- Brokerage User Guide

- Broker Details

- Capture Broker Details

2.2.1 Capture Broker Details

This topic provides systematic instructions to capture broker details.

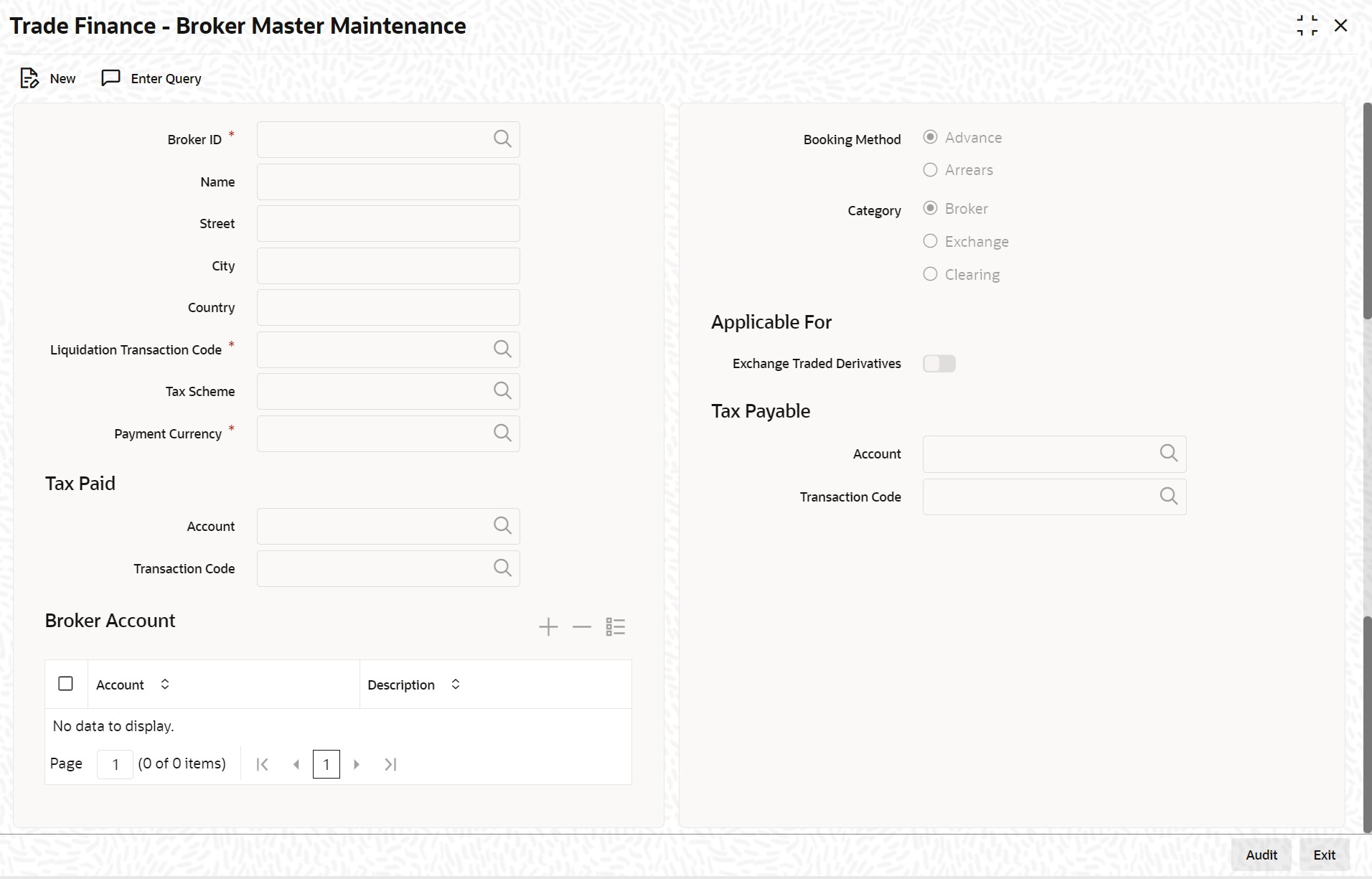

- On the Homepage, type 'BRDTFMT’ in the text box, and click the next arrow.The ‘Trade Finance - Broker Master Maintenance’ screen is displayed:

In this screen, you can specify the following:- The broker’s code

- The name and address of the broker

- The booking currency

- The transaction code under which the system should track accounting entries involving the liquidation

- Whether it is to be paid in advance or as arrears

- The tax scheme applicable

- The tax paid and the tax payable accounts

- On ‘Trade Finance - Broker Master Maintenance’ screen, specify the fields.For more information on fields, refer to Table 2-1 :

Table 2-1 Trade Finance - Broker Master Maintenance - Field Description

Field Description Broker Identification In the ‘Trade Finance - Broker Master Maintenance’ screen, you should specify a (unique) Broker Identification for every broker with whom you deal. The Broker Identification has to be the same as the broker’s Customer Identification Number (since a broker will have an account with you - that is, will be a customer of your bank). The Customer Identification Number can be selected from a list that is displayed.

This Broker ID will be used to identify the broker. For example, when processing a deal on which you have to pay brokerage, or when generating reports for a broker, you need to enter the code of the broker involved.

Broker’s Address When you select a Customer Identification Number to identify a broker, the system maps and displays the name and address of the broker .You cannot change the name which displays in this screen, but according to the defined details you can enter the changed address of the broker.

The fields to be entered are as follows:

- Name

- Street

- City

- Country

Liquidation Transaction Code A broker gets the brokerage amount only after liquidation through the brokerage liquidation function. You should specify a liquidation transaction code from the codes maintained in the Core Entities module of Oracle Banking Trade Finance. The system passes accounting entries under the selected transaction code.

Tax Scheme A tax scheme holds the tax rules for the tax applicable on the brokerage paid.

Payment Currency The brokerage is booked into the Broker Account defined in this screen. If this account is either not specified or is not available when brokerage is being booked, the brokerage will be booked in any one of the broker’s savings or current accounts (in the currency specified here).

For every broker, you can specify the currency in which you would like to pay brokerage. If the currency that you specify is not the broker’s account currency, the standard exchange rate (for the day) will be used to convert the brokerage into the currency of the broker’s account.

Booking Method You can opt to book the brokerage payable to a broker either in:

- Advance

- Arrears

If you select:

- Advance: brokerage will be booked when the deal is initiated

- Arrears: brokerage will be booked when the deal is liquidated

Category This defines the category of the entity whether a broker, an Exchange member or a Clearing member:

- Broker

- Exchange

- Clearing Member

Applicable For Check or uncheck the box ‘Exchange Trade Derivatives’ accordingly.

If the flag is checked then it means that the broker defined is available for the Exchange trade derivative module.

Tax Paid If any tax is to be paid on the brokerage, you have to specify the following details:

Account The account from which the broker’s tax component debits. Transaction code You have to specify the transaction code for the tax payable account by selecting one from the list so that the system passes accounting entries for this transaction. The transaction code identifies the nature of the entry which passes.

If any tax is payable on the brokerage, you have to specify the following details:

Account The account to which the broker’s tax component credits.

Transaction code You have to specify the transaction code for the tax payable account so that the system passes accounting entries for this transaction.

Under the ‘Broker Account’ table you can specify the following.

Account Specify the account of the broker. The adjoining option list gives you a list of accounts. Choose the appropriate one. You cannot specify the same account number for another broker. Each broker should have account numbers unique to him.

Note:

It is mandatory for you to specify at least one account number for the broker. If the broker is dealing with Exchange Traded Derivatives, his external accounts have to be maintained here. You cannot specify the same account numbers for different brokers. Each broker should have unique account numbers.

Description Enter a brief description for the account.

Parent topic: Broker Details