2.7.1.2 Business Components

This topic describes about configuring various types of Business components applicable to the product.

All the business components defined for the product segment are defaulted to the product and Loan officer creating the product can deselect the components not applicable for this product.

New business components cannot be added directly to the product. They need to be added to the product segment and in turn to the product.

In this section, Loan officer can only de-link the components not applicable for the product. Also, in this section loan officer can configure the pricing preferences for interest components and charge code applicable for fee components.

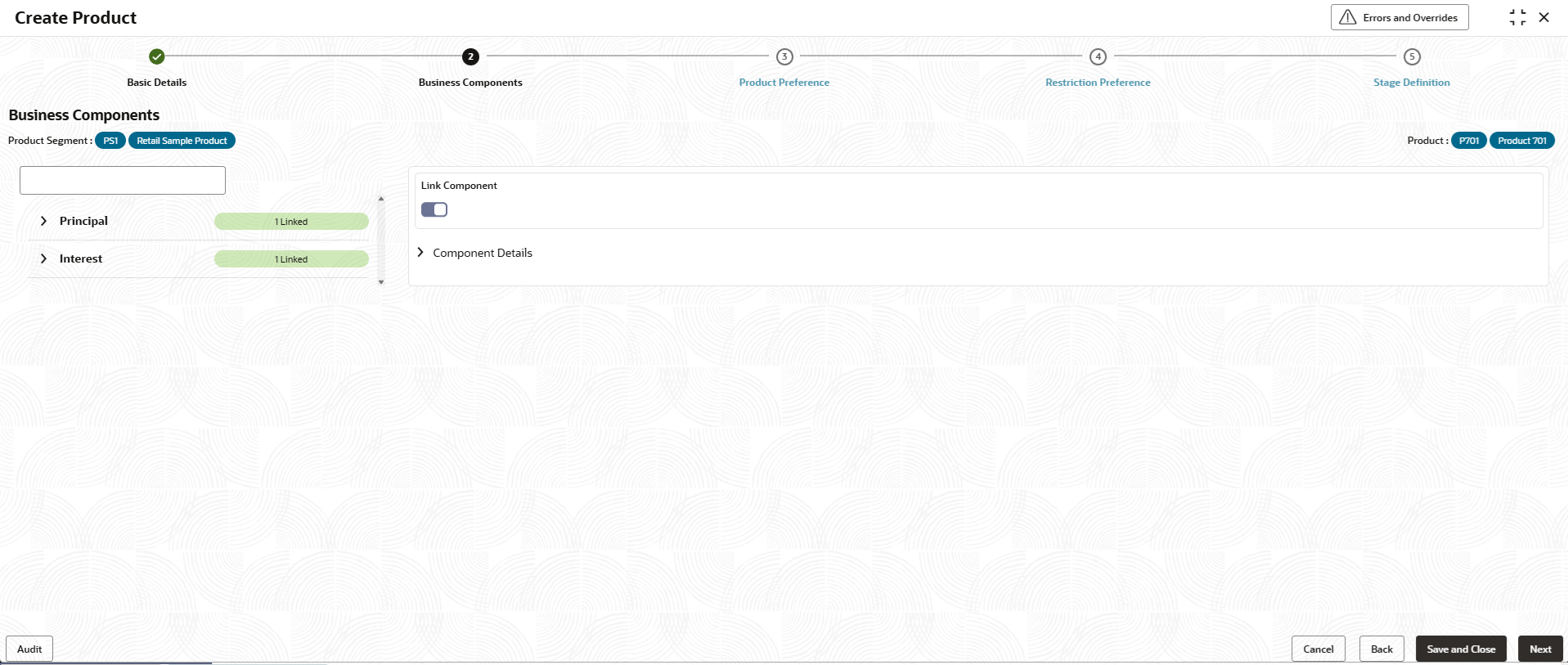

- Click Next in the Basic Details screen to link the components.The Business Components screen is displayed.

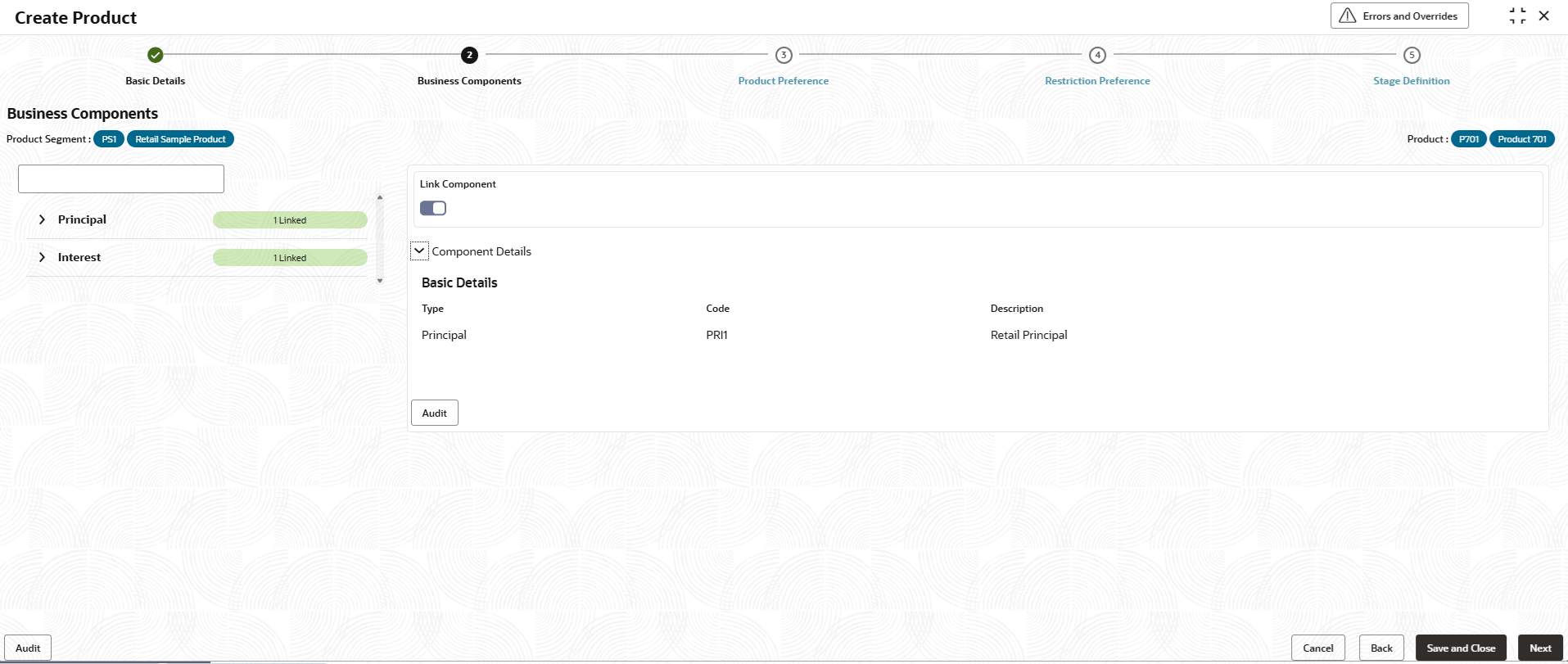

Principal

- Specify the fields on Principal screen.The Principal type components defined in the Business Components section of Product segment are listed here. Click on toggle status to disable the component selected.

Note:

Atleast one principal component type needs to be enabled.For more information on fields, refer to the field description table.

Table 2-32 Principal - Field Description

Field Description Type Displays the type of component. Code Displays the unique code. Description Displays the description of the code.

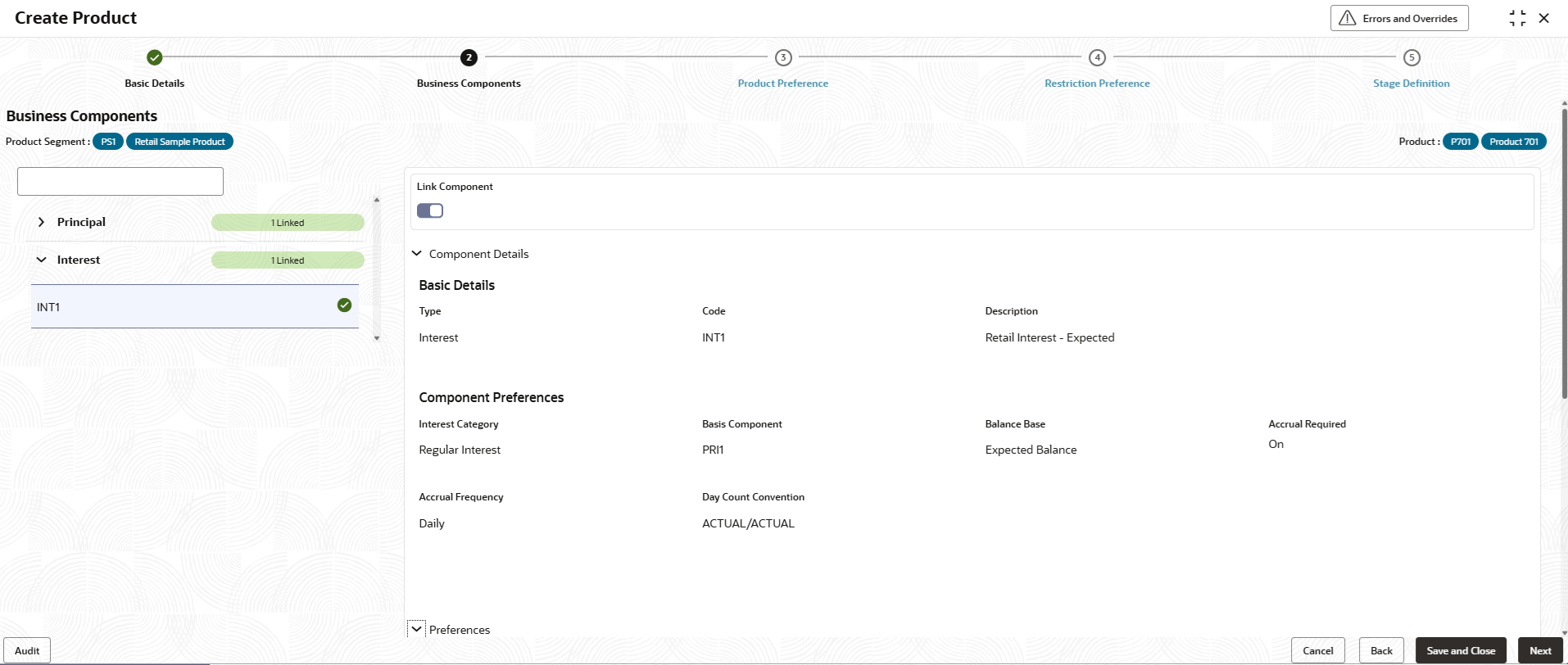

Interest

- Specify the fields on Interest screen.

The Interest type components defined in the Business Components section of Product segment are listed here. The user can link the component code by specifying the pricing preferences and currency wise rate preferences for interest and enable the toggle.

Figure 2-34 Interest - Basic Details and Component Preferences

For more information on fields, refer to the field description table.

Table 2-33 Interest - Basic Details and Component Preferences

Field Description Type Displays the type of component as Interest. Code Displays the unique code of interest component . Description Displays the description of the interest component code For more information on fields, refer to the field description table.Figure 2-35 Interest - Pricing Preferences

Interest pricing preferences for different periods are captured in this section. For example, For first 3 years the interest to remain fixed, followed by floating rate for the remaining term can be configured in this section as below.Table 2-34 Interest Pricing Preferences

Serial Number Period Unit Rate Application 1 3 Years Fixed 2 999 Years Floating Table 2-35 Interest - Interest Pricing Preferences - Field Description

Field Description Unit Displays the unit as Months from the list. User can modify the same.

The allowed values are defined by the lookup type PERIOD_UNIT.

Period Displays the default period as 999. User can modify the same.

Pricing Type Displays the type as User Defined from the drop-down list. The other values are:If it is User Defined, then interest rate value is directly given at the time of on-boarding loan account.- Rate Code Based

- Price Code Based

If it is Rate Code Based, interest rate value is derived based on the rate code maintenance configuration in common code

User can modify the same.

The allowed values are defined by the lookup type PRICING_TYPE.

Rate Code This field is enabled only if the Pricing Type is selected as Rate Code Based.

Price Code This field is enabled only if the Pricing Type is selected as Price Code Based.

Rate Application Displays the rate application as Fixed by default. Loan officer can modify the same to Floating as well. This field is enabled and mandatory only if Pricing Type is Rate Code Based or Price Code Based.

On selecting Fixed, the rate value remains fixed for the period selected in the row, eventhough the rate changes at the rate code/price code level.

On selecting Floating, the rate value varies as per the changes to the rate code/price code level, for the period selected in the row.

The allowed values are defined by the lookup type RATE_APPLICATION.

Spread Type This field refers to bank's profit margin. Displays the type as User Defined from the drop-down list. User can modify the same. User defined means that the spread is specified at the time of loan account onboarding.

The allowed values are defined by the lookup type SPREAD_TYPE.

Currency Displays the currency selected. Minimum Rate Displays the minimum rate for the interest type component. This value is populated from Currency Wise Rate Preference setup at product segment and can be modified. Specify the minimum rate value up to 6 decimals and ensure that the value is less than the Maximum rate and also within the range of product segment level minimum rate and maximum rate for the same component.

Also, note that system validates during account on-boarding and also during the Life cycle of the loan and displays an error if final rate of loan account goes below the minimum rate or goes above the maximum rate.

Maximum Rate Displays the maximum rate for the interest type component. This value is populated from Currency Wise Rate Preference setup and can be modified. Specify the maximum rate value up to 6 decimals and ensure that the value is more than the above field minimum rate and also within the range of product segment level minimum rate and maximum rate for the same component.

Also, note that system validates during account on-boarding and also during the Life cycle of the loan and displays an error if final rate of loan account goes below the minimum rate or goes above the maximum rate.

Minimum Spread Rate Displays the minimum spread rate for the interest type component. This value is populated from Currency Wise Rate Preference setup and can be modified. Specify the minimum spread rate value up to 6 decimals and ensure that the value is within the range of product level minimum spread rate and maximum spread rate for the same component defined in product.

Also, note that system validates this value either during account on-boarding or during the Life cycle of the loan and displays an error if spread value goes below the minimum spread rate or if minimum spread rate is greater than maximum spread rate.

Maximum Spread Rate Displays the maximum spread rate for the interest type component. This value is populated from Currency Wise Rate Preference setup and can be modified. Specify the maximum spread rate value up to 6 decimals and ensure that the value is within the range of product level minimum spread rate and maximum spread rate for the same component defined in product.

Also, note that system validates this value either during account on-boarding or during the Life cycle of the loan and displays an error if spread value goes below the minimum spread rate or if minimum spread rate is greater than maximum spread rate.

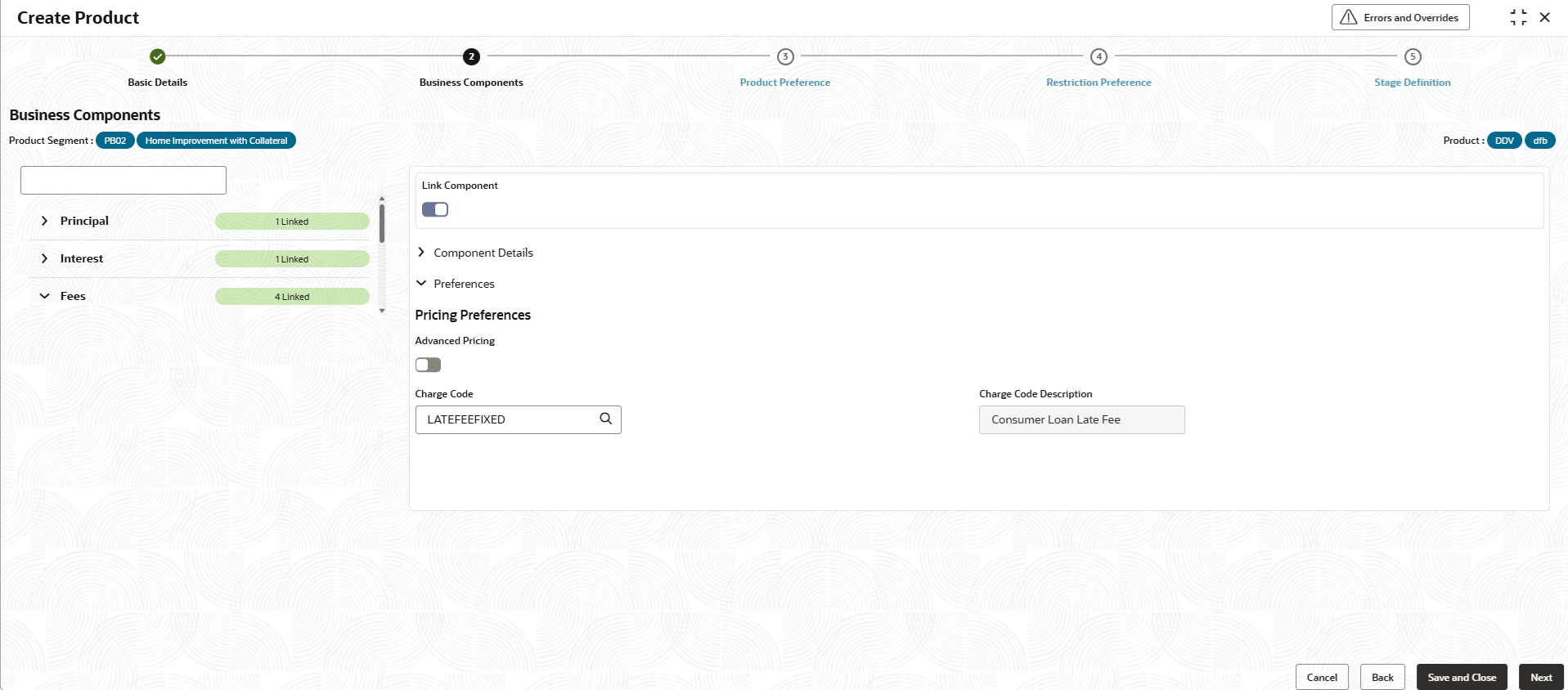

Fees

- Specify the fields on Fees screen.

The Fee type components defined in the Business Components section of Product segment are listed here. The user can link the component code by specifying the charge code preferences and enabling the toggle.

For more information on fields, refer to the field description table.

Table 2-36 Fees - Field Description

Field Description Charge Code Select the charge code from the list. Displays the charge codes from Charge Code maintenance screen. Charge Code Description Displays the description of the charge code selected. First Due Date This is applicable only for periodic fees component. It is defaulted as First Due Date. The first due of periodic fees will be same as installment due date and further fee due dates will be by adding fee frequency to the previous due date.

The allowed values are defined by the lookup type FEE_FIRST_DUE_DATE.

Fee Frequency This is frequency of charging the periodic fees. The allowed values are :- MONTHLY

- QUARTERLY

- ANNUALLY

- HALF YEARLY

The allowed values are defined by the lookup type FEE_FREQUENCY.

- Click Cancel to close the details without saving.

- Click Back to navigate to previous screen (Basic Details.

- Click Save and Close to save the details.

- Click Next to save and navigate to the next screen (Product Preference).

Parent topic: Create Product