- Charges and Fees User Guide

- Charge Class

- Define a Charge Class

1.4.1 Define a Charge Class

This topic provides systematic instructions to define a charge class.

A class is a specific type of component that you can build with certain attributes. You can build a charge class, for instance, with the attributes of a specific type of charge, such as ‘Charges for amending the terms of a transaction’, or ‘Charges for provision of services’. To recall, a charge rule is built to calculate a specific type of charge component.

Once such a rule is built, you can define attributes like what should be the basis amount on which the charge rule is applied, when the charge should be associated to the contract and when the charge should be calculated and collected.

- The module in which you would use the class

- The charge type (whether borne by the counter party or by the bank)

- The association event

- The application event

- The liquidation event

- The default settlement currency

- The default charge rule

- The basis amount on which the charge is calculated

Specify User ID and Password, and login to Homepage.

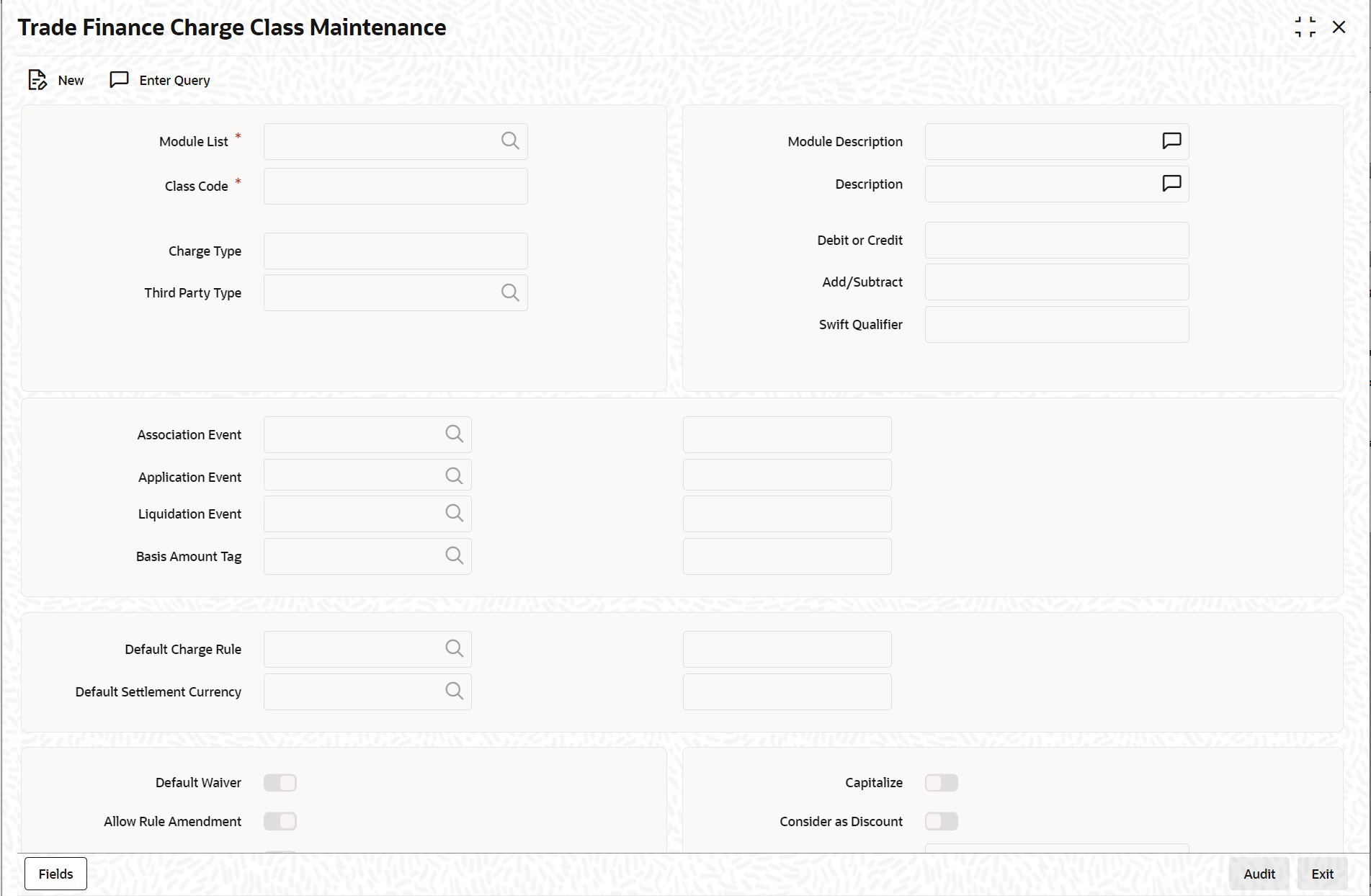

- On Homepage, type ‘CFDTFCCM' in the text box, and click next arrow.You can define the attributes of a charge class in the ‘Trade Finance Charge Class Maintenance’ screen, loaded from the Application Browser.The ‘Trade Finance Charge Class Maintenance’ screen is displayed.

- On ‘Trade Finance Charge Class Maintenance’screen, specify the fields.For more information about the fields, refer Table 1-4:

Table 1-4 Trade Finance Charge Class Maintenance - Field Description

Field Description Class Code Before defining the attributes of a charge class, you should assign the class a unique identifier, called the Class Code and briefly describe the class. A description would help you easily identify the class.

Module List A charge class is built for use in a specific module. As a charge component would be applied on different basis amounts, in different modules. In the Letters of Credit module, for instance, you would apply a flat processing charge or fee on all LCs. In the Securities module, you could levy a flat charge or fee on portfolios that you maintain on behalf of a customer. The basis on which the component is applied is different, in these two cases.

Note:

The Basis Amount Tags available would depend on the module for which you build the class.

The charges or fee that you levy will be recovered, typically, from the counterparty involved. Therefore, when building a charge class, you may indicate the charge to be of ‘Counterparty’ type.

Charge Type Charges can be collected from the counter party or from a third party. You can select one of the following values from the adjoining drop-down list:

- Counter Party – This indicates that the customer is captured as part of the contract

- Third Party – This indicates that the charges are levied on another entity on behalf of customer (Example: Custodian)

- Their Charges – This indicates that your bank is collecting other bank’s charges as in the case of LC and BC contracts.

Debit /Credit Choose the Debit option in this field, if the charge component associated with the product is to be debited to the customer. If you would bear the charge component, choose the ‘Credit’ option.

The following example illustrates how a charge could be of a ‘Credit’ type.

Propagation Required Check this option to indicate that the charge collected from the borrower must be passed on to the participants of the contract.

Net Consideration The sum of the different components of a contract determines the net value of the contract. You can indicate that a charge component should be taken into account when determining the net value of a contract by choosing the Net Consideration option.

Note:

The Net Consideration option is applicable if you are defining a charge class for Securities module.

Add/Subtract If you choose to include the charge component in the net value, you should indicate if the charge component is to be added, while calculating the net consideration amount, or subtracted.

SWIFT Qualifier You can report the charge component of a contract in the SWIFT messages that you generate. To do this, identify the component, when building it in the ‘Charge Class Maintenance’ screen, with the appropriate SWIFT code.

Events A contract goes through different stages in its life cycle, such as:- Initiation

- Amendment

- Rollover

Each of these stages is referred to as an ‘Event’ in Oracle Banking Trade Finance.

At any of these events, you can choose to apply a charge or fee. When defining a charge class, you should specify:- The association event

- The application event

- Liquidation event

The event at which you would like to associate a charge component to a contract is referred to as the Association Event. At this event, no accounting entry (for the charge component) is passed.

The event at which the charge component is actually calculated is referred to as the Application Event. At this event, no accounting entry (for the charge component) is passed. The charge or fee is liquidated at the Liquidation event that you specify.

If the event chosen for the liquidation of the charge component at the charge class and the event chosen for liquidating the same charge component at the ‘Product Events and Accounting Entries’ screen are different, the charge will not be liquidated and accounting entries will not be posted.

Basis Amount Tag The basis on which interest, charge, fee, or tax is calculated is referred to as the Basis Amount. (A charge or fee can be on the basis of the contract amount, for instance.) The different basis amounts, available in a module, are associated with a unique ‘tag’. When building a charge component, you have to specify the tag associated with the Basis Amount. When charge or fee is calculated for a contract, the basis amount corresponding to the tag will be picked up automatically.

Basis amount refers to:

- Principal amount or commitment

- Transaction amount in the case of a teller entry

- Transfer amount in case of a Remittance

- LC amount in the case of a Letter of Credit

- Bill amount in the case of a Bill

Default Charge Rule You can link a charge rule that you have defined to the charge component that you are building. When you link a rule to a component, the attributes that you have defined for the rule will default to the component.

To recall, a charge rule identifies the method in which charge or fee of a particular type is to be calculated. A rule is built with, amongst others, the following attributes:

- The charge currency

- Whether the charge or fee is to be a flat amount or calculated on a rate basis

- The minimum and maximum charge that can be applied

- The tier or slab structure on which the charge is to be applied

- The customer and currency restrictions, etc.

The charge component to which you link a rule acquires these properties. Charges for the product with which you associate a charge component will be calculated, by default, according to the rule linked to the component. However, when processing a contract, you can choose to waive the rule altogether.

When building a charge class, you can choose to allow the amendment of the rule linked to it, in the following conditions:- You can choose to allow amendment after the association event

- You can choose to allow amendment after the application event

- You can choose to allow amendment of the charge amount

Default Settlement Currency Charges or fees levied on a contract will be settled in the Settlement Currency that you specify for the charge class associated with the product (under which the contract is processed). However, when processing a contract, you can choose to settle the charge in another currency. The charge currency defined for the rule is used only for booking charges. The actual settlement is done in the default settlement currency' maintained for the charge class. The final charge is computed based on preferences defined in the charge rule set-up. The amount is converted to the settlement currency in case the charge currency is different from the contract currency.

When you associate a charge component with a product, you can choose to allow the amendment of the rule linked to it, under the following conditions:Note:

- For the liquidation of charge components with a charge currency not equal to the contract currency during discounting, the charge amount is calculated in the contract currency based on the exchange rate between the settlement currency and the contract currency as on the discounting date. The charge amount in contract currency is used for accounting.

- If the charge currency is different from the contract currency and the contract currency is same as the settlement account currency, the exchange rate maintained for the settlement account through the ‘Settlement Message Details – Account Details’ screen is used to convert the charge amount into the contract currency amount.

Default Waiver The charge component to which you link a charge rule acquires the properties defined for the rule. Charges for contracts (maintained under the product with which you associate the class you are building) will be calculated, by default, according to the rule linked to the component. However, when maintaining a product, you can choose to waive the rule altogether. If you want to indicate that the charge rule must be deemed as waived by default, select this option. Allow Rule Amendments If you would like to allow the amendment of a rule for a charge component when linked to a contract, check this box. Amend After Association If you would like to allow the amendment after association of a rule for a charge component, check this box. Once checked the system will allow you to modify the rule after the association event is triggered for the linked contract. Allow Amount Amendment If you would like to allow amendment of the charge amount calculated by the system as per the charge rule, check this box. Amend After Application If you would like to allow the amendment of the charge amount after application of a rule for a charge component, check this box. Once checked the system will allow you to modify the charge amount after the application event is triggered for the linked contract. Capitalize You can capitalize the payment of charges and fees. If the charge is not paid on a scheduled date, the outstanding charge amount will be added to the outstanding principal and this becomes the principal for the next schedule. If a partial payment has been made, the unpaid amount will be capitalized (the unpaid charge is added to the unpaid principal and this becomes the principal for the next schedule). Note:

If the ‘Capitalize’ option is not checked for the broker, deal, product and currency combination, then the option ‘Consider as discount’ cannot be checked for the securities module.Consider as Discount While defining a charge class for either the securities or the bills module, you can indicate whether the charge component is to be considered for discount accrual on a constant yield basis. If you select this option the charge received against the component is used in the computation of the constant yield and subsequently amortized over the tenor of the associated contract.

Checking this option also indicates that the component is to be used for IRR calculation.

Note:

IRR, the Internal Rate of Return is the annualized effective compounded return rate which can be earned on the invested capital, i.e. the yield on the investment.Accrual Required Checking this indicates that the charges have to be accrued. Subsequently, the charges are accrued using the upfront fee system. Note:

This option is disabled for BC contracts.

Collect LC Advising Charges in Bills Check this box to indicate that the charge class used with an LC should be liquidated or transferred as a part of the bill availed against the LC. You can check this option only for LC module. If you check this box for other modules, then system will display an error message. This check box indicates whether the charge component needs to be transferred onto the bill or should be collected from the customer during the liquidation event of the charge component as a part of the LC. During authorization of charge component the system automatically creates liquidation amount tags for the component for LC module.

If you select this option, then the system will allow for definition of accounting for the component as a part of Bill and/or as a part of the LC. This enables to define the accounting entries for this component and can be recovered the same as part of Bill. Accounting roles of the bills module are associated with such charges. These roles can be used to transfer the charges onto Bills.

Discount Basis While defining a charge class for the bills module, you can define the discount basis for the purpose of IRR computation. You can choose either of the following as discount basis: - Inflow – If you choose Inflow, the charge will be considered as an inflow for IRR computation

- Outflow – If you choose Outflow, the charge will be treated as an outflow for IRR computation

Collect LC Charges in Bills Check this box to indicate that the charge class, when used with an LC, needs to be liquidated / transferred as a part of the bill availed against the LC . When selected, the system shall allow for definition of accounting for the component as a part of Bill and / or as a part of the LC. This shall enable any receivable accounting to be set up as a part of the LC, and subsequent transfer from the receivable GL as a part of the Bill.

This flag is enabled only for LC module. For other modules, this is disabled with default value as ‘No’.

Note:

- The charge component can be marked as ‘Collect LC Charges in Bill’ or ‘Collect LC Advising Charges in Bill’. Either one of the selected but not both. Both can be null.

- Collect LC Charges in Bill’ and ‘Collect LC Advising Charges in Bill’ cannot be selected when track receivable or payable is selected at rule level.

- Collect LC Charges in Bill’ and ‘Collect LC Advising Charges in Bill’ cannot be selected along with third party charge type.

Price Details External Pricing Check this box to indicate that external charges can be fetched from external pricing and billing engine for contracts created under this product. Debit Customer as part of Billing Check this box to indicate that the configured charge will be debited from customer account as part of billing feed from external pricing and billing engine. Charge Components for a Product - On ‘Product Definition’ screen, click ‘Charges’ button.You can specify the charge components applicable to a product.The ‘Charge Details’ screen is displayed:

You should necessarily use a charge class to indicate the charge components applicable to a product. (A charge class is a specific type of component that you can build with certain attributes.)

Parent topic: Charge Class