5.1.14 Drawer/Drawee IC

This topic provides the systematic instructions to capture the Drawer/Drawee IC details.

- whether charges to be collected from the drawer or drawee

- whether charges/interest is waived or cannot be waived

View all these details on the advice and upon the settlement of the bill. The system populates and validates all the data.

For instance, in the normal scenario, drawer’s bank charges are collected from the drawer, and the drawee collects drawee bank’s charges. However, some time drawer’s bank asks their charges also from the drawee only and additionally; the drawer also will like to collect some interest as well along with the invoice value. The system records the details of these charges/ interest and mentions if these charges is waived or not.

Navigate to Bills and Collection Contract Detailed screen

- On Bills and Collection Contract Detailed screen, click

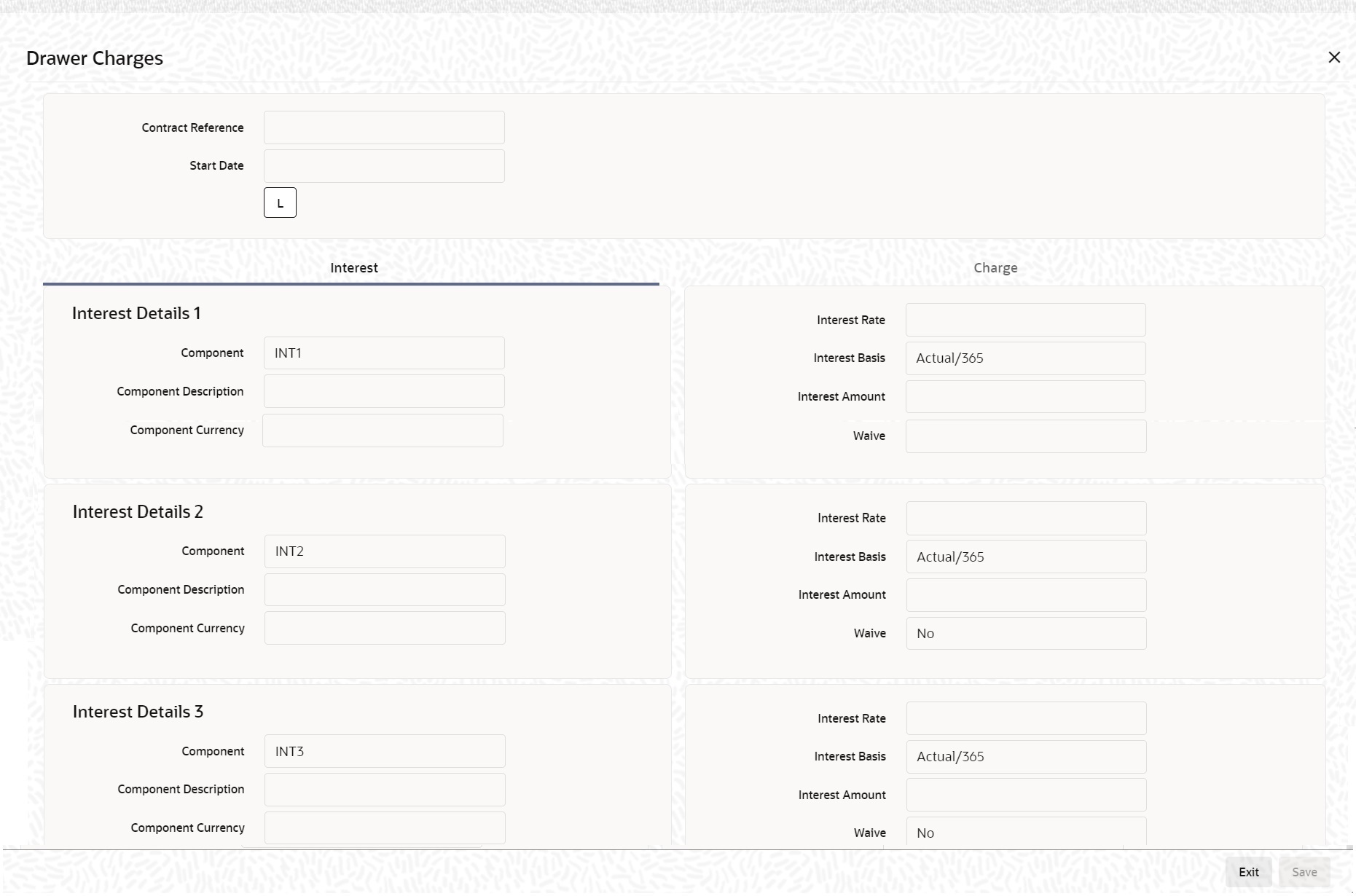

Drawer/Drawee IC.Drawer Charges screen is displayed.

- Specify the details as required and click Ok.For information on fields, refer to: Table 5-12

Table 5-12 Drawer Charges - Field Description

Field Description Contract Reference Number Contract Reference Number is displayed. Start Date Specify the Start date for interest details. Start date cannot be less than bill booking date. Interest Tab Specify the following details pertaining to interest:

Interest Details 1 Specify the following details

Component Specify the interest component. Component Description Specify the description of the interest component. Component Currency Specify the currency of the interest component. Interest Details 2 Specify the following details:

Component Specify the interest component Component Description Specify the description of the interest component. Component Currency Specify the currency of the interest component. Interest Details 3 Specify the following details:

Component Specify the interest component. Component Description Specify the description of the interest component. Component Currency Specify the currency of the interest component Interest Rate Specify interest rate. Interest rate cannot be greater than 100. Interest Basis Select the interest basis from the drop-down list. You have the following options: - Actual/360

- Actual/365

- Actual/364

- 30(Euro)/360

- 30(US)/360

- 30(Euro)/365

- 30(US)/365

- 30(Euro)/Actual

- 30(US)/Actual

- Actual/Actual

- 30(Euro)/364

- 30(US)/364

Interest Amount The interest amount is the interest to be levied on the drawer. Waive Select the waiver from the drop-down list. You have the following options: - Yes - If you select this option, then there will be no implications of calculated interest amount

- No - If you select this option, then modify the calculated interest amount

The system considers the period between the start date and the date of liquidation for calculating interest amount.

During liquidation, the system calculates and displays the amount for each of the defined components.

- On the Drawer Charge screen, click

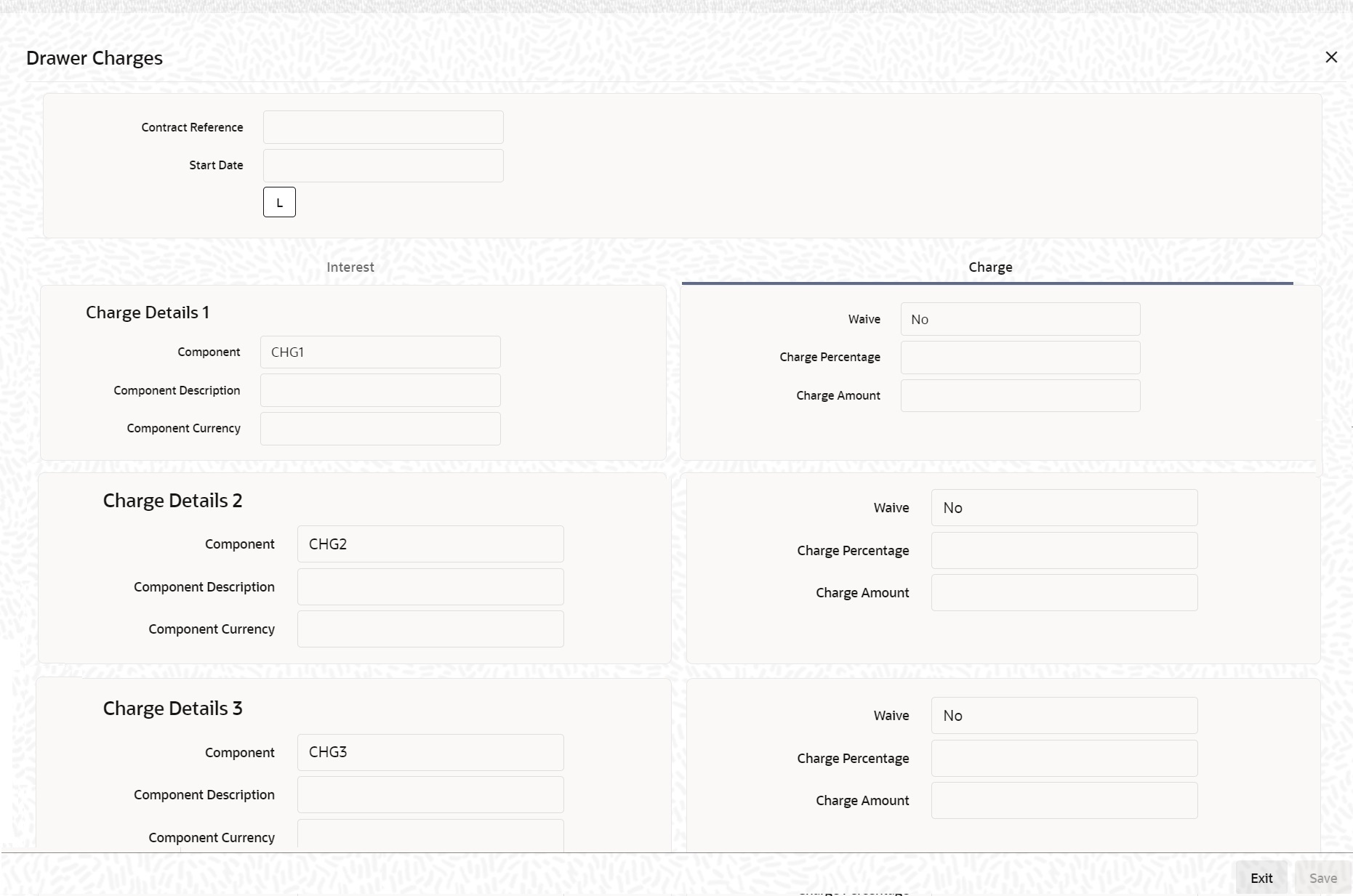

Charge tab.Drawer Charges - Charge tab screen is displayed.

- Specify the details as required, click Ok to save the

details or Exit to view Bills and Collections

- Contract Input - Detailed screen.For information on fields, refer to:

Table 5-13 Charge Details - Field Description

Field Description Charge Details 1 Specify the following details

Component Specify the charge component Component Description Specify the description of the charge component. Component Currency Specify the currency of the charge component. Charge Details 2 Specify the following details

Component Specify the charge component. Component Description Specify the description of the charge component. Component Currency Specify the currency of the charge component Charge Details 3 Specify the following details

Component Specify the charge component. Component Description Specify the description of the charge component. Component Currency Specify the currency of the charge component. Waive Select the waiver from the drop-down list. You have the following options: - Yes - If you select this option, then there will be no implications of calculated charge amount.

- No - If you select this option, then modify the calculated charge amount

Charge Percentage Specify charge percentage. It cannot be greater than 100. System calculates the final charge based on this value.

Charge Amount The charge amount is the charge to be levied on the drawer. In case of Partial Liquidation, the system calculates the drawer’s/drawee’s Interest and Charges in full and recovers during the first liquidation. Interest is calculated until the maturity date of the bill. During liquidation, the remaining Bill amount, the drawer’s/drawee’s Interest and Charges are not applicable. During liquidation, the system calculates and displays the amount for each of the defined components.

In the BC module the initial operations include Purchase, Discount and Negotiation (BPUR,

BDIS and INIT) events; refer to Table 5-14.

The corresponding events in Loan would trigger the LIQD event in the Loan module, whose appropriate accounting entries are as documented in the table: Table 5-15.

In addition to the above events, the system maintains normal LIQD accounting tags for any further Manual Liquidations in the Loan module. For example, let us illustrate accounting entries for the additional events using conditions bulleted below:- Funds received in NOSTRO = USD 600

- Bill Amount = USD 600

- Loan Outstanding in LCY (Principal and Interest) = INR 10,000

- Bills Purchased = USD300

- Effective LCY Exchange Rate USD/INR = 50

For LPUR/LDIS/LIQD events in the BC module, refer to the table: Table 5-16

In case of the event LIQD, you need not maintain accounting entries about Purchase.

In the case of Normal Liquidation without any Purchase or Loan linkages, you need to maintain the existing tags BILL_LIQ_AMT and BILL_LIQ_AMTEQ. Finally, in the case or Loan or Purchase Liquidation, the excess funds are linked to the COLL_LIQ_AMT tag. The order for Liquidation Proceeds is Loan Asset, Bills Purchased Asset and then Customer. The corresponding event in the Loan module triggers a Loan LIQD event shown in the table: Table 5-17.

Table 5-14 Initial Operations

Dr/ Cr Account role code Amount tag FCY Amount Exch. Rate LCY Amount Date Dr BILLS PURCHASED LOAN_LIQD_A MT 200 USD 50 10000 Cr BRIDGE GL LOAN_LIQD_A MT 200 USD 50 10000 Dr BILLS PURCHASED AMT_PURCHAS ED 100 USD 50 5000 Cr CUSTOMER AMT_PURCHAS ED 100 USD 50 5000 Table 5-15 Accounting entries of LIQD Event

Dr/ Cr Account role code Amount tag LCY Amount Date Dr BRIDGE GL PRINCIPAL_LCRY 9000 7-SEP-09 Cr ASSET GL PRINCIPAL_LCRY 9000 7-SEP-09 Dr BRIDGE GL <INTEREST>_LCRY 1000 7-SEP-09 Cr INTERESTREC <INTEREST>_LCRY 1000 7-SEP-09 Table 5-16 LPUR/LDIS/LIQD events

Dr/ Cr Account role code Amount tag FCY Amount Exch. Rate LCY Amount Date Dr NOSTRO LOAN_LIQD_ AMT 200 USD 50 10000 10-SEP-02 Cr BRIDGE GL LOAN_LIQD_ AMT 200 USD 50 10000 10-SEP-02 Dr NOSTRO AMT_PURCH ASED 300 USD 50 15000 10-SEP-02 Cr BILLS PURCHASE D AMT_PURCH ASED 300 USD 50 15000 10-SEP-02 Dr NOSTRO COLL_LIQ_A MT 100 USD 50 5000 10-SEP-02 Cr CUSTOMER COLL_LIQ_A MTEQ 100 USD 50 5000 10-SEP-02 Table 5-17 Loan LIQD

Dr/ Cr Acc-role Amount tag LCY Date Dr BRIDGE GL PRINCIPAL_LCRY 9000 10-SEP-02 Cr ASSET GL PRINCIPAL_LCRY 9000 10-SEP-02 Dr BRIDGE GL <INTEREST>_LCRY 1000 10-SEP-02 Cr INTERESTREC <INTEREST>_LCRY 1000 10-SEP-02

Parent topic: Additional Details