- Islamic Bills and Collections User Guide

- Define Attributes of Islamic Bills and Collections Product

- Characteristics for a Product

- Define Characteristics for Product

3.1.1 Define Characteristics for Product

This topic describes the systematic instruction to define the characteristics for product in Islamic Bills & Collections Product Definition screen.

The advantage of maintaining document details is that at the time of creating a product or at the time of entering the details of a bill, you need only specify the code assigned to the document. All the details maintained for the document will be automatically picked up. This reduces the effort taken as there is no need to enter the contents of the document every time you use it.

It is necessary to maintain a mandatory program, to run the Islamic Bills & Collections Product Definition screen.

- On Homepage, type IBDPRMNT in the text box, and then

click next arrow.The Islamic Bills & Collections Product Definition screen is displayed.

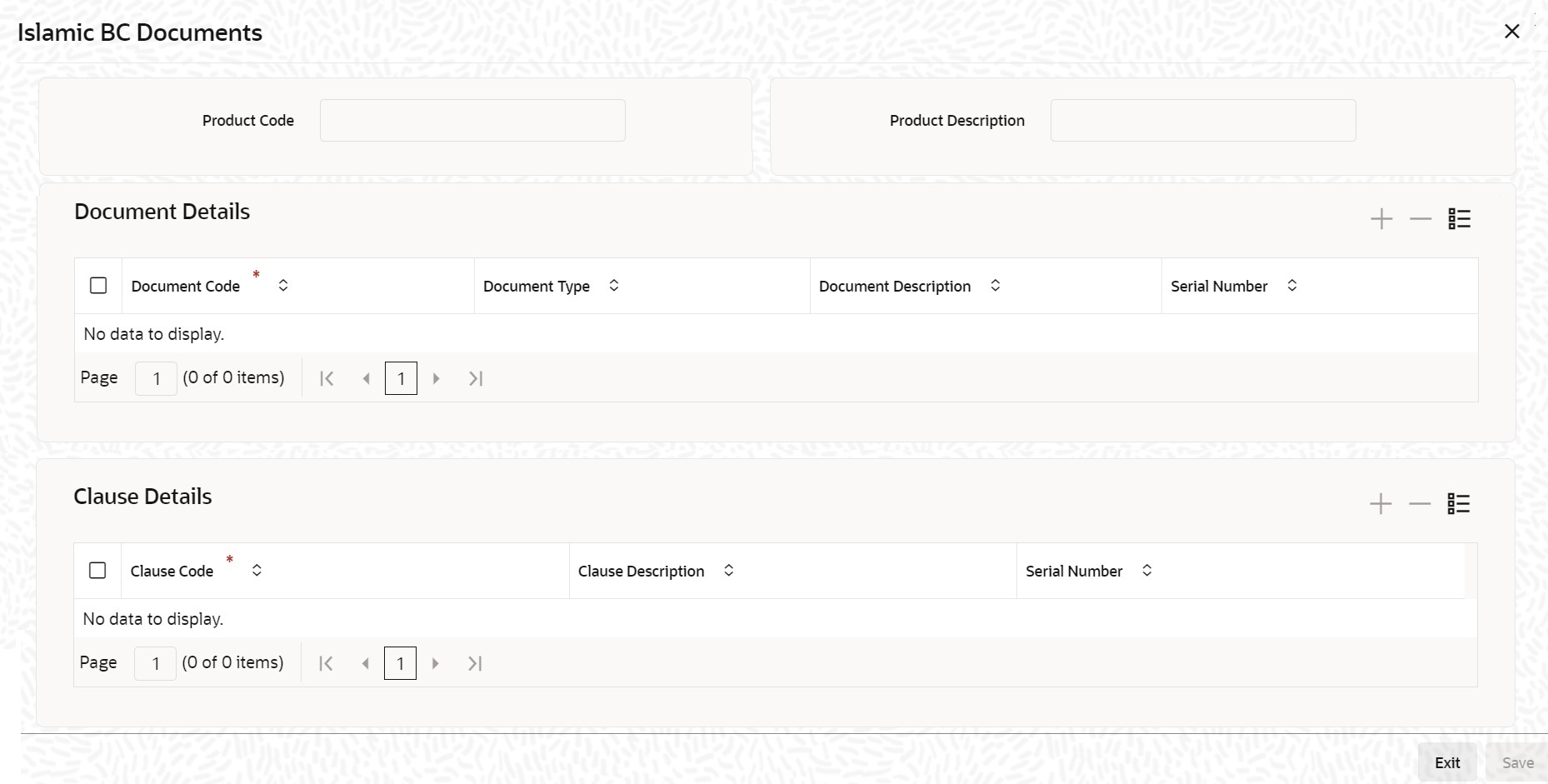

Figure 3-1 Islamic Bills & Collections Product Definition

Description of "Figure 3-1 Islamic Bills & Collections Product Definition" - If you are maintaining the details of a new document, On Islamic Bills & Collections Product Definition screen, click New.

- On Islamic Bills & Collections Product Definition

screen, specify the fields, and then click Enter

Query.For more information on the fields, refer to the below Field Description table.

Table 3-1 Islamic Bills & Collections Product Definition - Field Description

Field Description Product Code Specify the product code. This field is mandatory.

Product Description Specify a description for the product. This field is mandatory.

Product Type An important detail in defining a product is to specify the type of product you are creating. A Bill product that you create in Oracle Banking Trade Finance can be of the following types: - Import

- Export

The type of bill product you are creating determines the operations that can be performed on a bill.

This field is mandatory.

Description Description of the product type selected. Slogan Here you can specify a slogan for the product, if required. Product Group Select the group to which the product is associated, from the option list provided. Product Group Description Description of the product group selected, Start Date Specify the start date for the product. End Date Specify the end date for the product. Remarks Enter any remarks related to the product, if required. Operation This indicates the operation that is allowed for the bills linked to a product. The operation that you can select for the product is determined by the type of bill product you define (import, export, and collection). The operation type selected for the bill determines the type of accounting entries passed and the messages that are generated. See Table 3-2.

This field is mandatory.

Tenor Code The tenor that you define indicates when the bills linked to the product will be paid (immediately or after a usance period). The bills linked to a product can be paid either at: - Sight - Indicating that the bill is paid immediately

- Usance - indicating that bill is paid after a usance period

- Multi-Tenor – Select if you want to pay the bill in multiple tenors

Document A bill that is drawn under an LC issued at your bank or at another bank can be either clean or documentary. If you indicate that bills under an LC can be processed using the product, you can also indicate the type of LC that the bill was drawn under. The options available are: - Clean - indicate that no documents are required to process the bills linked to this product

- Documentary - indicate that documents are required for the processing of bills linked to this product

Under Letter of Credit The bills that you process at your bank can be drawn under an LC that was issued at your bank or at another bank. You can indicate whether bills drawn under an LC can be processed using the product you are creating. Reimbursement Claim Check this option to indicate that the product is applicable for processing reimbursement claims. This field is enabled only when the operation is chosen as Payment and the type is specified as ‘Import’. Change of Operation Allowed In addition to indicating the operation that is allowed for the bills linked to a product, you also have an option to indicate whether a change of operation is allowed for the bills linked to the product. Acceptance To Discount If you are creating a product with operation type Acceptance you can indicate that the bills, which are processed, using this product, can also be discounted. Acceptance To Advance If you are creating a product with operation type Acceptance you can also indicate that the bills, which are processed, using this product, can be advanced as well. Collection To Purchase If you are creating a product with operation type Collection you can indicate that the collection bills processed using this product can be purchased as well. Discount To Collection If you are creating an export bill product with operation type Discount, click here to indicate that discounted bills processed using this product can be booked for collection also. If you select this option, you should also maintain accounting entries for the events BCOL and LCOL. Purchase To Collection If you are creating an export product with operation type Purchase click here to indicate that purchase bills processed using this product be changed to Collection also. If you select this option, you should also maintain accounting entries for the event BCOL and LCOL. Acceptance To Forfaiting If you are creating an export product of Bills under LC with Tenor as Usance, you can indicate that the bills coming under this product can be forfaited, by checking this option. This option will be available only if the selected operation for the product is Acceptance. The system will trigger the event FACP if the bill operation changes from Acceptance to Forfaiting.

Discount To Forfaiting If you are creating an export product of Bills under LC with Tenor as Usance, you can indicate that a discounted bill coming under this product can be forfaited, by checking this option. This option will be available only if one of the two cases is true: - The selected operation for the product is ‘Discount’.

- The selected operation for the product is Acceptance with the change preference Acceptance to Discount checked.

The system will trigger the event FDIS if the bill operation changes from Discount to Forfaiting. If the initial operation for an export bill with tenor Usance is set as Acceptance then you can change the operation to Acceptance to Discount. If Acceptance to Discount’ is chosen, then you will be able to select any one of the following operations:- Discount to Collection

- Discount to Forfaiting

On save of the product, the system will check whether the bill product was saved initially with the Forfaiting operations or not. If the product had been saved earlier with any of the forfaiting operations, the system will not allow you to save the product. The process for changing a bill status is given below:- First you have to unlock the contract

- Secondly, you have to change the operation code

- Specify the limits tracking parameters for the changed contract

Collection To Transfer Check this box to indicate that the operation for the contracts created under this product can be changed from Collection to Transfer. You can do this operation only for Collection Bills. In the Collection to Transfer field, After you save the changes, a BCOL (Collection of Bill under Purchase/Advance/Discount) event is passed for the transaction. During BCOL event, the system will: - Reverse all the purchased/discounted/advanced assets

- Execute a complete profit accrual

- Pass collection contingent entries

- Pass profit liquidation entries ¡V if profit collection is of arrears type

- If there is any compensation, then it will also be liquidated

Partially liquidated contracts can also be reverted to collection operation. Also, this can be done before/on/after maturity date. In case it is done after the maturity date and if there is any compensation due and compensation accounting entries are defined in BCOL event of product, then it will liquidate the compensation as well. Limits utilization will get matured on triggering the BCOL event.

See Table 3-3.

Collection To Discount Check this box if you want to change the operation from Collection to Discount. If an under LC Bill needs to be partially financed, the same can be booked under Collection and then moved to Discount operation with partial Discount.

Payment Operation is not supported for multi-tenor products; however, a multi-tenor contract can be booked with collection operation and then liquidated when it has to be marked as payment.

Acceptance To Free of Payment Check this box to change the operation from Acceptance to Free of Payment and on change FOPY event to be triggered Collection To Free of Payment Check this box to change the operation from Collection to Free of Payment and on change FOPY event to be triggered Acceptance To Coacceptance Check this box to change the operation from Acceptance to Coacceptance and on change BCAC event to be triggered. Coacceptance To Discount Check this box to change the operation from Coacceptance to Discount and on change BDIS event to be triggered. You can select an operation from the option list available. The type of operation that you can perform on a bill has been represented below:Table 3-2 Incoming - Outgoing

Incoming (International and Domestic) Outgoing (International and Domestic) Advance Negotiation Payment Payment Discounting Discounting Collection Collection Acceptance Acceptance Purchase Purchase Following are the accounting entries passed during the BCOL:Table 3-3 Passed Accounting Entries

Accounting Role Amount Tag Dr./Cr. BC CUSTOMER BILL_OS_AMTEQV DR BILLSPURCHASED/DISCOUNT BILL_OS_AMTEQV CR CONT GL BILL_OS_AMTEQV DR CONT OFFSET GL BILL_OS_AMTEQV CR BC CUSTOMER INT_LIQD DR RECIEVABLE GL INT_LIQD CR BC CUSTOMER PENINT_LIQD DR RECIEVABLE GL PENINT_LIQD CR Note:

Last two entries of profit liquidation should be defined only for arrears type collection products.Following are the accounting entries passed during LCOLTable 3-4 Passed Accounting Entries Passed During LCOL

Accounting Role Amount Tag Dr./Cr. CONT GL BILL_LIQ_AMTEQ CR CONT OFFSET GL BILL_LIQ_AMTEQ DR BC CUSTOMER BILL_LIQ_AMTEQ DR NOSTRO ACCOUNT BILL_LIQ_AMTEQ CR For forfaited bills, BCOL entries should be defined with MRG_AMT_EQUIV tag instead of BILL_OS_AMTEQV. In LCON event, MRG_LIQ_AMOUNT should be used in place of BILL_LIQ_AMTEQ.This operation type is treated as a foreclosure and outstanding discount accruals are completed unconditionally when the operation is carried out before the maturity date of an IBC contract linked to the product.

For forfaited bills, BCOL entries should be defined with MRG_AMT_EQUIV tag instead of BILL_OS_AMTEQV. In LCON event, MRG_LIQ_AMOUNT should be used in place of BILL_LIQ_AMTEQ.This operation type is treated as a foreclosure and outstanding discount accruals are completed unconditionally when the operation is carried out before the maturity date of an IBC contract linked to the product.

While processing a bill involving the product, you need to book a bill under Discount. If you change the Operation to Collection, the accounting entries defined for BCOL will be passed. When the bill is liquidated, the accounting entries defined for LCOL will be passed.

This operation type is treated as a foreclosure and outstanding discount accruals are completed unconditionally when the operation is carried out before the maturity date of a BC contract linked to the product.

You can refer to the chapter titled ‘Defining Discount Accrual Fee Classes’ for more information on discount accruals.

The process for changing a bill status in Oracle Banking Trade Finance is given below:- First you have to unlock the contract.

- Secondly, you have to change the operation code.

- Specify the limits tracking parameters for the changed contract.

After you save the changes, a BCOL (Collection of Bill under Purchase/Advance/Discount) event is passed for the transaction. During BCOL event, the system will:- Reverse all the purchased/discounted/advanced assets

- Execute a complete profit accrual

- Pass collection contingent entries

- Pass profit liquidation entries – if profit collection is of arrears type

- If there is any compensation, then it will also be liquidated

Partially liquidated contracts can also be reverted to collection operation. Also, this can be done before/on/after maturity date. In case it is done after the maturity date and if there is any compensation due and compensation accounting entries are defined in BCOL event of product, then it will liquidate the compensation as well.

Limits utilization will get matured on triggering the BCOL event.

Following are the accounting entries passed during the BCOL:Table 3-5 Passed Accounting Entries Passed During BCOL

Accounting Role Amount Tag Dr./Cr. BC CUSTOMER BILL_OS_AMTEQV DR BILLSPURCHASED/DISCOUNT BILL_OS_AMTEQV CR CONT GL BILL_OS_AMTEQV DR CONT OFFSET GL BILL_OS_AMTEQV CR BC CUSTOMER INT_LIQD DR RECIEVABLE GL INT_LIQD CR BC CUSTOMER PENINT_LIQD DR RECIEVABLE GL PENINT_LIQD CR Note:

Last two entries of profit liquidation should be defined only for arrears type collection products.Following are the accounting entries passed during LCOL:Table 3-6 Passed Accounting Entries Passed During BCOL

Accounting Role Amount Tag Dr./Cr. CONT GL BILL_LIQ_AMTEQ CR CONT OFFSET GL BILL_LIQ_AMTEQ DR BC CUSTOMER BILL_LIQ_AMTEQ DR NOSTRO ACCOUNT BILL_LIQ_AMTEQ CR Note:

For forfeited bills, BCOL entries should be defined with MRG_AMT_EQUIV tag instead of BILL_OS_AMTEQV. In LCON event, MRG_LIQ_AMOUNT should be used in place of BILL_LIQ_AMTEQ. - On the Islamic Bills & Collections Product

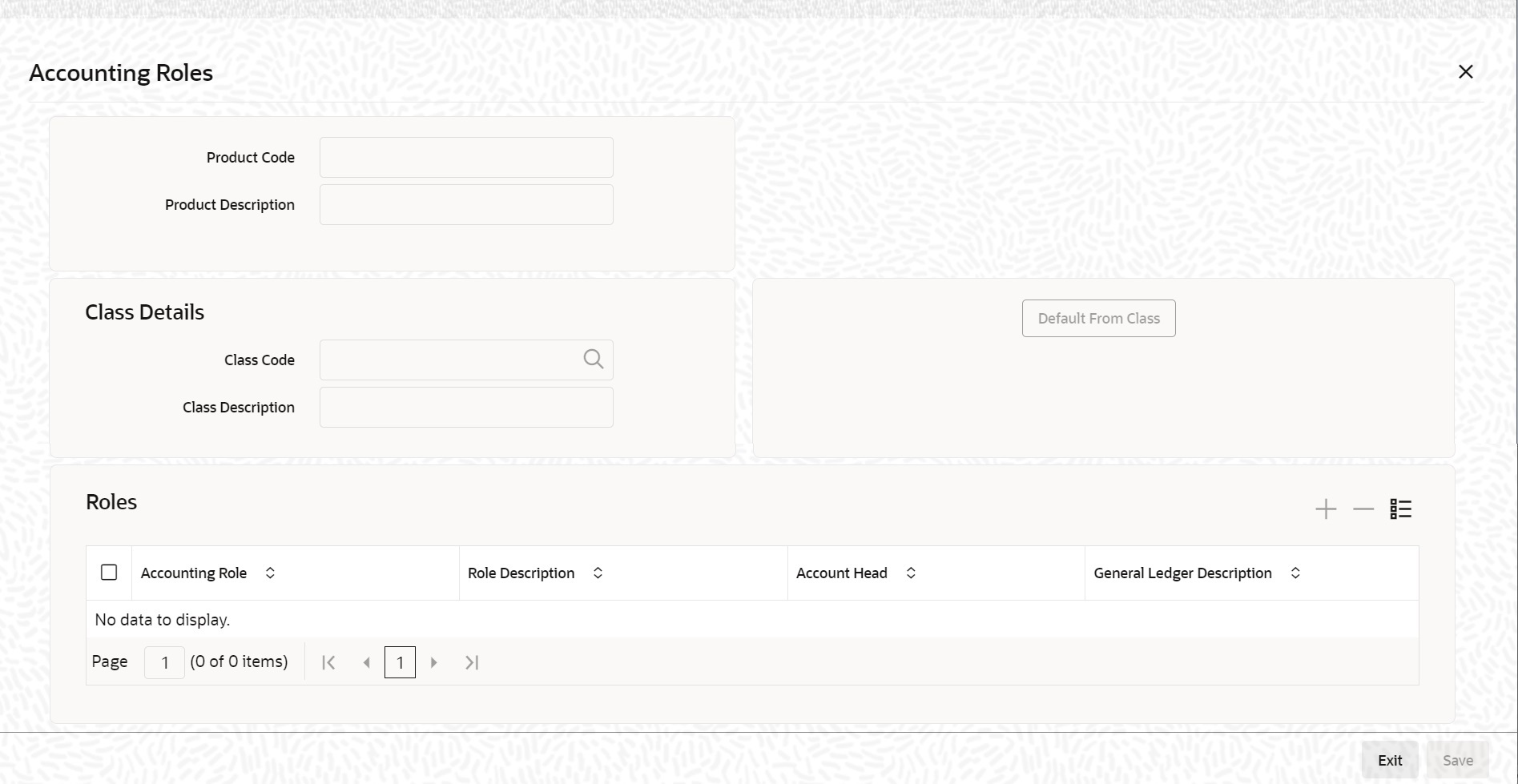

Definition, click the Accounting Roles

button.The Accounting Roles screen is displayed.

In the screen that corresponds to this icon you can map Accounting Roles to Accounting Heads.

For more information on specifying Accounting Roles, refer Products User Manual under Modularity.

- On the Islamic Bills & Collections Product

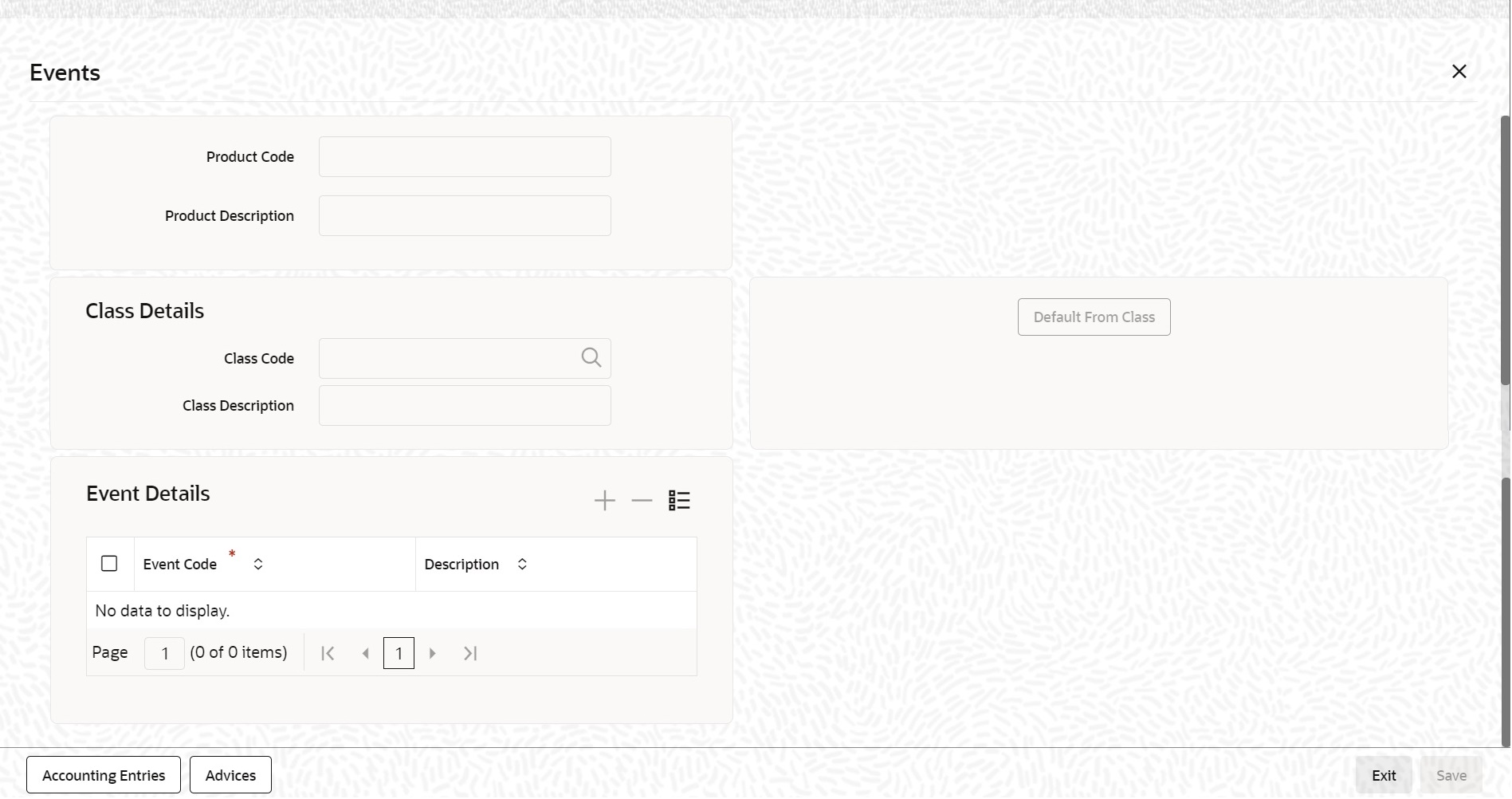

Definition click the Events button.The Events screen is displayed.

Through Events screen, you can specify the details of the Accounting Entries and Advices that have to be generated for the events that take place during the life cycle of a bill.

For more information on specifying Event Details, refer Product Definition User Manual under Modularity. - On the Islamic Bills & Collections Product

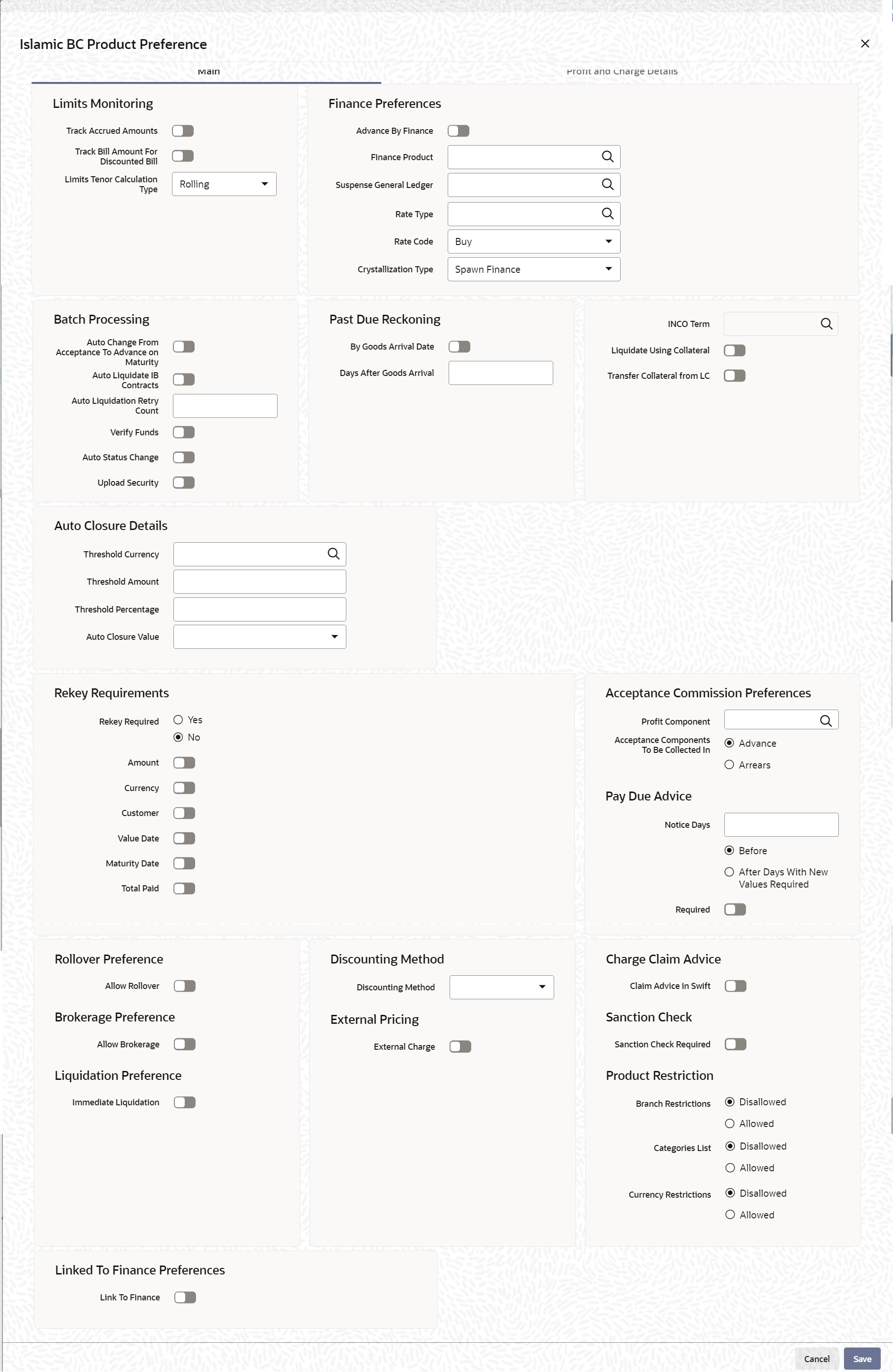

Definition click Preference.The Islamic BC Product Preference screen is displayed.

The Preferences that you define for a product will be made applicable to all Bills involving the product.

Preferences are the options available to you for defining attributes that will help distinguish a product. The preferences that you state will ultimately shape the product.

By default, a bill involving a product inherits all the attributes defined for the product. However, the attributes defined as the product’s preferences can be changed for a bill.

Through this screen you can define preferences for the product you are creating.

Liquidation Preference: For an import sight PAY product, specify the preference for bill liquidation on single stage.

Immediate Liquidation: For an import sight PAY product, specify the preference for bill liquidation on single stage.

- On Islamic BC Product Preference screen, specify the

fields in the Main tab.The Preferences that you define for a product will be made applicable to all Bills involving the product.For more information on the fields, refer to the below Field Description tables.

Table 3-7 Islamic BC Product Preference - Main Tab - Field Description

Field Description Limits Monitoring Limits Monitoring Specify the following details:

Track Accrued Amounts You have to specify whether the accrued profit of bills that have not yet been paid should also be considered as the utilized amount for the purpose of credit administration. You can make more than one profit type of component applicable to a bill product. In such a case, one type is designated as the main profit. The following example illustrates how this concept works. Track Bill Amount for Discounted Bill Under a discounted bill, the profit that is calculated for the bill is deducted at the time of initiating the bill. For the purpose of limits tracking, you should indicate whether the actual bill amount or the discounted amount should be tracked, against the limit assigned to the customer under a Credit Line. Check against this field, to indicate that the actual bill amount should be considered for the purpose, of limits tracking. Leave it unauthorized to indicate that the discounted amount should be considered.

Limits Tenor Calculation Type For tenor-based bills, you can indicate the type or manner in which the bill needs to be tracked. The tenor calculation type can be either of the following: - Fixed

- Rolling

If you indicate fixed for a tenor-based bill, throughout its tenor, it will be tracked against the relevant credit line.

Finance Preferences Specify the following details:

Advance by Finance Checking this option allows you to book finance. Finance booking is allowed only during final liquidation and is not allowed during partial liquidation of bill. Once you have opted for this option, you need to specify the finance product and the bridge GL in the consecutive fields under Finance Preference section. Note:

You are allowed to create finance only for import bills that are of Acceptance type.Suspense General Ledger To create finance, you need to transfer the principal from Bills to Finances. For this purpose, a Bridge GL has to be specified in this field. Select the GL from the option list. The Suspense GL selected as a part of the crystallization preferences is used as a bridge for transfer of the charges in bill contract transferred from the LC.

Note:

The system displays only GLs in the option list and will not display any customer accounts.Finance Product After opting to book finance, you need a finance product to create finance. Choose the finance product from the option list. The finance will be created using this product at the time of liquidating the bills. Note:

Only Finance products will be displayed in the option list.Rate Type Select the appropriate rate type in case the charge components transferred onto the finance are in different from the finance currency, from the option list. This exchange rate will also be used in the case of the finance currency is different from the bill currency to arrive at the finance amount. Rate Code Select the appropriate rate code in case the charge components transferred onto the finance are in different from the finance currency, from the option list. This exchange rate will also be used in the case of the finance currency is different from the bill currency to arrive at the finance amount. Crystallization Type Select the type of bill crystallization from the drop-down list. The two values allowed here are Spawn Finance and Linked Contracts. - Spawn Finance – Selecting this indicates that the finance contract is to be spawned on the maturity date of the bill

- Linked Contracts – Selecting this indicates that a finance will be manually linked to the bill

Note:

If the crystallization type parameter is set to – linked finance, the Auto liquidate Flag in the BC contract would be set to ‘Y’ and the user shall not be allowed to modify the same.Default Asset Details This check box is used to default the goods details from the Bills Contract to the multiple assets details of the loan. Check this box for the system to validate the following: Past due Reckoning The Past Due Status preferences that you define for a product default to the bills processed under it.

By Goods Arrival Date In the Islamic BC Product Preference’ screen, you can indicate if the past due status (of bill contracts entered under the product) should be determined with respect to the Goods Arrival Date. Days after Goods Arrivals If you opt to determine the past due status with respect to the Goods Arrival Date, you can enter the number of days vis-à-vis the Goods Arrival Date that should determine the past due status. The following example illustrates what this implies. Batch Processing Specify the following details:

Auto Change From Acceptance To Advance A product to cater to the acceptance type of bills is being created. You can indicate whether the bills linked to this product, should be automatically converted into a payment type of bill, on its liquidation date. Auto Liquidate IB Contracts on Maturity Components of a bill can be liquidated automatically or manually. In the Product Preferences screen, you can indicate whether the mode of liquidation is to be automatic or manual under Batch Processing section. If the automatic mode of liquidation is specified, a bill will be automatically liquidated on the day it falls due, by the Contract Auto Liquidation function run as part of the BOD processing. If a bill for which you have specified auto liquidation matures on a holiday, the bill will be processed based on your holiday handling specifications in the Branch Parameters table.- If you have specified that the processing has to be done on the last working day before the holiday, a bill maturing on a holiday will be liquidated during the End of Day processing on the last working day.

- If you have specified that the processing has to be done only up to the system date, the bills maturing on a holiday will be processed on the next working day, during the Beginning of Day process.

If you do not specify auto liquidation, you have to give specific instructions for liquidation through the Manual Liquidation screen on the day you want to liquidate the bill.

Auto Liquidation Retry Count Specify the Auto Liquidation Retry Count. Verify Funds Check this option to check the available balance in settlement account of a bills contract during its auto liquidation. If you check this option, the system verifies the balance only to cover the bill amount. Charges associated with the bill liquidation will not be considered. If the account has insufficient funds during manual liquidation of a bills contract, the system does not generate advices to issuing bank and claiming bank. An error message is displayed in such instances. If the account has insufficient funds during auto liquidation of a bills contract, the system triggers LIQF event. Auto Status Change A status change is one in which the status of a bill changes from one to the next. If you specify that status changes have to be carried out automatically, the status of the bill will be changed after the specified number of days. If not, you have to change the status of a bill, through the bill processing function. In the Bills - User Defined Status Maintenance screen, you can specify whether the status change should be in the forward or reverse direction. Other details related to the status change can also be specified here.

Even if automatic status change has been specified for a product and therefore a bill involving it, you can manually change the status of a bill, before the automatic change is due. It can be done through, the Contract On-line Details screen.

If a product has been specified with manual status change, you cannot specify automatic status change, for a bill involving the product.

Note:

You will be allowed to specify whether automatic status change should be in the forward or reverse direction in the status maintenance screen only if you specify that automatic status change is allowed for the product.Upload Security This needs to be checked if the Bills contract is to be considered as Banker’s Acceptance and uploaded as an instrument into the Securities module. The value date of the Bill would be the issue date of the Security and maturity date will be mapped to the redemption date of the security. The Bill amount will be uploaded as the initial and current Face Value of the security. INCO Term Specify the INCO Term. Alternatively, you can select from the option list. Liquidate Using Collateral Check this box to indicate that the bill should be liquidated using the collateral account instead of customer account if the collateral account has sufficient funds. Transfer Collateral from LC Check this box to indicate that the collateral amount obtained during LI creation should be transferred to the Bill availed under LI proportionately. This flag is defaulted from product level and can be modified at contract level after which it cannot be changed. Auto Closure Details Threshold Currency Specify the valid currency. Threshold Amount Positive residual amount to be provided Threshold amount is mandatory when Threshold Currency is provided. System validates the same. Value will be compared with the outstanding bill amount during Auto Closure Batch.

Threshold Percentage Threshold percentage below 100 to be provided. Value will be compared with the outstanding bill amount during Auto Closure Batch. Auto Closure Value Possible Values of Auto Closure Value are - Blank – Default

- Higher of Percentage and Amount

- Lower of Percentage and Amount

Auto Closure Value should be either Higher of Percentage and Amount or Lower of Percentage and Amount when both Threshold amount and Threshold Percentage is provided.

Rekey Requirements Specify the following details:

Rekey Requirements All operations on a bill (input, modification, manual liquidation etc.) have to be authorized by a user other than the one who carried out the operation. Authorization is a way of checking the inputs made by a user. All operations on a bill, except placing it on hold, should be authorized before you can begin the End of Day operations.

As a cross-checking mechanism to ensure that you are invoking the right bill for authorization, you can specify that the values of certain fields should be entered before the other details are displayed. The complete details of the bill will be displayed only after the values to these fields are entered. This is called the rekey option. The fields for which the values have to be given are called the rekey fields. If you indicate positively for the cross-checking mechanism, you should also specify the fields that will have to be re-keyed at the time the contract is authorized. You can specify any or all of the following as rekey fields:- Amount

- Currency

- Customer

- Value date

- Maturity date

- Total Paid

If no re-key fields have been defined, the details of the bill will be displayed immediately once the authorizer calls the bill for authorization.

This facility has been incorporated as a safety measure. It is advisable to indicate positively in these fields as the possibility of human error cannot be discounted. For instance, let us assume that the value date has been input incorrectly for a bills contract. You have specified Yes at the Rekey Required field and checked on Value date under it. At the time when the contact is being authorized this field will have to be re-keyed and the error that could have otherwise been overlooked can be corrected.

Acceptance Commission Preferences For incoming bills in the acceptance stage, you can collect Acceptance commission. This is different from main profit and compensation profit applicable to advance bills. Acceptance profit can be either fixed profit or floating profit or special profit.

Profit Component To compute and accrue acceptance commission, you need to associate a profit component. Select the profit component from the option list. All profit components maintained through the product ‘ICCB Details’ screen are made available here. During acceptance, you have not funded your customer. If you select an acceptance profit commission component here and click on the OK button, system checks whether the Consider as Discount option is checked at the corresponding product ICCB Details screen. If checked, system does not allow you to save the same. It gives you an error message. This is because you do not compute IRR during the acceptance stage.

Acceptance Components To Be Collected In After choosing the profit component, you need to specify the mode in which the Profit is to be collected. Indicate this by choosing either: - Advance

- Arrears

Note:

Acceptance commission fields are enabled only for Incoming Acceptance Bills.Acceptance Commission is not considered as the Main Profit component or the Compensation component.

Islamic BC Product Preference Specify the following details:

Notice Days Specify the number of days before/after maturity when the advice should be generated under Pay due Advice Preference section. The advice will be automatically generated as part of BOD for all Incoming Collections associated with the product based on the preferences that you specify Required Specify the number of days before/after maturity when the advice should be generated. The advice will be automatically generated as part of BOD for all Incoming Collections associated with the product based on the preferences that you specify.

Refer to the chapter titled Automatic Processes of this User manual for the procedure to manually generate a Payment due Advice before the automatic generation date.

Allow Rollover Specify the following details:

Allow Rollover For a Bills product, you can specify whether bill contract can be rolled over into a new bill if it is not liquidated on its Maturity Date under Rollover Preference section. Checking this box will indicate that the rollover is allowed for the bill, involving the product you are defining. Once you specify this option, the system allows you to change/extend the rollover to a new maturity date.

Rollover is possible on maturity date or after maturity date. However, rollover option is enabled only when:- The IB product is an import bill with operation as ‘Advance’

- The IB product is an import bill with operation as Acceptance and Acceptance to Advance option is enabled. However the bill can be rolled over only when the current operation is advance and not when it is in the acceptance stage.

- Both the above products have profit collection type specified as Arrears

For handling Rollover, you will have to maintain two events and associate the relevant accounting roles and amount tags while defining the Bills Product. The two events are:- ROLL – Triggered on Old Bills Contract

- INIT – Triggered on New Bills Contract

see Accounting Entries.

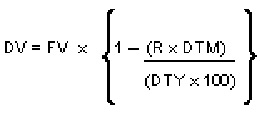

Discounting Method Specify the following details:

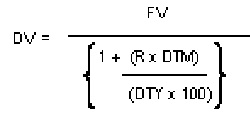

Discounting Method As a product preference, you have to specify the discounting method that would be applicable when discounting a bill. Discounted (Straight Discounting basis) The following formula will be used for calculating the discounted value:

Description of the illustration equation_1.pngIn the formula above,- DV = Discounted Value

- FV = Face Value

- R = Discount Rate

- DTM = Days to Maturity/Number of Days

- DTY = Number of Days in a year

True Discounted (Discount to Yield basis) In the Discount to Yield method, the following formula will be used: In the formula above,- DV = Discounted Value

- FV = Face Value

- R = Discount Rate

- DTM = Days to Maturity/Number of Days

- DTY = Number of Days in a year

In the True Discounted method, the profit will be computed on the discounted value and not on the Bill Amount.

Note:

This option will be available for selection only if you choose the Profit Collection Type as Advance.Charge Claim Advice Specify the following details:

Claim Advice in Swift Check this box to indicate that the Charge Claim Advice (CHG_CLAIM_ADV) that gets generated as part of LQ EOD batch should be in Swift MT799/MT499 Format. Brokerage Preference Specify the following details:

Allow Brokerage Under Brokerage Preference section, check this box to indicate that brokerage should be applicable to all the contracts under this product. External Pricing External Pricing Specify the following details:

External Charge Check this box to indicate that external charges can be fetched from external pricing and billing engine for contracts created under this product. Linked To Finance Preferences Specify the following details:

Link To Finance Check this box if you want to link an export bill contract to a finance. This is defaulted from the product level. You are allowed to modify this. Sanction Check Specify the following details:

Sanction Check Required Under Sanction Check section, check this box to indicate that sanction check is applicable for the product. This indicates whether any transaction booked using the product is subject to Sanction Check or not. If Sanction Check Required flag is checked, then the event SNCK should be maintained. System will check the MT400 message related maintenance is available at product level. If the maintenance is not available and if the Sanction Check Required check box is enabled, then the system will throw an error.

Note:

Sanction check is applicable only for Import Bills. If sanction check is enabled for other product categories, then the system will throw an error.Duplicate Check Specify the Duplicate check preferences as below: Contract Amount Check this box to indicate that system should check if same contract amount (along with other field, as applicable) exist in some other contracts’. Note:

It is a mandatory field to be checked, if duplicate check is required.Currency Check this box to indicate that system should check if same contract currency (along with other field, as applicable) exist in some other contracts’. Note:

It is a mandatory field to be checked, if duplicate check is required.Counter Party Check this box to indicate that system should check if there is an existing contract with same counterparty (along with other field, as applicable). Note:

It is a mandatory field to be checked, if duplicate check is required.Other Party Name Check this box to indicate that system should check if there is an existing contract with same other party name (along with other field, as applicable). Product Code Check this box to indicate that system should check if a contract with same product code (along with other field, as applicable) exist. Transaction Date Check this box to indicate that system should check if a contract with same transaction date (along with other field, as applicable) exist. Note:

It is a mandatory field to be checked, if duplicate check is required.Note:

System will sought an override message when it finds a duplicate contract with same details as ticked above. Also, If Duplicate check is not required, all the boxes should be unchecked.Product Restriction Specify the following details:

Branch Restrictions Indicate whether you want to create a list of allowed branches or disallowed branches by selecting one of the following options: - Allowed

- Disallowed

Currency Restrictions Indicate whether you want to create a list of allowed currencies or disallowed currencies by selecting one of the following options: - Allowed

- Disallowed

Categories List Indicate whether you want to create a list of allowed customers or disallowed customers by choosing one of the following options: - Allowed

- Disallowed

The system posts the following accounting entries when rollover is initiated manually on the bills contract:Table 3-8 Accounting Entries

Event Dr./Cr. Indicator Accounting Role Amount Tag ROLL DR ROLL_BRIDGE_GL PRINCIPAL_ROLL ROLL CR ADV UNDER LCS PRINCIPAL_ROLL INIT DR ADV UNDER LCS PRINCIPAL_ROIN INIT CR ROLL_BRIDGE_GL PRINCIPAL_ROIN - On Islamic BC Product Preference screen, click the

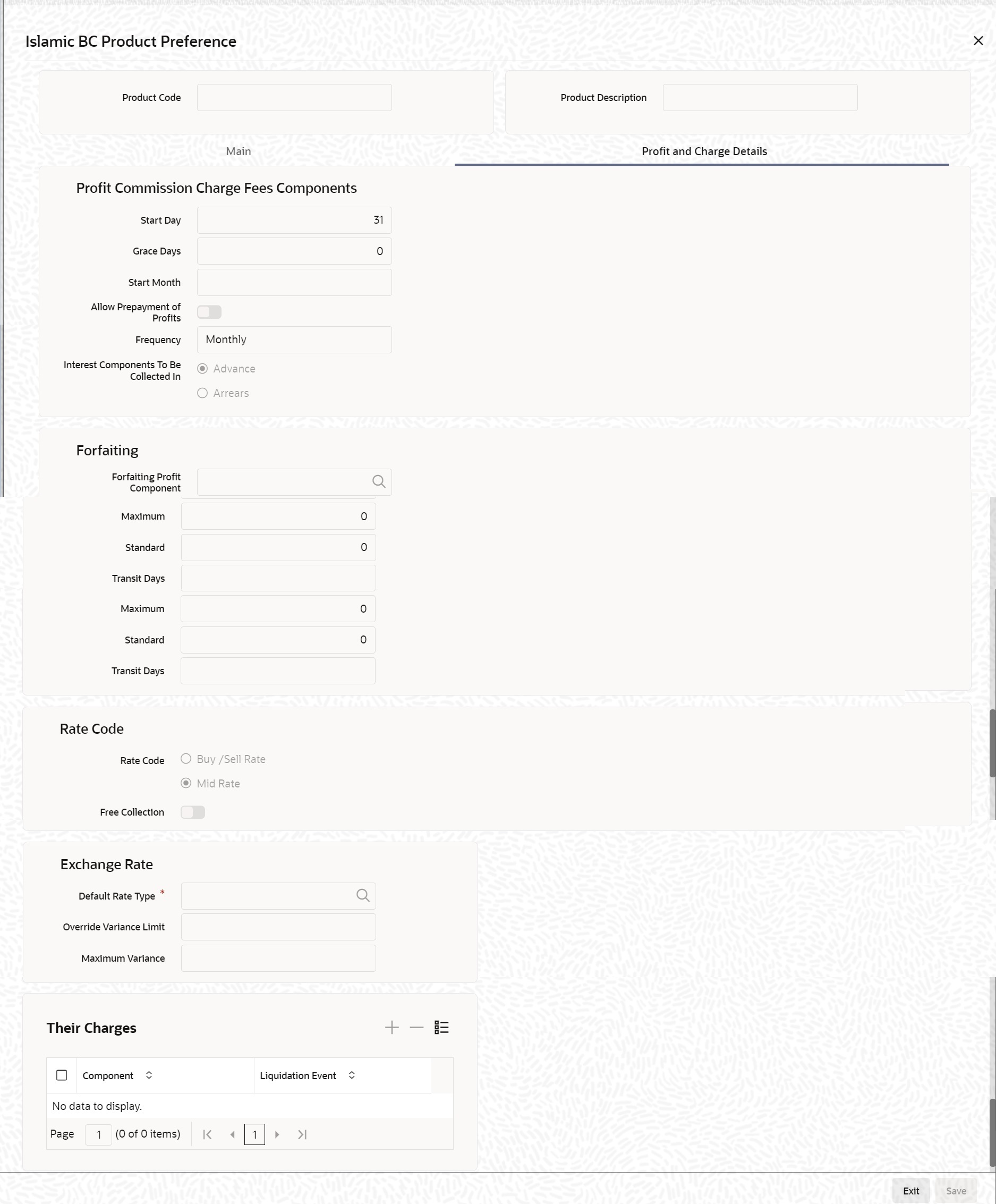

Profit and Charge Details tab.The Profit and Charge Details section appears.

- On the Profit and Charge Details tab, specify the

details.For more information on the fields, refer to the below Field Description tables.

Table 3-9 Islamic BC Product Preference - Field Description

Field Description Profit Commission Charge Components Specify the following details:

Start Day In the case of monthly, quarterly, half yearly or yearly accruals, you should specify the date on which the accruals have to be done during the month. For example, if you specify the date as 30, accruals will be carried out on that day of the month, depending on the frequency. If you want to fix the accrual date for the last working day of the month, you should specify the date as 31 and indicate the frequency. If you indicate the frequency as monthly, the accruals will be done at the end of every month. That is, on 31st for months with 31 days, on 30th for months with 30 days and on 28th or 29th, as the case may be, for February. If you specify the frequency as quarterly and fix the accrual date as 31, the accruals will be done on the last day of the month at the end of every quarter. It works in a similar manner for half-yearly and yearly accrual frequency.

Grace Days The grace period specifies the period after the repayment date, within which the compensation profit (if one has been defined for the product) will not be applied, even if the repayment is made after the due date. This period is defined as a specific number of days and will begin from the date the repayment becomes due. Compensation profit will be applied, on a repayment made after the grace period. The compensation profit will be calculated for the entire period it has been outstanding (that is, from the date the payment was due).

Start Month If you set the accrual frequency as quarterly, half yearly or yearly, you have to specify the month in which the first accrual has to begin along with the date. Allow Prepayment of Profits Check this box to Allow Prepayment of Profits. Frequency Apart from the bill amount, a bill can have other components, such as profit, charges or fees. They can be accrued over the tenor of the bill. The frequency, at which these components should be accrued, can be specified as a Product Preference. The attributes of the other components are defined in the ICCB sub-system of Oracle Banking Trade Finance. However the frequency with which the components should be accrued is specified in this screen

The system carries out automatic accruals at the frequency specified by you, as part of the End of Cycle processing. However, if the accrual date falls on a holiday, the accruals are done as per your holiday handling specifications in the Branch Parameters screen:- You could have specified that automatic events for a holiday(s) are to be processed on the working day before the holiday. The accruals falling due on a holiday(s) will be then processed during End of Day processing on the last working day before the holiday.

You could have specified that the automatic events for a holiday(s) are to be processed on the working day following the holiday; the automatic events falling due on a holiday(s) will be processed on the next working day, during the Beginning of Day processing.

The frequency can be one of the following:- Daily

- Monthly

- Quarterly

- Half yearly

- Yearly

Interest Components to be collected in You can have the interest collected in one of the following ways: Advance - When interest is to be collected in advance, it will be collected at the time of initiating the bill. For example, you have purchased a bill on Jan 10th and set it up as having interest to be collected in advance.

In this case 10th is the transaction date of the bill. Therefore, the interest amount due on the bill is collected on Jan 10th.

Note:

If you opt to collect interest in advance, you can also specify the discounting method applicable on the bill. This is discussed in the section titled ‘Specifying the Discounting Method’ of this chapter.Arrears - If the interest component of a bill is to be collected in arrears, the interest is collected on the maturity date of the bill.

For example, you have discounted a bill on 10 January 1999, which matures on 31 April 1999. You have specified that the bill is to be collected in arrears.

In this case, on 31 April 1999, which is the expiry date of the bill, the interest amount due on the bill, will be collected.

Interest Components To Be Collected In After choosing the profit component, you need to specify the mode in which the Profit is to be collected. Indicate this by choosing either: - Advance: If the profit component of a bill is to be collected in arrears, the profit is collected on the maturity date of the bill.

- Arrears: When profit is to be collected in advance, it will be collected at the time of initiating the bill.

Forfaiting Specify the following details:

Forfeit Profit Component For bills that can be forfeited, you need to specify the profit component at the product preference level. The adjoining option list displays all the profit components (except the main profit component) attached to the product. You can select the appropriate one Tenor (In Days) You can set the Standard, Minimum and the Maximum limits for tenor based bills. The tenor details that you specify for a bill product, is always expressed in days.

Minimum You can fix the minimum tenor of a product. The tenor of the bills that involve the product should be greater than or equal to the Minimum tenor that you specify Maximum You can fix the maximum tenor of a product. The tenor of the bills that involve the product should be less than or equal to the Maximum tenor that you specify. Standard The standard tenor is the tenor that is normally associated with a bill, involving a product. The standard tenor of a bill is always expressed in days and is applicable to all bills involving the product. If you do not specify any specific tenor while processing a bill, the standard tenor will be applicable to it. However, the standard tenor applied on a bill can be changed during bill processing. Note:

You can create a product with the standard tenor as zero. While processing a bill involving such a product, you will need to specify the maturity and the expiry date of the bill.If you attempt to save the bill without entering the expiry or maturity date you will be prompted for an override.

Transit Days The transit days is used to compute the maturity date of the bill. Enter the transit days for the bill. The system does not allow you to save the record in case the transit day exceeds the standard tenor. Rate Code Specify the following details:

Buy/ Sell Rate Select this option if you want to specify Buy/Sell rate for exchange under Rate Code Details. Mid Rate If it is a cross currency bill the exchange rate that has to be used for conversion can be mentioned as MID/BUY/SELL rate. Select this option if you want to specify the exchange rate as Mid rate. Free Collection Check this option if you wish to use the product for free collection. Exchange Rate Specify the following details:

Default Rate Type You can specify the exchange rates that are to be picked up and used for, liquidating the Bill Amount, Profit and Charge components of a bill under Exchange Rate Related Details section. You can indicate that the standard rate prevailing, as of the issue date of the bill should be used. You can also specify an exchange rate of your choice. The possible values for the rate pickup are:- As per Standard rate

- As input in the Contract

If you specify ‘As input’ in the contract, then the system computes the components of the bill, based on your input in the Exchange rate field, in the Bills Contract Main screen.

If you choose ‘As per standard rate’ the system computes the applicable components, by picking up the exchange rates as of the transaction date, from the Currency table maintained in the Core Services module of Oracle Banking Trade Finance.

This field is mandatory.

Override Variance Limit For a Bills product, you can specify the exchange rate type to be used to process the bill amount, the profit, or charge components of the bill. At the time of entering a contract involving a product, you have the option of, changing the exchange rate defaulted from the product and specifying an exchange rate, of your choice. The exchange rate variance is applicable only if you have decided to change the standard rate defaulted from the currency table and if the contracts linked to the product involves a foreign currency. You can specify the minimum and maximum limit by which, the exchange rate entered for contracts involving this product can exceed the standard exchange rate.

Specify the minimum percentage over which you can exceed the normal exchange rates.

Maximum Variance Specify the maximum percentage up to which you can exceed the normal exchange rate. Other Details Specify the following details:

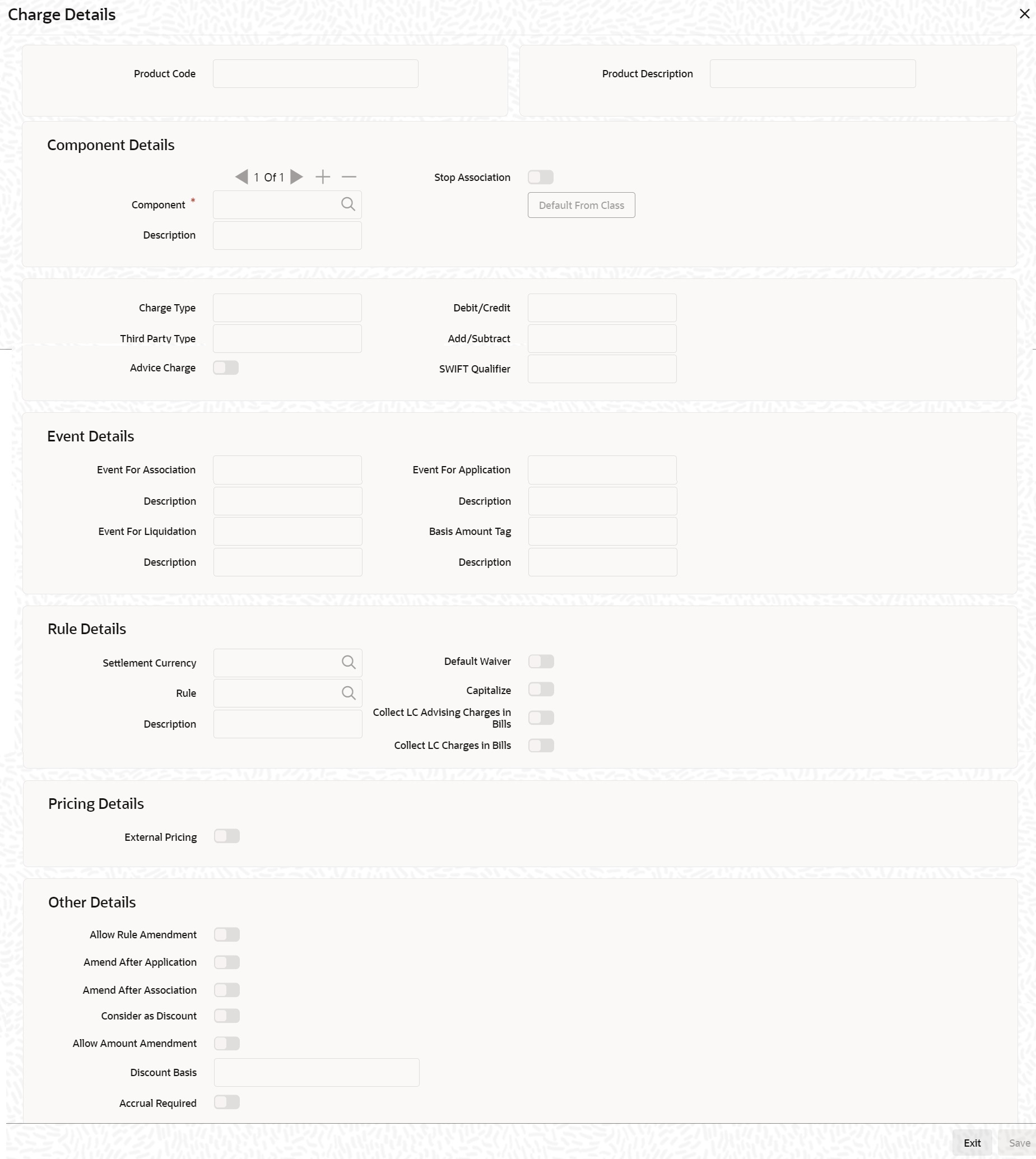

Their Charges Specify the charge component for the charges that are due to the counterparty bank. - On the Islamic Bills & Collections Product

Definition, click the Charges

button.The Charge Details screen is displayed.

Charge Details screen gives the charge component for the charges that are due to the counterparty bank.

The steps involved in processing charges for a contract, that is defining charge rules, defining charge classes, associating charge classes with a product, and amending charge details to suit a contract are explained in the Building Charge Components User Manual. - On the Islamic Bills & Collections Product

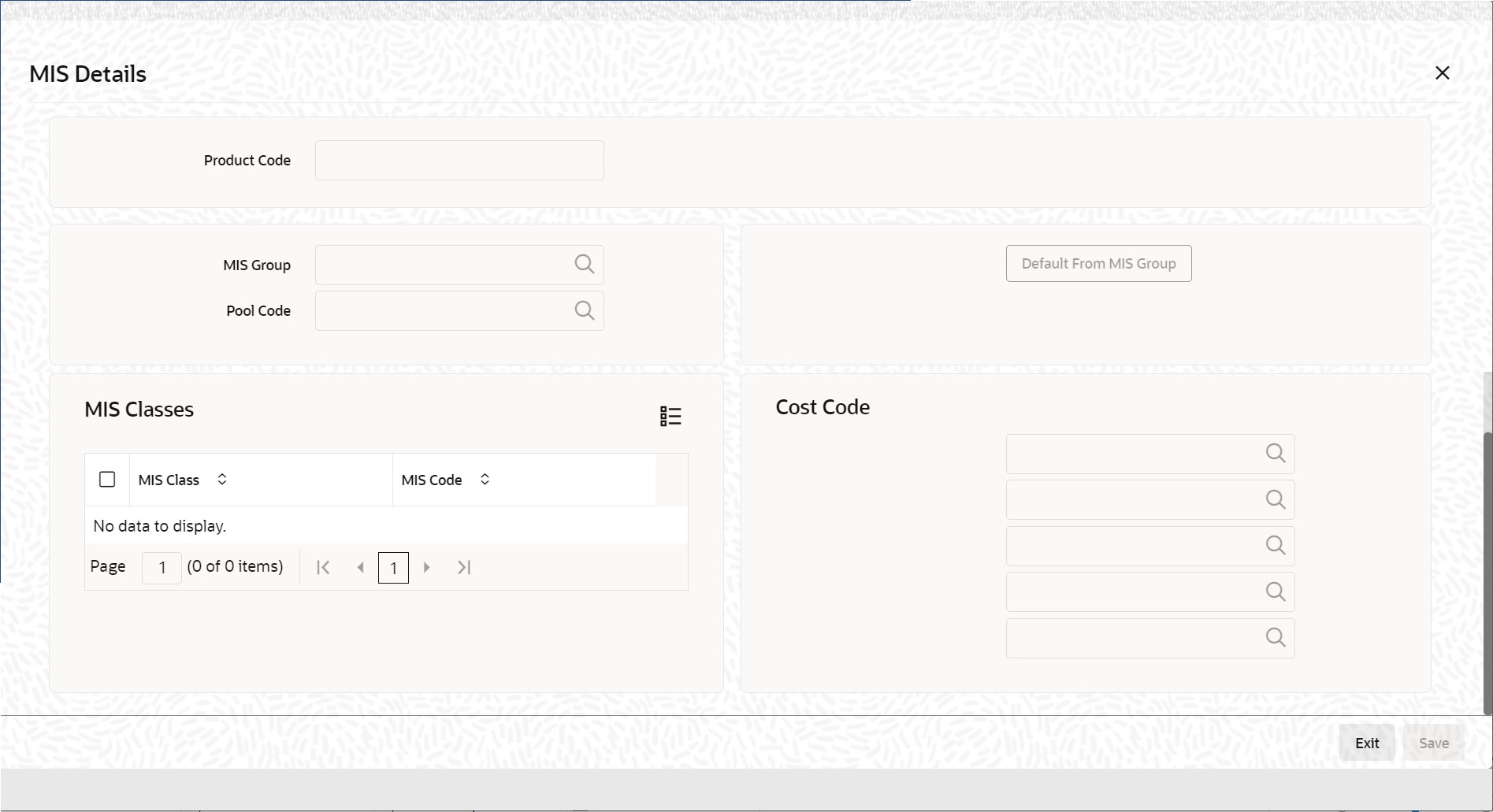

Definition, click MIS.The MIS Details screen is displayed.

For more information on specifying MIS Details, refer Product Definition User Manual under Modularity.

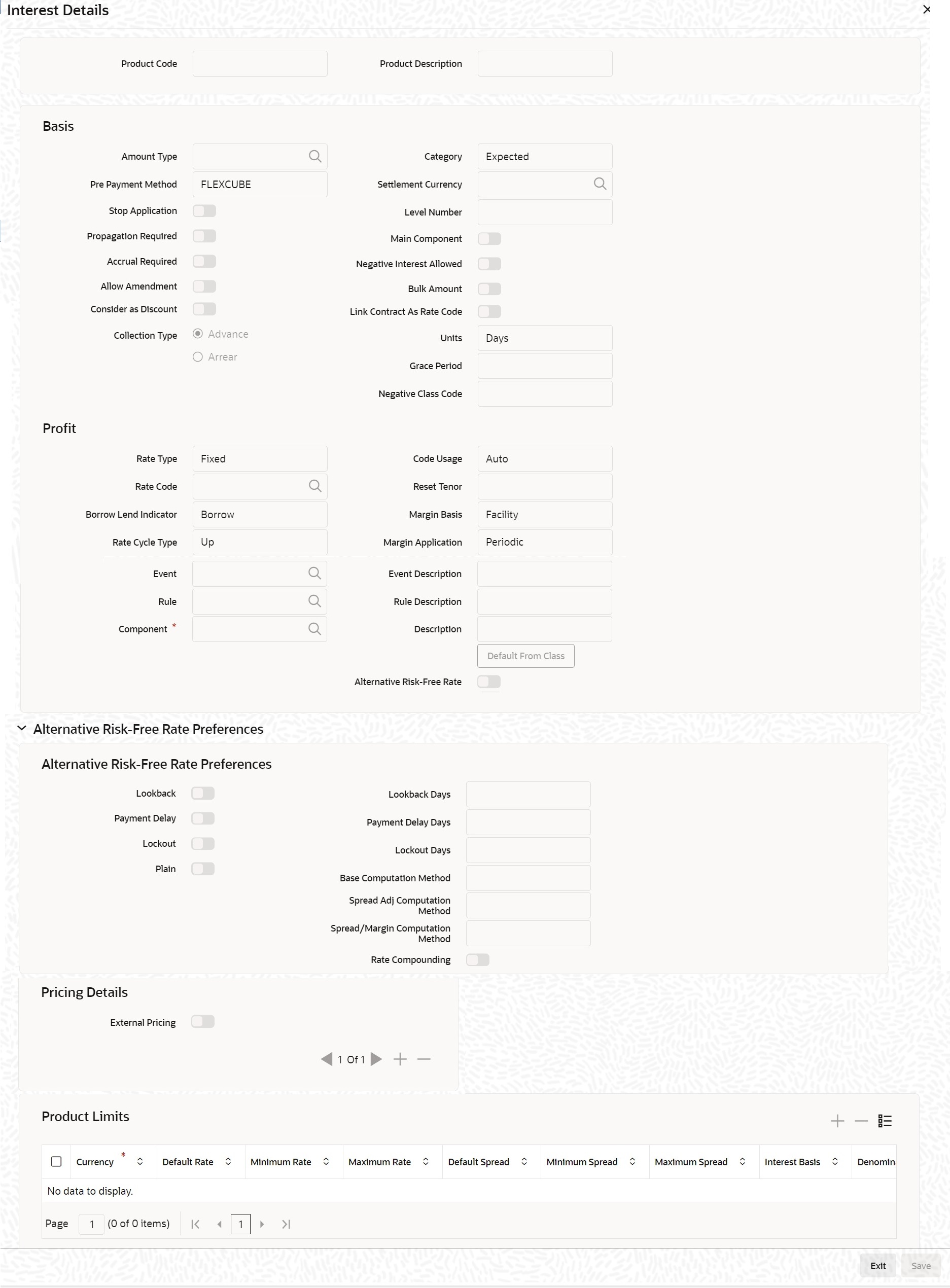

- On the Islamic Bills & Collections Product

Definition, click Profit.The ICCB Details screen is displayed.

For more information on specifying ICCB Details, refer Interests User Manual under Modularity.

- On the Islamic Bills & Collections Product

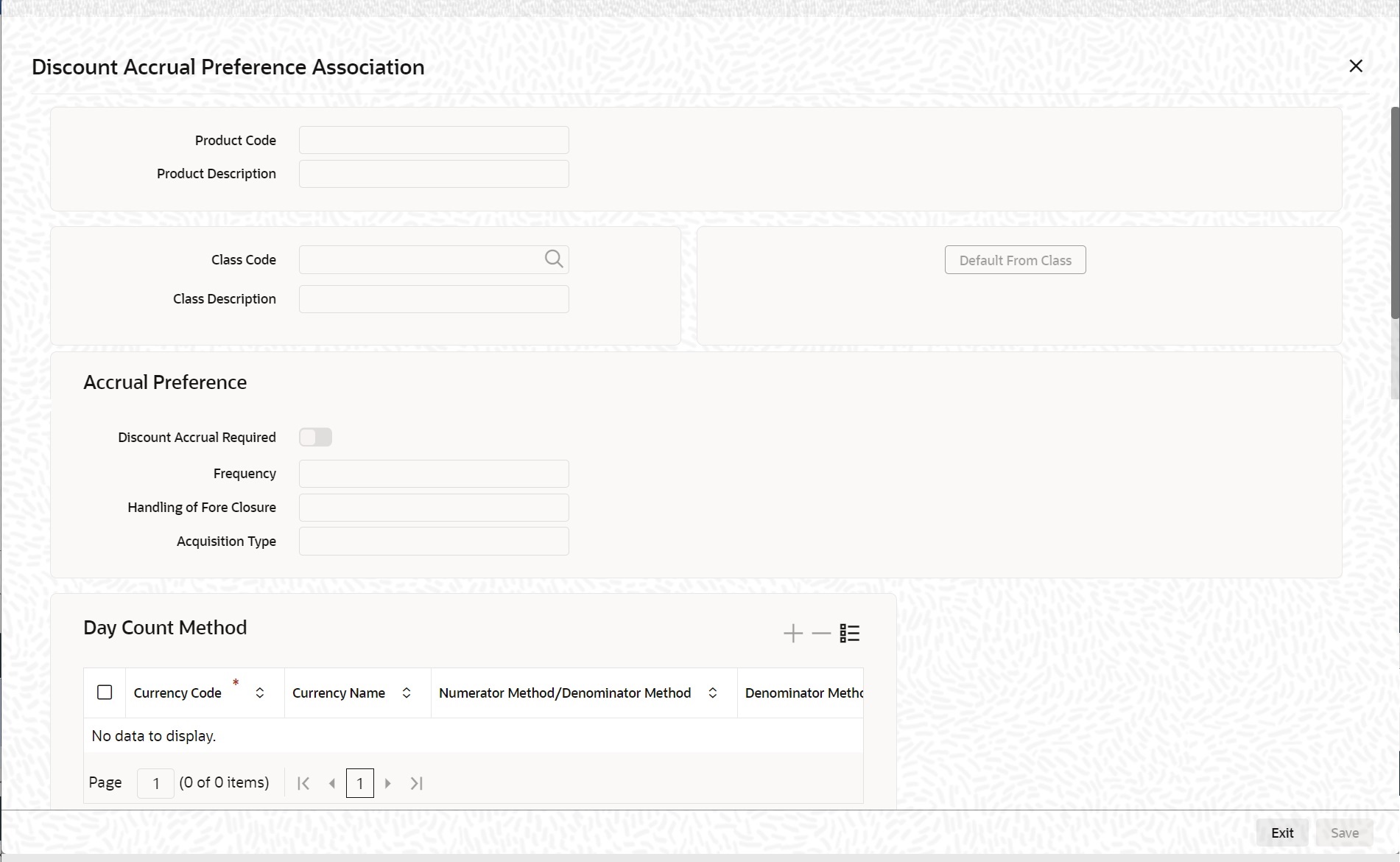

Definition, click Discount Accrual.The Discount Accrual Preference Association screen is displayed.

Figure 3-9 Discount Accrual Preference Association

For more information on discount accruals, refer to the chapter titled Defining Discount Accrual Classes in this manual.

- On the Islamic Bills & Collections Product

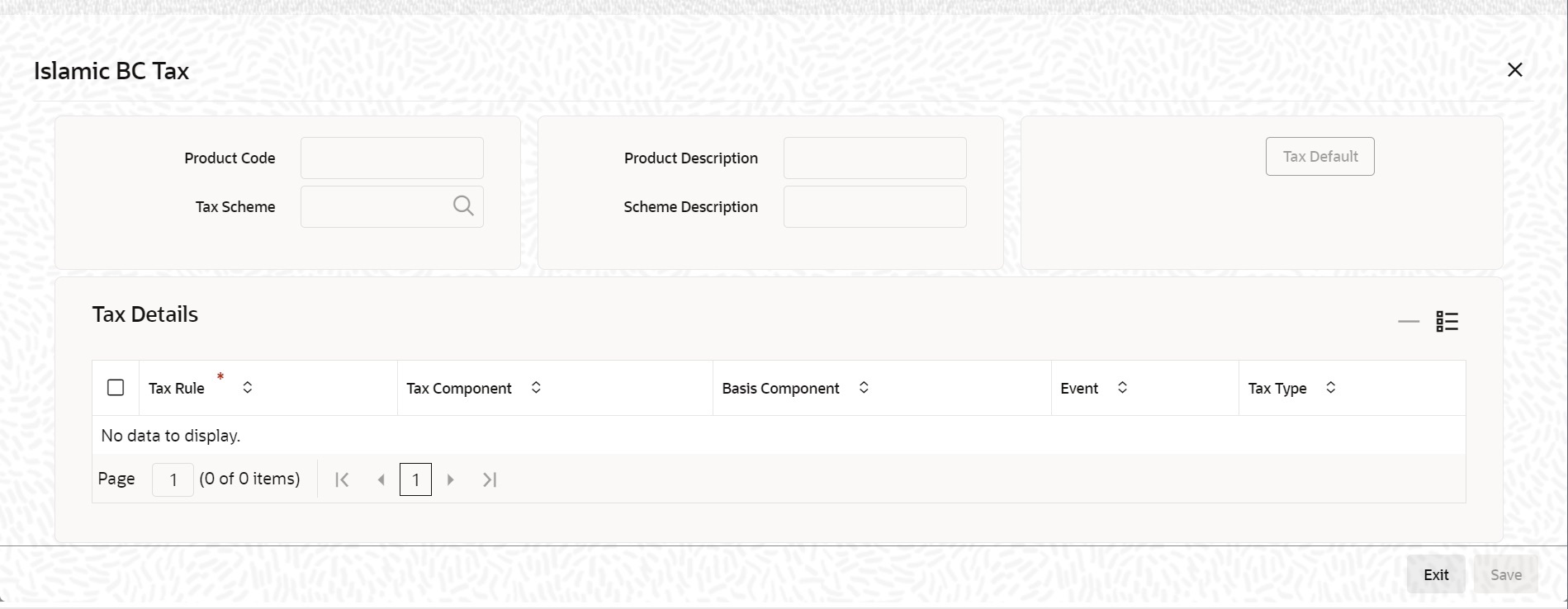

Definition, click Tax.The Islamic BC Tax screen is displayed.

- On Islamic BC Tax screen, indicate the tax schemes that

are applicable to the product you are creating and click

OK.For more information on specifying Tax details, refer Tax User Manual under Modularity.

- On the Islamic Bills & Collections Product

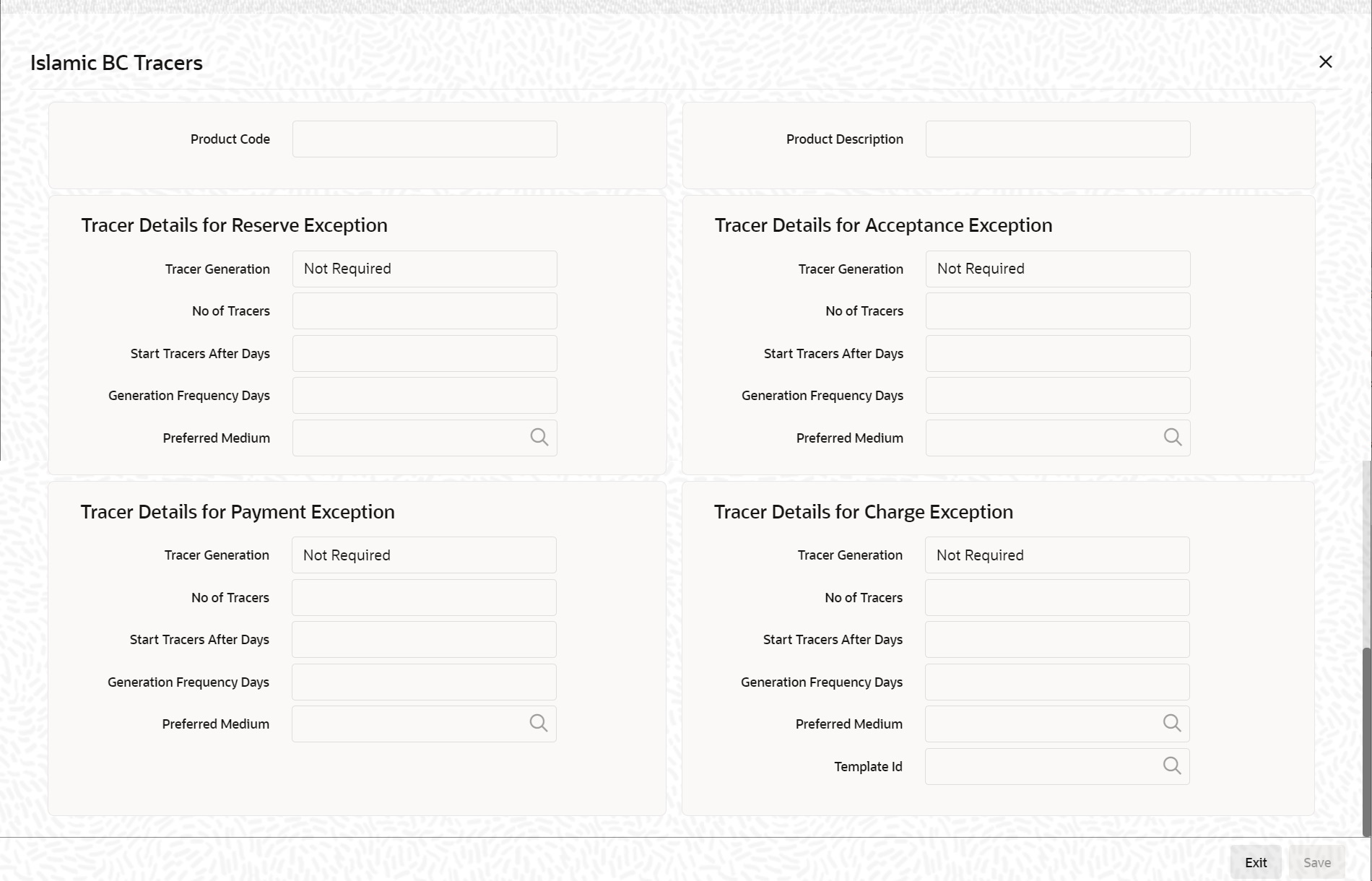

Definition, click Tracers.The Islamic BC Tracers screen is displayed.

For more information on specifying Tax details, refer Tax User Manual under Modularity.

Tracers are reminders, sent to various parties involved in a bill indicating that an exception that has occurred, while processing the bill.

In this screen, you can capture tracer details for the following exception events:- Payment Exception

- Acceptance Exception

- Charge Exception

- Reserve Exception

Reserve Exception – sent by negotiating bank (for bills under LC), if discrepancies are noted and negotiation is done under reserve (right of recourse). The tracers are for reminding resolution of the discrepancies and get stopped when the respective discrepancy is marked as resolved.

The details specified for the product involved in the bill will be defaulted to the contract. You can change the defaults to suit the requirements of the bill you are processing.

- On Islamic BC Tracers screen, specify the fields, and

then click OK.For more information on the fields, refer to the below Field Description table.

Table 3-10 Islamic BC Tracers

Field Description Tracer Generation You can indicate whether the exception tracer is applicable to the bill you are processing. You can select one of the following options: - Required - If you specify that a tracer is applicable to a bill, you should also specify the number of tracers that should be generated, for the exception

- Not Required - You can select this option to indicate that the exception tracer is not applicable, to the bill you are processing

- Till resolved - If you indicate that the tracer should be generated until the exception is resolved, you need not specify the number of tracers that should be sent. This is because the tracer will be generated at the frequency that you specify, until the exception is resolved.

No. of Tracers If you have indicated that the tracer is applicable, to the bill you are processing, you should also specify the maximum number of tracers that should be generated, for each of the exception events. By default, the first tracer for all authorized bills linked to this product, will be sent after the number of days that you prescribe, for the product. Start Tracer after Days Exception tracers can be generated, only after the maturity date of the bill. While creating a product, you have also indicated the number of days that should elapse after the Bill matures on which the first tracer should be generated. Generation Frequency Days You can specify the frequency (in days), with which the tracer should be sent to the concerned parties, involved in the bills linked to this product. Preferred Medium For each of the exception tracers that you specify, indicate the preferred medium through which the tracer should be generated to the concerned party. For a bill involving the product, you can change the medium that is defaulted. The medium you specify here is only the preferred medium, for the exception tracer. Template ID Specify the template related to MT799 or MT499 message types. The adjoining option list displays all the templates related to MT799 (if it is under LI) or MT499 (if it is not under LI) message types defined in the Swift FFT Template Screen Maintenance screen. You can choose the appropriate one. This field is mandatory if the Tracer Generation is indicated as Required and Preferred Medium as SWIFT. This Template id is used while generating Charge and Commission Tracer (CHG_COM_TRACER) in MT799/MT499 swift format as part of LQ EOD Batch if the ‘Preferred Medium’ is ‘SWIFT’.

For further details on Swift FFT Template Screen Maintenance screen, refer the section Maintaining SWIFT FFT Template in the Defining Free Format Messages chapter in the Messaging System User Manual.

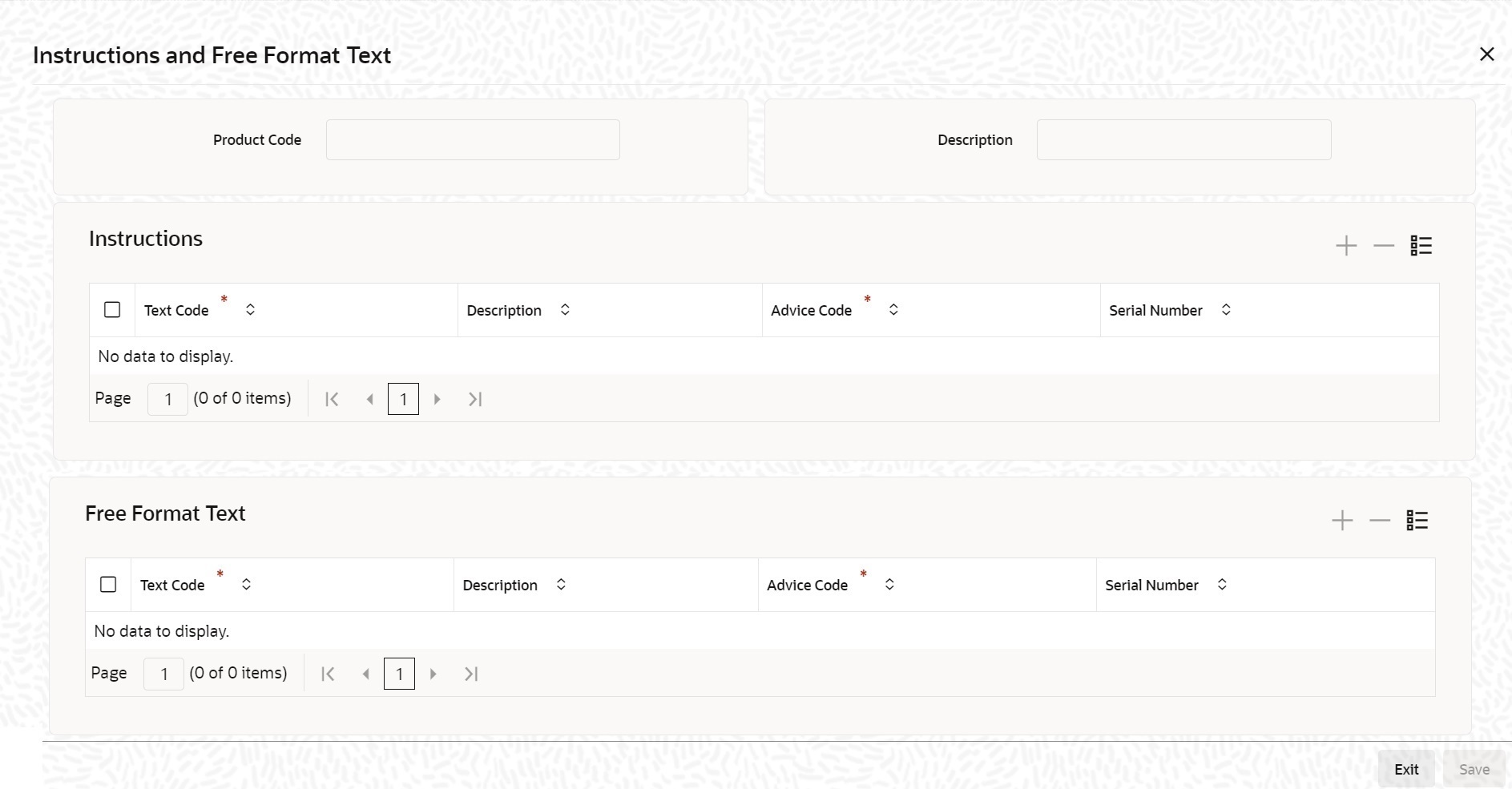

- On the Islamic Bills & Collections Product

Definition, click the Free Format Text

button.The Instructions and Free Format Text screen is displayed.

Figure 3-12 Instructions and Free Format Text

Description of "Figure 3-12 Instructions and Free Format Text"Free Format Texts (FFTs), Instructions applicable to the product you are creating can be defined here. These FFTs and Instructions can appear along with the advices that are generated, during the life-cycle of the Bills linked to this product.

- Specify the FFTs that are applicable, to the bills product you are

creatingA list of the standard FFTs that can accompany a bill is maintained in the Free Format Text Maintenance screen. You can select an FFT code from the predefined list of FFTs. The description associated with the FFT code you have selected will be displayed.

More than one of the predefined FFTs can be specified for the product you are creating. The FFTs, including the other details that you define for it will be defaulted to all bills involving this product.

While entering a bill contract involving this product, you can however, add to or delete from the defaulted list of FFTs.

- Specify whether the FFT should appear in the Advices Sent for the Bill.You have an option to specify whether the FFT or instruction is for the internal reference of the bank or should it appear on the advices generated, for the bills linked to the product.

If you do not specify an advice code for an FFT or instruction it is assumed that it is for the internal reference of the bank. If the FFT is to appear on the advices, you can specify the advice on which, the FFT or Instruction should be printed. Select an advice code from the list of the advices that you specified for the product, in the Advices screen.

After you have specified details for an FFT, click add icon to add it to the list of FFTs, for the product.

- Click Delete icon to delete a FFT from the screen.

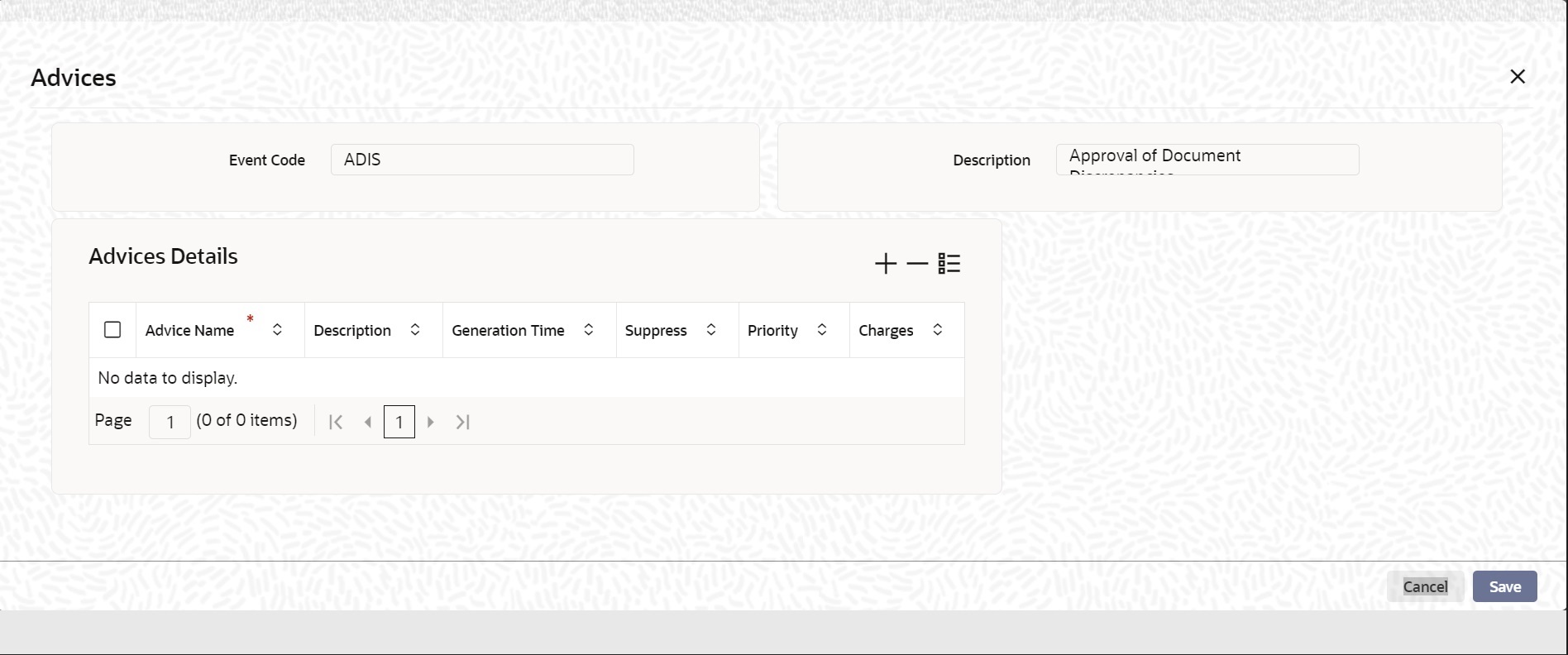

- Indicate whether advice processing charges need to be collected.Oracle Banking Trade Finance provides you with the facility to automatically debit customers of the charges you incur in sending them advices over different media types. When creating a product, you can set up these charges. However, when processing a contract, you can opt to waive these charges.At the time of saving a contract, the system displays the Product Event Advices Maintenance screen wherein you will be allowed to:

- Suppress an advice from being sent

- Change the Priority of the advice

- Indicate that charges have to be collected from the

receiving party.

If you indicate that the customer is the receiver of charges, the system automatically locates the relevant Receiver, Media and Country combination from the available Charge Maintenance Details records, and deducts the charge amount associated with the particular combination. The Charge amount is deducted from the customer account in the specified currency.

Note:

If you have not maintained a Charge Maintenance Details record for the particular customer, the system uses the wild card entry type record to deduct the charge amount.

- Specify Instructions Details.Through this screen, you can specify the instructions that are applicable to the Bills product you are creating. A list of the standard instructions that can accompany the bill is maintained in the Instructions Codes Maintenance screen. Select an Instruction code from the list of instructions maintained earlier.

More than one of the predefined Instructions can be made applicable to the product you are creating. The instructions, including the other details that you define for it, will be defaulted to all bill contracts, involving this product.

However, while entering a bill involving this product, you can add to or delete from the defaulted list of instructions.

- Specify if the Instruction should Appear in the Advices Sent for the

Bill.You have the option to specify whether the instruction is for the internal reference of your bank or should it appear on the advices generated for the bills linked to the product.

If you do not specify an advice code for an instruction it is treated as an internal instruction. If the Instruction is to appear on the advices, you can specify the advice on which, the Instruction should be printed. You can select an advice code from the list of the advices in the Advices screen.

After you have specified details, of the Instructions applicable to a product, click Add icon to add it to the list of instructions, for the product.

- Click the Delete icon to delete an instruction from the screen.

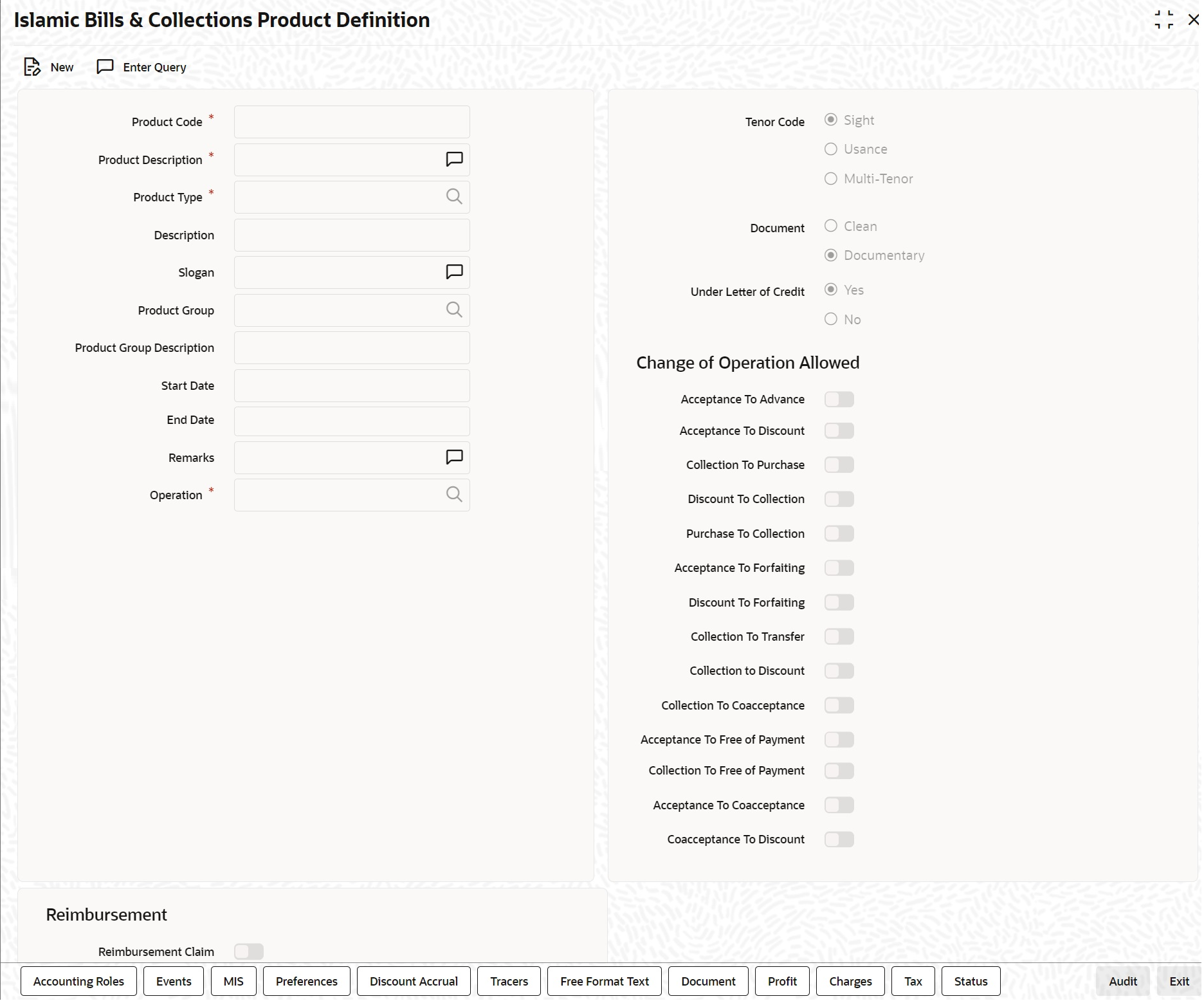

- On the Islamic Bills & Collections Product

Definition click the Document

button.The Islamic BC Documents screen is displayed.In addition to the Instructions and FFTs that you specify for a product, you can also specify the documents and clauses.

- Specify the documents applicable to the product you are creatingThe documents that can be associated with a bill are broadly classified into:

- Transport documents

- Insurance documents

- Invoices

- Other documents (includes packaging list, certificate of origin and so on).

There are certain standard documents that are required, under a documentary bill. You can specify the documents that are applicable to the bills that are linked to the product.

A list of the standard shipping documents that can accompany the bill is maintained in the Documents Maintenance screen. Along with these documents, you will also be provided with a predefined list of documents.

- Select a document code from the list of documents maintained earlier.You can specify more than one of the predefined documents, for the product you are creating. All the documents that you define for the product will be defaulted to all the bills involving this product. However, while entering a bill you can add to or delete, from the defaulted list of documents.The description and the document type associated, with the code you have selected will be displayed.

- Click Add icon to add it to the list of documents, applicable to the product.

- Click Delete icon to delete a document from the product.

- Specify the Clauses that should Accompany the Document.A clause is a statement that can accompany a document, sent under a bill. After indicating the documents applicable to a product, you can specify the related clauses that should accompany the document.

A list of the standard clauses that can accompany a document required under a bill is maintained in the ‘Clauses Maintenance’ screen.

- From the predefine list of clauses, select the clauses applicable. You can

attach more than one clause, to a document that you have specified, for a bills

product.By default, all the clauses including the number of copies that you specify for the product will be sent for all bills involving this product. However, while entering a bill, you can add to or delete, from the defaulted list of clauses.

- After you have specified details of the clause, click Add icon to add it to the list of clauses, for the document.

- Click the Delete icon to delete a clause from the screen.

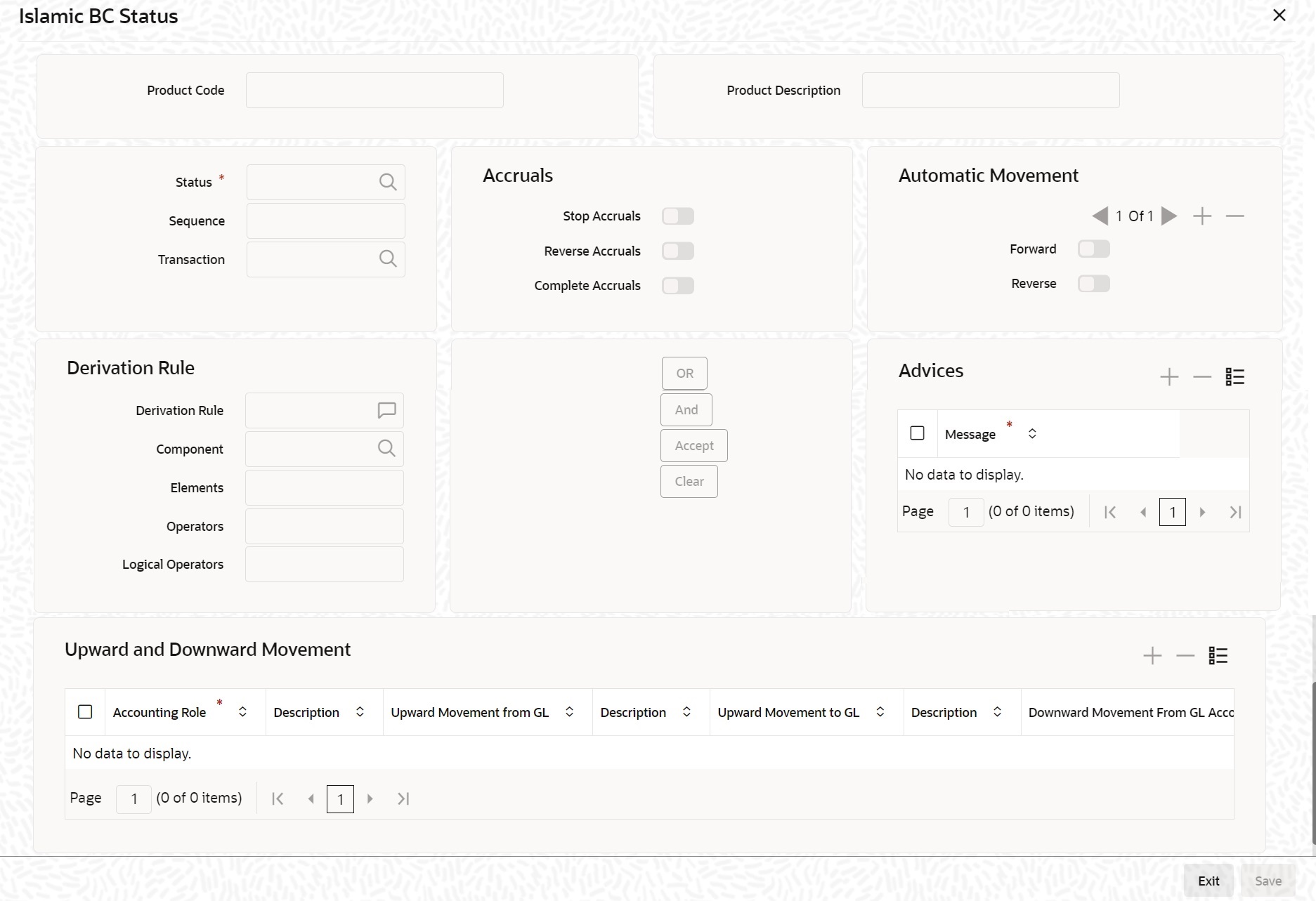

- On the Islamic Bills & Collections Product

Definition, click the Status

button.An Active status is automatically allotted to a bill on its initiation. However, a bill on which payment has not been made, on the due date can pass through more than one status.You can define attributes for each status through the User Defined Status Maintenance screen. These attributes are:

- The number of days for which a bill should stay in a particular status, after its repayment date has been reached

- Whether the GL under which it is reported should be changed when there is a status change

- The new GL under which it should be reported

The Islamic BC Status screen is displayed. - On IIslamic BC Status screen, specify the fields, and

then click OK.For more information on the fields, refer to the below Field Description table.

Table 3-11 Islamic BC Status - Field Description

Field Description Status This is the sequence in which, a bill should move to the status you are defining. Usually, more than one status is defined for a product. In this context, you should indicate the sequence in which a bill moves from status to status. You can also specify the number of days after a repayment falls due that a component has to be moved to the status you are defining.

In case of a component for which repayment is due; you can specify the number of days after the Maturity date, on which the component should be moved, to the status being defined.

This field is mandatory.

Transaction When the GL under which a component is reported is changed along with the status of a bill, an accounting entry is passed. This accounting entry will be to transfer the component from one GL to another. A Transaction Code is associated with every accounting entry in Oracle Banking Trade Finance. You should indicate the Transaction Code to be used for the GL transfer entries, involved in the status change.

Stop Accrual You can indicate that accruals (on all accruable components of the bill), should be stopped, when the bill moves to the status being defined. By doing so, you can ensure that your Receivable accounts, for profit and other components, are not updated for a bill on which repayment has been defaulted. Reverse Accrual You can indicate that the outstanding accruals (where a component has been accrued but not paid) on the bill should be reversed when it moves to the status that you are defining. If you specify so, the accrual entries passed on the bill, will be reversed when the status change is carried out. Note:

Future accruals should necessarily be stopped, if those done till the date of status change have to be reversed.Complete Accrual Check this option to complete accruals. - Indicate if Status Changes have to be carried out Automatically.A forward status change is one in which the status changes from one to the next. In our example, the movement from Active to PDO, PDO to NAB and NAB to Write Off are forward changes.

A reverse status change is one in which the status changes from present status to the previous. Such a situation arises when a payment is made on a bill with a status other than Active.

If you specify that forward changes have to be carried out automatically, the status of the bill will be changed, after the specified number of days. If not, you have to change the status of a bill through the bill processing function. Even if automatic status change has been specified for a product and therefore a bill involving it, you can manually change the status of a bill before the automatic change is due. You can do it through the, Contract On-line Details screen.

If a product has been specified with manual status change, then you cannot specify automatic status change for a bill involving the product.

If you specify, that reverse changes have to be carried out automatically, the status will be changed when a payment is made on a bill with a status, other than Active. If you specify that reverse changes should not be automatic, the status remains unchanged, even if a repayment is made on the bill. The status has to be changed by you through the, Contract Processing function.

A reverse change may also become necessary, when the number of days of default is increased for a product.

If you specify that forward changes or reverse changes have to be carried out automatically, the status changes will be carried out by the Automatic Contract Update function during BOD processing. This is done on the day the change falls due. If the day on which the forward or reverse status change is due happens to be a holiday, then, the processing would depend upon your specifications in the Branch Parameters screen.

If you have not specified that the forward or reverse changes should be carried out automatically, the status remains unchanged till you change it for a bill, through the Contract Processing function.

- Generate the Advices for a Status change.You can specify whether an advice has to be generated to inform the customer about the status change of the bill. You can also specify the kind of advices, to be generated.

You can generate advices, to notify the customer of the forward status change and possibly urge him to take action, to make the payments for liquidating the outstanding components.

You can specify the advice or message that you want sent to the customer, when a bill moves automatically (forward) into the status you are defining. These messages or advices are maintained by the messaging sub-system of Oracle Banking Trade Finance.

- Specify the Number of Days for a Status Change.The number of days after which, a component should be moved to a particular status can vary for each of the components of the bill.

The number of days is always counted as calendar days, from the maturity date specified for the bill. The following example illustrates how this concept works:

- Change the GL under which the Bill is Reported.You may have a GL structure under, which bills in the Active status are reported in on GL, while those with defaulted payments are in different GLs, depending on their status.For example, the GL structure for Discounted bills for 45 days could be as follows:

Table 3-12 GL Structure

Status GL Active 1001ASSF PDO 1001ASSF NAB 1110ASSC WO 1111ASSE For each component, you should indicate the GL to which it has to be moved, when there is a status change.

For principal, the GL will be changed, while for the other components, the receivable accounts will be moved to the new GL.

Specify the accounting role (asset, liability, contingent asset, etc), for the GL into which the bill has to be transferred, when its status changes.

Also specify the new GL (accounting head), under which the bill has to be reported. Select an option from the option list, which displays the description of the GL.

Parent topic: Characteristics for a Product