- Islamic Bills and Collections User Guide

- Introduction

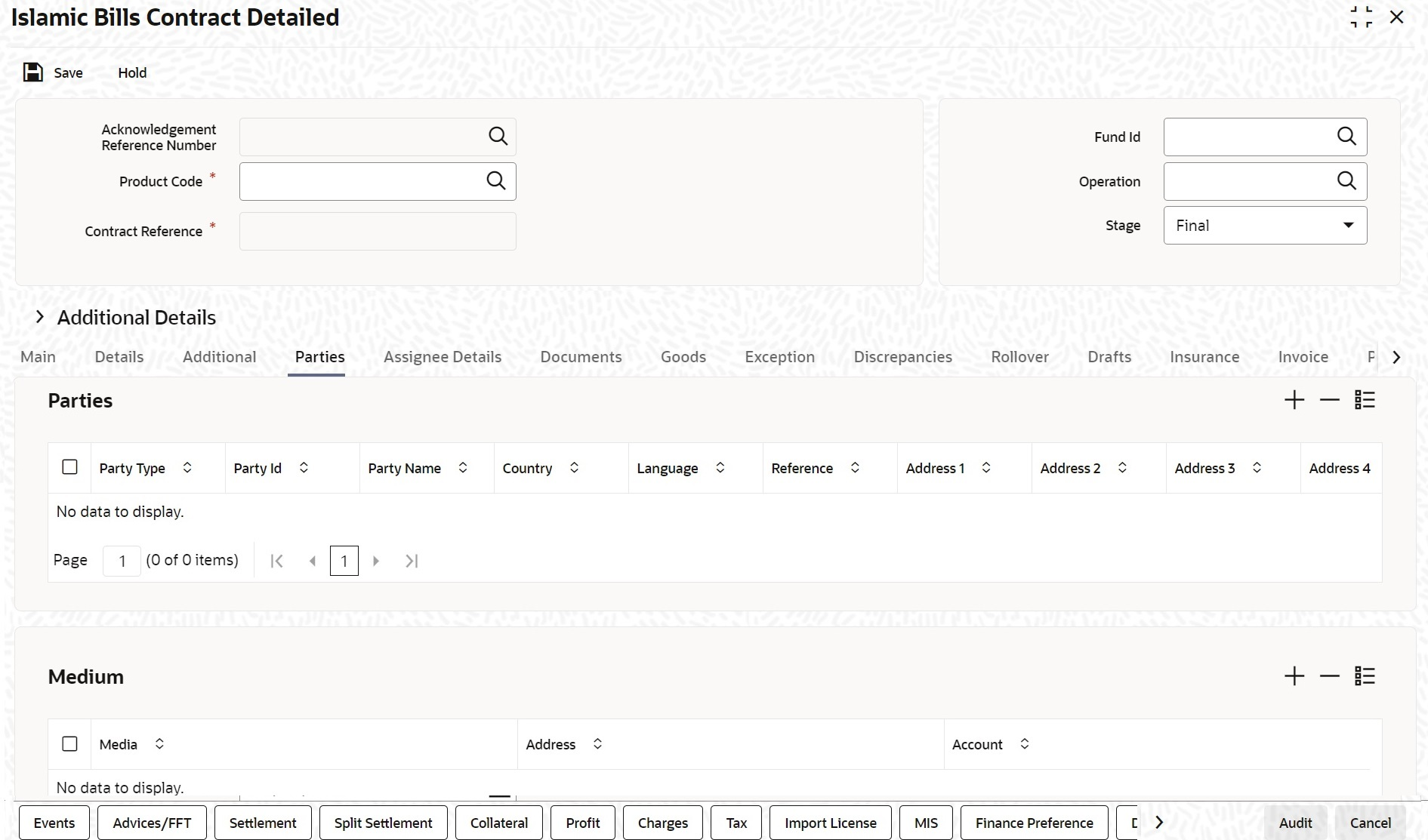

- Process Islamic BC Contract Detailed

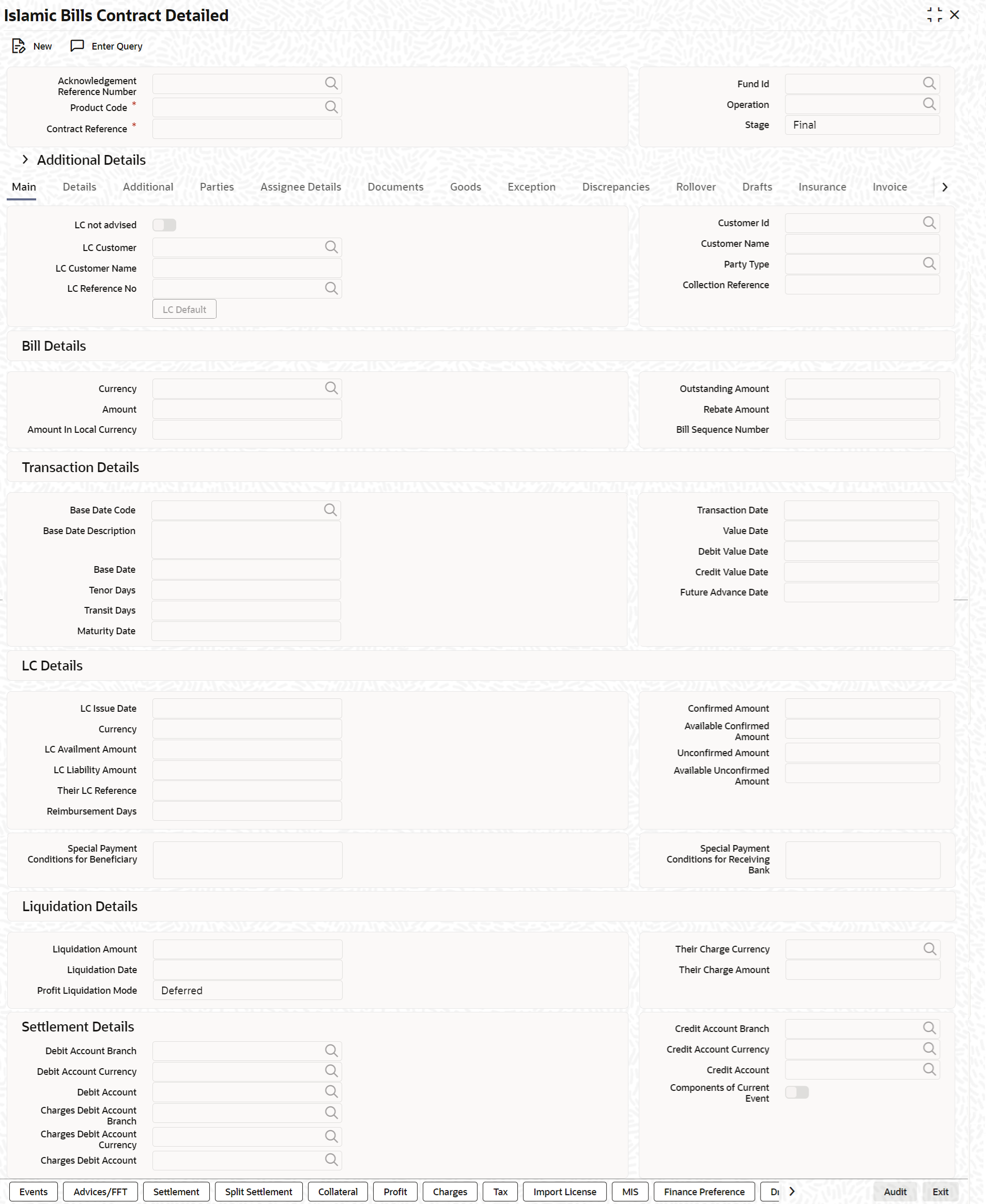

4.1 Process Islamic BC Contract Detailed

This topic describes the systematic instruction to process the Islamic BC Contract Detailed screen.

- On Homepage, type IBDTRONL in the text box, and then

click next arrow.The Islamic Bills & Collections Contract Detailed screen is displayed.

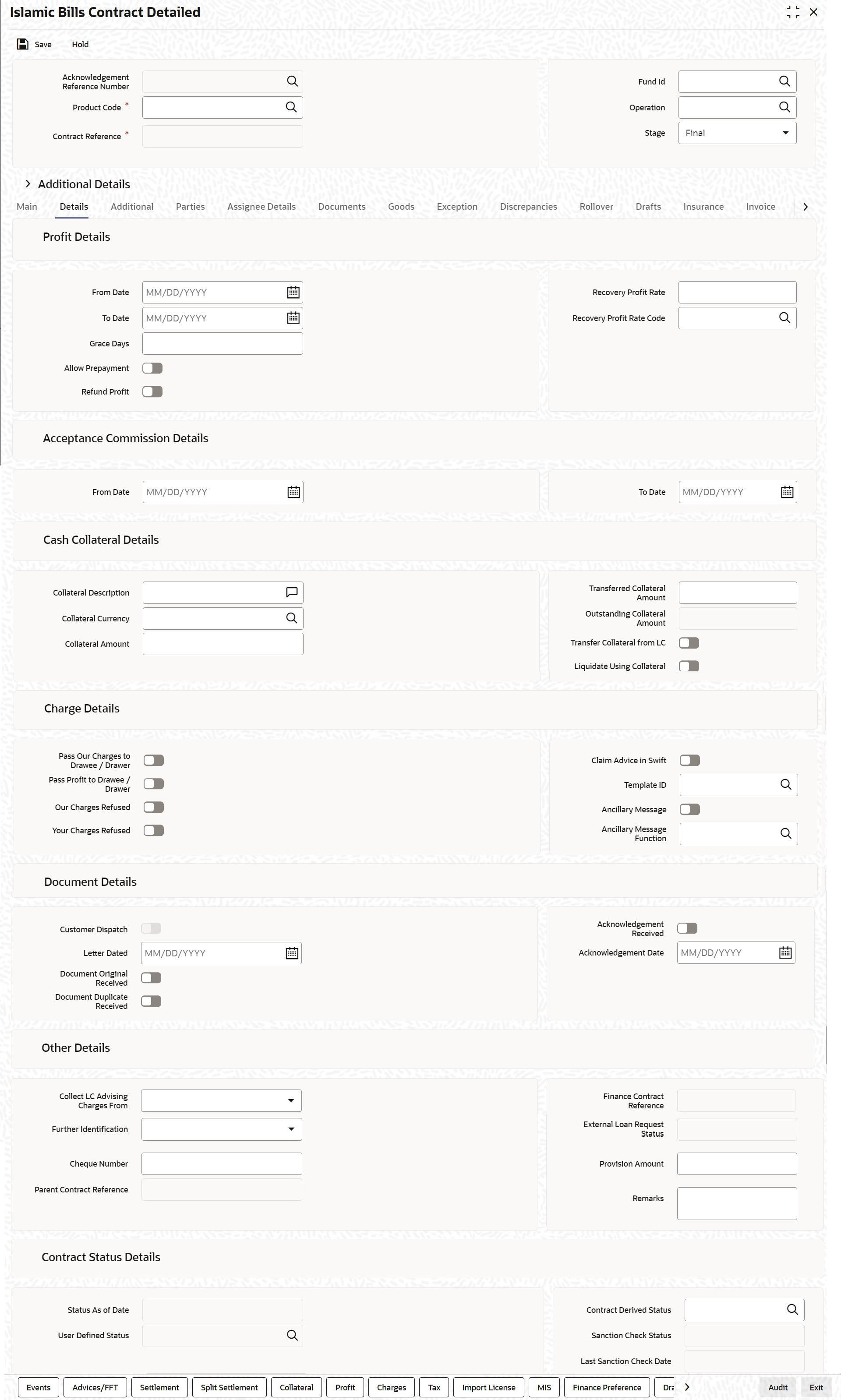

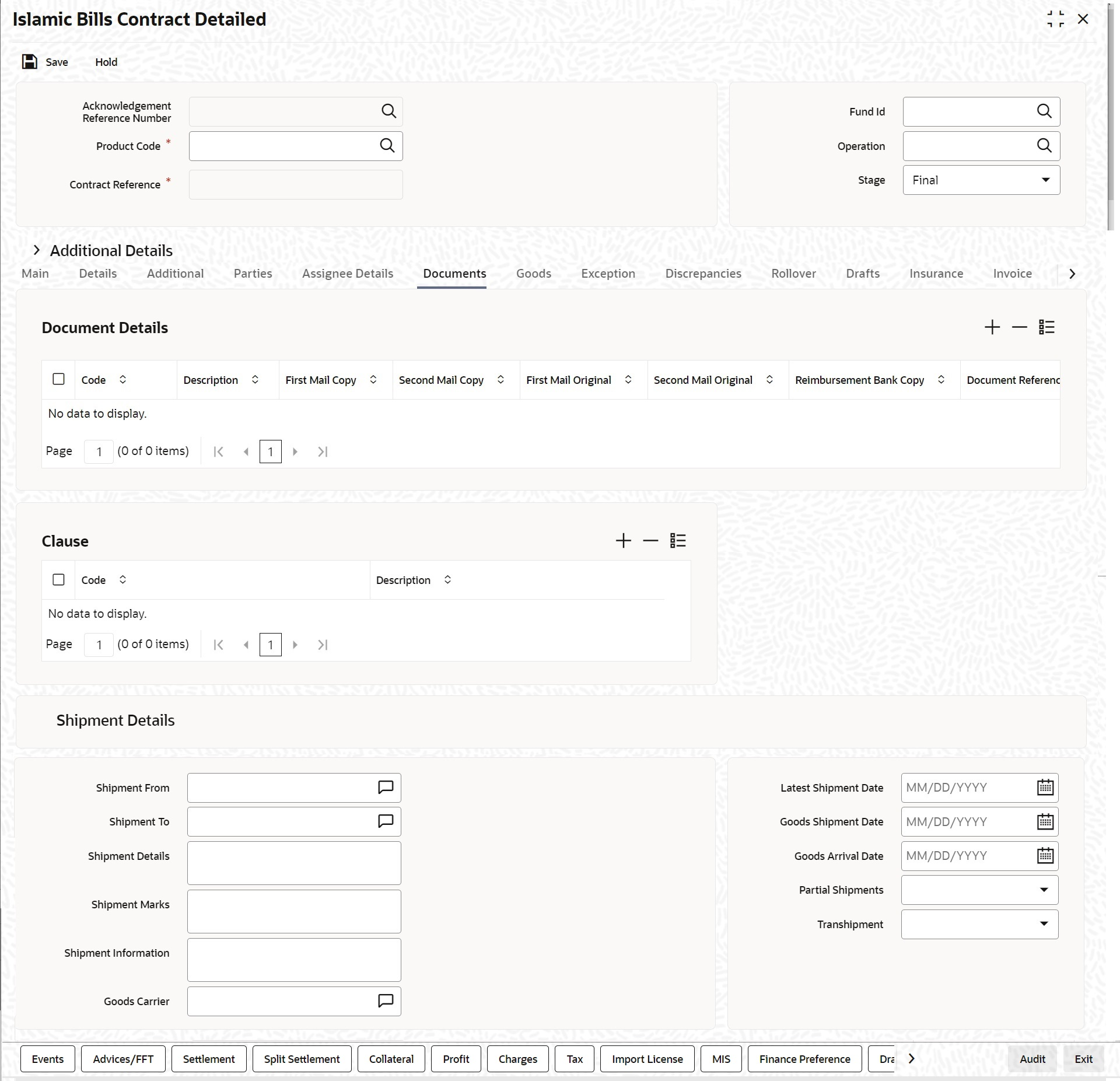

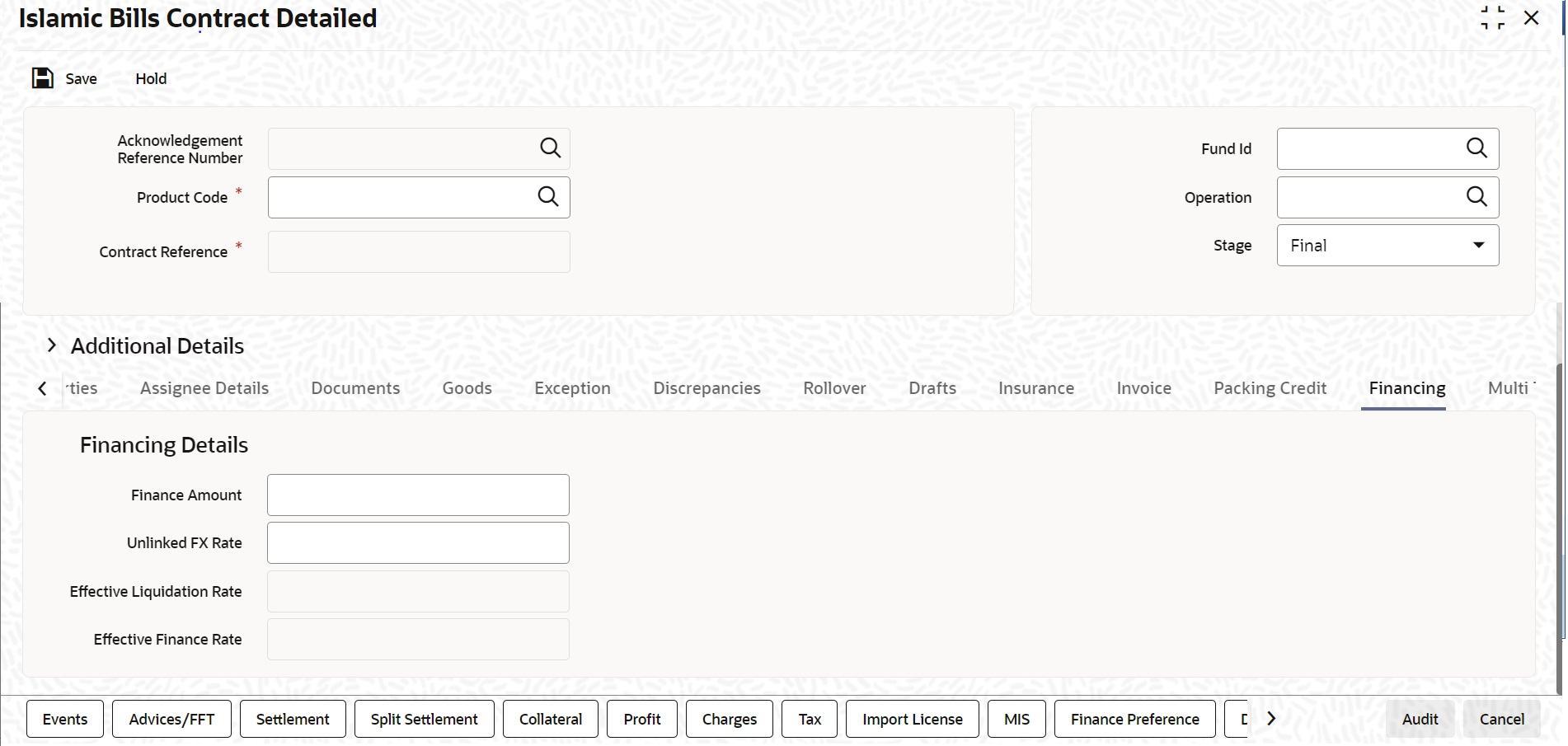

Figure 4-1 Islamic Bills & Collections Contract Detailed

Description of "Figure 4-1 Islamic Bills & Collections Contract Detailed" - On Islamic Bills & Collections Contract Detailed

screen, specify the fields, and then click OK to generate

report.

- To call a document maintenance record that area already defined, select the Summary option, under Documents.

- Double click on a document code of your choice to open it.

The Summary screen is displayed.Through the screens that follow in this section, you can process all type of bills - Import and Export (both domestic and international).

You can choose to enter the details of a contract either by:- Copying the details, from an existing contract and changing only those details that are different for the contract, you are entering

- Using your keyboard and the option lists that are available at the various fields, to enter the details of the bill afresh

To facilitate quick input, you only need to enter the product code. Based on the product code you choose, many of the fields will be defaulted. You can over write these defaults to suit your requirement. You can also add further, which are specific to the bill like the bill amount.

For more information on the fields, refer to the below Field Description table.Table 4-1 Islamic Bills & Collections Contract Detailed - Field Description

Field Description Acknowledgment Reference Number Specify the acknowledgment reference number. Alternatively, you can select the reference number from the option list. The list displays all the acknowledgment reference numbers and type of registration maintained at registration screen which are authorized and unprocessed. Note:

System will update the status of registration as ‘Processed’ and contract reference no at registration screen, if acknowledgment reference number is captured at contract screen and (new) contract is created.Fund ID Select the fund id from the adjoining option list populated from FCUBS application. The fund information is fetched based on the below criteria.

- Funds with OBTF Application date in between Fund Start and end dates.

- Funds which belong to the global OBTF Branch.

Product Code Enter the code of the product to which you want to link the contract. You can select an authorized product code from the adjoining option list. The contract will inherit all the attributes of the product you have selected. This field is mandatory.

Contract Reference The Contract Reference Number identifies a contract uniquely. It is automatically generated by the system for each contract. The Contract Reference Number is a combination of the branch code, the product code, the date on which the contract is booked (in Julian format) and a running serial number for the booking date. The Reference Number consists of a three-digit branch code, a four-character product code, a five-digit Julian Date and a four-digit serial number.

The Julian Date has the following format:

YYDDD

Here, YY stands for the last two digits of the year and DDD for the number of day(s) that has/ have elapsed, in the year.

This field is mandatory.

User Reference In addition, a contract is also identified by a unique User Reference Number. By default, the Contract Reference Number generated by the system will be taken as the User Reference Number. But you have the option to change the User Ref Number. Oracle Banking Trade Finance also provides you the facility to generate the user reference number in a specific format. However, the number, thus generated will be non-editable. Note:

You can specify a format for the generation of the User Reference Number in the ‘Sequence Generation’ screen available in the Application Browser. Refer to the Core Services User Manual for details on maintaining a sequence format.Operation The operations that you can perform on a bill are determined by the type of bill you are processing. The operation that you perform on a bill, also determines the accounting entries, that are passed and the messages that will be generated. Stage Select the stage at which your branch is processing the bill from the drop-down list. The options available are: - Initial

- Final

- Registered

Use the ‘ial’ stage of processing if the documents received are pending approval from the applicant. When a bill is processed in the ial stage, no accounting entries will be passed.

You can indicate ‘Registered’ only if you are processing a collection.

The type of operation that you can perform on a bill has been listed below:Table 4-2 Type of Operations

Incoming (International and domestic) Outgoing (International and domestic) Advance Negotiation Payment Payment Discounting Discounting Collection Collection Acceptance Acceptance Purchase Purchase Co-Acceptance Forfaiting Transfer -- The Islamic Bills and Collections Contract Detailed screen is designed to contain tabs along the lines of which, you can enter details of the contract. The tabs are as follows:Table 4-3 Tab Details

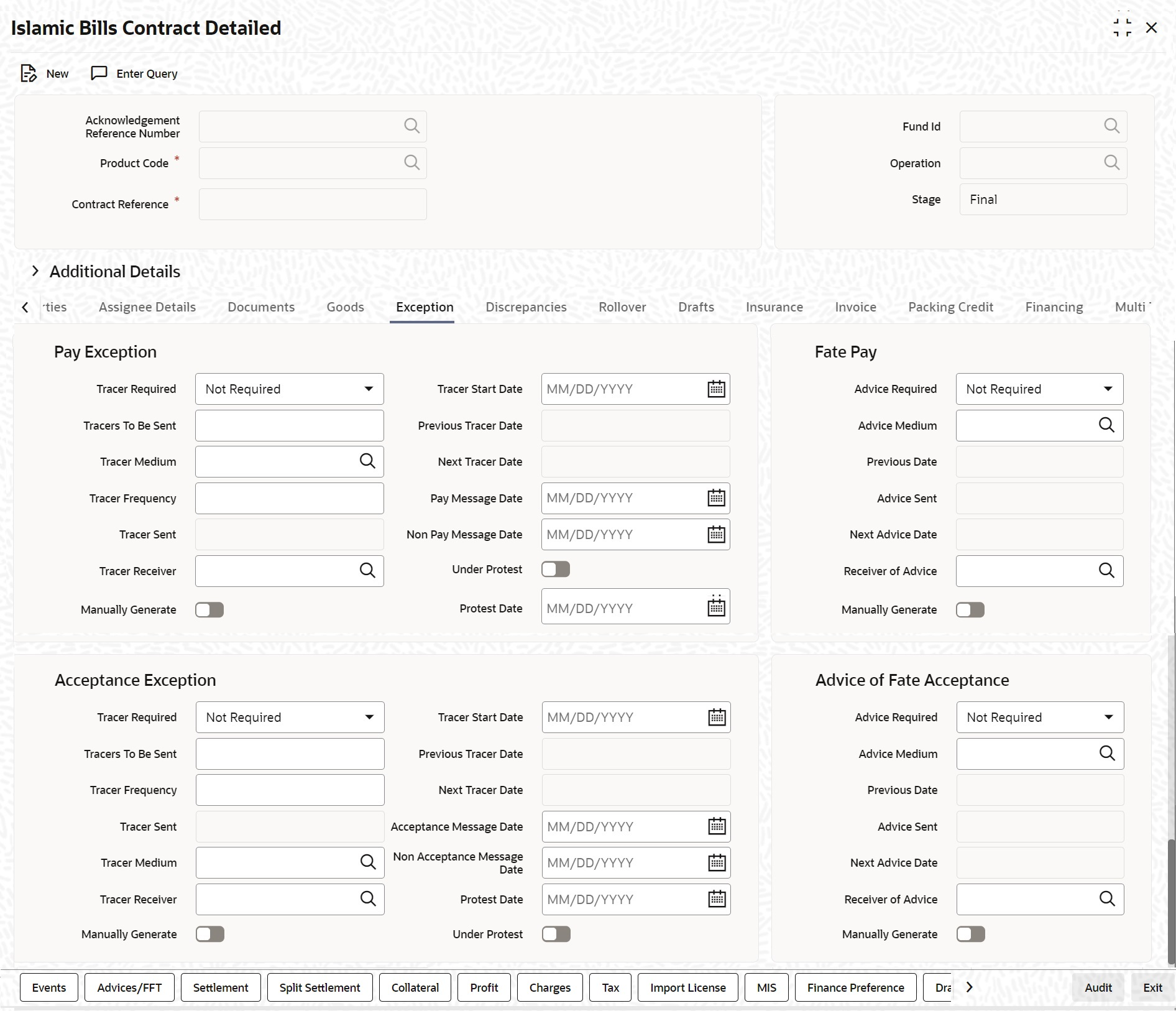

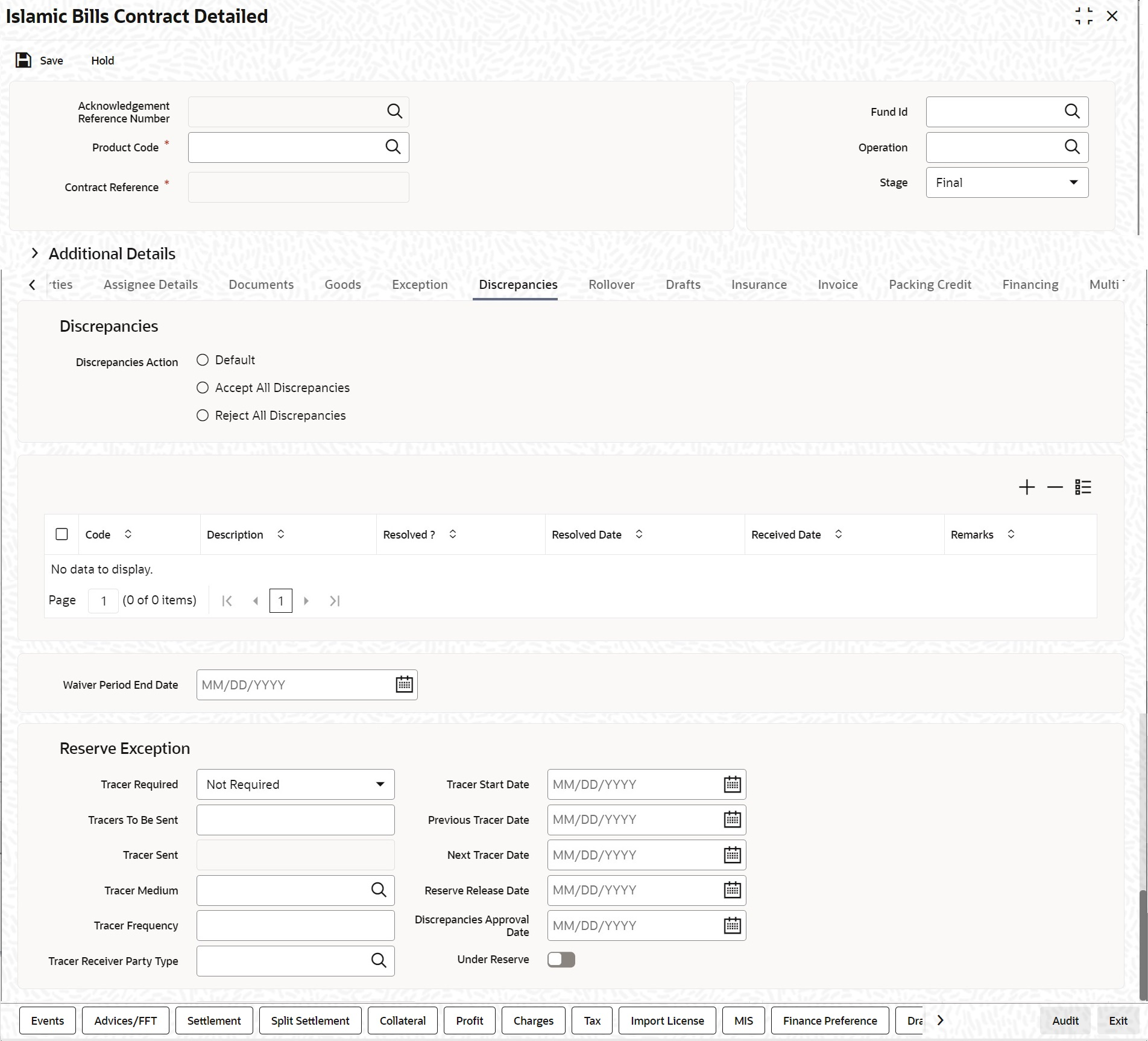

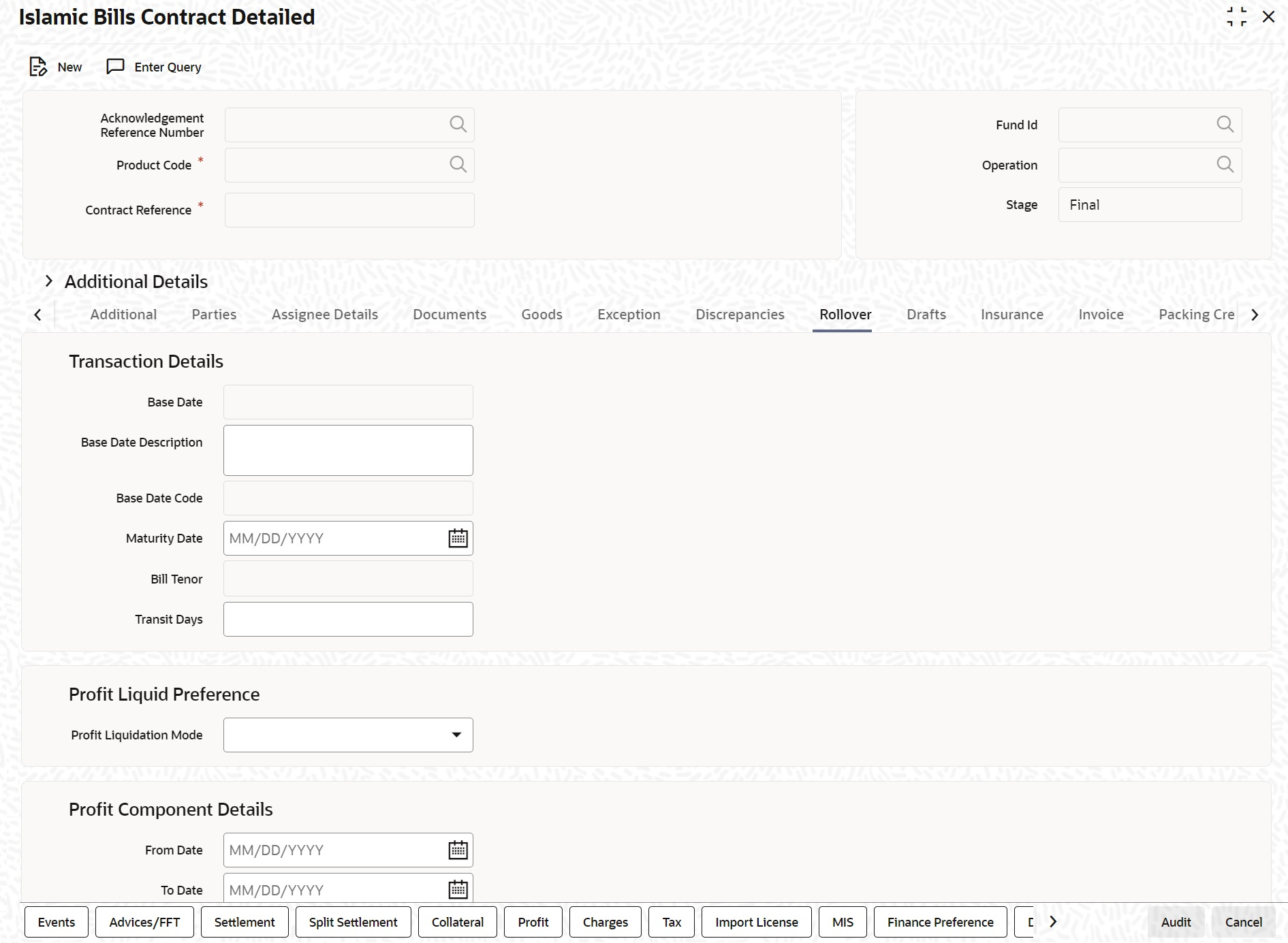

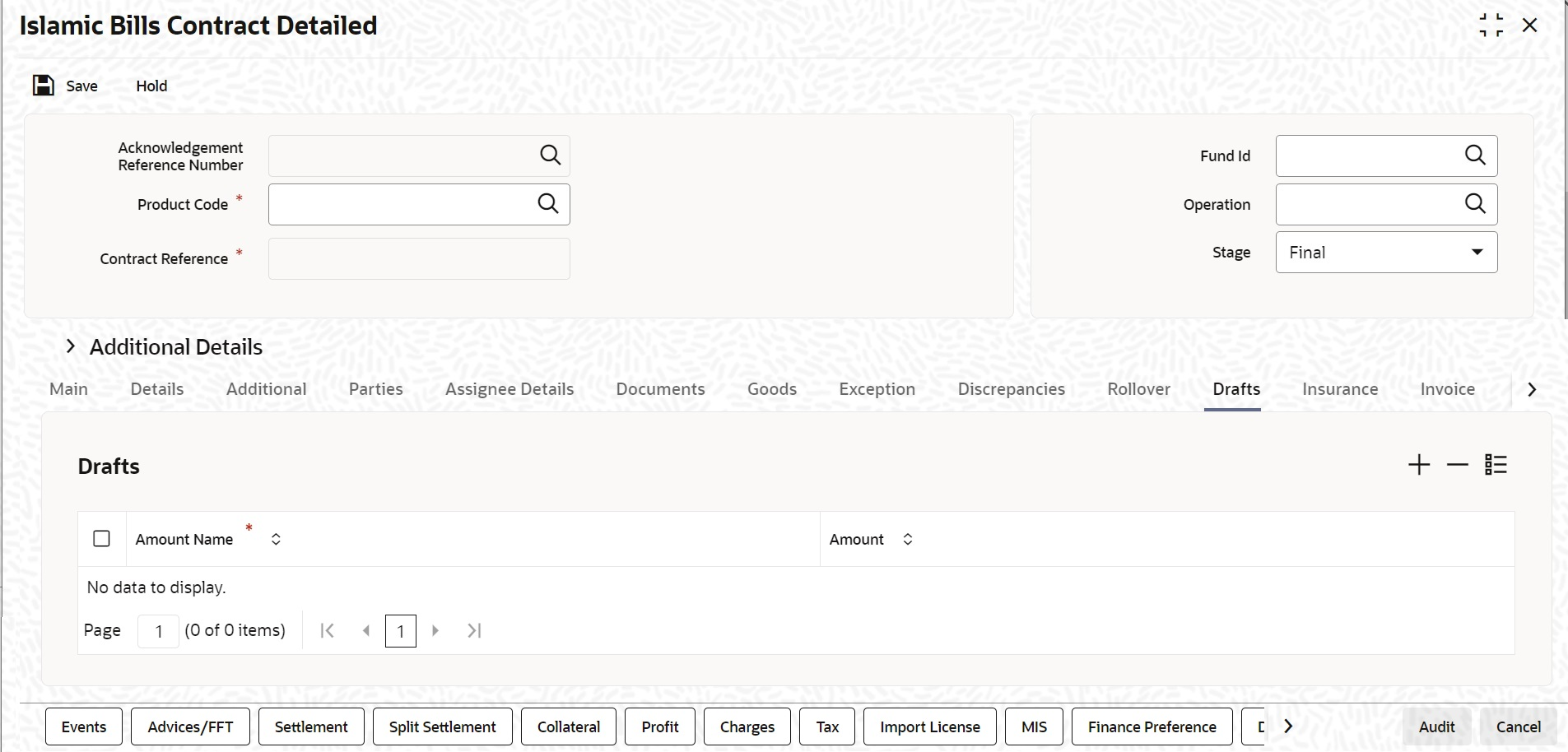

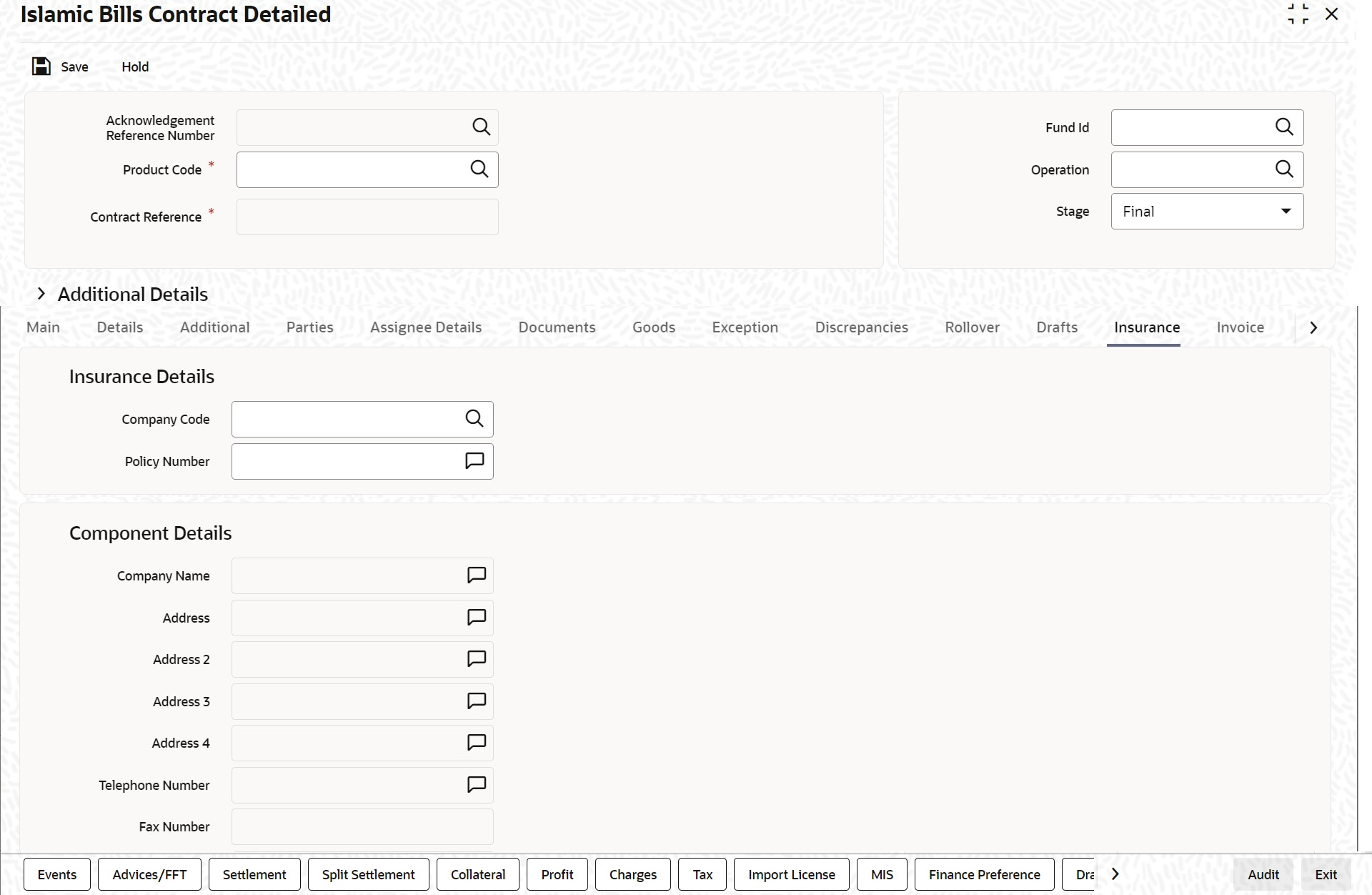

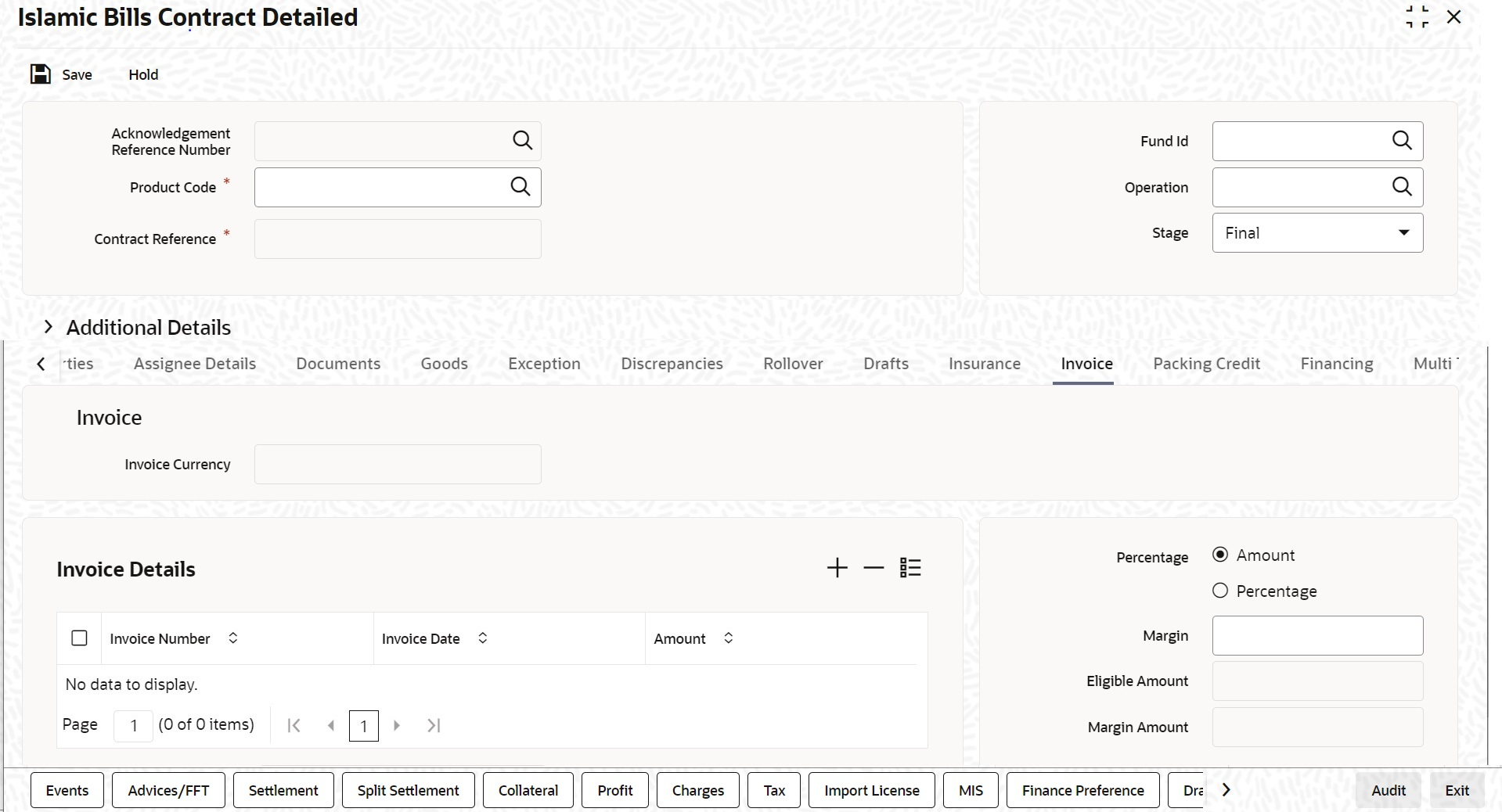

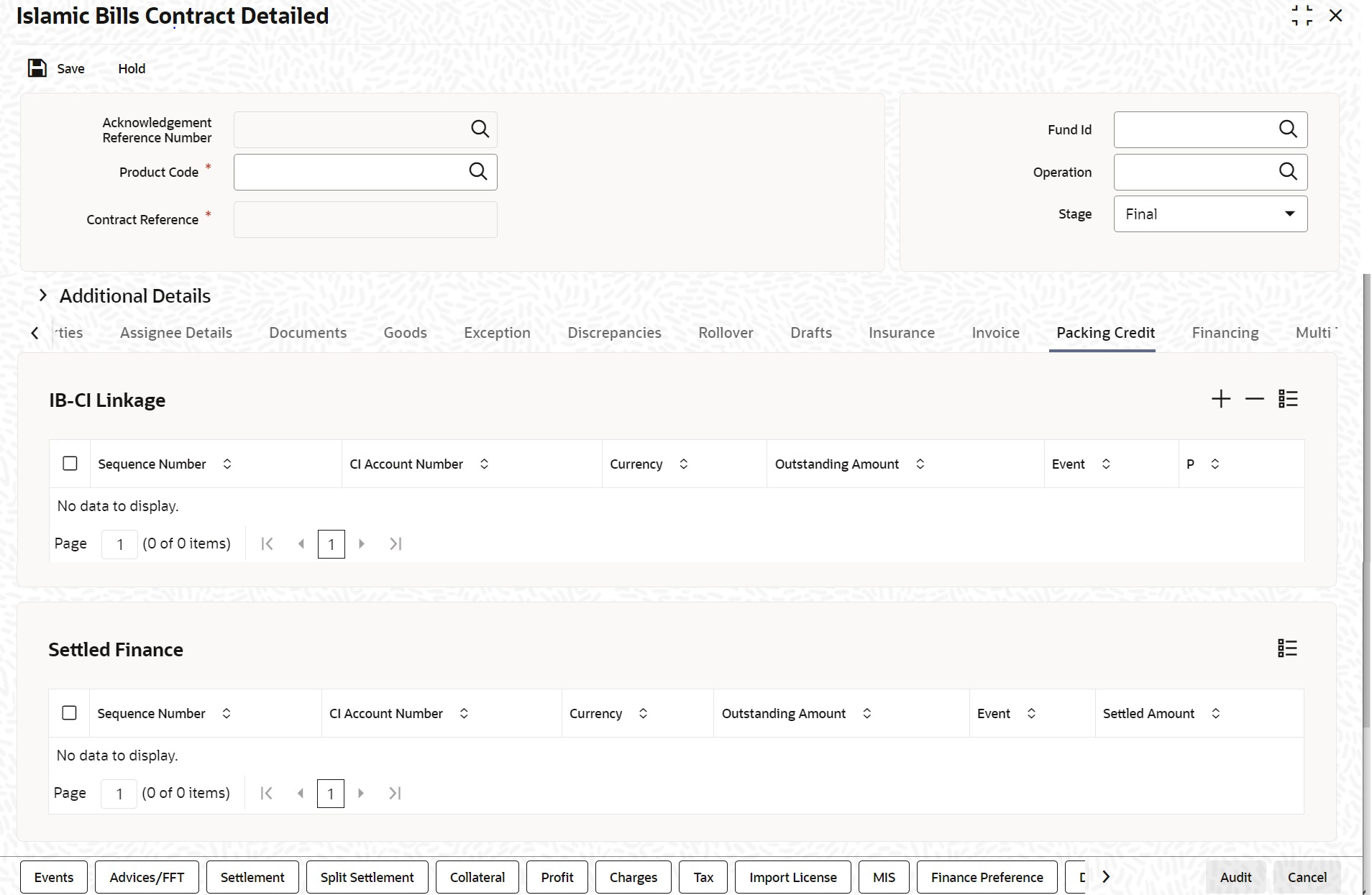

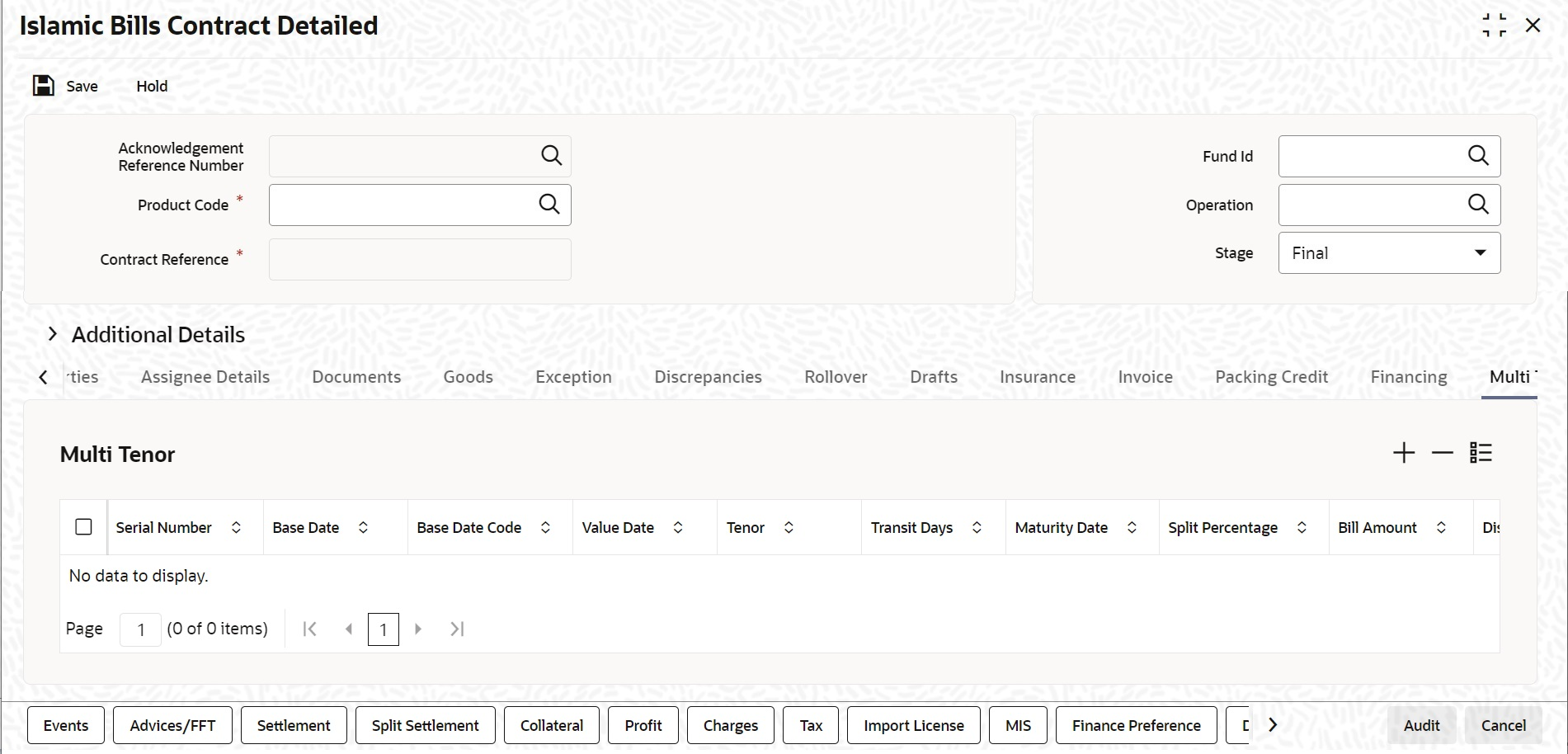

Tabs Details Main Click on this tab to enter the essential details of the bill you are processing. Details In this screen, you can enter the fields that provide detailed information about the contract. Additional In this screen, you can provide additional information on the contract. Parties In the screen that corresponds to this tab, you can enter details of all the parties involved in the bill. This screen, along with its fields, has been detailed under the head ‘Entering Party Details’. Document In the screen corresponding to this tab, you can enter details of the documents required under an Islamic bill and the clauses that should accompany the documents. You can also specify details, of the merchandise that was traded and the shipping instructions based on which, the goods were transported. Goods Click on this tab to enter details of the goods Exception Click on this tab to enter details of the exception tracers that should be generated for the exceptions that occur while processing the bill. Discrepancies In the screen that corresponds to this tab, you can enter details of the discrepancies that occur while processing the bill. The screen also captures details of the tracers that should be generated for Reserve exceptions. Rollover Click on this tab to maintain rollover details for the bill. Drafts Click on this tab to view the components that make up the Bill Amount. Insurance Click on this tab to associate the appropriate Insurance Company with the Bill contract. Invoice Click this tab to define the invoice margin that should be withheld whenever an invoice is raised against a discounted bill. Packing Credit Click on this tab to maintain the packing credit details. Financing Click on this tab to maintain the financing details. Multi Tenor Click on this tab to maintain the multi tenor details. Note:

On booking an Import LC Drawing - System validates if the same ‘Negotiating Bank Reference’ exists for any other existing bills and restricts the bill processing.

On booking an Import Documentary Collection Bills - System validates if the same ‘Remitting Bank Reference’

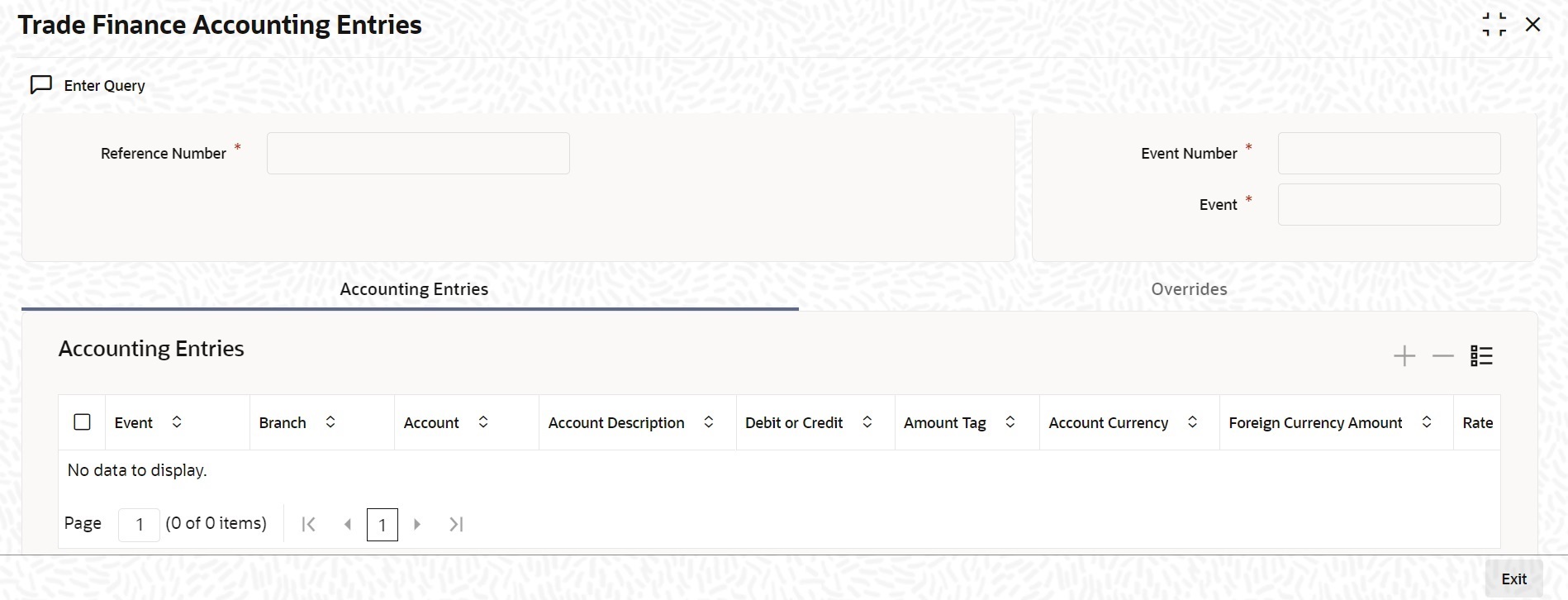

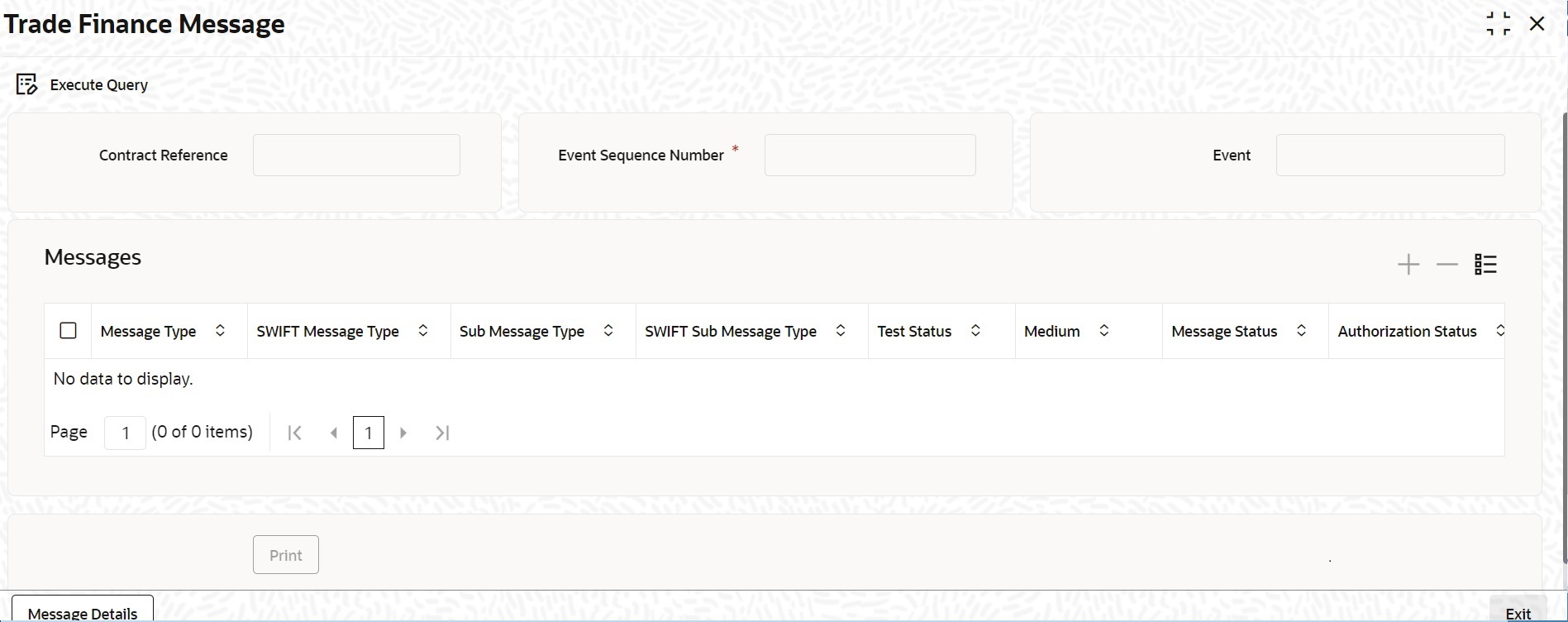

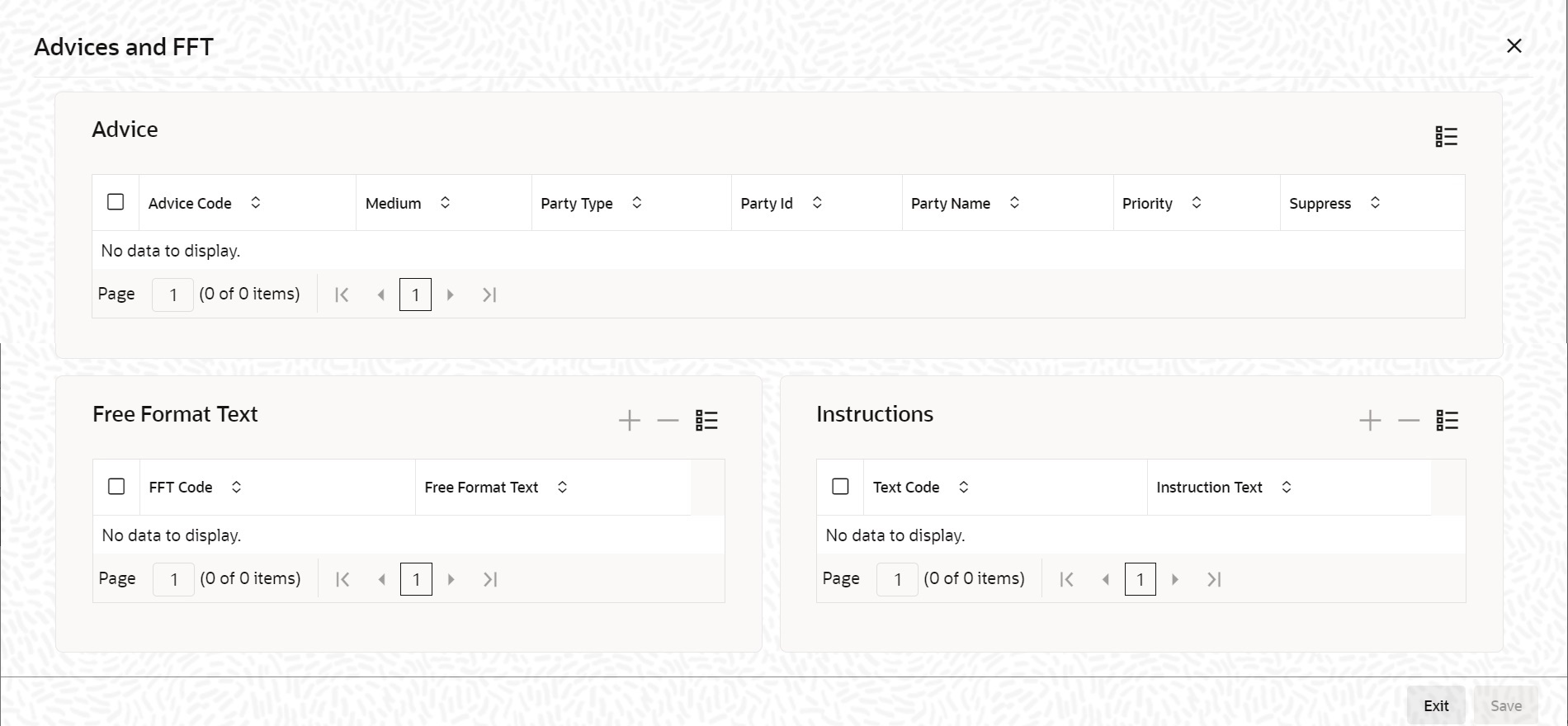

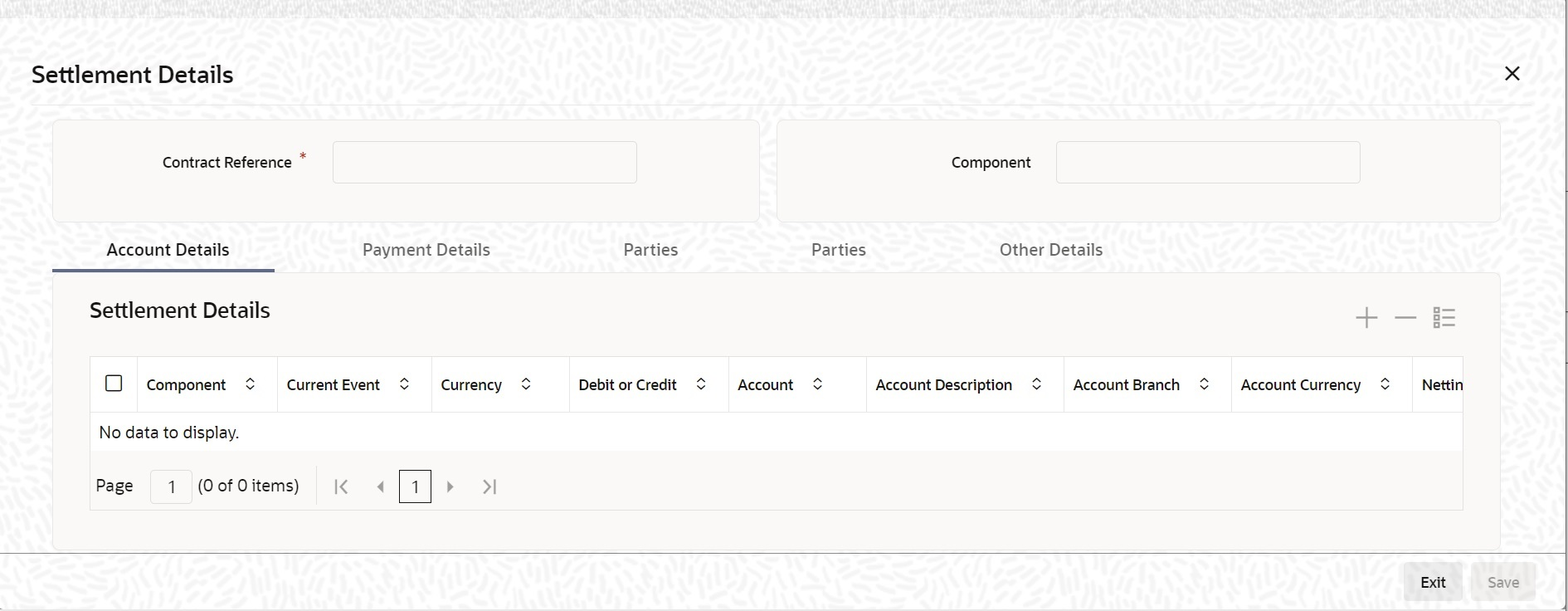

exists for any other existing bills and display the override messageOn the Islamic Bills & Collections Contract Detailed screen, there is also a horizontal toolbar. The links on this toolbar enable you to invoke a number of functions that are vital to the processing of a bill. These links have been briefly described below:Table 4-4 Toolbar Links

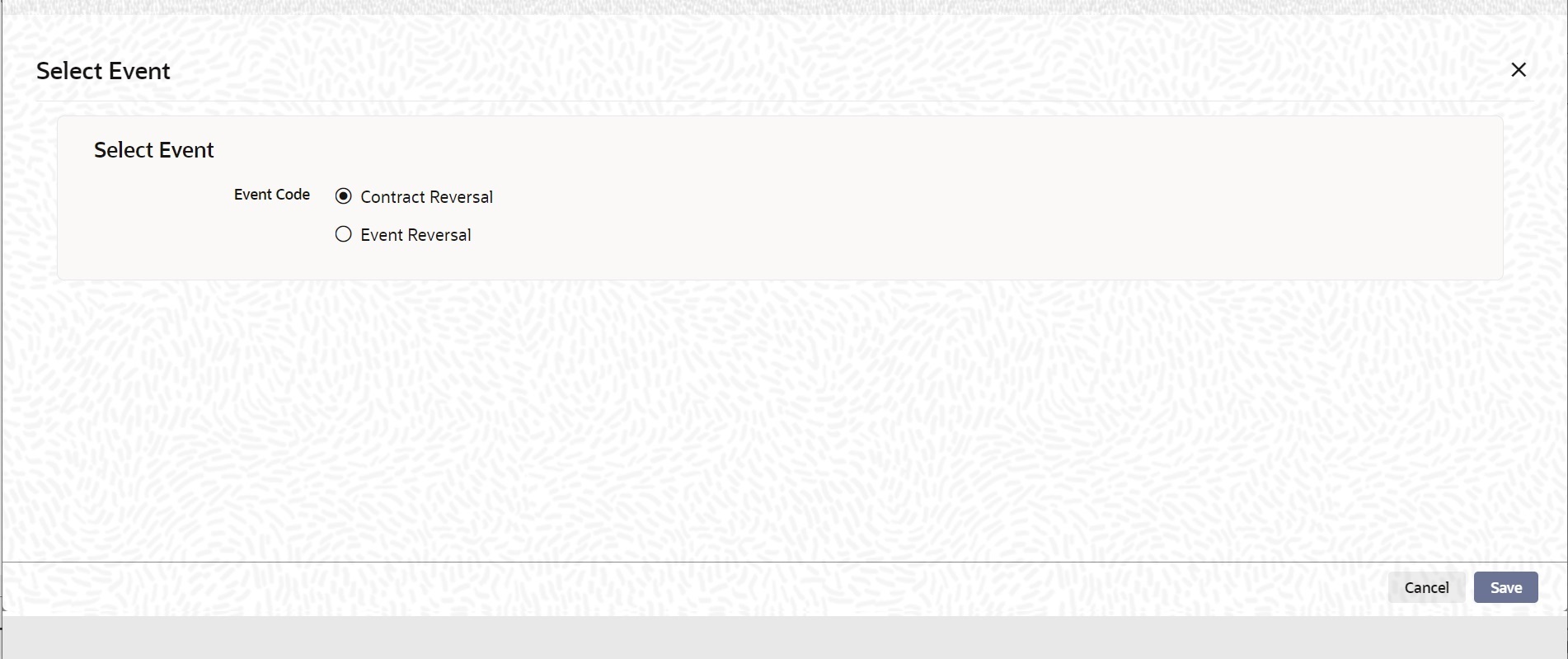

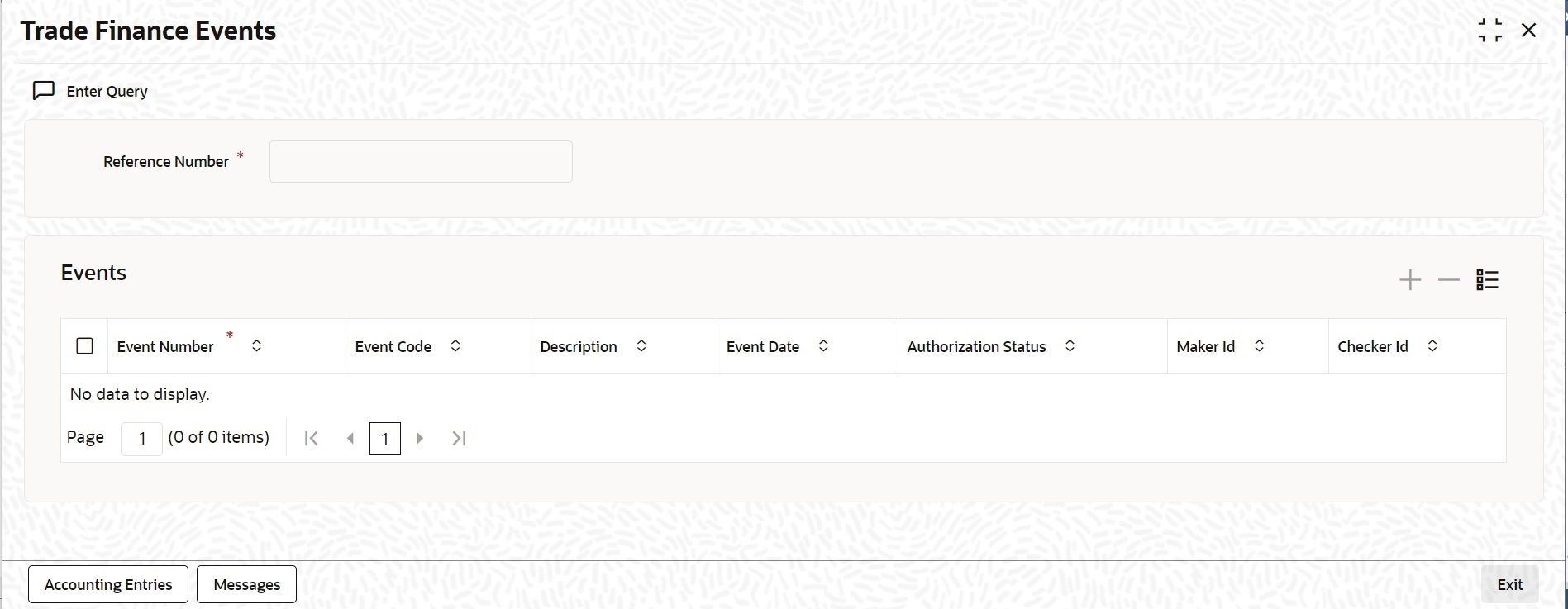

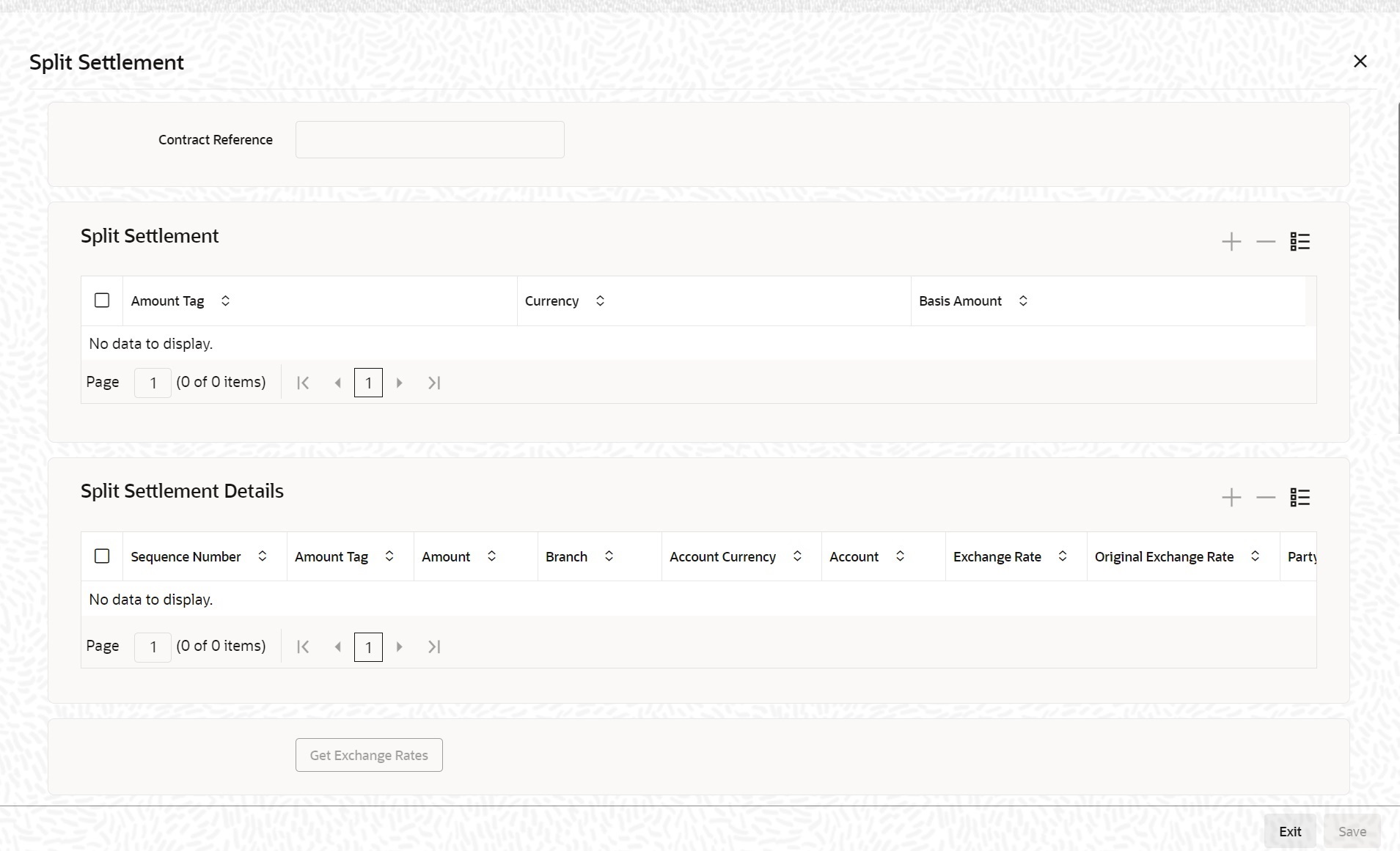

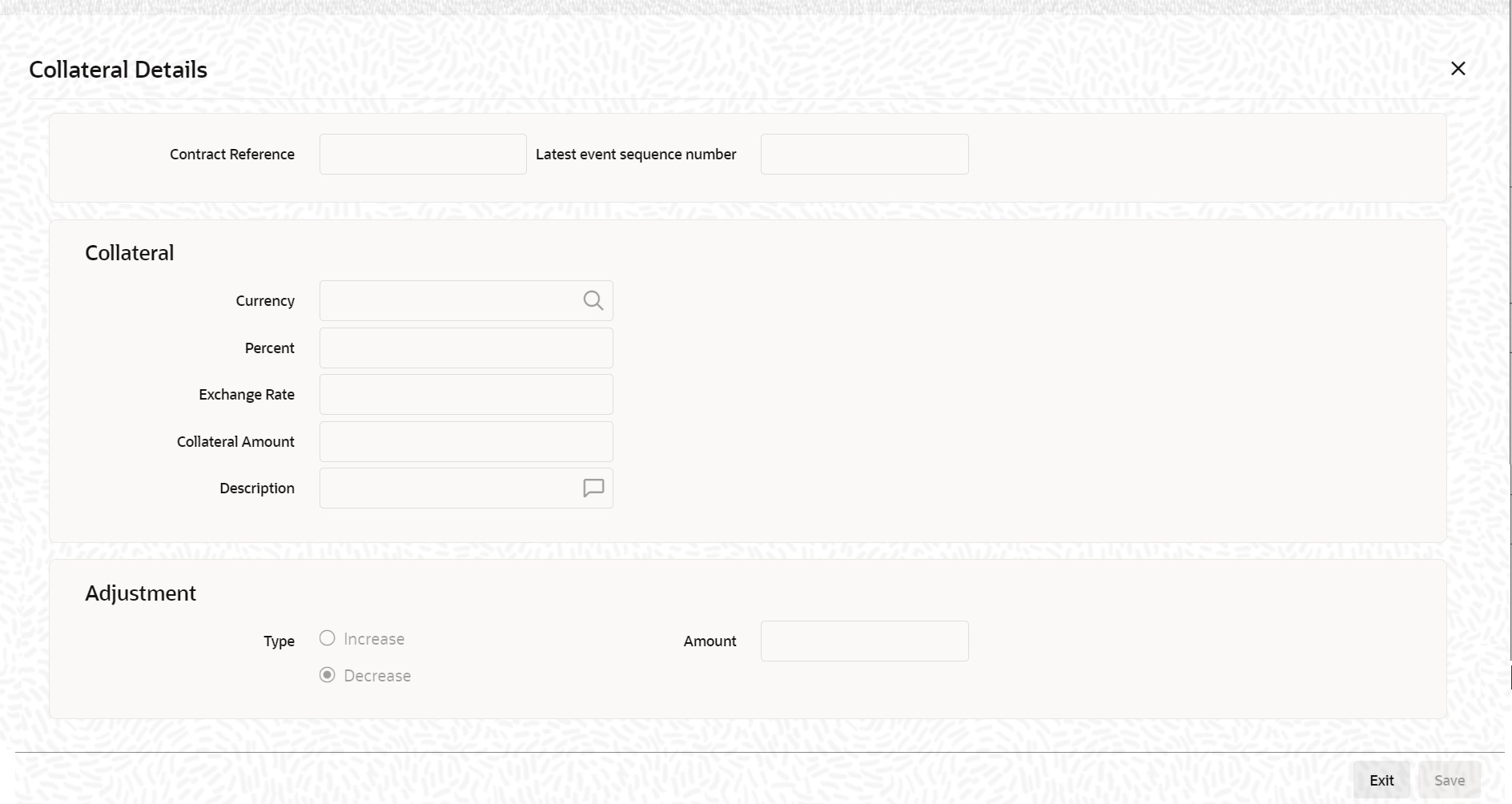

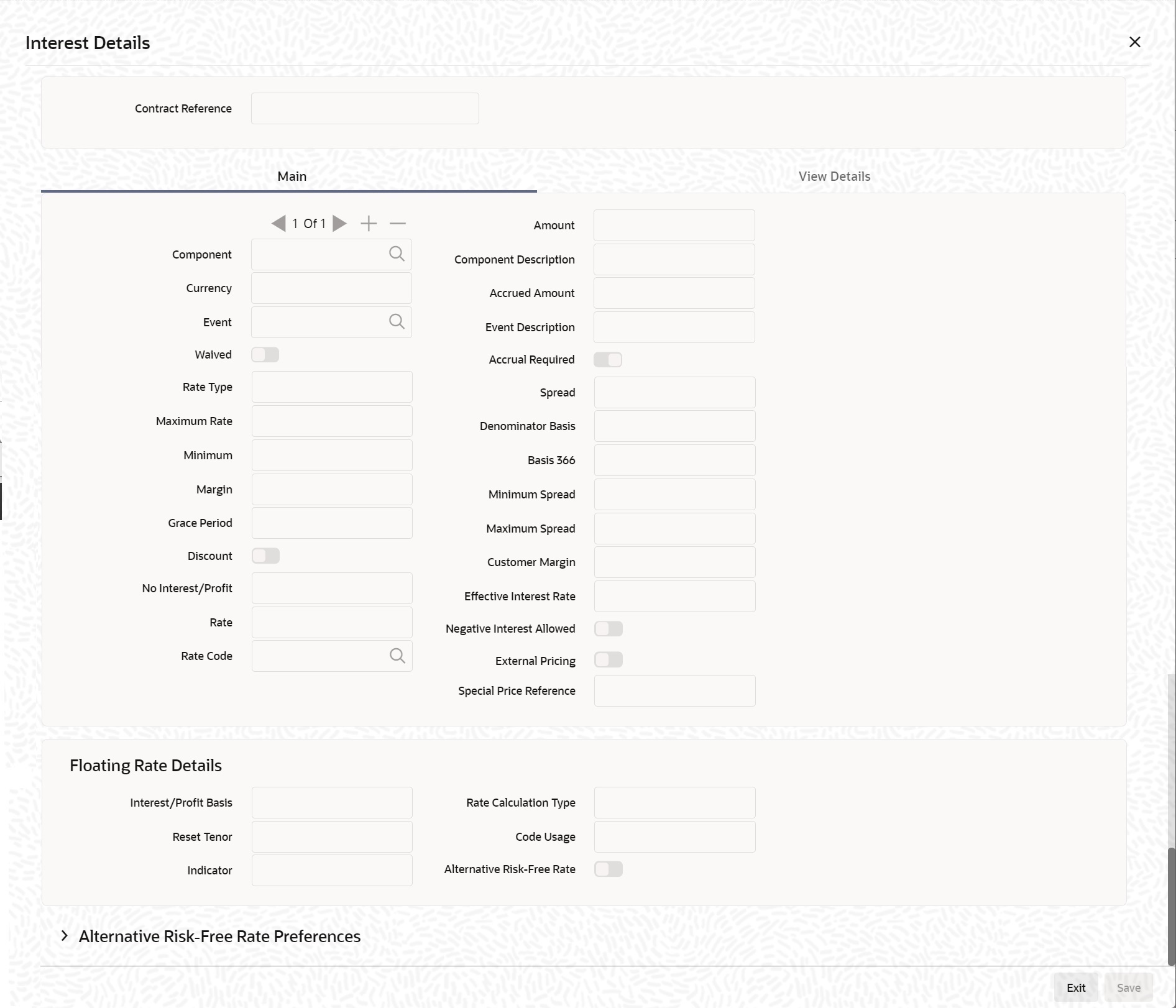

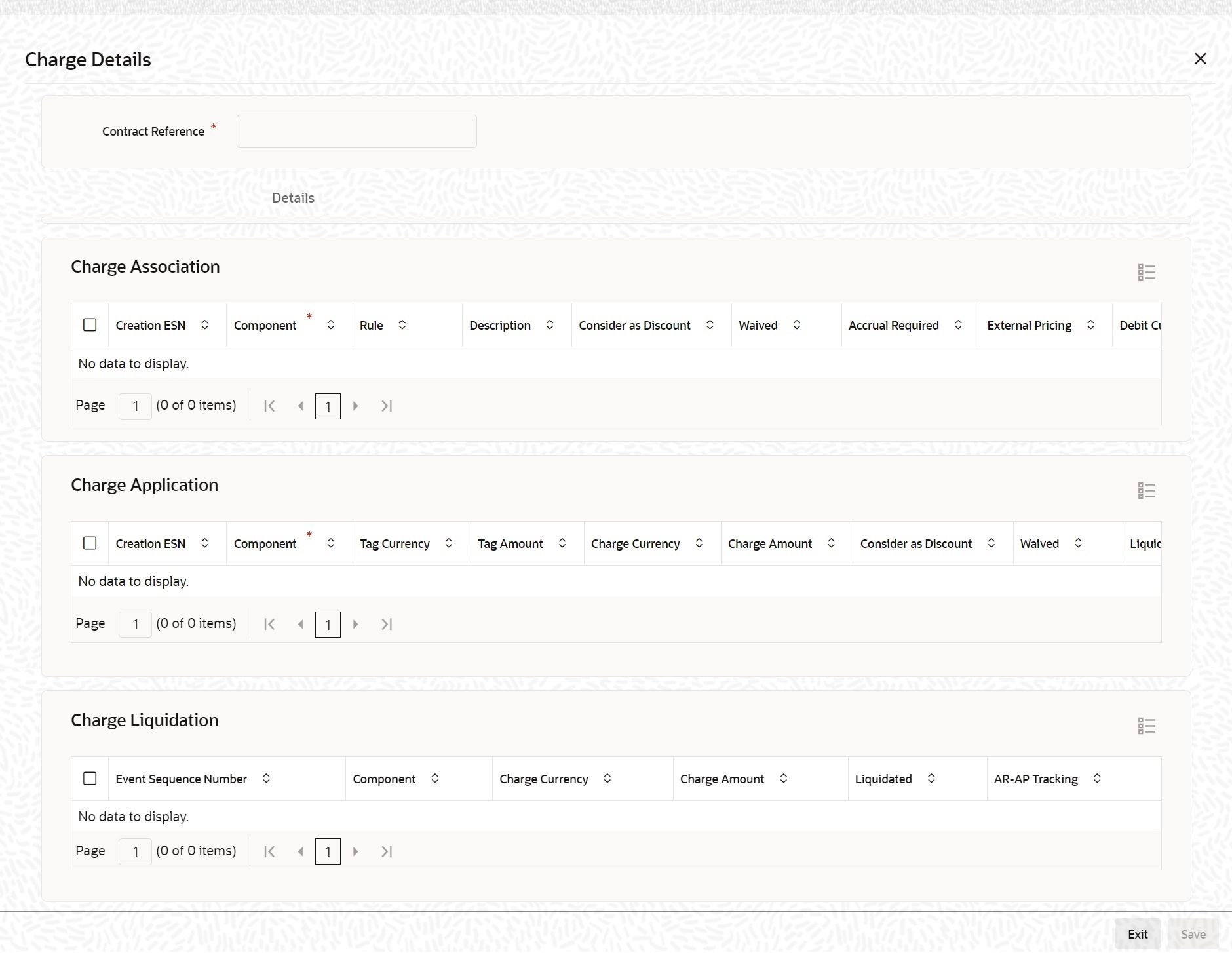

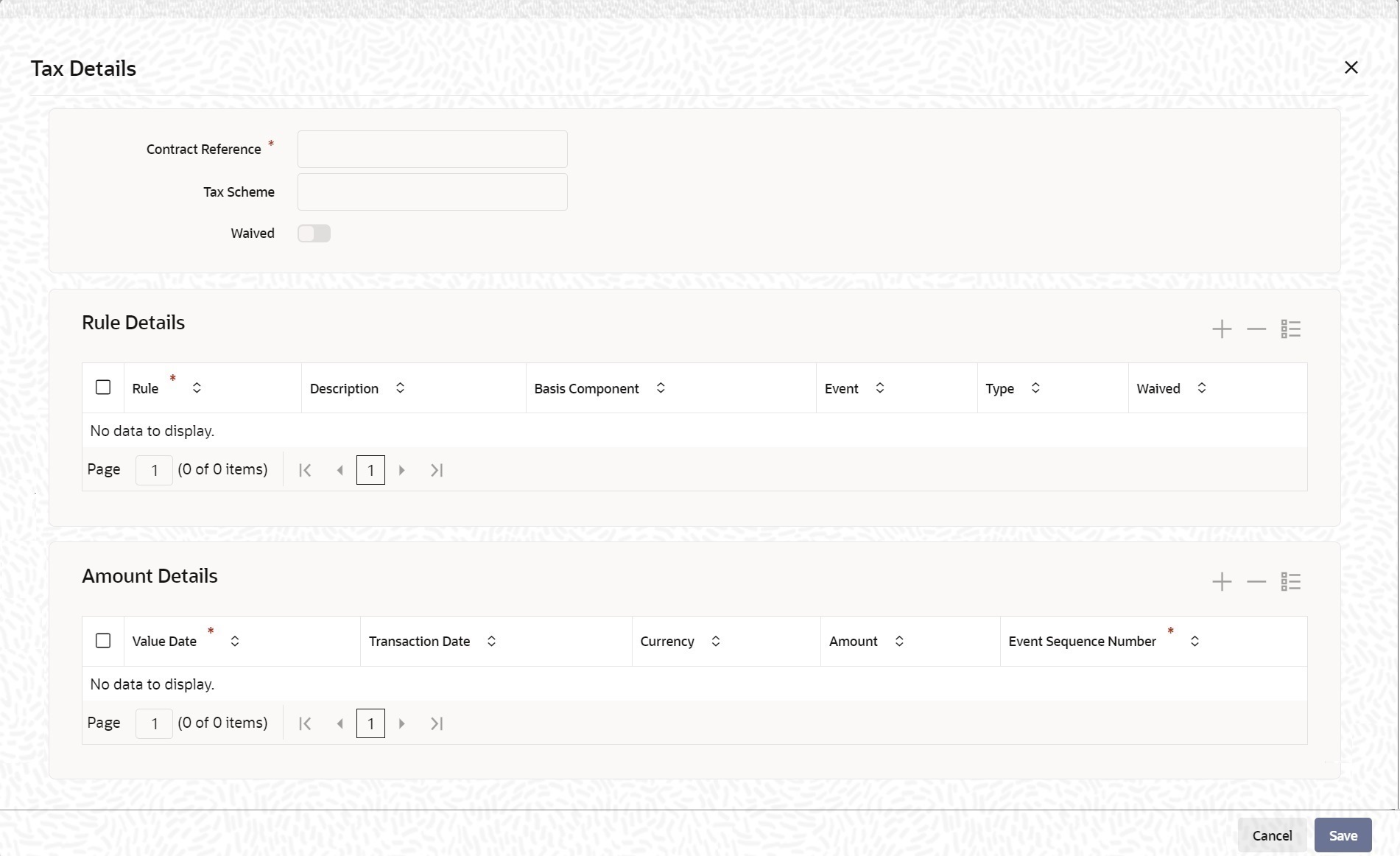

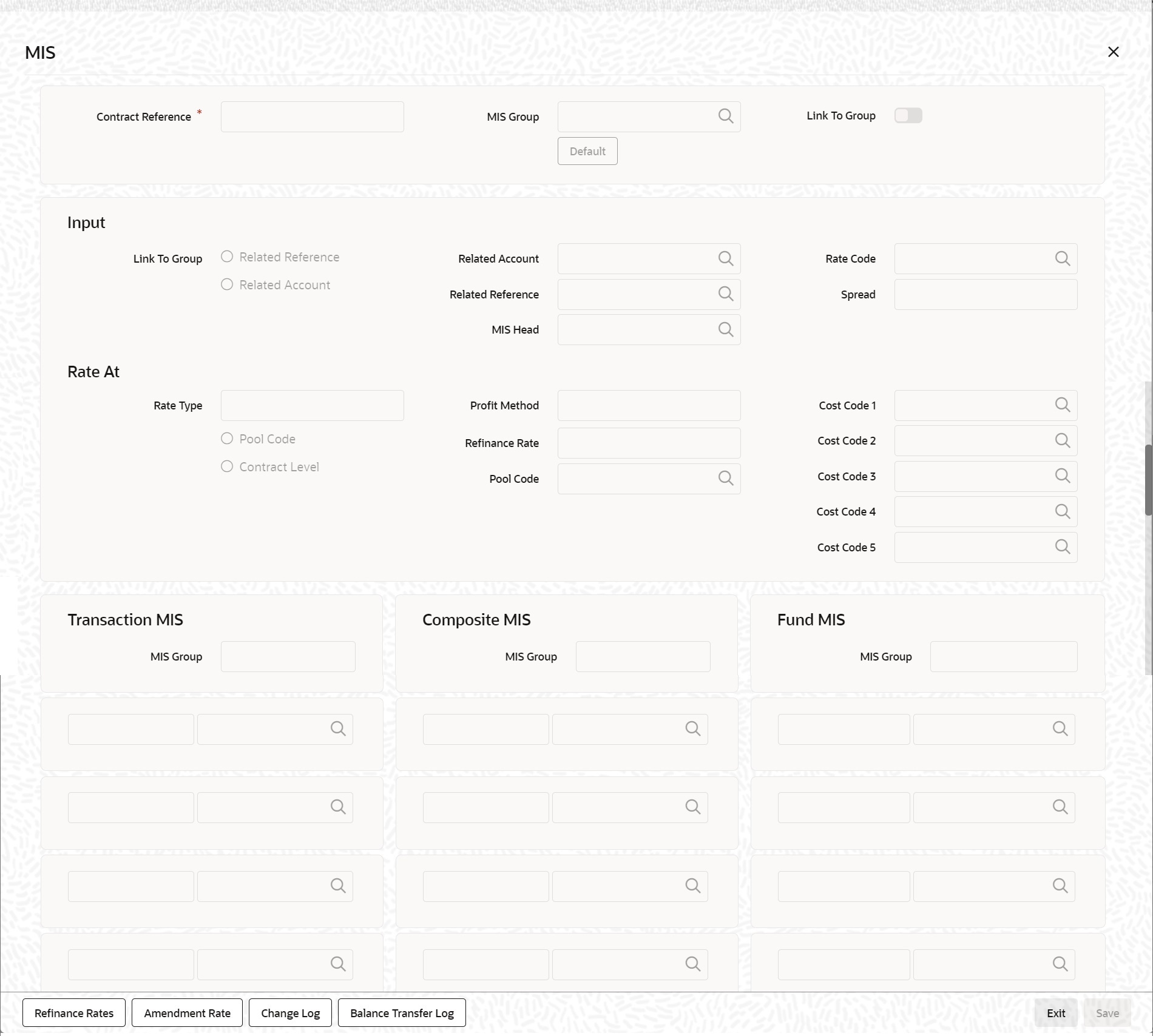

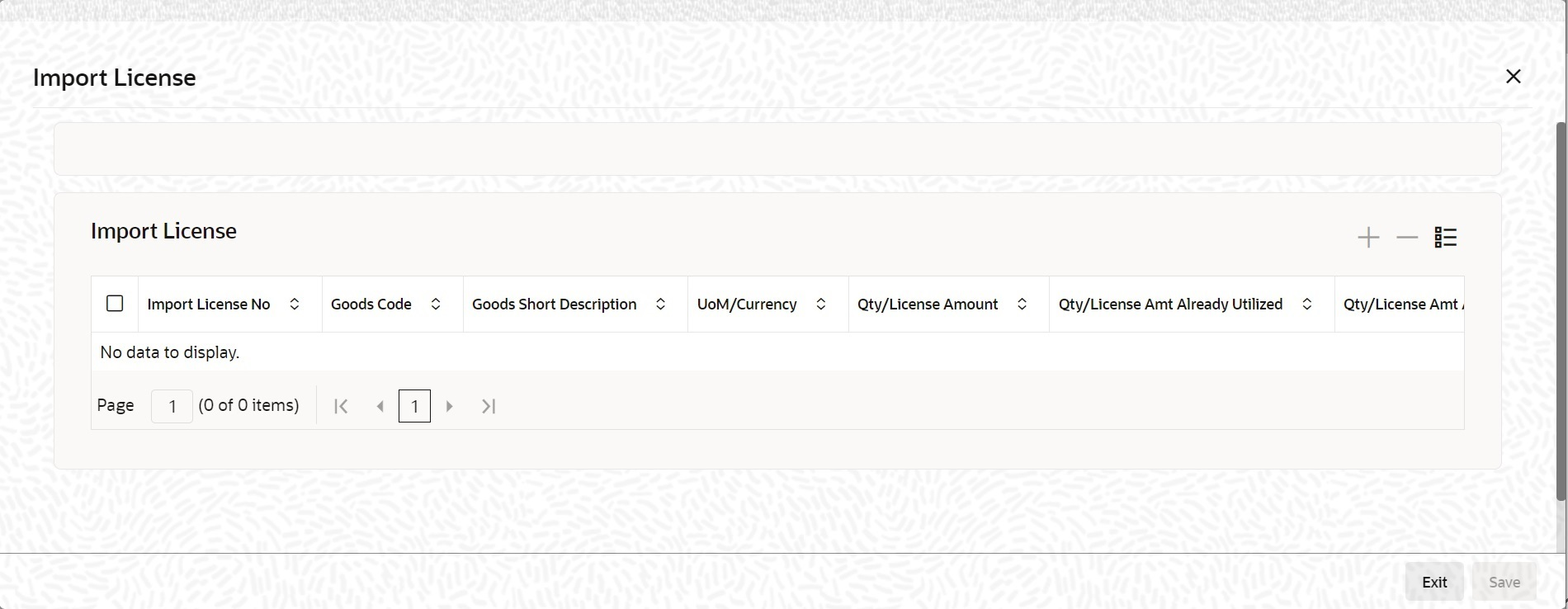

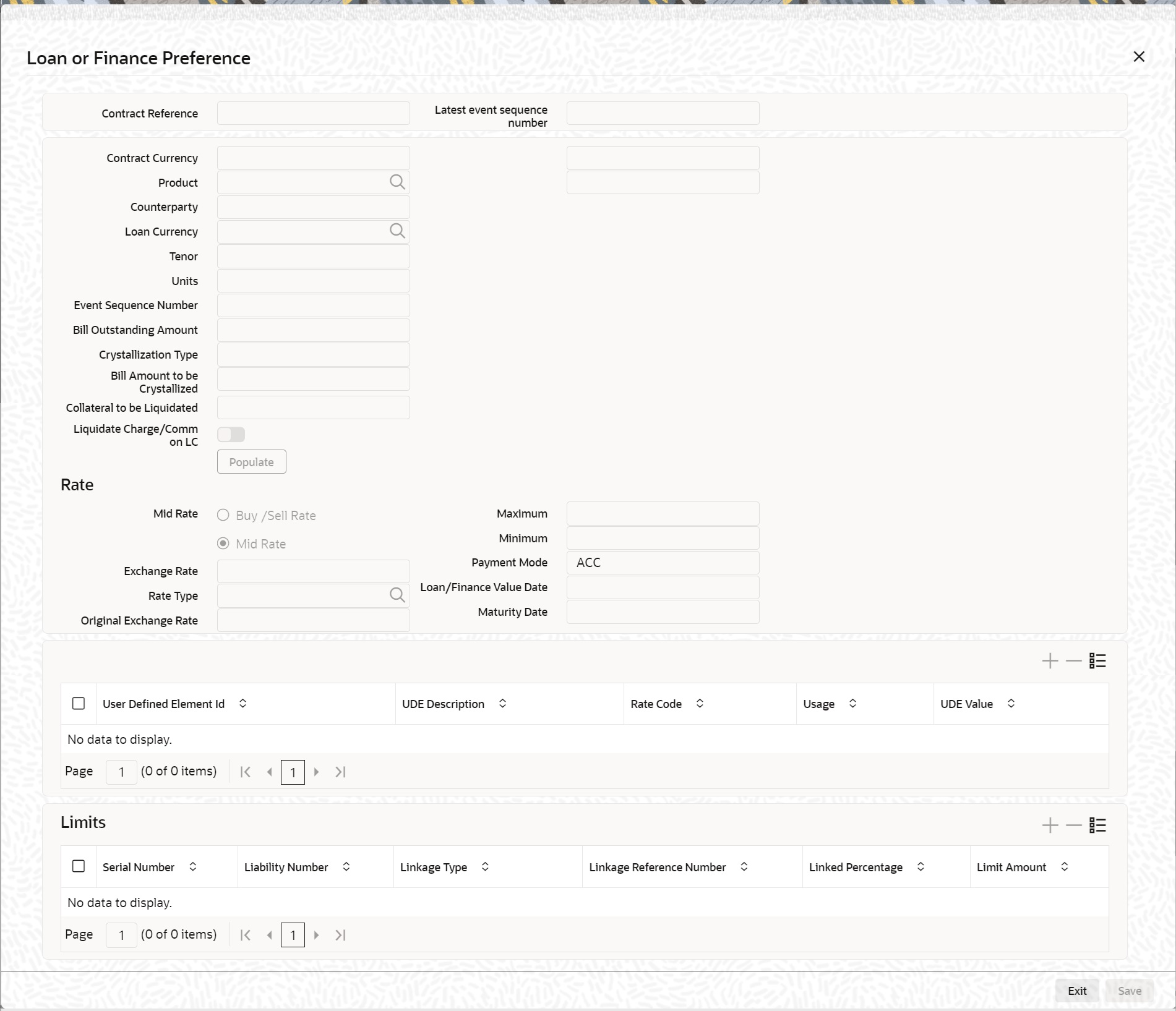

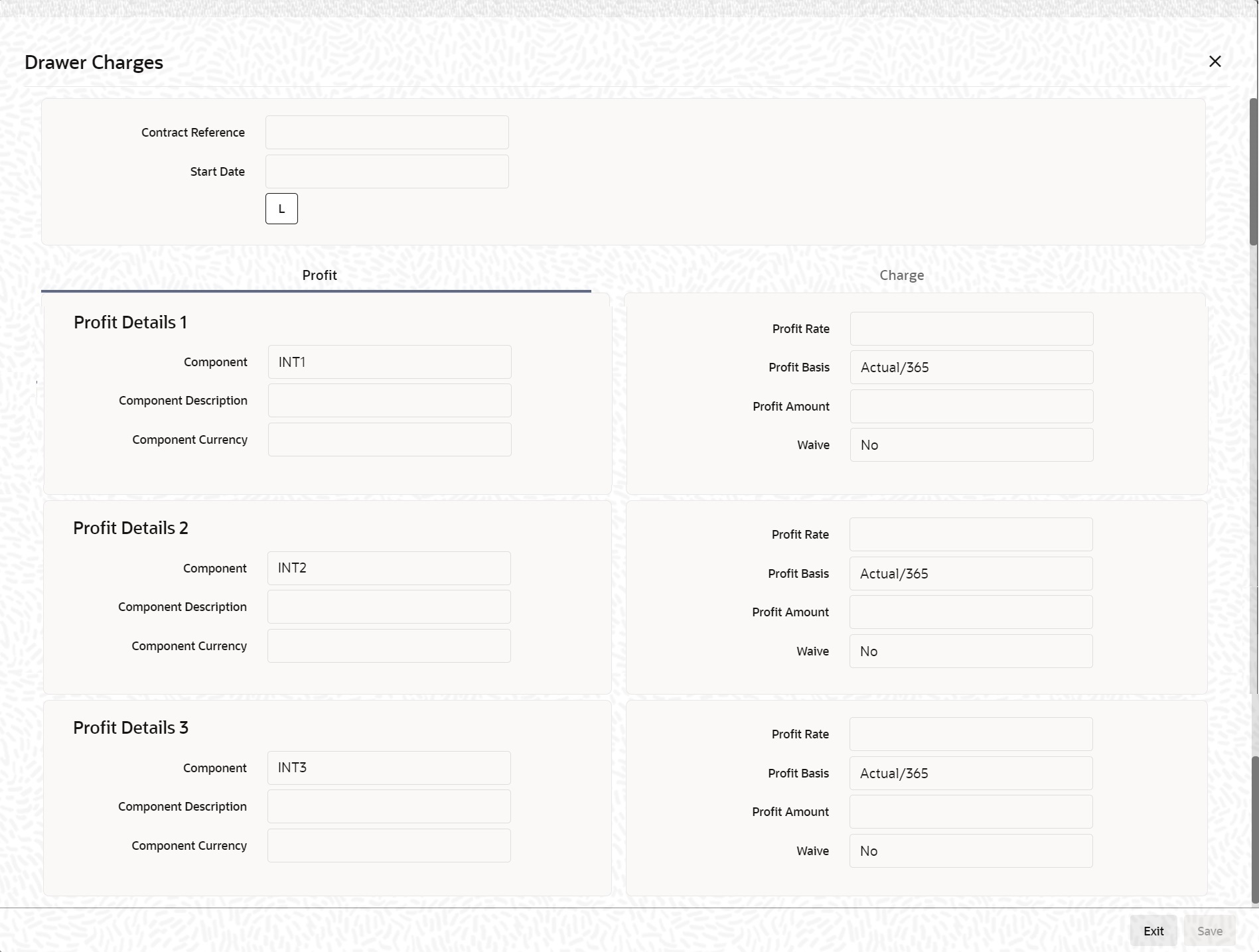

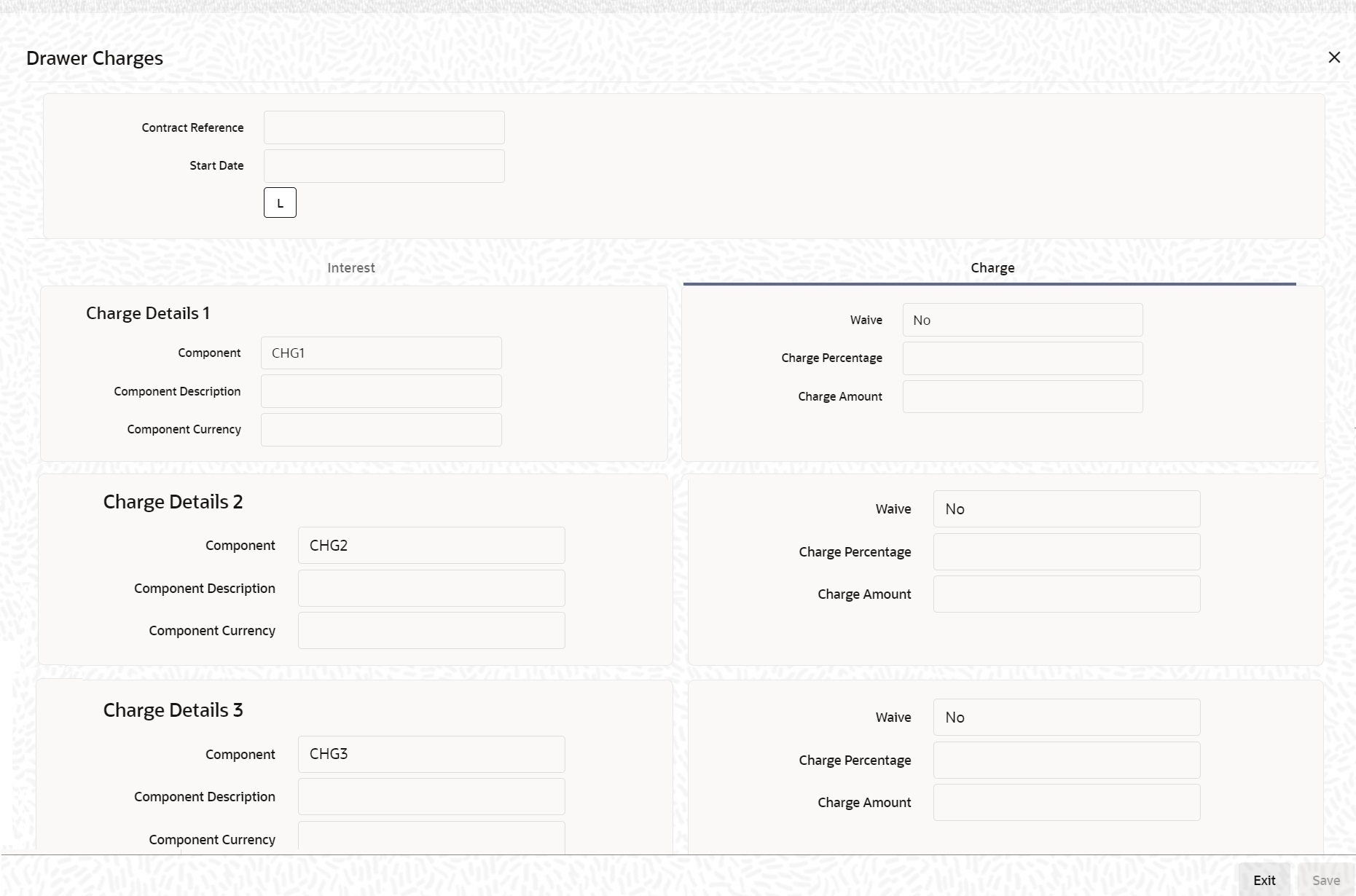

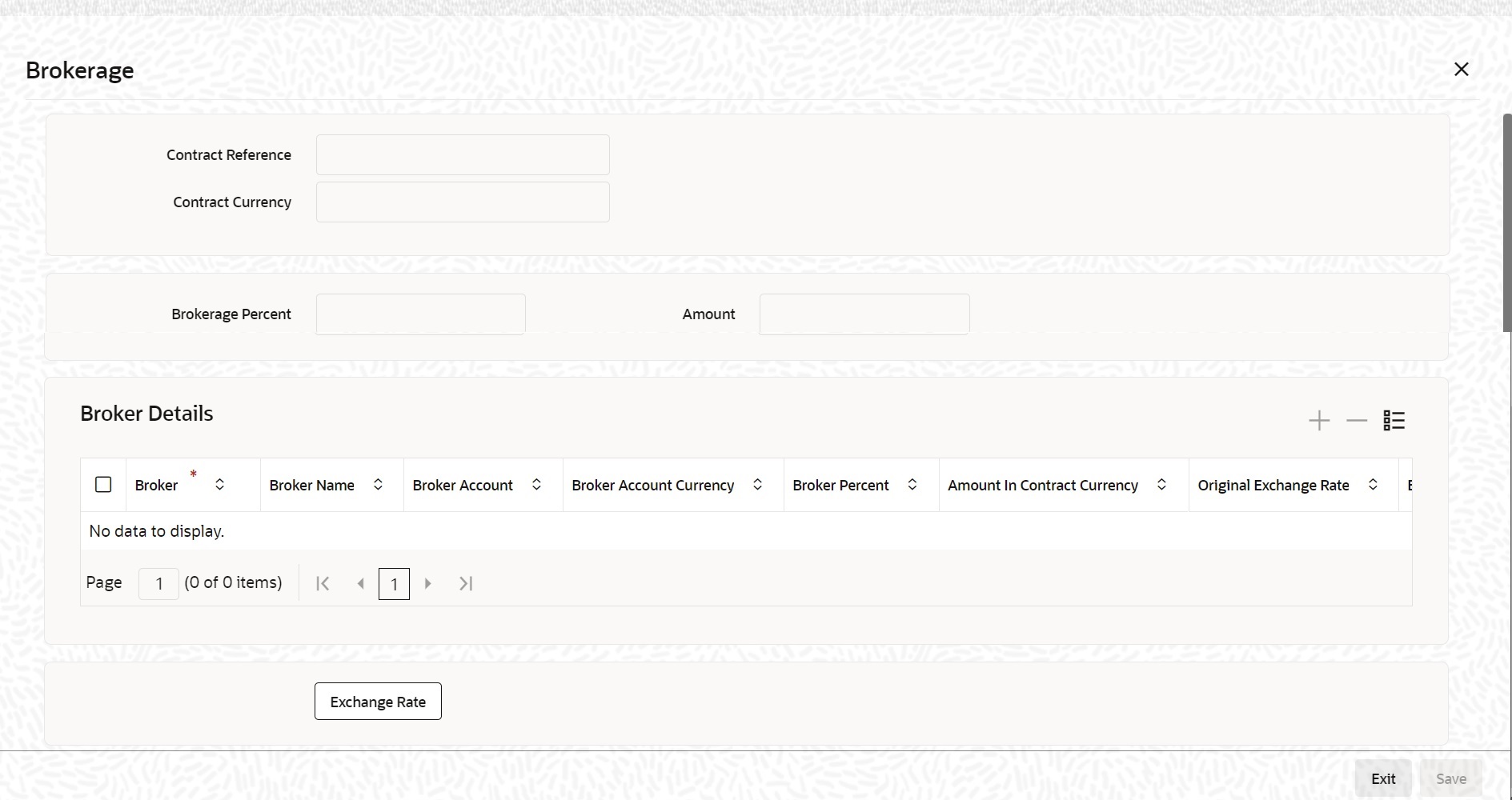

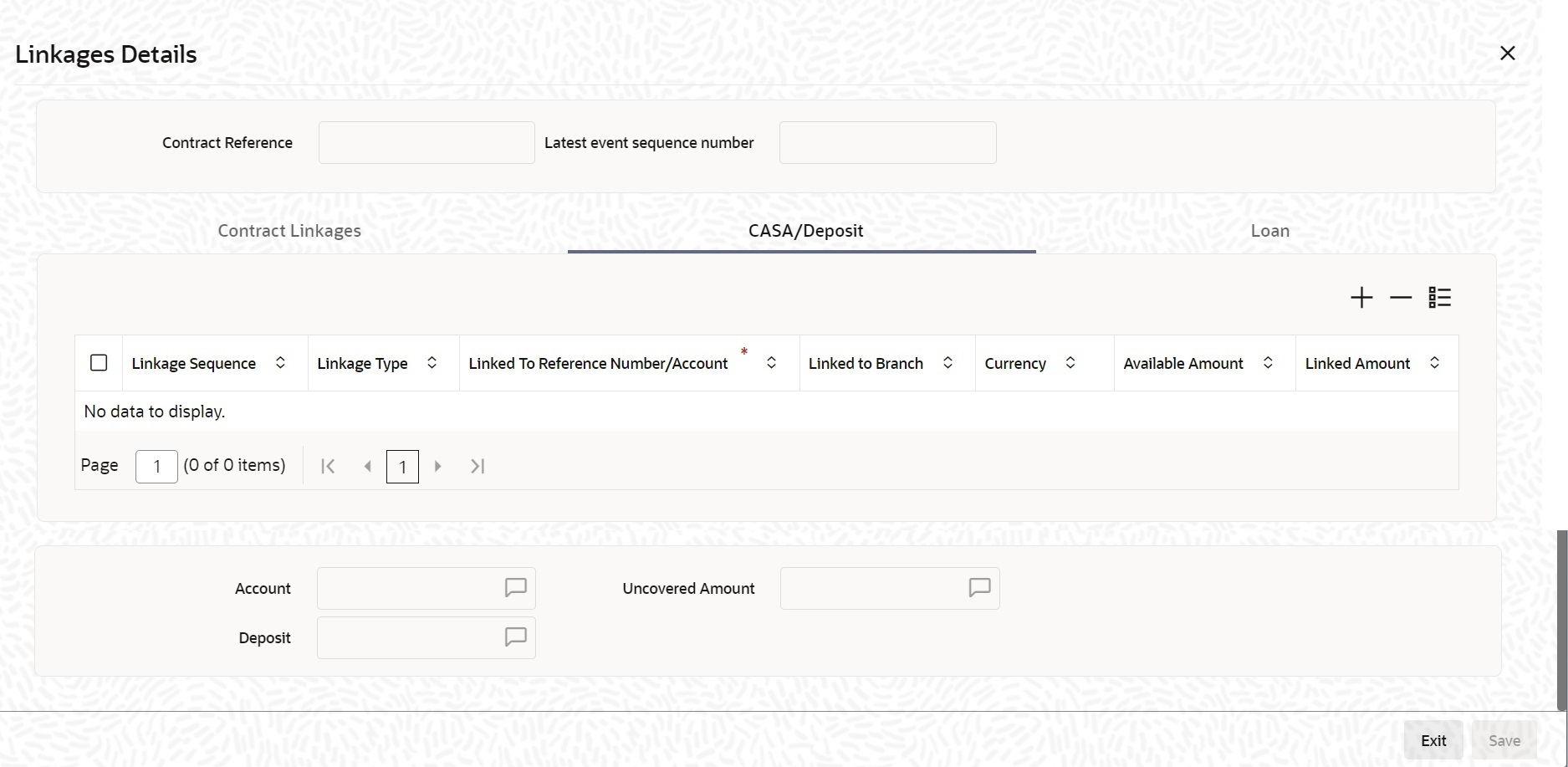

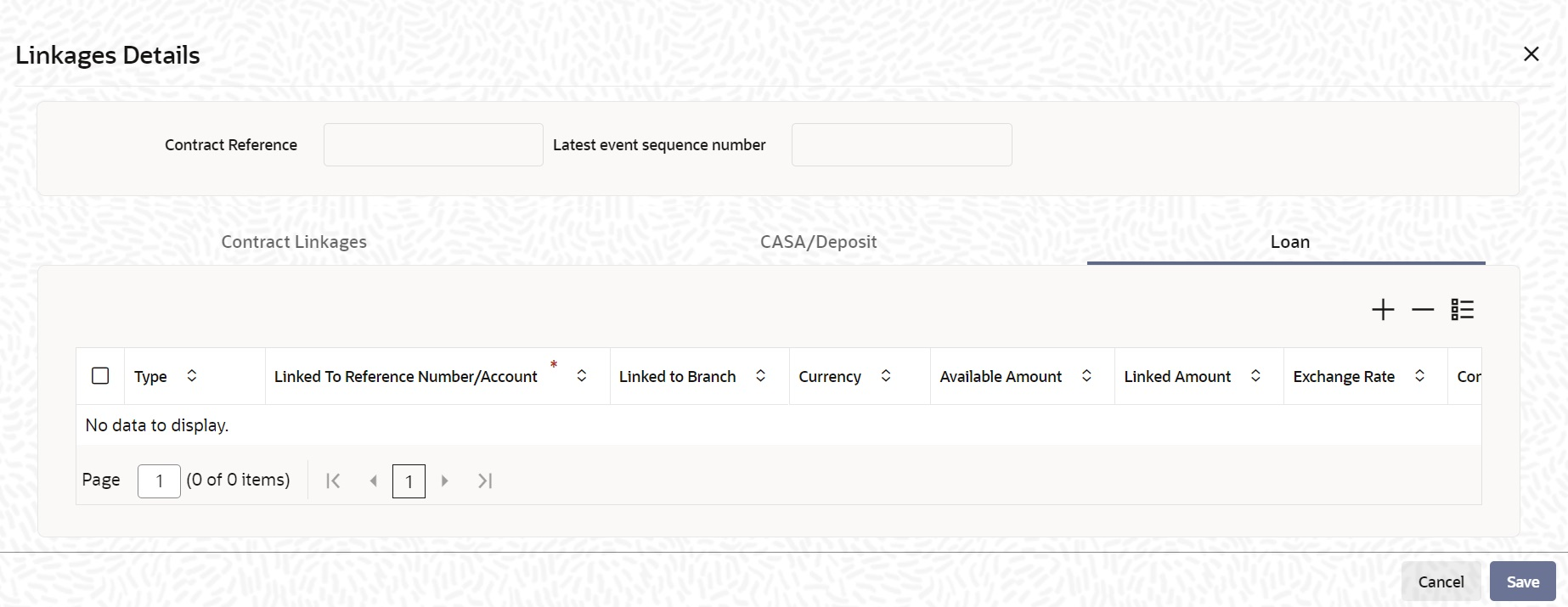

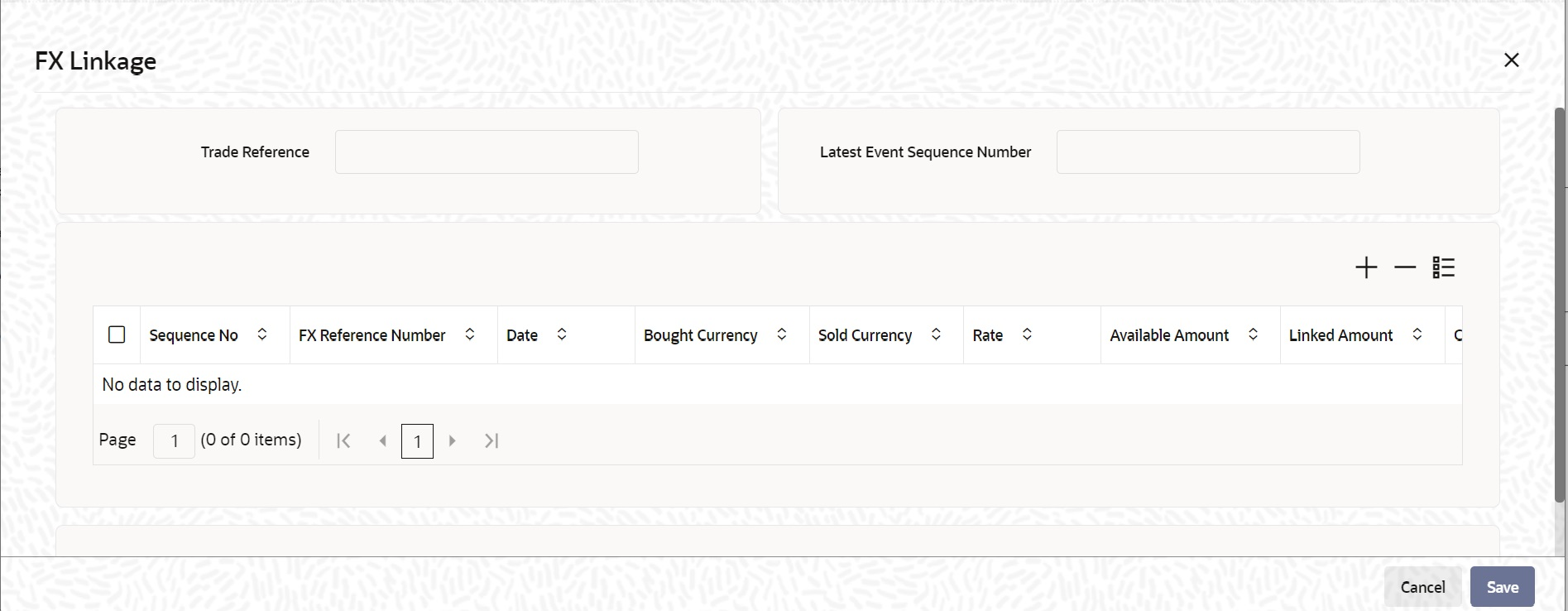

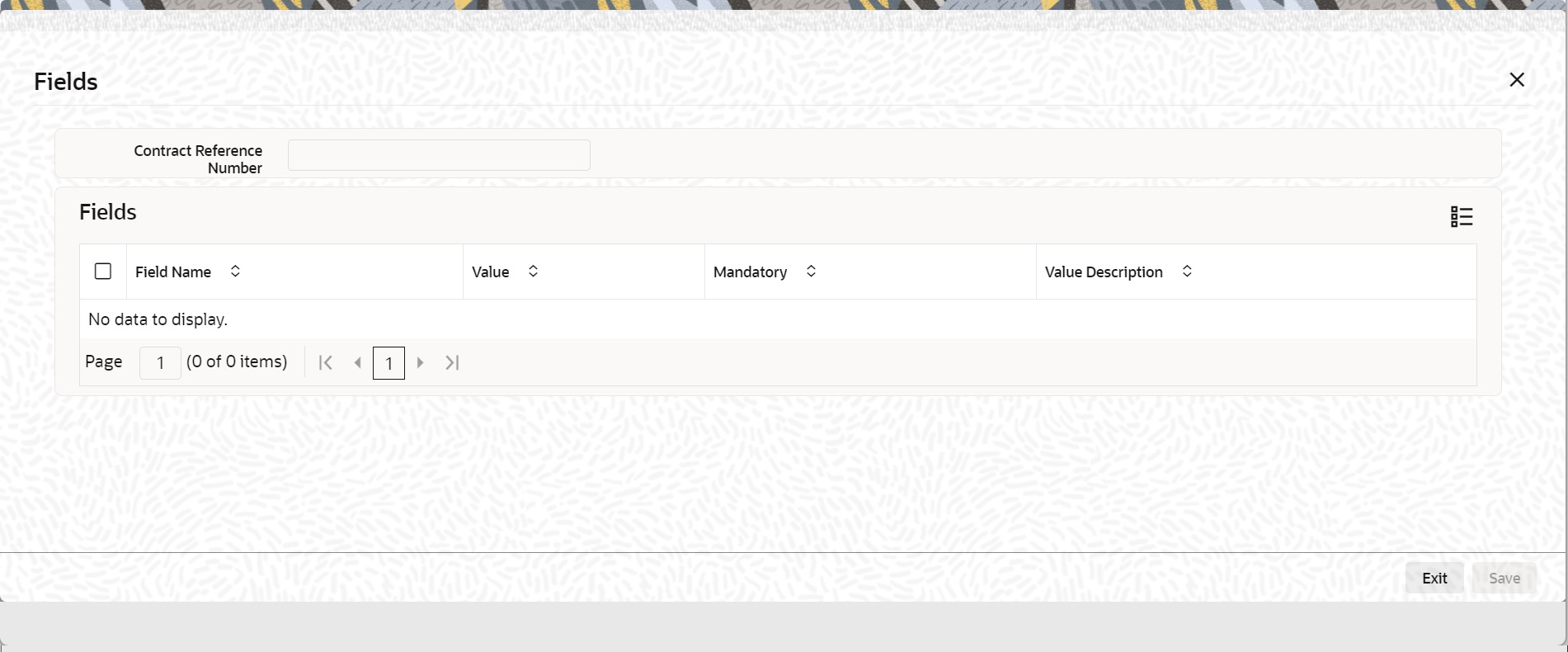

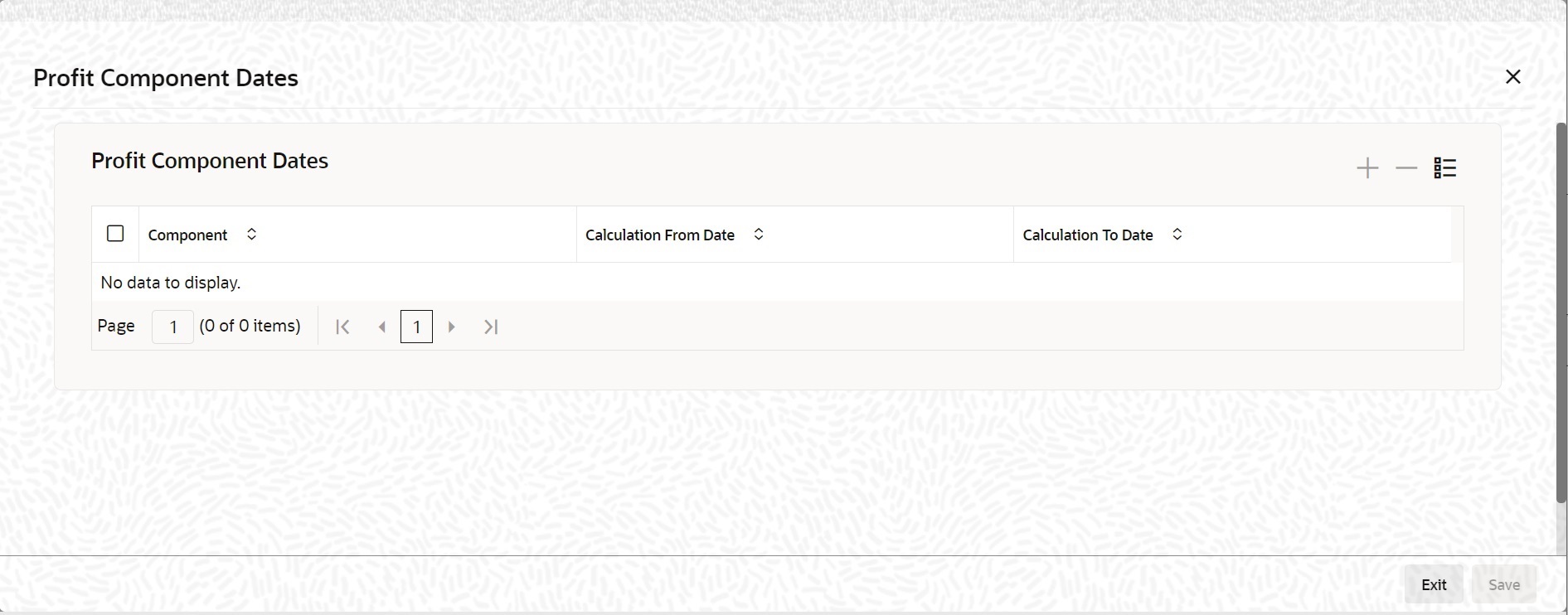

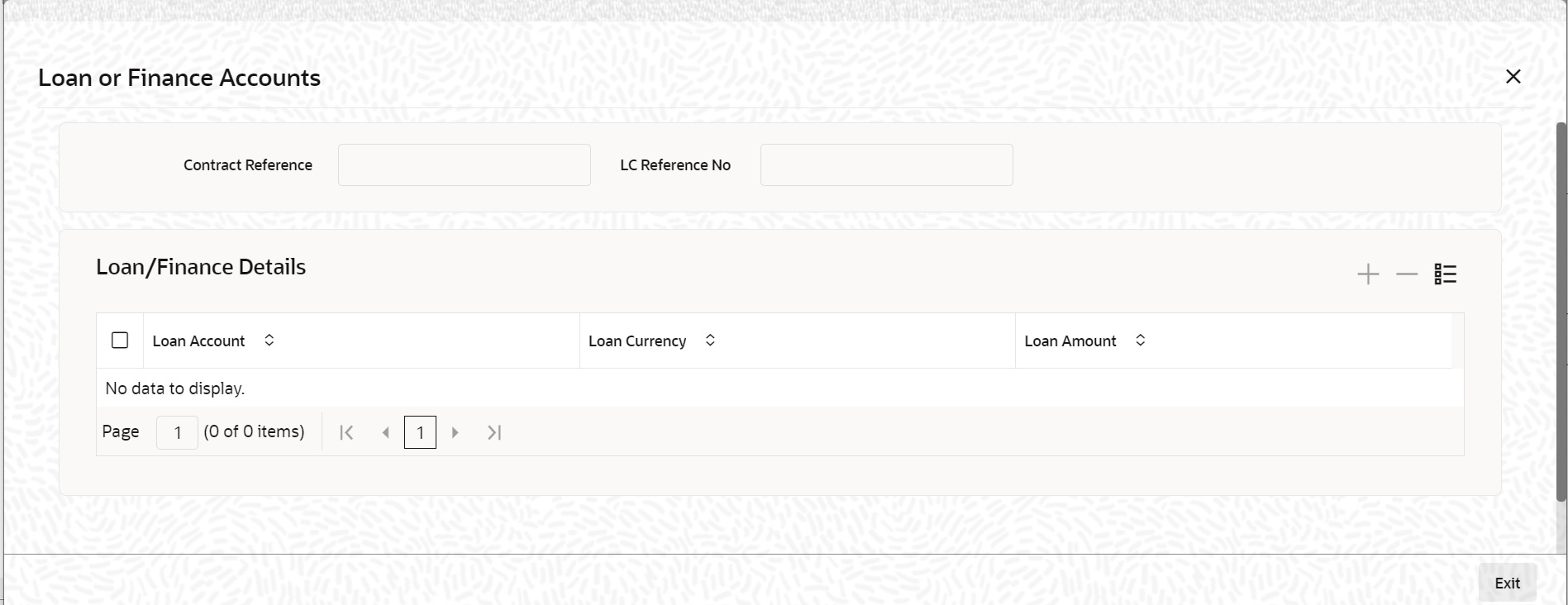

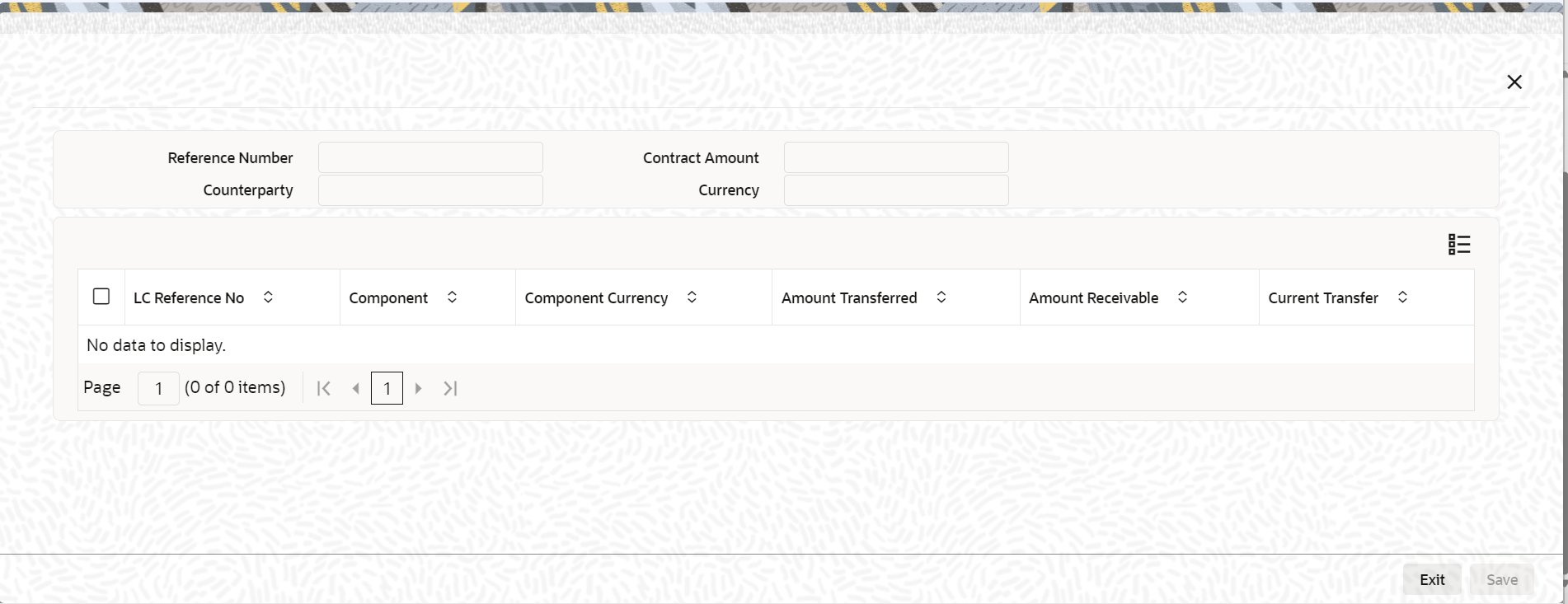

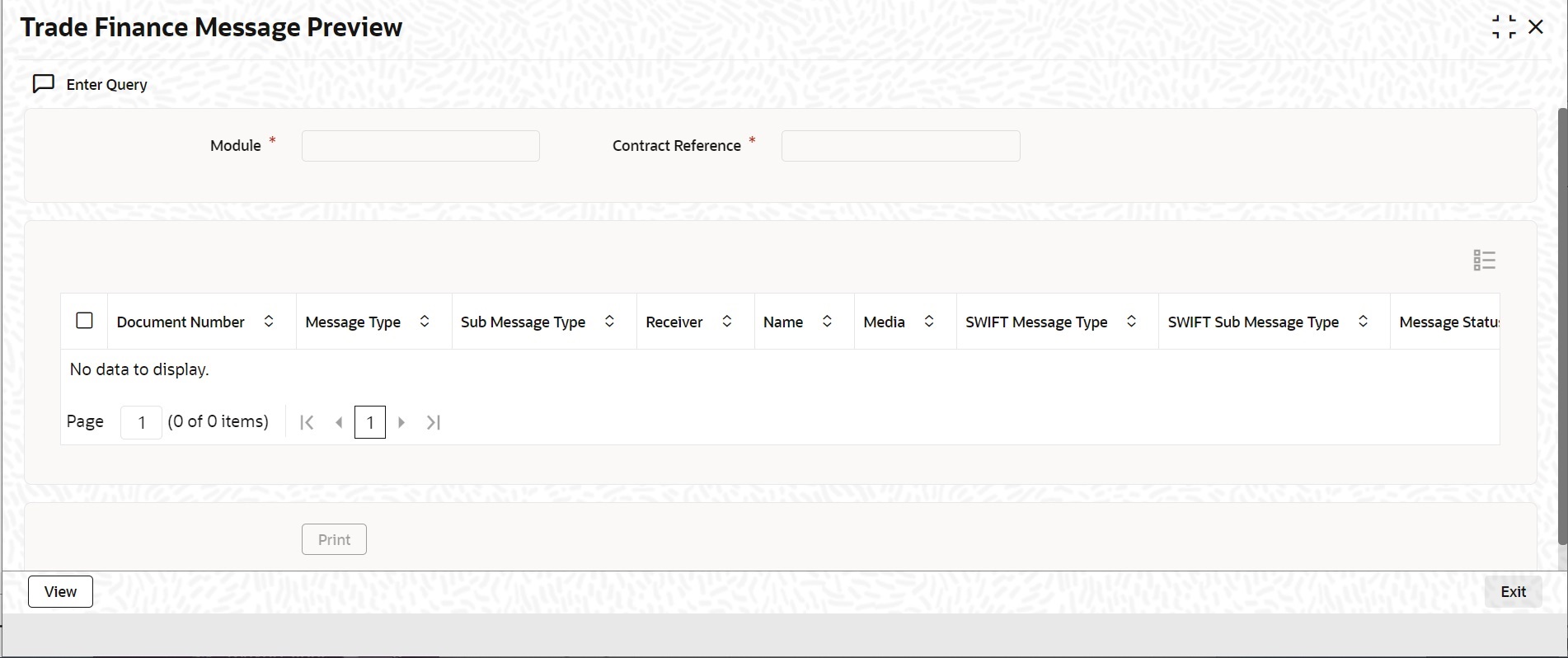

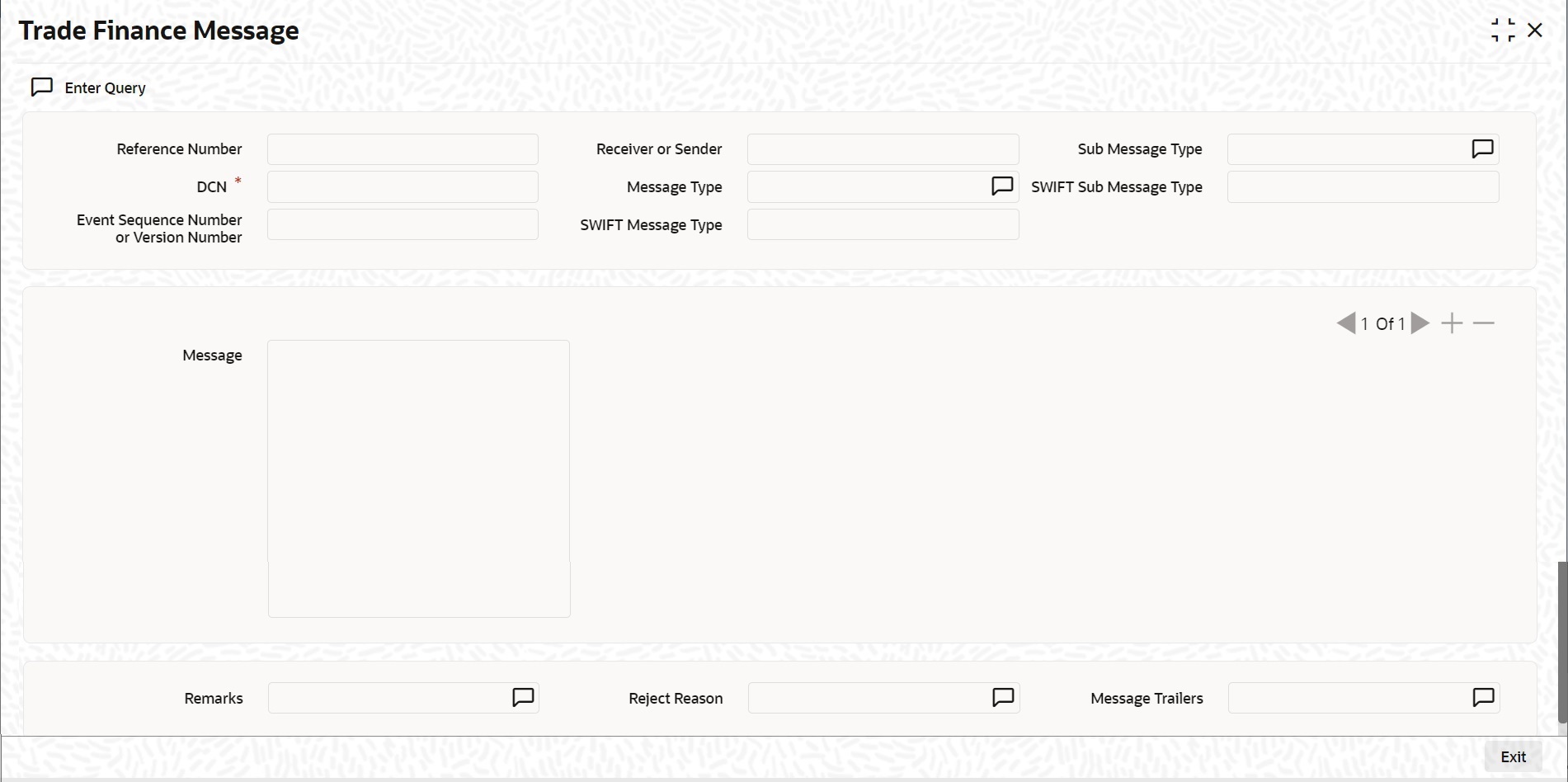

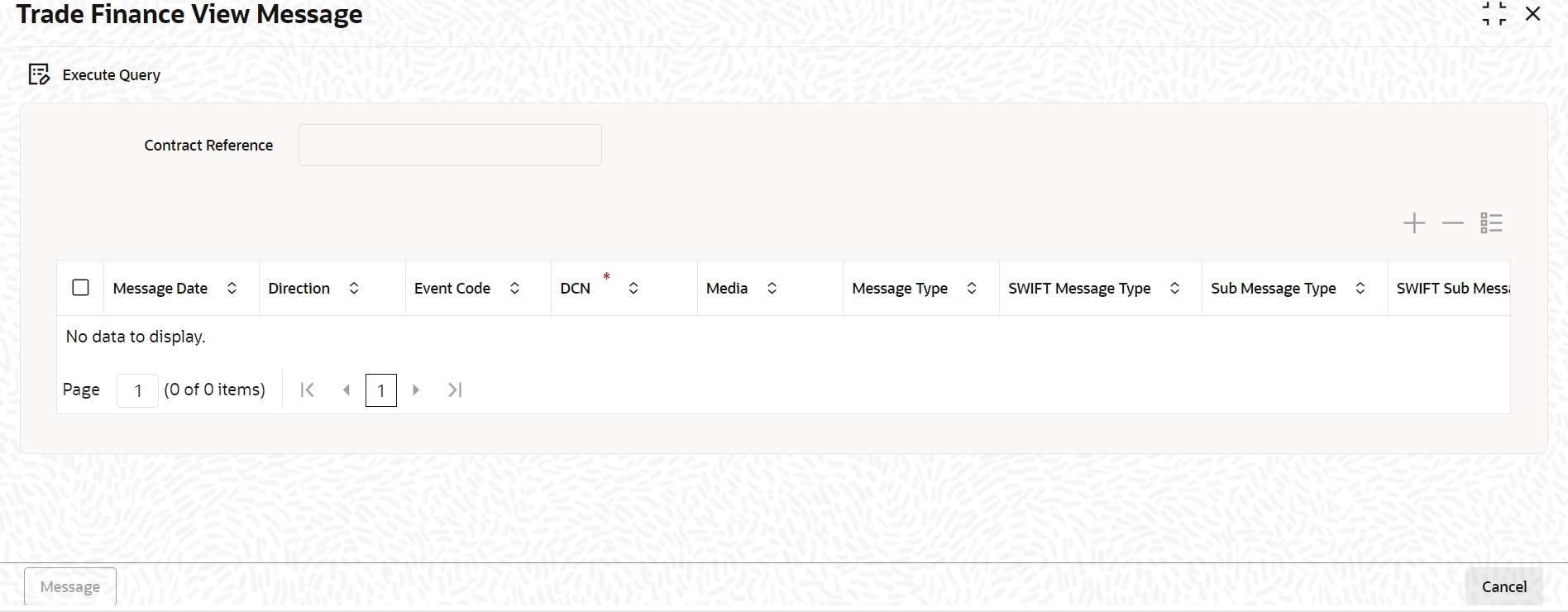

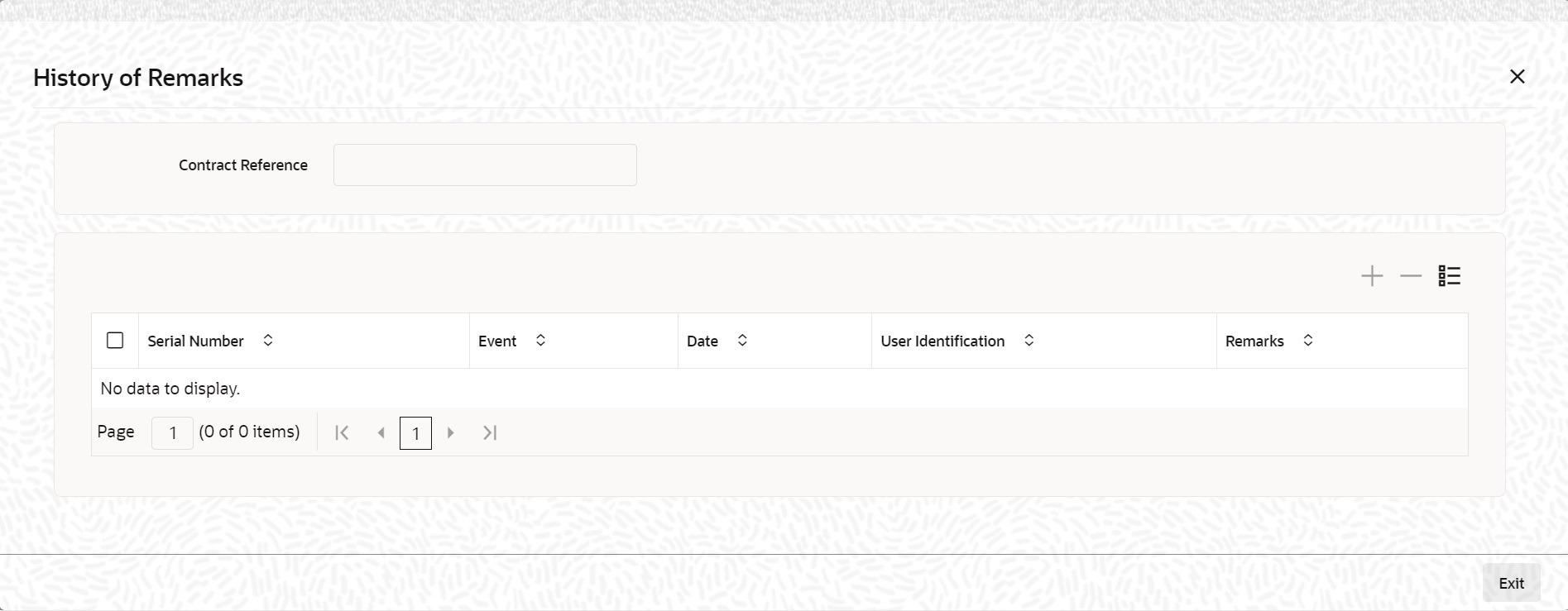

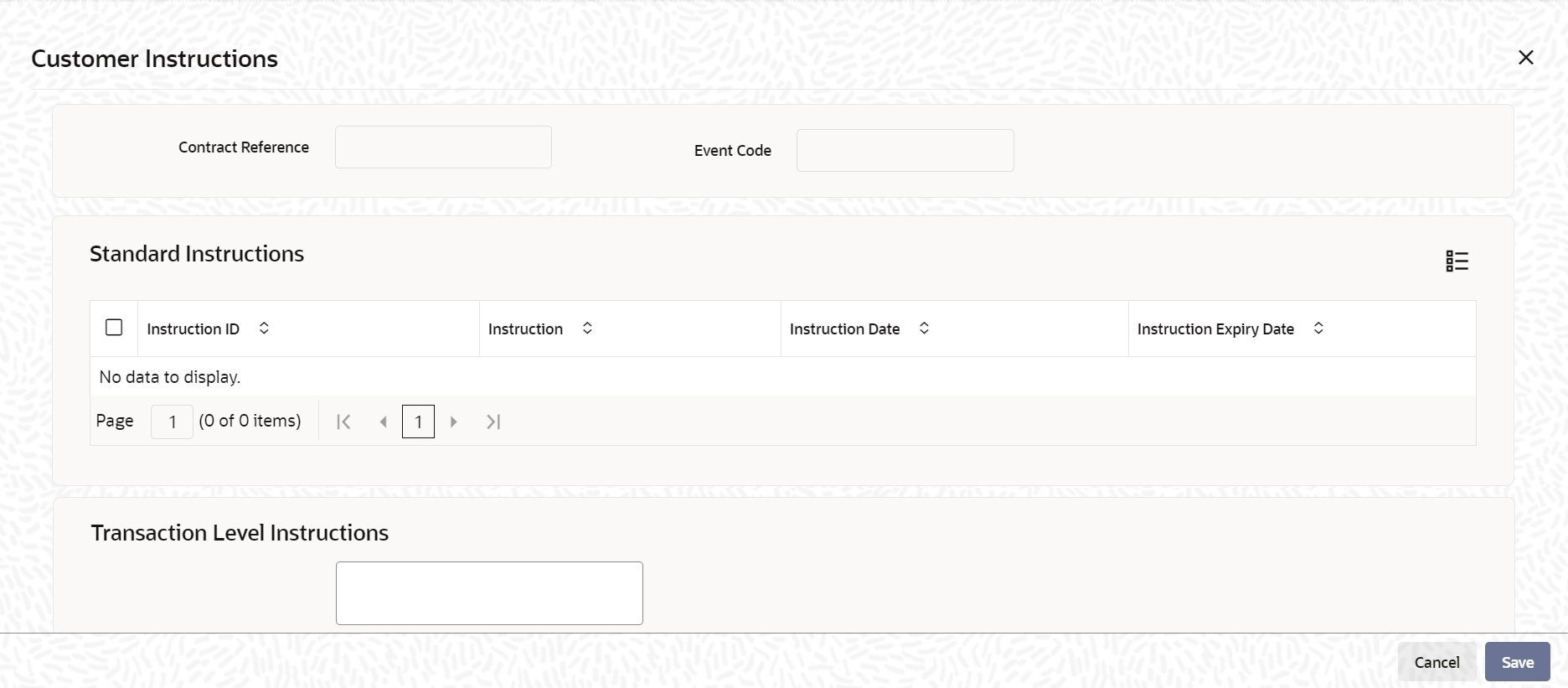

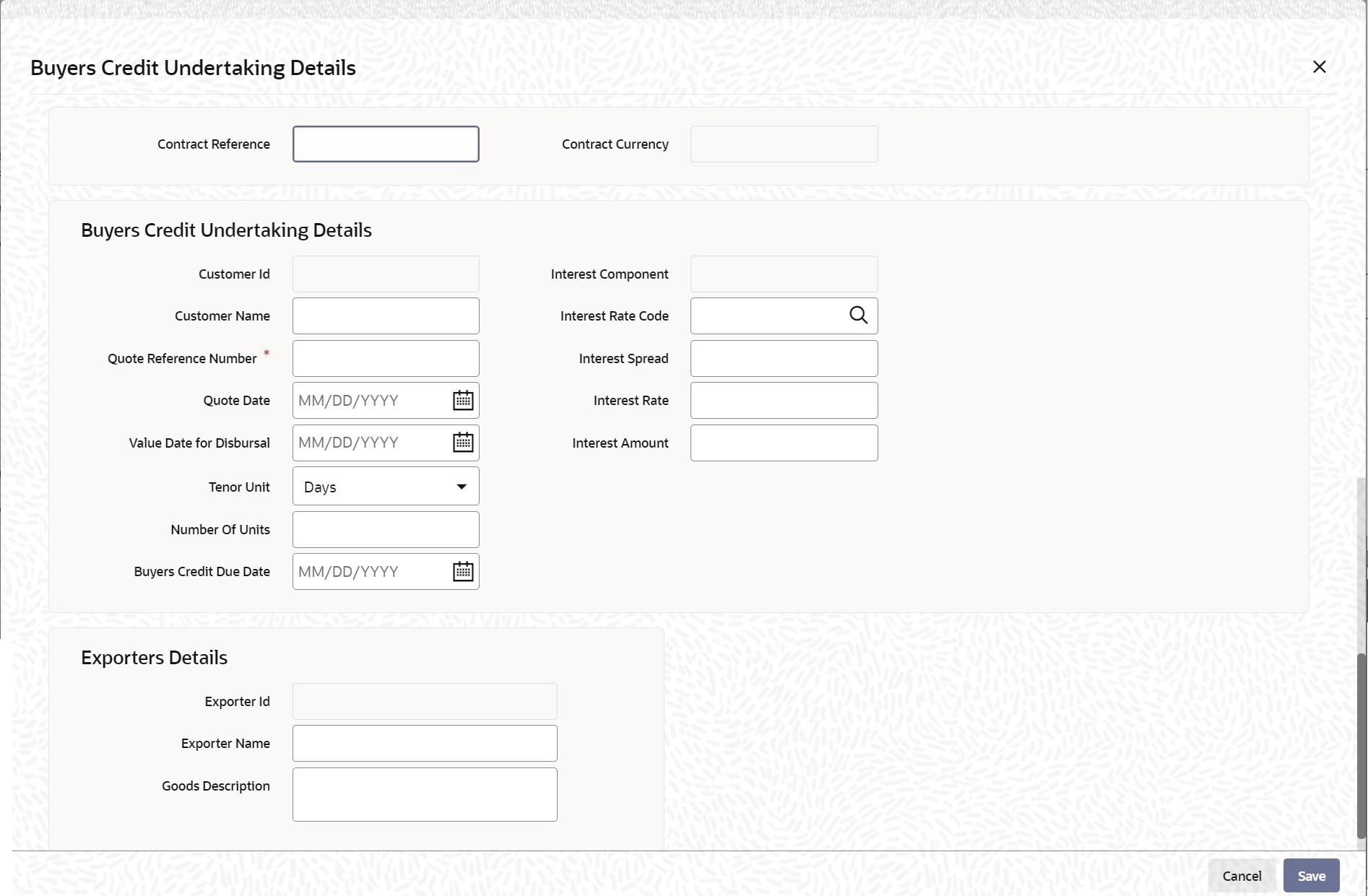

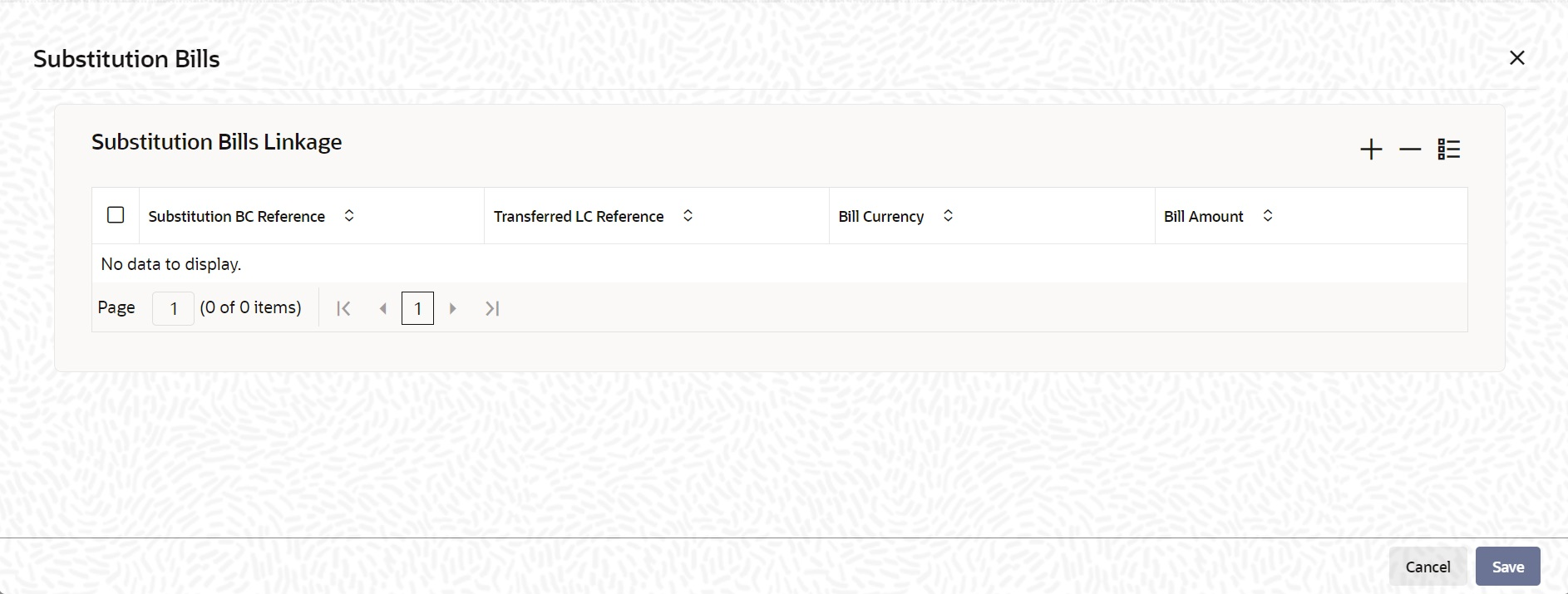

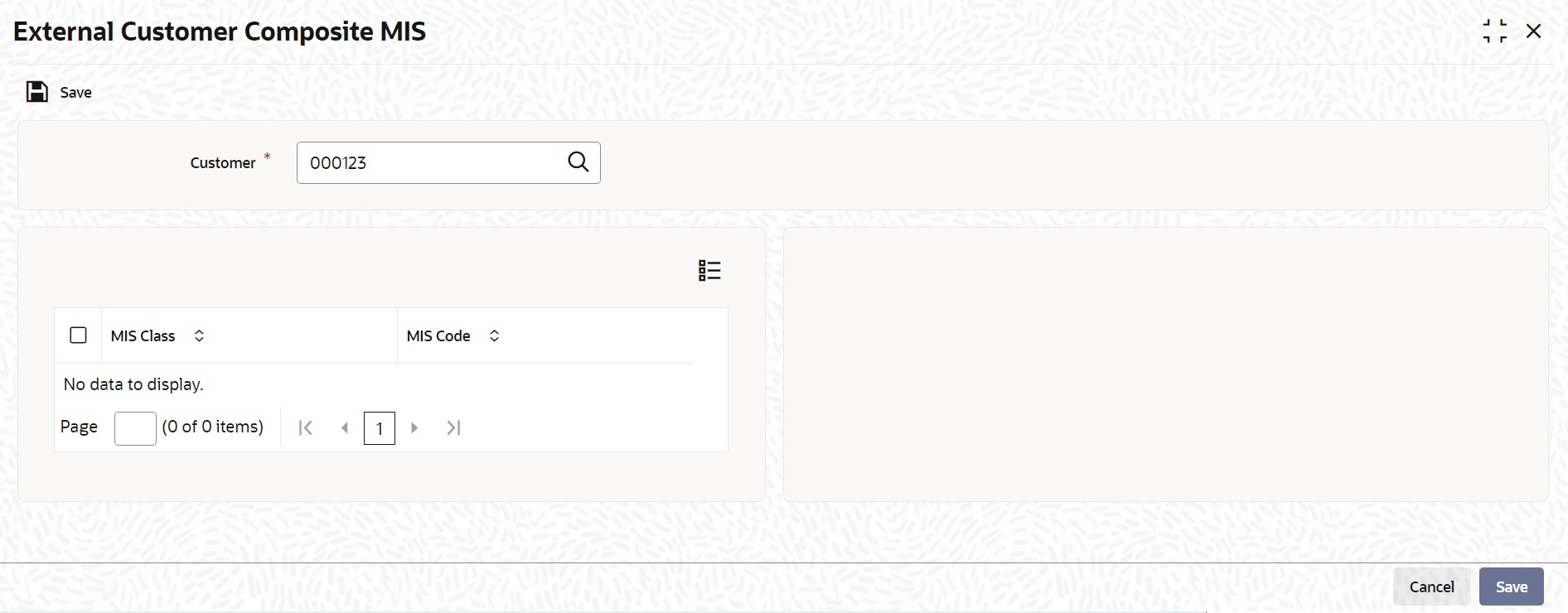

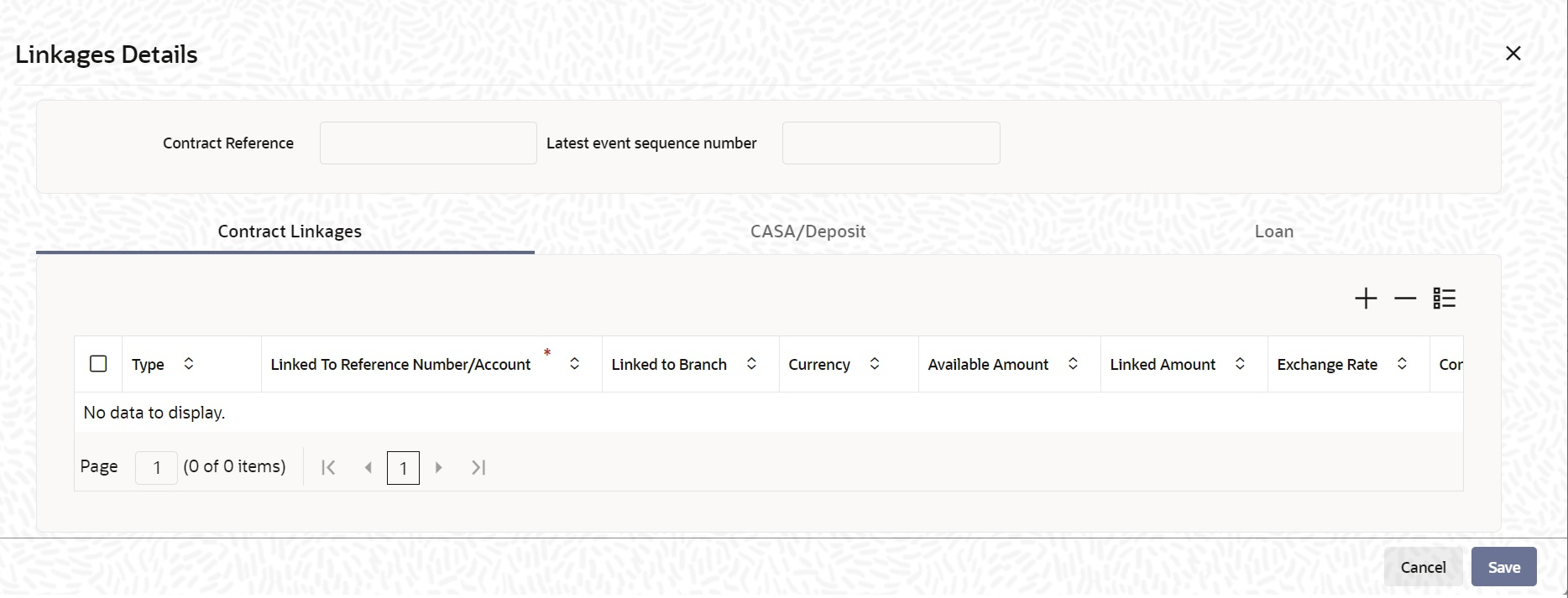

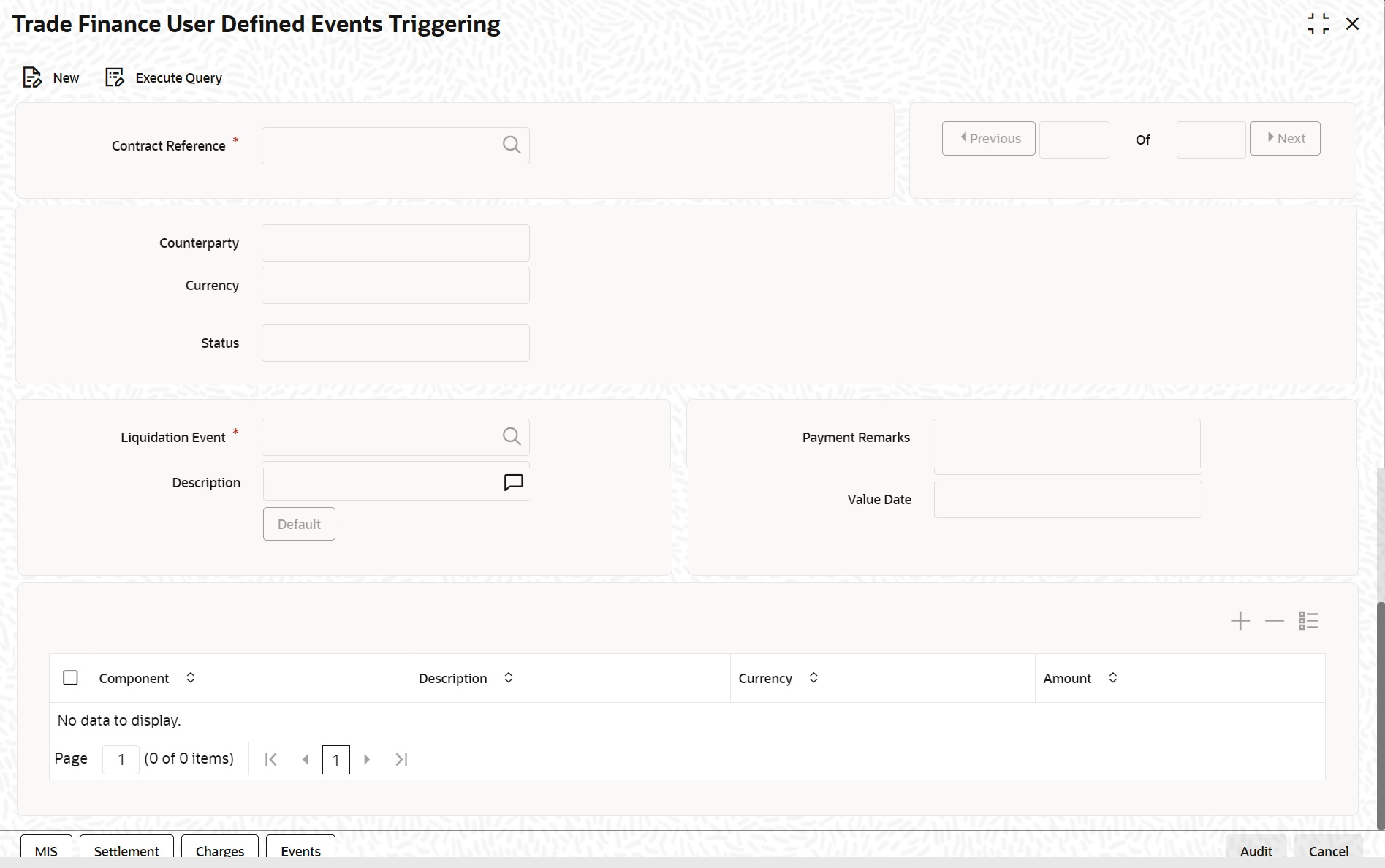

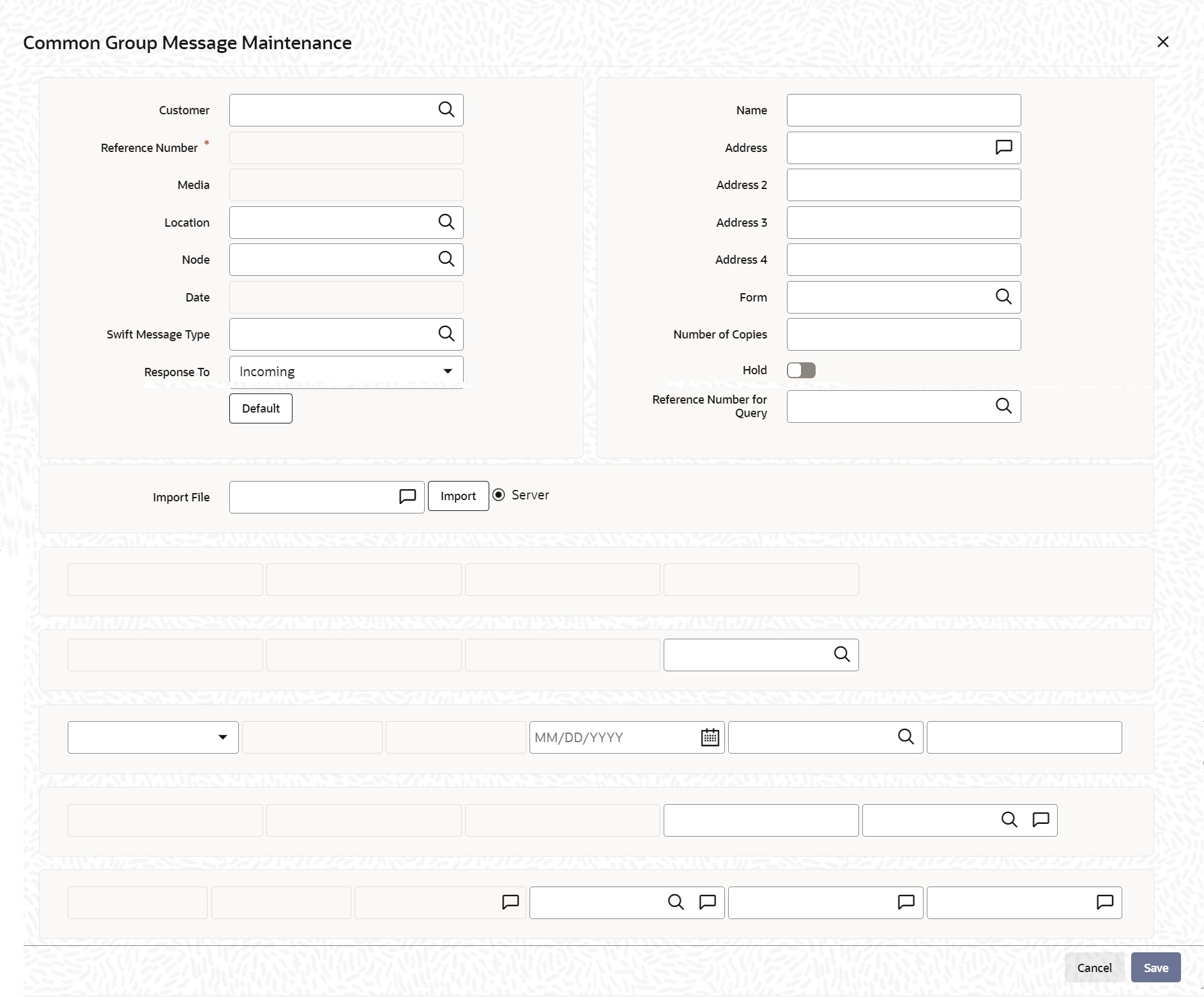

Tabs Details Events Click this link to view details of the events, accounting entries and Messages generated for each event in the life-cycle of a bill. Advices/FFT In the screen corresponding to this link, you can view, suppress and prioritize the advices that are to be generated for a contract. You can also specify the FFTs and Instructions that should accompany the advices generated for the bill. Settlement This invokes the Settlement screen. Based on the details that you enter in the settlement screens, the bill will be settled. The details of these screens have been discussed in the Settlements manual. Split Settlements Click on this link to specify split settlement details of the bill. Collateral In the screen that corresponds with this link, you can reduce the cash offered as collateral for the LC to which the Bill is associated. Charges Click this link to invoke the Contract Charge Details screen. The Charges and Fees manual details the entire procedure of applying charges to a bill. Tax This link invokes the Tax services. On invoking this function you can define a tax scheme, the rule details and the amount details of the contract. The Processing Tax manual details the entire procedure of maintaining tax rules and schemes. It also deals with the linking of a tax scheme to a product and the application of the scheme on a bill’. Import License Click this link to capture import license details, MIS Click this link to define MIS details for the bill. Finance Preference Click on this link to invoke the Finance Preference screen. You can maintain the details of the Finance. Drawer/Drawee IC Click this link to invoke the Drawer/Drawee Profit and Charges screen. You can define the Profit and charge components at the time of initiation of contract. Brokerage Click this link to specify the details of the broker and brokerage. Linkage Details Clicking this link invokes the Contract Linkages screen. Here, you can link the bill to funds available in an account or deposit. Fields Click this link to enter values for custom fields associated with the bill. Effective Profit Rate Click on this link to invoke the Commission and Charges Transfer Screen. Profit Dates Click on this link to capture forfeiting profit computation dates. Finance Accounts Click on this link to preview the linked finance details. Profit This link invokes the Profit and Charges or Fees (ICCB) service. The Processing Profit manual deals with the application of profit on a bill. Message Preview Click this link to view the messages or advices generated for the contract. Charges/Commission Transfer Click this link to invoke the ‘Charges/Commission Transfer’ screen. All Messages Click this link to view all messages associated to contract. Remarks Click this link to invoke the ‘History of Remarks’ screen. Common Group Message Click this link to invoke the common group message screen. Substitution Bills Click this link to invoke the Substitution Bills screen. UDE Click this link to invoke the User Defined Event Triggering screen. FX Linkage Click this link to invoke the FX Linkage screen. Enter valid inputs into all the mandatory fields; or to save the contract. The contract can be saved by either clicking the save icon in the toolbar or selecting Save from the ‘Actions’ menu.

On saving the contract, your User ID will be displayed in the ‘Input By’ field at the bottom of the screen. The date and time at which you saved the record will be displayed in the Date Time field.

A contract that you have entered should be authorized by a user, bearing a different login Id, before the EOD is run. Once the contract is authorized, the ID of the user who authorized the contract will be displayed in the Checker field.

While authorizing the contract, you can view the values that were modified in a specific version of a bills contract, in the Change Log screen.

- On Islamic Bills & Collections Contract Detailed

screen, click Main tab.The Main tab displays.

While defining a product, you have already defined a broad outline that will be applicable to all bills involving the product.

- On Islamic Bills & Collections Contract Detailed

screen, under Main tab, specify the fields.For more information on the fields, refer to the below Field Description table.

Table 4-5 Main - Field Description

Field Description Customer Details The bills that you process can be raised against an Islamic LC drawn at an earlier date by another bank or by your bank itself, or the bill might have come to you for collection.

LC Not Advised Check this box if LC is not advised for a bill by the negotiating bank. LC Customer Specify the customer in whose name the LC was drawn. Specify the LC Customer for which you need to maintain. Alternatively, you can select ‘Counterparty’ from the adjoining option list also. Note:

BIC Code appears next to the Counterparty only if the BIC Code is mapped with that Customer Number. If the BIC code is not mapped with that Customer Number then the BIC Code will not appear next to the ‘Counterparty’ in the adjoining list.LC Customer Name Specify the LC customer name. LC Reference If the export or import bill is under an LC that was advised or issued by your bank, you can enter the Reference number assigned to the LC, by your bank. The option list displays all the available LC contract reference numbers along with the respective user reference numbers. If the LC module of Oracle Banking Trade Finance has been installed at your bank, you can enter the contract reference number assigned by the system to the LC. In which case the following should be true of the LC:- The status of the LC should be open

- It should be authorized

- The amount for which the bill is raised should be available under the LC

Note:

If the bill amount that you specify is greater than the amount available under the LC to which it is associated, you will not be allowed to proceed with the processing of the bill.Multiple Bills under Same LC You can book more than one bill under LC, even if the previous bills under the same LC are unauthorized. When a bill is booked under LC and if any unauthorized bills are available under the same LC with SG linkage, then the system displays an error message. When Bill with SG linkage is not authorized, then no further bill under same LC will be booked until the bill with SG linkage is authorized. Cancellation of SG - CASG, Cancellation of LC – CANC and Availment – AVAL will be triggered during bill authorization.

When a bill is booked under LC, contingent entries are posted from bills. However, contingent entries posted in LC will get released only during authorization of the bills since AVAL event in LC will be fired during authorization.

If a BC is booked under LC when the previous BC is in unauthorized status, then while booking a new BC under the same LC, the amount is displayed in BCDTRONL after deducting the amount of the first BC. In LCDTRONL the LC outstanding amount will be displayed as the full amount itself.

During booking the bill under LC, Transfer Collateral from LC is selected, then collateral is transferred from LC to BC but accounting entries for collateral transfer at BC will happen in INIT event during save of the bill and accounting entries for collateral transfer at LC will happen in AVAL event when the bill is authorized.

Customer ID In the Contract screen, you can capture details of the party who is your customer. The details of the other parties involved in the bill are captured in the parties screen. Specify the ‘Customer ID’ for which you need to maintain. Alternatively, you can select Customer No from the adjoining option list also.

Note:

BIC Code appears next to the Customer No only if the BIC Code is mapped to that Customer Number. If the BIC Code is not mapped with that Customer Number, then the BIC Code will not appear next to the Customer No in the adjoining option list.Customer Name The system displays the name of the customer. Party Type Specify the Party Type of the customer. In the case of an Import bill, you should specify details of the Drawee of the bill. If the Drawee is a customer of your bank you should specify the customer reference, assigned to the customer, in the Customer Information File (CIF) of the Core Services module of Oracle Banking Trade Finance. The other details of the customer will be automatically picked up. If you are processing an Export bill, you should specify details of the Drawer of the bill. If the drawer is a customer of your bank, you should specify the customer reference assigned to the customer, in the Customer Information File (CIF) of the Core Services module of Oracle Banking Trade FinanceBanking Trade Finance. The other details of the customer will be automatically picked up.

Collection Reference If you are entering the details of a bill that was registered earlier, you should indicate the reference number assigned to the collection, when it was registered. All the details that you specified for the collection, during registration will be defaulted to the ‘Contract’ screen. For example, a customer of your bank has requested you to collect a sum of money due to him under a bill. You have registered the bill and sent it for collection. The reference number assigned to the bill is - 000COB7993630007.

Bills Details Specify the below Bills Details.

Currency Specify the currency in which the bill is drawn. Amount Specify the amount for which the bill is drawn. Amount in Local Currency System displays the amount for which the bill is drawn, in terms of the local currency. Outstanding Balance The outstanding amount which is the amount that is yet to be liquidated under the bill is automatically displayed. In the case of a collection it is computed as follows: Outstanding Amount = Bill Amount - Liquidation Amount

Rebate Amount Specify the rebate amount for the reduction of bill amount. You can enter the rebate amount only when the mode is Unlock and the stage is Final. Transaction Details Specify the below Transaction Details.

Base Date Code The system displays the date by which the tenor specified for the bill becomes effective. Base Date Description Enter a description for the Base Date under Transaction Details section. Base Date The base date is the date from which, the tenor specified for the bill becomes effective. The base date is used to calculate, the maturity date of the bill. In effect the tenor of the bill will begin from this date. Note:

When you accept an Inward Bill of Usance without specifying the Base Date, an Acceptance Advice in an MT 499 format will be generated. When you enter the Base Date for the bill, the Acceptance Advice will be generated in an MT 412 format.Tenor Days Usance bills are generally associated with a tenor. The tenor of a bill is always expressed in days. The tenor that you specify for a bill should be within the minimum and maximum tenor specified for the product, to which the bill is linked. The standard tenor defined for the product associated with the bill is defaulted. You can change the default and specify a tenor, to suit the bill you are processing. If the product to which he bill is associated is defined with the standard tenor as zero, you need to specify the maturity and the expiry date of the bill.

If you attempt to save the bill without entering the expiry or maturity date you will be prompted for an override.

Note:

The tenor of a sight bill is always defaulted to zero days. You do not have an option to change it.Transit Days The transit days refer to the notional period for the realization of the proceeds of a sight or matured usance bill. The transit days will be used in the computation of the maturity date, of the bill. Maturity Date The maturity date is the date on which the bill falls due, for payment. The maturity date is calculated in the following manner, based on the entries made to the previous fields: Maturity Date = Base date + Tenor + Transit days

You can change the maturity date of a bill that is arrived at using the above method. However, the maturity date that you specify should be later than or equal to the Value date specified for the bill.

Note:

For an IB product under which you may be creating a contract here, you may have chosen the ‘Consider as Discount’ option (specified through the ‘ICCB Details’ screen) and you may have specified the profit collection method to be advance (specified through the Islamic Bills and Collections Product Definition - Preferences screen). In such a case, you cannot change the Maturity Date here.Transaction Date The transaction date is the date on which, the bill was entered into Oracle Banking Trade Finance. The system automatically defaults the transaction date to today’s date. You cannot amend or change the date that is defaulted. Value Date The Value date of a bill, is the date from which a bill becomes effective. The accounting entries triggered off by events like input, amendment and liquidation hitting the Nostro and the customer accounts will be passed as of the value date. The Value date should be earlier than or the same as today’s date.

The Value date can be one of the following:- Today’s Date

- A date in the past

- A date in the future (you can enter a date in the future only if future dating has been allowed for the product)

If you do not enter a value date for a bill, the system defaults to today’s date.

Note:

The Value date of a bill should not be earlier than the Start Date or later than the End Date specified for the product, involved in the bill.Debit Value Date For accounting entries hitting nostro or customer accounts, you can specify a debit and credit value date that is different from the value date specified for the bill. The value date of the Bill will be defaulted as the Debit and Credit value date. You have an option to change it to suit the requirement of the bill you are processing. In this case, the value date of the bill will be used only for debiting and crediting GLs involved in the bill.

Credit Value Date Specify the Credit value date for the bill. Future Advance Date Future Advance Date is the date on which system automatically changes the operation code from Acceptance to Advance. This field applicable for Import Usance Bills under LC for Acceptance Operation.Future Advance date cannot be modified during bill liquidation.

The system displays override messages for below scenarios:- Bills is having discrepancies in INIT stage when Future Advance date is provided

- Full Liquidation before change of operation from Acceptance to Advance when Future Advance date is provided.

- Partial Liquidation before change of operation from Acceptance to Advance when Future Advance date is provided.

- Future Advance Date falls on currency or local holiday.

The system displays error messages for below scenarios:- Future Advance Date greater than Bill Maturity date.

- Future Advance Date less than branch date.

- Partial Liquidation after change of operation from Acceptance to Advance when Future Advance date is provided.

- Manual change of operation from Acceptance to Advance when Future Advance date is provided.

- Modifying Future advance date post change of operation from Acceptance to Advance.

Confirmed Amount The system displays the confirmed amount. Unconfirmed Amount The system displays the unconfirmed amount. Available Confirmed Amount The system displays the available confirmed amount. Available Unconfirmed Amount The system displays the available unconfirmed amount. LC Details Specify the below details:

LC Issue Date Specify the date on which the LC was issued under LC Details section. Currency Specify the currency type. LC Amount The Letter of Credit Amount gets defaulted from the LC Contract. This is a display only field. LC Liability Amount The Letter of Credit Liability Amount also is defaulted from the LC Contract. This is a display only field. For a collection bill, most of its details are captured during registration. The details of the collection will be displayed in the respective fields of this screen, when you specify the collection reference.

Their LC Reference If the bill you are processing is drawn under an LC, you should specify the following references: - The customer in whose name the LC was drawn

- The date on which the LC was issued

- The reference of the LC

Choose the Use LC Ref in Messages option if you would like to furnish the related LC Reference Number in the messages generated for the bill. If you do not choose this option, Field 20 of the SWIFT messages and the mail messages generated for the bill will furnish the Bill Reference Number.

If ‘LC Not Advised’ is enabled, then original LC reference number of the issuing bank should be provided as Their LC Reference number. Their LC Ref number will be defaulted to the Parties tab against ‘Issuing Bank’ under field ‘Reference’ during save.

The following fields are not applicable if LC not Advised is checked and Their LC Reference number is specified:- LC Customer

- LC Customer Name

- LC Reference No

Reimbursement Days Enter the Reimbursement Days for the bill you are processing. The Reimbursement Claim for the bill will be automatically generated on reimbursement (working) days prior to the maturity date. For instance, the maturity date of a bill is 23 March 2001. You specify the Reimbursement days as 2. Two working days prior to the maturity date (i.e., on 21 March 2001), as a part of the BOD process, the Reimbursement Claim (MT742) for the bill will be automatically generated.

Confirmed Amount When you book a bill contract under a letter of credit, the system displays the current confirmed amount of the letter of credit contract. Available Confirmed Amount When you book a bill contract under a letter of credit, the system displays the current available confirmed amount of the letter of credit contract. Unconfirmed Amount When you book a bill contract under a letter of credit, the system displays the current unconfirmed amount of the letter of credit contract. Available Unconfirmed Amount When you book a bill contract under a letter of credit, the system displays the current available unconfirmed amount of the letter of credit contract. Special Payment Conditions for Beneficiary Specify the special payment conditions for beneficiary. Special Payment Conditions for Receiving Bank Specify the special payment conditions for receiving bank. Liquidation Details Liquidation Amount On selection of Liquidate option in tool bar, user can enter the bill amount to be liquidated under Liquidation Details section. This is a display only field showing the actual bill amount which is liquidated once a bill is liquidated. Liquidation Date A liquidation date is meaningful, if you have specified that the bill should be automatically liquidated. By default, the liquidation date of a bill is taken to be the maturity date specified for the bill. The Auto liquidation function will automatically liquidate the bill on the liquidation date that you specify.

Note:

Suppose you are processing an acceptance bill, for which you had specified automatic change of operation from acceptance to advance. Then the automatic processes run as part of EOD or BOD will automatically change the operation of the bill from Acceptance to Advance on its liquidation date.Profit Liquidation Mode At the time of final liquidation of principal, you have the option of either recovering profit immediately or later. The profit liquidation mode with ‘immediate’ and deferred values are enabled only at the time of final liquidation of principal. If Immediate’ option is selected at the time of final liquidation, of principal, the entire outstanding profit will be liquidated along with the principal and the contract status becomes ‘liquidated’.

If ‘deferred’ option is chosen at the time of final liquidation of principal, only principal gets liquidated and recovery of profit gets deferred. The contract status would remain active. The outstanding profit can be liquidated later either partially in stages or fully through BC profit payment screen. Once the entire outstanding profit is liquidated, contract status will be shown as ‘liquidated’.

In case the rollover of the bill is specified after the maturity date of the bill, the contract will have profit components along with compensation profit on principal as outstanding. You need to specify the mode in which the system liquidates both the profit components i.e. Normal and Penal components by choosing either of the following:- Immediately: At the time of final liquidation, the system liquidates all outstanding profit components and transfers the outstanding Principal to new Bills Contract.

- Deferred: At the time of final liquidation, the system only transfers the outstanding Principal to new Bills contract without liquidating the profit components. These profit components can be liquidated partially or fully using Bills Payment Online.

Note:

Oracle Banking Trade Finance does not support backdated or future dated rollover. The value date for the Rollover event will always be the current system date.In case of auto liquidation, the system will apply Immediate mode to liquidate the bill.

Their Charge Currency When entering the details of a bill, you can capture the charge details of other banks (for instance, the charge levied by the remitting bank on an import bill) in the ‘Their Charge’ fields. In this field you can specify the charge currency. Their Charge Amount Specify the charge amount here. In a phased manner, you can settle this charge by debiting your customer and crediting the correspondent bank. Components of Current Event System enhanced to show the amount tags pertaining to the current event in settlement screen for LC contracts. - During settlement pickup of LC contract input screen, current value of components of current event on contract input screen is considered to show the amount tags in ‘Settlements’ screen.

- If the flag is checked at contract input screen, the amount tags pertaining only to the current event will be available in settlement screen with ‘Current event’ checked.

- If the flag at contract input screen is unchecked, the amount tags of all the events will be available in ‘Settlements’ screen with current event flag checked for those amount tags of current event and unchecked for those amount tags not pertaining to current event.This field is optional. By default the field will be unchecked.

SWIFT Messages for the Documents Received When you receive a document for Usance LCs, an Authorization to Reimburse Advice in an MT 740 format will be generated. associate the preshipped advice tag LC_AUTH_REIMB to the event.

When the Islamic Bills Contract is authorized, the MT 740 is generated from the Outgoing Message Browser with the bills contract reference number and it displays all the details of the LC contract excluding the credit amount.

The expiry date of LC contract and maturity date from Bills contract are also displayed in the generated MT740 message. For swift MT740 message, the 31D field will display the expiry date specified in the LC contract and 42P field will display the maturity date specified in the BC contract. But for mail MT740, the system will display both LC and BC dates.

The bill amount that is defaulted includes the contract and its currency. However, the BC amount will be converted to LC contract currency equivalent using STANDARD mid rate in case the LC contract currency is different from the bill contract currency.

Sender to Receiver Info Tag FFT codes SND2RECMTxxx will be used to pick up the sender to receiver information in various swift messages. In the FFT code “MTxxx” will stand for the SWIFT message type in which the FFT code will be picked up. This facilitates defining a separate FFT code for each of the SWIFT message.

This will be applicable for the following swift messages: MT700, 707, 705, 710, 720, 730, 740, 747, 760, 767, 768, 400, 410, 412, 420,422, 430, 734, 732, 742, 756, 750, 752, 754

The various FFT codes for SND2RECMTxxx are maintained in the Free Format Code maintenance screen. During contract processing, based on the event being processed system defaults the advices maintained for the particular event. For messages of SWIFT type, you can select the corresponding SND2RECMTxxx FFT code from the list of values

In the SWIFT message generated, the tag 72 will be populated with the text associated with the FFT code SND2RECMTxxx attached for the advice at the contract level.System will not validate the FFT code SND2RECMTxxx being attached with the advice. This has to be operationally controlled.

During advice generation, if the FFT code SND2RECMTxxx corresponding to the advice is not attached or if a different SND2RECMTxxx is attached, system will not populate the tag 72 in the advice generated.

Capturing Charge References When entering the details of a bill, you can capture the charge details of other banks (for instance, the charge levied by the remitting bank on an import bill) in the Their Charge fields. In these fields, you can specify the charge amount and the charge currency. In a phased manner, you can settle this charge by debiting your customer and crediting the correspondent bank. - On Islamic Bills & Collections Contract Detailed

screen, click Details tab.The Details tab displays.

- On Islamic Bills & Collections Contract Detailed

screen, under Details tab, specify the fields.For more information on the fields, refer to the below Field Description table.

Table 4-6 Details - Field Description

Field Description Profit Details You can specify the period for which, the tenor based profit components of the bill must be calculated.

From Date The From Date that you enter indicates the start date of the profit calculation period. The From Date should not be later than today's date. It is mandatory for you to enter a start date for all bills, with at least one tenor based profit component. To Date The To Date refers to the date up to which the tenor based profit components of the bill should be calculated. The To Date that you specify should be greater than or equal to today's date. If the non-compensation profit components of the bill are to be collected in advance, it is mandatory for you indicate a To Date. The tenor based profit components of the bill will be calculated for the period between the From Date and the ‘To Date’.

Note:

For an IBC product under which you may be creating a contract here, you may have chosen the Consider as Discount option (specified through the ICCB Details screen) and you may have specified the profit collection method to be advance (specified through the ‘Islamic Bills & Collections Product Details – Preferences’ screen). In such a case, you cannot change the Profit ‘To Date’ here.Grace Days The grace period indicates the period, after the To date specified for a bill within which the compensation profit (if one has been defined for the product to which the bill is linked) will not be applied. This period is defined as a specific number of days and will begin from the date the repayment becomes due. If the repayment is made after the due date, but within the grace period, compensation is not changed. Compensation profit will be applied on a repayment made after the grace period. The compensation profit will be calculated for the entire period it has been outstanding (that is, from the date the payment was due).

Note:

The compensation type Profit Components of a bill will become applicable after the To date + No of Grace days, for compensation defined for the bill.Allow Prepayment Indicate if the prepayment for the bill is to allowed or not. Refund Profit Check this box to refund profit for the following: - Reduction of Bill Amount as Rebate

- Reduction of Maturity Date

- Back dated liquidation

- Early Liquidation

Recovery Profit Rate Specify the recovery profit rate to capture profit rate during refund of profit due to rebate. Recovery Profit Rate Code Specify the recovery profit rate code. Note:

If the recovery profit rate and recovery profit code is not specified then the rate applicable for the profit component is considered as recovery profit rate.Acceptance Commission Details For Incoming Bills in Acceptance stage you can specify the dates for calculating the commission components.

From Date Indicate the From Date. To Date Indicate the To Date. Based on the preferences for acceptance commission, the system calculates the commission:- In case the Acceptance commission is collected in Advance, the system liquidates the commission during the INIT event.

- On moving a bill from acceptance to advance, the pending accruals are passed as part of Acceptance to Advance (BADV) event.

- In case the Acceptance commission is calculated in Arrears, the system liquidates the commission during BADV event. However, in case of no change in the operation, the system liquidates the commission during LIQD event.

- Acceptance commission is always calculated based on the original bill amount and From and To dates specified for acceptance commission irrespective of BADV/

- Liquidation date and Mode of liquidation (Partial or Full liquidation).

Cash Collateral Details When your bank accepts discounts or advances a bill on behalf of its customers, the bank in reality undertakes to pay even if the confirming bank does not fulfill its obligation, under the bill. Thus, accepting or advancing a bill is a liability for your bank.

Ideally, you would track your exposure to the credit-seeking customer, under a Credit Line. The credit granted to a customer under a Credit Line can be backed by Collateral that the customer offers. Often you may accept cash, as collateral for the bill. For a bill you can specify the following collateral details:

Collateral Description Specify details of the collateral that is intended for the internal reference of your bank. These details will not be printed on any of the advices generated for the bill. The Bills – Contract Details screen allows you to accept a decrease in the collateral linked to the bill during liquidation, by specifying the Collateral Contribution.

The accounting roles allowed for the collateral entries are the collateral account / GL role. Typically, the accounting entry setup is to reduce the collateral accounts balance to the extent of payment from the collateral.

The system validates the amount specified as the collateral contribution being used to pay up the bill, is less than or equal to the overall collateral contribution linked to the bill.

The default value for the collateral contribution is displayed based on the total amount being paid. The default value is computed as the percentage of the collateral linked to the bill proportional to the percentage of the bill amount being paid against the outstanding bill amount. This can be modified.

Collateral Currency Specify the currency in which the cash collateral account is opened. Collateral Amount Specify the value of the collateral. Outstanding Collateral Amount Outstanding Collateral amount is sum of collateral amount and transferred collateral amount. Outstanding collateral will be updated with Bills Collateral Amount, when you save the contract. This is a display field. Field ‘Outstanding Collateral’ will be updated with remaining collateral amount, after each Bill liquidation. Transfer Collateral from LC This is defaulted from the product. However, you can modify it at contract level during bill booking. Later this cannot be changed. This indicates that the collateral amount may be collected from LC as part of Bill availed under LC. Transferred Collateral gives the LC collateral amount in LC collateral currency to the extent of Bill Booked is transferred to bill.

Liquidate Using Collateral This is defaulted from the product. However, you can modify this at any point in time prior to bill liquidation. If this is checked, it indicates that the bill should be liquidated using the collateral amount. If Liquidate Using Collateral is checked, then proportionate collateral amount will be used for bill liquidation.

Transferred Collateral Amount Specify the transferred collateral amount. Outstanding Collateral The system displays the outstanding collateral amount. Charge Details Specify the charge details.

Pass our Charges to Drawee/Drawer During initiation of a bill, you can indicate that the drawer’s charges can be passed on to the drawee. Check against this option to indicate that the remitting bank can pass on our charges to the drawee under Charge Details section. Pass Profit to Drawee/Drawer During initiation of a bill, you can indicate that the drawer’s profit can be passed on to the drawee. Check against this option to indicate that the same. Our Charges Refused During liquidation of an incoming bill, the drawee may refuse to pay the drawers charges. Check against this option to indicate the same. Your Charges Refused During liquidation of an incoming bill, the drawee may refuse to pay the charges due. Check against this option to indicate that the drawee has refused to pay the charges due. Claim Advice in Swift Check this box to indicate that the Charge Claim Advice (CHG_CLAIM_ADV) that gets generated as part of LQ EOD batch should be in Swift MT799/MT499 Format. Template ID Specify the template related to MT799 or MT499 message types. The adjoining option list displays all the templates related to MT799 (if it is under LI) or MT499 (if it is not under LI) message types defined in the ‘Swift FFT Template Screen Maintenance’ screen. You can choose the appropriate one. Document Details For the documentary bills that are processed at your branch, you can keep track of the documents that are required under the bill.

Letter Dated The date printed on the covering letter of the documents based on which the contract was entered. This date can be used to retrieve information on pending documents. Document Original Received Indicate if the original set of documents that are required under the bill have been received (and the number of copies of the same) or not. Document Duplicate Received Indicate if the duplicate set of documents that are required under the bill have been received or not. Note:

If you had unauthorized the ‘Document Original Received’ field, you should check the option ‘Document Duplicate Received’ because, the bill contract should be entered based on the first set of documents received.Acknowledgment Received Indicate if the acknowledgment has been received or not. Acknowledgment Date Specify the date on which the acknowledgment has been received. Other Details Specify other details.

Collect LC Advising Charges From Specify the bank from which the LC advising charges should be collected under Other Details section. The drop-down list displays the following options: - Issuing Bank – If you choose this, the system derives the counterparty details for ISB based on the linked LC and applies LC advising charges accordingly.

- Beneficiary Bank – If you choose this, the system deducts the advising charges from the reimbursement claim and processes the remaining amount. This amount will be mentioned in MT756

- None – If you choose this, the system will not impose any advising charges

Choose the appropriate one. The amount shown in MT756 is dependent on the bank chosen here. Hence, while generating MT756, the system observes this field and updates the field ‘Amount’ accordingly.

Note:

This field is applicable to reimbursement bills only.Further Identification Select further identification from the adjoining drop-down list. The options available are: - Debit

- Negotiate

- Accept

- Reimburse

- Remitted

Cheque Number In case the payment for the bill has been made by cheque, specify the cheque number here. Parent Contract Reference You can view the reference number of the parent contract if the current contract is a child contract. Finance Contract Reference This is the reference number of the finance that is created automatically at the time of liquidation of the Bill. You will not be allowed to change this reference number. Provision Amount Specify the amount set aside for provisioning. Remarks Enter the information describing the contract details here. - This will be available when you retrieve information on the contract.

- During the closure of the bill, value provided in Remarks will be populated in “Closure Advice” under “CLOSURE REASON”

Contract Status Details While defining a product, you have also specified the various stages or status that the bill should pass through, if repayment is not made on the due date against a bill. These details are defaulted to all the bills that involve the product.

Status As Of Date The date on which the bill moved into the status is displayed here. User Defined Status The current status of a bill is displayed here. If you have specified the status change as a manual event, you can change the status of a bill from one status to another in this screen. The option list available for this field contains all the lists of Status codes, defined for the product, to which this contract is linked.Contract Derived Status The system displays the derived status of the bills contract. You cannot modify this.

Contract Derived Status The system displays the derived status of the contract. Sanction Check Status The system displays the status of sanction check once the sanction check is performed at contract level. The system displays any of the following statuses: - P - Pending, Pending Sanctions Check and contract sent in unauthorized mode

- X - Pending, Pending Sanctions Check and contract sent in auto authorized mode

- A - Approved, Sanction Check Approved

- R - Rejected, Sanction Check Rejected

- N - Not Required, Sanction Check Not Required

Last Sanction Check Date The system displays the date when last sanction check was performed. This field will store the date on which the response for last sanction check was received. If the last sanction check date and re-check days is greater than or equal to the current date, then the last sanction check performed is still valid.

Processing Sanction Check during Save of a Transaction

When a contract is saved, the system processes the sanction check as follows:- Check if the MT400 message maintenance is available for the contract.

- Checks if sanction check is required for transaction branch.

- If sanction check is required for transaction branch, then checks if sanction check is required for the product used to book the contract.

- If sanction check is required for the product used to

book the contract, then check if sanction check is required for the

counterparty of the contract.

- If sanction check is required for the

counterparty of the contract, then:

- From the sanction check preference maintenance, picks the sanction check recheck days for the branch. If there are no maintenance then re-check days will be treated as zero (0).

- If the last sanction check date for the contract is null or if the last sanction check date plus re-check days is less than the current date then the validity of last sanction check will be expired and it has to be performed again.

- If sanction check is required for the

counterparty of the contract, then:

- Details of each party will be sent for sanction check as a single request. Response from external system will be updated in sanction check queue for the request.

- The party type field in the above list depends upon the information from parties / broker / agent / insurance / settlement instructions that is being transmitted to the sanctions check queue.

- Sanction check status at the contract level will be

updated to ‘P’ if the contract is saved in an unauthorized mode and

updated as ‘X’ if the contract is saved in an auto authorized mode.

The contract's authorization status in both the cases will be U or

unauthorized. The system will then trigger the event SNCK for the

contract.

- If last sanction check date plus re-check days

is greater than or equal to the current date, it means that

the last sanction check performed is still valid. If it is

valid, then:

- The system checks if the parties information maintained in the contract's settlement instructions has changed since the last sanction check. If it is changed, a sanction check request is generated and placed in sanction check queue even though last sanction check is still valid.

- If there are no changes in parties information, it means that sanction check is not required and sanction check request will not be made.

- If last sanction check date plus re-check days

is greater than or equal to the current date, it means that

the last sanction check performed is still valid. If it is

valid, then:

- Information will be placed in sanction check queue only if data is available in Parties tab for the party type.

- Any contract that is in ‘X’ or ‘P’ status cannot be

authorized or modified. It can only be deleted. If a contract or

event in ‘X’ or ‘P’ status is deleted, then the associated sanction

check request should also be deleted.

Receipt of Response from Sanction Check System and Post Response Processing:

- Sanction check system will provide a

response for the request. This response will be updated

as the contract's sanction check status. The response

can be as follows:

- A - Approved: This indicates that the contract passed sanction check.

- R - Rejected: This indicates that the contract failed sanction check.

- Sanction check system will provide a

response for the request. This response will be updated

as the contract's sanction check status. The response

can be as follows:

- If the contract's sanction check response status is approved and the contracts sanction check status is ‘P’, it can be authorized and processed further.

- If the contract's sanction check response status is approved and the contract's sanction check status is ‘X’, then the post sanction check process will automatically authorize the contract. Any override generated as part of this authorization will be logged.

- The last sanction check date will be updated with the response date.

- If the contract's sanction check response status is rejected, then irrespective of the contract's sanction check status (P or X), the contract remains unauthorized. The only option allowed for such contracts is modification or deletion.

- If sanction check is not required at transacting branch, counterparty or product level, then the contract's sanction check status will be updated to ‘N’ and information will not be placed in the sanction check queue. The last sanction check date will not be updated with the current date.

- On Islamic Bills & Collections Contract Detailed

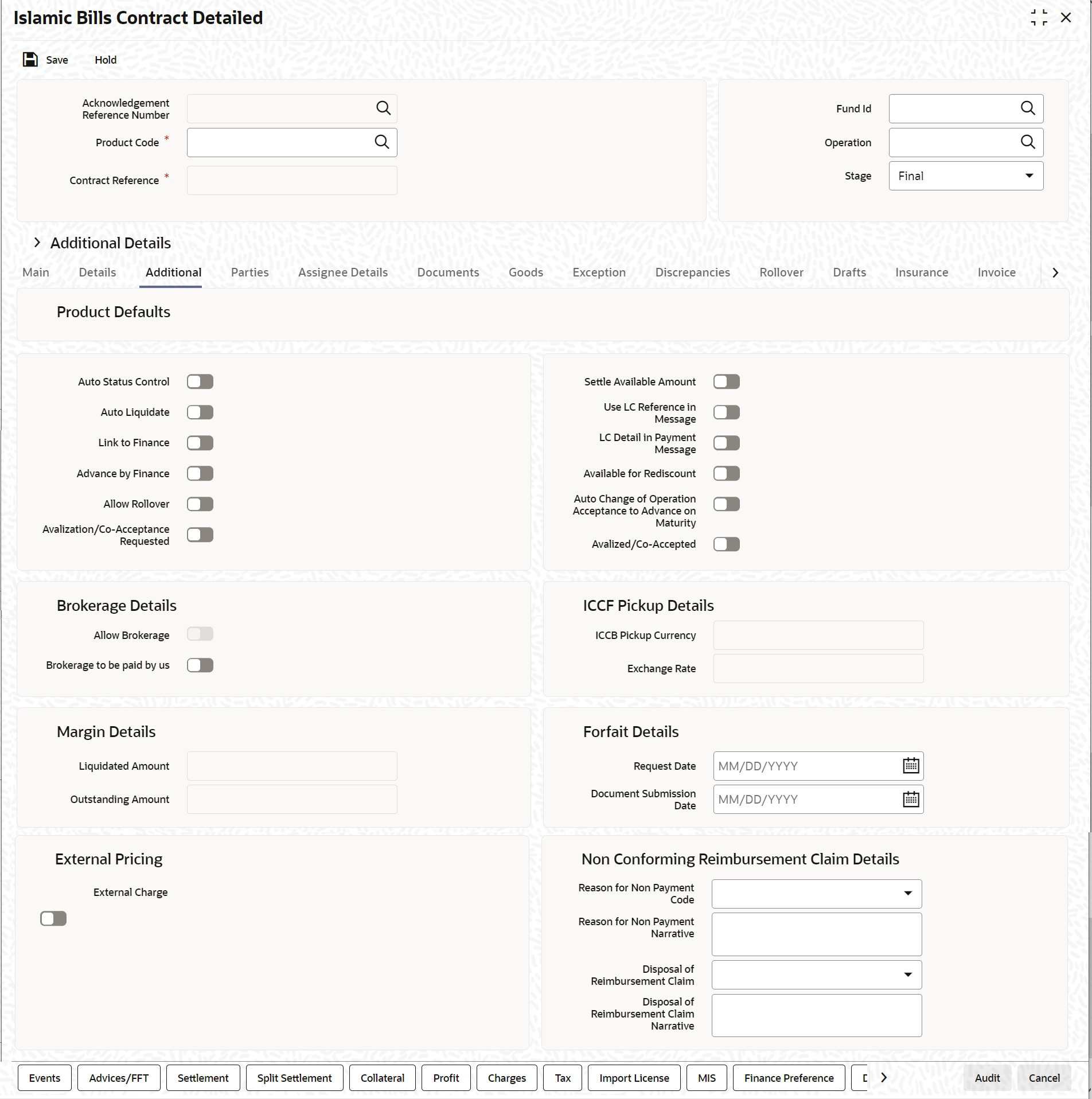

screen, click Additional tab.The Additional tab displays.

This topic describes to maintain Additional tab in the Islamic BC Contract Detailed screen. Some events are triggered automatically when the batch process is run as part of the EOD or BOD. Batch processing preferences for a product is specified in the Bills - Product Preferences screen. The preferences indicated for the product involved in the bill will be defaulted. You can change these defaults to suit the requirements of the bill you are processing.

- On Islamic Bills & Collections Contract Detailed

screen, under Additional tab, specify the fields.For more information on the fields, refer to the below Field Description table.

Table 4-7 Additional Tab - Field Description

Field Description Auto Status Control A status change is one in which the status of a bill changes or moves, from one defined status to another. In the Bills - Product Preferences screen, you can indicate whether the bills linked to the product, should move from one status to another, automatically or manually. The preference indicated for the product involved in the bill, will be defaulted. You can change the default for the bill. If you specify that status changes have to be carried out automatically, the status of the bill will be automatically changed, after the specified number of days. If not, you have to change the status of a bill through the Bills -Contract Details screen.

You can indicate other preferences for the status change like should the change be in the forward or reverse direction, through the Bills - User Defined Status Maintenance screen.

Even if the product, to which a bill is associated, is specified with automatic status change, you can manually change the status of the bill, before the automatic change is due.

However, if a product associated with the bill has been specified with manual status change, you cannot specify automatic status change for the bill.

Note:

You will be allowed to specify whether automatic status change should be in the forward or reverse direction in the Status Maintenance screen, only if you specify that automatic status change is allowed.Auto Liquidate The components of a bill can be liquidated automatically or manually. In the Bills - Product Preferences screen you can indicate the mode of liquidation. The preference indicated for the product involved in the bill, will be defaulted. You can change the default. If you choose the automatic mode of liquidation, the bill will be automatically liquidated, on the day it falls due, by the Contract Auto Liquidation function run as part of the BOD processing. If a bill for which you have specified auto liquidation matures on a holiday, the bill will be processed based on your holiday handling specifications, in the Branch Parameters table.- If you have specified that the processing has to be done on the last working day before the holiday, a bill maturing on a holiday will be liquidated during the EOD processing, on the last working day before the holiday.

- If you have specified that the processing, has to be done only up to the system date, then the bills maturing on a holiday will be processed on the next working day after the holiday, during the BOD process.

If you do not specify auto liquidation, you have to give specific instructions for liquidation through the Manual Liquidation screen, on the day you want to liquidate the bill.

Link To Finance Check this box if you want to link an export bill contract to a finance. This is defaulted from the product level. You are allowed to modify this. Advance by Finance Oracle Banking Trade Finance provides the facility to book finance through the Bills module. Check this option to book a finance while liquidating the bills. Once you have selected this option, you need to specify the finance product and the bridge GL in the consecutive fields. Note:

You are allowed to create finance only for import bills that are of Acceptance type.Crystallization of a bill occurs when ‘Advance by Finance’ has been selected for the bills product on final liquidation of the bill. Refer the section ‘Crystallization of bills’ in this chapter for further details.

Once the Import Bill contract is liquidated using Finance, then on final liquidation of the import bill contract the status of the contract is changed to ‘Devolved’. i.e If the Bill Amount and Liquidation Amount is found to be the same in the Main tab, the status is changed to ‘Devolved’.

Oracle Banking Trade Finance provides the facility to book a loan through the Bills module. Check this option to book a loan while liquidating the import bills. Once you have selected this option, you need to specify the loan product and the bridge GL in the consecutive fields. During Liquidation, Customer account will be debited to the extend of available Balance and for the remaining amount loan will be created.

Allow Rollover Specify whether the Bill contract can be rolled over into a new bill. This field is enabled only if you have opted for the rollover option at the product level. You can choose to change this option during initiation or amendment of the Bill. Note:

If the box is unchecked, the Bill contract will not be rolled over even though rollover is specified at the product level.Settle Available Amount Oracle Banking Trade Finance allows you to check if there are sufficient funds available in the customer’s account. The system will settle the acceptance to the debit of whatever funds are available in the account and auto creates a loan for the shortfall amount. If there is no sufficient balance available in the customer’s account even after considering the OD limits, then the loan will be created for the entire Bill Liquidation amount. Check this box to verify the customer balance and in turn to create the loan for the shortfall amount during liquidation. You can also amend the settlement account.

Note:

This field is enabled only if the ‘Advance by Loan’ field is checked. The customer balance check and loan creation is not applicable during Auto liquidation and will be applicable only for Manual Liquidation.Use LC Reference in Message Choose the ‘Use LC Ref in Messages’ option if you would like to furnish the Related LC Reference Number in the messages generated for the bill. If you do not choose this option, Field 20 of the SWIFT messages and the mail messages generated for the bill will furnish the Bill Reference Number. LC Detail in Payment Message If this option is checked then MT756 (Advice of reimbursement or Payment) is generated with tag32B containing the LC Contract Currency and Amount. Available for Rediscount A discounted bill, which is in the final stage, can be made available for re-discounting. You can indicate that a bill is eligible for rediscounting, by checking the field. The discounted bill will be reported available for rediscounting, when they are in final stage but not yet matured. Note:

No processing will be done, based on your specifications to this field. It only helps retrieve information, on discounted bills available for rediscounting. The Bills eligible for Rediscounting report, lists the bills that are eligible for rediscounting. Based on the report you can send a discounted bill for rediscounting.Auto Change of Operation Acceptance to Advance on Maturity If you are processing an acceptance type of bill, you can indicate whether the bill should be automatically converted, into an advance type of bill on its liquidation date. Avalization/Co-Acceptance Requested During bill booking or amendment, User can enable the flag “Availization/Co-Acceptance requested” flag. By default, the flag will be Unchecked. Once the flag is enabled, it cannot be unchecked during any further actions or operations. During amendment the flag can be enabled only when the stage is FINAL. Change of operation and enabling the flag cannot be done together. Flag is not applicable for Sight bills, Multi-tenor and Bills Under LC. In Case Export product, Operation Should be COL or ACC or DIS and Party Type “Collecting Bank” is mandatory. In Case Import product, Operation Should be COL or ACC and Party Type “Remitting Bank” is mandatory.

Instruction Code: COACCP_REQ will be automatically defaulted for Avalization/Co-Acceptance Requested related advices.

.Avalized/Co-Accepted Post receiving the Co-Acceptance, user can amend the bill and do the change of operation to CAC (Co-acceptance). By default, the flag will be Unchecked. During change of Operation to CAC from ACC/COL with stage as FINAL, the flag will be enabled by the system on save of the contract. Once the flag is enabled, it cannot be unchecked during any further actions or operations. Flag is not applicable for Sight bills, Multi-tenor and Bills Under LC. Acceptance Message Date is mandatory. Override will be displayed to user during Co-acceptance if the flag Avalization/Co-Acceptance Requested is not enabled. Post Co-Acceptance, if the customer request for Finance user to change the operation from CAC to DIS. If Co Acceptance is received post finance, user can Amend the bill and manually select the flag “Avalized/Co-Accepted”. Changing of operation from DIS to CAC is not allowed. In Case Export product, Party Type “Collecting Bank” is mandatory. In Case Import product, Party Type “Remitting Bank” is mandatory.

Instruction Code: COACCEPTED will be automatically defaulted for Avalized/Co-Accepted related advices.

Brokerage Details Specify the brokerage details.

Allow Brokerage This preference is defaulted from the product screen under Brokerage Details section. Brokerage To Be Paid By Us Check this box to indicate that the brokerage will be paid by the importer or exporter depending on the bill product. Note:

This field is enabled only if the box ‘Allow Brokerage’ is checked.ICCB Pickup Details For any export purchases, you can indicate whether you want to levy the charges and profit in the ICCB pickup currency or the contract currency for the customer.

When you invoke the contract, the bill currency you select will be taken by default as the ICCB pickup currency. However, you can change this currency for the customer.

ICCB Pickup Currency Indicate the currency in which profit and the charge pickup will happen for the contract. Exchange Rate Indicate the exchange rate between ICCB pickup currency and contract currency. Note:

You are not allowed to change the ICCB pickup currency for EIM (Effective Profit Method) contracts. It gets defaulted to the contract currency and will be disabled here.You have to manually select the settlement account for BC module tags in the ICCB pickup currency. Settlement pickup of ICCB and charge tags will happen based on the ICCB pickup currency.

In case where the charges and profit are based on ICCB pickup currency, you have to maintain the ICCB rule as follows:

Basis Amount Currency - ICCB Pickup Currency

Charge Currency - ICCB Pickup Currency

Booking Currency - Charge Currency

Floating rate pickup and customer margin pickup for profit components will be based on ICCB pickup currency. Therefore, you need to maintain the floating rate code and customer margin for the respective ICCB pickup currency.

In addition, if you want to apply charges in ICCB pickup currency, then you have to define the charge component with amount tags suffixed by _ICCY. If charge components are defined with normal bills amount tags, then charges will be computed in contract currency. Thus, you can apply charges in contract currency or ICCB pickup currency based on basis amount tag of a charge component.

Margin Details Liquidated Amount While processing a collection type of bill, partial liquidation is allowed. In this field you can indicate the amount that has been liquidated under a collection. Outstanding Amount The outstanding amount, which is the amount that is yet to be liquidated under the bill, is automatically displayed. In the case of a collection it is computed as follows: Outstanding Amount = Bill Amount - Liquidation Amount

For bills other than collection type the bill amount will always be equal to the liquidation amount.

Forfait Details Request Date Specify the date on which your customer requests for bill forfaiting. Document Submission Date The requestor of forfaiting will invariably submit a document. This may or may not happen on the date of request. So you can capture the date of submission of the forfaiting document here. Note:

These two fields are only meant for information purpose. The system performs no processing or validation on them.External Pricing Following are the External Pricing

External Charge While booking a contract under a product for which ‘External Charges’ is enabled at product level, it defaults the same value for contract also which fetches external charges from external pricing and billing engine. Non-Conforming Reimbursement Claim Details System is enhanced to generate the SWIFT message MT744 - Notice of Non-conforming Reimbursement Claim on bill booking as per SR2018 standard. - Fields to capture the Non-conforming Reimbursement Claim details in BC contract online screen is introduced.

- Support to generate message Notice of Non-conforming Reimbursement Claim, provided the mandatory details are included during bill booking or bill closure

- As per the existing system, message

MT744 will be generated only during bill closure and

the only possible value supported for tag 73S is

CANC whereas the current system is enhanced to

support the generation of the message both in bill

booking and in bill closure. The possible values of

tag 73S is also updated as per the SR2018

standards.

- Fields are introduced online in

BC Contract Screen to capture the details of

Non-Conforming Reimbursement Claim Details. Below

are the list of fields added in BCDTRONL (Tab –

Additional)

- Reason for Non Payment Code

- Reason for Non Payment Narrative

- Disposal of Reimbursement Claim

- Disposal of Reimbursement Claim Narrative

- Reason for Non Payment Code is a

drop-down list and will list the applicable codes

of tag 73R as per SR2018 standard.

- Below are the possible values:

- DIFF

- DUPL

- INSU

- NAUT

- OTHR

- OVER

- REFE

- TTNA

- WINF

- XAMT

- Fields are introduced online in

BC Contract Screen to capture the details of

Non-Conforming Reimbursement Claim Details. Below

are the list of fields added in BCDTRONL (Tab –

Additional)

Narrative value of tag 73R can be captured against the field Reason for Non Payment Narrative. Provided text can be appended with the code against tag 73R.Only narrative cannot be provided when the code is blank.

Disposal of Reimbursement claim is a drop-down list and will list the applicable codes of tag 73S as per SR2018 standard. Below are the list of possible values:- CANC

- HOLD

- RETD

Narrative value of tag 73S can be captured against the field Disposal of Reimbursement claim narrative. Provided text can be appended with the code against tag 73S. Only narrative cannot be provided when the code is blank. An override message will be thrown if the Disposal of Reimbursement claim is HOLD and the corresponding narrative is blank.- System will ensure to validate the below scenarios:

- Non-confirming reimbursement claim details are applicable only for the reimbursement claim products. Bill processing will not be allowed for other products with these details.

- Non-confirming reimbursement claim details are applicable only for the bills during bill booking (stage as INITIAL) or bill closure. System restricts the details to be provided for any other events.

- System restricts the value of Disposal of Reimbursement claim to be only HOLD during bill booking and other than HOLD (only CANC or RETD) during bill closure.

- Narrative fields cannot be provided when the claim code is not available.

- Override will be displayed when Disposal of Reimbursement claim is HOLD and the narrative text is blank.

- Both the claim codes are mandatory and if any one of it is not provided, the message will not be processed and it will be suppressed.

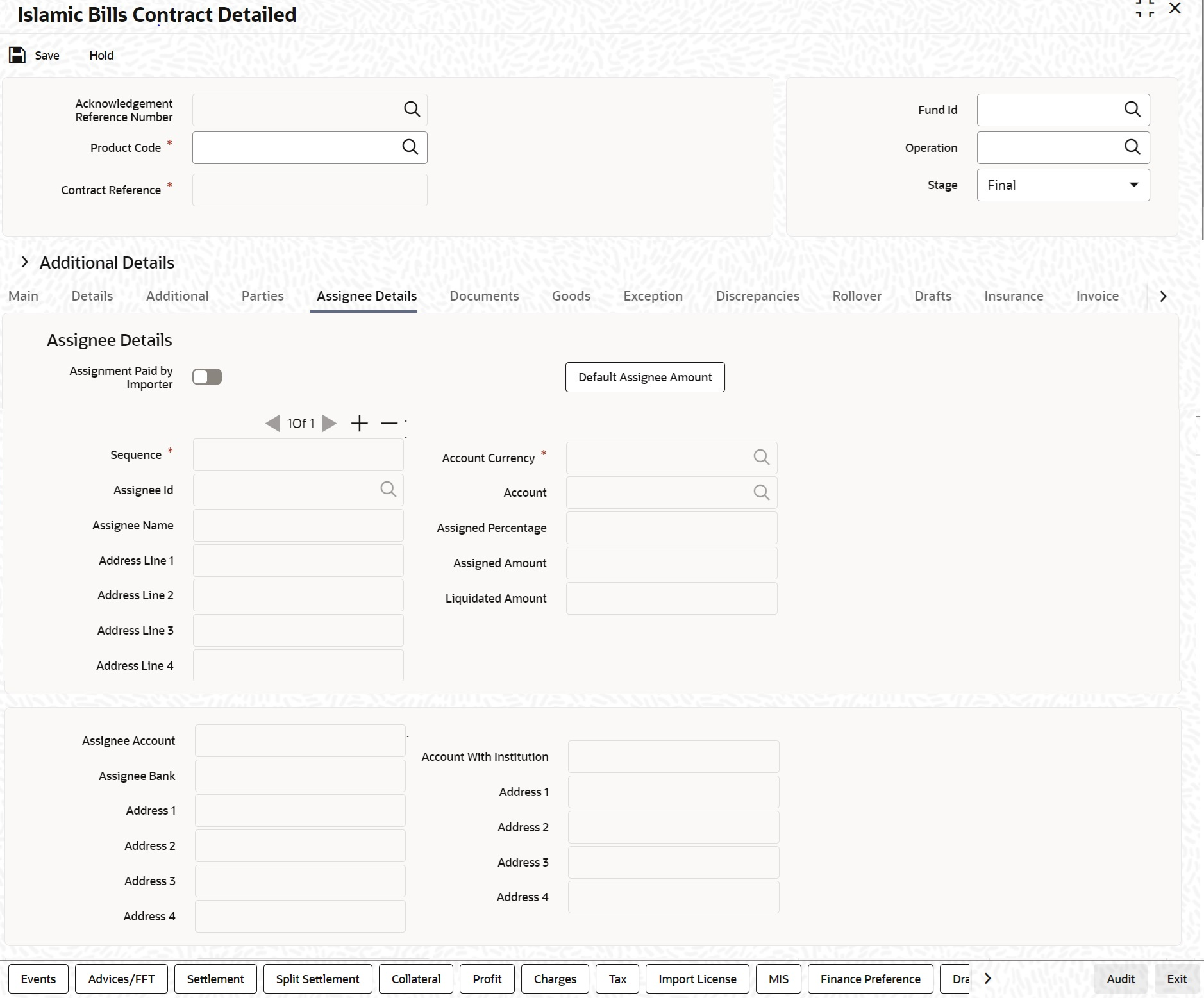

Assignee Details Assignee details will be defaulted from Export LC on LC default. Assignees cannot be added in Bills not under LC. Assignees cannot be added in Bills if assignees available for LC. Assignees can be added in Bills if assignees is not available for LC. Assignee can be walk-in customers, Bank customers and Third Party customers . For Third Party Customers, user must maintain those parties in Third Party screen (TFDTPMNT). It will be possible to maintain assignee details in export type of letter of credit contract. You can set the following assignee details:

Sequence Sequence in which the assignee details are maintained. Value for this should be greater than or equal to zero. Sequence will not accept any decimal points. This should be unique. Assignee Id To maintain the party ID. This will fetch all the parties maintained in Other Party screen. It will not be possible to maintain the same assignee multiple times. Assignee Name Assignee name will be displayed based on the Assignee Id. Assignee name can be modified only Walk-in Customer.

Assignee Address Line 1 Address Line 1 will be displayed based on the Assignee ID.Address Line 1 can be modified only for Walk in customer. This field is optional.

Assignee Address Line 2 Address Line 2 will be displayed based on the Assignee ID.Address Line 2 can be modified only for Walk in customer. This field is optional.

Assignee Address Line 3 Address Line 3 will be displayed based on the Assignee ID.Address Line 3 can be modified only for Walk in customer. This field is optional.

Assignee Address Line 4 Address Line 4 will be displayed based on the Assignee ID.Address Line 4 can be modified only for Walk in customer. This field is optional.

Account Currency Specify the currency of the account of the assignee. Accounts Specify the account to which the amount should be credited. This can be the account of the assignee with the bank if he is a customer of the bank. If he is not the customer of the bank then this can be the Nostro account of his bank maintained in the current bank. If Assignee is a bank customer ( Individual/Corporate/Bank customer) then Account LOV will provide customer accounts maintained in External Customer Account for the selected bank customer. If Assignee is a Third party or Walk in customer then Account LOV will display NOSTRO accounts for the currency. Assigned Percentage Specify the percentage of assignment to the assignee. Sum of assignee percentage should not exceed 100 percent.Either Assigned Percentage or Assigned Amount should be entered. If assigned percentage is provided and assigned amount is not provided, system will compute assigned amount based on assigned percent of contract amount.If assigned amount is provided and assigned percentage is not provided, system will compute assigned percentage based on assigned amount. If both assigned percentage and assigned amount is provided, system will compute assigned amount based on assigned percentage If both assigned percentage and assignment amount is not provided, system will provide error message. Assigned Amount Specify the amount of assignment to the assignee in LC currency.bThis should be greater than zero. Decimal points will be based on the LC currency. Liquidated Amount This will give the liquidated amount in bill currency against each assignee. This will be populated by the system and will be a read only field. Assignment Paid by Importer If this flag is checked, then it is mandatory to maintain the assignment details. Validation will be there to check whether assignee details are maintained. For export type of products the assignment details will be defaulted from the linked letter of credit contract:- On click of Default button in the main tab, system will default the assignment details captured at the Letter Of Credit contract

- It will not be possible to add or delete assignees

- Assignees details and Account details cannot be modified

- It will be possible to modify the assignment amount

- If the assigned amount for each assignee considering all the BC contracts booked under the same LC goes above the assignment amount at LC contract level for the corresponding assignee, then system will throw an error message

- If the assignment amount for each assignee is not in proportion with the BC amount to LC amount proportion, then system will throw an override

For import type of contract data can be entered by the user as mentioned in below section:- Before doing the maintenance of assignee details in BC contract screen, those parties should be maintained in Other Party screen

- All validations related to assignee details mentioned for Letter of Credit contract will be applicable in this case as well.

- It will be possible to add any number of assignees in this block.

- All the fields are mandatory to input.

- It will be possible to amend the details of the assignee. The above mentioned validation will be applied on modification as well.

- It will be possible to add new assignees, system will validate the total amount against the bill amount.

- It will be possible to delete the existing details. But the below validations will be applicable.

- Once the liquidation against one assignee has happened, it will not be possible to delete that assignee.

- Amount cannot go below the liquidated amount against the assignee.

Once the liquidation is done, it will not be possible to change the Assignee Name, Assignee Id, Account Currency or Account. There will be validation to check whether the sum of the amount for all the assignee does not exceed the bill amount. Assignment of proceeds is done at import or export bill based on the business scenario. A new flag is introduced to indicate this A new flag, Assignment Done by Us will be introduced at Bills and collections contract screen. Check this flag to mandatory to maintain the assignment details. Validation is there to check whether assignee details are maintained.

Assignee Details Assignee details will be defaulted from Export LC on LC default.Assignees cannot be added in Bills not under LC.Assignees cannot be added in Bills if assignees available for LC.Assignees can be added in Bills if assignees is not available for LC . Assignee can be walk-in customers, Bank customers ,Third Party customers and Other Party Customers.For Other Party Customers user should maintain those parties in Other Party screen (TFDOPMNT) first. For Third Party Customers, user must maintain those parties in Third Party screen (TFDTPMNT). It will be possible to maintain assignee details in export type of letter of credit contract.

You can set the following assignee details:

Sequence Sequence in which the assignee details are maintained. Value for this should be greater than or equal to zero. Sequence will not accept any decimal points. This should be unique. Assignee Id To maintain the party ID. This will fetch all the parties maintained in Other Party screen. It will not be possible to maintain the same assignee multiple times. Assignee Name Assignee name will be displayed based on the Assignee Id. Assignee Address Line 1 Address Line 1 will be displayed based on the Assignee ID.Address Line 1 can be modified only for Walk in customer. This field is optional.

Assignee Address Line 2 Address Line 2 will be displayed based on the Assignee ID.Address Line 2 can be modified only for Walk in customer. This field is optional.

Assignee Address Line 3 Address Line 3 will be displayed based on the Assignee ID.Address Line 3 can be modified only for Walk in customer. This field is optional.

Assignee Address Line 4 Address Line 4 will be displayed based on the Assignee ID.Address Line 4 can be modified only for Walk in customer. This field is optional.

Account Currency Specify the currency of the account of the assignee. Accounts Specify the account to which the amount should be credited. This can be the account of the assignee with the bank if he is a customer of the bank. If he is not the customer of the bank then this can be the Nostro account of his bank maintained in the current bank. Account LOV will display all active and authorized CASA, NOSTRO accounts of the specified currency. Assigned Percentage Specify the percentage of assignment to the assignee. Sum of assignee percentage should not exceed 100 percent.Either Assigned Percentage or Assigned Amount should be entered. If assigned percentage is provided and assigned amount is not provided, system will compute assigned amount based on assigned percent of contract amount.If assigned amount is provided and assigned percentage is not provided, system will compute assigned percentage based on assigned amount. If both assigned percentage and assigned amount is provided, system will compute assigned amount based on assigned percentage If both assigned percentage and assignment amount is not provided, system will provide error message. Assigned Amount Specify the amount of assignment to the assignee in LC currency.bThis should be greater than zero. Decimal points will be based on the LC currency. Liquidated Amount This will give the liquidated amount in bill currency against each assignee. This will be populated by the system and will be a read only field. Assignment Paid by Importer If this flag is checked, then it is mandatory to maintain the assignment details. Validation will be there to check whether assignee details are maintained. For export type of products the assignment details will be defaulted from the linked letter of credit contract:- On click of Default button in the main tab, system will default the assignment details captured at the Letter Of Credit contract

- It will not be possible to add or delete assignees

- Assignees details and Account details cannot be modified

- It will be possible to modify the assignment amount

- If the assigned amount for each assignee considering all the BC contracts booked under the same LC goes above the assignment amount at LC contract level for the corresponding assignee, then system will throw an error message

- If the assignment amount for each assignee is not in proportion with the BC amount to LC amount proportion, then system will throw an override

For import type of contract data can be entered by the user as mentioned in below section:- Before doing the maintenance of assignee details in BC contract screen, those parties should be maintained in Other Party screen

- All validations related to assignee details mentioned for Letter of Credit contract will be applicable in this case as well.

- It will be possible to add any number of assignees in this block.

- All the fields are mandatory to input.

- It will be possible to amend the details of the assignee. The above mentioned validation will be applied on modification as well.

- It will be possible to add new assignees, system will validate the total amount against the bill amount.

- It will be possible to delete the existing details. But the below validations will be applicable.

- Once the liquidation against one assignee has happened, it will not be possible to delete that assignee.

- Amount cannot go below the liquidated amount against the assignee.