9.5 Lodging Guarantee Claim

This topic provides the systematic instruction to lodge guarantee claim.

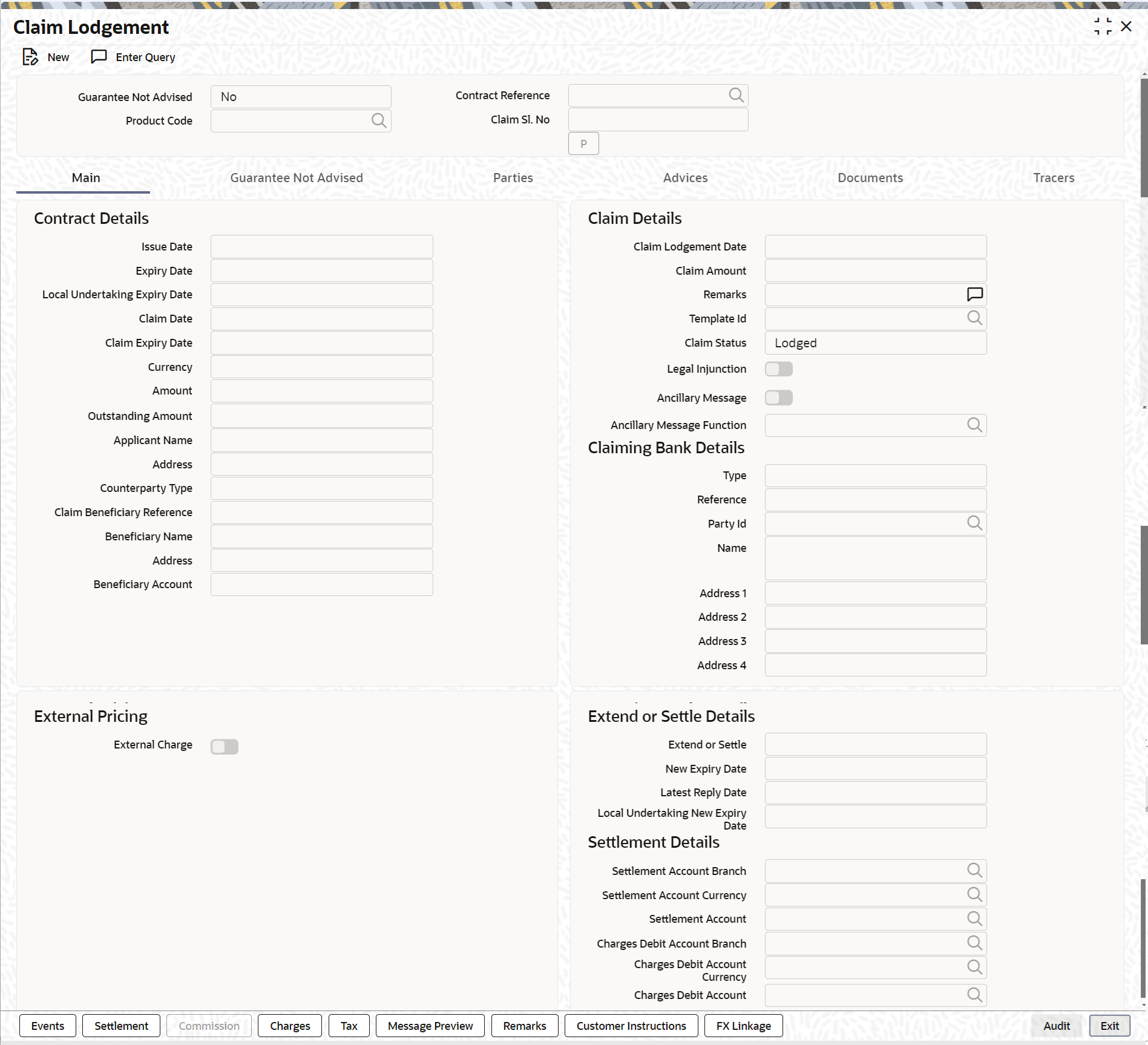

- On the Homepage, type LCDGCLM in the text box, and click next arrow.The Claim Lodgement screen is displayed.

- On the Claim Lodgement screen, click New.The Claim Lodgment screen is displayed without any details.

Table 9-28 Claim Lodgement - Field Description

Field Description Guarantee Not Advised Select the option based on the nature of the Guarantee for which Claim has to be lodged. For Guarantee Not Advised contracts, choose the option as Yes. Contract Reference Select the guarantee contract reference number from the option list for Guarantee Advised by Bank. Contract reference number will be generated by system if Guarantee Not Advised flag is selected as Yes.

Product Code Select Guarantee Not Advised products from the option list. This will list Guarantee Not Advised products when Guarantee Not Advised Flag is selected as Yes. Claim Sl. No System will generate Claim serial Number. - On the Main details in the Claim Lodgement screen, you can view the contract details. The system displays the contract details.For more information on Main details, refer the Field Description table given below:

Table 9-29 Main - Field Description

Field Description Issue Date Date on which the guarantee is issued Expiry Date Date of expiry of the guarantee Local Undertaking Expiry Date Expiry date of the local undertaking Claim Date Date for claiming the guarantee Claim Expiry Date End date for settling the claim Currency Currency of the guarantee Amount Amount of the guarantee Outstanding Amount The system displays the outstanding amount of the guarantee by default. Applicant Name The system defaults the applicant name. Address Address of the counterparty. Counterparty Type Party type of the counterparty Counterparty Reference Reference Number of the counterparty. Beneficiary Name Name of the beneficiary Address Specify the address details. Beneficiary Account Specify the account details of beneficiary. This field is read only. Claim Details Specify the claim details: Claim Lodgement Date Specify the claim lodgement date using the calendar icon. Claim Amount Specify the amount of the claim. The claim amount should not be greater than the guarantee amount and the outstanding guarantee amount. Remarks Specify remarks, if any. Template Id Select the template ID from the option list. Template ID is applicable only when the party type is applicant bank or issuing bank. Template ID is applicable only if SWIFT 2018 is enabled. Note:

The claim message is generated only if the template is selected.Claim Status The status of the claim is displayed here. The statuses are as follows: - Lodged on claim lodgement

- Injunction Received on receipt of Legal Injunction

- Rejected on Reject

- Settled on settlement

Legal Injunction Check this box to indicate that there is a legal injunction received against the claim, to be captured during Claim Amendment. Note:

System triggers GCAM event and Claim Status is updated as Injunction Received.Ancillary Message Check this box to generate MT 759 on contract authorization. Ancillary Message Function Specify the ancillary message function. Alternatively, you can select the ancillary message from the option list. The list displays all valid options maintained in the system. Ancillary Message Function is mandatory if Ancillary Message is checked. External Pricing Specify the External Pricing details. External Charge While lodging guarantee claim for a contract for which External Charges is enabled at product level, external charges is fetched from external pricing and billing engine. Claiming Bank Details Specify Claiming Bank Details. Type Select the Claiming Bank Party type. Allowed values are:

- Counter Guarantee Issuing Bank

- Local Guarantee Issuing Bank

- Advice Through Bank

- Advising Bank

- Others

Reference Enter the Claiming Bank Reference, it cannot exceed 16 characters. It will be sent the outgoing message. Party Id Select the Claiming Bank Party ID from LOV. Based on the selected Party Id, other fields like Name, Address1, Address2, Address3 and Address4 will be populated. Name Claiming Bank Party Name will be defaulted based on Party Id. Address 1 Claiming Bank Party Address 1 will be defaulted based on Party Id. Address 2 Claiming Bank Party Address 2 will be defaulted based on Party Id. Address 3 Claiming Bank Party Address 3 will be defaulted based on Party Id. Address 4 Claiming Bank Party Address 4 will be defaulted based on Party Id. Extend or Settle Details Specify Extend or Settle details: Extend or Settle Select the option from the drop-down list. The list displays the following options: - Extend or Settle

- Extension

- Settle Only

During claim amendment from Extend or Settle to Extension system will initiate Guarantee amendment without beneficiary confirmation and increase Expiry date. GCEX event will be triggered. Charges, Tax and Advices of claim amendment and guarantee amendment will be processed as part of GCEX. This event will be available to view from Guarantee online Screen(LCDGUONL) and Claim lodgement screen(LCDGCLM).

New Expiry Date Specify the new expiry date. The New Expiry date is mandatory when Query to Extend or Settle option is selected. Latest Reply Date Specify the latest reply date. The Latest Reply date is mandatory when Query to Extend or Settle option is selected. Local Undertaking New Expiry Date Specify the new expiry date for the local undertaking. Settlement Details You can set the following settlement details: Settlement Account Branch The system displays the settlement account branch on selection of the debit account number: Settlement Account Currency The system displays the settlement account currency on selection of the debit account number. Settlement Account The system displays the settlement account details. Charges Debit Account Branch The system displays the charges debit account branch on selection of the charges debit account number. Charges Debit Account Currency The system displays the charges debit account currency on selection of the charges debit account number. Charges Debit Account The system displays the charge debit account details. - On the Claim Lodgement screen, click the Guarantee Not

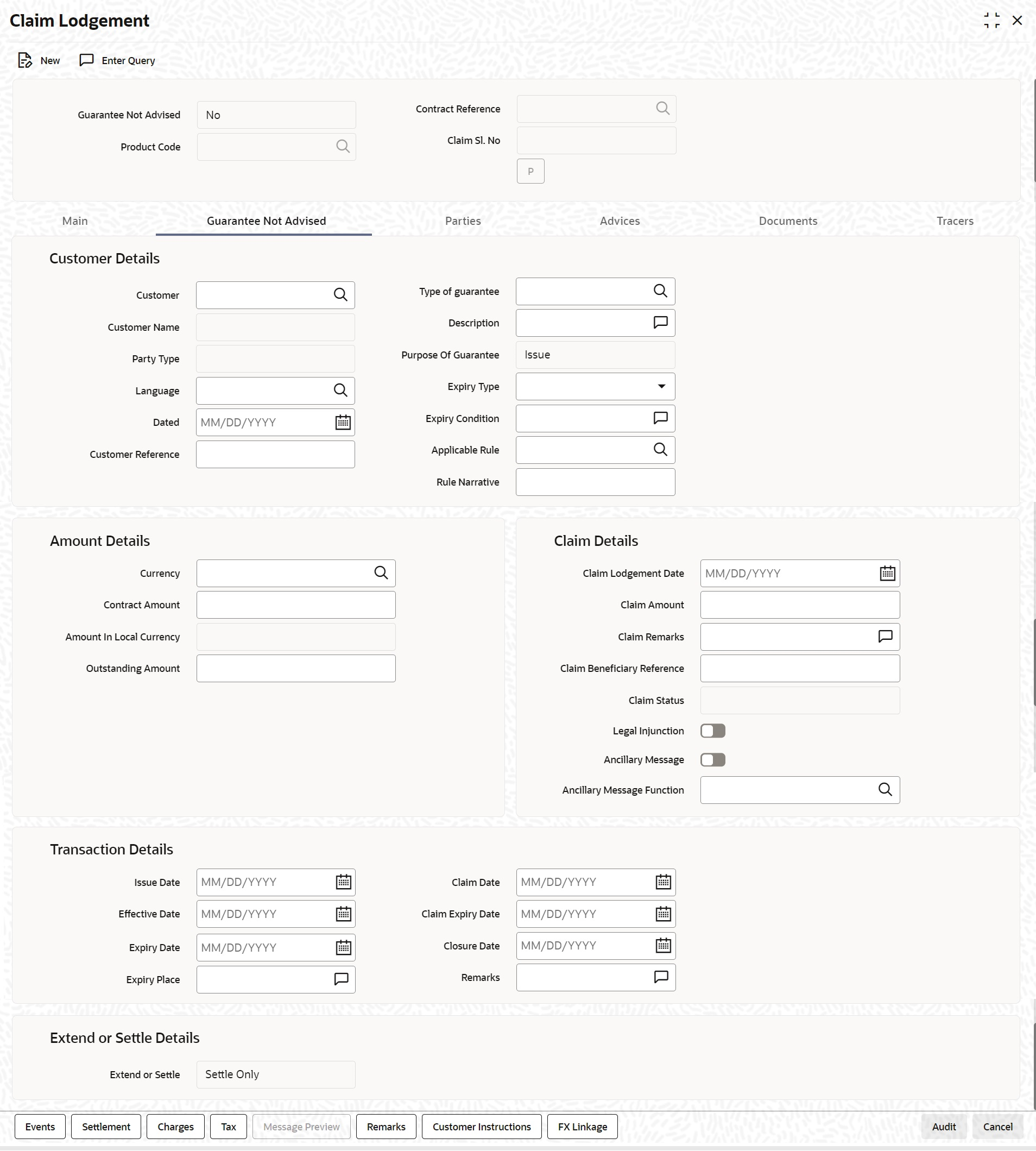

Advised tab. The Guarantee Not Advised tab is displayed.

- Specify the Guarantee Not Advised Details. For more information on fields, refer the Field Description table given below:

Table 9-30 Guarantee Not Advised - Field Description

Field Description Customer List of values with list of all valid customers. Customer Name System will default Customer Name based on Customer Party Type System will default BEN and will be read only. Language System will default user language and the same can be modified. List of values with list of languages will be provided.

Dated Specify the Customer reference date. Customer Reference Specify the Customer reference number. Type of Guarantee LOV with list of guarantee types : - APAY- Advance Payment Guaranteeb.

- BILL- Bill of Lading Guaranteec.

- CUST- Customs Guaranteed.

- DPAY- Direct pay Guaranteee.

- INSU- Insurance Guaranteef.

- JUDI- Judicial Guaranteeg.

- LEAS- Lease Guaranteeh.

- OTHR- Other Guaranteei.

- PAYM- Payment Guaranteej.

- PERF- Performance Guaranteek.

- RETN- Retention Guaranteel.

- SHIP- Shipping Guaranteem.

- TEND- Tender Guaranteen.

- WARR- Warranty/Maintenance

Description System will default Guarantee type description and the same can be modified. Purpose of Guarantee System will default Issue and will be read only. Expiry Type Expiry type will have options as Fixed, Open and Conditional -With Expiry and Conditional - Without Expiry. Expiry Condition Specify the expiry condition, if Expiry type is Conditional. Applicable Rule System will default from product maintenance and the same can be modified. LOV with list of Applicable Rules namely ISPR, NONE, OTHR, UCPR, URDG will be provided. Rule Narrative This field is applicable if Applicable Rule is OTHR Amount Details Currency System will default local currency and the same can be modified. List of values provided with list of valid currencies.

Contract Amount Specify the contract amount. This field is mandatory.

Amount in Local Currency System will default local currency equivalent and will be read only. Outstanding Amount User to provide manually and will be mandatory. Should not be greater than contract amount.

Outstanding amount will be reduced on claim settlement.

Claim Lodgement Date Specify the claim lodgement date using the calendar icon. This field is mandatory.

Claim Amount Specify the amount of the claim. The claim amount should be less than or equal to outstanding amount and will be mandatory.

Claim Remarks Specify remarks, if any. Claim Beneficiary Reference Specify the Claim Beneficiary Reference details. Claim Status System will default claim status as per existing functionality. The statuses are as follows: - Lodged on claim lodgement

- Reject on claim Reject

- Settled on claim settlement

- Injunction Received on providing Legal Injunction

Legal Injunction Select this check box during claim amendment. Ancillary Message Check Box to support ancillary message generation during claim amendment Ancillary Message Function List of values with list of ancillary message function and description. To be provided when ancillary message is enabled.- CLSVCLOS- Closing of a service call by Trade Operations

- CLSVOPEN- Opening of a service call by Trade Operations

- FRAUDMSG- Advice of a fraud attempt

- GENINFAD- General information advice

- OTHERFNC- Other request

- REIMBURS- Request related to a reimbursement

- REQFINAN- Financing request

- REXTMATU- Request to extend the maturity date

- TRANSFER- Transfer of a undertaking

Transaction Details Issue Date Specify the issue date. The issue date should be back dated.

Effective Date Specify the effective date. The effective date should be back dated.

Expiry Date Specify the expiry date. The expiry date should be should be greater than issue date.

Claim Date Specify the claim date. Closure Date Specify the closure date. Remarks Specify remarks, if any. Extend or Settle System will default Settle only and will be read only. Extension is not supported.

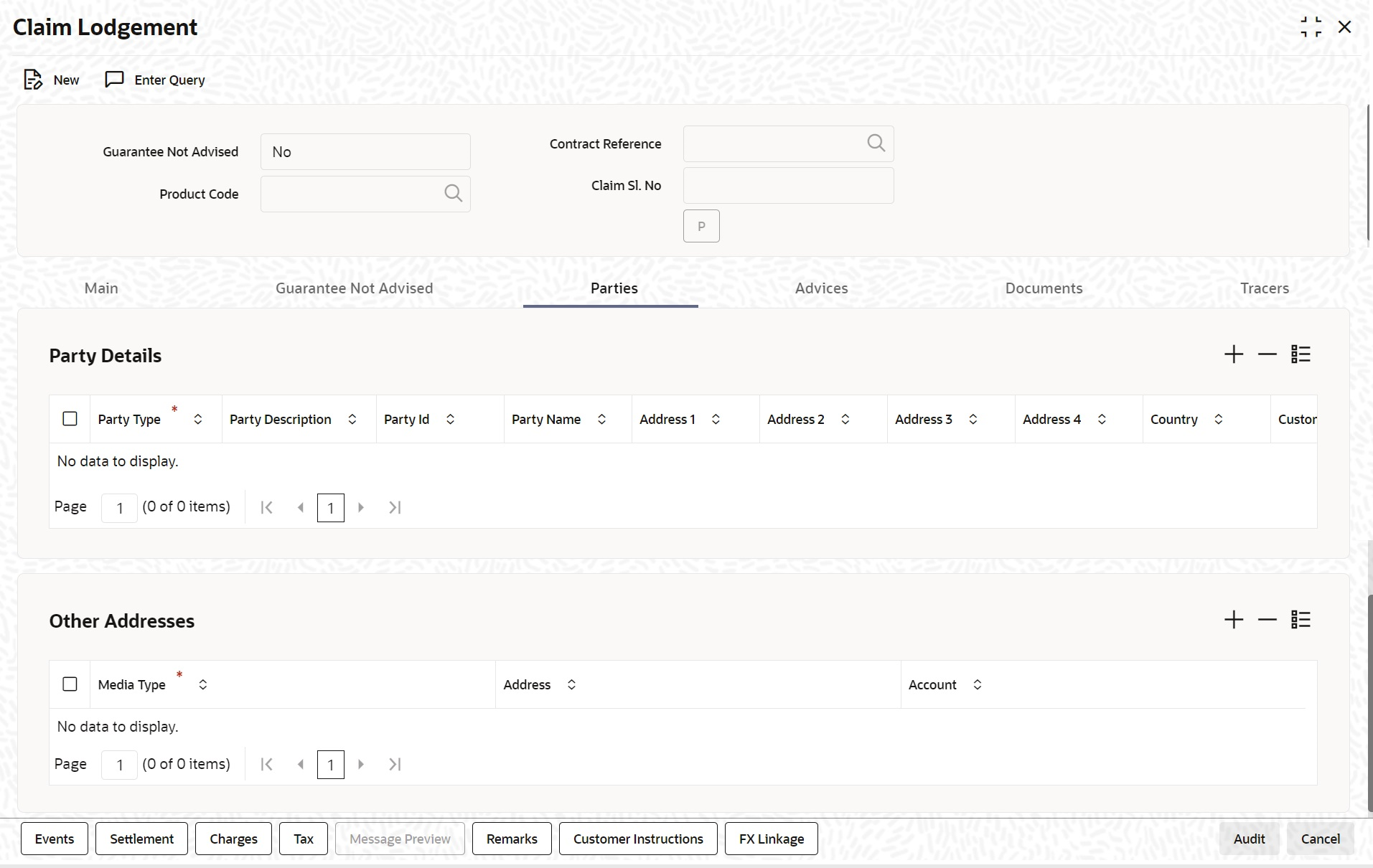

- On the Claim Lodgement screen, click the

Parties tab. The Parties tab is displayed.

- Specify the Parties details. For more information on fields, refer the Field Description table given below:

Table 9-31 Parties - Field Description

Field Description Party Type Specify the party type (beneficiary, applicant, advising bank, issuing bank). The option list displays all party types available for the LC. Select the appropriate party type from the list. The field is mandatory.

Party Description Specify the party description for the party type here.

The field is optional.Party ID Specify a Party ID for which you need to maintain. Alternatively, you can select the Customer No from the List of Values Party Id.

The field is optional.Party Name Specify the name of the Customer. The party name can be 150 characters in length.

The field is optional.Address 1 to 4 Specify the address of the customer who has initiated the transaction.

The field is optional.Country Specify the country of the customer.

The field is optional.Customer Reference Specify the sender’s reference number. Input to this field will be mandatory for the party type ISB.

The field is optional.Dated Specify the date of transaction initiation.

The field is optional.Language Specify the language in which advices should be sent to the customer.

The field is optional.Issuer Bank Select this option to indicate that the issuer is a bank.

The field is optional.Other Addresses Provide the other addresses details: Media Type Select the Media Type from the option list.

The field is mandatory.

Address This field indicates the party’s mail address.

The field is optional.Account Specify the account number.

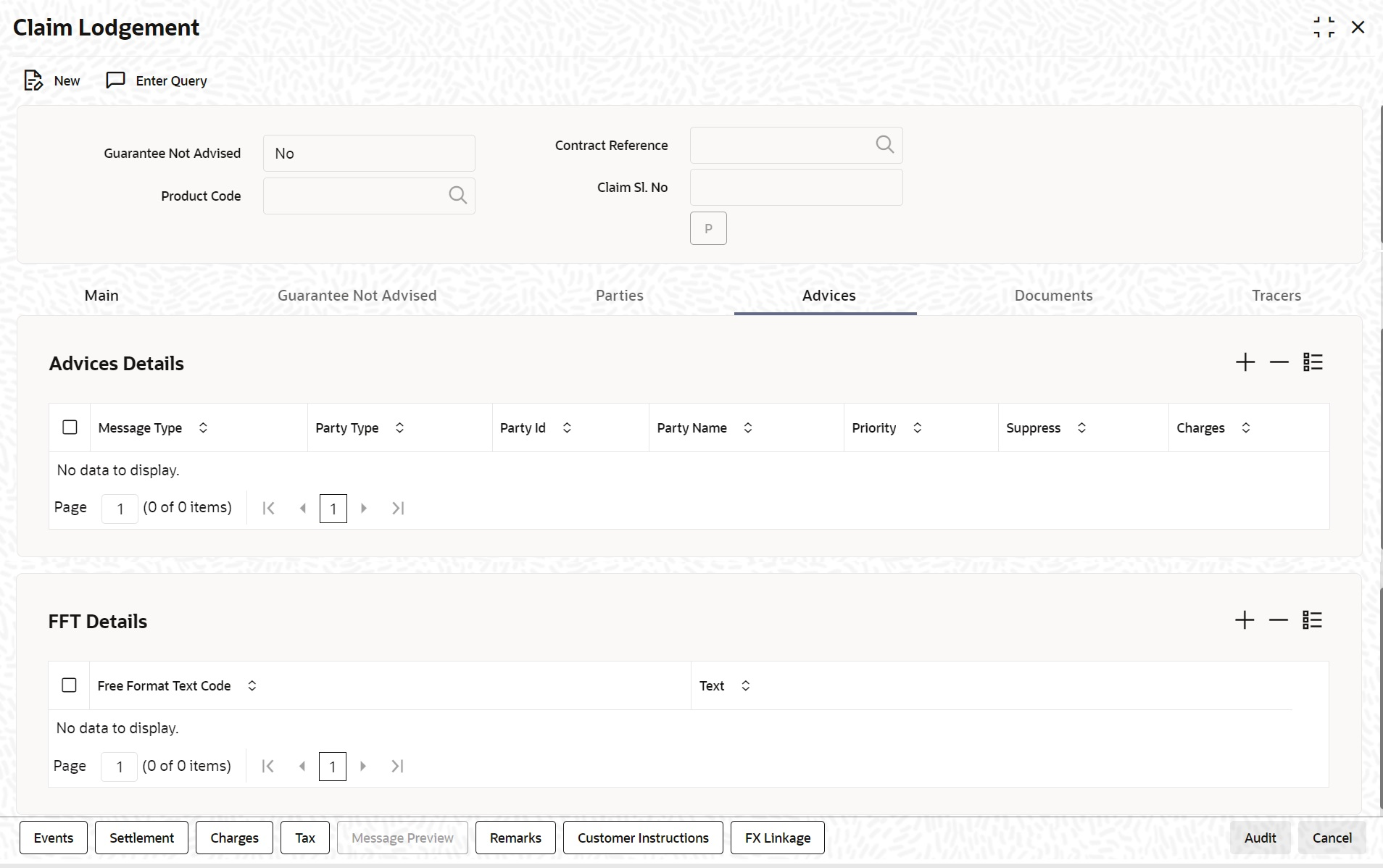

- On the Claim Lodgement screen, click the Advices tab. The Advices Details is displayed.

- Specify the Advices details. Once you select the Advise Details check box and click on add icon to capture the Advices details.For more information on fields, refer the Field Description table given below:

Note:

Click on add icon to include to include parties details.Table 9-32 Advices - Field Description

Field Description Advise Details Specify the Advise Details. Message Type The system displays the message type of the advice generated.

This field is optional.Party Type The system displays the party type for which the message is generated.

Claims can be lodged for SBLCs with Reimbursing Bank if Bills are not booked under the SBLC. If a Bill is booked under SBLC, system will provide appropriate error message during Claim lodgement.

This field is optional.Party Id The system displays the party ID for which the message is generated.

This field is optional.Party Name The system displays the name of the party for which the advice is generated.

This field is optional.Medium Select the medium through which the message has to be sent from the option list.

This field is optional.Priority Select the priority of sending message from the drop-down list.

This field is optional.Suppress Check this box to suppress the message.

This field is optional.Charges The system displays the charges configured. This field is optional.Note:

Guarantee claim Settlement advice GUA_CLAIM_ADV/MT765 is generated during claim Settlement if SWIFT 2019 is enabled.Guarantee claim Settlement advice

GUACLAIM_ADV/MT799 is generated

during claim rejection if SWIFT 2018 is

enabled.If Ancillary Message is checked during

claim Settlement then advice

GUACLAIM_ADV/MT759 is generated

during claim Settlement if SWIFT 2018

is enabled.Guarantee claim rejection advice GUA_-

CLAIM_REJ/MT786 is generated during

claim rejection if SWIFT 2019 is enabled.Guarantee claim rejection advice GUA_-

CLAIM_REJ/MT799 is generated during

claim rejection if SWIFT 2018 is enabled.If Ancillary Message is checked during

claim rejection then advice GUA_-

CLAIM_REJ/MT759 is generated during

claim rejection if SWIFT 2018 is enabled.FFT Details Specify the FFT Details.

This field is optional.Free Format Text Code Select the free format text code from the option

list.

You can select the required code as given in the Table 9-33.

This field is optional.Text The system displays a brief description on free format text.

This field is optional.Table 9-33 FFT Details

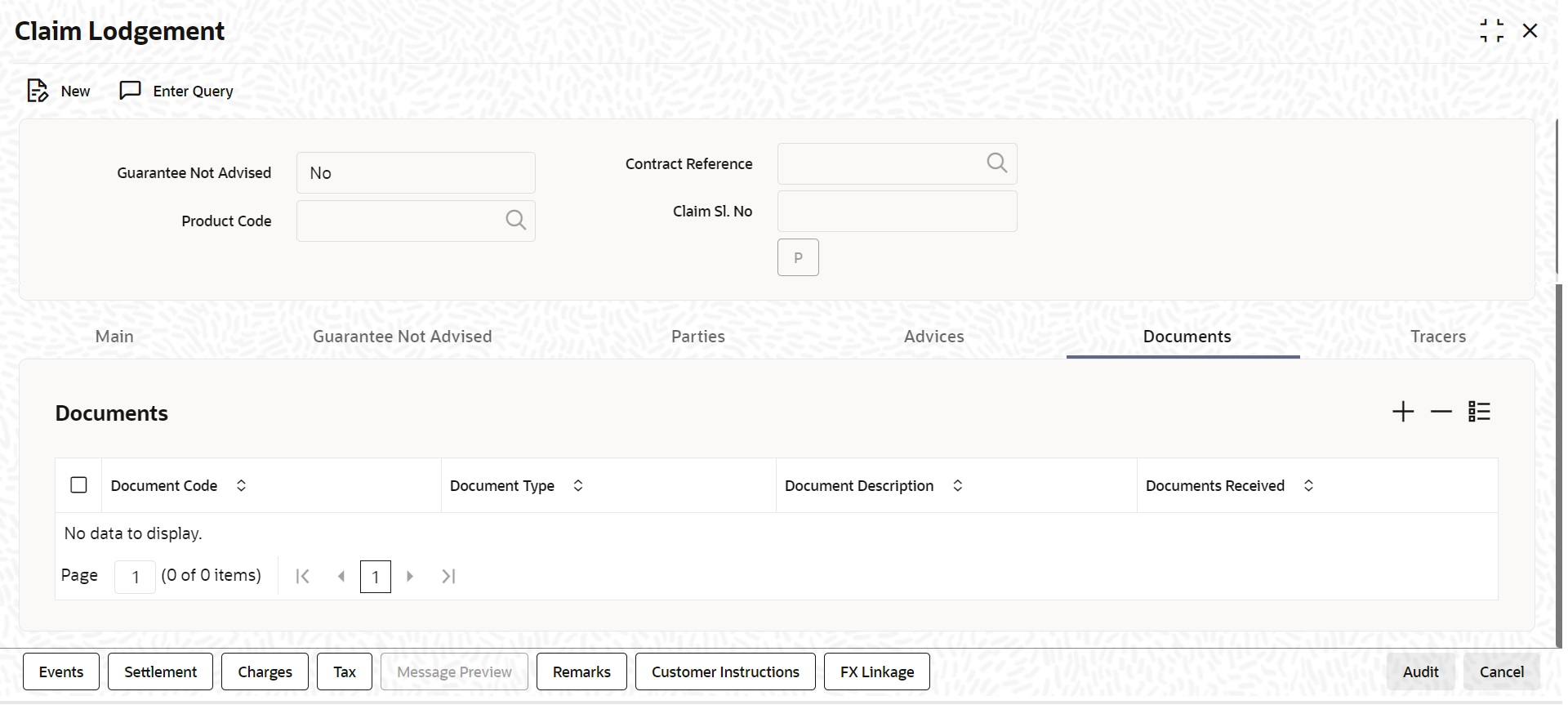

FFT Code Message 56AINTRMEDRY MT765 - On the Claim Lodgement screen, click Documents. The Documents details is displayed.

- Provide the document details. The documents captured during Guarantee Issuance are defaulted when claim is lodged.For more information on fields, refer the following field description table.

Table 9-34 Documents - Field Description

Field Description Document Code The code of the document captured during guarantee issuance is defaulted here.

This field is optional.Document Type The type of document captured during guarantee issuance is defaulted here.

This field is optional.Document Description The description of the document is defaulted here.

This field is optional.Document Received Check this box to indicate that documents are received. The following table provides the list of SWIFT messages and the fields of SWIFT messages that utilizes the information provided in this screen.

This field is optional.The following table provides the list of SWIFT messages and the fields of SWIFT messages that utilizes the information provided in this screen: The above details are applicable only if SWIFT 2019 is enabled.

Table 9-35 SWIFT Messages

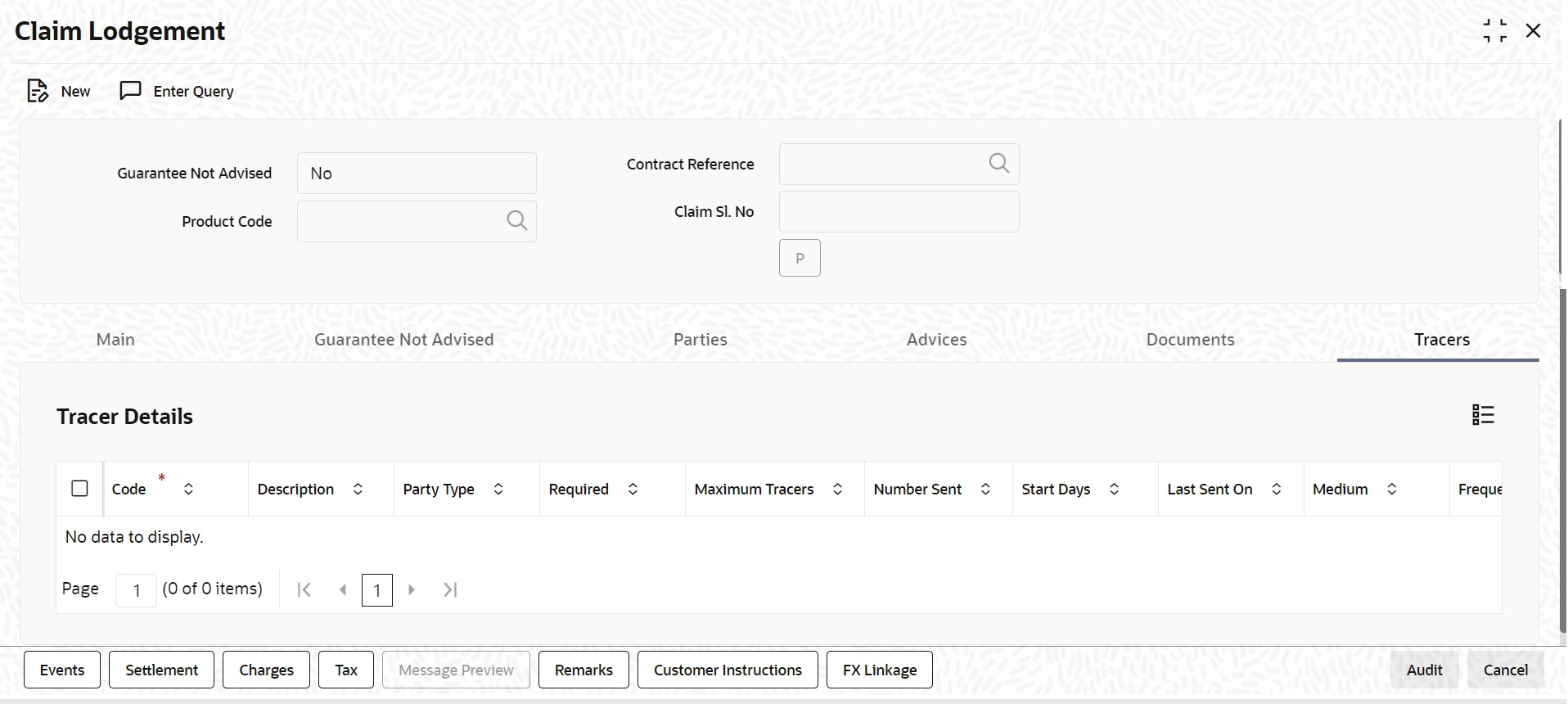

Field in Oracle Banking Trade Finance SWIFT Message Field of the SWIFT message Contract Reference MT765,MT786 20 Claim Lodgement date MT765 30A Extend or Settle MT765 21M Claim Amount MT765,MT786 32B New Expiry Date MT765 31J Claim Lodgement date MT786 30 - On the Claim Lodgement screen, click Tracers.The Tracers details is displayed.

Note:

Tracers are reminders that can be sent to various parties involved in a claim.

New tracer code Guarantee claim tracer (GUA_CLM_TRACER) introduced to support tracer generation for claims lodged.

- On the Tracer tab, specify the fields, and click Ok.By default, you can view the tracers specified for an LC.For more description on fields, refer to Table 9-36:

Table 9-36 Tracers - Field Description

Field Description Code For the tracer code that is highlighted, the details are defaulted from the product and can be changed to suit the LC you are processing.

This field is mandatory.Description Enter the document description of the document that is defaulted to suit the LC you are processing.

This field is optional.Party Type Enter the party type.

This field is optional.Required You can stop the generation of a tracer at any point during the life cycle of an LC contract.

For instance, you had specified that an acknowledgement tracer is to be generated for a contract. When you receive the acknowledgement from the concerned party, you can disable its generation. At a later stage when you wish to generate the tracer again, you only need to enable it for the LC by using this facility.

If this box is checked, it means that the tracer should be applied for all new LCs involving the product. If not, it means that it should not be applied for new LCs involving the product. Amen If for some reason you want to stop generating the tracer for a product, uncheck this box through the product modification operation. The tracer will not be generated for new LCs involving the product.

This field is optional.Maximum Tracers You can specify the maximum number of tracers that should be sent for the LC. The value is defaulted from the product under which you are processing the LC.

This field is optional.Number Sent Number of tracers sent to the party. This field is optional.

Start Date The tracers that you specify for an LC can be generated only after it has been authorized. Specify the default number of days that should elapse after an LC has been authorized, on which the first tracer should be sent.

By default, the first tracer for an authorized LC contract will be sent, after the number of days prescribed for the product under which it is processed.

This field is optional.Last Sent On Date on which the tracer was last sent to the party.

This field is optional.Medium If you have specified that tracers should be generated for an LC, you should also specify the medium through which it is to be generated. A tracer for an LC can be sent through Mail, Telex or other compatible media.

This field is optional.Frequency You can specify the frequency (in days) with which the tracer should be re-sent, for the LC you are processing.

This field is optional.Template ID Specify the template ID for the SWIFT message type.

If the medium is SWIFT, then the system will generate the tracers in the SWIFT MT799 format based on the template ID mentioned at the LC Contract level for populating the tag 79.

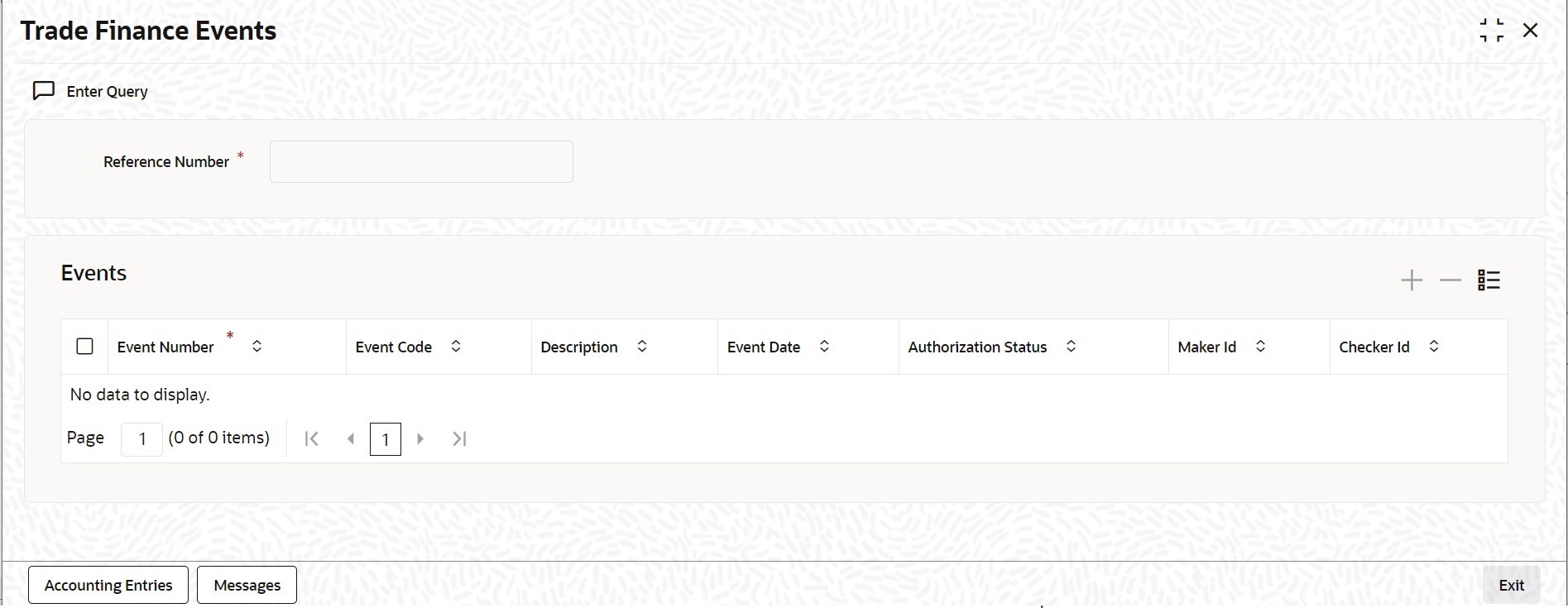

This field is optional. - On the Claim Lodgement screen, click the Events button.The Trade Finance Events is displayed. The system displays the events, accounting entries and advices here.

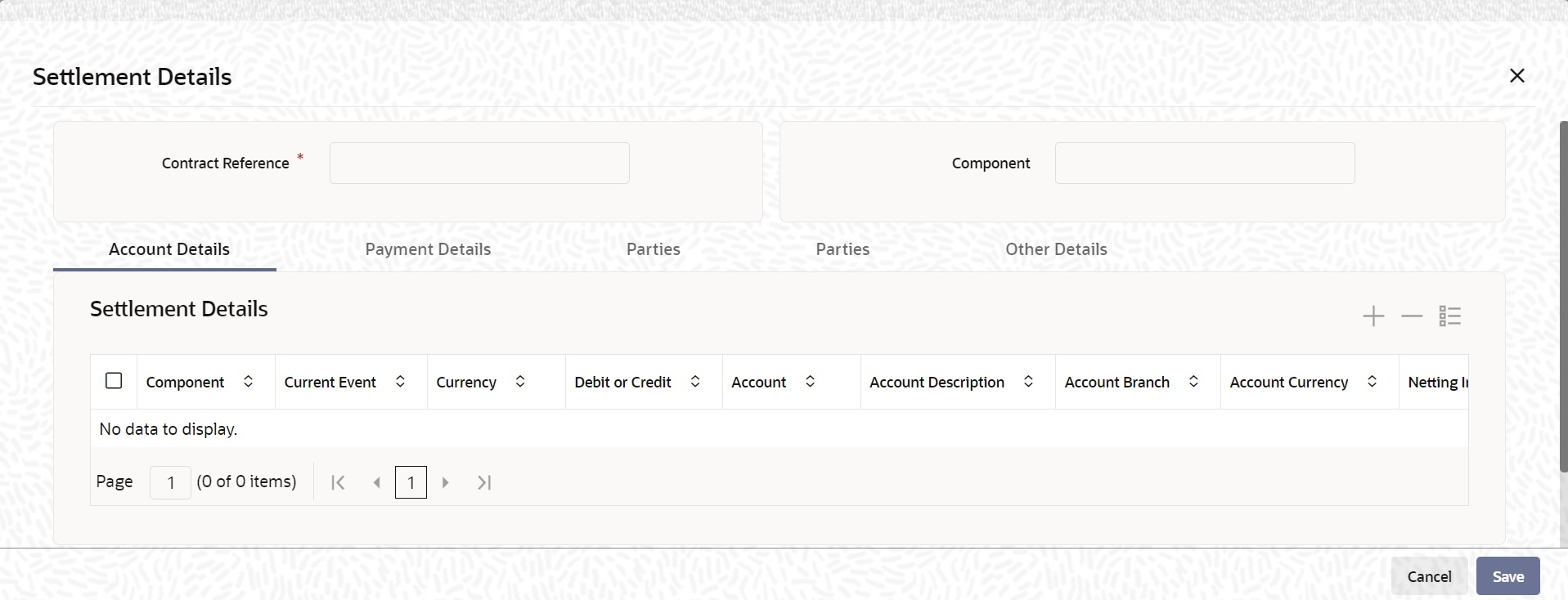

- On the Claim Lodgement screen, click the Settlement button. The system displays the settlement information for charges here. Current Event:

Current event of settlements will be checked for the amount tags pertaining to the current event and will be unchecked for the amount tags not pertaining to the current event.

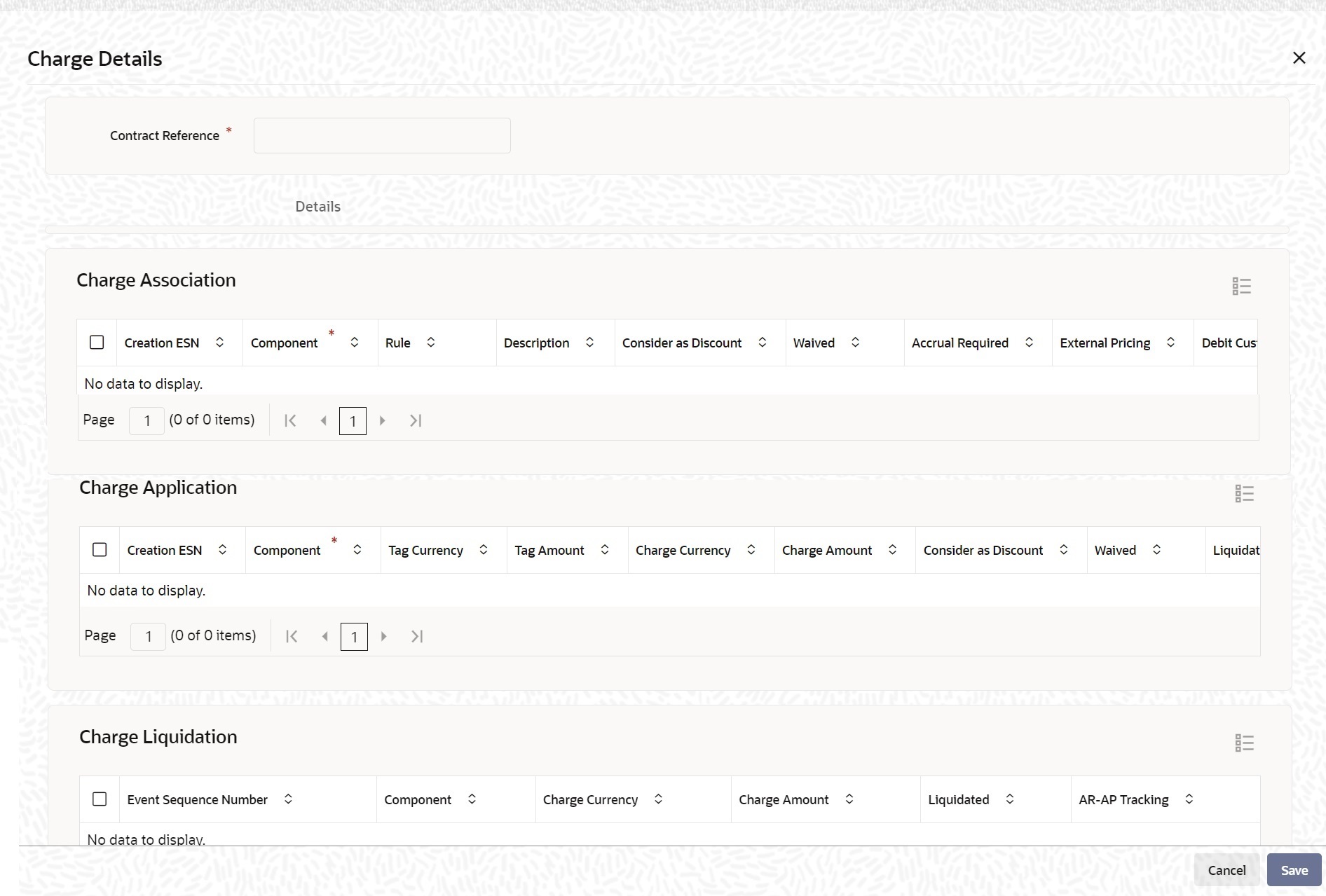

- On the Claim Lodgement screen, click the Charges button. The Charge Details screen is displayed. The system displays the charges configured for the event at product definition here.

Note:

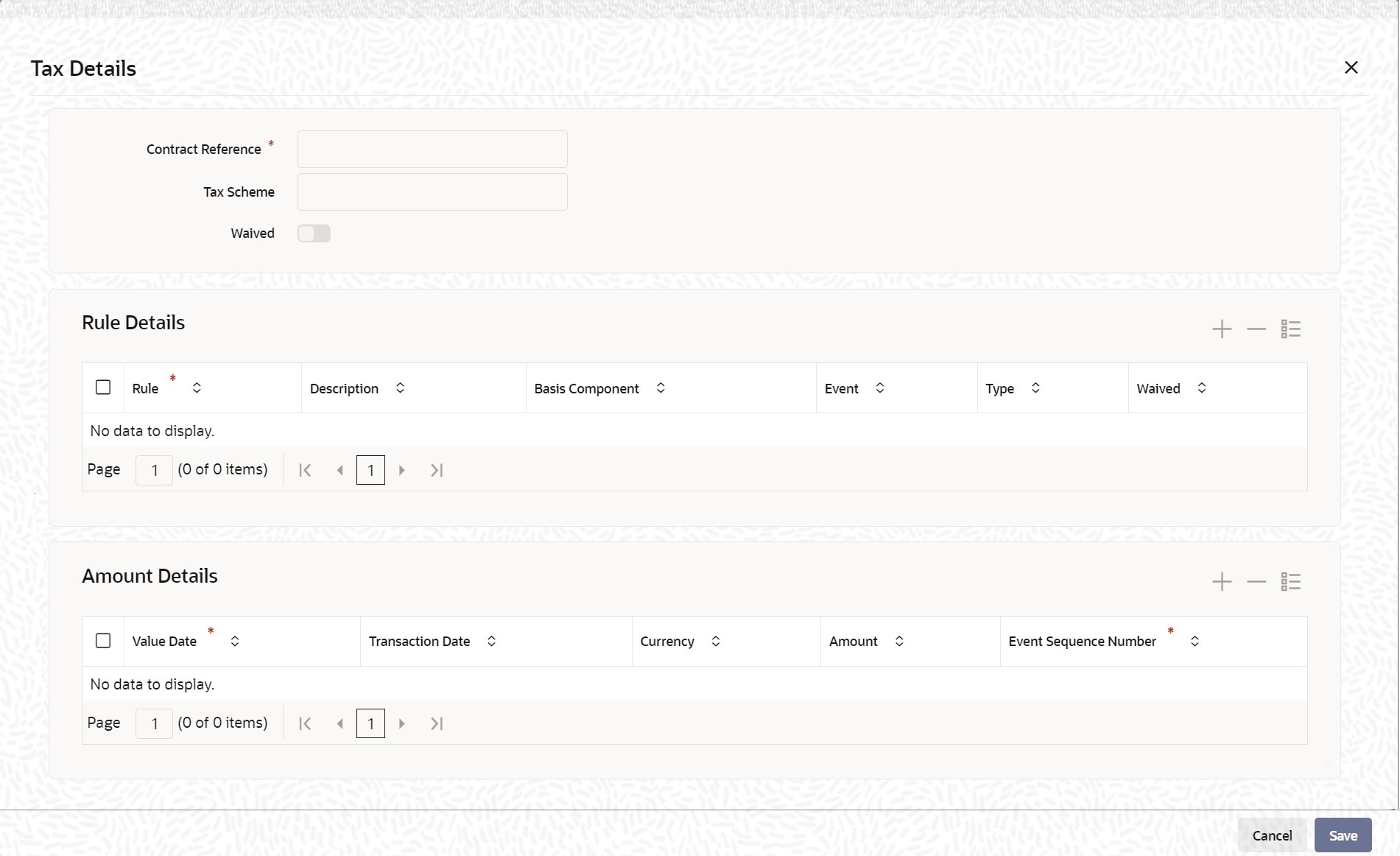

For more details on the Charges Details screen, refer the topic Contract Charge Details in Charges and Fees User Guide under Modularity. - On the Claim Lodgement screen, click the Tax button.The system displays the details of the tax configured in the screen.

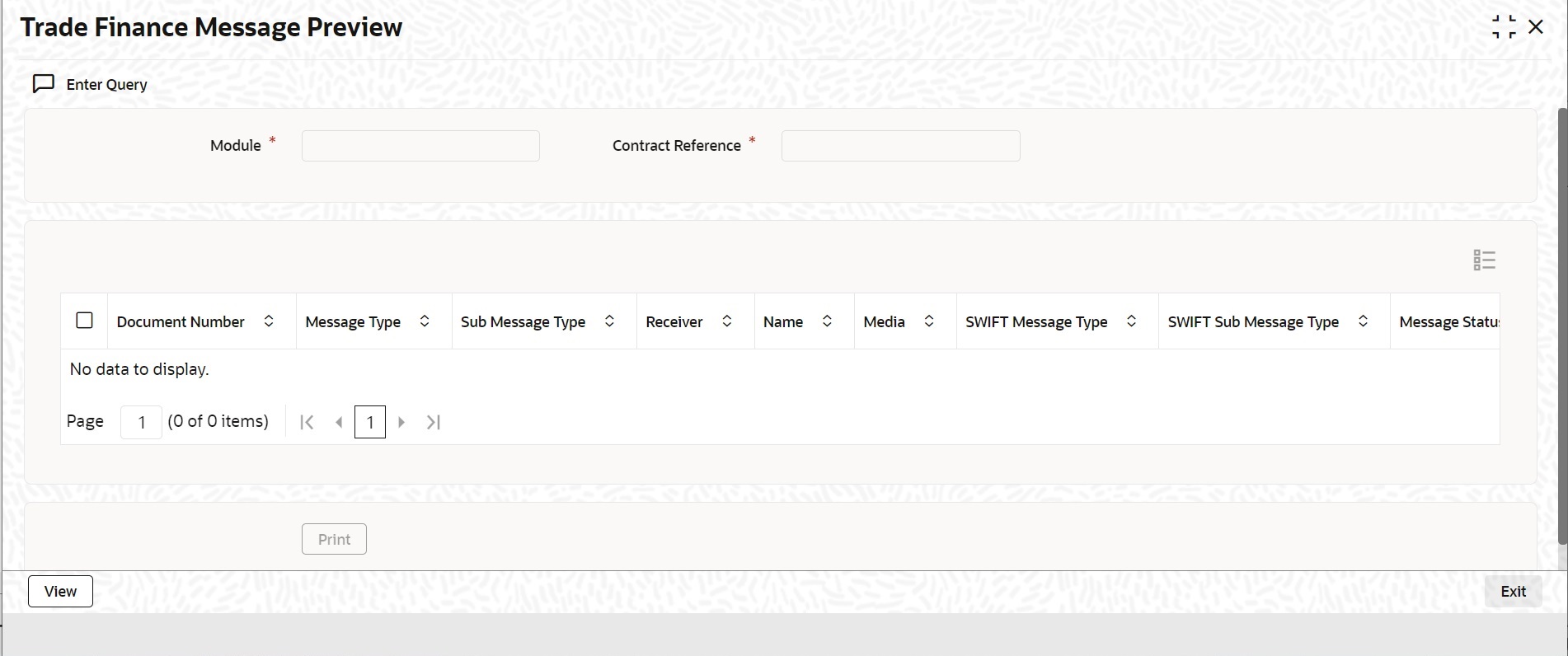

- On the Claim Lodgement screen, click the Message Preview button. You can view the message or advice generated in the screen.

Note:

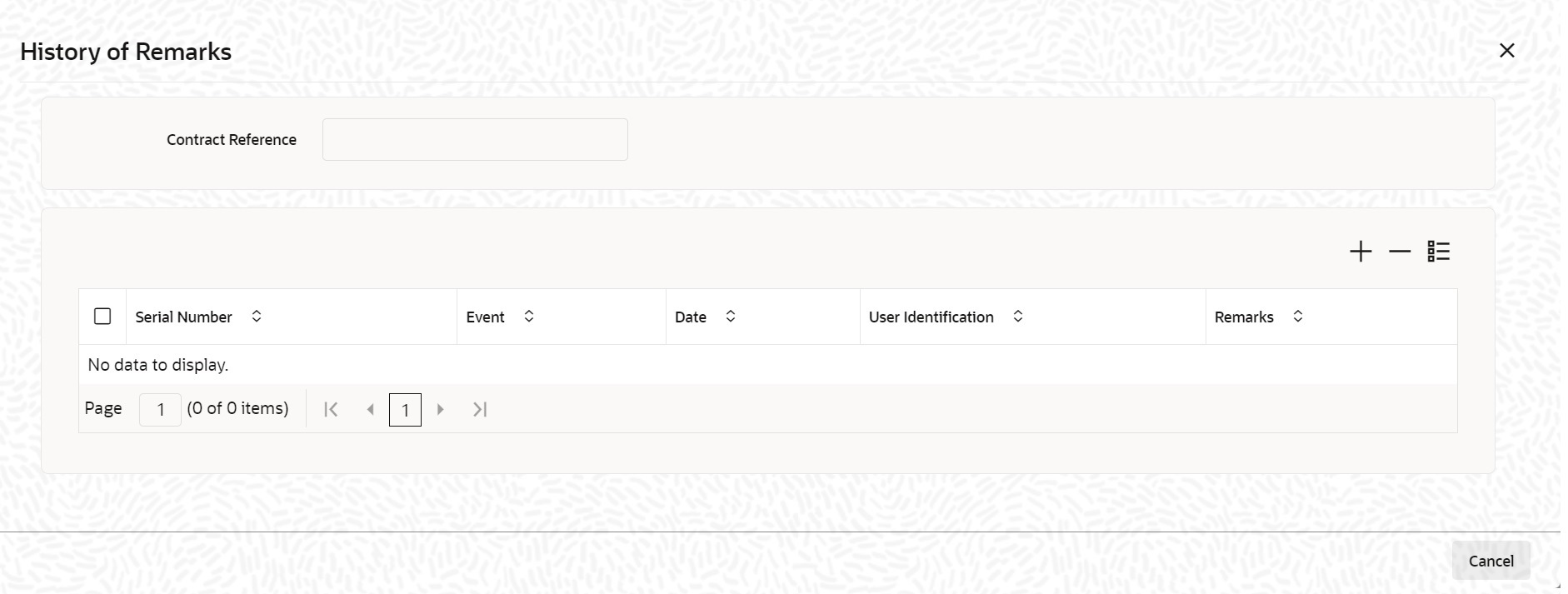

You can view the message or advice generated in the screen. - On Claim Lodgement screen, click Remarks button.The History of Remarks screen is displayed.

Note:

For more details on this screen refer Remarks in the topic Capturing Additional Details in this user manual. - Click Save. The Claim Lodgement details are saved.

- Click the Hold button. You can hold the data entered. On hold of the contract, the status of the contract will be updated as Hold and the system will not do any mandatory validation on the data.

Note:

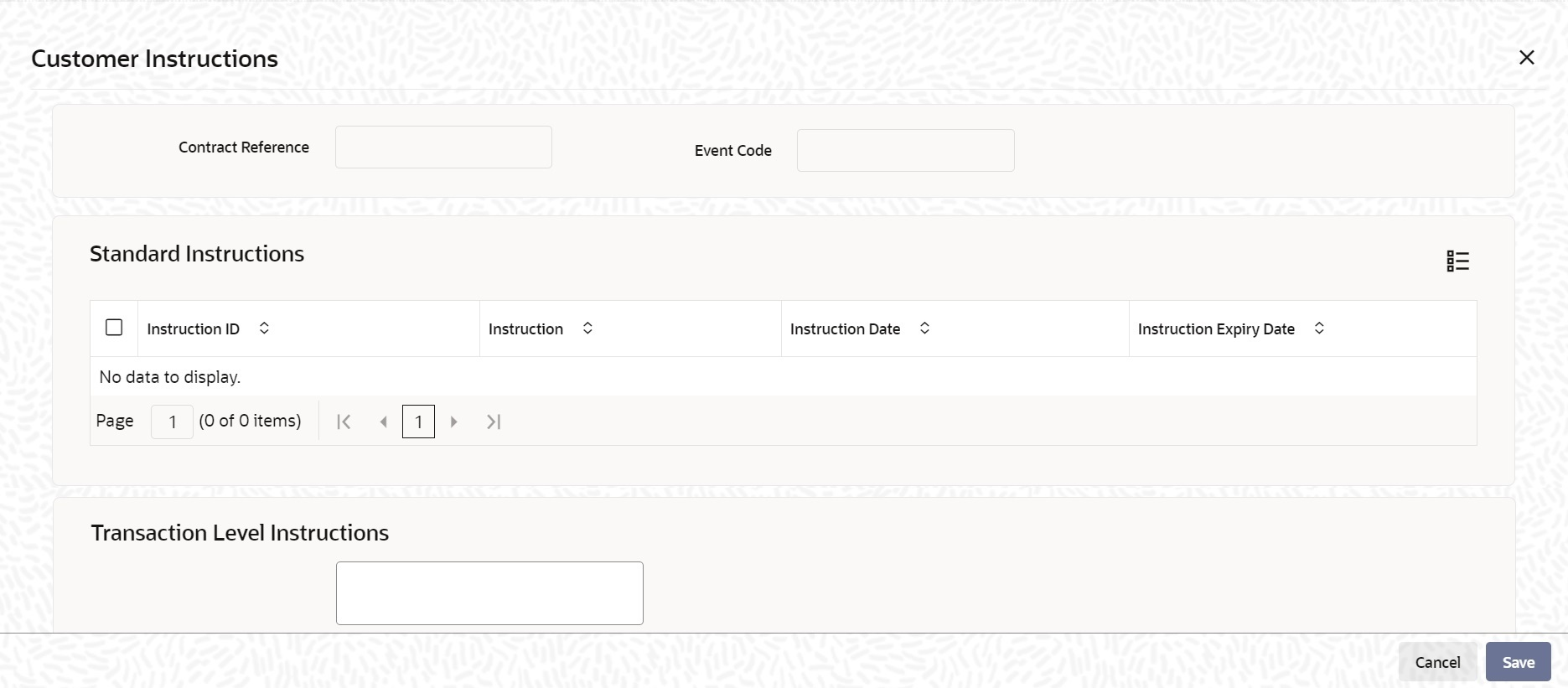

In auto-auth case, if hold is selected, then the contract will be in unauthorized status. System will not consider the contract which is on hold for any other processing. During EOD, system will not consider the records which are on hold as pending transactions. - On the Claim Lodgement screen, click the Customer Instructions button. The Customer Instructions screen is displayed.

Table 9-37 Customer Instructions - Field Description

Field Description Contract Reference Number System displays the contract reference number. Event Code System displays the Event Code of the contract. Standard Instructions Customer would want to give Standard instructions in advance to the bank that need to be referred by the

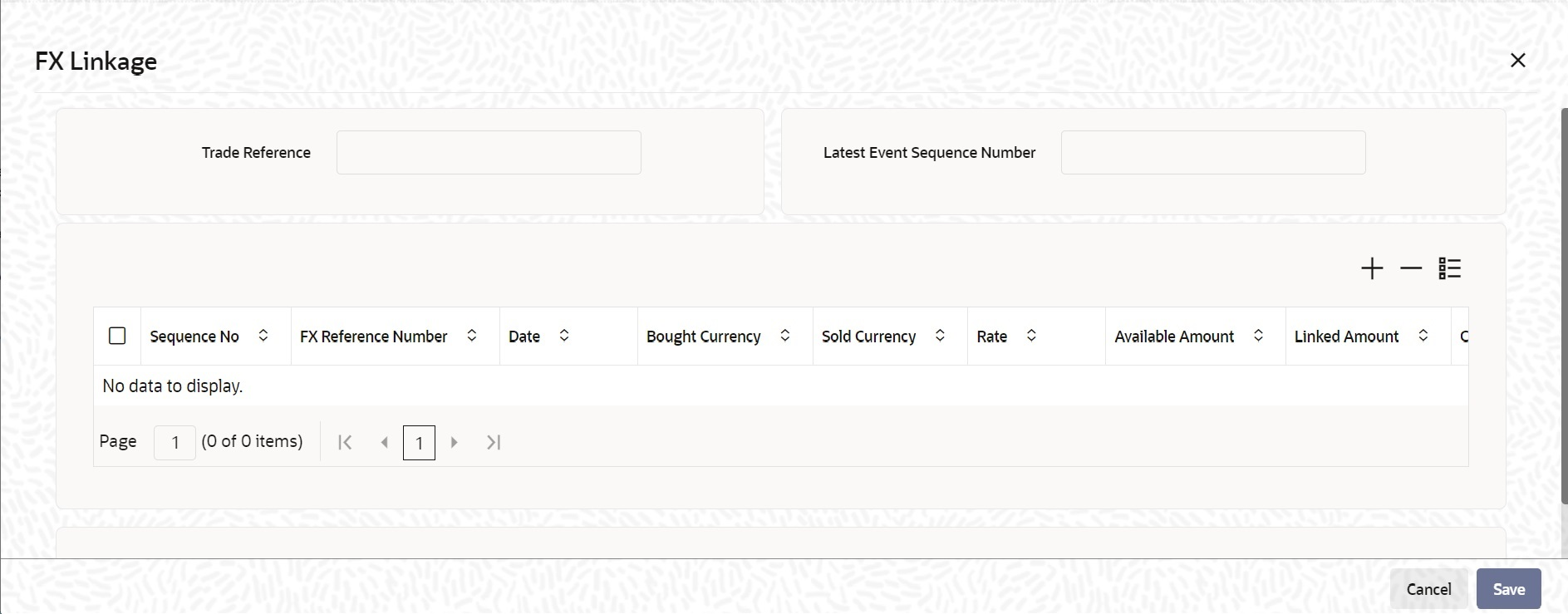

bank while processing certain type of transactions.Instruction ID System displays the Instruction ID. Instruction System displays the customer standard instruction. Instruction Date System displays the start date of the customer instruction. Instruction Expiry Date System displays the expiry date of the customer instruction. Transaction Level Instruction Enter the transaction level instructions for the event. - On the Claim Lodgement screen, click the FX Linkage tab.The FX Linkage screen is displayed.

This link loads a screen in which you can link a LC involving a specific counterparty with FX deals involving the same counterparty.

You can link one or more FX deals to a bill. The value of an FX deal should not exceed the value of the bill it hedges. If you link several FX deals to a bill, the total value of all the deals should not exceed the bill amount.OBTF system initiatesTable 9-38 FX Linkage - Field Description

Field Description Sequence No System generates the ‘Sequence No’ for linked FX contracts sequentially. FX Reference no Indicates FX deal reference no. from treasury system. Date Indicates FX deal value date. FX Value date should be greater or equal to LC Expiry Date. BOT/SOLD Currency Guarantee Claim currency should be BOT currency of the FX transaction in case of Guarantee Advised or the SOLD currency in case of an Guarantee Issued. Bought Currency: Presents FX Deal Bought Currency. Incase of Guarantee Advised Claim, Guarantee Claim currency should be same FX Bought Currency.

Sold Currency: Presents FX Deal Bought Currency. Incase of Guarantee Issued contract, Guarantee Claim currency should be same FX Sold Currency.Rate Presents FX deal Exchange rate. Available Amount Present FX available amount (that is) FX contract amount minus total linked FX amount. Linked Amount User will capture Linked amount at FX Linkage screen. Sum of Linked amount will not be greater than Guarantee Claim contract amount. Linked amount will not be greater than the available amount for linkage. Current Utilized amount Current Utilized amount will display the current amount utilized of the event. Total Utilized amount Total Utilized amount will display the total amount utilized of the contract. - Link/Utilization request to treasury system,

- During linkage or utilization of FX contract at Guarantee / Islamic Guarantee Claim Settlement

- Link request to treasury system,

- During linkage of FX, at Guarantee / Islamic Guarantee Claim Lodgement.

- Amendment of Guarantee / Islamic Guarantee Claim Lodgement for linked amount or difference in linked amount during amendment.

- Delink request to treasury system,

- Manual reduction / delink of FX at Guarantee / Islamic Guarantee Claim Lodgement / Settlement.

- During deletion of Claim Event.

- During closure of the claim.

- When Linked FX is not utilized during claim settlement.

- Guarantee Not Advised Contract - Details:

ISB Party's Customer Reference, Issuing bank, claim amount, currency will be validated for duplications. It will be configurable override.

Issue date has to be lesser than branch date.

Effective date has to be lesser than branch date.

Claim amount has to be greater than Outstanding Amount.

Outstanding Amount has to be Greater than Contract Amount.

On Save, BDAV and GCLM Event will be triggered simultaneously.

Processing of these contracts are restricted from LCDGUONL/LCDGUAMD /LCDGUTRF, but can be viewed from LCDGCLM/LCDGCLP.

On Successful settlement, Outstanding amount will be shown as reduced by claim amount.

Hold Operation is not supported. Main tab will be disabled for these contracts.

Guarantee Not Advised and Parties tab only applicable for Guarantee Not Advised contracts.

- Link/Utilization request to treasury system,

Parent topic: Guarantees and Standby Letters of Credit