- Payments Core User Guide

- Payment Maintenance

- India Payments Maintenance

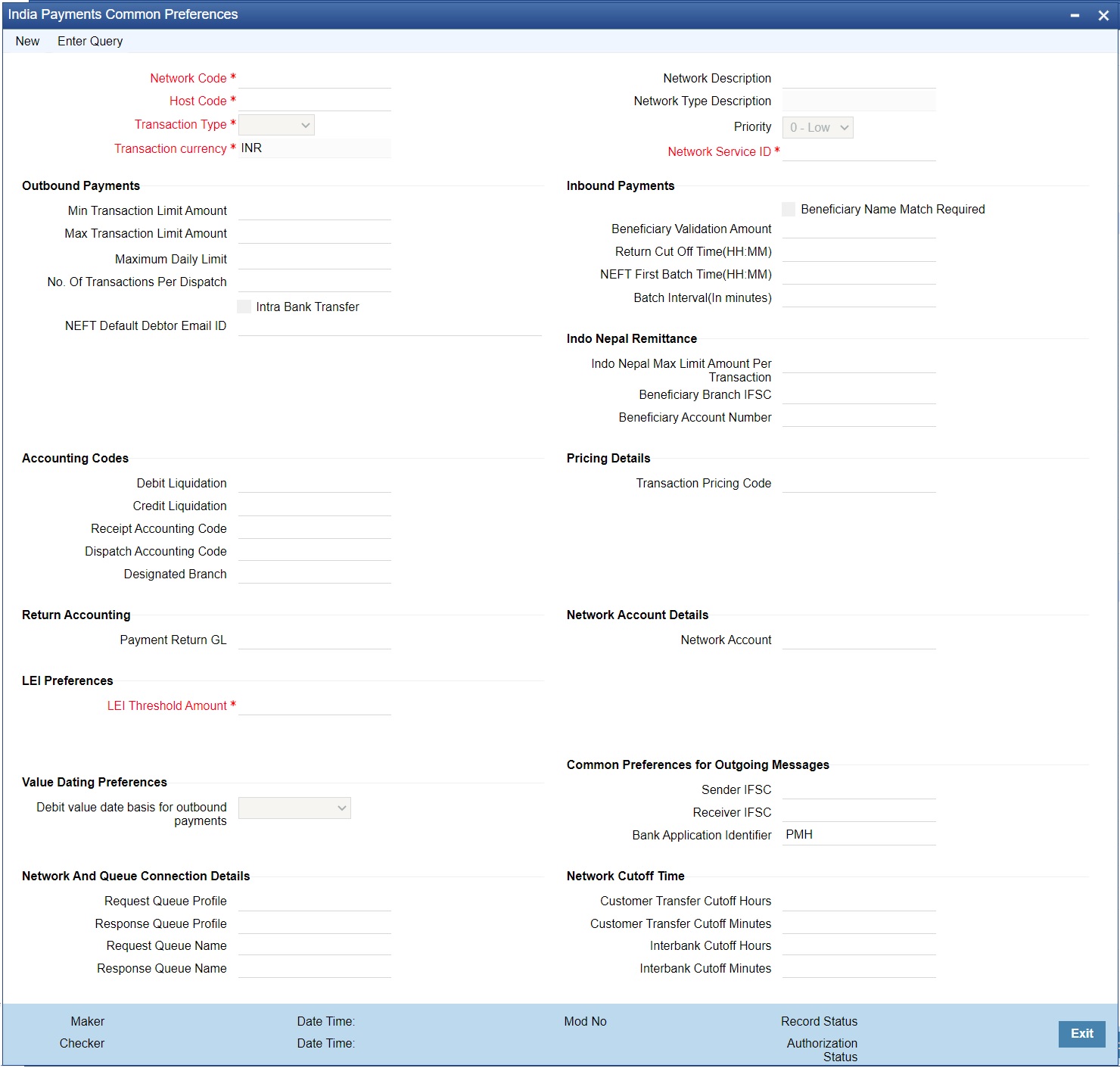

- India Payments Common Preferences

India Payments Common Preferences

- NEFT

- India RTGS

- On Homepage, specify PMDNFTPF in the text box, and click next

arrow.India Payments Common Preferences screen is displayed.

Figure 2-238 India Payments Common Preferences

Description of "Figure 2-238 India Payments Common Preferences" - Click New button on the Application toolbar.

- On India Payments Common Preferences screen, specify the fields.For more information on fields, refer to the field description below:

Table 2-126 India Payments Common Preferences - Field Description

Field Description Network Code Specify the Network Code from the list of values. You can select NEFT/ RTGS.

If only one Network is maintained with payment type as ‘NEFT/ RTGS’ for the host code, the same gets defaulted in this field. In case multiple networks are found for the same combination, all applicable networks are listed. Select the required network.

Network Description System defaults the description of the Network selected. Network Type Description System defaults the Network Type Description of the Network selected. Host Code System defaults the Host Code of transaction branch on clicking ‘New’. Transaction Type Select Transaction Type from the following: - Outbound

- Inbound

Transaction Currency System defaults the option as ‘INR’ for India Payments. Priority Select the Priority from 0 to 9.

“0” indicates ‘Low’ priority and “9” indicates ‘High’ priority. Different priorities can be set for the individual networks and payment types.

Network Service ID Specify the Network Service ID. This is mandatory field. Outbound Payments -- Min Transaction Limit Amount Specify the minimum limit applicable for a transaction. Note:

For RTGS transfers, Rs. 2 Lacs is the minimum limit amount.Max Transaction Limit Amount Specify the maximum limit applicable for a transaction. Minimum daily Limit Specify the minimum limit allowed for a customer per day. Maximum Daily Limit Specify the maximum limit allowed for a customer per day. Note:

The maximum transaction limit amount would be as per the RBI guidelines.No. of Transactions per Dispatch Specify the number of transactions per dispatch. Based on the number of transactions specified, system bundles the transactions for dispatch in the respective batch timings defined in the Dispatch Parameters maintenance screen (PADISPTM).

The maximum count for the following message type are as follows:- N06 - Maximum number of transactions which can be bundled and sent as one N06 message. System dispatches N06 in a bundle of 10 or less when maintained as ‘10’.

- N07 - Maximum number of return transactions which can be bundled and sent as one N07 dispatch message.

- N10 - Maximum number of credit confirmation messages which can be bundled and sent as one N10 dispatch message.

Note:

This field is applicable only for NEFT payments.Intra Bank Transfer By default 'Intra Bank Transfer Check' check box is unchecked.

System checks the following:

- System checks if the beneficiary bank IFSC code is of the same bank branch. A ‘Branch’ record is present in the screen Branch IFSC Code Mapping 'PMDIFSBR' for the given IFSC Code.

If a record is found in screen Branch IFSC Code Mapping 'PMDIFSBR' for the given IFSC Code, then the system checks the following:- If the Intra Bank Transfer flag is ‘N’ the system gives an error message PT-TXP-023 ‘Intra Bank Transfer is not allowed'.

- If the ‘Intra Bank Transfer’ flag is ‘Y’ the system allows to process as ‘Outbound NEFT payment and generate N06 message for dispatch to Network even if beneficiary bank IFSC code is of the same bank branch.

NEFT Default Debtor Email ID Specify the default Email ID for sender.

If Mobile Number or Email ID is not maintained at customer level then this default email ID gets mapped to NEFT outgoing (N06) message.

Inbound Payments -- Beneficiary Name Match Required System performs the Beneficiary name match for the inbound payments, if this is checked. When the Beneficiary name match fails, the transaction is moved to Repair Queue. Beneficiary Validation Amount Specify the Amount in INR currency. Return Cutoff Time (HH:MM) Specify the cutoff time for the return of transaction as - ‘02:00’ hours for the payment type, ‘NEFT’.

The transaction is returned, when the beneficiary bank does not receive the credit for valid reasons. System derives the return cut off time based on the batch time plus the 2 hours (B+2 Criteria) defined here. Once the inbound payment is returned within 2 hours, system generates a N07 message.

For the payment type - RTGS, specify the Return Cutoff Time as ‘1’ hour.

NEFT First Batch Time (HH:MM) Specify the Batch time for the Bach Number 0001. Batch Interval (In minutes) Specify the Batch interval between two Batches of NEFT payments. Indo Nepal Remittance The below fields are applicable only for NEFT outbound Indo Nepal Remittances, and the system defaults these fields only for these transactions.

Indo Nepal Max Limit Amount Per Transaction Specify the Indo Nepal maximum limit amount per transaction. Note:

As prescribed by RBI, the maximum limit for Indo Nepal Remittance per transaction is INR 2 lakh.Beneficiary Branch IFSC Specify Beneficiary Branch IFSC. Beneficiary branch's IFSC should mandatory carry SBI IFSC 'SBIN0004430'. Beneficiary Account Number Specify the Beneficiary Account Number. Beneficiary Customer Account Number should mandatory be '2399468044302'. Accounting Codes -- Debit Liquidation Specify the Credit leg (Intermediary GL) of the DRLQ event. System picks this GL as offset account for Debit entries. Credit Liquidation Specify the Debit leg (Intermediary GL) of the CRLQ event. System picks this GL as offset account for Debit entries. Receipt Accounting Code Specify the accounting code for the RCLG event. System picks this accounting code for the incoming payment. This is applicable only for NEFT payment type. Dispatch Accounting Code Specify the accounting code for the DCLG event. System picks this accounting code during the dispatch of the N06 bundle. This is applicable only for NEFT payment type. Pricing Details -- Transaction Pricing Code Specify the Pricing code for the network from the list of values. Taxes and charges maintained in the PPDCDMNT is picked from the list of the values. Return Accounting -- Payment Return GL Specify the Payment return GL. The GL specified is picked, when the inbound payment is not completed and the return is initiated from the repair queue. Network Account Details -- Network Account Specify the Network account from the list of values. Nostro account of the network account is specified.

This account is applied while processing inbound/outbound payments for the credit/debit leg of the CRLQ/DRLQ events.

LEI Preferences -- LEI Threshold Amount Specify the LEI Threshold Amount. This mandatory field. The value should not be zero or than zero. Value Dating Preferences -- Debit Value Date Basis for Outbound Payments You can set the debit value date basis for outbound payments in the payments common preferences screen. Based on the preferences set, Debit Value date gets defaulted in the Outbound NEFT transaction screen. The options are: - Activation Date

- Instruction Date

- Null

Common Preferences for Outgoing Messages -- Sender IFSC Select the Sender IFSC from the list of values. All the valid IFSC codes are listed. - NEFT - This is a one-time maintenance to capture the bank’s service center branch IFSC and the branch defined here sends out the messages to RBI NEFT Clearing centre.

- RTGS - This is a one time maintenance to capture the bank’s service center branch IFSC. All valid IFSC are listed in the LOV. This branch sends out messages to RBI RTGS Clearing Centre.

Receiver IFSC IFSC code of RBI NEFT and RBI RTGS Clearing centres are defined. - The default value for Receiver IFSC code for NEFT is 'RBIP0NEFTSC'

- The default value for Receiver IFSC code for RTGS is 'RBIN0RTGS00'

Bank Application Identifier This is the identifier with which Bank application is registered at the branch server.

'PMH' (Payment Hub) value is maintained. However, bank can configure the actual application identifier.

Network and Queue Connection Details -- Request Queue Profile Specify the Request Queue Profile from the list of values. All the valid queue profiles defined in the Queue Profile Maintenance (PMDQPROF) is listed. Response Queue Profile Specify the Response Queue Profile from the list of values. All the valid queue profiles defined in the Queue Profile Maintenance (PMDQPROF) is listed. Request Queue Name Specify the Outbound/ Inbound Queue JNDI here. Response Queue Name Specify the Outbound/ Inbound Queue JNDI here. Network Cutoff Time -- Customer Transfer Cutoff Hours Specify the Customer Transfer Cutoff Hours. Customer Transfer Cutoff Minutes Specify the Customer Transfer Cutoff Minutes. Interbank Cutoff Hours Specify the Interbank Cutoff Hours. Interbank Cutoff Minutes Specify the Interbank Cutoff Minutes.