3.9.3 Modify Interest Rate

You can add or modify the future interest rates defined for a loan account using the Modify Interest Rate screen.

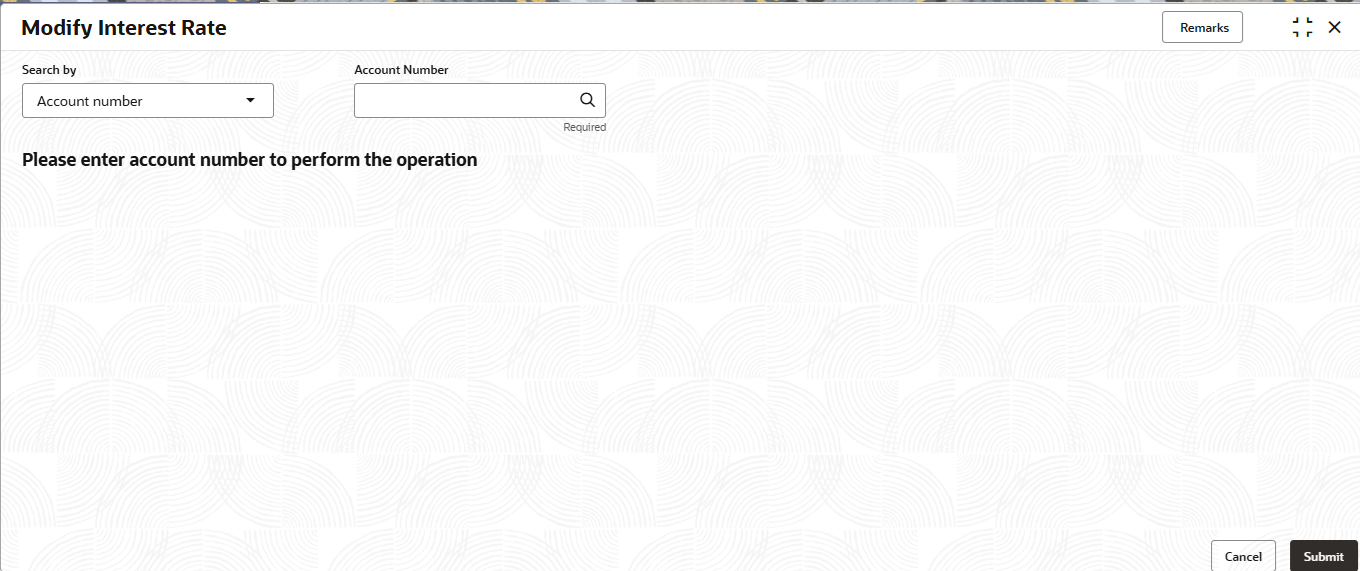

To modify interest rate of a loan account:

Note:

The fields marked as Required are mandatory.- On the Homepage, from Retail Lending

Services mega menu, under Schedule, click

Modify Interest Rate. User can also open the screen

by specifying Modify Interest Rate in the search icon bar

and selecting the screen.The Modify Interest Rate screen is displayed.

- Select the appropriate option from the Search by field.

- Perform the required action, based on the option selected from the

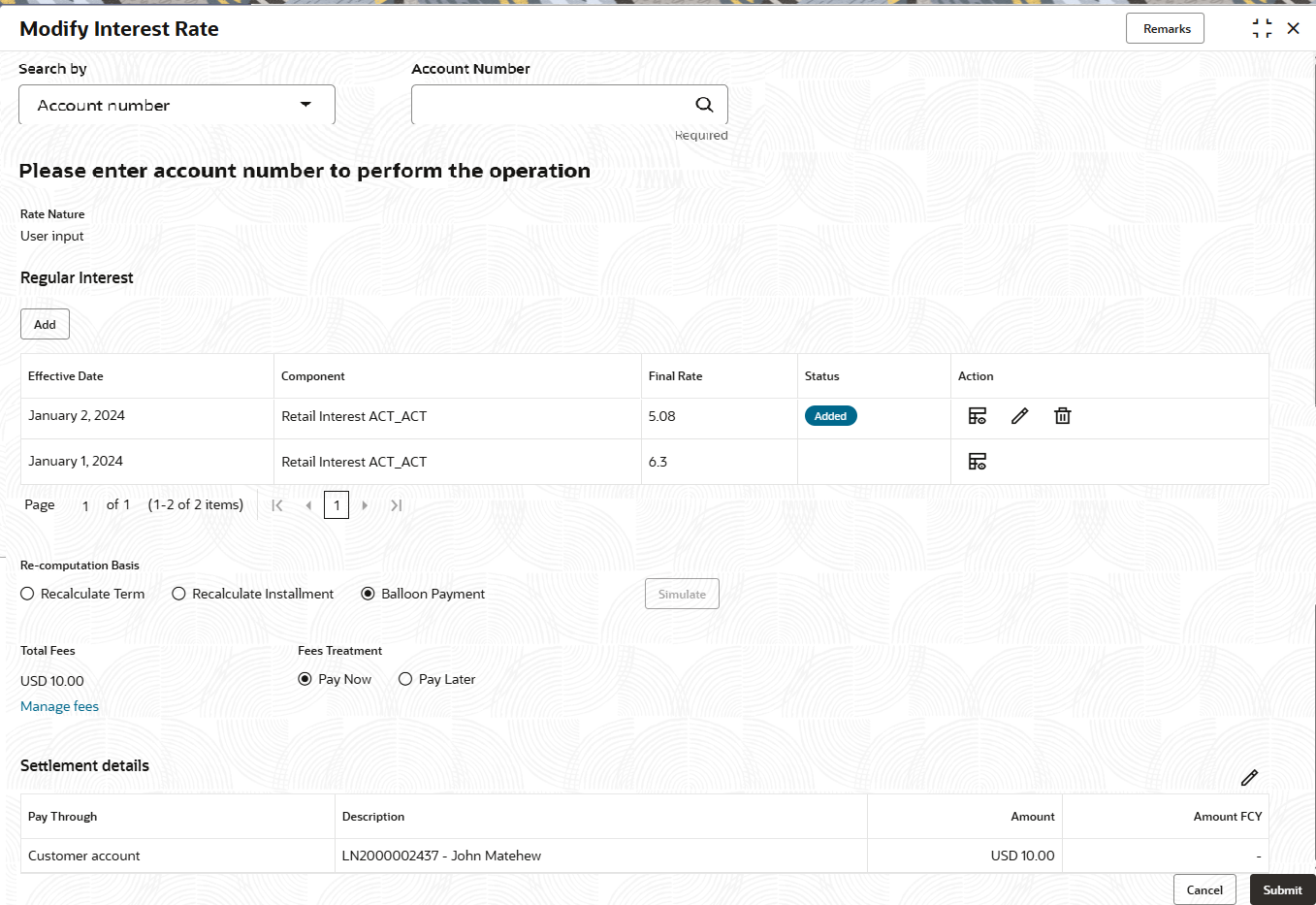

Search by field.The existing interest details are displayed.

- On the Modify Interest Rate screen, perform the required

action. For more information on fields, refer to field description table

below:

Table 3-86 Modify Interest Rate – Field Description

Field Description Search by Users can search for an account number by using any of the available search criteria. The account number is set as the default search option. Users can specify the account number directly in the adjacent field or search for an account number by clicking the Search icon. Users can also search for the specific account number by providing customer ID, account number, or account name.

Other search options available in the Search by field are Customer ID, SSN, Mobile Number, and Email.

A specific customer ID can be searched by providing the customer name or customer ID. If SSN, mobile, or email IDs are chosen to find an account number, the respective IDs have to be input entirely in the adjacent field for the system to display the account number. For a given search criteria, multiple account numbers may be linked.

For example, two or more account numbers can be linked to a single mobile number. In such cases, the system displays all the account number matches and the user can select the relevant account number on which to perform a servicing operation.

Rate Nature Displays the nature of interest rate. Regular Interest This section displays the regular interest rate of the selected deposit account. Note:

If no interest details are present for the account selected, then this section will display only the Add button. You can click Add, and proceed with adding the required interest details.Effective Date Displays the effective date of the interest. Component Displays the interest component. Final Rate Displays the final rate of interest. Status Displays status of the interest rate. The possible option is: - Added

Action Displays the actions that can be performed on the details added. The options are: - View: Click this icon to view more details of the interest.

- Edit: Click this icon to edit the interest details.

- Delete: Click this icon to delete the interest rate details added.

Re-computation Basis Displays the basis for re-computing the interest rate. The options are: - Recalculate Term

- Recalculate Installment

- Balloon Payment

Note:

- This field is displayed, if user update any details and click Update in the Edit section.

- If user delete the newly updated details, then this field will not be displayed.

Total Fees Displays the total fees applicable for the account. Note:

This field is displayed if user select an option from the Re-computation Basis field, and click Simulate.You can also manage fees using the Manage Fees link displayed below this field.Note:

The Manage Fees link is displayed below this field.Fees Treatment Select the option for treating the fees amount. The options are: - Pay Now: If you select this option, then Settlement details section is displayed.

- Pay Later

Note:

This field is displayed if user select an option from the Re-computation Basis field, and click Simulate.Settlement details This section displays the existing settlement details. If no settlement details are present for the account, then user can add new settlement details using the Add New Settlement button. For more information, refer Pay Through Customer Account and Pay Through Other Customer's Account. Note:

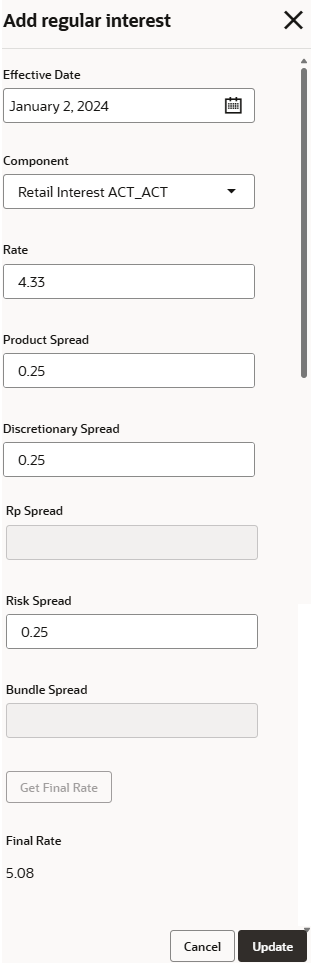

This section is displayed, if Pay Now option is selected from the Fees Treatment field.To add interest details:- Click Add from the

Regular Interest

section.

The Add regular interest section is displayed.

- Specify or select the required details. For more information on

fields, refer to field description table below:

Table 3-87 Add regular interest - Field Description

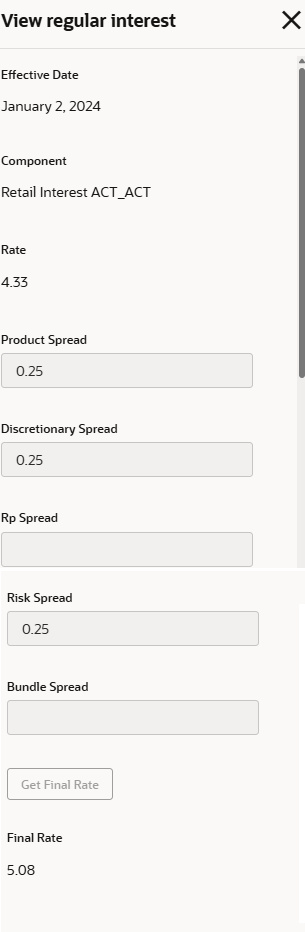

Field Description Effective Date Select or specify the effective date for the interest to be charged. Component Select the interest component. Rate Specify the interest rate. Product Spread Specify the product spread for the interest. Discretionary Spread Specify the discretionary spread for the interest. Rp Spread Specify the Rp spread for the interest. Risk Spread Specify the risk spread for the interest. Bundle Spread Specify the bundle spread for the interest. Final Rate Displays the final rate of interest. Note:

The value in this field is displayed only after you click Get Final Rate. - Click Get Final Rate.

- Click

Update.

The details are added and displayed in tabular format in the Regular Interest section.

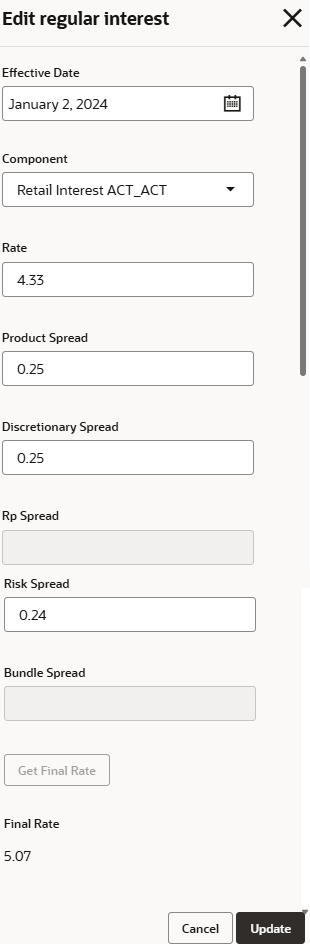

To edit the interest details:- From the Action field, click

Edit.

The Edit regular interest section is displayed.

- You can edit the requried details. For more information on the fields, refer the Table 3-87.

- Click Update.

To view interest details:- From the Action field, click

View.

The View regular interest section is displayed.

- You can view the requried details. For more information on the fields, refer the Table 3-87.

To manage fees:- Click the Manage Fees

link.

The Manage Fees section is displayed.

For more information on fields, refer to field description table below:

Table 3-88 Manage Fees - Field Description

Field Description Fees Details Displays the details of the fees applicable for the account. Defaulted Amount Displays the fee amount defaulted. Modified Amount Specify the amount to be paid. - Click Save.

To view the revised schedule:- Select an option from the Re-computation

Basis field and click

Simulate.

The Show Revised Schedule button is enabled in the Disbursement Details section.

- Click Show Revised

Schedule.

The Revised Schedule section is displayed.

For more information on fields, refer to field description table below:

Table 3-89 Revised Schedule - Field Description

Field Description Date Displays the year and the dates in a year when the arrear is raised. This column lists the years for which the schedule is generated. If you click the Expand icon corresponding to a particular year, the monthly date schedule list for a year displays.

Rate Displays the rate of interest. Principal Displays the amount of principal arrears. Interest Displays the amount of interest. Fees Displays the amount of fees. Due Displays the amount due. Balance Displays the balance amount after every installment.

- Click Submit.The screen is successfully submitted for authorization.

- Settlement through Customer Account

User can settle the amount using the customer account. - Settlement through Other Customer's Account

User can settle the amount using the other customer's account.

Parent topic: Schedule