the fields, refer the Field Description table given below.

Table 9-2 Main - Field Description

Field Description Customer Details Specify the Customer Details. Customer Specify the customer for which you need to maintain or select the customer from the option list. The list displays all valid customer numbers. This field is mandatory.Note:

BIC Code appears next to the Customer only if the BIC code is mapped with that customer number. If the BIC Code is not mapped with that customer number, then the BIC Code will not appear next to the Customer in the option list.Customer Name The system displays the customer name. Party Type Specify the party type of the customer who is the counter party of the Guarantee/SBLC. Alternatively, you can select the party type from the option list. The list displays all the valid party types maintained in the system. During amendment, add a new party type REB and save the amendment.

On Amendment initiation (AMNV) MT767 will be generated.

On confirmation, advices of Guarantee and StandbyLC contract input screen (LCDGUONL) should list the message MT740. On confirmation authorization, MT740 should be processed and generated.

During amendment confirmation of SBLC contract for which REB already exists and the REB party id has been amendment in this amendment, on confirmation advices of LCDGUONL should list the messages MT740 and MT747 along with the amendment message, and those will be processed and generated on authorization. MT740 will be generated with new party id as receiver and MT747 will be generated with old party id as a receiver.During amendment confirmation of SBLC contract for which REB is deleted, on confirmation advices of LCDGUONL should list the messages MT747 along with MT767 message and those will be processed and generated on authorization. MT740 should be automatically suppressed.

LIB will be a party in Counter Guarantee if purpose of guarantee to be request.

Counter Guarantee Issuing Bank will be captured as APB if purpose of guarantee is selected as Issue.

This field is mandatory.Language Specify the language to be used for Guarantees/SBLC. You can select the language from the option list. The list displays all valid language codes. This field is mandatory.

Dated Enter the date of the customer reference. This would normally be the date on which you have a correspondence from the party regarding the Guarantees/SBLC. This field is optional.

Customer Reference Specify the customer reference number. This field is optional.

Guarantee Details Specify the Guarantee Details. Type of guarantee Select the guarantee type from the option list. This is maintained using static type maintenance screen. This field is optional.

Description The system displays the guarantee description based on the type of guarantee you select. This field is optional.

Purpose of Guarantee If the LC that you are processing is a guarantee you should specify the purpose of guarantee. Click the drop-down list and select one of the following values: - Issue

- Request

Expiry Type Select the type of validity from the list provided. The list is as follows: - Fixed

- Open

- Conditional - With Expiry

- Conditional - Without Expiry

Expiry Condition Specify the details for conditional guarantee. This field is optional.

Auto Renewal This flag specifies if the Open ended guarantee is to be auto renewed on EOD. Amount Details Specify the Amount Details: Currency Specify the currency of the transaction. Alternatively, you can select the currency from the option list. The list displays all valid currencies maintained in the system. This field is mandatory.

Contract Amount Specify the amount for which the Guarantee and SBLC is drawn. This field is mandatory.

Amount in Local Currency When FCY amount is given in 'Contract Amount' field for Guarantee, system converts in local currency and respective value is displayed in this screen. This field is mandatory for FCY contracts Positive Tolerance It indicates the increment, expressed as a percentage that must be made to the amount of a letter of credit, to arrive at the Maximum LC Amount. This field is optional.

Negative Tolerance It indicates the reduction, expressed as a percentage that must be made to the amount of a letter of credit, to arrive at the Minimum LC Amount. This field is optional.

Max Amount Maximum contract amount will be defaulted. This is the sum of contract amount and (%(tolerant) of contract amount). This field is optional.

Liability Tolerance The liability percentage is used to track the maximum LC amount against a given percentage. A bank would like to limit its exposure to a new or existing customer as LC is a commitment given by the bank. Although the bank sanctions an LC limit (maximum LC amount which includes tolerance) to a customer it may like to specify a percentage over and above this limit. This will result in the customer being shown to be liable or tracked for a higher amount. Specifying a liability percentage is from the perspective of risk management and provides cushion to the bank. This field is optional.

Liability Amount Based on the value you specify in Revolves In field, the LC Liability Amount will be computed and displayed. This field is mandatory.

Outstanding Amount The balance amount available after the availment of Guarantee/SBLC is displayed here. This field is mandatory.

Outstanding Liability The system displays the liability amount. Supplementary Information Amount This field specifies the supplementary information about amount related to the undertaking. Default Click the Default button. The following details will be defaulted:

Issue Date will be defaulted to application date and Effective Date will be defaulted to issue date. If you accept the overrides, you can modify the defaulted details.

The tenor for Open ended/Conditional Without Expiry Guarantees/Standby LCs will default with 3 years and Open ended/Conditional Without Expiry counter guarantees with 3 years 30 days and

corresponding local guarantee with 3 years. For Open ended guarantee under URDG Applicable rule, the defaulted expiry date cannot be modified. In other cases, if you accept the overrides, you can modify the defaulted details.The system displays Liability Amount, Max Amount, Tenor, Expiry Date, Claim Expiry Date, Closure Date, Stop Date by default. .

Transaction Details Specify the transaction details: Issue Date Specify the issue date using the calendar icon. This field is optional.

Effective Date Specify the effective date using the calendar. This field is optional.

Tenor Specify the tenor of the contract. This field is optional.

Expiry Date Specify the date on which the Guarantee/SBLC contract expires from the calendar. This field is optional.

Expiry Place Specify the expiry place in the text box and click Ok. Note:

The typed text is displayed against the expiry place.Claim Date Select the claim date from the calendar. Claim date indicates the date by which all claims needs to be lodged for the guarantee. Claim Date should be on or before Claim Expiry Date. This field is optional.

Claim Expiry Date Select the claim expiry date from the calendar. Claim expiry date indicates the date by which all claims lodged need to be settled. Claim Expiry Date = Expiry Date + Claim Days.

System defaults Claim Expiry date as Expiry Date + Claim Days on Product default. If Claim Days is zero, Claim Expiry date will be Expiry Date. Claim Expiry Date can be modified. On Save, system will validate the following:- Claim Expiry Date cannot be before Claim Date

- Claim Expiry Date can be on or after Guarantee Expiry Date

- Claim Expiry Date should not be after Closure Date

This field is optional.Note:

The Commission is computed till Claim Expiry Date. During Guarantee Issuance Claim Expiry Date is considered to validate Limit Line expiry date.Auto Closure Check this option to indicate that the Guarantee/SBLC should be automatically closed. This field is optional.

Closure Date The date of closure is based on the Closure Days maintained for the product involved in the Guarantees/SBLC. The number of days specified as the Closure Days is calculated from the expiry date of the Guarantee/SBLC, to arrive at the Closure Date. Closure Date = Expiry Date + Closure Days

This field is optional.Stop Date This date will be defaulted to Claim Expiry date. Stop date cannot be earlier than Issue date and later than claim expiry date. Stop date will default from the main tab to commission sub system. This field is optional.

Remarks Specify remarks, if any. This field is optional.

Credit Specify the credit details: Type Select the type from the drop-down list. The available option are - Straight

- Negotiable

Mode Select the mode from the drop-down list. The available option are - Sight Payment

- Acceptance

- Deferred Payment

- Mixed Payment

- Negotiable

Credit Available With Specify the credit available with in the text box and click Ok. Note:

The typed text is displayed against the Credit Available With field.Details Specify the details in the text box and click Ok. Note:

The typed text is displayed against the details field.Contract Status Specify the Contract Status details. User Defined Status Specify the status of the Guarantee/SBLC contract. The option list displays all valid statuses that are applicable. Choose the appropriate one. This field is optional.

Derived Status The system displays the derived status of the Guarantee/SBLC contract. You cannot modify this. This field is optional.

Auto Status Change The system defaults the status of the check box based on the product maintenance. However, you can modify this. If you check this box, the system picks up the contract during EOD operations for status processing. If you do not check this, the system will not consider the Guarantee/SBLC contract for automatic status processing. This field is optional.

Sanction Check Status The system displays the sanction check status. The statuses can be any of following: - P- Pending

- X- Pending

- A-Approved

- R- Rejected

- N- Not Required

Last Sanction Check Date The system displays the last sanction check date. This field is optional.

Settlement Details Specify the Settlement Details. Debit Account Branch Specify the debit account branch. Select the debit account branch from the option list. The list displays all valid values. This field is optional.

Debit Account Currency Specify the debit account currency. Select the currency from the option list. The list displays all valid values. This field is optional.

Debit Account Specify the debit account. Select debit account from the option list. The list display all valid values. This field is optional.

Charges Debit Account Branch Specify the charges debit account branch. Select the charges debit account branch from the option list. The list displays all valid values. This field is optional.

Charges Debit Account Currency Specify charges debit account currency. Select charges debit account currency from the option list. The list displays all valid values. This field is optional.

Charges Debit Account Specify the charges debit account. Select charges debit account from the option list. The list displays all valid values. This field is optional.

Components of Current Event System enhanced to show the amount tags pertaining to the current event in settlement screen for LC contracts. - During settlement pickup of LC contract input screen, current value of components of current event on contract input screen is considered to show the amount tags in ‘Settlements’ screen.

- If the flag is checked at contract input screen, the amount tags pertaining only to the current event will be available in settlement screen with ‘Current event’ checked.

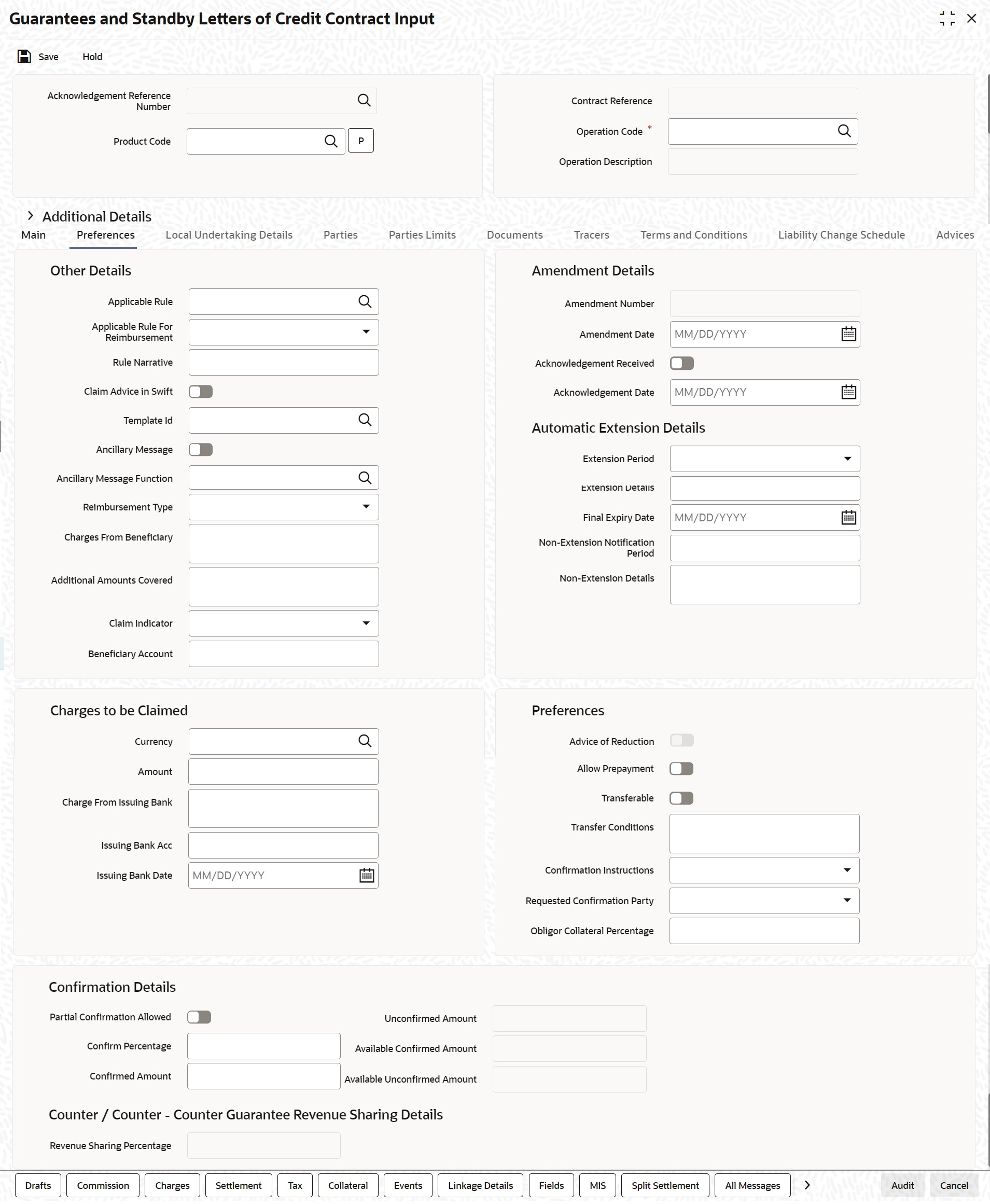

- On the Guarantees and Standby Letters of Credit Contract Input, click the Preferences tab.The preferences details is displayed. For more information on the fields, refer to the Field Description table given below:

Table 9-3 Preferences

Field Description Other Details Specify the Other Details. Applicable Rule The system defaults the applicable rule for the product type. However, you can modify this. This field is optional.Note:

Please refer to the section Specifying the Applicable Rules under topic Defining Product Attributes in this user manual.Applicable Rule For Reimbursement Select the applicable rule for reimbursement from the drop-down list.

The available options are- URR Latest Version

- Not URR

Reimbursement Type Select the reimbursement type from the drop-down list.

The available options are- Ours

- Claimants

Rule Narrative This is enabled only if Applicable Rule is set to OTHR. It is mandatory to specify the rule narrative if the applicable rule is OTHR.

This field is optional.Claim Advice in Swift Check this box to generate the charge claim advice in MT799 SWIFT format.

This field is optional.Template Id Specify the template ID related to MT799 message types from the option list.

This field is optional.Ancillary Message Check this box to generate MT 759 on contract authorization.

This field is optional.Ancillary Message Function Specify the ancillary message function. Select the ancillary message from the option list. The list displays all valid options maintained in the

system. Ancillary Message Function is mandatory if Ancillary Message is checked.

This field is optional.Reimbursement Type Select the Reimbursement Type from the drop-down list. The available options are - Ours

- Claimants

Charges From Beneficiary Specify the charge amount borne by the beneficiary.

This field is optional.Additional Amounts Covered Specify the additional amount covered.

This field is optional.Claim Indicator Select the indicator for claim from the drop-down list. The list displays the following options: - Multiple demands not permitted

- Multiple and partial demands not permitted

- Partial demands not permitted

Beneficiary Account Specify the account details of beneficiary.

This field is read only.Amendment Details Provide the Amendment Details. Amendment Number The system displays the amendment number.

This field is optional.Amendment Date Specify the amendment date from the calendar icon.

This field is optional.Acknowledgement Received Check this box to indicate that the acknowledgment has received.

This field is optional.Acknowledgement Date Specify the date on which the acknowledgement is received.

This field is optional.Automatic Extension Details The balance amount available after the availment of Guarantee/SBLC is displayed here.

This field is optional.Extension Period Select the extension period. You can select one of the following options: - Days

- One Year

- Others

Extension Details Specify the extension details. Extension Details is mandatory when Period is Days/Others.

This field is optional.Final Expiry Date Select the final expiry date for automatic extension from the calendar. This date indicates the final expiry date after which undertaking will no longer be subject to automatic extension.

This field is optional.Non-Extension Notification Period Specify the non-extension notification period. Notification Period will be minimum number of calendar days prior to the current expiry date. This indicates period by which notice of non-extension must be sent.

This field is optional.Non-Extension Details Specify the non-extension details. Non-extension details are applicable only when notification period is provided.

This field is optional.Charges to be Claimed Specify the charges to be claimed.

Currency Specify the currency in which the charges attributed to the issuing bank is expressed.

This field is optional.Amount Specify the charge amount.

This field is optional.Charge From Issuing Bank Give a brief description of the charge.

This field is optional.Issuing Bank Account Specify the account from which charge should be collected.

This field is optional.Issuing Bank Date Specify the date of charge collection.

This field is optional.Preferences Specify preferences details: Advice of Reduction The system displays the value for Advice of Reduction (MT 769) message.

This field is optional.Allow Prepayment Check this option to indicate that the customer can make a prepayment on the contract.

This field is optional.Transferable Check this box to indicate that the Guarantee/SBLC is transferable. Guarantee/SBLC can be transferred only if SWIFT 2019 is enabled.

This field is optional.Transfer Conditions Specify the transfer conditions for the Guarantee/SBLC transfer.

This field is optional.Confirmation Instructions Select the confirmation instructions from the drop-down list. The available options are:

- May Confirm

- Confirm

This field is optional.

Requested Confirmation Party Select the confirmation party type. You can select one of the following messages:

- Advising Bank

- Advise Through Bank

- Confirming Bank

Obligor Collateral Percentage Specify the Obligor collateral percentage. If Obligor Collateral Percentage is provided, system will collect the collateral partially from Applicant and Obligor Party depending on the percentage provided. Else system will collect the entire collateral from Applicant.

This field is optional.Revenue Sharing Percentage Specify the Revenue sharing percentage maintained at TF customer level for CO-BANK.

Partial Confirmation Allowed Select Partial Confirmation Allowed check box to confirm the partial amount. The remaining amount can be confirmed after you receive the approval from the external agent.

Confirm Percentage Specify the percentage of Contract Amount to be confirmed. If percentage is not specified, the system will calculate the percentage based on the confirm Amount specified.

This field is optional.Confirmed Amount Specify the amount to be confirmed. If Confirm Amount is not specified, the system will calculate the confirmed amount based on the Confirm Percentage specified.

If both Confirm Amount and Confirm Percent are specified then the system will display an override message as “Both Confirm Amount and Confirm Percent are entered. Confirm Percent is considered for calculation.”

The system will calculate and display the Confirm Amount based on the confirm percentage specified. Confirm Percentage and Confirm Amount can be changed or recalculated either on save or on pressing Default Button available in Main tab of Guarantee Contract Online screen.

The system will display an error message for the following conditions:- If Partial Confirmation Allowed check box is unchecked and if you specify the value Confirmation Percentage and Confirmation Amount fields.

- If the value of the amount confirmed is greater than the unconfirmed unavailed amount.

- If the value of the confirm amount is lower than the availed confirmed amount.

- If Operation is confirm or advice and confirm and confirm percent is greater than 100 or confirm Amount is greater than Guarantee current availability.

Unconfirmed Amount The system displays the current maximum unconfirmed Guarantee amount. This amount is derived by deducting the confirmed amount from the maximum Guarantee amount.

This field is optional.Available Confirmed Amount The system displays the available confirmed portion of the maximum Guarantee amount.

This field is optional.Available Unconfirmed Amount The system displays the available unconfirmed portion of the maximum Guarantee amount.

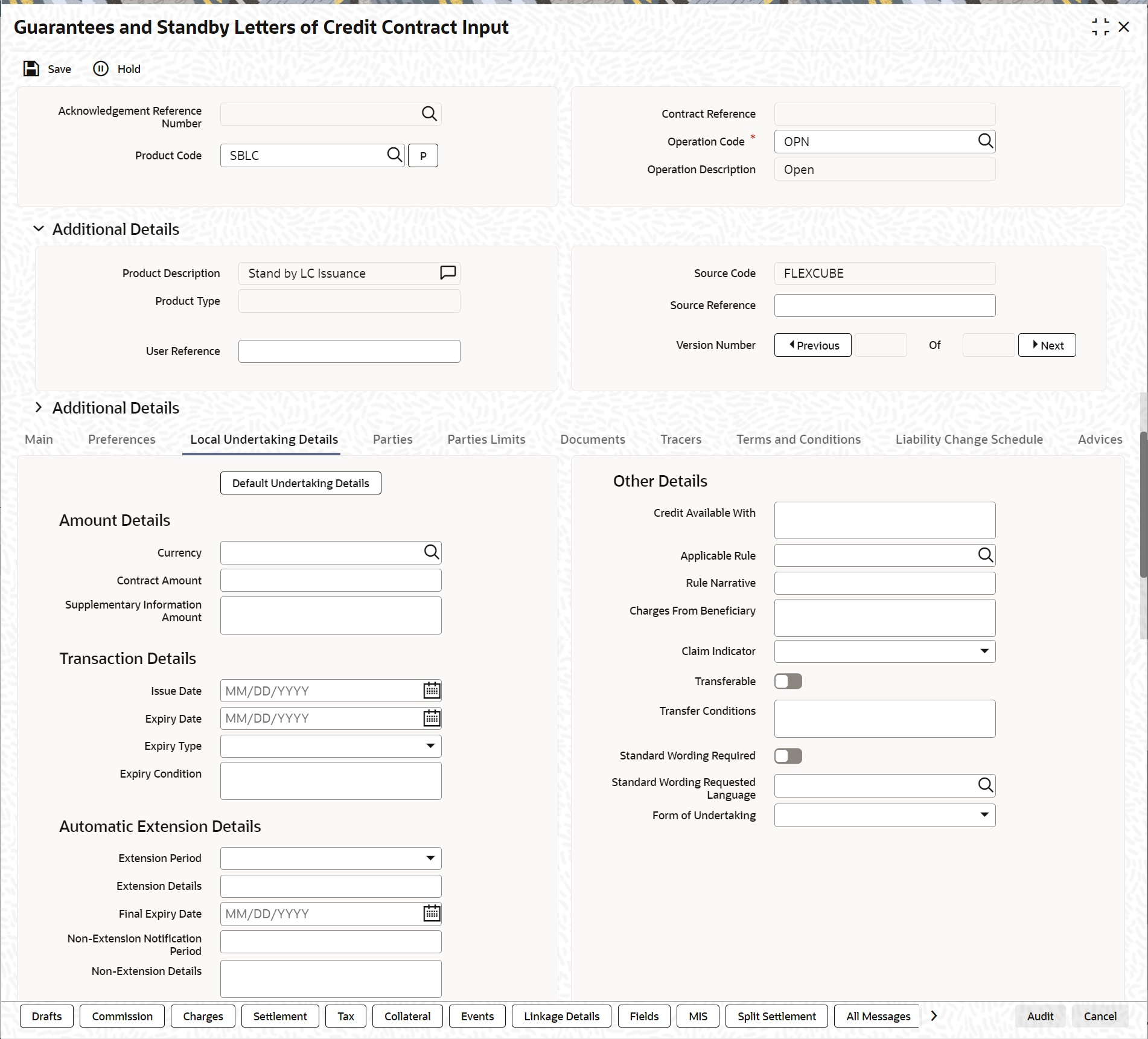

This field is optional. - On the Guarantees and Standby Letters of Credit Contract Input screen, click the Local Undertaking Details tab.The Local Undertaking Details screen is displayed. For more information on the fields, refer the Field Description table given below:

Table 9-4 Local Undertaking Details - Field Description

Field Description Currency Select the local undertaking currency from the list. This field is optional.

Contract Amount Specify the local undertaking contract amount. This field is optional.

Supplementary Information Amount This field specifies the supplementary information about amount related to the undertaking. Default Undertaking Details The system will provide an override message and the local undertaking details will be defaulted. On accepting the override, you can modify the defaulted details. This field is optional.

Transaction Details Specify the transaction details: Issue Date Specify the issue date from the calendar. This field is optional.

Expiry Date Specify the expiry date from the calendar icon. This field is optional.

Expiry Type Select the Expiry Type from the drop-down list. The available options are:

- Fixed

- Open

- Conditional - With Expiry

- Conditional - Without Expiry

Expiry Condition Specify the expiry condition and click Ok. This field is optional.Note:

You can provide expiry condition details if the expiry type is selected as ‘conditional’. If Expiry Type is ‘Fixed’ or ‘Open’ then Expiry Condition is NULL.Other Details Specify the other details: Credit Available With Specify the Credit Available with details for local SBLC and click Ok.

This field is optional.Applicable Rule Select the applicable rule for local undertaking from the list of values.

This field is optional.Rule Narrative This is enabled only if ‘Applicable Rule’ is set to ‘OTHR’. It is mandatory to specify the rule narrative if the applicable rule is ‘OTHR’.

This field is optional.Charges From Beneficiary Specify the charges from Beneficiary for Local Undertaking and click Ok.

This field is optional.Claim Indicator Select the claim indicator for local undertaking. The available options are:

- Multiple demands not permitted.

- Multiple and partial demands not permitted.

- Partial demands not permitted.

Transferable Select this check box to indicate the Local Undertaking is transferable. Transfer Conditions Specify the transfer conditions: Standard Wording Required Check this option to indicate that the customer needs standard wording for local undertaking details. Standard Wording Requested Language Specify the language in which the standard wording is requested. Alternatively, you can select the standard wording requested language from the list. Automatic Extension Details Specify the automatic extension related details for local undertaking. Extension Period Select the extension period from the drop-down list.

The available options are- Days

- One Year

- Others

Extension Details The extension details is mandatory when extension period is selected as Days/Others. This field is optional.Note:

The Extension Details should be a positive number from 1 to 999 when Extension Period is Days.Non-Extension Details Specify the non-extension details and click Ok.. Non-extension details are applicable only when notification period is provided.

This field is optional.Non-Extension Notification Period Select the Notification Period for non-extension of Local Undertaking.

Notification Period will be minimum number of calendar days prior to the current expiry date. This indicates period by which notice of non-extension must be sent.Final Expiry Date Select the Final Expiry Date for Automatic Extension. This field is mandatory.Note:

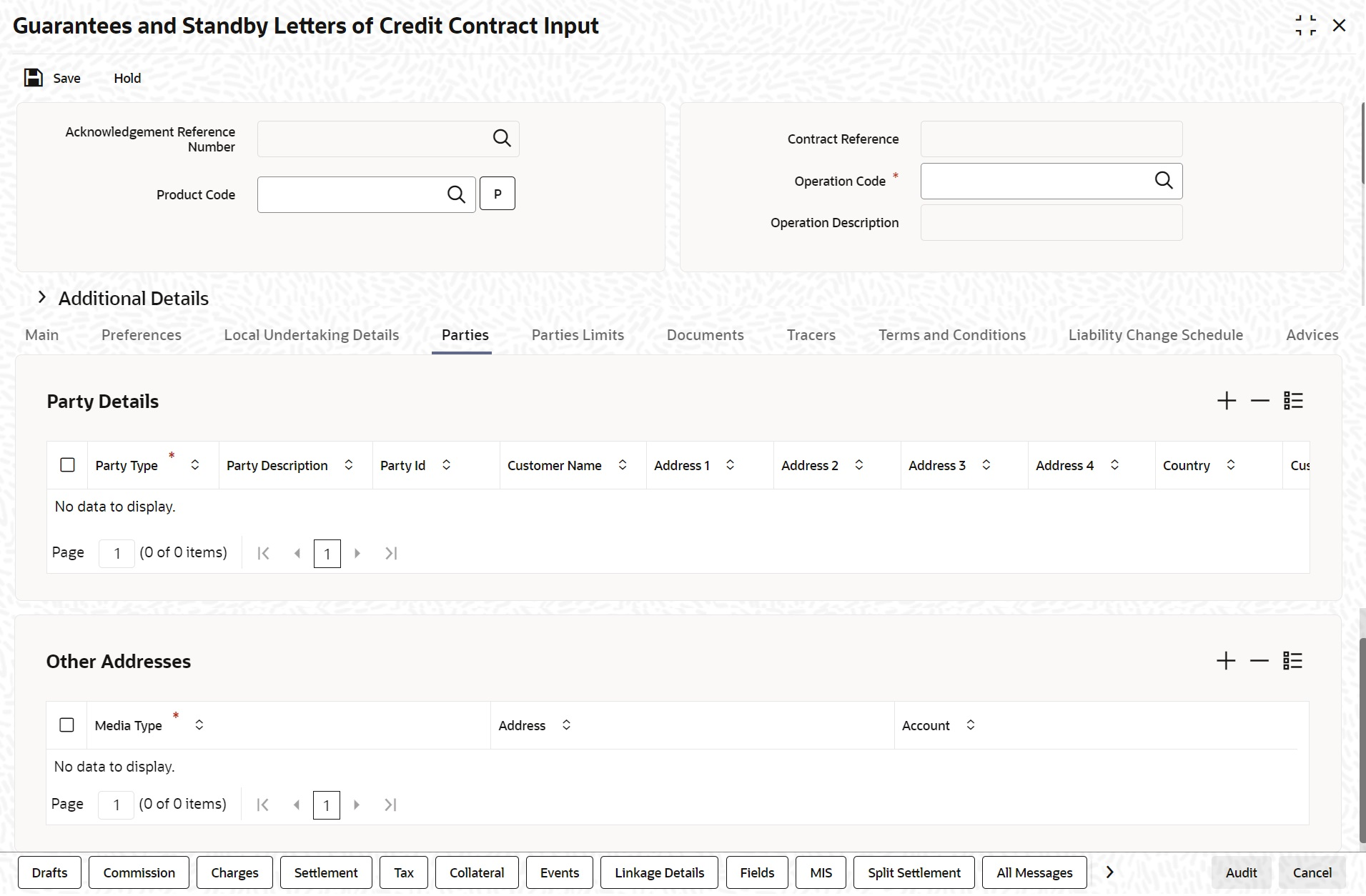

The Final Expiry Date should be greater than Local Guarantee Expiry Date. If the final expiry date is not greater than local guarantee then the system will display an override and default it to Local Guarantee Expiry Date. - On the Guarantees and Standby Letters of Credit Contract Input screen, click the Parties tab. The Parties Details is displayed. For more information on fields, refer the Field Description table given below:

Table 9-5 Parties - Field Description

Field Description Party Type Specify the party type. Select the party type from the option list. The list displays all the valid party types maintained in the system.

This field is mandatory.Party Description The system displays the party description.

This field is optional.Party Id Specify the Party ID for which you need to maintain. Select the Customer No from the option list. This field is optional.Note:

BIC Code appears next to the Customer No only if the BIC code is mapped with that customer number. If the BIC Code is not mapped with that customer number, then the BIC Code will not appear next to the Customer No in the option list.Customer Name Specify the customer name.

This field is optional.Address 1-4 Specify the address of the customer.

This field is optional.Country Specify the country code. Select country code from the option list. The list displays all valid values.

This field is optional.Customer Reference Specify the customer reference number.

This field is optional.Dated Enter the date of the customer reference. This would normally be the date on which you have a correspondence from the party regarding the

SBLC.

This field is optional.Language Specify the language in which advices should be sent to the customer.

This field is optional.Issuer Check this option to indicate that the issuer is a bank.

This field is optional.Media Type Specify the media type. Select the media type from the option list. The list displays all valid values.

This field is mandatory.Address Specify the address of the party.

This field is optional.Account The system defaults the account number. However, you can edit this field.

The parties involved in a Guarantee/SBLC depend upon the type of guarantee/SBLC you are processing. The following table indicates the minimum number of parties required for the types of Guarantee/SBLC that you can process.

For more information, refer Table 9-6.

This field is optional.Table 9-6 Parties involved in Guarantee/SBLC - Field Description

LC type Parties applicable Mandatory Parties Parties not allowed Shipping Guarantee Applicant/Accountee

Advising Bank

Beneficiary

Confirming Bank

Advice Through Bank

Reimbursing BankApplicant and Beneficiary Issuing Bank Guarantee Applicant and Beneficiary Applicant and Beneficiary Advise Through Bank Reimbursement Bank Issuing Bank Standby Applicant/Accountee

Advising bank

Beneficiary

Confirming bank

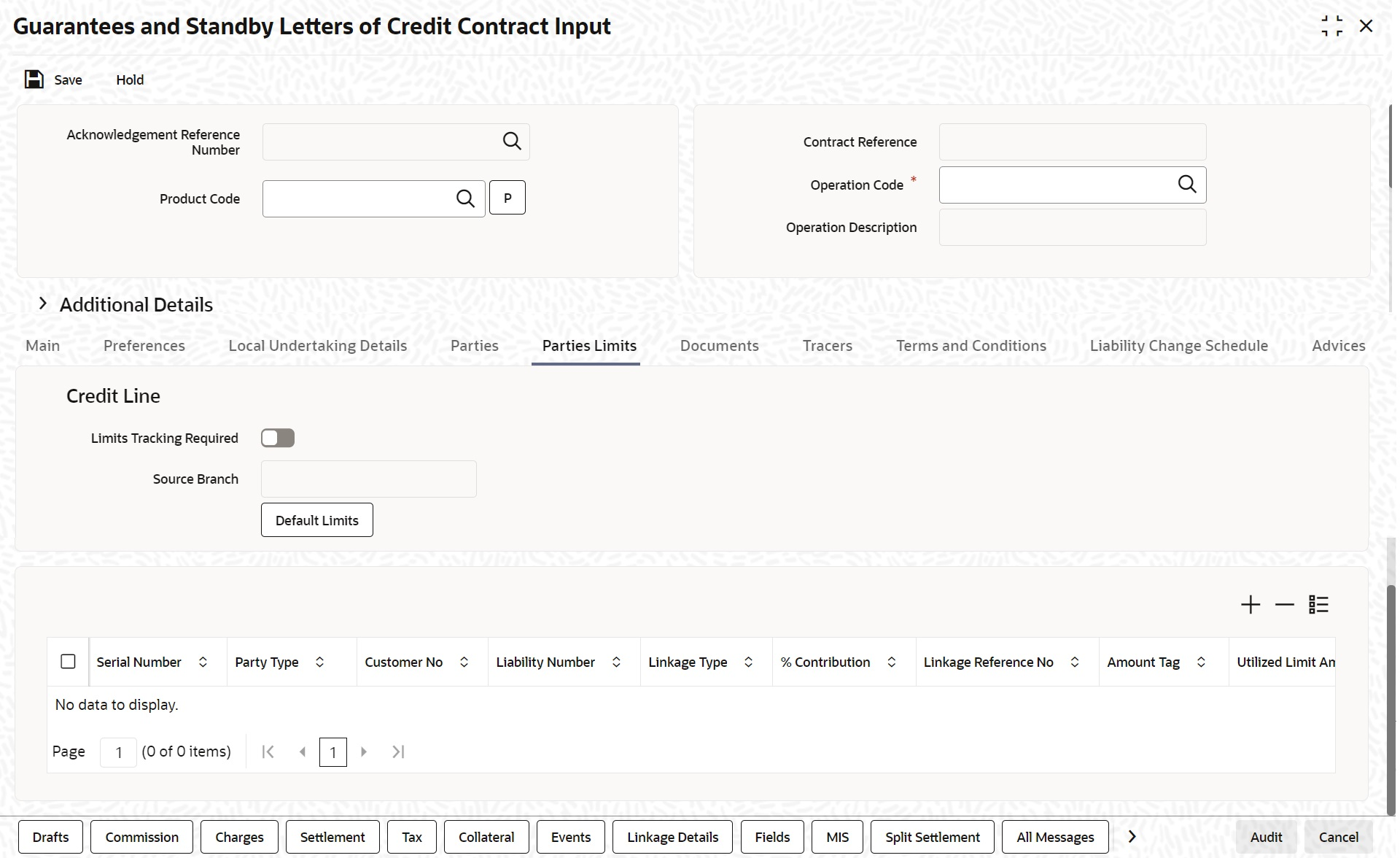

Reimbursing bankApplicant and Beneficiary Issuing Bank - On the Guarantees and Standby Letters of Credit Contract Input screen, click the Parties Limits tab. The Parties Limits details is displayed.For more information on the fields, refer the Field Description table given below:

Note:

You can add new records or delete defaulted records and then click the save button. The saved details is available in the system.Table 9-7 Parties involved in Guarantee/SBLC - Field Description

Field Description Credit Line Specify the details. Limits Tracking Required Specify whether the credit granted under the LC you are processing should be tracked against the credit limit assigned to the customer under a Credit Line. Check this box to indicate that limit tracking is required for the Guarantee/SBLC.

If left unchecked, the system will display an override message Limit tracking not done for the contract’ while saving the record. In the subsequent fields of this screen, you can specify details of the line under which the credit is to be tracked.Default Limits Click the Default Limits button. Note:

The system will default the following basic limit details.Serial Number On the Guarantees and Standby Letters of Credit Contract Input screen, click on the save button. The , serial number details is displayed. Party Type The system defaults the party type of the counter party of the contract. Customer No The system defaults the Customer Noor CIF Id of the counterparty. Liability Number Specify the Liability Number. The system displays multiple liabilities that are attached to the Customer. Linkage Type The system defaults the linkage type as Facility.

The drop-down list has the following options:- Facility

- Liability

% Contribution Specify the proportion of limits to be tracked for the credit line.

This field is optional.Linkage Reference No Specify the reference number that identifies the facility/liability. Linkage Reference No displays all valid facilities and liabilities for the specific liability number. Choose the appropriate one. Amount Tag The system defaults the Amount Tag.as Liability Amount.

The system tracks the limits for non joint venture customers based on the amount tag.Limit Amount When you click Default button, the system defaults the amount tracked for each credit line. The amount is derived based on the amount tag specified above. Note:

You can add more rows to the list of credit lines using add button. Similarly, you can remove a selected row from the list using delete button. This field is optional.JV Parent When you click ‘Default Limits’ button, the system defaults the joint venture customer number of the party. This customer number is defaulted based on the details

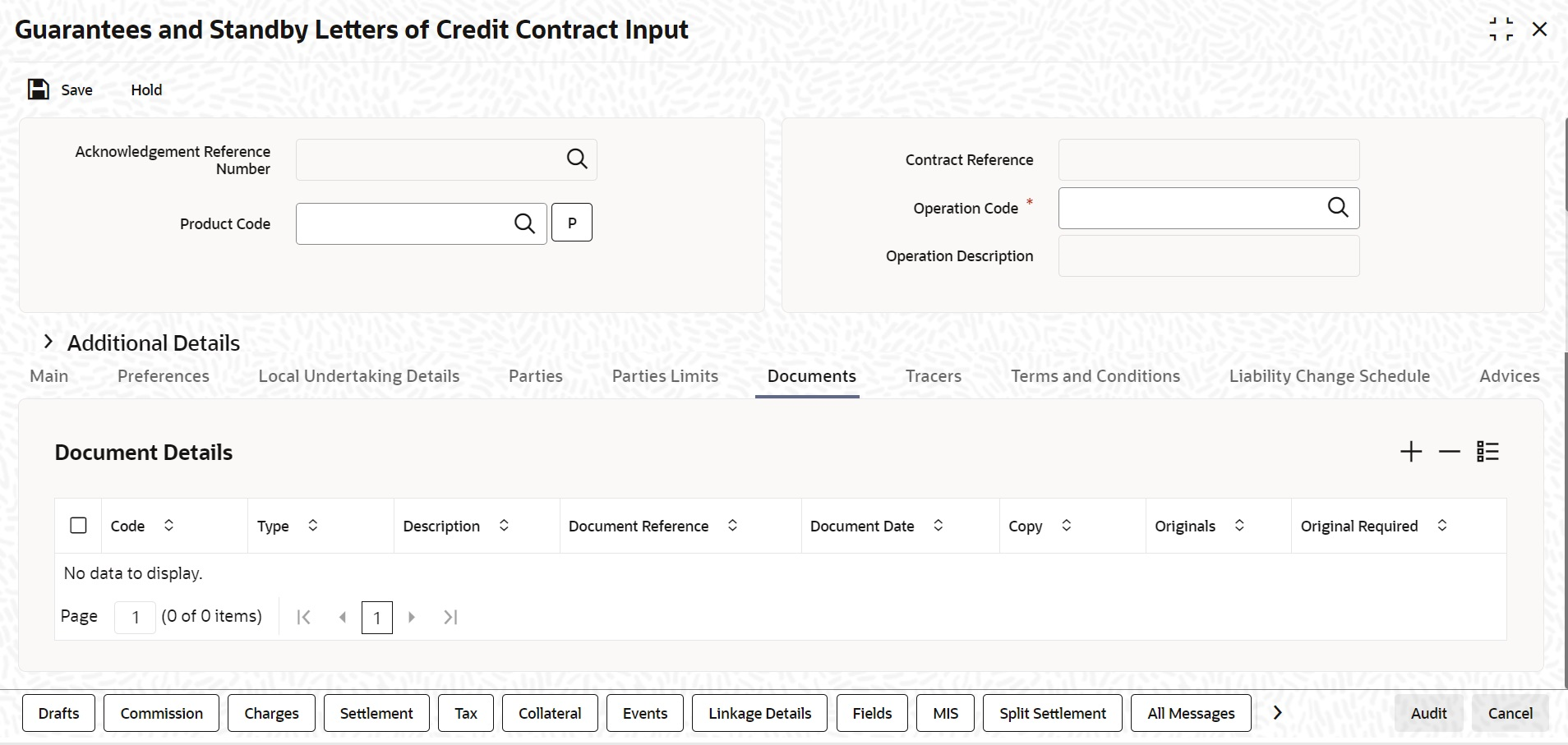

maintained in ‘Joint Venture’ sub-screen of ‘Customer Maintenance’ screen. - On the Guarantees and Standby Letters of Credit Contract Input screen, click the Documents tab. The Document Details tab is displayed. For more information on fields, refer to the Field Description table given below:

Table 9-8 Documents - Field Description

Field Description Code Specify the document code. Select the document code from the option list.

This field is optional.Type Select the type of document from the drop-down list.

This field is optional.Description The system displays the document description.

This field is optional.Document Reference Enter the document reference number based on which the Guarantee/SBLC issued.

This field is optional.Document Date Specify the Document Date.

Document date should be less than or equal to issue date.Copy Enter the number of copies of the document.

This field is optional.Originals Enter the number of Original documents here.

This field is optional.Original Required Check this box if original document is required.

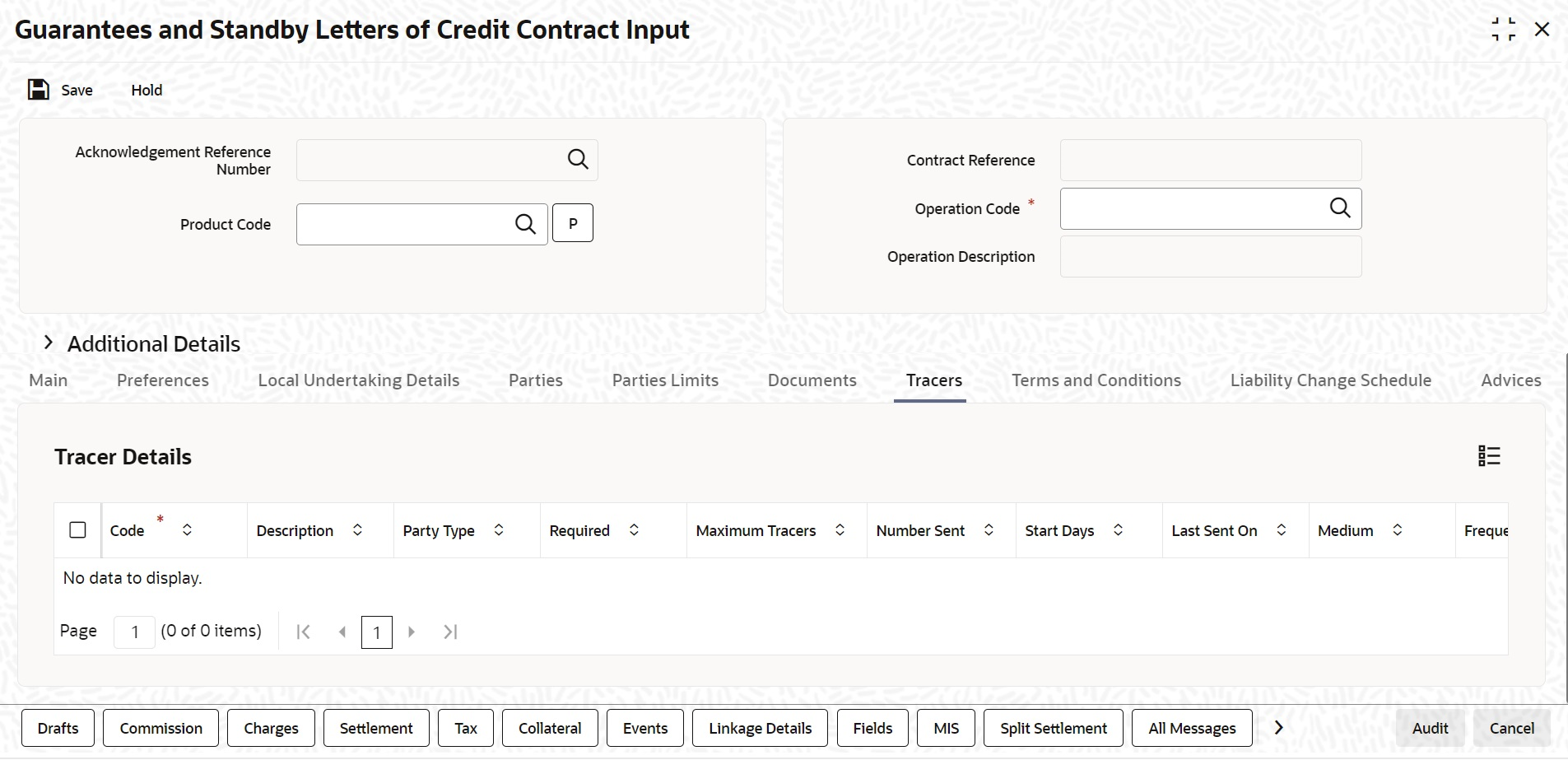

This field is optional. - On the Guarantees and Standby Letters of Credit Contract Input screen, click the Tracers tab. The Tracer Details is displayed.Tracers are reminders that can be sent to various parties involved in Guarantees and SBLCs. The list of tracers that you can send for an Guarantee/SBLC is predefined (hard coded in the system) and is as follows:

- The Non-Extension Notification (NTF_FOR_NENX) tracer (sent to the advising bank to intimate that the undertaking will no longer be considered for automatic extension)

Table 9-9 Tracers - Field Description

Field Description Code The tracers, specified for the product to which you have linked the Guarantee/SBLC is defaulted to this screen.

This field is mandatory.Description By default, the system displays the description for the product to which you have linked the Guarantee/SBLC.

This field is optional.Party Type By default, the system displays the party type for the product to which you have linked the Guarantee/SBLC.

This field is optional.Required By default, the system displays the required for the product to which you have linked the Guarantee/SBLC.

This field is optional.Maximum Tracers By default, the system displays the maximum tracers for the product to which you have linked the Guarantee/SBLC.

This field is optional.Number Sent By default, the system displays the number sent for the product to which you have linked the Guarantee/SBLC.

This field is optional.Start Days By default, the system displays the start days for the product to which you have linked the Guarantee/SBLC.

This field is optional.Last Sent On By default, the system displays the last sent on for the product to which you have linked the Guarantee/SBLC.

This field is optional.Medium By default, the system displays the medium for the product to which you have linked the Guarantee/SBLC.

This field is optional.Frequency By default, the system displays the frequency for the product to which you have linked the Guarantee/SBLC.

This field is optional.Template Id By default, the system displays the template id for the product to which you have linked the Guarantee/SBLC.

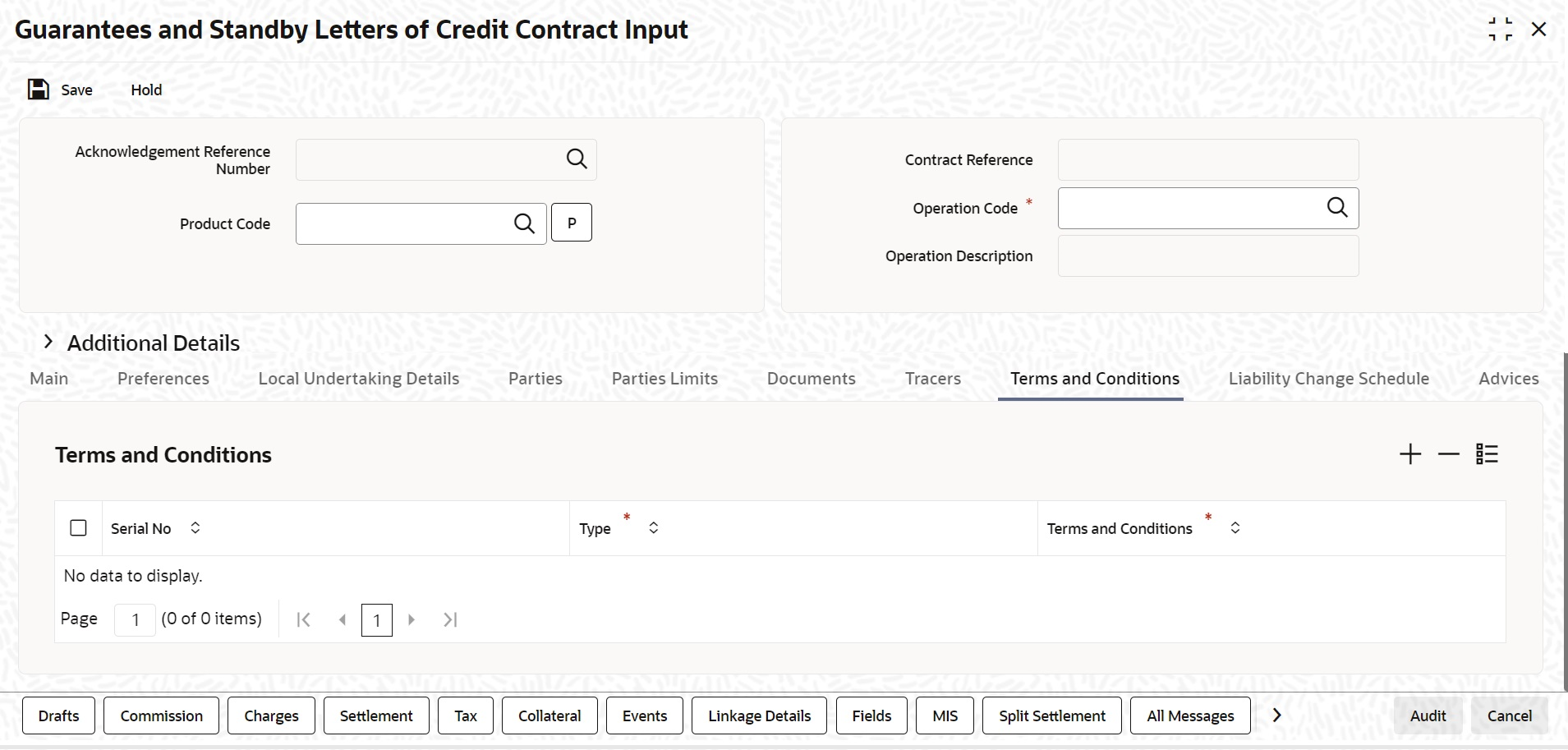

This field is optional. - On the Guarantees and Standby Letters of Credit Contract Input screen, click the Terms and Conditions tab. The Terms and Conditions is displayed. For more information on fields, refer the Field Description table given below:

Table 9-10 Terms and Conditions - Field Description

Field Description Serial No. Specify the serial number for terms and conditions.

This field is optional.Type Select the guarantee type from the drop-down list.

The available options are:- Guarantee

- Local Guarantee

Terms and Conditions Specify the terms and conditions.

Terms and Conditions for Guarantee are mandatory.

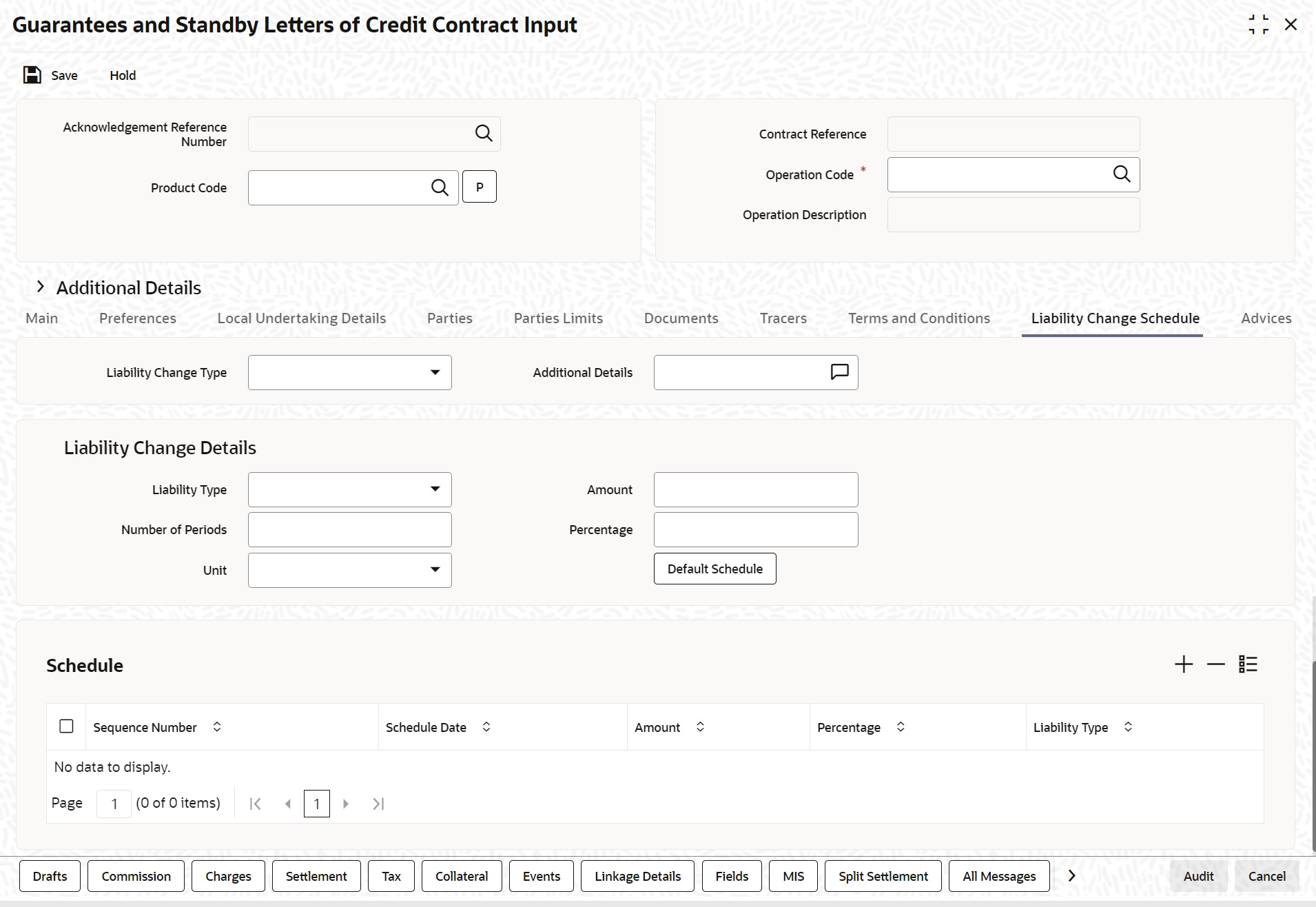

This field is mandatory. - On the Guarantees and Standby Letters of Credit Contract Input screen, click the Liability Change Schedule tab. The Liability Change Schedule screen is displayed. For more information on fields, refer the Field Description table given below:

Table 9-11 Liability Changes Schedule - Field Description

Field Description Liability Change Type Indicates whether Liability Change is Time Based or Event Based: - Processing will be scheduled in case of Time Based

- Additional details can be provided in case of Event Based. There is no functional impact.

Additional Details Additional details can be provided in case of Event Based Liability Type Indicates Increase or Decrease or Both increase and decrease of liability

Increase to be provided to increase the Guarantee amount- Decrease to be provided to decrease the Guarantee amount

- Both to be provided in case of increase and decrease of Guarantee amount.

Number of Periods Indicates Number of Schedules. Should be greater than zero. Unit Indicates Unit of Payment or Retention namely: Yearly / Half-Yearly / Quarterly / Monthly Drop-down will be provided for the same. Amount Indicates schedule amount. Amount should be greater than zero.

If Liability Type is decrease, Amount should not be less than Contract Amount.Percentage Indicates percentage of Contract amount to be considered for Liability change. Value should be 1 to 100. Default Schedule Button to default Liability Change Schedules based on above input parameters. Schedule The system displays the schedules. Sequence Number Indicates Schedule sequence number. System derives the same and will be display field. Schedule Date Indicates date on which system will initiate Liability Change Schedule.

User can modify the defaulted schedule date. Schedule date will be defaulted based on Unit.If Units is Yearly, schedule date will be one Year

from Guarantee Issue Date.- 366 Days will be considered in case of leap year

- 365 Days will be considered if not a leap year

- Calendar Days will be considered

Amount Indicates amount applicable for each schedule: Amount should be greater than zero

- If Liability change is increase, schedule amount can be greater or lesser than the Contract Amount

- If Liability change is decrease, schedule amount should not be lesser than the Contract Amount

Percentage Indicates percentage of Contract amount. Should be 1 to 100. - Amount will be computed based on percentage, if amount is not available

- If both Percentage and Amount is available, percentage will be considered to derive the amount.

Liability Type Indicates Increase or Decrease based on liability processing. User can modify the same. - System will default Increase when Liability processing is Increase

- System will default decrease when Liability processing is Decrease.

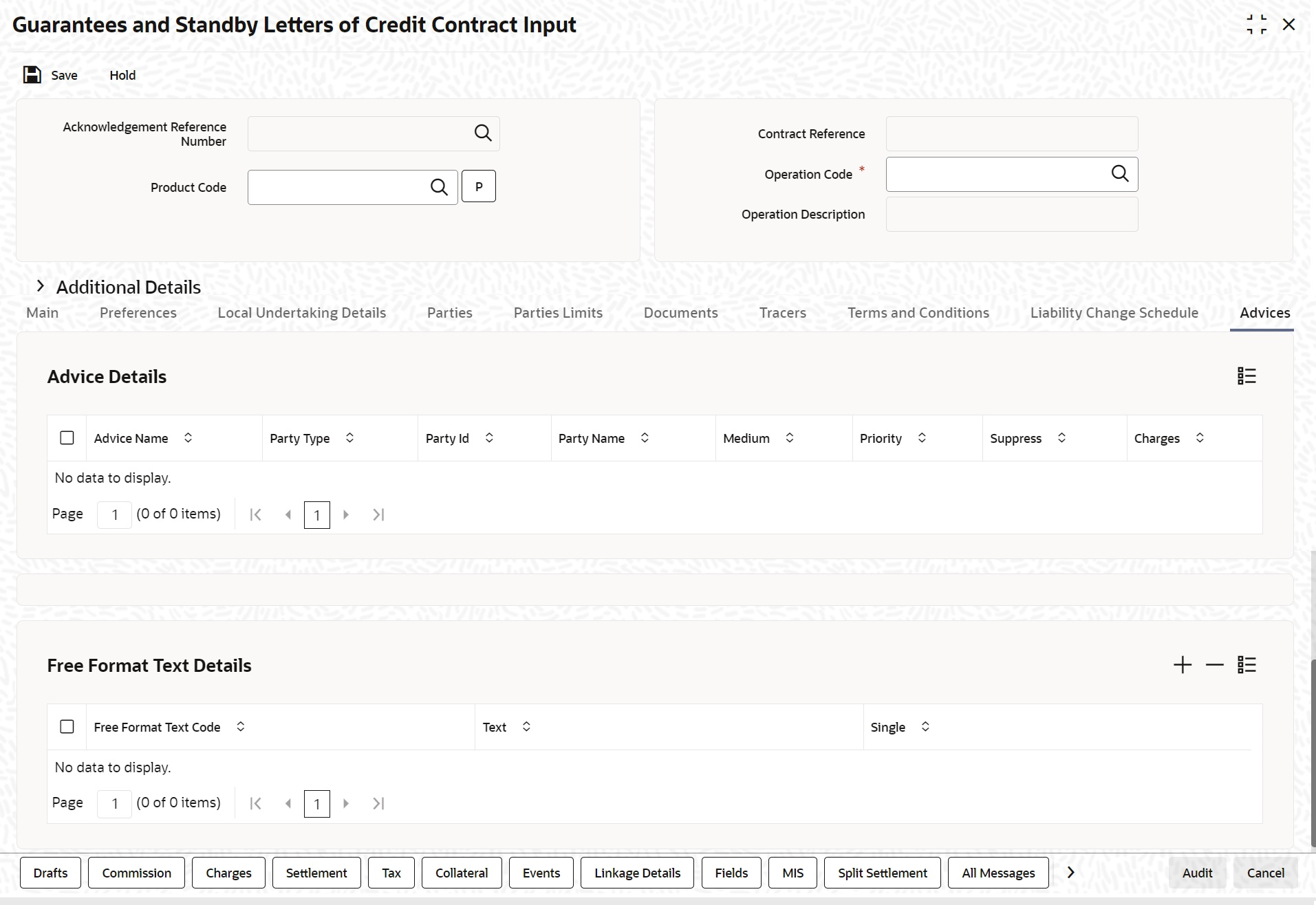

- On the Guarantees and Standby Letters of Credit Contract Input screen, click the Advices tab.The Advice Details is displayed. The details of the advices for an event are displayed in the Advices screen. The party type to whom a specific advice should be sent is picked up automatically based on the type of Guarantee/SBLC being processed and the parties involved.

For more information on fields, refer the Field Description table given below:

Table 9-12 Advice Details - Field Description

Field Description Advice Name Specify the advice name.

This field is optional.Party Type The system displays the party type for which the message is generated.

This field is optional.Party Id The system displays the party ID for which the message is generated.

This field is optional.Party Name The system displays the name of the party for which the advice is generated.

This field is optional.Medium The medium by which an advice will be transmitted

and the corresponding address will be picked up based on the media and address maintenance for a customer.

You can change either of these while processing the LC. If changed, both of them will be changed. After selecting the advices to be generated for the LC, click Ok to save it. Click Exit or Cancel button to reject the inputs you have made. In either case, you will be taken to the Contract Main screen.

This field is optional.Priority For a payment message by SWIFT, you also have the option to change the priority of the message. By default, the priority of all advices is marked as low. The priority of a payment message can be changed to one of the following: - Low

- Medium

- High

Suppress By default, all the advices that have been defined for a product will be generated for the LCs involving it. If any of the advices are not applicable to the LC you are processing, you can suppress its generation by checking against the Suppress field.

This field is optional.Charges The system displays the charges configured.

This field is optional.Free Format Text Details Specify Free Format Text Details:

This field is optional.Free Format Text Code To add an FFT to the list, click add icon. Select an FFT code from the option list that is displayed.

New FFTs 24GDLYCOLAMD and 24GDLYCLAMDC introduced for Tag 24G in MT760. BENE or OTHR can be provided in FFT. If OTHR is provided , then Address details must be provided.

CANC has to be provided against MT747 for message generation.

This field is optional.Text After selecting the code that identifies the FFT you wish to attach to the advice, its description is automatically picked up and displayed. The FFT description can be changed to suit the requirements of the LC you are processing.

This field is optional.Single Check this option to indicate that the FFT is a

single message.Note:

For more details on the buttons in Guarantees and SBLC Contract Input screen, refer the topic titled Capturing Additional Details in this user manual.The details are applicable if SWIFT 2019 is enabled. The following table provides the list of SWIFT messages and the fields of SWIFT messages that utilizes the information provided in this screen: Table 9-13

This field is optional.Table 9-13 SWIFT Messages - Field Description

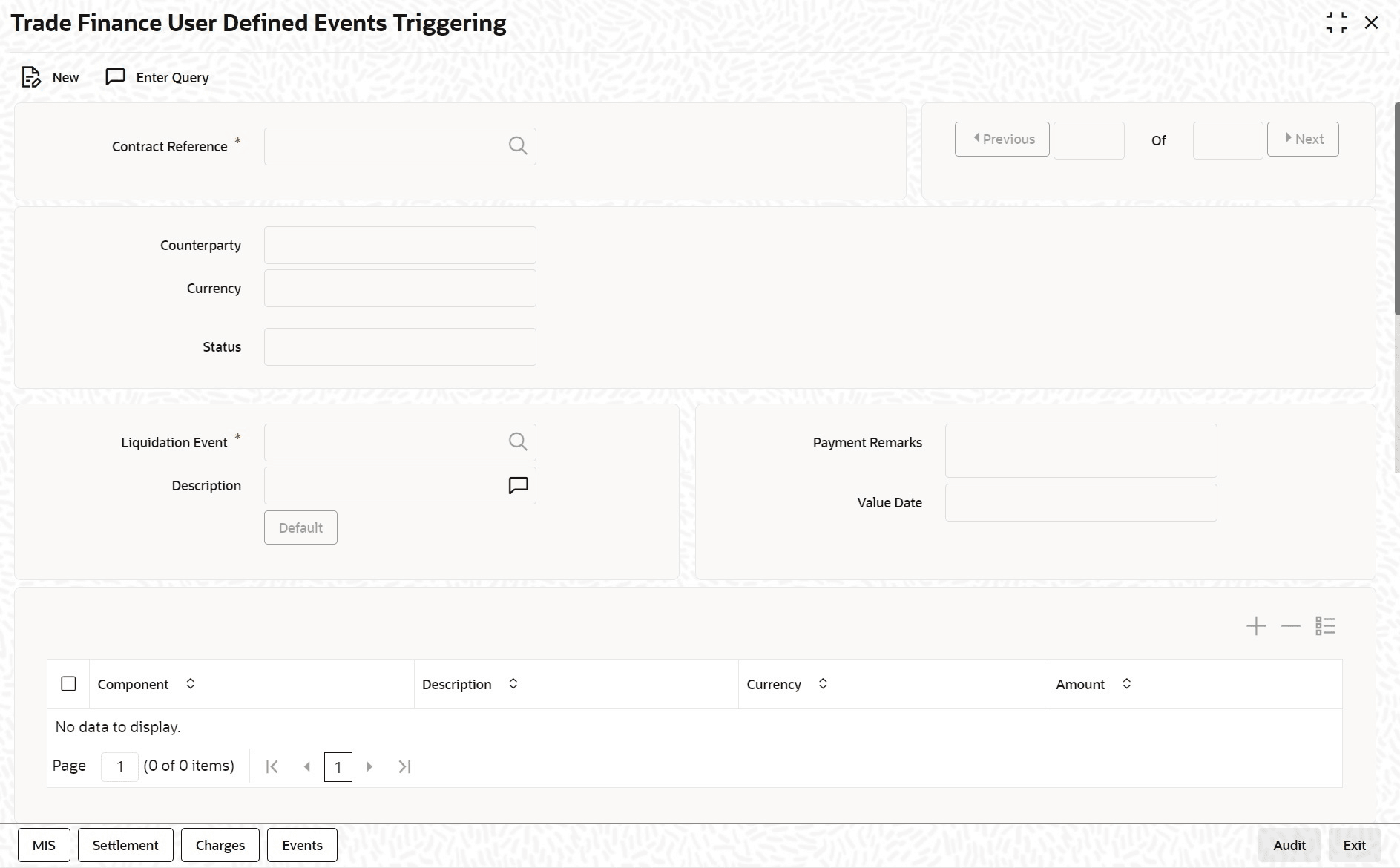

Field in Oracle Banking Trade Finance SWIFT Message Field of the SWIFT message Operation Code MT760 22A,49 Purpose of Guarantee MT760 22A Contract Reference MT760,MT761,MT768,MT769 20 Issue Date MT760 30 Product Type MT760 22D Applicable Rule MT760 40C Validity Type MT760 23B Expiry Date MT760 31B Expiry Condition MT760 35G Party Id – APP MT760 50 Party Id – APB MT760 51 Party Id – ISB MT760,MT761 52a Party Id - BEN MT760 59 Party Id - ABK MT760 56a Party Id - ATB MT760 57a Contract Amount MT760 32B Documents - Description MT760 45C May Confirm MT760 49 Party Id - COB MT760 49a Claim Indicator MT760 48B Transferable MT760 48D Local Guarantee Details - Issue Date MT760 31C Local Guarantee Details - Expiry Date MT760 31B - Sequence C Charges to be Claimed - Amount MT768,MT769 32a Charges to be Claimed - Currency MT768,MT769 32a Issuing Bank Date MT768,MT769 32a Issuing Bank Acc MT768,MT769 25 Charge From Issuing Bank MT768 71D Additional Amounts Covered MT769 39C Charges From Beneficiary MT769 71D Party Type - REB MT760 41a - Sequence B & Sequence C Party Id- REB MT740 Sequence C ICCO - ABK and ATB MT760 22D Sequence C APB/OBP/APP MT760 51 Amendment of Local Guarantee Details - ABK, APB MT767/775 Sequence B - On Query from contract input screen click UDE to launch the Trade Finance User Defined Events Triggering screen (UDDTFEVT) and perform additional accounting entries for active and authorized contracts.The UDE screen is displayed.

Figure 9-11 Trade Finance User Defined Events Triggering

Table 9-14 Trade Finance User Defined

Field Description Contract Reference Number On click of New the contract reference number defaults. Counterparty On click of New the counterparty defaults. Status On click of New the status defaults. Currency On click of New the currency defaults Liquidation Event Select the event from the adjoining option list. Description Description defaults on select of event from the field liquidation event Payment Remarks Specify remarks pertaining to the payment on the account. Payment Remarks If the value date derivation rule has been maintained for the event code, the system will calculate the value date and display it here. However, you can change it Click ‘Default’ to default the following details:

Amount Details: The system displays the following amount detailsComponent

Description

Currency

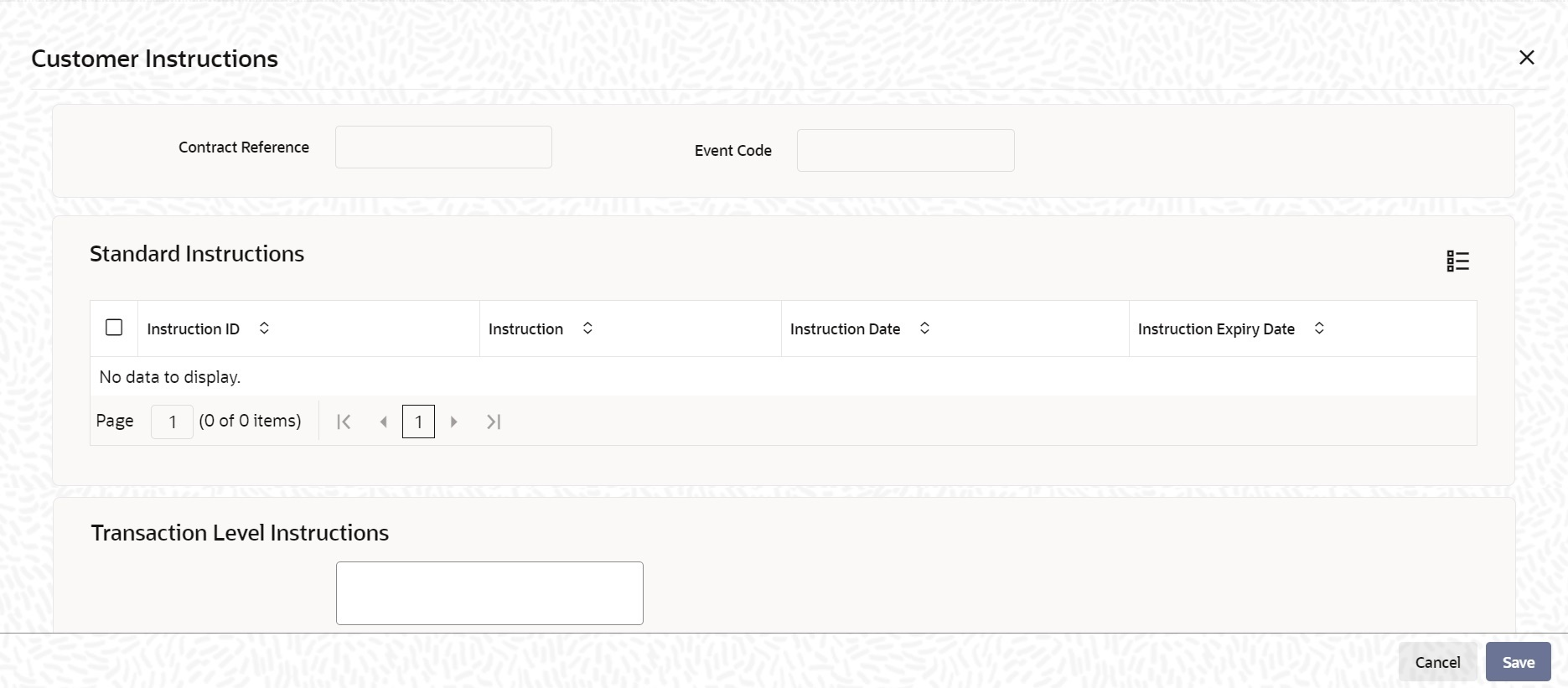

Amount - On the Guarantees and Standby Letters of Credit Contract Input screen, click the Customer Instructions tab.The Customer Instructions screen is displayed.

Table 9-15 Customer Instructions - Field Description

Field Description Contract Reference Number System displays the contract reference number. Event Code System displays the Event Code of the contract. Standard Instructions Customer would want to give Standard instructions in advance to the bank that need to be referred by the bank while processing certain type of transactions.

Instruction ID System displays the Instruction ID. Instruction System displays the customer standard instruction. Instruction Date System displays the start date of the customer instruction. Instruction Expiry Date System displays the expiry date of the customer instruction. Transaction Level Instruction Enter the transaction level instructions for the event. - On the Guarantees and Standby Letters of Credit Contract Input screen, click the Split Settlement buttonSplit Settlement Master details get populated for the Cash collateral. User needs to provide the split details for the Split Master Basis Amount. During Cancel or Close, the outstanding collateral will be refunded to the customer accounts.Split Settlement Master and Split Settlement Details get populated for the Charges and Commission component if split flag is checked in the respective subsystems. System will default the split settlement details with two splits for a charge/commission component one for counterparty and another one for Other party. System will default split amount 50% of charge/commission component between parties. User can modify the amount and percentage will be derived based on modified amount. If AR-AP is unchecked for a component then Split account will default with settlement instructions of Customer and Split Account can be modified to another valid account of the Customer. If AR-AP is checked then Split account will be defaulted with AR-AP GL and Split account cannot be modified. Maximum of two splits is allowed for Charges and Commission components.

Table 9-16 Party Type Derivation for Charges and Commission

Category Counter Party Other Party Other Party Resolution Guarantee/SBLC Issuance APP/ACC/APB BEN/CIB/LIB/ABK If Beneficiary is a bank customer Else CIB if exists Else LIB if exists Else Advising Bank Guarantee/SBLC Advice BEN APP/ISB If Applicant is a bank customer else Issuing bank The Split Settlement screen is displayed. For more information on the fields, refer to Table 9-17:Table 9-17 Split Settlement - Field Description

Field Description Specify Settlement Split Master You can specify the details of the settlement split master in the following fields: Basis Amount Tag Specify the amount tag involved in the contract. The option list displays all valid amount tags maintained in the system. You can choose the appropriate one. For example, on booking a new contract, the only tag allowed is PRINCIPAL. This is referred to as the basis amount tag.

This field is optional.Currency The system displays the currency associated with the amount tag. This field is optional.

Basis Amount The system displays the basis amount associated with the amount tag. For example, the amount involved in the contract would be displayed against the amount tag PRINCIPAL. The amount is in terms of the currency associated with the amount tag.

You can use Get Exchange Rate button to get the original exchange rates defaulted in the screen.

This field is optional.Specify Settlement Split Details For each split amount tag, you need to specify the following details:

This field is optional.Amount Specify the amount for the split amount tag. This amount should not be greater than the amount of the corresponding basis amount tag. The split amount is in the currency of the basis amount tag. This is a mandatory field and you will not be allowed to save the details if you do not specify the amount. This field is optional, if percentage of proceeds is provided. Amount will be derived based upon the percentage.

Branch Specify the branch. The list displays all valid values. This field is mandatory.

Account Currency Specify the account currency. This field is mandatory.

Account Specify the account. This list displays all the accounts. For Cash Collateral the account should be account of the counterparty. If the account selected is other than counterparty account, then system will throw error. This field is mandatory.

Loan/Finance Account Check this box to indicate that the specified account should be the loan account. This field is optional.

Exchange Rate Specify the exchange rate that must be used for the currency conversion.

Specify the destination to which the goods transacted under the LC should be sent by selecting the appropriate option from the list of values.

This field is optional.Original Exchange Rate The base or the actual exchange rate between the contract currency and collateral currency gets displayed here. Party Type System defaults this field for Charges and Commission components if split flag is checked in respective components.

This field is applicable only for charges and commission components.

AR-AP Tracking System defaults this field for charges and commission components based upon the AR-AP tracking selection in charges and commission component when split flag is checked in respective components.

This field is applicable only for Charges and Commission components.

Customer Select the customer number from the list. Percentage of Proceeds Specify the percentage of proceeds. Negotiated Rate Specify the negotiated cost rate that should be used for foreign currency transactions between the treasury and the branch. You need to specify the rate only when the currencies involved in the transaction are different. Otherwise, it will be a normal transaction. The system will display an override message if the negotiated rate is not within the exchange rate variance maintained at the product.

This field is optional.Negotiated Reference Specify the reference number that should be used for negotiation of cost rate, in foreign currency transaction. If you have specified the negotiated cost rate, then you need to specify the negotiated reference number also. This field is optional.Note:

Oracle Banking Trade Finance books then online revaluation entries based on the difference in exchange rate between the negotiated cost rate and transaction rate.

- View Guarantees and SBLC Contract Details

This topic provides systematic instruction to view guarantees and SBLC contract details.

Parent topic: Guarantees and Standby Letters of Credit