2.4.1 Create Business Component

This topic describes the systematic procedure for creating the component using various preferences.

- From Home screen, click Retail Lending. Under Retail Lending, click Maintenance.

- Under Maintenance, click Business

Components, then click Create Business

Component.The Create Business Component screen is displayed.

- Specify the fields on Create Business Component screen.For more information on fields, refer to the field description table.

Note:

The fields marked as Required are mandatory.Table 2-7 Create Business Component - Field Description

Field Description Type Select the type from the drop-down list. The available options are:- Principal

- Interest

- Fees

- Tax

- Down Payment

- Insurance

The allowed values are defined by the lookup type COMP_CODE_TYPES.

Code Specify the code for component type. Description Specify the short description for component type. - Under Type field, select

Principal to display the fields on

Principal component. The Create Business Component - Principal screen is displayed.

Figure 2-8 Create Business Component - Principal

- Specify the fields on Create Business Component - Principal screen.For more information on fields, refer to the field description table.

Note:

The fields marked as Required are mandatory.Table 2-8 Create Business Component - Principal - Field Description

Field Description Type Displays the component type as Principal. Code Specify the code for component. Description Specify the description for component. - Under Type field, select Interest

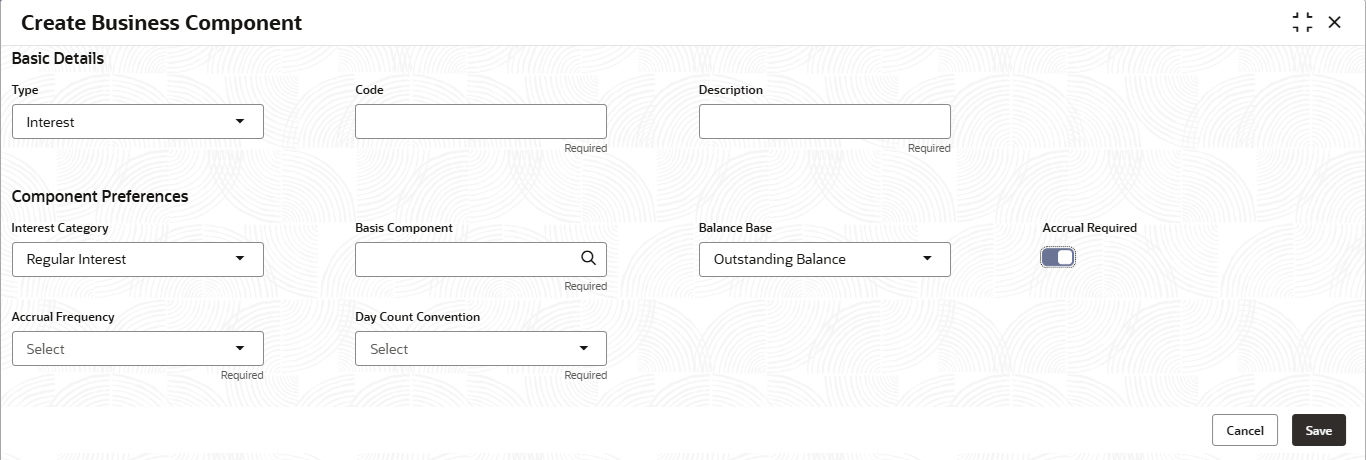

to display the fields on Interest component.The Create Business Component - Interest screen displays.

Figure 2-9 Create Business Component - Interest

- Specify the fields on Create Business Component - Interest screen.For more information on fields, refer to the field description table.

Note:

The fields marked as Required are mandatory.Table 2-9 Create Business Component - Interest - Field Description

Field Description Type Displays the component type as Interest. Code Specify the code for component. Description Specify the description for component. Interest Category Select the category from the drop-down list. The available options are:- Regular Interest

- Penalty Interest - Penalty Interest is applicable for Non-Billing Accounts. Refer Product Segment for enabling Billing Functionality.

The allowed values are defined by the lookup type INT_CATEGORY.

Basis Component This field refers to the amount basis up on which the business component type will be computed. For regular interest, this component basis will refer to PRINCIPAL. Click

icon and select the basis component from the

list.

icon and select the basis component from the

list.

This field is displayed only if the Interest Category is selected as Regular Interest.

This field is displayed as drop-down list if the Interest Category is selected as Penalty Interest.

The available options are:- Principal Overdue

- Interest Overdue

- Installment Overdue

The allowed values are defined by the lookup type FEE_BASIS_ELEMENT.

Balance Base Select the balance from the drop-down list. The available options are:- Expected Balance

- Outstanding Balance

This field displays only if the Interest Category is selected as Regular Interest.

The allowed values are defined by the lookup type BALANCE_BASE.

Accrual Required Click the toggle to enable the accrual. The toggle is disabled by default.

When accrual is enabled, interest is recognized as income at the accrual frequency mentioned, even before interest is due/received

Accrual Frequency Select the frequency at which accrual entries are to be posted, from the drop-down list. The available values are:- Daily

- Monthly

This field is displayed only if the Accrual Required is enabled.

The allowed values are defined by the lookup type ACCRUAL_FREQUENCY.

Day Count Convention This field refers to the method used to derive the no of days computed at the time of calculation of interest. The numerator refers to method of calculating of no of days in the interest period. If it is ACTUAL, then it is the actual no of days between start date and end date of the interest computation period (including start date and excluding end date).

Denominator refers to the total no of days in a year. If it is ACTUAL, a leap year will be taken as 366 days and a non-leap year will be taken as 365 days.

If it is 365/360, no of days is taken as 365/360, irrespective of the leap year.

Select the value from the drop-down list.The available options are:- ACTUAL/ACTUAL

- ACTUAL/365

- ACTUAL/360

- 30US/360

- '30/360ISDA

The allowed values are defined by the lookup type DAY_COUNT_CONVENTION.

Grace Days for Penalty Specify the number of days after which penalty interest will be applied. A grace period allows a borrower to postpone payment for a short duration beyond the due date without incurring Penalty Interest or triggering default. This field displays only if the Interest Category is selected as Penalty Interest.

Charging Frequency Select the frequency from the drop-down list. The available options are:- Daily

- Installment Due Date and Post Maturity Daily

Specify the frequency in which Penalty Interest calculated balances to be charged to the account.

The allowed values are defined by the lookup type PENL_CHARGE_FREQUENCY.

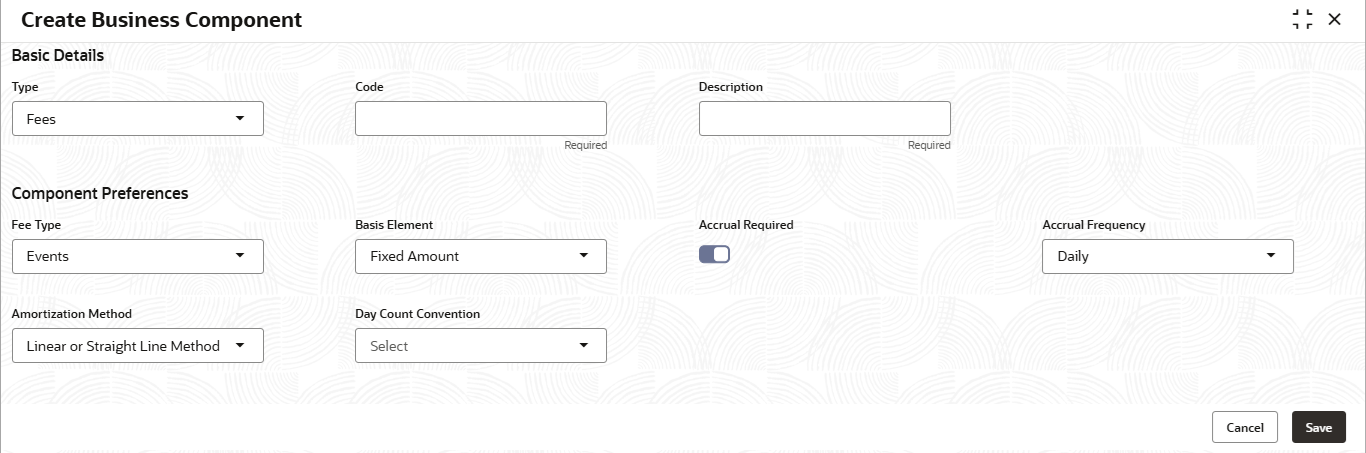

- Under Type field, select Fees to

display the fields on Fees component.The Create Business Component - Fees screen is displayed.

Figure 2-10 Create Business Component - Fees

- Specify the fields on Create Business Component - Fees screen.For more information on fields, refer to the field description table.

Note:

The fields marked as Required are mandatory.Table 2-10 Create Business Component - Fees - Field Description

Field Description Type Displays the component type as Fees. Code Specify the code for component. Description Specify the description for component. Fee Type Select the type from the drop-down list. The available options are:- Events - In case of fee to be charged on specific event everytime the event occurs or periodic/scheduled in nature or to be raised in manually/adhoc application.

- Periodic - The fees are defined for a specific periodicity. The Frequency and periodicity are defined further in linking the Fee in Product Segment.

The allowed values are defined by the lookup type FEE_TYPE.

Basis Element Select the element type from the drop-down list. The available options are:- Fixed Amount

- Sanctioned Amount

- Disbursed Amount

- Prepaid Amount

- Installment Amount

The Basis Element is defaulted to Fixed Amount if the Assessment Method is selected as Adhoc Based.

The allowed values are defined by the lookup type FEE_BASIS_ELEMENT.

Accrual Required Click the toggle to enable the accrual. The toggle is disabled by default.

When accrual is enabled, interest is recognized as income at the accrual frequency mentioned, even before interest is due/received

Accrual Frequency Select the frequency at which accrual entries are to be posted, from the drop-down list. The available values are:- Daily

- Monthly

This field is displayed only if the Accrual Required is enabled.

The allowed values are defined by the lookup type ACCRUAL_FREQUENCY.

Amortization Method Select the method from the drop-down list. The options are:- Linear or Straight Line Method

- Yield Based

Day Count Convention This field refers to the method used to derive the no of days computed at the time of calculation of interest. The numerator refers to method of calculating of no of days in the interest period. If it is ACTUAL, then it is the actual no of days between start date and end date of the interest computation period (including start date and excluding end date).

Denominator refers to the total no of days in a year. If it is ACTUAL, a leap year will be taken as 366 days and a non-leap year will be taken as 365 days.

If it is 365/360, no of days is taken as 365/360, irrespective of the leap year.

Select the value from the drop-down list.The available options are:- ACTUAL/ACTUAL

- ACTUAL/365

- ACTUAL/360

The allowed values are defined by the lookup type FEE_AMORT_METHOD.

- Click Save to save the details.The Business Components is successfully created and can be viewed using the View Business Component screen.

Parent topic: Business Components