- Islamic Bills and Collections User Guide

- Introduction

- Bill Amount Amendment

- Amend Bill Amount

4.2.1 Amend Bill Amount

This topic describes the systematic instruction to amend bill amount.

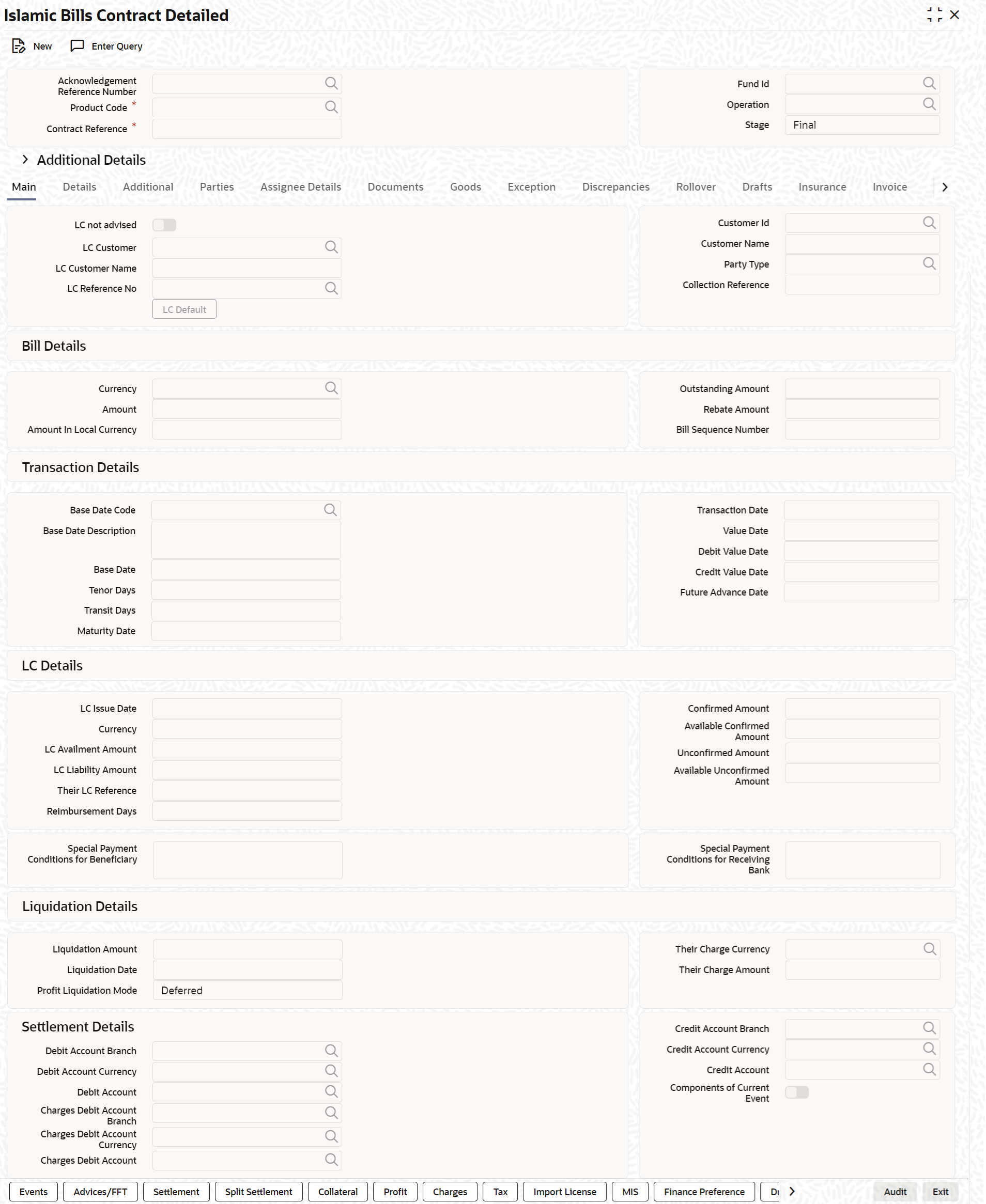

- On Homepage, type IBDTRONL in the text box, and then

click next arrow.The Islamic Bills & Collections Contract Detailed screen is displayed.

- Open Islamic Bills & Collections Contract Detailed

screen, specify the details and click Rebate

Amount.For more information on the fields, refer to the below Field Description table.

Table 4-46 Amend - Field Description

Field Description Specifying the Bill Reference Number In this screen, you need to first indicate the reference number of the bill on which you want to make the amendment. Bill Amount The original bill amount of the bill that you selected is displayed; you can amend the amount (decrease) suitably. There is no limit on the number of amendments that can be made to the bill amount for a collection. However, for the amendment to be effective it should be authorized.

Value Date The Value date, is the date from which the amendment becomes effective. The accounting entries triggered off by the amendment event hitting Nostro and other accounts will be passed as of the value date. The Value date should be earlier than or the same as today’s date. The Value date can be one of the following:- Today’s Date

- A date in the past

- A date in the future (you can enter a date in the future only if future dating has been allowed for the product)

If you do not enter an amendment value date, the system defaults the Bill Value Date.

Note:

The amendment value date should not be earlier than the Start Date or later than the End Date specified for the product, involved in the bill.Debit Value Date and Credit Value Date For amendment related accounting entries hitting nostro or customer accounts, you can specify a debit and credit value date that is different from the amendment value date. The amendment value date is defaulted as the Debit and Credit value date. You have an option to change it to suit the requirement of the bill you are processing. In this case, the amendment value date is used only for debiting and crediting GLs involved in the bill.

Maturity Date and Profit Rates of a Bill You can extend/reduce the maturity date either before or after the maturity date. You also have the option of amending the profit rates. You will be allowed to amend profit rates for main profit component and compensation profit component provided that the component is of a fixed type. Both these amendments can be done for advance and arrears type of collection, through the IBC Contract On-line screen after unlocking a contract. If the collection type is of advance, then you have to define accounting entries for profit adjustment (with _ADJ tags) and liquidation (with _LIQD tags) in amendment event. You have the option of amending maturity date and profit rate together as well. Maturity date or profit rate amendment is allowed for any value date (past/present/future). However, the value date you specify should be within the profit start date and profit end date of a bills contract.

To amend the profit rate you have to access the Profit Rate screen by clicking the ‘Profit’ button.

For details on specifying profit details for a contract, refer to the ICCB Details explained in the Profit section of this manual. The value date you specify for the amendment can be current/back/future date. After you save your amendment, the accounting entries will be passed for the additional profit or excess profit with the specified value date.

Note:

You are allowed to delete an amendment only if it is still unauthorized. Subsequently, the contract will be reinstated to previous state.

Parent topic: Bill Amount Amendment