- Class User Guide

- Charge Class

- Maintain Charge Class

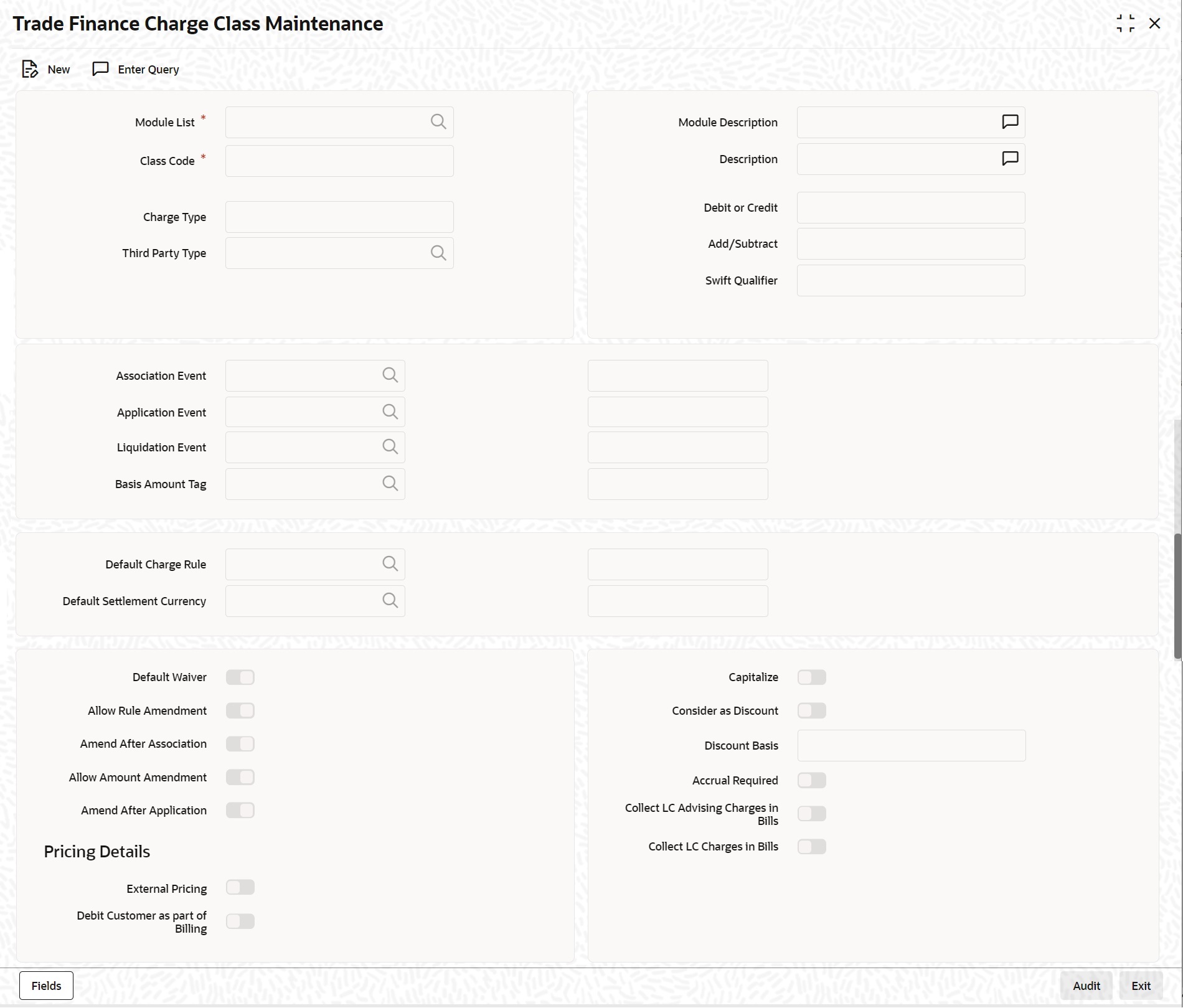

2.3.1 Maintain Charge Class

This topic provides the systematic instructions to maintain charge class.

You have to build a charge class, for instance, with the attributes of a specific type of charge, such as ‘Charges for amending the terms of a transaction’, or ‘Charges for provision of services’. To recall, a charge rule is built to calculate a specific type of charge component.

Once such a rule is built, you can define attributes like what should be the basis amount on which the charge rule is applied, when the charge should be associated to the contract and when the charge should be calculated and collected.

- The module in which you would use the class

- The charge type (whether borne by the counterparty or by the bank)

- The association event

- The application event

- The liquidation event

- The default settlement currency

- The default charge rule

- The basis amount on which the charge is calculated

- On the Homepage, type ‘CFDTFCCM’ in the text box, and click the next arrow.The ‘Trade Finance Charge Class Maintenance’ screen is displayed.

- On Trade Finance Charge Class Maintenance screen, specify the fields.For more information on fields, refer to Table 2-2:

Table 2-2 Trade Finance Charge Class Maintenance - Field Description

Field Description Class Code Before defining the attributes of a charge class, you should assign the class a unique identifier, called the Class Code and briefly describe the class. A description would help you easily identify the class.

Module List A charge class is built for use in a specific module. As a charge component would be applied on different basis amounts, in different modules. In the Letters of Credit module, for instance, you would apply a flat processing charge or fee on all LCs. In the Securities module, you could levy a flat charge or fee on portfolios that you maintain on behalf of a customer. The basis on which the component is applied is different, in these two cases.

Note:

The Basis Amount Tags available would depend on the module for which you build the class.Charge Type Charges can be collected from the counter party or from a third party. You can select one of the following values from the adjoining drop-down list:

- Counter Party – This indicates that the customer is captured as part of the contract.

- Third Party – This indicates that the charges are levied on another entity on behalf of customer (Example: Custodian).

- Their Charges – This indicates that your bank is collecting other bank’s charges as in the case of LC and BC contracts.

Events A contract goes through different stages in its life cycle, such as:- Initiation

- Amendment

- Rollover

Each of these stages is referred to as an ‘Event’ in Oracle Banking Trade Finance.

At any of these events, you can choose to apply a charge or fee. When defining a charge class, you should specify:- The association event

- The application event

- Liquidation event

The event at which the charge component is actually calculated is referred to as the Application Event. At this event, no accounting entry (for the charge component) is passed. The charge or fee is liquidated at the Liquidation event that you specify.

If the event chosen for the liquidation of the charge component at the charge class and the event chosen for liquidating the same charge component at the ‘Product Events and Accounting Entries’ screen are different, the charge will not be liquidated and accounting entries will not be posted.

Basis Amount Tag The basis on which interest, charge, fee, or tax is calculated is referred to as the Basis Amount. (A charge or fee can be on the basis of the contract amount, for instance.) The different basis amounts, available in a module, are associated with a unique ‘tag’. When building a charge component, you have to specify the tag associated with the Basis Amount. When charge or fee is calculated for a contract, the basis amount corresponding to the tag will be picked up automatically.

Basis amount refers to:

- Principal amount or commitment

- Transaction amount in the case of a teller entry

- Transfer amount in case of a Remittance

- LC amount in the case of a Letter of Credit

- Bill amount in the case of a Bill

- Deal Nominal amount for a Security Deal

Default Charge Rule You can link a charge rule that you have defined to the charge component that you are building. When you link a rule to a component, the attributes that you have defined for the rule will default to the component.

To recall, a charge rule identifies the method in which charge or fee of a particular type is to be calculated. A rule is built with, amongst others, the following attributes:

- The charge currency

- Whether the charge or fee is to be a flat amount or calculated on a rate basis

- The minimum and maximum charge that can be applied

- The tier or slab structure on which the charge is to be applied

- The customer and currency restrictions, etc.

The charge component to which you link a rule acquires these properties. Charges for the product with which you associate a charge component will be calculated, by default, according to the rule linked to the component. However, when processing a contract, you can choose to waive the rule altogether.

When building a charge class, you can choose to allow the amendment of the rule linked to it, in the following conditions:- You can choose to allow amendment after the association event

- You can choose to allow amendment after the application event

- You can choose to allow amendment of the charge amount

Default Settlement Currency Charges or fees levied on a contract will be settled in the Settlement Currency that you specify for the charge class associated with the product (under which the contract is processed). However, when processing a contract, you can choose to settle the charge in another currency.

The charge currency defined for the rule is used only for booking charges. The actual settlement is done in the default settlement currency' maintained for the charge class. The final charge is computed based on preferences defined in the charge rule set-up. The amount is converted to the settlement currency in case the charge currency is different from the contract currency.

When you associate a charge component with a product, you can choose to allow the amendment of the rule linked to it, under the following conditions:Note:

- For the liquidation of charge components with a charge currency not equal to the contract currency during discounting, the charge amount is calculated in the contract currency based on the exchange rate between the settlement currency and the contract currency as on the discounting date. The charge amount in contract currency is used for accounting.

- If the charge currency is different from the contract currency and the contract currency is same as the settlement account currency, the exchange rate maintained for the settlement account through the ‘Settlement Message Details – Account Details’ screen is used to convert the charge amount into the contract currency amount.

Allow Rule Amendments If you would like to allow the amendment of a rule for a charge component when linked to a contract, check this box.

Amend after Association If you would like to allow the amendment after association of a rule for a charge component, check this box. Once checked the system will allow you to modify the rule after the association event is triggered for the linked contract.

Allow Amount Amendment If you would like to allow amendment of the charge amount calculated by the system as per the charge rule, check this box.

Amend After Application If you would like to allow the amendment of the charge amount after application of a rule for a charge component, check this box. Once checked the system will allow you to modify the charge amount after the application event is triggered for the linked contract.

Default Waiver Check this box to indicate that even if charge is computed, it should not be liquidated.

Capitalize You can capitalize the payment of charges and fees. If the charge is not paid on a scheduled date, the outstanding charge amount will be added to the outstanding principal and this becomes the principal for the next schedule. If a partial payment has been made, the unpaid amount will be capitalized (the unpaid charge is added to the unpaid principal and this becomes the principal for the next schedule).

Note:

If the ‘Capitalize’ option is not checked for the broker, deal, product and currency combination, then the option ‘Consider as discount’ cannot be checked for the securities module.Consider as Discount While defining a charge class for either the securities or the bills module, you can indicate whether the charge component is to be considered for discount accrual on a constant yield basis.

If you select this option the charge received against the component is used in the computation of the constant yield and subsequently amortized over the tenor of the associated contract.

Checking this option also indicates that the component is to be used for IRR calculation.

Note:

IRR, the Internal Rate of Return is the annualized effective compounded return rate which can be earned on the invested capital, i.e. the yield on the investment.Accrual Required Checking this indicates that the charges have to be accrued. Subsequently, the charges are accrued using the upfront fee system.

Note:

This option is disabled for BC contracts.Discount Basis While defining a charge class for the bills module, you can define the discount basis for the

purpose of IRR computation. You can choose either of the following as discount basis:- Inflow – If you choose Inflow, the charge will be considered as an inflow for IRR computation

- Outflow – If you choose Outflow, the charge will be treated as an outflow for IRR computation

Parent topic: Charge Class