- Class User Guide

- Interest Class

- Define Interest Class

2.2.1 Define Interest Class

This topic provides the systematic instructions to define interest class.

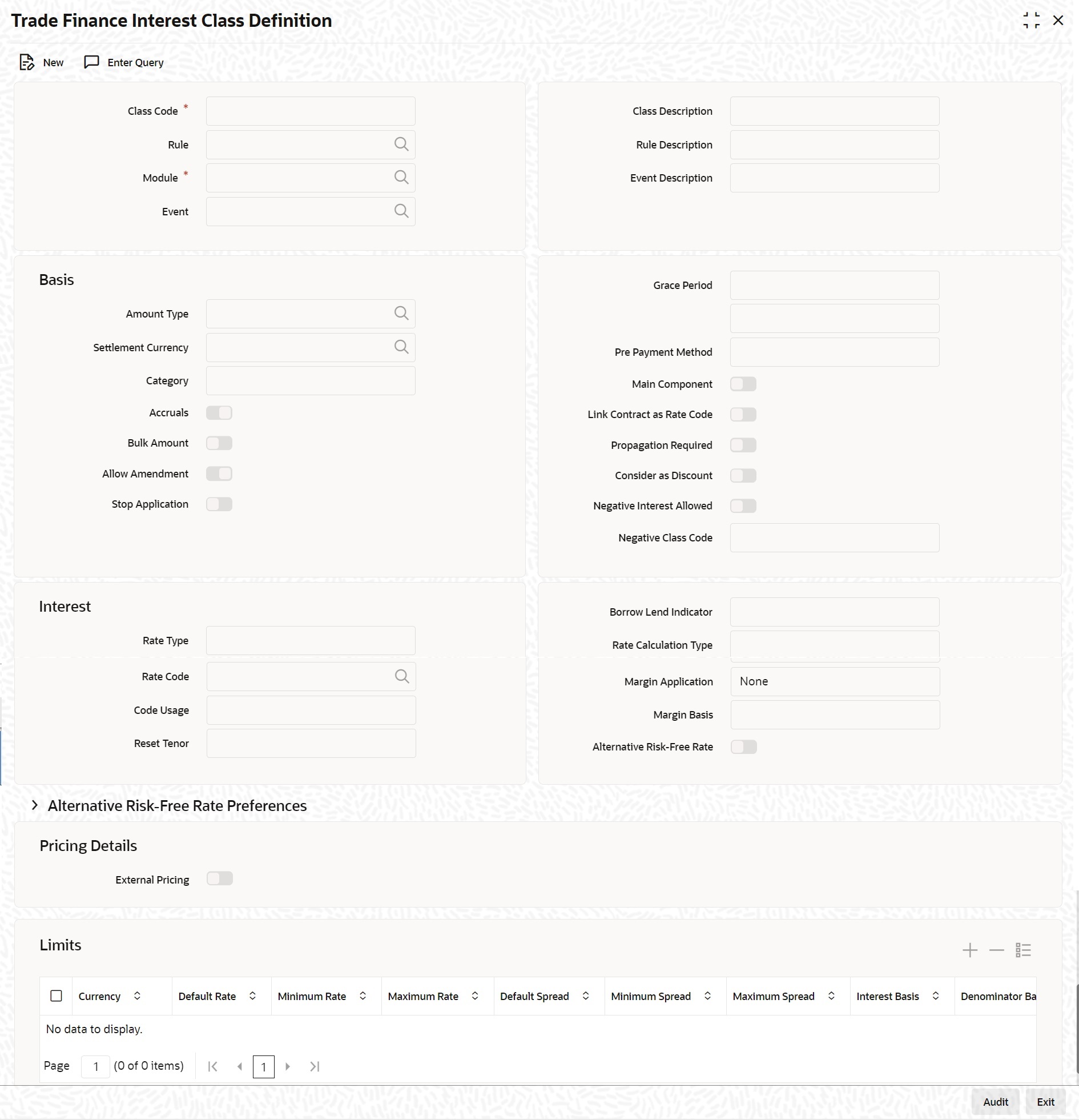

- On the Homepage, type ‘CFDTFINC’ in the text box, and click the next arrow.The Trade Finance Interest Class Definition screen is displayed:

- On Trade Finance Interest Class Definition screen, specify the fields.For information on fields, refer to Table 2-1:

Table 2-1 Trade Finance Interest Class Definition - Field Description

Field Description Class Code Specify a unique code to identify the class.

Class Description Specify a brief description for the class.

Rule Specify the rule that should be linked to the class. The adjoining option list displays all valid rules maintained in the system. You can choose the appropriate one.

Rule Description The system displays the description based on the rule chosen.

Event Specify the event at which collection of the interest should be triggered, The adjoining option list displays all events available in the system for the module specified. You can choose the appropriate one.

Module Specify the module to which the class should be applicable. The adjoining option list displays all module codes available in the system. You can choose the appropriate one.

Basis You can indicate the following details:

Amount Type If the interest rate type is Fixed or Floating, specify the basis amount on which the interest rate has to be applied. For example, for the FT module, it could be the Transfer amount, for the LC module, it could be the LC Contract Amount and so on.

Settlement Currency The Settlement Currency is the currency in which the interest amount will be calculated. The interest amount applicable for a contract will be calculated in this currency. The appropriate conversion rate (defined for the product as the applicable Rate Type) will be applied to carry out a conversion if the repayment account is in a different currency.

Category If the interest rate type is Fixed or Floating, specify the type of balance that has to be considered for interest application. It could be any one of the following:

- Expected

- Overdue

- Normal

- Outstanding

Accruals Check this box to indicate that accruals have to be carried out for the accruable components.

Bulk Amount When a contract gets rolled over, you may wish to split it into two contracts - one for the interest amount (I) and the other for the principal amount (P). If you want the floating rate pickup for both the new contracts (tenor/amount) to be based on P+I of the original contract, check this box.

Allow Amendment If you would like to allow amendment of the interest amount calculated by the system as per the charge rule, check this box.

Stop Application Check this box to indicate that collection should stop for the interest component.

Grace Period Specify the number of grace days, beyond the main interest due date, after which that interest component becomes applicable.

Pre Payment Method Select the method for actual prepayment penalty computation from the adjoining drop-down

list. The options available are:- Oracle Banking Trade Finance - This option is used where pre payment has to be applied on the deposit contract for contract elapsed days.

- Custom - If the Prepayment Method is Custom, then the prepayment penalty in this case will be the minimum of prepayment penalty and Gross interest on the premature withdrawal amount. The system computes the interest amount to be liquidated due to prepayment of principal. You will not be allowed to specify the interest amount during the Payment input in such a case.

Also, if you have chosen the prepayment method as Custom, you cannot prepay or manually liquidate either the interest or the principal component. This option is used where pre payment has to be applied on the deposit contract for contract remaining days.Note:

Here, the system does not include the Acquired interest for processing.

Main Component Check this box to indicate that the component should be treated as the main interest component.

Link Contract as Rate code Check this box to indicate that a fixed rate contract may be linked to the floating rate component, instead of a rate code.

Propagation Required Check this option to indicate that the charge collected from the borrower must be passed on to the participants of the contract.

Consider as Discount Check this box to indicate that the fee component should be considered as part of discount accrual.

Negative Interest Allowed Check this box to allow negative interest for interest class. You can check this box only if interest class is maintained for Money Market, Corporate Deposit or Bills and Collections module and ‘Main Component’ flag is checked.

If negative interest is allowed for an interest class, system will generate a negative interest component on saving the interest class. Negative Interest Class name is derived as Main Interest Class Code_N. If the length of main interest class code is more than 8, then the system truncates the interest class code to first eight characters and adds ‘_N’.

Negative Class Code The system displays the negative class code.

Interest Specify the following details:

Rate Type Indicate whether the interest is a Fixed Rate, a Floating Rate or a Special amount. If the Rate Type is a Floating Rate, you should also specify the Rate Code.

Rate Code Each Rate Code corresponds to a rate defined for a combination of Currency, Amount (if it is necessary) and an Effective Date. These details are maintained in the ‘Floating Rates Input’ screen. This rate will be applied to all contracts under products linked to the class.

Code Usage Specify the method in which the floating rates have to be applied. It could either be automatic application (meaning the rate has to be applied every time it changes), or periodic application (meaning the rate has to be applied at a regular frequency, defined for each contract involving the product linked to this class).

Reset Tenor Floating interest rates are defined for specific amount slabs and tenor combinations. If you are defining a floating interest component or a fixed type with rate code attached, you can indicate the reset tenor for which floating rates need to be picked up.

The tenor that you specify for the component is defaulted to all contracts with which the floating interest component is associated.

Borrow Lend Indicator Indicate the nature of the floating rate that needs to be picked up for the interest component. The options available are:

- Borrow

- Lend

- Mid

Rate Calculation Type For floating type of interest components and fixed type with rate code attached, you can indicate the manner in which floating rates should be applied. The preference that you specify here is used when an interest component does not fit into any direct parameter defined for the floating rate code. The options available are:

- Up – Choose this option to indicate that the rate of the upper tenor slab should be used.

- Down - Choose this option to indicate that the rate of the lower tenor slab should be used.

- Interpolate - Choose this option to indicate that the rate should be interpolated between the rates of the upper and lower slabs.

- Round Off - Choose this option to indicate that the tenor of the component should be rounded off to the nearest whole number. The rate defined for the derived tenor will be applied to the component.

Margin Application Indicate the frequency of margin application by choosing one of the following options from the drop-down list.

Margin Basis Indicate the basis for the interest margin and the method for applying the interest margin on

the selected interest component. The available options are:- Facility – The system defaults the margin from the borrower facility contract with which the drawdown is linked.

- Tranche – The system defaults the margin from the borrower tranche contract with which the drawdown is associated.

- Drawdown – If this option is chosen, you must enter the applicable margin when the interest rate is fixed.

- This component which you select is excluded from all the processing including liquidation and this calculation type is only used for margin application.

- After defining this component, booked formula for main interest component needs to be modified by replacing INTEREST_RATE with INTEREST_RATE + MARGIN_RATE. By doing this the interest gets calculated based on resolved interest rate (i.e. including floating rate and spread if applicable) and the margin.

- Customer – If this option is chosen, then the margin will be applicable to all drawdown contracts under the selected customer.

Limits Specify the following details:

Currency Specify the currency of interest rate application. The adjoining option list displays all valid currency codes maintained in the system. You can choose the appropriate one.

Default Rate Specify the default rate that should be applied for on contracts under the products linked to this class. Default rate allows negative values if the negative interest is allowed for the class.

Minimum Rate Specify the minimum interest rate that can be applied on contracts under the products linked to this class. Minimum rate allows negative values if the negative interest is allowed for the class.

Maximum Rate Specify the maximum interest rate that can be applied on contracts under the products linked to this class. Maximum rate allows negative values if the negative interest is allowed for the class.

Default Spread You are allowed to specify both positive and negative spread as default for the class you are maintaining. The system validates this spread against the maximum and minimum spread you have specified for the currency. Subsequently, the spread will be defaulted to the contract under the products linked to this class.

Minimum Spread Specify the minimum spread that can be applied on the rate for the currency.

Maximum Spread Specify the maximum spread that can be applied on the rate for the currency.

Denominator Basis This is applicable to the interest methods which have their interest basis set to ACTUAL i.e. 30(EURO)/ACTUAL, 30(US)/ACTUAL and ACTUAL/ACTUAL. Denominator Basis is used to specify how the month of February is treated when the denominator is 'Actual'.

There are two types of denominator basis methods:

- Per Interest Basis – Here the computation would be done based on ACT/ACT–ISMA Interest Method. In this case, the '366 Basis' field will not be applicable.

Basis 366 This is applicable only if the Denominator Basis is set to 'Per Annum'. You can select one of the following values here:

- Leap Year

- Leap Date – computation would be done based on ACT/ACT–FRF Interest Method.

Note:

In the ACT/ACT– ISMA Interest Method the Numerator would be Actual number of days between two interest dates. Denominator would be computed as the product of the number of times interest is to be received.

Number of Interest Period Specify the number of Interest period.

Pre Payment Spread Specify the Pre Payment Spread. This field is specific to Deposits. Based on the Pre Payment Method chosen at the product level, the penalty rate is derived.

Parent topic: Interest Class