2.4 Exceptions

This topic helps you quickly get acquainted with the Exceptions process.

As per regulatory requirement, all tasks are scrutinized for KYC, Compliance and Sanctions. The checks to external system/internal system is initiated after the Data Enrichment stage.

Exception - Amount Block

As part of amount block validation, application will check if sufficient balance is available in the account to create an amount block. On hand-off, system will debit the blocked account to the extent earmark and credit charges/ commission account in case of charges block or credit the amount in suspense account for earmarks created for collateral.

The transactions that have failed amount block due to non-availability of amount in respective account will reach the amount block exception stage.

Log in into OBTFPM application, amount block exception queue. Amount block validation failed tasks for trade transactions will be listed in the queue. Open the task to view summary of updated available fields with values.

On Approval, system should not release the Amount Block against each applicable account and system should handoff the “Amount Block Reference Number“ to the back office. On successful handoff, back office will make use of these “Amount Block Reference Number” to release the Amount Block done in the mid office ( OBTFPM) and should debit the CASA account from the Back office. If multiple accounts are applicable, Amount Block.

Exception is created when sufficient balance is not available for blocking the settlement account and the same can be addressed by the approver in the following ways:

- Settlement amount will be funded (outside of this process)

- Allow account to be overdrawn during hand-off

- Refer back to DE providing alternate settlement account to be used for block.

- Different collateral to be mapped or utilize lines in place of collateral.

Reject:

Reject the transaction due to non-availability of sufficient balance in settlement account

Amount Bock Exception

This section will display the amount block exception details.

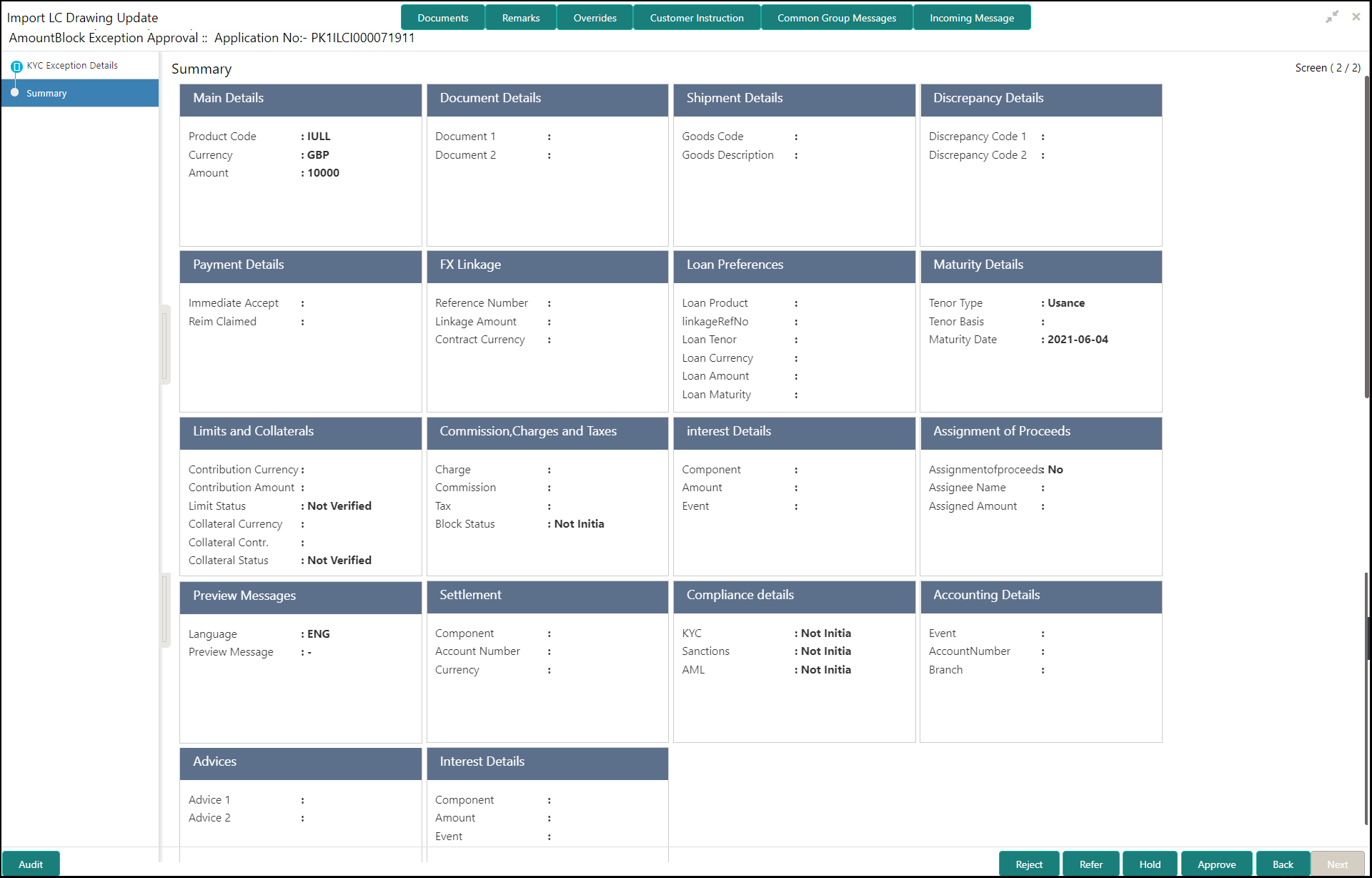

Summary

Description of the illustration amountblockexceptionsummary.png

- Main Details - User can view details about application details and LC details.

- Document Details - User can view document details.

- Shipment Details - User can view the shipment details.

- Discrepancy Details - User can view the discrepancy details of the drawing.

- Payment Details - User can view the payment details of the drawing.

- FX Linkage - User can view FX linkage details.

- Loan Preferences - User can view the loan preferences details.

- Maturity Details - User can view the maturity details.

- Limits and Collaterals - User can view limits and collateral details.

- Commission, Charges & Taxes - User can view the charge details.

- Assignment of Proceeds - User can view assignment of proceeds details.

- Preview Messages - User can preview the draft message generated if any.

- Settlement - User can view the settlement details.

- Compliance Details - User can view compliance details. The status must be verified for KYC and to be initiated for AML and Sanction Checks.

- Accounting Details - User can view the accounting entries

generated in back office.

Note:

When the Value Date is different from the Transaction Date for one or more accounting entries, system displays an Alert Message “Value Date is different from Transaction Date for one or more Accounting entries. - Advices - User can view the advices.

- Interest Details - User can view the interest details.

- Click Approve. to approve thw export booking amount bolck exception check.

For more information on Action Buttons, refer to the field description table below.

Table 2-37 Amount Bock Exception - Action Buttons - Field Description

| Field | Description |

|---|---|

| Documents | View/Upload the required document. |

| Remarks | Specify any additional information regarding the

drawing update. This information can be viewed by other users

processing the request.

Content from Remarks field should be handed off to Remarks field in Backend application. |

| Overrides | Click to view the overrides accepted by the user. |

| Customer Instruction | Click to view/ input the following

|

| Common Group Message | Click Common Group Message button, to send MT799 and MT999 messages from within the task. |

| Incoming Message | Displays the incoming message, if any. |

| Signatures | Click the Signature button to verify the signature of

the customer/ bank if required.

The user can view the Customer Number and Name of the signatory, Signature image and the applicable operation instructions if any available in the back-office system. If more than one signature is required, system should display all the signatures. |

| Hold | The details provided will be saved and status will be

on hold.User must update the remarks on the reason for holding the

task.

This option is used, if there are any pending information yet to be received from applicant. |

| Reject | On click of Reject, user must select a Reject Reason

from a list displayed by the system.

Reject Codes are:

Select a Reject code and give a Reject Description. |

| Refer | Select a Refer Reason from the values displayed by

the system.

User can refer the task back to the Data Enrichment user.User must select a Refer Reason from the values displayed by the system. Refer Codes Refer Codes are:

|

| Approve | On approve, application must validate for all mandatory field values, and task must move to the next logical stage. |

| Back | Task moves to previous logical step. |

Exception - Know Your Customer (KYC)

- Log in into OBTFPM application, KYC exception queue. KYC exception failed tasks for Trade Finance transactions will be listed in your queue.

- Open the task, to see summary tiles that display a summary of

available updated fields with values.

User can pick up a transaction and do the following actions:

Approve- After changing the KYC status in the back end application (outside this process).

- Without changing the KYC status in the back end application.

- Reject (with appropriate reject reason).

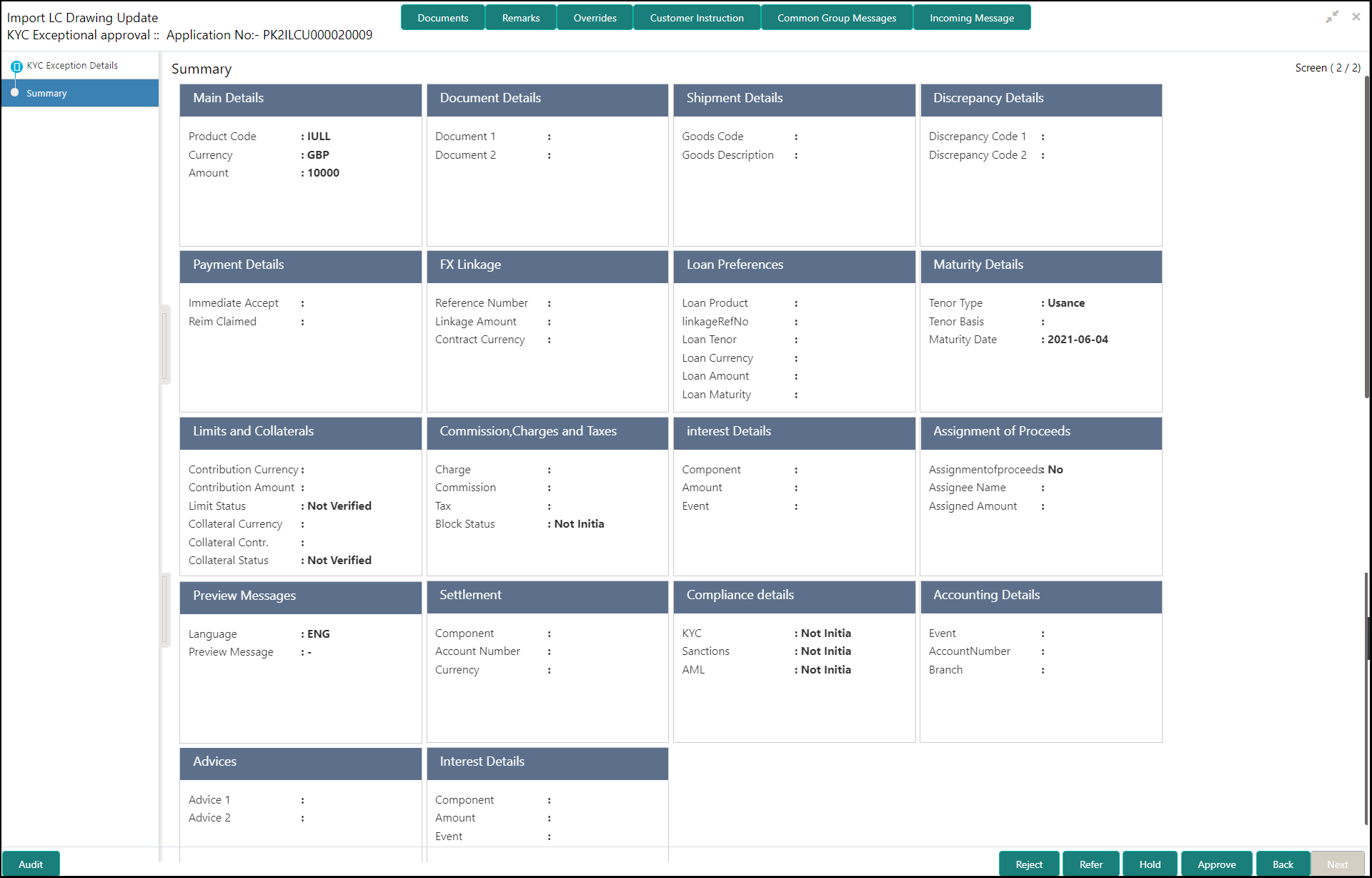

Figure 2-29 Exception - Know Your

Customer (KYC) Summary

Description of the illustration kycexceptionsummary.png

- Main Details - User can view details about application details and LC details.

- Document Details - User can view document details.

- Shipment Details - User can view the shipment details.

- Discrepancy Details - User can view the discrepancy details of the drawing.

- Payment Details - User can view the payment details of the drawing.

- FX Linkage - User can view FX linkage details.

- Loan Preferences - User can view the loan preferences details.

- Maturity Details - User can view the maturity details.

- Limits and Collaterals - User can view limits and collateral details.

- Commission, Charges & Taxes - User can view the charge details.

- Assignment of Proceeds - User can view assignment of proceeds details.

- Preview Messages - User can preview the draft message generated if any.

- Settlement - User can view the settlement details.

- Compliance Details - User can view compliance details. The status must be verified for KYC and to be initiated for AML and Sanction Checks.

- Accounting Details - User can view the accounting entries generated

in back office.

Note:

When the Value Date is different from the Transaction Date for one or more accounting entries, system displays an Alert Message “Value Date is different from Transaction Date for one or more Accounting entries. - Advices - User can view the advices.

- Interest Details - User can view the interest details.

For more information on Action Buttons, refer to the field description table below.

Table 2-38 Exception - Know Your Customer (KYC) Summary - Action Buttons - Field Description

| Field | Description |

|---|---|

| Documents | View/Upload the required document. |

| Remarks | Specify any additional information

regarding the drawing update. This information can be viewed by

other users processing the request.

Content from Remarks field should be handed off to Remarks field in Backend application. |

| Overrides | Click to view the overrides accepted by the user. |

| Customer Instructions | Click to view/ input the following

|

| Incoming Message | Displays the incoming message, if any. |

| Signatures | Click the Signature button to verify the signature of

the customer/ bank if required.

The user can view the Customer Number and Name of the signatory, Signature image and the applicable operation instructions if any available in the back-office system. If more than one signature is required, system should display all the signatures. |

| Reject | On click of Reject, user must select a Reject Reason

from a list displayed by the system.

Reject Codes are:

Select a Reject code and give a Reject Description. |

| Refer | Select a Refer Reason from the values displayed by

the system.

Refer Codes are:

|

| Hold | The details provided will be saved and status will be

on hold. User must update the remarks on the reason for holding the

task.

This option is used, if there are any pending information yet to be received from applicant. |

| Approve | On approve, application must validate for all mandatory field values, and task must move to the next logical stage. If there are more approvers, task will move to the next approver for approval. If there are no more approvers, the transaction is handed off to the back end system for posting. |

| Back | Task moves to previous logical step. |

Parent topic: Import LC Update Drawings - Islamic