2.7.1.3 Product Preference

This topic describes about configuring various loan account specific preferences applicable for the accounts created under this product.

This topic describes about configuring various loan account preferences applicable for the accounts created under this product and these preferences control the account's behavior throughout its life cycle. Preference related to Term, Amount and Currencies and lifecycle events like disbursement, repayment, closure etc are configured in this section. The sections following, go into greater detail on the preferences, intended functionality, and related parameters.

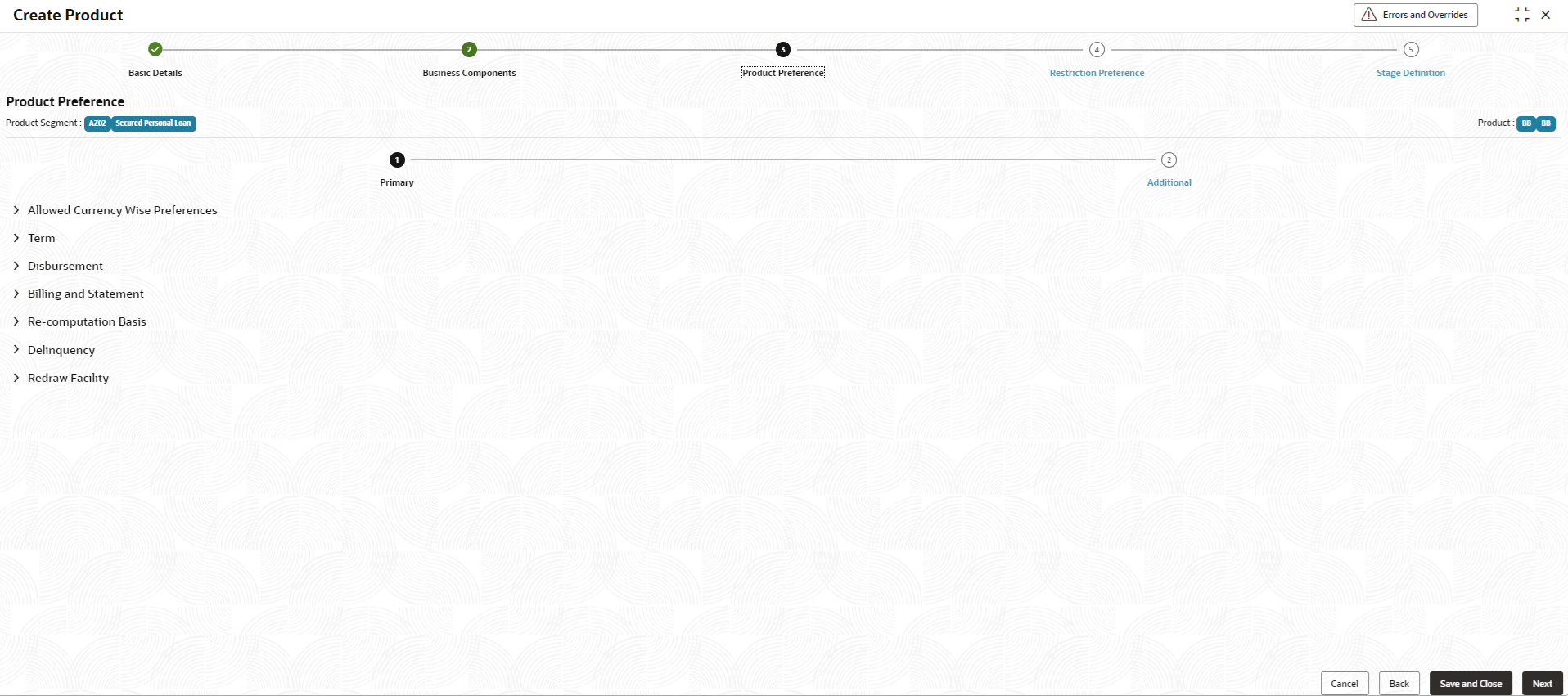

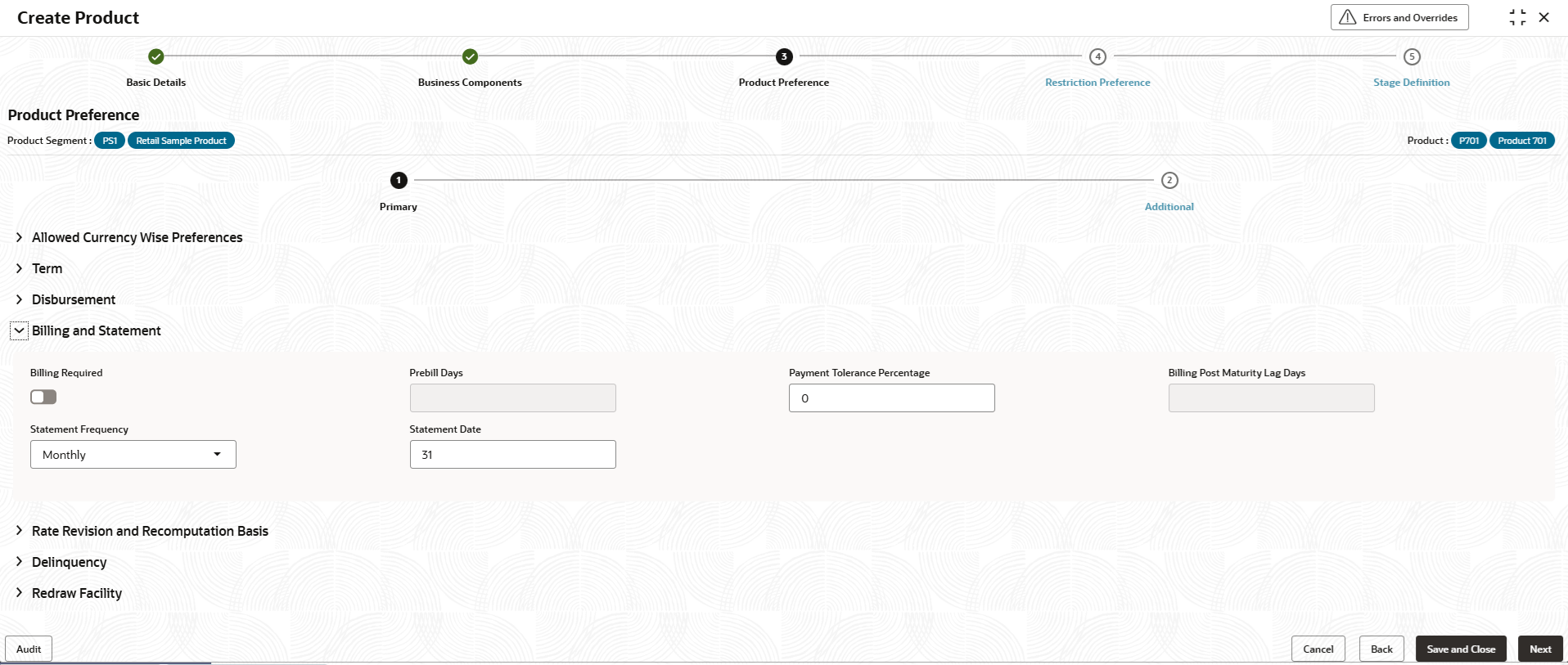

- Click Next in the Business Components screen to add the preferences.The Contract Preferences - Primary screen displays.

Figure 2-37 Contract Preferences - Primary

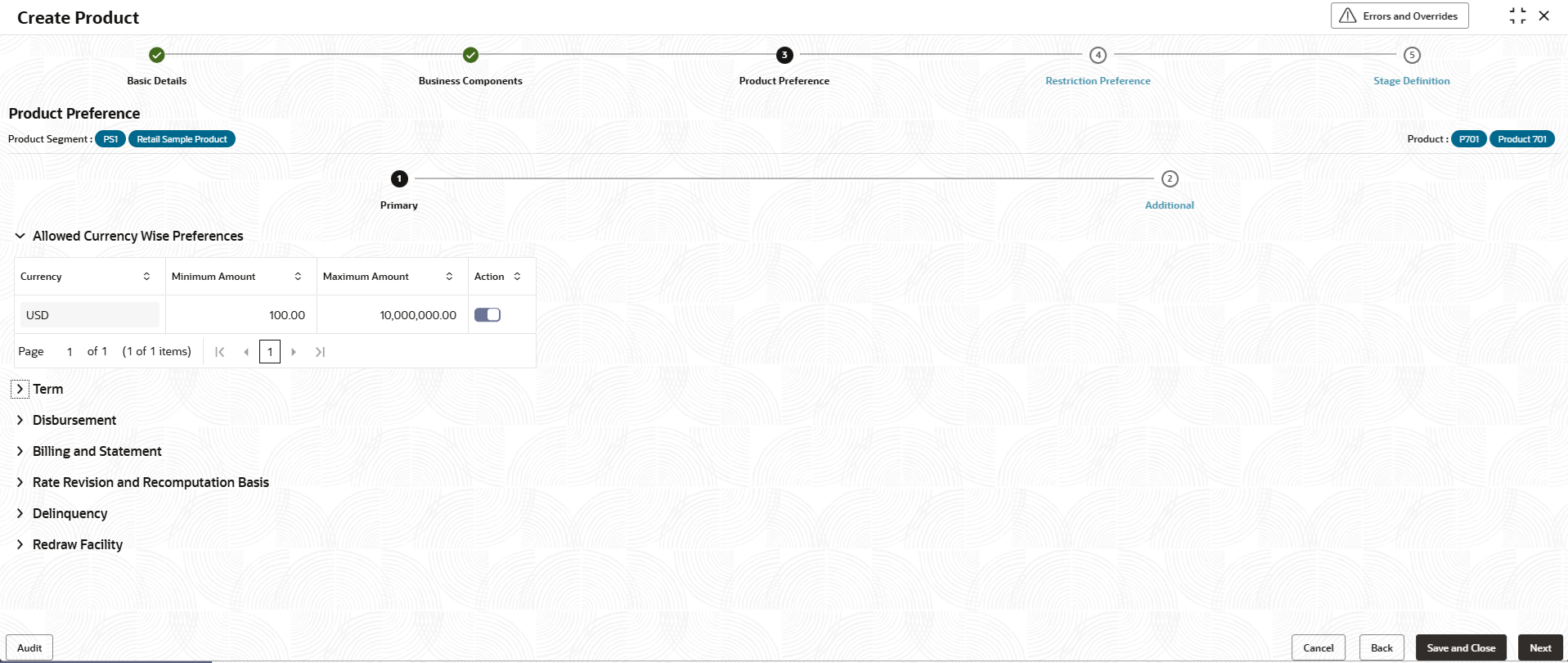

Allowed Currency Wise Preference

- Specify the fields on Contract Preferences - Primary screen.

This section describes the list of allowed currencies under which loan accounts of this product can be opened. Currencies defined in Product segment are defaulted and enabled here. They can disabled by toggling the Action button.

On loan account onboarding validation is done to ensure the loan amount lies within the range of minimum amount and maximum amount.

For more information on fields, refer to the field description table.Figure 2-38 Allowed Currency Wise Preference

Table 2-37 Allowed Currency Wise Preference - Field Description

Field Description Currency Displays the currency selected for a loan account. Minimum Amount Displays the minimum amount in the specified currency for a loan account opened under the product. User can modify the same.

Maximum Amount Displays the maximum amount in the specified currency for the loan account opened under the product. User can modify the same.

Action By default, this option is enabled. Indicates if the allowed currency wise preference is enabled or not. Note: Enabling at least one currency row is required.

For more information on fields, refer to the field description table.

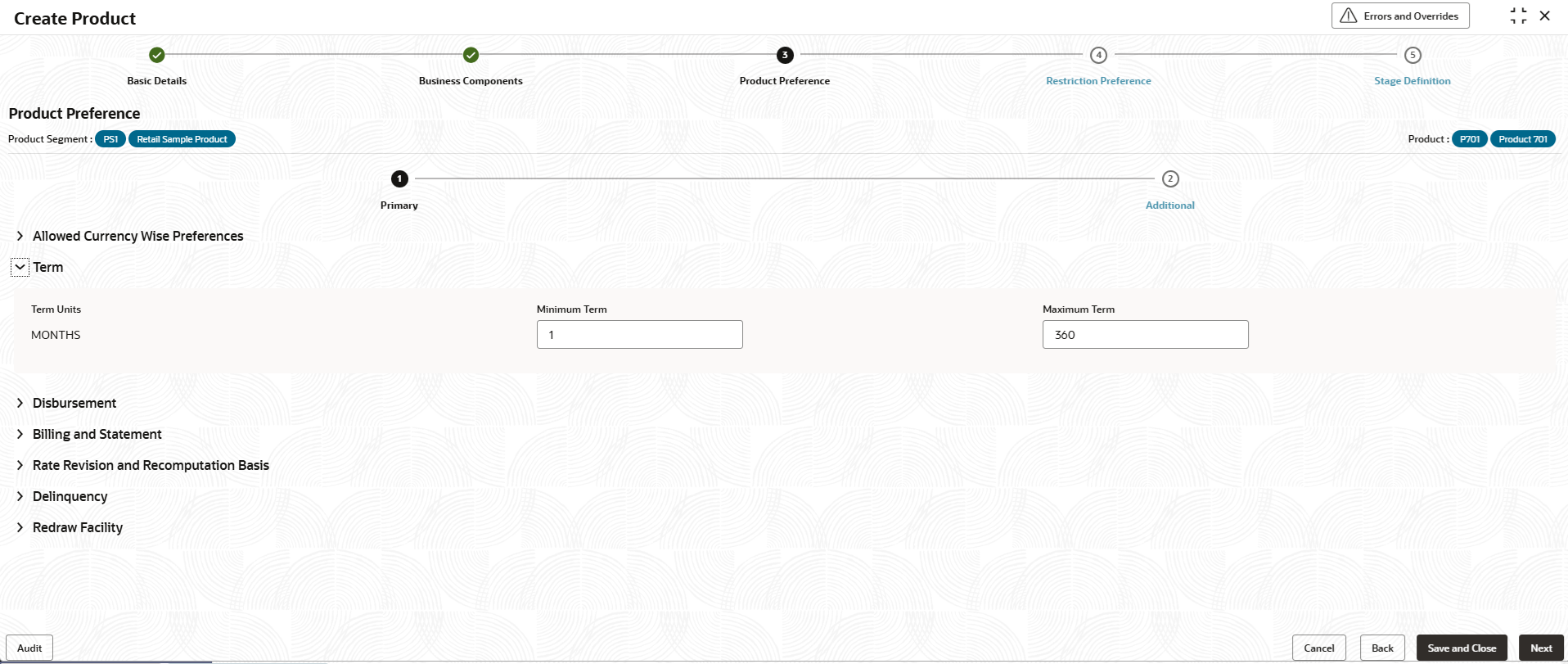

Table 2-38 Term - Field Description

Field Description Term Units Displays the term units as selected in product segment → prefernces → term → term units. Minimum Term Specify the minimum term for a account opened under the product. Maximum Term Specify the maximum term for a account opened under the product. For more information on fields, refer to the field description table.

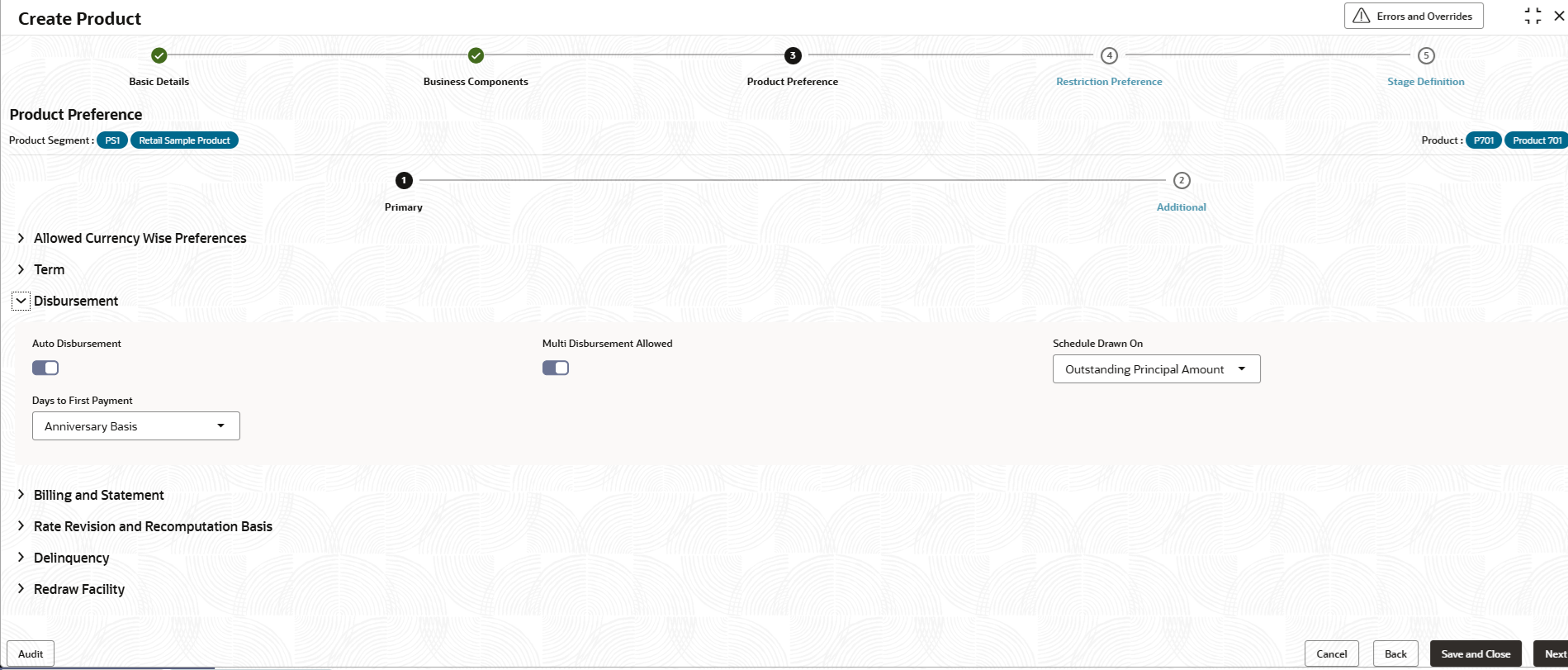

Table 2-39 Disbursement - Field Description

Field Description Auto Disbursement Indicates if auto disbursement is enabled or not. The toggle is enabled by default but will be allowed to disable.

Multi Disbursement Allowed Indicates if multiple disbursement is enabled or not. The toggle is enabled by default but will be allowed to disable.

Schedule Drawn On Select the schedule drawn from the drop-down list. The available options are: - Sanction Amount

- Outstanding Principal Amount

If schedule is drawn on Sanction Amount, installment amount is computed on sanctioned amount and schedule is drawn for the same installment amount. If schedule is drawn on Outstanding Principal amount, installment amount is computed on outstanding principal at the time of disbursement and schedule is re-computed on every disbursement

The allowed values are defined by the lookup type SCHEDULE_DRAWN_ON.

Days to First Payment This field is to specify the number of days post first disbursement, when the first payment will become due on the loan account. For example, if a loan account is disbursed on 10-Jan and Days to First payment is say 45 days, then first payment due date is derived as 24-Feb. Subsequent payment dates of loan are derived by adding the frequency of installment payment to the first due date derived.

The allowed values are:- Anniversary

- 30

- 45

- 60

- 90

The allowed values are defined by the lookup type DAYS_FIRST_PAYMENT.

For more information on fields, refer to the field description table.

Table 2-40 Billing and Statement - Field Description

Field Description Billing Required This field indicates if loan billing notice to be generated or not. The toggle is disabled by default and can be modified to enable.

Prebill Days Specify the number of days before the schedule due date for generating the billing notice. Input in this field is required if Billing Required is enabled. Payment Tolerance Percentage Specify the tolerange percentage for the payment. Note: This field is for future use.

Billing Post Maturity Lag Days Specify the number of days after maturity date, when loan billing notice will be sent to the customer, after every lag days is crossed, if the loan account is not fully settled. Input in this field is required if Billing Required is enabled. For example if this field is maintained as 15 days and 10-Jan is the maturity date, then Post maturity bill will be sent every 15 days on 25-Jan, 09-Feb, 24-Feb and so on until the loan is fully repaid.

Statement Frequency Select the frequency from the drop-down list, when the loan account statement needs to be generated. The allowed values are defined by the lookup type STMT_FREQ.

Start Month Specify the month on which statement generation will begin. This field is required if statement frequency is greater than Monthly. Valid values are Jan, Feb, Mar etc. If frequency is Quarterly and Start month is Feb, then statement will be generated every Feb, May, Aug and Nov.

The allowed values are defined by the lookup type MONTH.

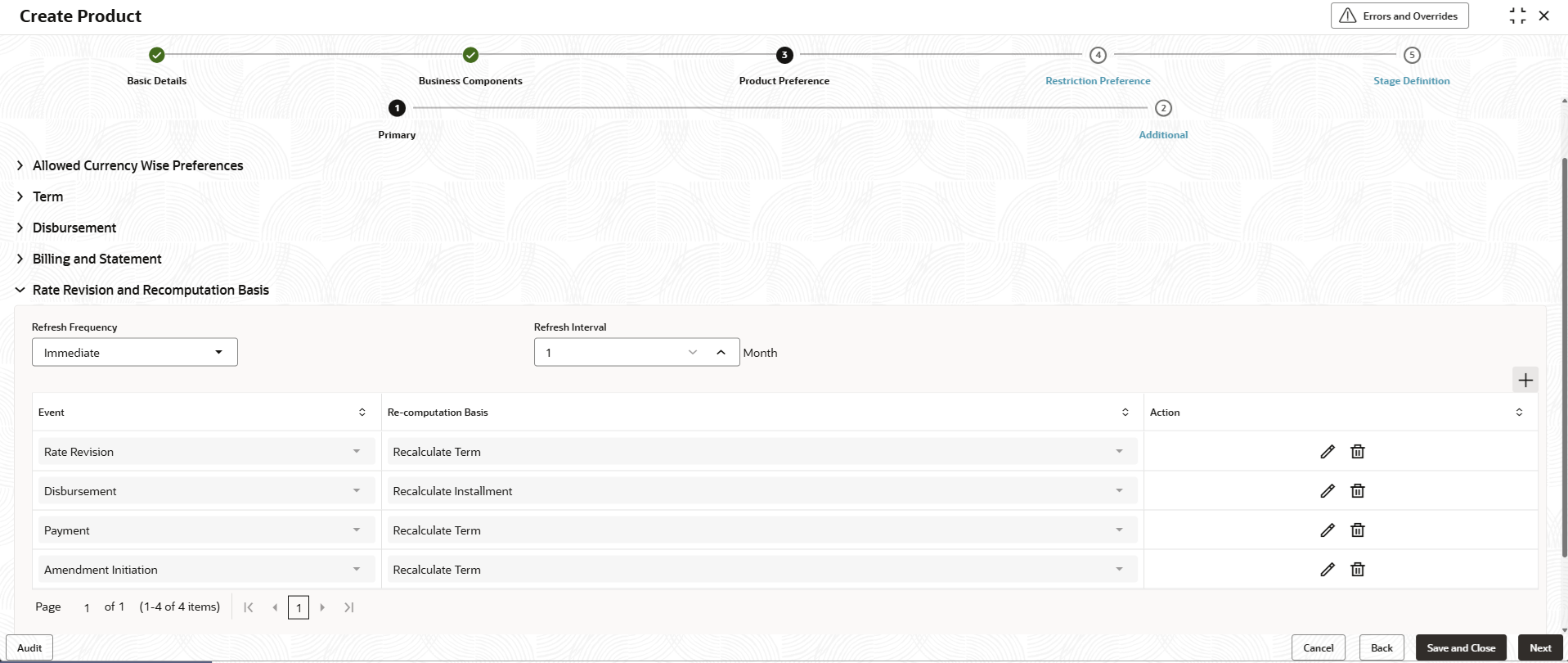

Statement Date Specify the date when the statement is to be generated as per the statement frequency. If statement frequency is Quarterly and Start Month is Feb and Statement Date is 5, then statement will be generated on 5-Feb, 5-May, 5-Aug and 5-Nov. Figure 2-42 Rate Revision and Re-computation Basis

Description of the illustration product-preference-rate-revision-and-computation-basis.pngFor more information on fields, refer to the field description table.

Table 2-41 Re-computation Basis - Field Description

Field Description Refresh Frequency This field refers to the frequency at which the rate changes at rate code/price code level to be propagated to loan account. This field is applicable when Interest Pricing level, Rate Application is selected as Floating for interest component. Select the frequency from the drop-down list. The available options are: - Immediate

- Every Due Date

- Every Bill Generation Date

- Every N months

The allowed values are defined by the lookup type RATE_REFRESH_FREQUENCY.

Refresh Interval Specify the refresh interval. This field refers to refresh period when rate revision is to be triggered if Refresh frequency is Every N months. Specify the refresh interval in months. Allowed value can be from 1 – 12 months. Event Select the event from the drop-down list. The available options are: - Disbursement

- Payment

- Amendment Initiation

- Rate Revision

The allowed values are defined by the lookup type PRODUCT_EVENTS_RECOMPBASIS.

Re-computation Basis Select the recoputation basis from the drop-down list. The available options are: - Recalculate Term - The installment amount remains same as before the operation and term is recomputed.

- Recalculate Installment - The term remains the same as before and Installment amount is recomputed.

- Balloon Payment - Neither the term nor the installment is changed, anything excess will be adjusted in maturity schedule or schedules with zero dues are drawn.

The allowed values are defined by the lookup type RECOMPUTE_BASIS.

For more information on fields, refer to the field description table.

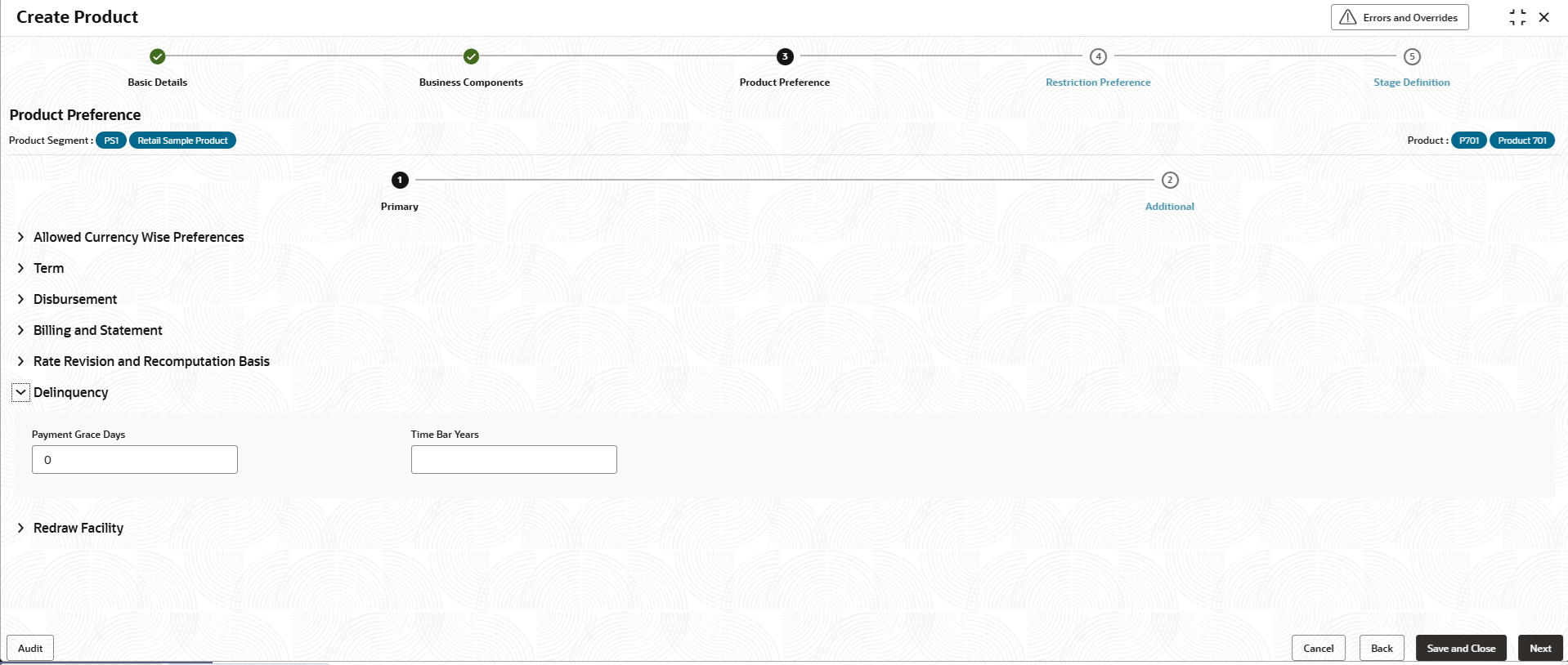

Table 2-42 Delinquency - Field Description

Field Description Payment Grace Days Specify the number grace days to be provided for payment of dues after the installment has become due. Account does not become delinquent if payment is done with in the grace days. For example, if due date is 10-Jan-2024 and grace days is 3 days, if payment due is cleared on or before 13-Jan-2024, then the account does not become delinquent.

Time Bar Years Specify the time bar. For more information on fields, refer to the field description table.

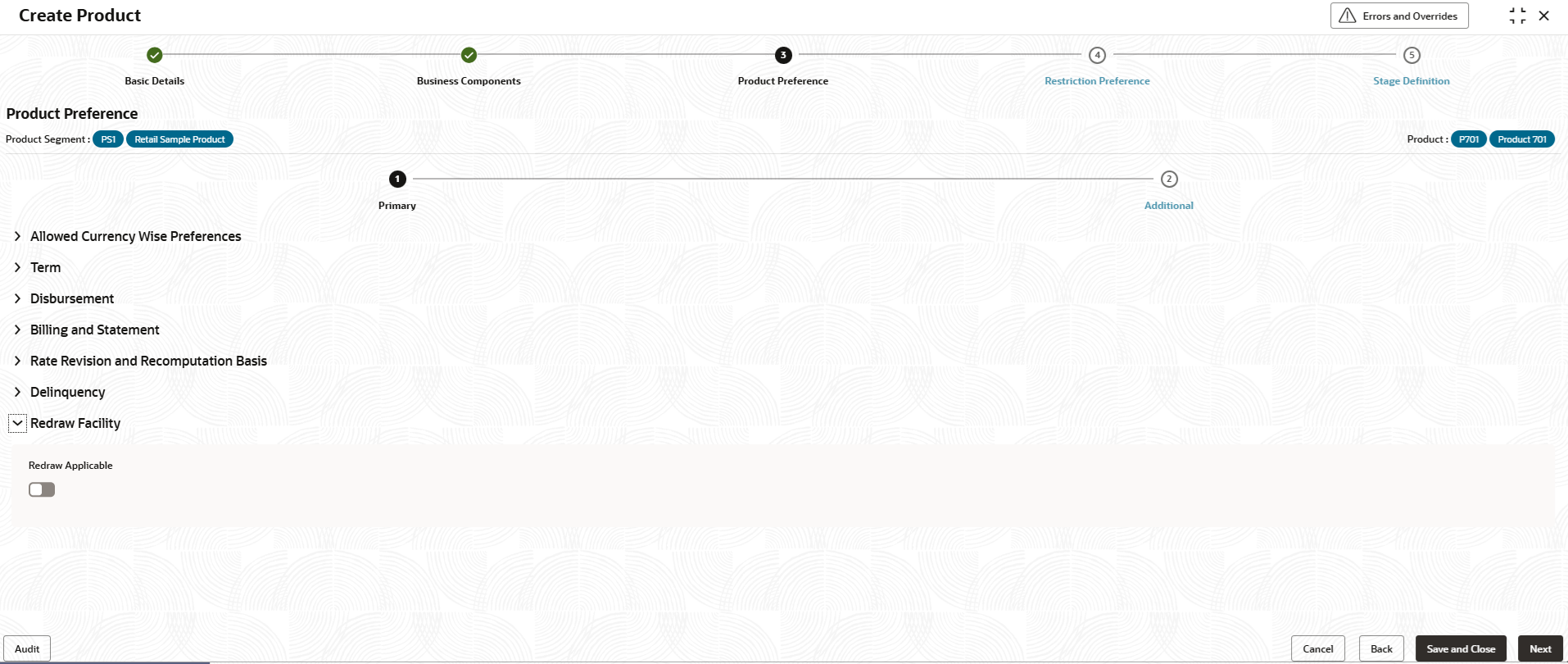

Table 2-43 Redraw Facility - Field Description

Field Description Redraw Applicable This feature allows to refund the excess amount paid by customer. Click the toggle status to enable this feature. - On Product Preference screen, click

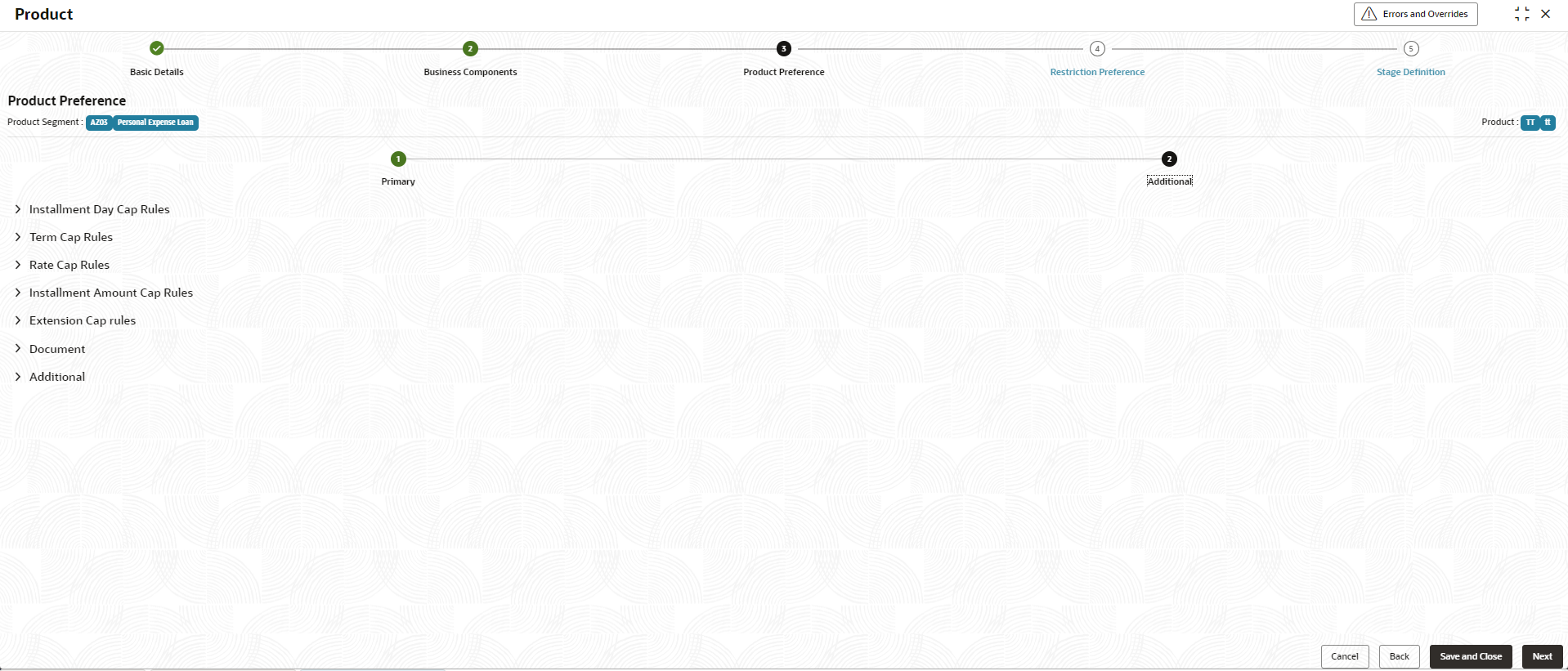

Additional tab.The Product Preference - Additional screen displays.

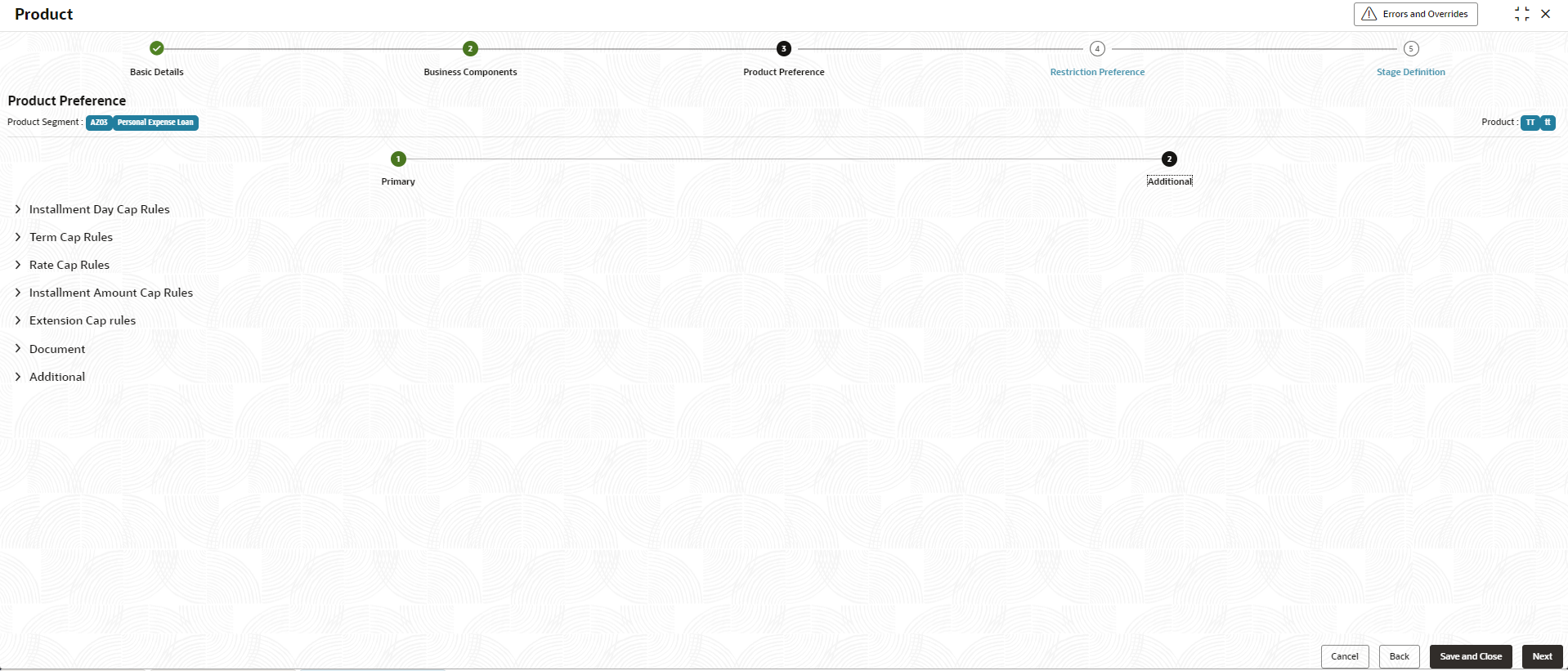

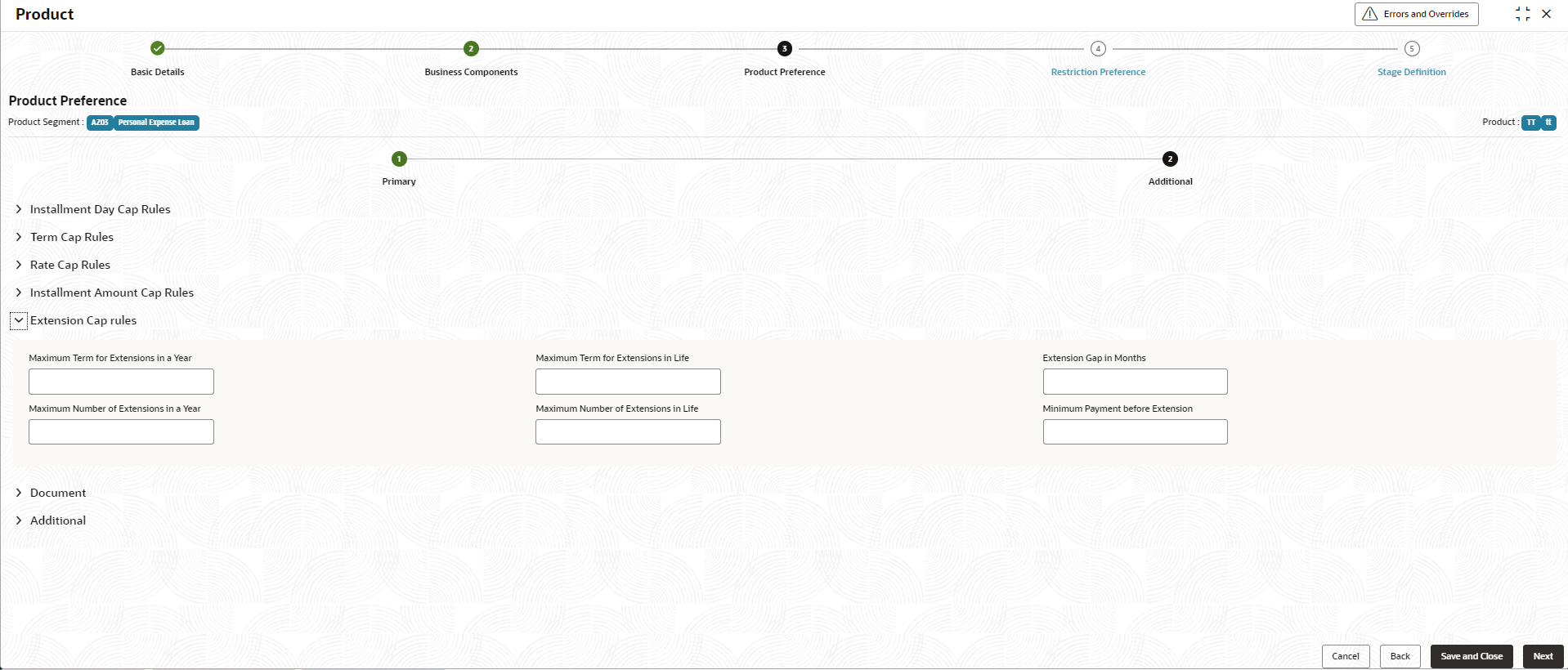

Figure 2-45 Product Preference - Additional

Figure 2-46 Installment Day Cap Rules

For more information on fields, refer to the field description table.Table 2-44 Installment Day Cap Rules - Field Description

Field Description Minimum Installment Day Specify the minimum start day for the the repayment frequency. For example, For the minimum installment frequency set to monthly and the minimum installment day set to 10, any installment or schedule due date ranging from the 1st to the 9th cannot be accepted during the onboarding or installment change operation, as the minimum start day is the 10th.

Maximum Installment Day Specify the maximum start day for the the repayment frequency. For example, With the minimum installment day set to 10 and the maximum installment day set to 25, any installment or schedule due date must fall within the range of 10 to 25. Therefore, if an installment date is selected between the 1st to the 9th or the 26th to the 31st, it cannot be accepted during the onboarding or installment change operation.

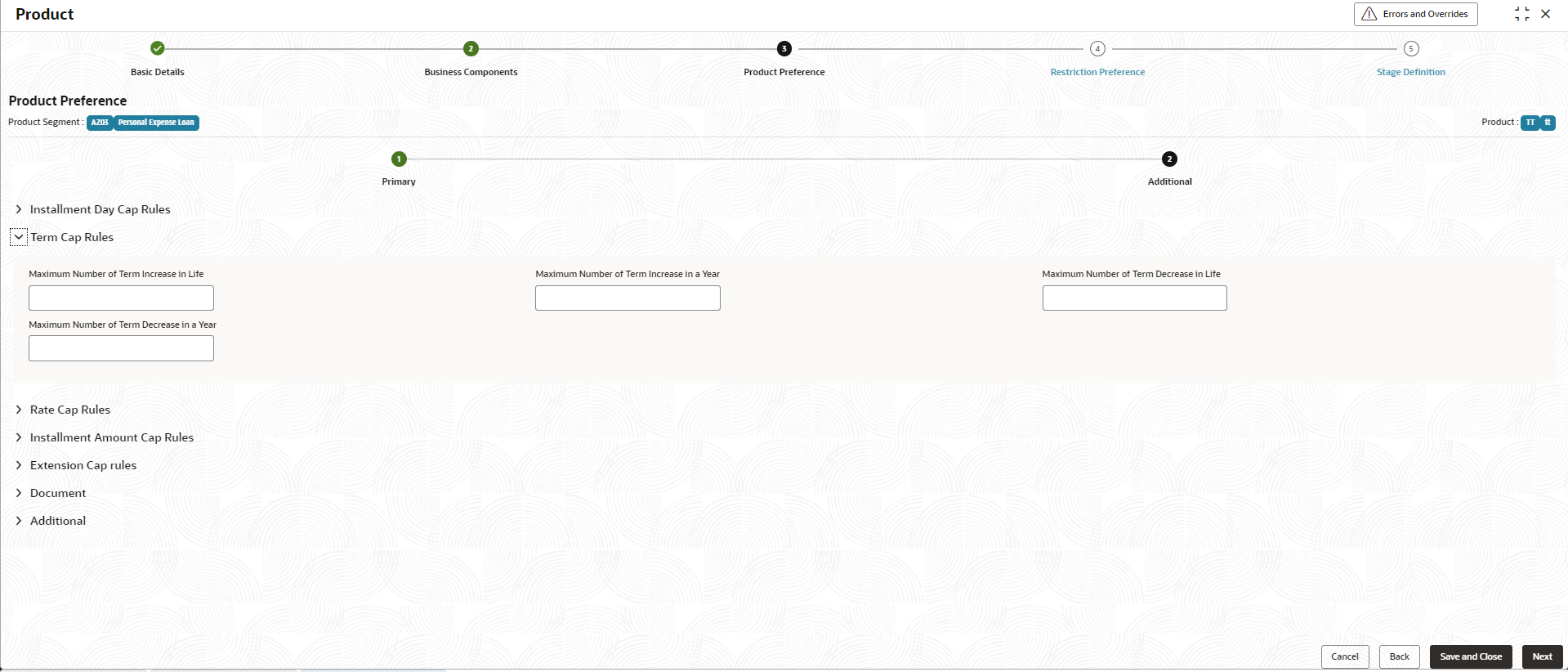

Date Change Gap Days Specify the gap days between each date change operation is captured. Maximum Number of Date Change in a Year Specify the maximum number of installment date changes allowed within a year. Maximum Number of Date Change in Life Specify the maximum number of loan term installment date changes allowed within a lefetime. Figure 2-47 Term Cap Rules

For more information on fields, refer to the field description table.Table 2-45 Term Cap Rules - Field Description

Field Description Maximum Number of Term Increase in Life Specify the maximum number of term increase in life. If there is a term increase, the system tracks the occurrence count. When this count (for the entire duration) exceeds the allowed number of term increases, the system will display an error message: Term Increase is not allowed as it exceeds the maximum number of term increases permitted during the lifetime. This validation is only applicable if the field is not blank; if the field is blank, the validation will be skipped.

Maximum Number of Term Increase in a Year Specify the maximum number of term increase in year. When there is a Term Increase, the system tracks the occurrence count for the year. If the count exceeds the allowed limit, the system will display the error message: Term Increase is not allowed as it exceeds the maximum number of term increases permitted in a year. This validation is only applied if the field value is not blank; if the field is blank, the validation will be skipped. The value will be compared with the original or booking-time term value to determine whether there is an increase or decrease.

Maximum Number of Term Decrease in Life Specify the maximum number of term decrease in life. When there is a Term Decrease, the system tracks the occurrence count for the entire duration. If the count exceeds the allowed limit, the system will display the error message: Term Decrease is not allowed as it exceeds the maximum number of term decreases permitted during the lifetime. This validation will only apply if the field value is not blank; if the field is blank, the validation will be skipped. The count will be compared against the original or booking-time term value to determine whether there is an increase or decrease.

Maximum Number of Term Decrease in a Year Specify the maximum number of term decrease in year. For a Term Increase, the system tracks the occurrence count within a year. If the count exceeds the allowed limit, the system will display the error message: Term Decrease is not allowed as it exceeds the maximum number of term decreases permitted in a year. This validation is only triggered if the field value is not blank; if the field is blank, the validation will be skipped. The value will be compared to the original or booking-time term value to assess whether there is an increase or decrease.

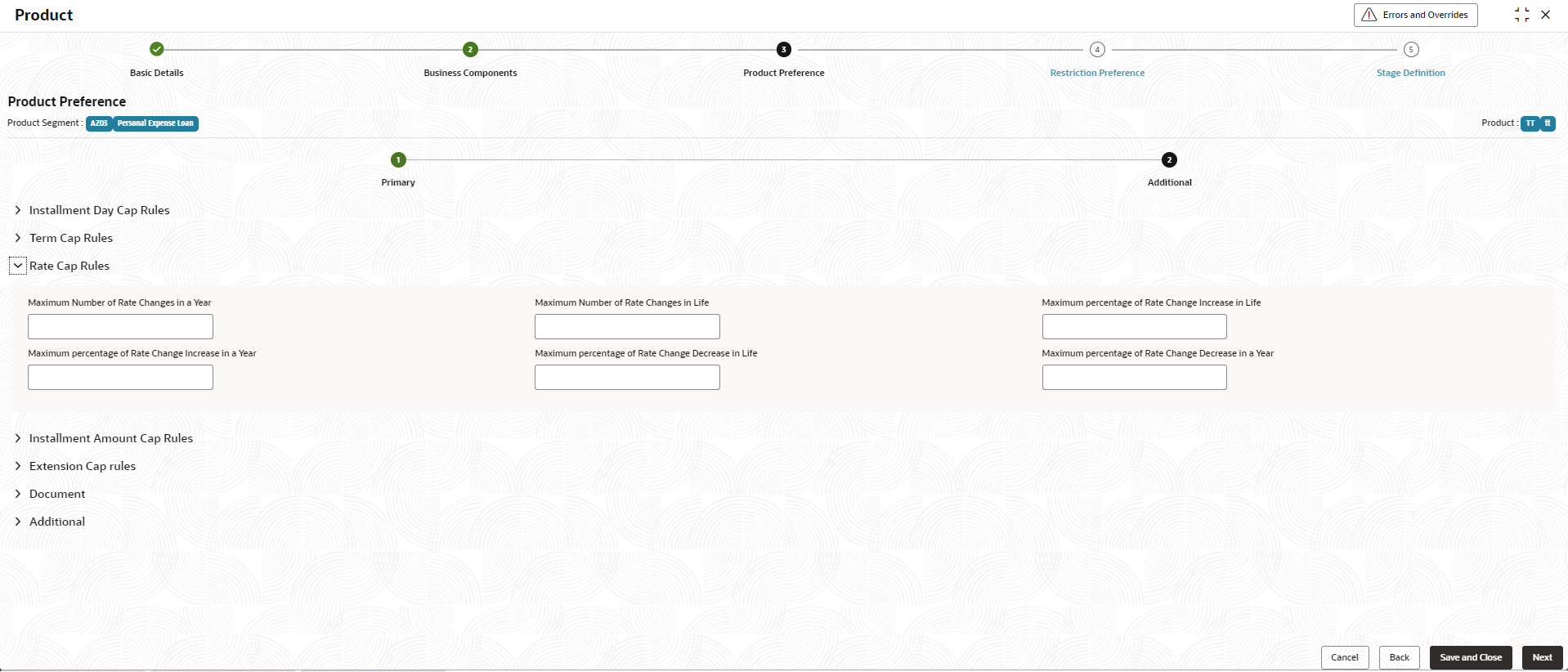

Figure 2-48 Rate Cap Rules

For more information on fields, refer to the field description table.Table 2-46 Rate Cap Rules - Field Description

Field Description Maximum Number of Rate Changes in a Year Specify the maximum number of rate changes allowed in a year. For an interest rate change, the system tracks the occurrence count within a year. If the number of changes exceeds the allowed limit, the system will display the error message: Interest Rate Increase is not allowed as it exceeds the maximum number of rate changes allowed in a year. This validation will only be applied if the field value is not blank; if the field is blank, the validation will be skipped.

Maximum Number of Rate Changes in Life Specify the maximum number of rate changes allowed in a lifetime. For an interest rate change, the system tracks the occurrence count over the entire life term. If the number of increases exceeds the allowed limit, the system will display the error message: Interest Rate Increase is not allowed as it exceeds the maximum number of interest rate increases allowed during the life term. This validation will only be applied if the field value is not blank; if the field is blank, the validation will be skipped.

Maximum percentage of Rate Change Increase in Life Specify the maximum percentage of rate changes allowed in a lifetime. For the maximum number of term increases allowed in a year, the system tracks the difference (including spread or net interest) from the original interest rate value. If the cumulative difference exceeds the specified field value over the life term, the system will display the error message: Interest Rate Increase is not allowed as it exceeds the maximum percentage of rate change increase in the life term. This validation will only be applied if the field value is not blank; if the field is blank, the validation will be skipped.

Maximum percentage of Rate Change Increase in a Year Specify the maximum percentage of rate changes allowed in a year. For an interest rate increase, the system tracks the difference from the original value at the start of the year. If the difference (including spread or net interest) exceeds the specified field value within a year, the system will display the error message: "Interest Rate Increase is not allowed as it exceeds the minimum percentage of rate change increase in the life term." This validation will only be applied if the field value is not blank; if the field is blank, the validation will be skipped.

Maximum percentage of Rate Change Decrease in Life Specify the maximum percentage of rate changes allowed in a lifetime. For an interest rate decrease, the system tracks the difference from the original value. If the decrease (including spread, i.e., net interest) exceeds the specified field value over the life term, the system will display the error message: Interest Rate Increase is not allowed as it exceeds the minimum percentage of rate change increase in the life term. This validation will only be applied if the field value is not blank; if the field is blank, the validation will be skipped.

Maximum percentage of Rate Change Decrease in a Year Specify the maximum percentage of rate changes allowed in a year. For an interest rate decrease, the system tracks the difference from the original value at the start of the year. If the decrease (including spread, i.e., net interest) exceeds the specified field value within a year, the system will display the error message: Interest Rate Increase is not allowed as it exceeds the minimum percentage of rate change increase in the life term. This validation will only be applied if the field value is not blank; if the field is blank, the validation will be skipped.

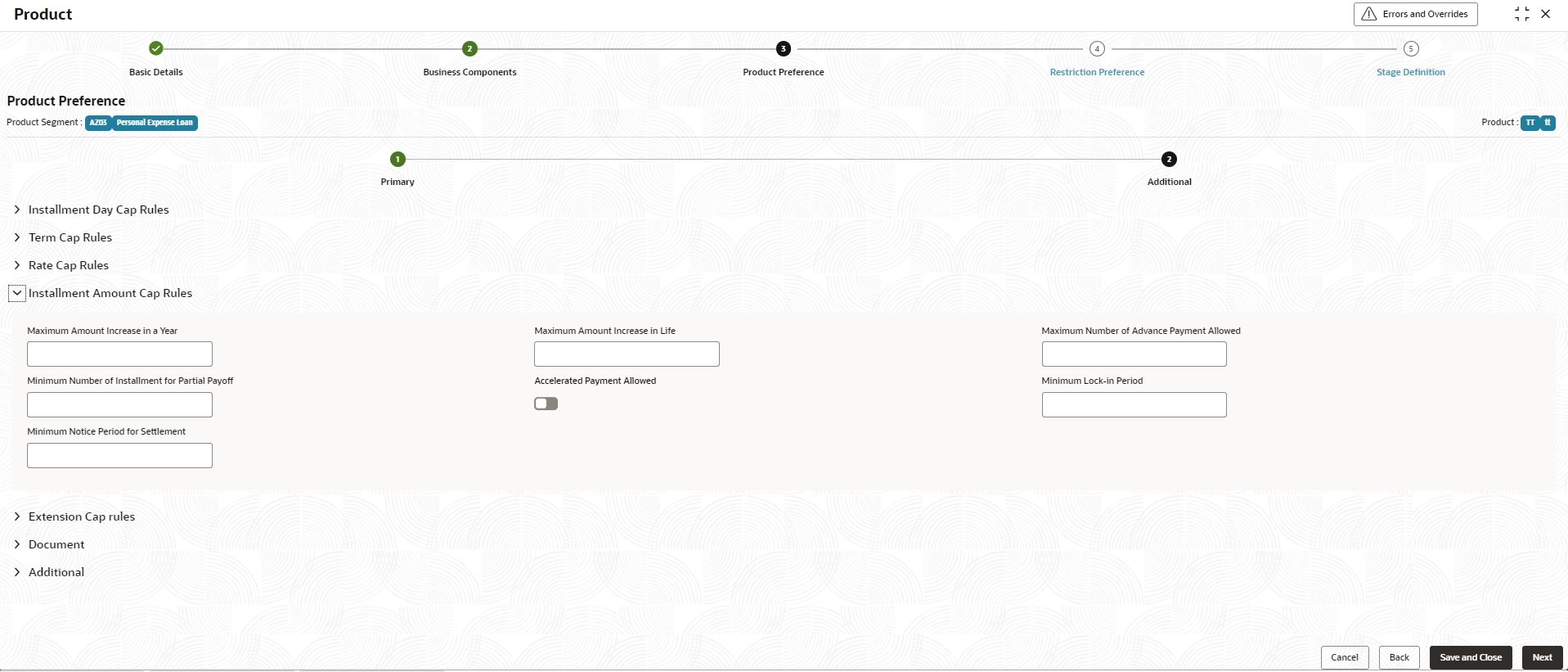

Figure 2-49 Installment Amount Cap Rules

For more information on fields, refer to the field description table.Table 2-47 Installment Amount Cap Rules - Field Description

Field Description Maximum Amount Increase in a Year Specify the maximum amount increase allowed in a year. For an Installment/EMI Amount Increase, the system tracks the total amount of increase within a year. If the increase exceeds the value specified in the field, the system will display the error message: Installment Amount Increase is not allowed as it exceeds the maximum installment amount increase allowed in a year and log the error in the exception table. This validation is only applied if the field value is not blank; if the field is blank, the validation will be skipped.

Maximum Amount Increase in Life Specify the maximum amount increase allowed in a year. For an Installment/EMI Amount Increase, the system tracks the total amount of increase over the life term, starting from the original or initial value. If the increase over the life term exceeds the specified field value, the system will display the error message: sInstallment Amount Increase is not allowed as it exceeds the maximum installment amount increase allowed during the life term and log the error in the exception table. This validation will only be triggered if the field value is not blank; if the field is blank, the validation will be skipped.

Maximum Number of Advance Payment Allowed Specify the minimum number of installments that needs to be prepaid for partial payoff transaction. The minimum amount is derived based on the number of installment maintained. Minimum Number of Installment for Partial Payoff Specify the minimum number of installments for which partial payoff can be prepaid. The minimum amount is derived based on the number of installment maintained. Accelerated Payment Allowed Click the toggle status to allow the accelerated payment. Minimum Lock-in Period Specify the lock in period( in Days) which is the minimum period before which an early settlement of loans. Minimum Notice Period for Settlement Specify the minimum duration or notice period in the given unit(Days)for the early and final premature settlement of the loan. Figure 2-50 Extension Cap rules

For more information on fields, refer to the field description table.Table 2-48 Extension Cap rules - Field Description

Field Description Maximum Term for Extensions in a Year Specify the maximum term(Days) of extension allowed in a year. During the payment suspension, the system will validate the gap in days between the maturity date and the revised maturity date upon extending the repayment holiday.

Maximum Term for Extensions in Life Specify the maximum term of extension allowed in Life. During payment suspension, the system will validate the gap in days between the maturity date and the revised maturity date following a repayment holiday extension.

Extension Gap in Months Specify the gap in months between two extension transactions. During payment suspension, the system will validate the gap in months.

Maximum Number of Extensions in a Year Specify the maximum term of extension allowed in a year. During payment suspension, the system will validate the count of extensions.

Maximum Number of Extensions in Life Specify the maximum term of extension allowed in a life. During payment suspension, the system will validate the count of extensions.

Minimum Payment before Extension Specify the minimum payment amount before posting extension. During a payment extension, the system will track the total payment amount received to date.

Figure 2-51 Document

This section is currently not supported

Figure 2-52 Additional

This section is currently not supported

- Click Cancel to close the details without saving.

- Click Back to navigate to previous screen (Business Components.

- Click Save and Close to save the details.

- Click Next to save and navigate to the next screen (Restriction Preference).

Parent topic: Create Product