5.1.8 Loan Preference

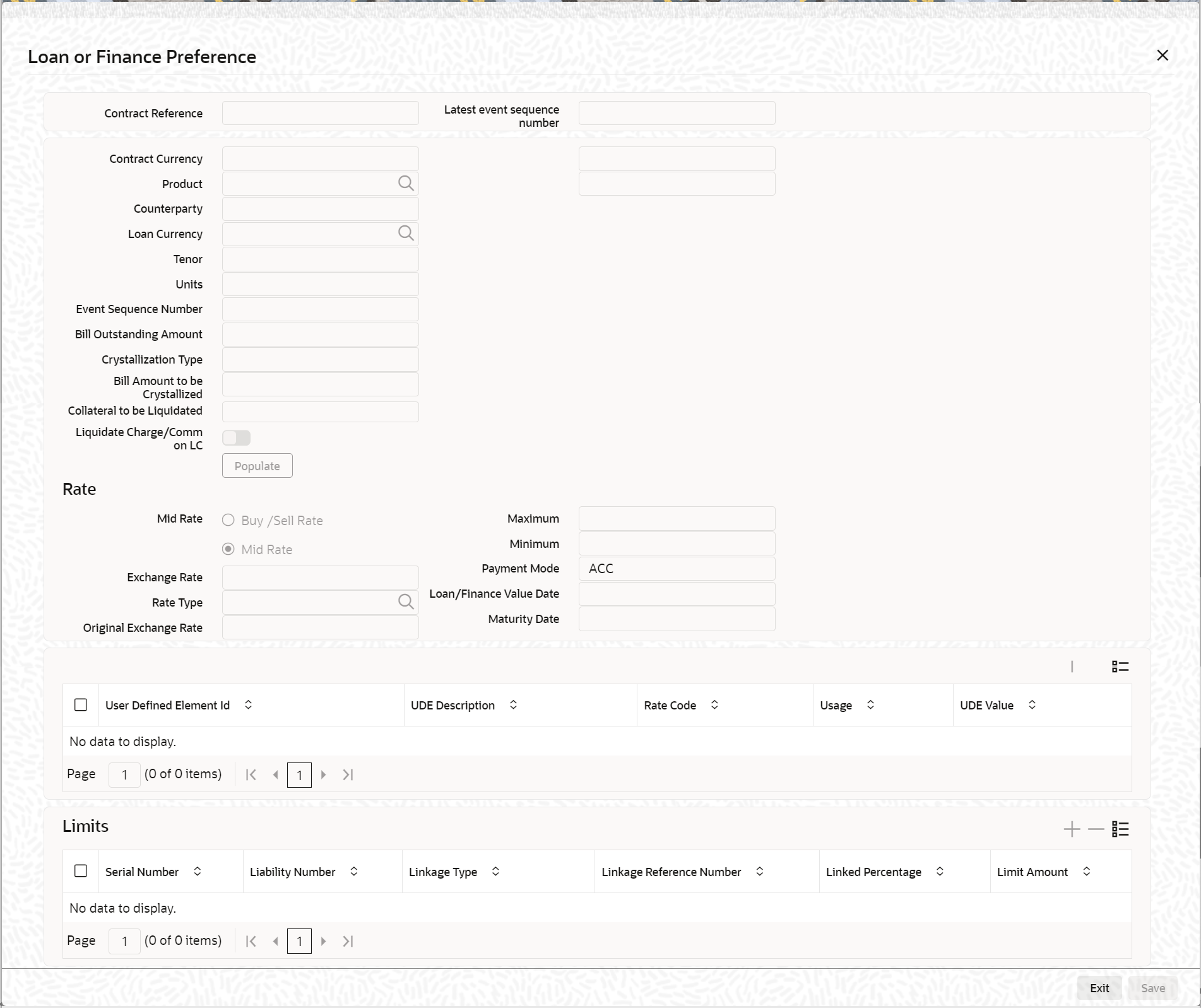

This topic provides the instructions to capture the Loan preference details.

Navigate to the Bills and Collection Contract Detailed screen.

- On the Bills and Collection Contract Detailed screen,

click Loan Preference.Loan or Finance Preference screen is displayed.

Note:

To recall, you have the option to create a loan from bills module. In case you opt for this option, the preferences you maintain in this screen will be used to create a loan during liquidation of bills.For information on fields, refer to the field description table below:Table 5-4 Loan Preference - Field Description

Field Description Contract Reference Number The system displays the contract reference number. Loan Currency The system will display the local currency of the Branch in which the loan is initiated. You cannot change this value. Tenor Here you need to indicate the tenor for each loan being maintained. The tenor is expressed in days. The minimum/maximum tenor specified in the loan product underlying the contract has to adhere. Exchange Rate Exchange rate will be the same as Original exchange rate, if the customer is not RP enabled. - During Import Bill liquidation, system should fetch RP Exchange Rate from FCUBS if Bill Counterparty is RP enabled.

- RP Exchange rate should be fetched on Subsystem pickup on visiting Loan Preference and will be defaulted in 'Exchange Rate'. User can modify the same if required. RP Exchange rate should be fetched on Save if user does not visit Loan preference. During authorization of Import Bill liquidation, loan amount is computed based on Exchange Rate available.

Rate Type The Rate Type indicates whether the rate applied for the conversion is the Buy rate, Mid Rate or the Sell Rate. Select the appropriate rate type from the options. Original Exchange Rate The base/actual exchange rate between the Contract currency and Collateral currency gets displayed here. Loan/Finance Value Date The system displays the debit value date. However, amend this field. For tracking the receivable from the current date, the system will create the loan one day before the debit value date and liquidate on the debit value date. In such cases, specify the loan value date as one day before the debit value date, so that, the system will create the loan (having one day as a tenor) as of that date and will mature on the debit value date.

Event Sequence Number The system displays the event sequence number. Units Specify the units in which the tenor is specified. While creating a loan from the bills module, the system defaults the interest rate and exchange rate specific to the customer. These rates are taken from the section Promotion Maintenance of the Customer Maintenance screen. In case the default rates are not available, the system defaults the standard mid-rate.

The system will calculate the penalty based on the loan creation date. That is, even if the value date is different from the loan creation date, the penalty will be calculated after the expiry of the penal start days counted from the date of creation of the loan. Manually change the number of penal value days to start applying the penalty from a different date. Example illustrates a bill with particulars; refer to Table 5-5 In this case, the system will calculate the penal interest from 30-Sep-2010. This date is derived by adding 30 penal start days to the loan creation date of 31-Aug-2010. Change the penal interest start date by manually changing the number of penal start days. That is, in the above case, set the penal start days as 24, and as a result, the effective date for the penalty is set to 24-Sep-2010.

Limits The following are limits entries. Serial Number Specify the serial number. Liability No Liability number will be defaulted from BC limits. Mutiple liabilities attached to that customer will be listed in the LOV. User can modify the same. Linkage Type The system displays the linkage type. Linkage Reference Number Select the linkage reference number from the option list. Linked Percentage Specify the linked percentage. Limit Amount The system displays the limit amount. Table 5-5 Example Instance

Particulars Value Bill Amount GBP 10000 Value Date 01-Aug-2010 Maturity Date 31-Aug-2010 Loan Creation Date/Liquidation Date 31-Aug-2010 Dr. Value Date 25-Aug-2010 Loan Value Date 25-Aug-2010 Penal Start Days 30 Days Table 5-6 Passed Account Entries

Event Code Dr/Cr Indicator Accounting Role Amount Tag DSBR Dr LOAN ASSET GL PRINCIPAL DSBR Cr BRIDGE GL PRINCIPAL Table 5-7 Bill Contract without Advance by Loan

Event Code Dr/Cr Indicator Accounting Role Amount Tag LIQD Dr BC CUSTOMER BILL_AMOUNT (or) BILL_AMT_EQUIV

LIQD Cr NOSTRO BILL_AMOUNT (or) BILL_AMT_EQUIV

Table 5-8 Bill Contract with Advance by Loan

Event Code Dr/Cr Indicator Accounting Role Amount Tag LIQD Dr BRIDGE GL BILL_LIQ_AMT (or) BILL_LIQ_AMTEQ

LIQD Cr NOSTRO BILL_LIQ_AMT (or) BILL_LIQ_AMTEQ

Parent topic: Additional Details